Key Insights

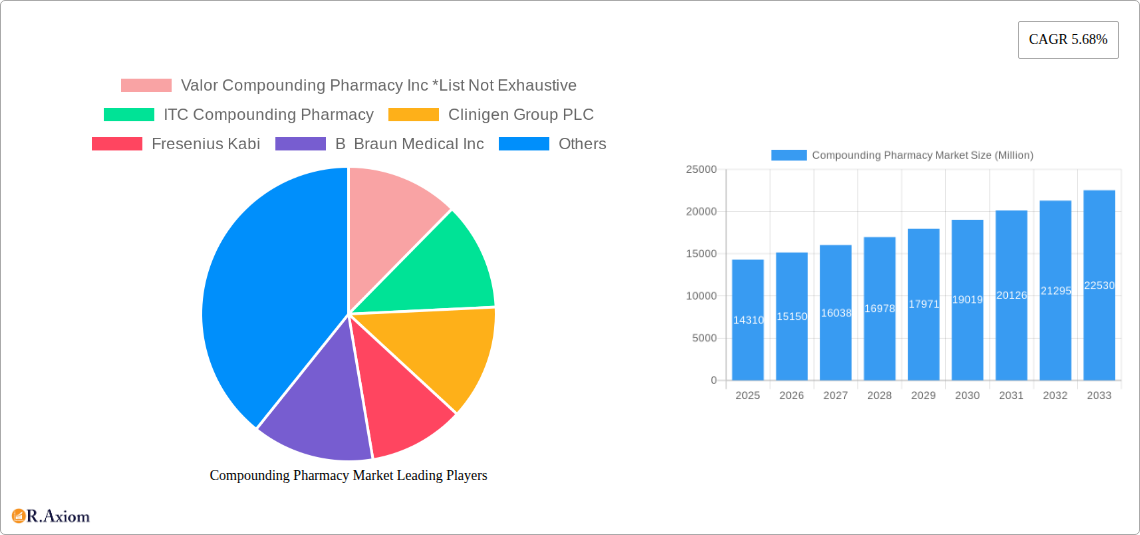

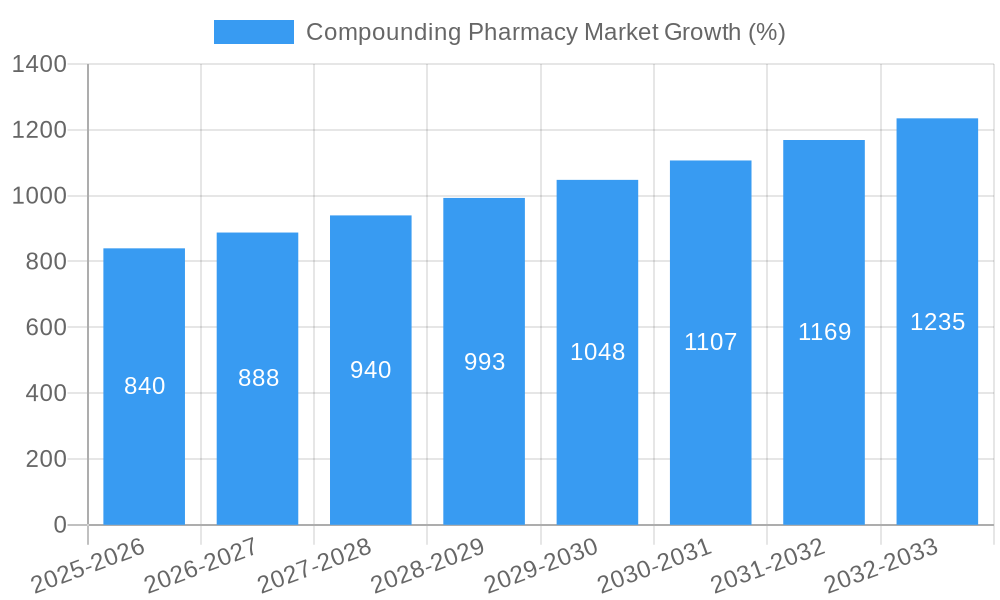

The compounding pharmacy market, valued at $14.31 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of chronic diseases requiring personalized medication regimens is a significant driver. Patients with complex needs or allergies often benefit from compounded medications tailored to their specific conditions, thus boosting market demand. Furthermore, the growing awareness of the limitations of commercially available drugs and the desire for customized formulations are fueling market growth across various therapeutic areas. Pain management, hormone replacement therapy, and the treatment of dermal disorders represent significant segments within the market, while the oral route of administration maintains the largest market share. The market's growth is further propelled by a rise in veterinary applications, reflecting a growing focus on personalized pet care. However, stringent regulatory frameworks and potential reimbursement challenges pose some constraints to market expansion. The increasing adoption of advanced technologies in compounding, coupled with a focus on improved quality control and patient safety, is expected to mitigate these challenges and facilitate market growth throughout the forecast period.

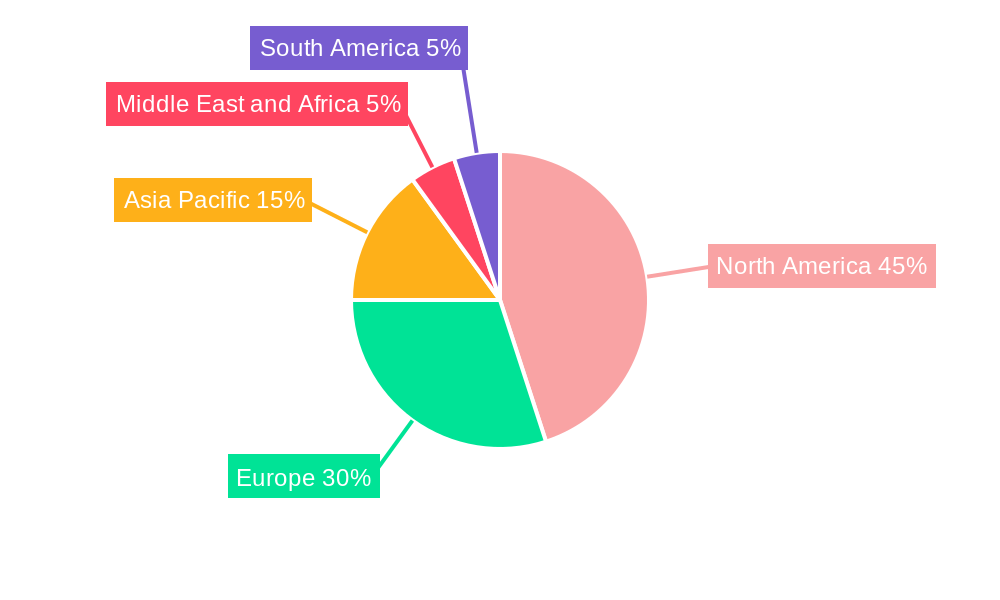

The geographical distribution of the compounding pharmacy market reveals a diversified landscape. North America, particularly the United States, currently holds a substantial market share due to higher healthcare expenditure and a well-established pharmaceutical infrastructure. Europe and the Asia-Pacific region are also poised for significant growth, driven by rising disposable incomes, increasing healthcare awareness, and a growing prevalence of chronic illnesses. The competitive landscape is characterized by a mix of large multinational companies and smaller, independent compounding pharmacies. These companies are strategically focusing on technological advancements, expanding their product portfolios, and pursuing mergers and acquisitions to enhance their market presence and cater to the growing demand for specialized pharmaceutical solutions. The future of the compounding pharmacy market appears promising, with sustained growth driven by the unmet needs of patients and advancements within the industry.

This comprehensive report provides an in-depth analysis of the Compounding Pharmacy Market, offering invaluable insights for industry stakeholders, investors, and market entrants. The study period covers 2019-2033, with 2025 as the base and estimated year. The report meticulously examines market size, segmentation, growth drivers, challenges, opportunities, and competitive dynamics, projecting market trends until 2033. Key players like Valor Compounding Pharmacy Inc, ITC Compounding Pharmacy, Clinigen Group PLC, Fresenius Kabi, and B Braun Medical Inc are profiled, highlighting their strategies and market positions.

Compounding Pharmacy Market Market Concentration & Innovation

The Compounding Pharmacy market exhibits a moderately fragmented landscape, with several large players and numerous smaller, regional compounding pharmacies. Market share is dynamic, influenced by M&A activity and the introduction of innovative compounding techniques. While precise market share data for each player remains proprietary, Fagron NV and Wedgewood Pharmacy stand out as significant players based on recent acquisitions. The market's innovation is driven by advancements in sterile compounding techniques, personalized medicine, and the development of new formulations for diverse therapeutic areas. Regulatory frameworks, primarily those governing 503A and 503B compounding pharmacies, significantly impact market dynamics. The presence of generic drugs and other pharmaceutical alternatives poses a degree of substitutability. End-user trends, particularly the growing demand for personalized medications and specialized veterinary compounding, are shaping market growth. M&A activity, exemplified by Fagron's acquisition of a Fresenius Kabi facility (July 2022) and Osceola Capital's purchase of Wedgewood Pharmacy's human health business (June 2022), indicate ongoing consolidation and strategic expansion within the sector. These deals, while not publicly disclosing exact values, represent substantial investments reflecting the market's attractiveness.

- Market Concentration: Moderately fragmented, with a few dominant players.

- Innovation Drivers: Advancements in sterile compounding, personalized medicine, new formulations.

- Regulatory Frameworks: Significant influence on market structure and operations.

- Product Substitutes: Generic drugs and other pharmaceutical options.

- End-User Trends: Growing demand for personalized and veterinary compounding.

- M&A Activity: Significant deals showcasing market consolidation (xx Million USD in estimated deal values for mentioned acquisitions).

Compounding Pharmacy Market Industry Trends & Insights

The Compounding Pharmacy market is experiencing robust growth, driven by several factors. The increasing prevalence of chronic diseases necessitates customized medications, fueling the demand for compounded formulations. Technological advancements in compounding equipment and techniques enhance efficiency and quality, leading to wider adoption. Consumer preferences for personalized healthcare and tailored treatment plans are also bolstering market expansion. However, competitive intensity remains high, with existing players facing pressure from new entrants and larger pharmaceutical companies entering the specialized compounding space. The market is characterized by significant regional variations; developed economies exhibit higher adoption rates due to greater awareness and higher disposable incomes. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, indicating sustained growth and significant market penetration. The rising prevalence of chronic conditions like pain management and hormone imbalances coupled with increasing acceptance of compounding among healthcare professionals, contributes to substantial market growth. Technological advancements improve efficacy, safety, and efficiency in the production and delivery of medications.

Dominant Markets & Segments in Compounding Pharmacy Market

By Therapeutic Area: Pain management consistently holds a prominent position due to the growing prevalence of chronic pain conditions. Hormone replacement therapy is another key driver, propelled by the increasing demand for tailored hormone solutions for various health issues. Dermal disorders represent a significant segment due to individualized treatment needs and the development of specialized topical formulations. Nutritional supplements are also gaining traction.

By Route of Administration: Oral administration remains the most dominant route, followed by topical administration, driven by the demand for localized treatment of skin conditions and other issues. Parenteral administration is significant, although it is usually restricted to more specialized medical situations.

By End-User: Human health represents the largest segment, accounting for xx% of the market due to the wide applications of compounded medications. Veterinary compounding is a growing segment, driven by the increasing preference for personalized veterinary care.

Key Drivers: Economic growth, increased healthcare spending, rising prevalence of chronic diseases, increased access to healthcare, and supportive regulatory environments are major contributors to market dominance in developed economies.

The United States currently holds a leading position in the global compounding pharmacy market, driven by a combination of factors. These factors include higher healthcare expenditure, increased prevalence of chronic illnesses demanding specialized treatments, a more established regulatory framework, and a high concentration of compounding pharmacies.

Compounding Pharmacy Market Product Developments

Recent innovations encompass advancements in sterile compounding techniques, the development of new drug delivery systems, and the customization of formulations to cater to specific patient needs. This includes technologies enhancing the stability and efficacy of compounded medications, along with the introduction of novel excipients and delivery methods, such as improved transdermal patches for enhanced absorption and reduced side effects. These advancements directly improve patient outcomes and compliance, driving market growth. There is an increasing trend towards using automation and technology to enhance efficiency and precision in the manufacturing process, leading to higher quality compounded products.

Report Scope & Segmentation Analysis

This report comprehensively segments the Compounding Pharmacy market across three key aspects: Therapeutic Area (Pain Management, Hormone Replacement, Dermal Disorders, Nutritional Supplements, Other Therapeutic Areas), Route of Administration (Oral, Topical, Parenteral, Other Route of Administrations), and End-User (Humans, Veterinary). Each segment is analyzed for market size, growth projections, and competitive dynamics. The Pain Management segment is projected to experience robust growth due to the rising prevalence of chronic pain conditions. The Oral route of administration is anticipated to dominate, reflecting the widespread applicability of oral medications. The Human segment is projected to hold the largest market share due to the broad range of applications of compounded medications for human health. Specific growth projections for each segment are detailed within the full report.

Key Drivers of Compounding Pharmacy Market Growth

The growth of the Compounding Pharmacy market is primarily driven by several key factors: the rising prevalence of chronic diseases requiring personalized medications; technological advancements leading to improved efficiency and quality of compounding; a growing demand for customized treatments catering to individual patient needs; and supportive regulatory frameworks enabling the growth of the sector. Increased healthcare expenditure and an aging population further bolster market growth.

Challenges in the Compounding Pharmacy Market Sector

The Compounding Pharmacy market faces several challenges, including stringent regulatory requirements, ensuring consistent quality control across compounding pharmacies, and managing supply chain complexities to secure high-quality ingredients. Competition from generic drugs and established pharmaceutical manufacturers, along with concerns regarding the pricing of compounded medications, also represent significant obstacles. These factors, collectively, limit market expansion. The industry needs to prioritize compliance and ensure supply chain resilience.

Emerging Opportunities in Compounding Pharmacy Market

Emerging opportunities include the expanding use of compounding pharmacies in personalized medicine, the development of novel drug delivery systems, and growth in the veterinary compounding segment. Expansion into new geographic markets with growing healthcare sectors and the integration of advanced technologies to enhance efficiency are additional areas of significant potential.

Leading Players in the Compounding Pharmacy Market Market

- Valor Compounding Pharmacy Inc

- ITC Compounding Pharmacy

- Clinigen Group PLC

- Fresenius Kabi

- B Braun Medical Inc

- Lorraine's Pharmacy

- Rx3 Compounding Pharmacy

- Mcguff compounding pharmacy services

- Fagron NV

- Dougherty's Pharmacy Inc

- Wedgewood Pharmacy

- Institutional Pharmacy Solutions

- Pencol Compounding Pharmacy

Key Developments in Compounding Pharmacy Market Industry

July 2022: Fagron acquired a 503B outsourcing facility from Fresenius Kabi, expanding its US sterile compounding capabilities. This significantly enhanced Fagron's market position in the US.

June 2022: Osceola Capital acquired Wedgewood Pharmacy's human health business, consolidating market share and expanding Revelation Pharma Corporation's portfolio. This acquisition further reinforced the trend towards market consolidation.

Strategic Outlook for Compounding Pharmacy Market Market

The Compounding Pharmacy market holds substantial potential for growth. Continued advancements in technology and the increasing demand for personalized medicine will drive market expansion. Strategic partnerships, investments in research and development, and a focus on regulatory compliance are crucial for sustained success in this dynamic sector. The market will continue to see increased consolidation, driven by the strategic advantages of acquiring compounding pharmacies with established reputations, distribution networks, and unique specialized expertise.

Compounding Pharmacy Market Segmentation

-

1. Therapeutic Area

- 1.1. Pain Management

- 1.2. Hormone Replacement

- 1.3. Dermal Disorders

- 1.4. Nutritional Supplements

- 1.5. Other Therapeutic Areas

-

2. Route of Administration

- 2.1. Oral

- 2.2. Topical

- 2.3. Parenteral

- 2.4. Other Route of Administrations

-

3. End-User

- 3.1. Humans

- 3.2. Veterinary

Compounding Pharmacy Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Compounding Pharmacy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Personalized Medicine; Shortage of Drugs; Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Compounding Pharmacists

- 3.4. Market Trends

- 3.4.1. Pain Management Segment is Expected to Dominate the Market During the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.1.1. Pain Management

- 5.1.2. Hormone Replacement

- 5.1.3. Dermal Disorders

- 5.1.4. Nutritional Supplements

- 5.1.5. Other Therapeutic Areas

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Topical

- 5.2.3. Parenteral

- 5.2.4. Other Route of Administrations

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Humans

- 5.3.2. Veterinary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6. North America Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.1.1. Pain Management

- 6.1.2. Hormone Replacement

- 6.1.3. Dermal Disorders

- 6.1.4. Nutritional Supplements

- 6.1.5. Other Therapeutic Areas

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Oral

- 6.2.2. Topical

- 6.2.3. Parenteral

- 6.2.4. Other Route of Administrations

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Humans

- 6.3.2. Veterinary

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7. Europe Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.1.1. Pain Management

- 7.1.2. Hormone Replacement

- 7.1.3. Dermal Disorders

- 7.1.4. Nutritional Supplements

- 7.1.5. Other Therapeutic Areas

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Oral

- 7.2.2. Topical

- 7.2.3. Parenteral

- 7.2.4. Other Route of Administrations

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Humans

- 7.3.2. Veterinary

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8. Asia Pacific Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.1.1. Pain Management

- 8.1.2. Hormone Replacement

- 8.1.3. Dermal Disorders

- 8.1.4. Nutritional Supplements

- 8.1.5. Other Therapeutic Areas

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Oral

- 8.2.2. Topical

- 8.2.3. Parenteral

- 8.2.4. Other Route of Administrations

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Humans

- 8.3.2. Veterinary

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9. Middle East and Africa Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.1.1. Pain Management

- 9.1.2. Hormone Replacement

- 9.1.3. Dermal Disorders

- 9.1.4. Nutritional Supplements

- 9.1.5. Other Therapeutic Areas

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Oral

- 9.2.2. Topical

- 9.2.3. Parenteral

- 9.2.4. Other Route of Administrations

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Humans

- 9.3.2. Veterinary

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10. South America Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10.1.1. Pain Management

- 10.1.2. Hormone Replacement

- 10.1.3. Dermal Disorders

- 10.1.4. Nutritional Supplements

- 10.1.5. Other Therapeutic Areas

- 10.2. Market Analysis, Insights and Forecast - by Route of Administration

- 10.2.1. Oral

- 10.2.2. Topical

- 10.2.3. Parenteral

- 10.2.4. Other Route of Administrations

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Humans

- 10.3.2. Veterinary

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 11. North America Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Compounding Pharmacy Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Valor Compounding Pharmacy Inc *List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ITC Compounding Pharmacy

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Clinigen Group PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Fresenius Kabi

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 B Braun Medical Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Lorraine's Pharmacy

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rx3 Compounding Pharmacy

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mcguff compounding pharmacy services

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Fagron NV

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Dougherty's Pharmacy Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Wedgewood Pharmacy

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Institutional Pharmacy Solutions

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Pencol Compounding Pharmacy

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Valor Compounding Pharmacy Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Compounding Pharmacy Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Compounding Pharmacy Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 13: North America Compounding Pharmacy Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 14: North America Compounding Pharmacy Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 15: North America Compounding Pharmacy Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 16: North America Compounding Pharmacy Market Revenue (Million), by End-User 2024 & 2032

- Figure 17: North America Compounding Pharmacy Market Revenue Share (%), by End-User 2024 & 2032

- Figure 18: North America Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Compounding Pharmacy Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 21: Europe Compounding Pharmacy Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 22: Europe Compounding Pharmacy Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 23: Europe Compounding Pharmacy Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 24: Europe Compounding Pharmacy Market Revenue (Million), by End-User 2024 & 2032

- Figure 25: Europe Compounding Pharmacy Market Revenue Share (%), by End-User 2024 & 2032

- Figure 26: Europe Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Compounding Pharmacy Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 29: Asia Pacific Compounding Pharmacy Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 30: Asia Pacific Compounding Pharmacy Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 31: Asia Pacific Compounding Pharmacy Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 32: Asia Pacific Compounding Pharmacy Market Revenue (Million), by End-User 2024 & 2032

- Figure 33: Asia Pacific Compounding Pharmacy Market Revenue Share (%), by End-User 2024 & 2032

- Figure 34: Asia Pacific Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Compounding Pharmacy Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 37: Middle East and Africa Compounding Pharmacy Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 38: Middle East and Africa Compounding Pharmacy Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 39: Middle East and Africa Compounding Pharmacy Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 40: Middle East and Africa Compounding Pharmacy Market Revenue (Million), by End-User 2024 & 2032

- Figure 41: Middle East and Africa Compounding Pharmacy Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Middle East and Africa Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Compounding Pharmacy Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 45: South America Compounding Pharmacy Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 46: South America Compounding Pharmacy Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 47: South America Compounding Pharmacy Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 48: South America Compounding Pharmacy Market Revenue (Million), by End-User 2024 & 2032

- Figure 49: South America Compounding Pharmacy Market Revenue Share (%), by End-User 2024 & 2032

- Figure 50: South America Compounding Pharmacy Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Compounding Pharmacy Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Compounding Pharmacy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 3: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global Compounding Pharmacy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 33: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 34: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 35: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 40: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 41: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 42: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 50: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 51: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 52: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 60: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 61: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 62: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Compounding Pharmacy Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 67: Global Compounding Pharmacy Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 68: Global Compounding Pharmacy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 69: Global Compounding Pharmacy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Compounding Pharmacy Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compounding Pharmacy Market?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the Compounding Pharmacy Market?

Key companies in the market include Valor Compounding Pharmacy Inc *List Not Exhaustive, ITC Compounding Pharmacy, Clinigen Group PLC, Fresenius Kabi, B Braun Medical Inc, Lorraine's Pharmacy, Rx3 Compounding Pharmacy, Mcguff compounding pharmacy services, Fagron NV, Dougherty's Pharmacy Inc, Wedgewood Pharmacy, Institutional Pharmacy Solutions, Pencol Compounding Pharmacy.

3. What are the main segments of the Compounding Pharmacy Market?

The market segments include Therapeutic Area, Route of Administration, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Personalized Medicine; Shortage of Drugs; Rising Geriatric Population.

6. What are the notable trends driving market growth?

Pain Management Segment is Expected to Dominate the Market During the Forecast Period..

7. Are there any restraints impacting market growth?

Lack of Skilled Compounding Pharmacists.

8. Can you provide examples of recent developments in the market?

July 2022: Fagron, the leading global player in pharmaceutical compounding, acquired a 503B outsourcing facility from Fresenius Kabi in Boston. With this acquisition, Fagron expanded its United States sterile compounding footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compounding Pharmacy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compounding Pharmacy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compounding Pharmacy Market?

To stay informed about further developments, trends, and reports in the Compounding Pharmacy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence