Key Insights

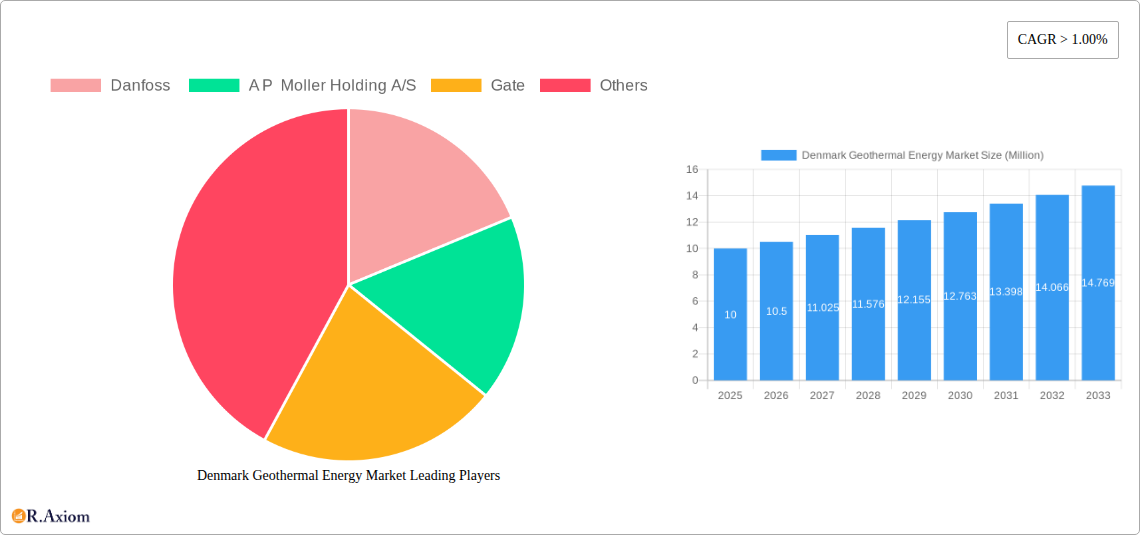

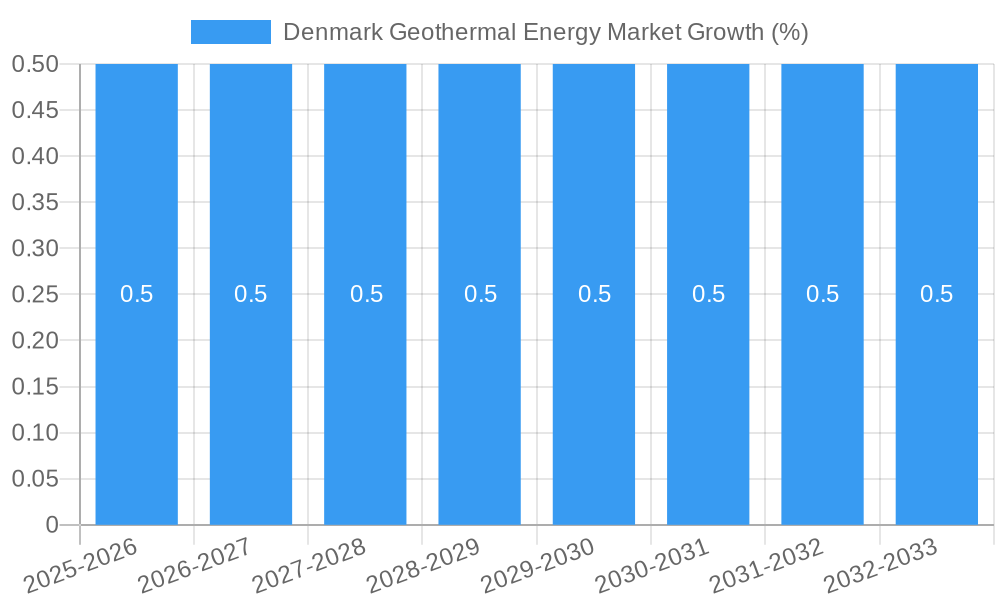

The Denmark geothermal energy market, while currently relatively small, exhibits promising growth potential driven by increasing government support for renewable energy sources and a rising awareness of climate change. The market is segmented by battery type and electrolyte type (Lead-acid, Gel, Lithium-ion, Liquid, Zinc Bromide, and others) and end-user applications (electric vehicles, energy storage, consumer electronics, and others). While precise market size data for 2019-2024 is unavailable, a reasonable estimate based on global trends and a reported CAGR exceeding 1.00% suggests a modest but steadily increasing market value. Considering Denmark's commitment to renewable energy and its geographical suitability for geothermal exploration (though potentially limited compared to more volcanically active regions), the market is likely to see substantial growth, particularly in the energy storage sector. This growth will be fueled by advancements in battery technology, reducing costs and improving efficiency, thereby making geothermal energy more competitive with traditional energy sources. However, restraints such as high initial investment costs associated with geothermal energy exploration and development and the potential environmental impacts of geothermal projects might moderate the growth rate. The focus will likely shift towards optimizing existing geothermal resources and exploring innovative technologies to maximize energy extraction.

Growth in the coming years will be significantly influenced by government policies promoting renewable energy adoption, technological advancements in geothermal energy harvesting and storage (particularly batteries), and the increasing demand for sustainable energy solutions in various sectors. The entry of new players in the market, spurred by the increasing appeal of geothermal energy, is another key factor. The competitive landscape involves established players like Danfoss, A.P. Moller Holding A/S, and Gate, among others. These companies are likely to engage in strategic partnerships and collaborations to accelerate market expansion. The forecast period (2025-2033) will witness a notable increase in the market size, fueled by technological advancements and the growing need for reliable and sustainable energy sources in Denmark.

Denmark Geothermal Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Denmark Geothermal Energy Market, offering valuable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, key players, technological advancements, and future growth prospects. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections (2025-2033) to deliver accurate and actionable intelligence.

Denmark Geothermal Energy Market Concentration & Innovation

This section analyzes the competitive landscape of the Denmark Geothermal Energy market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market exhibits a moderately concentrated structure, with a few dominant players like Danfoss, A P Moller Holding A/S, and Gate holding significant market share. However, the emergence of smaller, innovative companies is steadily increasing competition.

- Market Share: Danfoss holds an estimated xx% market share, while A P Moller Holding A/S holds approximately xx%, and Gate holds about xx%. Remaining players account for xx%.

- Innovation Drivers: Government incentives for renewable energy, coupled with rising concerns about climate change, are significant drivers of innovation. Focus areas include enhanced drilling techniques, improved heat extraction methods, and more efficient energy conversion technologies.

- Regulatory Framework: Denmark's supportive regulatory framework, including feed-in tariffs and tax benefits, encourages investment in geothermal energy. However, permitting processes and environmental regulations can pose challenges.

- Product Substitutes: Other renewable energy sources, such as wind and solar power, present some level of substitution. However, geothermal's baseload capacity offers a significant advantage.

- M&A Activities: While significant M&A activity is not yet prevalent, the January 2022 investment by ATP in a large geothermal plant signals potential for future consolidation within the sector. The estimated value of this deal is xx Million.

Denmark Geothermal Energy Market Industry Trends & Insights

The Denmark Geothermal Energy Market is witnessing robust growth, driven by increasing energy security concerns, government support for renewable energy transition, and the falling cost of geothermal technologies. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Market penetration is expected to increase significantly as the Danish government aims to transition from fossil fuels to renewable energy sources.

Technological advancements, particularly in drilling techniques and heat exchanger designs, are enhancing efficiency and reducing costs. This is attracting investments in larger scale projects like the planned Aarhus plant. The consumer preference for sustainable and reliable energy sources is further propelling market expansion. However, competitive pressures from other renewable sources, as well as the initial high capital costs associated with geothermal projects, need to be considered.

Dominant Markets & Segments in Denmark Geothermal Energy Market

The Danish geothermal energy market is currently dominated by the district heating segment, particularly in urban areas with established infrastructure. While the electric vehicle and energy storage sectors hold potential for future growth, their current contributions are relatively limited.

End-User Segments:

- District Heating: This segment is the most mature and dominant, driven by expanding district heating networks and government support for renewable heat sources. The market size for this segment in 2025 is estimated to be xx Million.

- Electric Vehicles: This segment has minimal penetration currently, though future growth potential is significant with increased EV adoption.

- Energy Storage: This sector presents opportunities for geothermal energy to provide baseload power for battery storage solutions.

- Consumer Electronics: This segment currently has negligible usage of geothermal energy.

- Other End Users: This includes industrial processes and agricultural applications with limited current usage.

Key Drivers:

- Government Policies: Supportive policies and incentives drive investments.

- Existing Infrastructure: Established district heating networks provide a ready market.

- Technological Advancements: Improvements in drilling and heat exchange technologies reduce project costs.

Denmark Geothermal Energy Market Product Developments

Recent product innovations in the Denmark Geothermal Energy Market center on improving drilling efficiencies and heat exchanger designs. These advancements lead to lower project costs and increased energy yield, making geothermal energy more competitive with other renewable energy sources. These innovative products are finding particular market fit in the district heating sector due to its existing infrastructure and regulatory support.

Report Scope & Segmentation Analysis

This report segments the Denmark Geothermal Energy Market by battery type and electrolyte type, as well as end-user applications.

- Battery Type and Electrolyte Type: Lead Acid, Gel Electrolyte, Lithium-ion, Liquid Electrolyte (Flow Battery), Zinc Bromide, and Other Battery Types and Electrolyte Types. The report projects future growth for Li-ion batteries driven by technological advancements and reduced costs.

- End User: Electric Vehicle, Energy Storage, Consumer Electronics, and Other End Users. The report emphasizes the current dominance of the district heating segment while also analyzing the future potential of Electric Vehicles and Energy Storage.

Each segment's growth projections, market sizes, and competitive dynamics are detailed within the full report.

Key Drivers of Denmark Geothermal Energy Market Growth

Several factors contribute to the growth of Denmark's geothermal energy market. Strong government support through subsidies and tax incentives is a primary driver. Rising energy prices and concerns over energy security further propel the adoption of domestically sourced geothermal energy. Technological advancements leading to cost reductions make geothermal increasingly competitive. Furthermore, Denmark's ambitious climate targets necessitate a transition away from fossil fuels, boosting the market for renewable alternatives like geothermal.

Challenges in the Denmark Geothermal Energy Market Sector

Despite the favorable conditions, the Denmark geothermal energy market faces challenges. High upfront capital costs associated with exploration and drilling can be a significant barrier for smaller projects. The unpredictable geological conditions in some areas add risks and complexity to project development. Furthermore, while the regulatory framework is supportive, navigating permitting processes can still prove time-consuming and complex.

Emerging Opportunities in Denmark Geothermal Energy Market

The integration of geothermal energy with other renewable sources, such as solar and wind power, presents significant opportunities. Exploring geothermal resources beyond urban areas for industrial or agricultural applications offers further potential. Advances in heat pump technology could boost the market's expansion into new applications, further driving growth. Finally, the increasing demand for reliable and sustainable energy sources will continue to fuel the market's expansion.

Leading Players in the Denmark Geothermal Energy Market Market

- Danfoss

- A P Moller Holding A/S

- Gate

Key Developments in Denmark Geothermal Energy Market Industry

- December 2022: Innargi's agreement with Fors to explore geothermal heating in Holbaek signals potential for expansion into new geographic areas and demonstrates the increasing collaboration between private developers and municipalities.

- January 2022: ATP's investment in Aarhus's planned geothermal plant represents a significant commitment to the sector and highlights the attractiveness of large-scale geothermal projects. This development could trigger further investments in the Danish geothermal energy sector.

Strategic Outlook for Denmark Geothermal Energy Market Market

The Denmark Geothermal Energy Market is poised for substantial growth over the next decade. Continued government support, technological advancements, and increasing awareness of climate change will fuel market expansion. The integration of geothermal energy into diverse applications, particularly in the transportation and energy storage sectors, holds significant potential. The ongoing development of large-scale projects signals a maturing market and promising future for geothermal energy in Denmark.

Denmark Geothermal Energy Market Segmentation

-

1. Type

- 1.1. Deep Geothermal Systems

- 1.2. Shallow Geothermal Systems

-

2. Application

- 2.1. Electricity Generation

- 2.2. Direct Heating

- 2.3. Heat Pumps

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Denmark Geothermal Energy Market Segmentation By Geography

- 1. Denmark

Denmark Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Geothermal energy is increasingly integrated into Denmark's district heating systems

- 3.2.2 providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend

- 3.2.3 enhancing the attractiveness of shallow geothermal resources.

- 3.3. Market Restrains

- 3.3.1 The upfront capital required for geothermal energy projects

- 3.3.2 including exploration

- 3.3.3 drilling

- 3.3.4 and plant construction

- 3.3.5 can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy

- 3.4. Market Trends

- 3.4.1 Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels

- 3.4.2 aligning with the country's sustainability objectives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Deep Geothermal Systems

- 5.1.2. Shallow Geothermal Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity Generation

- 5.2.2. Direct Heating

- 5.2.3. Heat Pumps

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danfoss

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A P Moller Holding A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 Danfoss

List of Figures

- Figure 1: Denmark Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Geothermal Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Denmark Geothermal Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Denmark Geothermal Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Denmark Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Denmark Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Denmark Geothermal Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Denmark Geothermal Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Denmark Geothermal Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Denmark Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Geothermal Energy Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Denmark Geothermal Energy Market?

Key companies in the market include Danfoss , A P Moller Holding A/S, Gate.

3. What are the main segments of the Denmark Geothermal Energy Market?

The market segments include Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Geothermal energy is increasingly integrated into Denmark's district heating systems. providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend. enhancing the attractiveness of shallow geothermal resources..

6. What are the notable trends driving market growth?

Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels. aligning with the country's sustainability objectives.

7. Are there any restraints impacting market growth?

The upfront capital required for geothermal energy projects. including exploration. drilling. and plant construction. can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy.

8. Can you provide examples of recent developments in the market?

December 2022: The Danish geothermal developer Innargi has entered into an agreement with Fors to investigate the possibility of geothermal heating in the Danish city of Holbaek. Innargi has indicated that the geothermal heat will be delivered in conjunction with the expansion of the district heating network in Holbaek by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Denmark Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence