Key Insights

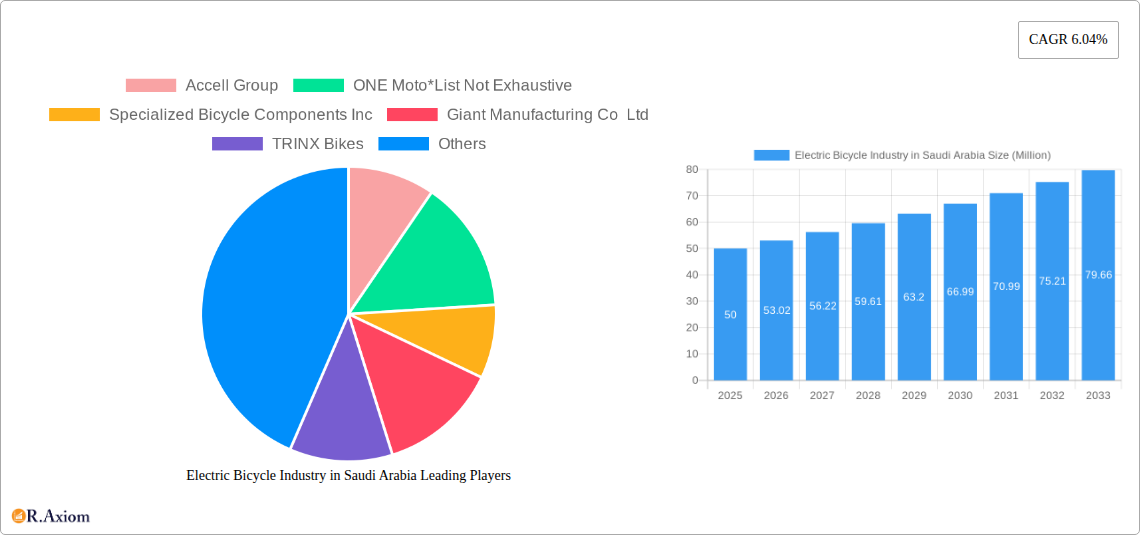

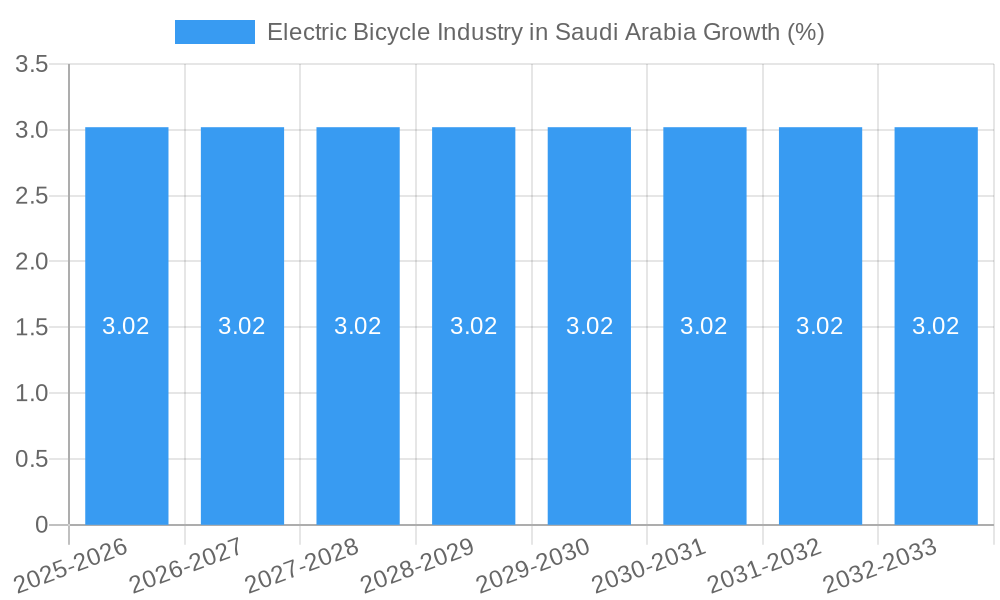

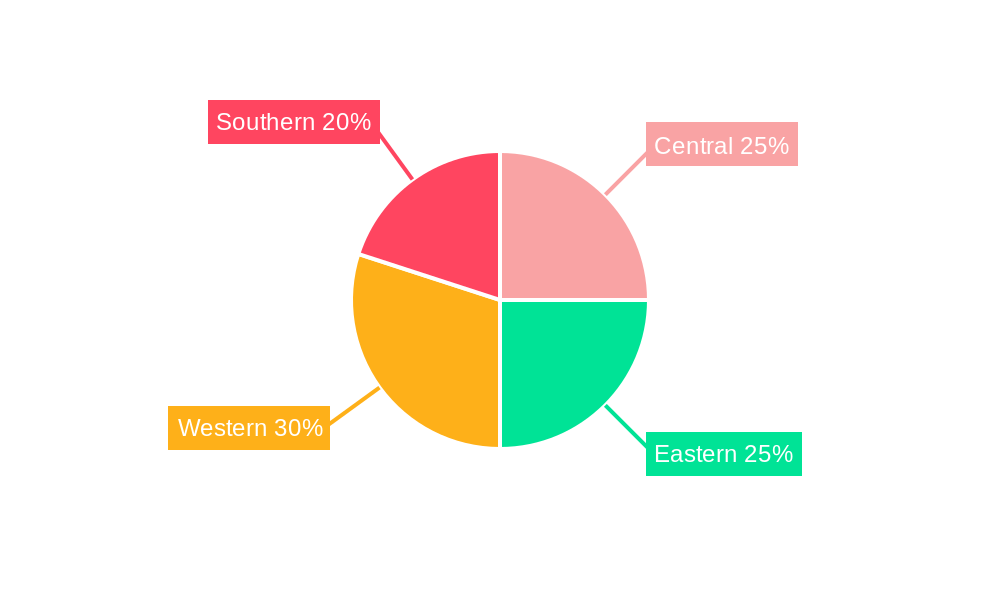

The Saudi Arabian electric bicycle market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.04% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives promoting sustainable transportation, coupled with rising fuel prices and increasing environmental awareness among consumers, are significantly boosting demand. The growing popularity of cycling as a recreational activity and the convenience offered by e-bikes for commuting within Saudi Arabia's urban centers further contribute to market growth. Market segmentation reveals strong interest in lithium-ion battery-powered e-bikes, particularly pedal-assisted and throttle-assisted models used for city/urban commuting and e-mountain biking. While the market is dominated by international players like Accell Group, Giant Manufacturing, and Specialized, domestic players are also emerging, capitalizing on localized preferences and distribution networks. However, challenges remain, including the relatively high initial cost of e-bikes compared to traditional bicycles and the need for expanded charging infrastructure across the country. Furthermore, consumer awareness regarding the benefits of e-bikes and their technological advancements still needs further promotion. The market's future hinges on addressing these restraints through targeted marketing campaigns, government incentives, and further investment in charging infrastructure. The regional distribution within Saudi Arabia – across Central, Eastern, Western, and Southern regions – indicates a potential for tailored marketing strategies to maximize penetration across diverse demographics.

The forecast period of 2025-2033 presents significant opportunities for both established and emerging players. Strategies focusing on affordable models, improved battery technology, and enhanced after-sales services will be crucial for success. Collaborations between manufacturers and local distributors, particularly in less-developed regions, can effectively expand market reach. The development of tailored financing options could also alleviate the high initial cost barrier, attracting a wider consumer base. Focusing on specific applications – such as last-mile delivery for businesses or dedicated models for tourism – presents additional avenues for growth. The diverse landscape of Saudi Arabia, with varying terrain and climatic conditions, requires e-bike models designed for specific regional needs. This necessitates a targeted approach that considers factors like temperature, terrain, and specific consumer preferences in each region.

Electric Bicycle Industry in Saudi Arabia: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the burgeoning electric bicycle (e-bike) industry in Saudi Arabia, covering the period 2019-2033. With a focus on market segmentation, key players, and future trends, this report offers actionable insights for industry stakeholders, investors, and businesses seeking to enter or expand within this rapidly evolving sector. The report leverages extensive market research and data analysis to provide a comprehensive overview of the Saudi Arabian e-bike market, including detailed forecasts and assessments.

Electric Bicycle Industry in Saudi Arabia Market Concentration & Innovation

The Saudi Arabian electric bicycle market is characterized by a moderately concentrated landscape, with both international and local players vying for market share. While major global brands like Accell Group, Specialized Bicycle Components Inc, Giant Manufacturing Co Ltd, Trek Bicycle Corporation, and myStromer AG hold significant influence, the presence of regional players like Eveons Mobility Systems LLC and TRINX Bikes indicates a growing local presence. Market share data for 2024 suggests that the top five players collectively account for approximately 60% of the market, indicating room for both expansion and competition.

Innovation is driven by several factors: Government initiatives promoting sustainable transportation are pushing for e-bike adoption. Technological advancements in battery technology (Lithium-ion battery dominating the market, with Lead-acid Battery holding a smaller share and Other Battery Types still emerging), motor efficiency (Less than and Equal to 250W and Above 250W segments experiencing varied growth), and connectivity are enhancing e-bike features and appeal. Furthermore, the emergence of shared e-bike programs, as evidenced by TIER's entry into the Saudi market, is fostering innovation in fleet management and usage models. Mergers and acquisitions (M&A) activities remain relatively limited in this market. However, strategic partnerships, like the one between TIER and Sela Sport Company, are increasingly common, driving innovation and market expansion. Predicted M&A deal values for 2025-2033 are estimated at xx Million, largely driven by potential investments in local startups and expansion by established international players.

Electric Bicycle Industry in Saudi Arabia Industry Trends & Insights

The Saudi Arabian e-bike market is experiencing substantial growth, fueled by a confluence of factors. Increasing awareness of environmental concerns and the government’s focus on sustainable transportation initiatives are key catalysts. The rising urban population and increasing traffic congestion are boosting the demand for efficient and eco-friendly personal transport options. Furthermore, decreasing battery costs and improving technology are making e-bikes increasingly affordable and attractive to a wider consumer base. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration remains relatively low compared to other developed markets, however, with significant potential for growth. This growth is also being further boosted by the improving public infrastructure in major cities which is better accommodating the use of e-bikes. Consumer preferences are shifting towards higher-performance models with advanced features such as integrated GPS, improved battery ranges, and smart connectivity options. The competitive landscape is dynamic with both established international players and emerging local brands actively shaping market dynamics. The introduction of shared e-bike services further enhances the market's evolution.

Dominant Markets & Segments in Electric Bicycle Industry in Saudi Arabia

Dominant Segments:

- By Propulsion Type: Pedal-assisted e-bikes currently dominate the market due to their balance of exertion and convenience, holding approximately 70% of market share. Throttle-assisted models are gaining popularity, but their market share remains smaller.

- By Application: City/Urban e-bikes constitute the largest segment, driven by their suitability for commuting and short-distance travel. However, the E-Mountain and Cargo segments are showing strong growth potential, particularly in niche markets.

- By Battery Type: Lithium-ion batteries overwhelmingly dominate the market due to their superior energy density and longevity.

- By Power: The Less than and Equal to 250W segment currently holds a larger market share, aligning with regulatory frameworks and consumer preferences for convenient urban commuting. However, the Above 250W segment is experiencing gradual growth, catering to more demanding users and off-road applications.

Key Drivers of Segment Dominance:

- Economic Policies: Government subsidies and incentives for green transportation are bolstering the adoption of e-bikes.

- Infrastructure: Improvements in cycling infrastructure in major urban areas are contributing to increased e-bike usage.

- Consumer Preferences: The preference for eco-friendly, convenient, and affordable transportation options is driving demand for specific e-bike types.

Electric Bicycle Industry in Saudi Arabia Product Developments

Recent product innovations focus on enhanced battery technology, improved motor efficiency, and integrated smart features. Manufacturers are emphasizing lightweight designs, longer battery ranges, and improved safety features to cater to diverse consumer needs. The integration of GPS tracking and connectivity features is also becoming increasingly common, creating opportunities for service providers. These developments are designed to enhance usability, performance, and overall consumer experience, leading to increased market penetration and brand differentiation.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the Saudi Arabian e-bike market, segmented by Propulsion Type (Pedal Assisted, Throttle-assisted), Application (E-Mountain, Cargo, City/Urban), Battery Type (Lithium-ion, Lead-acid, Other), and Power (Less than or equal to 250W, Above 250W). Each segment’s growth projections, market size (in Millions), and competitive dynamics are thoroughly investigated. The report provides a comprehensive overview of the current market landscape and future growth projections. The xx Million market size in 2025 is projected to reach xx Million by 2033, with the dominance of specific segments influencing this overall growth.

Key Drivers of Electric Bicycle Industry in Saudi Arabia Growth

The growth of the Saudi Arabian e-bike market is primarily driven by several factors: government initiatives promoting sustainable transportation, increasing urbanization and traffic congestion, declining battery costs, and technological advancements leading to improved e-bike performance and features. Furthermore, rising environmental awareness among consumers is bolstering the demand for environmentally friendly transportation alternatives. These combined forces are creating a favorable environment for the expansion of the e-bike market in Saudi Arabia.

Challenges in the Electric Bicycle Industry in Saudi Arabia Sector

Several challenges hinder the growth of the Saudi Arabian e-bike market. These include the relatively high initial cost of e-bikes compared to traditional bicycles, limited charging infrastructure in certain areas, and concerns regarding safety and security. Moreover, the lack of dedicated cycling lanes and infrastructure in some regions poses a significant constraint. The impact of these challenges is reflected in the slower-than-expected market penetration and the continued dominance of other modes of transportation.

Emerging Opportunities in Electric Bicycle Industry in Saudi Arabia

Significant opportunities exist for the expansion of the e-bike market in Saudi Arabia. These include the growing demand for last-mile connectivity solutions, the potential for integrating e-bikes into shared mobility programs, and the increasing interest in e-cargo bikes for logistics and delivery applications. The development of specialized e-bikes for tourism and recreation also presents considerable potential. Focusing on these opportunities can unlock significant growth for the sector.

Leading Players in the Electric Bicycle Industry in Saudi Arabia Market

- Accell Group

- ONE Moto*

- Specialized Bicycle Components Inc

- Giant Manufacturing Co Ltd

- TRINX Bikes

- Trek Bicycle Corporation

- Eveons Mobility Systems LLC

- myStromer AG

Key Developments in Electric Bicycle Industry in Saudi Arabia Industry

- June 2022: TIER launches shared e-bike services in Saudi Arabia through a partnership with Sela Sport Company, backed by SoftBank Investment Advisers. This marks a significant step towards establishing shared mobility options in the country.

- December 2021: Fenix launches on-demand shared e-bikes in the UAE and Qatar, indicating growing interest in shared micro-mobility services in the region, setting a precedent for potential expansion into Saudi Arabia.

Strategic Outlook for Electric Bicycle Industry in Saudi Arabia Market

The Saudi Arabian e-bike market holds significant future potential. Government support, rising environmental consciousness, and technological advancements are creating a positive environment for growth. The expansion of shared mobility programs and the development of innovative e-bike models tailored to specific needs will further drive market expansion. The sector's future hinges on addressing challenges related to infrastructure development and affordability to unlock its full potential.

Electric Bicycle Industry in Saudi Arabia Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Throttle-assisted (Power-on-demand)

-

2. Application

- 2.1. E-Mountain

- 2.2. Cargo

- 2.3. City/Urban

-

3. Battery Type

- 3.1. Lithium-ion Battery

- 3.2. Lead-acid Battery

- 3.3. Other Battery Types

-

4. Power

- 4.1. Less than and Equal to 250W

- 4.2. Above 250W

Electric Bicycle Industry in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Bicycle Industry in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations and Material Advancements is Likely to Fuel Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential

- 3.4. Market Trends

- 3.4.1. E-Cargo Bikes Segment is Expected to Play Key Role in the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Throttle-assisted (Power-on-demand)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. E-Mountain

- 5.2.2. Cargo

- 5.2.3. City/Urban

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lithium-ion Battery

- 5.3.2. Lead-acid Battery

- 5.3.3. Other Battery Types

- 5.4. Market Analysis, Insights and Forecast - by Power

- 5.4.1. Less than and Equal to 250W

- 5.4.2. Above 250W

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Throttle-assisted (Power-on-demand)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. E-Mountain

- 6.2.2. Cargo

- 6.2.3. City/Urban

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lithium-ion Battery

- 6.3.2. Lead-acid Battery

- 6.3.3. Other Battery Types

- 6.4. Market Analysis, Insights and Forecast - by Power

- 6.4.1. Less than and Equal to 250W

- 6.4.2. Above 250W

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Throttle-assisted (Power-on-demand)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. E-Mountain

- 7.2.2. Cargo

- 7.2.3. City/Urban

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lithium-ion Battery

- 7.3.2. Lead-acid Battery

- 7.3.3. Other Battery Types

- 7.4. Market Analysis, Insights and Forecast - by Power

- 7.4.1. Less than and Equal to 250W

- 7.4.2. Above 250W

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Throttle-assisted (Power-on-demand)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. E-Mountain

- 8.2.2. Cargo

- 8.2.3. City/Urban

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lithium-ion Battery

- 8.3.2. Lead-acid Battery

- 8.3.3. Other Battery Types

- 8.4. Market Analysis, Insights and Forecast - by Power

- 8.4.1. Less than and Equal to 250W

- 8.4.2. Above 250W

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Throttle-assisted (Power-on-demand)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. E-Mountain

- 9.2.2. Cargo

- 9.2.3. City/Urban

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lithium-ion Battery

- 9.3.2. Lead-acid Battery

- 9.3.3. Other Battery Types

- 9.4. Market Analysis, Insights and Forecast - by Power

- 9.4.1. Less than and Equal to 250W

- 9.4.2. Above 250W

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Throttle-assisted (Power-on-demand)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. E-Mountain

- 10.2.2. Cargo

- 10.2.3. City/Urban

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lithium-ion Battery

- 10.3.2. Lead-acid Battery

- 10.3.3. Other Battery Types

- 10.4. Market Analysis, Insights and Forecast - by Power

- 10.4.1. Less than and Equal to 250W

- 10.4.2. Above 250W

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Central Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 12. Eastern Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 13. Western Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 14. Southern Electric Bicycle Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Accell Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 ONE Moto*List Not Exhaustive

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Specialized Bicycle Components Inc

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Giant Manufacturing Co Ltd

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 TRINX Bikes

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Trek Bicycle Corporation

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Eveons Mobility Systems LLC

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 myStromer AG

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.1 Accell Group

List of Figures

- Figure 1: Global Electric Bicycle Industry in Saudi Arabia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Saudi Arabia Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 3: Saudi Arabia Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 5: North America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 6: North America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Battery Type 2024 & 2032

- Figure 9: North America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Battery Type 2024 & 2032

- Figure 10: North America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Power 2024 & 2032

- Figure 11: North America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Power 2024 & 2032

- Figure 12: North America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 15: South America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 16: South America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Application 2024 & 2032

- Figure 17: South America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Battery Type 2024 & 2032

- Figure 19: South America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Battery Type 2024 & 2032

- Figure 20: South America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Power 2024 & 2032

- Figure 21: South America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Power 2024 & 2032

- Figure 22: South America Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 25: Europe Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 26: Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Battery Type 2024 & 2032

- Figure 29: Europe Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Battery Type 2024 & 2032

- Figure 30: Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Power 2024 & 2032

- Figure 31: Europe Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Power 2024 & 2032

- Figure 32: Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 35: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 36: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Battery Type 2024 & 2032

- Figure 39: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Battery Type 2024 & 2032

- Figure 40: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Power 2024 & 2032

- Figure 41: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Power 2024 & 2032

- Figure 42: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 45: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 46: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Application 2024 & 2032

- Figure 47: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Application 2024 & 2032

- Figure 48: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Battery Type 2024 & 2032

- Figure 49: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Battery Type 2024 & 2032

- Figure 50: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Power 2024 & 2032

- Figure 51: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Power 2024 & 2032

- Figure 52: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 6: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Central Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southern Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 15: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 16: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 21: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 23: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 24: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 29: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 31: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 32: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Kingdom Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: France Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Spain Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Russia Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Benelux Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Nordics Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 43: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 45: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 46: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 54: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 56: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Power 2019 & 2032

- Table 57: Global Electric Bicycle Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 58: China Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Japan Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: ASEAN Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Oceania Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific Electric Bicycle Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bicycle Industry in Saudi Arabia?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the Electric Bicycle Industry in Saudi Arabia?

Key companies in the market include Accell Group, ONE Moto*List Not Exhaustive, Specialized Bicycle Components Inc, Giant Manufacturing Co Ltd, TRINX Bikes, Trek Bicycle Corporation, Eveons Mobility Systems LLC, myStromer AG.

3. What are the main segments of the Electric Bicycle Industry in Saudi Arabia?

The market segments include Propulsion Type, Application, Battery Type, Power.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations and Material Advancements is Likely to Fuel Demand.

6. What are the notable trends driving market growth?

E-Cargo Bikes Segment is Expected to Play Key Role in the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential.

8. Can you provide examples of recent developments in the market?

In June 2022, TIER, the world's leading shared micro-mobility provider that offers electric vehicles ranging from e-scooters to e-bikes, announces its arrival to the Kingdom of Saudi Arabia through a partnership with Sela Sport Company.The partnership was initiated by SoftBank Investment Advisers in Riyadh following SoftBank's investment in Tier in November 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bicycle Industry in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bicycle Industry in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bicycle Industry in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Electric Bicycle Industry in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence