Key Insights

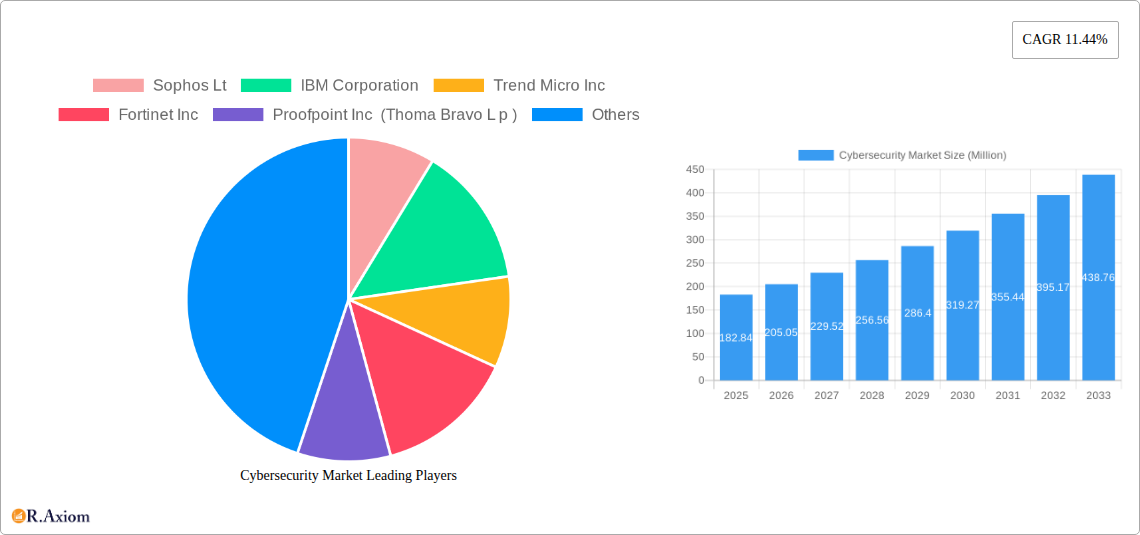

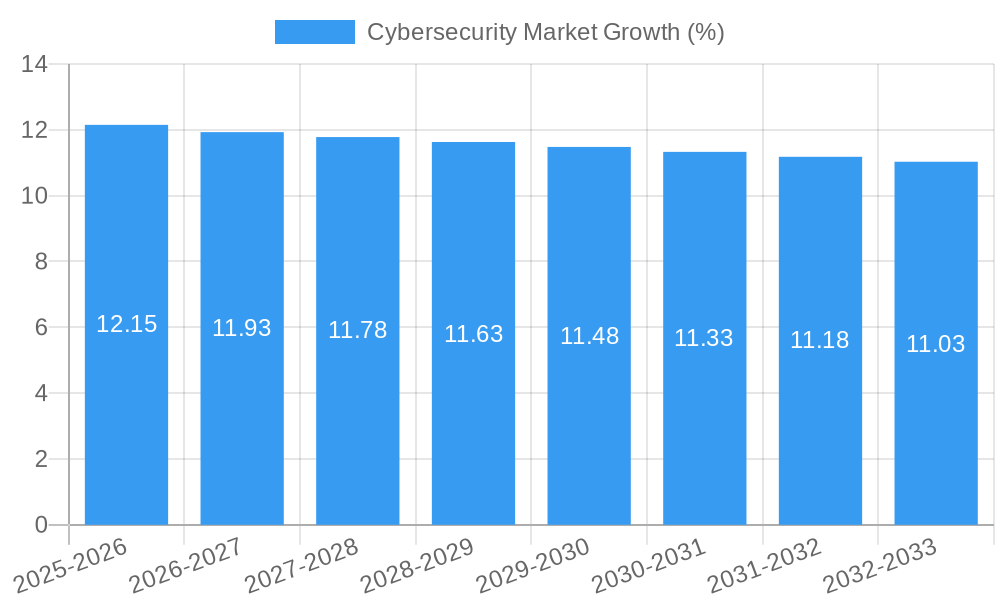

The global Cybersecurity Market is projected for robust expansion, with an estimated market size of $182.84 million in 2025, poised for substantial growth. This surge is driven by a compelling Compound Annual Growth Rate (CAGR) of 11.44% anticipated over the forecast period of 2025-2033. This significant upward trajectory is primarily fueled by the escalating sophistication and frequency of cyber threats, necessitating advanced security solutions across all industries. The increasing adoption of cloud computing, the proliferation of IoT devices, and the growing volume of sensitive data being processed and stored digitally further amplify the demand for comprehensive cybersecurity measures. Regulatory compliance mandates and the growing awareness among organizations regarding the financial and reputational repercussions of data breaches are also acting as powerful catalysts for market growth. Businesses are increasingly prioritizing investments in robust security frameworks to safeguard their digital assets and maintain customer trust.

Key market segments are exhibiting dynamic growth patterns. The "Solutions" segment, encompassing Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, and Network Security Equipment, is a primary engine of this expansion. Within this, Cloud Security and Identity and Access Management are experiencing particularly strong demand due to the widespread migration to cloud environments and the critical need for secure user access. "Services," including Professional Services and Managed Services, are also crucial, as organizations increasingly seek expert guidance and outsourced security operations. While On-Premise deployments remain relevant, Cloud-based deployments are rapidly gaining traction, offering scalability and flexibility. The IT and Telecom sector, along with BFSI, Retail and E-Commerce, and Government and Defense, are leading the charge in cybersecurity adoption, reflecting their high-stakes data environments and susceptibility to cyberattacks. Major players like IBM Corporation, Sophos Ltd., Trend Micro Inc., Fortinet Inc., and Microsoft Corporation are instrumental in shaping the market through innovation and strategic partnerships.

This in-depth report delivers a critical analysis of the global Cybersecurity Market, a sector experiencing unprecedented growth driven by escalating cyber threats and the imperative for robust digital protection. Spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033, this report provides actionable insights for stakeholders navigating this dynamic landscape. We delve into market concentration, key innovation drivers, evolving regulatory frameworks, the competitive environment shaped by product substitutes and end-user trends, and a comprehensive overview of M&A activities. The report estimates the market size to reach USD XXX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Cybersecurity Market Market Concentration & Innovation

The Cybersecurity Market exhibits a moderate to high level of concentration, with a significant portion of market share held by a few dominant players, including IBM Corporation, Microsoft Corporation, and Cisco Systems Inc. These companies leverage extensive R&D investments to drive innovation, focusing on areas such as artificial intelligence (AI) for threat detection, zero-trust architecture, and advanced encryption techniques. Key innovation drivers include the increasing sophistication of cyberattacks, the rapid adoption of cloud computing, and the growing regulatory pressure for data privacy and compliance. The market is further influenced by a complex web of regulatory frameworks, such as GDPR and CCPA, which mandate stringent data protection measures. Product substitutes are emerging, particularly in the realm of AI-powered analytics and behavior-based detection, challenging traditional signature-based security solutions. End-user trends show a clear preference for integrated security platforms and managed security services, driving a shift towards comprehensive solutions. Merger and acquisition (M&A) activities are prevalent, with deal values in the hundreds of millions, as established players seek to acquire innovative technologies and expand their market reach. For instance, Thoma Bravo LP's acquisition of Proofpoint Inc. underscores the consolidation trend and strategic importance of specialized cybersecurity solutions.

Cybersecurity Market Industry Trends & Insights

The Cybersecurity Market is experiencing robust growth fueled by a confluence of technological advancements, evolving threat landscapes, and changing consumer and business preferences. The escalating volume and sophistication of cyber threats, ranging from ransomware attacks to advanced persistent threats (APTs), are the primary growth drivers, compelling organizations across all sectors to prioritize cybersecurity investments. The widespread adoption of cloud computing, the proliferation of IoT devices, and the increasing reliance on remote work have expanded the attack surface, creating new vulnerabilities that demand sophisticated security solutions. Technological disruptions, such as the integration of AI and machine learning (ML) in threat detection and response, are revolutionizing the industry, enabling proactive defense mechanisms and faster incident remediation. AI-powered solutions can analyze vast amounts of data to identify anomalous behavior and predict potential attacks, significantly enhancing security efficacy. Consumer preferences are shifting towards greater transparency and control over personal data, driving demand for solutions that offer robust data privacy and compliance features. Businesses are increasingly looking for integrated security platforms that provide end-to-end protection, rather than relying on disparate, point solutions. This trend is leading to consolidation within the market, with companies seeking to offer comprehensive suites of cybersecurity services. The competitive dynamics are characterized by intense innovation, with companies constantly developing new products and services to stay ahead of emerging threats. Market penetration is steadily increasing, particularly within the BFSI and IT and Telecom sectors, which are early adopters of advanced cybersecurity technologies due to the sensitive nature of their data and operations. The ongoing digital transformation across industries necessitates continuous investment in cybersecurity, ensuring sustained market expansion.

Dominant Markets & Segments in Cybersecurity Market

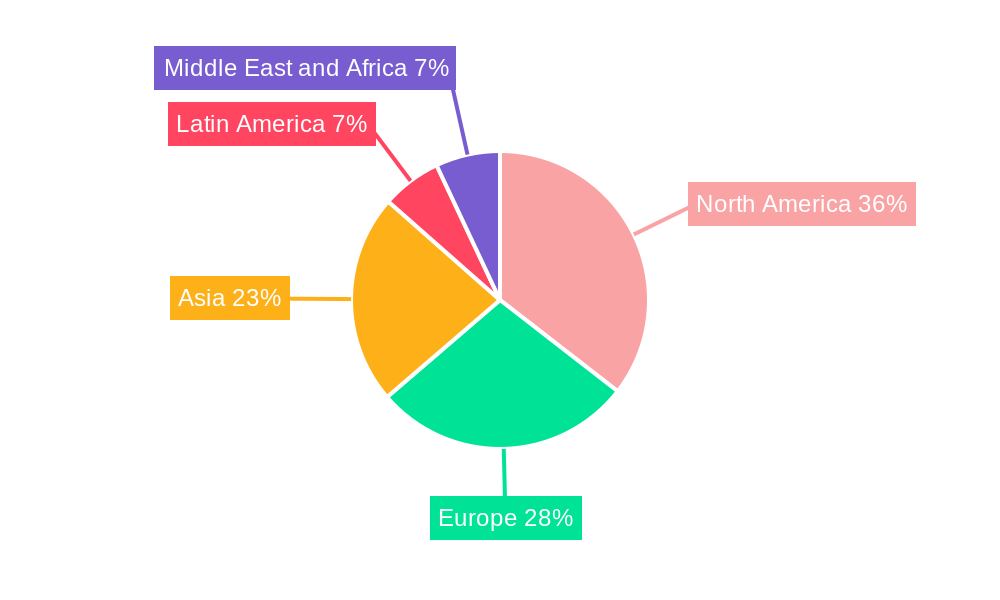

The Cybersecurity Market is witnessing significant dominance in specific regions and segments, driven by a combination of factors including economic policies, infrastructure development, and the inherent nature of end-user industries.

Leading Region: North America currently holds a dominant position in the global cybersecurity market, largely attributed to its advanced technological infrastructure, high spending on IT and cybersecurity, and the presence of a large number of leading cybersecurity vendors. Stringent regulatory frameworks like HIPAA and a high prevalence of sophisticated cyber threats further bolster this dominance.

Dominant Segments by Offering:

Solutions:

- Cloud Security: The accelerated migration of data and applications to cloud environments has propelled Cloud Security to the forefront. Organizations are seeking robust solutions to protect their cloud infrastructure from breaches, misconfigurations, and unauthorized access. Key drivers include the scalability and flexibility offered by cloud platforms, necessitating equally dynamic security measures.

- Network Security Equipment: Despite the rise of software-defined security, traditional network security equipment, including firewalls, intrusion detection systems, and VPNs, remains a critical component of enterprise security architectures. The need to secure complex, hybrid network environments continues to drive demand.

- Identity and Access Management (IAM): With the increasing adoption of remote work and the use of multiple devices and applications, securing user identities and managing access privileges has become paramount. IAM solutions are crucial for preventing unauthorized access and ensuring compliance with data security policies.

- Application Security: As businesses increasingly rely on custom-built and third-party applications, securing these software assets from vulnerabilities and exploits is a major focus. The growing threat of web application attacks fuels the demand for comprehensive application security testing and protection.

- Data Security: Protecting sensitive data from theft, leakage, and unauthorized disclosure is a universal concern. Data security solutions, encompassing encryption, data loss prevention (DLP), and data masking, are integral to compliance and risk management strategies.

- Infrastructure Protection: Securing critical IT infrastructure, including servers, endpoints, and operational technology (OT), remains a foundational element of cybersecurity. The increasing connectivity of industrial control systems (ICS) in sectors like manufacturing and energy heightens the need for robust infrastructure protection.

- Integrated Risk Management (IRM): Organizations are seeking holistic approaches to manage their cybersecurity risks. IRM solutions integrate various security disciplines, enabling better visibility, assessment, and mitigation of cyber risks across the entire enterprise.

- Other Solutions: This category encompasses emerging areas such as security orchestration, automation, and response (SOAR) platforms, threat intelligence services, and security awareness training solutions, all of which are gaining traction.

Services:

- Managed Services: The shortage of skilled cybersecurity professionals and the complexity of managing security operations have led to a surge in demand for managed cybersecurity services. These services offer continuous monitoring, threat detection, incident response, and security management, allowing organizations to outsource their security functions to experts.

- Professional Services: This segment includes consulting, risk assessment, compliance audits, and incident response services. As cyber threats evolve, businesses require expert guidance to develop effective security strategies and respond to security incidents.

Deployment:

- Cloud: Cloud deployment models are dominating the cybersecurity market due to their scalability, flexibility, and cost-effectiveness. Many cybersecurity solutions are now offered as Software-as-a-Service (SaaS), enabling easier deployment and management.

- On-Premise: While cloud adoption is high, on-premise deployments remain relevant for organizations with specific regulatory requirements, legacy systems, or a preference for direct control over their security infrastructure.

End-User Industry:

- IT and Telecom: This sector is a significant driver of the cybersecurity market due to its extensive use of technology, vast amounts of data, and the critical nature of its services. The demand for securing networks, applications, and user data is exceptionally high.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector is a prime target for cybercriminals due to the sensitive financial data it handles. Stringent regulatory compliance and the need to maintain customer trust drive substantial investments in advanced cybersecurity solutions.

- Retail and E-Commerce: With the massive growth of online transactions and the collection of customer data, the retail and e-commerce sector faces significant risks. Protecting payment card information and customer PII is crucial for maintaining business operations and reputation.

- Government and Defense: These sectors handle highly sensitive national security information and critical infrastructure. The ever-present threat of state-sponsored attacks and sophisticated espionage makes cybersecurity a top priority.

- Manufacturing: The increasing integration of IT and OT in manufacturing, leading to smart factories and industrial IoT (IIoT), has created new vulnerabilities. Securing production lines, supply chains, and intellectual property is becoming increasingly critical.

- Oil Gas and Energy: This sector is vital for global economies and is a high-value target for cyberattacks that could disrupt operations and pose physical risks. Securing critical infrastructure and operational technology is paramount.

- Other End-user Industries: This broad category includes healthcare, education, and transportation, all of which are increasingly adopting digital technologies and facing evolving cybersecurity challenges.

Cybersecurity Market Product Developments

The Cybersecurity Market is witnessing a rapid evolution in product development, driven by the need to counter increasingly sophisticated cyber threats. Innovations are heavily focused on leveraging Artificial Intelligence (AI) and Machine Learning (ML) for predictive threat detection and automated incident response. Solutions like advanced endpoint detection and response (EDR) and extended detection and response (XDR) platforms are gaining prominence, offering comprehensive visibility and faster threat mitigation. The development of zero-trust architecture frameworks is a significant trend, shifting the security paradigm from perimeter defense to continuous verification of every access request. Furthermore, advancements in cloud security solutions, including Cloud Workload Protection Platforms (CWPP) and Cloud Security Posture Management (CSPM), are crucial for securing dynamic cloud environments. Encryption technologies are also evolving to provide stronger data protection in transit and at rest, especially in distributed systems. Competitive advantages are being gained by vendors offering integrated security platforms that consolidate multiple security functions, simplifying management and enhancing overall security posture for businesses.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Cybersecurity Market. The Offering is divided into Solutions, encompassing Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, Network Security Equipment, and Other Solutions. The Services segment includes Professional Services and Managed Services. Deployment types are categorized into On-Premise and Cloud. Furthermore, the market is analyzed across various End-User Industries, including IT and Telecom (Use Cases), BFSI, Retail and E-Commerce, Oil Gas and Energy, Manufacturing, Government and Defense, and Other End-user Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering detailed insights into specific areas of opportunity and investment.

Key Drivers of Cybersecurity Market Growth

The Cybersecurity Market is propelled by several key drivers. The escalating frequency and sophistication of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), are compelling organizations to bolster their defenses. The rapid digital transformation and adoption of cloud computing, IoT devices, and remote work have significantly expanded the attack surface, creating new vulnerabilities. Stricter data privacy regulations worldwide, such as GDPR and CCPA, mandate robust cybersecurity measures and compliance, driving significant investments. The increasing reliance on data for business intelligence and decision-making underscores the importance of protecting sensitive information from breaches. Furthermore, the growing adoption of AI and ML in cybersecurity solutions enhances threat detection and response capabilities, fostering innovation and market growth.

Challenges in the Cybersecurity Market Sector

Despite its robust growth, the Cybersecurity Market faces several challenges. A significant hurdle is the persistent global shortage of skilled cybersecurity professionals, leading to increased operational costs and impacting the effectiveness of security teams. The ever-evolving nature of cyber threats necessitates continuous adaptation and investment in new technologies, making it challenging for organizations to keep pace. The complexity of integrated security solutions and the potential for vendor lock-in can also be a deterrent for some businesses. Furthermore, the fragmented nature of the market, with numerous vendors offering specialized solutions, can create integration challenges and complicate procurement decisions. Supply chain vulnerabilities in software and hardware also present a persistent risk, requiring constant vigilance.

Emerging Opportunities in Cybersecurity Market

Emerging opportunities in the Cybersecurity Market are significant and diverse. The increasing adoption of AI and ML for predictive analytics and automated threat response presents a substantial growth area. The burgeoning Internet of Things (IoT) landscape, with its vast network of connected devices, offers a massive opportunity for specialized IoT security solutions. The growing demand for cloud security solutions, driven by the continued migration to cloud environments, remains a key area for expansion. Furthermore, the increasing focus on data privacy and compliance is driving the need for advanced data protection and identity management solutions. The rise of decentralized technologies like blockchain also presents opportunities for developing new security paradigms.

Leading Players in the Cybersecurity Market Market

- Sophos Lt

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- Proofpoint Inc (Thoma Bravo L p )

- Check Point Software Technologies Ltd

- Mcafee LLC

- Cisco Systems Inc

- Microsoft Corporation

- Nortonlifelock Inc (Gen Digital Inc )

Key Developments in Cybersecurity Market Industry

- November 2023: Microsoft Corporation unveiled its Secure Future Initiative (SFI), marking the launch of a new endeavor to pursue the next generation of cybersecurity protection. This initiative will unite Microsoft employees from various departments to advance cybersecurity protection, anchored on three pillars: AI-based cyber defenses, advancements in fundamental software engineering, and advocacy for stronger enforcement of international norms to safeguard civilians from cyber threats.

- May 2023: Proofpoint announced a strategic partnership with The Cybersecurity and Infrastructure Security Agency (CISA) within the Joint Cyber Defense Collaborative (JCDC). Through this collaborative effort, CISA aims to enhance cyber defense by fostering collaboration between government agencies and the private sector.

Strategic Outlook for Cybersecurity Market Market

- November 2023: Microsoft Corporation unveiled its Secure Future Initiative (SFI), marking the launch of a new endeavor to pursue the next generation of cybersecurity protection. This initiative will unite Microsoft employees from various departments to advance cybersecurity protection, anchored on three pillars: AI-based cyber defenses, advancements in fundamental software engineering, and advocacy for stronger enforcement of international norms to safeguard civilians from cyber threats.

- May 2023: Proofpoint announced a strategic partnership with The Cybersecurity and Infrastructure Security Agency (CISA) within the Joint Cyber Defense Collaborative (JCDC). Through this collaborative effort, CISA aims to enhance cyber defense by fostering collaboration between government agencies and the private sector.

Strategic Outlook for Cybersecurity Market Market

The strategic outlook for the Cybersecurity Market is exceptionally positive, driven by the persistent and evolving threat landscape and the increasing reliance on digital technologies across all sectors. The continuous need for robust data protection, compliance with evolving regulations, and the proactive defense against sophisticated cyberattacks will fuel sustained market expansion. Key growth catalysts include the widespread adoption of cloud-native security solutions, the integration of AI and machine learning into cybersecurity platforms for enhanced threat intelligence and automated response, and the growing demand for managed security services to address the cybersecurity talent shortage. The increasing interconnectedness of devices through IoT and the expansion of critical infrastructure into digital realms will create further opportunities for specialized security solutions. Companies focusing on integrated, end-to-end security platforms and those that can offer adaptive and intelligent defense mechanisms are well-positioned for future success.

Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Data Security

- 1.1.4. Identity and Access Management

- 1.1.5. Infrastructure Protection

- 1.1.6. Integrated Risk Management

- 1.1.7. Network Security Equipment

- 1.1.8. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-User Industry

-

3.1. IT and Telecom

- 3.1.1. Use Cases

- 3.2. BFSI

- 3.3. Retail and E-Commerce

- 3.4. Oil Gas and Energy

- 3.5. Manufacturing

- 3.6. Government and Defense

- 3.7. Other End-user Industries

-

3.1. IT and Telecom

Cybersecurity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Greece

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Indonesia

- 3.6. Philippines

- 3.7. Malaysia

- 3.8. Singapore

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise and Other Operational Challenges

- 3.4. Market Trends

- 3.4.1. The Cloud Deployment Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Data Security

- 5.1.1.4. Identity and Access Management

- 5.1.1.5. Infrastructure Protection

- 5.1.1.6. Integrated Risk Management

- 5.1.1.7. Network Security Equipment

- 5.1.1.8. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. IT and Telecom

- 5.3.1.1. Use Cases

- 5.3.2. BFSI

- 5.3.3. Retail and E-Commerce

- 5.3.4. Oil Gas and Energy

- 5.3.5. Manufacturing

- 5.3.6. Government and Defense

- 5.3.7. Other End-user Industries

- 5.3.1. IT and Telecom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Solutions

- 6.1.1.1. Application Security

- 6.1.1.2. Cloud Security

- 6.1.1.3. Data Security

- 6.1.1.4. Identity and Access Management

- 6.1.1.5. Infrastructure Protection

- 6.1.1.6. Integrated Risk Management

- 6.1.1.7. Network Security Equipment

- 6.1.1.8. Other Solutions

- 6.1.2. Services

- 6.1.2.1. Professional Services

- 6.1.2.2. Managed Services

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. IT and Telecom

- 6.3.1.1. Use Cases

- 6.3.2. BFSI

- 6.3.3. Retail and E-Commerce

- 6.3.4. Oil Gas and Energy

- 6.3.5. Manufacturing

- 6.3.6. Government and Defense

- 6.3.7. Other End-user Industries

- 6.3.1. IT and Telecom

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Solutions

- 7.1.1.1. Application Security

- 7.1.1.2. Cloud Security

- 7.1.1.3. Data Security

- 7.1.1.4. Identity and Access Management

- 7.1.1.5. Infrastructure Protection

- 7.1.1.6. Integrated Risk Management

- 7.1.1.7. Network Security Equipment

- 7.1.1.8. Other Solutions

- 7.1.2. Services

- 7.1.2.1. Professional Services

- 7.1.2.2. Managed Services

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. IT and Telecom

- 7.3.1.1. Use Cases

- 7.3.2. BFSI

- 7.3.3. Retail and E-Commerce

- 7.3.4. Oil Gas and Energy

- 7.3.5. Manufacturing

- 7.3.6. Government and Defense

- 7.3.7. Other End-user Industries

- 7.3.1. IT and Telecom

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Solutions

- 8.1.1.1. Application Security

- 8.1.1.2. Cloud Security

- 8.1.1.3. Data Security

- 8.1.1.4. Identity and Access Management

- 8.1.1.5. Infrastructure Protection

- 8.1.1.6. Integrated Risk Management

- 8.1.1.7. Network Security Equipment

- 8.1.1.8. Other Solutions

- 8.1.2. Services

- 8.1.2.1. Professional Services

- 8.1.2.2. Managed Services

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. IT and Telecom

- 8.3.1.1. Use Cases

- 8.3.2. BFSI

- 8.3.3. Retail and E-Commerce

- 8.3.4. Oil Gas and Energy

- 8.3.5. Manufacturing

- 8.3.6. Government and Defense

- 8.3.7. Other End-user Industries

- 8.3.1. IT and Telecom

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Solutions

- 9.1.1.1. Application Security

- 9.1.1.2. Cloud Security

- 9.1.1.3. Data Security

- 9.1.1.4. Identity and Access Management

- 9.1.1.5. Infrastructure Protection

- 9.1.1.6. Integrated Risk Management

- 9.1.1.7. Network Security Equipment

- 9.1.1.8. Other Solutions

- 9.1.2. Services

- 9.1.2.1. Professional Services

- 9.1.2.2. Managed Services

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. IT and Telecom

- 9.3.1.1. Use Cases

- 9.3.2. BFSI

- 9.3.3. Retail and E-Commerce

- 9.3.4. Oil Gas and Energy

- 9.3.5. Manufacturing

- 9.3.6. Government and Defense

- 9.3.7. Other End-user Industries

- 9.3.1. IT and Telecom

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Solutions

- 10.1.1.1. Application Security

- 10.1.1.2. Cloud Security

- 10.1.1.3. Data Security

- 10.1.1.4. Identity and Access Management

- 10.1.1.5. Infrastructure Protection

- 10.1.1.6. Integrated Risk Management

- 10.1.1.7. Network Security Equipment

- 10.1.1.8. Other Solutions

- 10.1.2. Services

- 10.1.2.1. Professional Services

- 10.1.2.2. Managed Services

- 10.1.1. Solutions

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-Premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. IT and Telecom

- 10.3.1.1. Use Cases

- 10.3.2. BFSI

- 10.3.3. Retail and E-Commerce

- 10.3.4. Oil Gas and Energy

- 10.3.5. Manufacturing

- 10.3.6. Government and Defense

- 10.3.7. Other End-user Industries

- 10.3.1. IT and Telecom

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. North America Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Sophos Lt

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 IBM Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Trend Micro Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Fortinet Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Proofpoint Inc (Thoma Bravo L p )

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Check Point Software Technologies Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Mcafee LLC

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Cisco Systems Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Microsoft Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Nortonlifelock Inc (Gen Digital Inc )

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Sophos Lt

List of Figures

- Figure 1: Global Cybersecurity Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cybersecurity Market Revenue (Million), by Offering 2024 & 2032

- Figure 15: North America Cybersecurity Market Revenue Share (%), by Offering 2024 & 2032

- Figure 16: North America Cybersecurity Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: North America Cybersecurity Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: North America Cybersecurity Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 19: North America Cybersecurity Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 20: North America Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Cybersecurity Market Revenue (Million), by Offering 2024 & 2032

- Figure 23: Europe Cybersecurity Market Revenue Share (%), by Offering 2024 & 2032

- Figure 24: Europe Cybersecurity Market Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Europe Cybersecurity Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Europe Cybersecurity Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 27: Europe Cybersecurity Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 28: Europe Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Cybersecurity Market Revenue (Million), by Offering 2024 & 2032

- Figure 31: Asia Cybersecurity Market Revenue Share (%), by Offering 2024 & 2032

- Figure 32: Asia Cybersecurity Market Revenue (Million), by Deployment 2024 & 2032

- Figure 33: Asia Cybersecurity Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 34: Asia Cybersecurity Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 35: Asia Cybersecurity Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 36: Asia Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Cybersecurity Market Revenue (Million), by Offering 2024 & 2032

- Figure 39: Latin America Cybersecurity Market Revenue Share (%), by Offering 2024 & 2032

- Figure 40: Latin America Cybersecurity Market Revenue (Million), by Deployment 2024 & 2032

- Figure 41: Latin America Cybersecurity Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 42: Latin America Cybersecurity Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 43: Latin America Cybersecurity Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 44: Latin America Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Cybersecurity Market Revenue (Million), by Offering 2024 & 2032

- Figure 47: Middle East and Africa Cybersecurity Market Revenue Share (%), by Offering 2024 & 2032

- Figure 48: Middle East and Africa Cybersecurity Market Revenue (Million), by Deployment 2024 & 2032

- Figure 49: Middle East and Africa Cybersecurity Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 50: Middle East and Africa Cybersecurity Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 51: Middle East and Africa Cybersecurity Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 52: Middle East and Africa Cybersecurity Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Cybersecurity Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Global Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 52: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 53: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 54: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: United States Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Canada Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 58: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 59: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 60: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: United Kingdom Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Germany Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: France Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Italy Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Spain Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Greece Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 68: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 69: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 70: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Australia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Indonesia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Philippines Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Malaysia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Singapore Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 80: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 81: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 82: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Brazil Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Argentina Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: Mexico Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Global Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 87: Global Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 88: Global Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 89: Global Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Saudi Arabia Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 91: United Arab Emirates Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: South Africa Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cybersecurity Market?

The projected CAGR is approximately 11.44%.

2. Which companies are prominent players in the Cybersecurity Market?

Key companies in the market include Sophos Lt, IBM Corporation, Trend Micro Inc, Fortinet Inc, Proofpoint Inc (Thoma Bravo L p ), Check Point Software Technologies Ltd, Mcafee LLC, Cisco Systems Inc, Microsoft Corporation, Nortonlifelock Inc (Gen Digital Inc ).

3. What are the main segments of the Cybersecurity Market?

The market segments include Offering, Deployment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 182.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions.

6. What are the notable trends driving market growth?

The Cloud Deployment Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Expertise and Other Operational Challenges.

8. Can you provide examples of recent developments in the market?

November 2023: Microsoft Corporation unveiled its Secure Future Initiative (SFI), marking the launch of a new endeavor to pursue the next generation of cybersecurity protection. This initiative will unite Microsoft employees from various departments to advance cybersecurity protection, anchored on three pillars: AI-based cyber defenses, advancements in fundamental software engineering, and advocacy for stronger enforcement of international norms to safeguard civilians from cyber threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence