Key Insights

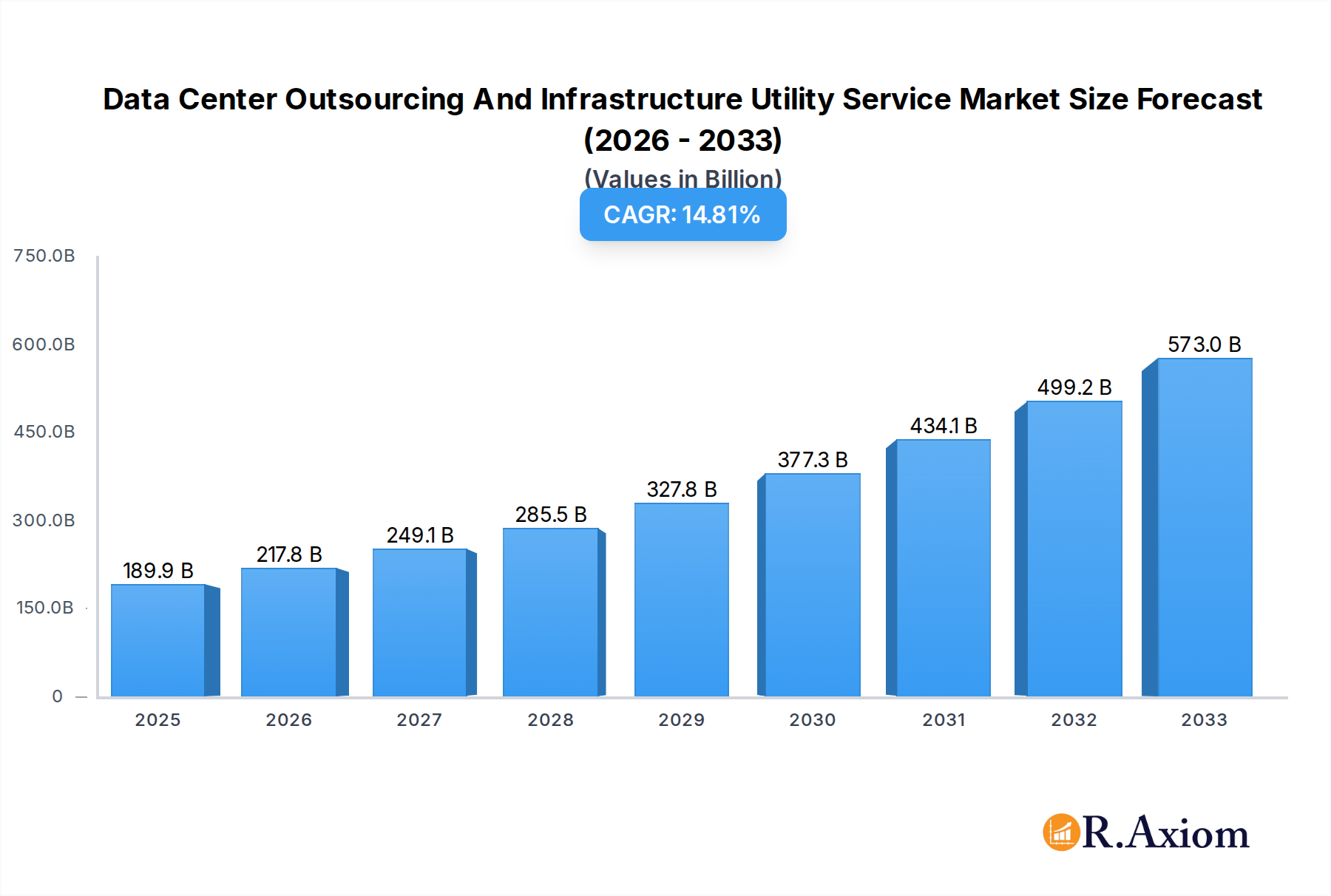

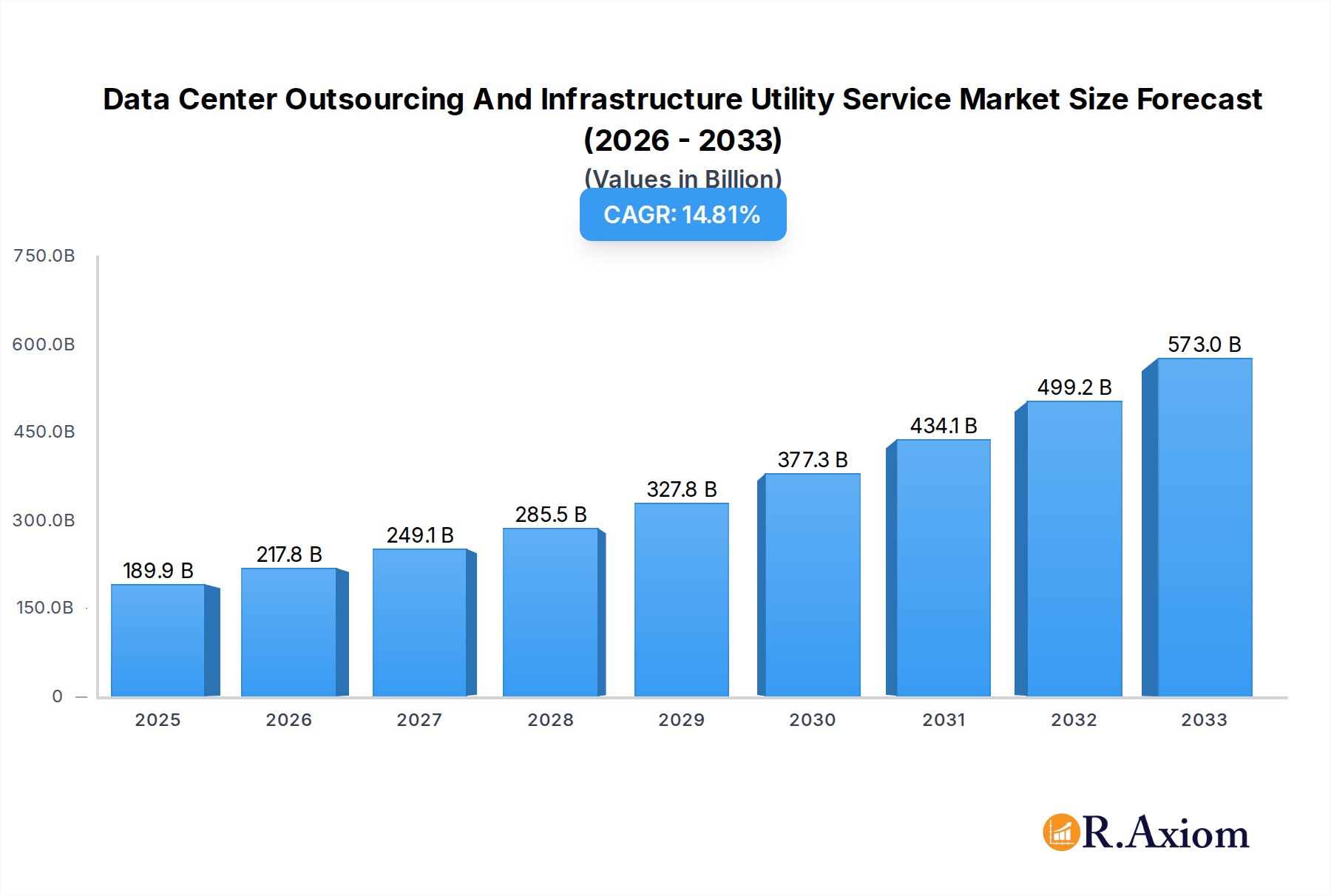

The global Data Center Outsourcing and Infrastructure Utility Service market is poised for significant expansion, with a projected market size of $189.88 billion in 2025. This growth is propelled by a compelling compound annual growth rate (CAGR) of 14.8%, indicating a robust and sustained upward trajectory throughout the forecast period. The primary drivers fueling this market surge include the escalating demand for cost-efficiency, the need for enhanced scalability and flexibility, and the increasing complexity of IT infrastructure management. Organizations across various sectors are recognizing the strategic advantage of outsourcing these critical functions to specialized providers, allowing them to focus on core business competencies while benefiting from expert-level management of their data center operations and utility services. The advent of cloud computing and hybrid cloud strategies further amplifies the need for sophisticated data center outsourcing solutions that can seamlessly integrate with these modern IT architectures.

Data Center Outsourcing And Infrastructure Utility Service Market Size (In Billion)

The market is segmented by application, with BFSI, Healthcare, and IT & Telecommunication sectors emerging as key consumers of these services, driven by their stringent data security requirements, regulatory compliance needs, and the continuous evolution of digital services. The 'Data Center Outsourcing' segment, encompassing colocation, managed hosting, and disaster recovery services, is expected to witness substantial growth, alongside the 'Infrastructure Utility Service' segment, which focuses on power, cooling, and network connectivity management. Emerging trends like the adoption of AI and machine learning for optimizing data center performance, the growing emphasis on sustainability and energy efficiency in data center design, and the rise of edge computing are all contributing to the dynamic landscape. While the market presents immense opportunities, potential restraints include high initial investment costs for some outsourcing models, concerns around data security and vendor lock-in, and the availability of skilled IT professionals to manage complex outsourced environments. Nevertheless, the overarching benefits of agility, reduced operational overhead, and access to cutting-edge technology are expected to outweigh these challenges, driving robust market penetration.

Data Center Outsourcing And Infrastructure Utility Service Company Market Share

This detailed report offers an in-depth analysis of the global Data Center Outsourcing and Infrastructure Utility Service market, providing critical insights for industry stakeholders. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report leverages historical data from 2019–2024 to illuminate current market dynamics and future trajectories. The market, valued in the billions, is meticulously segmented by application and service type, with a focus on key players and transformative industry developments. This analysis is designed to equip businesses with actionable intelligence to navigate the evolving landscape of data center services and infrastructure utilities.

Data Center Outsourcing And Infrastructure Utility Service Market Concentration & Innovation

The global Data Center Outsourcing and Infrastructure Utility Service market exhibits moderate to high concentration, with a significant market share held by a few prominent players like IBM, Accenture, and Fujitsu, collectively commanding an estimated 40 billion in market share in 2025. Innovation remains a key differentiator, driven by the relentless demand for enhanced scalability, security, and cost-efficiency. Key innovation drivers include the adoption of AI and machine learning for predictive maintenance and resource optimization, advancements in hybrid and multi-cloud environments, and the development of sustainable data center solutions. Regulatory frameworks, such as data privacy laws (e.g., GDPR, CCPA), continue to shape operational requirements and compliance strategies, representing a significant industry development valued at xx billion in annual compliance spending. The market faces minimal threats from direct product substitutes due to the specialized nature of data center infrastructure, but indirect competition arises from on-premise solutions for niche applications. End-user trends are heavily influenced by digital transformation initiatives across all sectors, propelling the demand for robust and flexible data center services. Mergers and acquisitions (M&A) are a common strategy to expand service portfolios and geographical reach, with an estimated 50 billion in M&A deal values projected for the forecast period. Notable M&A activities include the consolidation of smaller service providers and strategic acquisitions by larger enterprises to bolster their cloud and infrastructure capabilities.

Data Center Outsourcing And Infrastructure Utility Service Industry Trends & Insights

The Data Center Outsourcing and Infrastructure Utility Service market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033, reaching an estimated market size of 350 billion by 2033. This upward trajectory is fueled by several key market growth drivers. Foremost among these is the escalating volume of data generated globally, necessitating sophisticated infrastructure for storage, processing, and analysis. Digital transformation initiatives across all industries, from BFSI to Healthcare and IT & Telecommunication, are compelling organizations to offload their IT infrastructure management to specialized providers, thereby enhancing agility and operational efficiency. The increasing adoption of cloud computing, particularly hybrid and multi-cloud strategies, is creating a significant demand for outsourcing services that can seamlessly integrate and manage these complex environments. Furthermore, the drive towards cost optimization and capital expenditure reduction encourages businesses to shift from CapEx-intensive on-premise data centers to OpEx-based outsourcing models. Technological disruptions are also playing a pivotal role. The proliferation of AI and machine learning is enabling more intelligent data center operations, including predictive maintenance, automated resource allocation, and enhanced cybersecurity. Edge computing, while creating new infrastructure needs, also drives demand for distributed data center solutions and management services. Consumer preferences are increasingly leaning towards service providers who offer high levels of reliability, security, scalability, and compliance with stringent data privacy regulations. Businesses are seeking partners who can demonstrate expertise in managing complex IT environments and offer tailored solutions to meet specific industry needs. The competitive dynamics within the market are intensifying, characterized by strategic partnerships, service differentiation, and a growing focus on niche service offerings. Companies are investing heavily in R&D to develop innovative solutions, such as green data center technologies and advanced managed services, to gain a competitive edge. The market penetration of outsourcing services is expected to continue its upward climb, particularly in emerging economies that are rapidly digitalizing their economies. The ongoing evolution of the market underscores a shift towards more specialized, outcome-based services that directly contribute to business objectives, rather than simply providing IT infrastructure.

Dominant Markets & Segments in Data Center Outsourcing And Infrastructure Utility Service

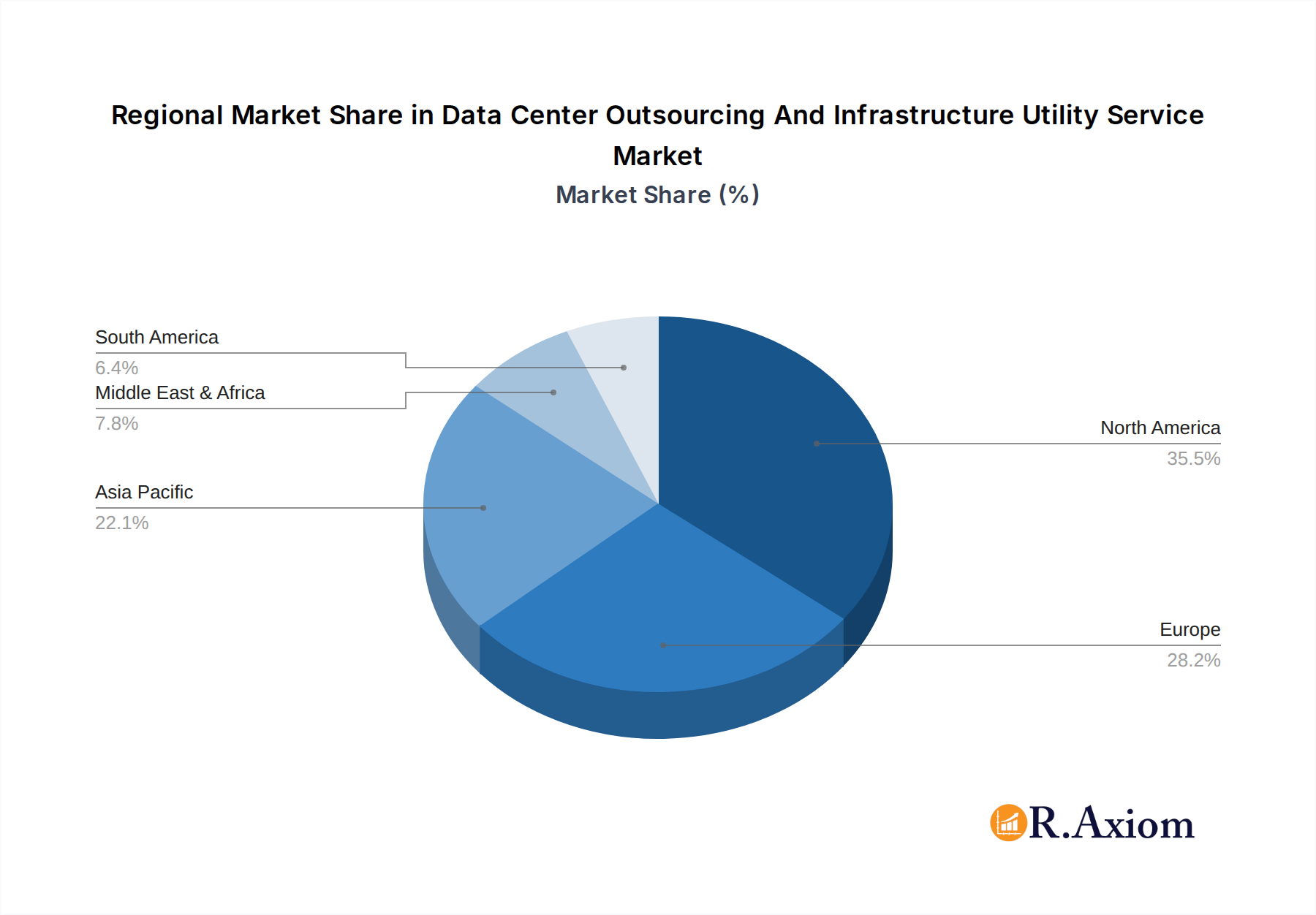

The global Data Center Outsourcing and Infrastructure Utility Service market exhibits significant regional and segment dominance, with North America currently leading in market size, accounting for approximately 35% of the global market share in 2025, projected to reach over 120 billion by 2033. This dominance is attributed to the region's mature digital economy, high adoption of advanced technologies, and a strong presence of major IT corporations. Within North America, the United States stands out as the leading country, driven by its robust technological infrastructure, substantial investments in cloud computing, and a concentration of enterprises across key application segments.

Leading Application Segments:

- BFSI: This segment is a major driver of market growth, accounting for an estimated 25% of the market share in 2025, projected to reach over 87 billion by 2033.

- Key Drivers: Stringent regulatory compliance requirements (e.g., SOX, Basel III), the need for secure and reliable transaction processing, increasing adoption of digital banking services, and the demand for advanced data analytics for risk management and customer insights. Economic policies supporting financial innovation and a mature banking sector further bolster this segment.

- IT & Telecommunication: This sector is another significant contributor, representing approximately 20% of the market share in 2025, projected to reach over 70 billion by 2033.

- Key Drivers: The continuous need for scalable and robust infrastructure to support expanding network services, rapid adoption of new technologies like 5G, the demand for outsourcing non-core IT functions to focus on innovation, and the increasing trend of telcos offering managed cloud services themselves. Industry developments in telecom infrastructure and governmental support for digital connectivity are crucial.

- Healthcare: This segment is poised for substantial growth, holding an estimated 18% market share in 2025, projected to reach over 63 billion by 2033.

- Key Drivers: The transition to electronic health records (EHRs), the rise of telemedicine and remote patient monitoring, the growing use of big data analytics for research and personalized medicine, and stringent data security and privacy regulations (e.g., HIPAA). Government initiatives to modernize healthcare IT infrastructure and substantial healthcare spending contribute significantly.

- Government: This segment is also a key player, accounting for around 15% of the market share in 2025, projected to reach over 52 billion by 2033.

- Key Drivers: Digital transformation of public services, the need for secure data storage for sensitive citizen information, increasing cybersecurity threats, and initiatives for smart city development. Government policies promoting digitization and the necessity for resilient infrastructure are key factors.

- Travels & Logistics: This segment represents approximately 10% of the market share in 2025, projected to reach over 35 billion by 2033.

- Key Drivers: The demand for real-time data management for supply chain visibility, optimization of logistics operations through data analytics, the need for scalable infrastructure to handle fluctuating demand, and the adoption of IoT for tracking and monitoring. Economic policies influencing trade and logistics efficiency are impactful.

- Others: This segment, encompassing manufacturing, retail, and education, represents the remaining 12% of the market share in 2025, projected to reach over 42 billion by 2033.

Dominant Service Types:

- Data Center Outsourcing: This remains the most dominant service type, accounting for roughly 60% of the market share in 2025, driven by the core need to offload infrastructure management.

- Infrastructure Utility Service: This is a rapidly growing segment, representing approximately 35% of the market share in 2025, characterized by pay-as-you-go models and flexible resource provisioning.

- Others: This includes specialized services like colocation and managed hosting, accounting for the remaining 5% in 2025.

The dominance of these segments is underpinned by strong economic policies, robust existing infrastructure, and a forward-looking approach to technological adoption.

Data Center Outsourcing And Infrastructure Utility Service Product Developments

Product developments in the Data Center Outsourcing and Infrastructure Utility Service market are sharply focused on enhancing efficiency, security, and sustainability. Innovations include advanced AI-driven predictive maintenance tools that minimize downtime and optimize energy consumption, contributing to a significant reduction in operational costs. The integration of hybrid and multi-cloud management platforms is a key trend, offering seamless orchestration and governance across diverse cloud environments. Furthermore, there is a growing emphasis on developing energy-efficient cooling technologies and renewable energy sources for data centers, addressing growing environmental concerns and regulatory pressures. These product developments provide competitive advantages by enabling service providers to offer more resilient, cost-effective, and eco-friendly solutions that meet the evolving demands of their clients.

Report Scope & Segmentation Analysis

This report comprehensively segments the Data Center Outsourcing and Infrastructure Utility Service market across key application and service type categories.

Application Segments:

- BFSI: This segment is projected to grow at a CAGR of 9.2% from 2025–2033, driven by the financial sector's critical need for secure, compliant, and highly available data infrastructure. Market size is estimated at over 87 billion by 2033.

- Healthcare: Expected to witness a CAGR of 10.5% during the forecast period, fueled by the digital transformation of healthcare services and the demand for secure patient data management. Market size is projected to exceed 63 billion by 2033.

- IT & Telecommunication: This segment is forecast to grow at a CAGR of 8.0%, supported by the continuous expansion of digital infrastructure and network services. Market size is estimated to reach over 70 billion by 2033.

- Government: Projected to grow at a CAGR of 8.8%, driven by government initiatives for digital public services and enhanced cybersecurity. Market size is estimated to reach over 52 billion by 2033.

- Travels & Logistics: Forecasted to grow at a CAGR of 7.5%, propelled by the need for real-time data management and supply chain optimization. Market size is estimated to reach over 35 billion by 2033.

- Others: This segment is expected to grow at a CAGR of 7.8%, encompassing diverse industries and their evolving IT infrastructure needs. Market size is projected to exceed 42 billion by 2033.

Type Segments:

- Data Center Outsourcing: This segment is expected to maintain its lead, growing at a CAGR of 7.9%, as organizations continue to leverage external expertise for their data center needs.

- Infrastructure Utility Service: This segment is anticipated to experience the highest growth at a CAGR of 11.0%, reflecting the increasing demand for flexible, on-demand IT infrastructure solutions.

- Others: This segment is projected to grow at a CAGR of 6.5%, catering to niche requirements within the data center ecosystem.

Key Drivers of Data Center Outsourcing And Infrastructure Utility Service Growth

The primary growth drivers for the Data Center Outsourcing and Infrastructure Utility Service market are multifaceted. Technological advancements, particularly in cloud computing, AI, and automation, enable more efficient and scalable infrastructure solutions. The increasing volume and complexity of data generated by businesses globally necessitate specialized expertise and robust infrastructure that outsourcing providers can offer. Furthermore, the persistent drive for cost optimization and a desire to shift from capital expenditure to operational expenditure models are compelling organizations to adopt outsourcing services. Evolving regulatory landscapes, while posing compliance challenges, also create opportunities for specialized service providers adept at ensuring data security and privacy. The growing trend of digital transformation across all industries further fuels demand for agile and resilient IT infrastructure.

Challenges in the Data Center Outsourcing And Infrastructure Utility Service Sector

Despite significant growth, the Data Center Outsourcing and Infrastructure Utility Service sector faces several challenges. Regulatory hurdles, including evolving data privacy laws and cross-border data transfer restrictions, can increase compliance costs and complexity. Supply chain issues, such as the availability of specialized hardware and skilled labor, can impact service delivery timelines and costs. Intense competitive pressures from both established players and new market entrants drive down pricing and necessitate continuous innovation. Security vulnerabilities and the ever-present threat of cyberattacks remain a critical concern, requiring substantial investment in robust security measures. The transition to sustainable data center practices also presents challenges in terms of upfront investment and operational adjustments.

Emerging Opportunities in Data Center Outsourcing And Infrastructure Utility Service

Emerging opportunities in the Data Center Outsourcing and Infrastructure Utility Service market are driven by several key trends. The growing adoption of edge computing presents a significant opportunity for distributed data center solutions and management services. The increasing demand for AI and machine learning capabilities within data center operations opens doors for specialized AI-as-a-service offerings. Sustainability is becoming a major differentiator, creating opportunities for providers who can offer green data center solutions and renewable energy integration. The expansion of cloud-native architectures and microservices further drives the need for specialized managed services that can support these modern applications. Furthermore, the digital transformation in emerging economies offers substantial untapped market potential for data center outsourcing and infrastructure utility services.

Leading Players in the Data Center Outsourcing And Infrastructure Utility Service Market

- Atos

- Fujitsu

- CGI

- Accenture

- Capgemini

- Cognizant

- CSC (DXC)

- Ensono

- HCL Technologies

- HPE ES (DXC)

- IBM

- Infosys

- NTT Data

- Sungard AS

- Tata Consultancy Services

- Tech Mahindra

- Unisys

- Wipro

- Zensar

Key Developments in Data Center Outsourcing And Infrastructure Utility Service Industry

- 2023 March: IBM launches a new suite of hybrid cloud services aimed at simplifying data center management for enterprise clients.

- 2023 April: Accenture announces a strategic acquisition of a specialized cloud consulting firm to bolster its multi-cloud capabilities.

- 2023 May: Fujitsu unveils an AI-powered solution for predictive data center maintenance, promising to reduce downtime by 20%.

- 2023 June: Capgemini expands its data center outsourcing services portfolio with a focus on sustainability and energy efficiency.

- 2023 July: Infosys partners with a leading network provider to offer enhanced edge computing infrastructure solutions.

- 2023 August: NTT Data acquires a European data center operator to strengthen its presence in the EMEA region.

- 2024 January: Wipro introduces a new managed services offering for hybrid cloud environments, targeting mid-sized enterprises.

- 2024 February: HCL Technologies launches a next-generation data center modernization program for BFSI clients.

- 2024 March: DXC Technology announces significant investments in expanding its cybersecurity capabilities for data center outsourcing.

- 2024 April: Tech Mahindra expands its global footprint with the opening of new data center facilities in Asia.

- 2024 May: Cognizant announces advancements in its data analytics services for healthcare clients leveraging outsourced infrastructure.

- 2024 June: Zensar Technologies enhances its disaster recovery and business continuity services for the logistics sector.

- 2024 July: Ensono introduces a new sustainability framework for its data center managed services.

- 2024 August: Unisys rolls out enhanced cloud migration services for government agencies.

- 2024 September: Atos announces a partnership to develop green data center technologies.

- 2025 January: Sungard AS enhances its resilient cloud offerings with advanced data protection features.

Strategic Outlook for Data Center Outsourcing And Infrastructure Utility Service Market

The strategic outlook for the Data Center Outsourcing and Infrastructure Utility Service market is exceptionally positive, driven by the ongoing digital transformation and the increasing reliance on robust and scalable IT infrastructure. Service providers are strategically focusing on expanding their capabilities in areas such as hybrid and multi-cloud management, edge computing, and AI-driven automation. The emphasis on sustainability and green IT practices will continue to be a key differentiator and growth catalyst. Furthermore, strategic partnerships and mergers and acquisitions will remain crucial for market players to broaden their service portfolios, enhance their geographical reach, and consolidate their market positions. The future of the market lies in delivering outcome-based solutions that directly contribute to business agility, cost savings, and competitive advantage for clients across all sectors.

Data Center Outsourcing And Infrastructure Utility Service Segmentation

-

1. Application

- 1.1. BFSI

- 1.2. Healthcare

- 1.3. IT & Telecommunication

- 1.4. Government

- 1.5. Travels & Logistics

- 1.6. Others

-

2. Type

- 2.1. Data Center Outsourcing

- 2.2. Infrastructure Utility Service

- 2.3. Others

Data Center Outsourcing And Infrastructure Utility Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center Outsourcing And Infrastructure Utility Service Regional Market Share

Geographic Coverage of Data Center Outsourcing And Infrastructure Utility Service

Data Center Outsourcing And Infrastructure Utility Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. BFSI

- 5.1.2. Healthcare

- 5.1.3. IT & Telecommunication

- 5.1.4. Government

- 5.1.5. Travels & Logistics

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Data Center Outsourcing

- 5.2.2. Infrastructure Utility Service

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. BFSI

- 6.1.2. Healthcare

- 6.1.3. IT & Telecommunication

- 6.1.4. Government

- 6.1.5. Travels & Logistics

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Data Center Outsourcing

- 6.2.2. Infrastructure Utility Service

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. BFSI

- 7.1.2. Healthcare

- 7.1.3. IT & Telecommunication

- 7.1.4. Government

- 7.1.5. Travels & Logistics

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Data Center Outsourcing

- 7.2.2. Infrastructure Utility Service

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. BFSI

- 8.1.2. Healthcare

- 8.1.3. IT & Telecommunication

- 8.1.4. Government

- 8.1.5. Travels & Logistics

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Data Center Outsourcing

- 8.2.2. Infrastructure Utility Service

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. BFSI

- 9.1.2. Healthcare

- 9.1.3. IT & Telecommunication

- 9.1.4. Government

- 9.1.5. Travels & Logistics

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Data Center Outsourcing

- 9.2.2. Infrastructure Utility Service

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. BFSI

- 10.1.2. Healthcare

- 10.1.3. IT & Telecommunication

- 10.1.4. Government

- 10.1.5. Travels & Logistics

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Data Center Outsourcing

- 10.2.2. Infrastructure Utility Service

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Atos

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fujitsu

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CGI

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accenture

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Capgemini

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cognizant

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CSC (DXC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ensono

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HCL Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HPE ES (DXC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IBM

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Infosys

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NTT Data

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sungard AS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tata Consultancy Services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tech Mahindra

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Unisys

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Wipro

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Zensar

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Atos

List of Figures

- Figure 1: Global Data Center Outsourcing And Infrastructure Utility Service Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Data Center Outsourcing And Infrastructure Utility Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Data Center Outsourcing And Infrastructure Utility Service Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Outsourcing And Infrastructure Utility Service?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the Data Center Outsourcing And Infrastructure Utility Service?

Key companies in the market include Atos, Fujitsu, CGI, Accenture, Capgemini, Cognizant, CSC (DXC), Ensono, HCL Technologies, HPE ES (DXC), IBM, Infosys, NTT Data, Sungard AS, Tata Consultancy Services, Tech Mahindra, Unisys, Wipro, Zensar.

3. What are the main segments of the Data Center Outsourcing And Infrastructure Utility Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Outsourcing And Infrastructure Utility Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Outsourcing And Infrastructure Utility Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Outsourcing And Infrastructure Utility Service?

To stay informed about further developments, trends, and reports in the Data Center Outsourcing And Infrastructure Utility Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence