Key Insights

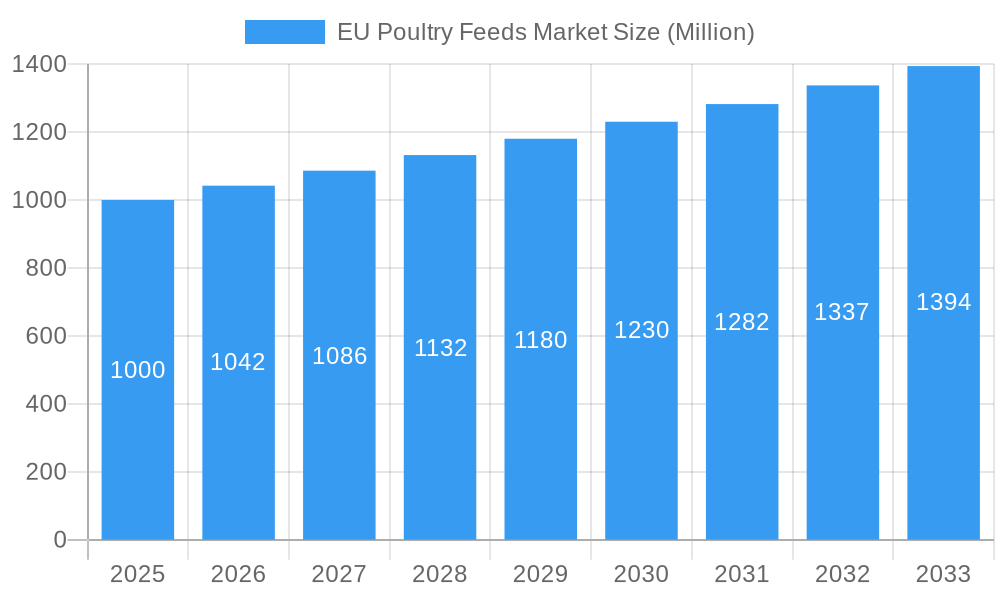

The EU poultry feeds market, valued at approximately €[Estimate based on market size XX and value unit Million - let's assume XX = 1000 for example purposes, resulting in 1000 million Euros in 2025] million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 4.20% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing poultry consumption within the EU, fueled by rising populations and changing dietary preferences, necessitates a larger feed supply. Secondly, advancements in feed formulation, focusing on improved nutrient utilization and enhanced animal health, are contributing to higher productivity and profitability for poultry farmers. Finally, the EU's focus on sustainable agriculture practices is driving innovation in feed ingredient sourcing and processing, with a greater emphasis on locally sourced, environmentally friendly components such as cereals and oilseed meals, partially replacing imported ingredients like fishmeal.

EU Poultry Feeds Market Market Size (In Billion)

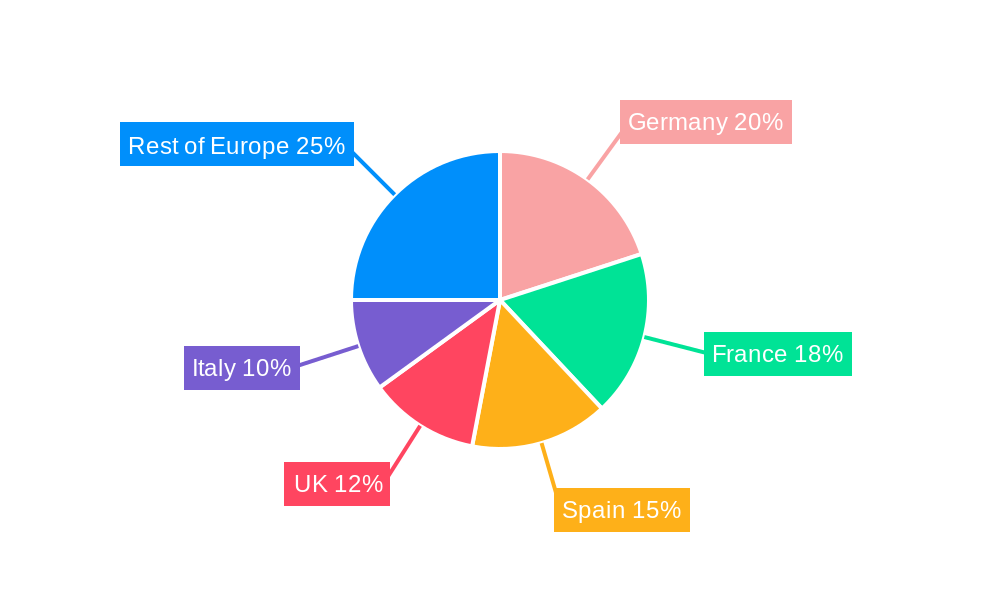

However, the market faces certain restraints. Fluctuations in raw material prices, particularly for essential ingredients like cereals and oilseed meals, can impact profitability and overall market growth. Furthermore, stricter regulations regarding feed safety and environmental impact are increasing production costs and operational complexities for feed manufacturers. The market is segmented by animal type (layer, broiler, turkey, others) and ingredient type (cereals, oilseed meals, molasses, fish oils and fish meals, supplements, others). Broiler feed currently dominates the market due to high broiler meat consumption, while cereals form the largest ingredient segment due to their cost-effectiveness and nutritional value. Key players like Royal Agrifirm Group, Roquette Freres S.A., Nutreco NV, BASF SE, and Cargill Inc. are actively shaping the market landscape through innovation and strategic expansions. Regional variations exist, with Germany, France, Spain, and the UK representing significant market segments, reflecting differing poultry production levels and consumer preferences within those nations.

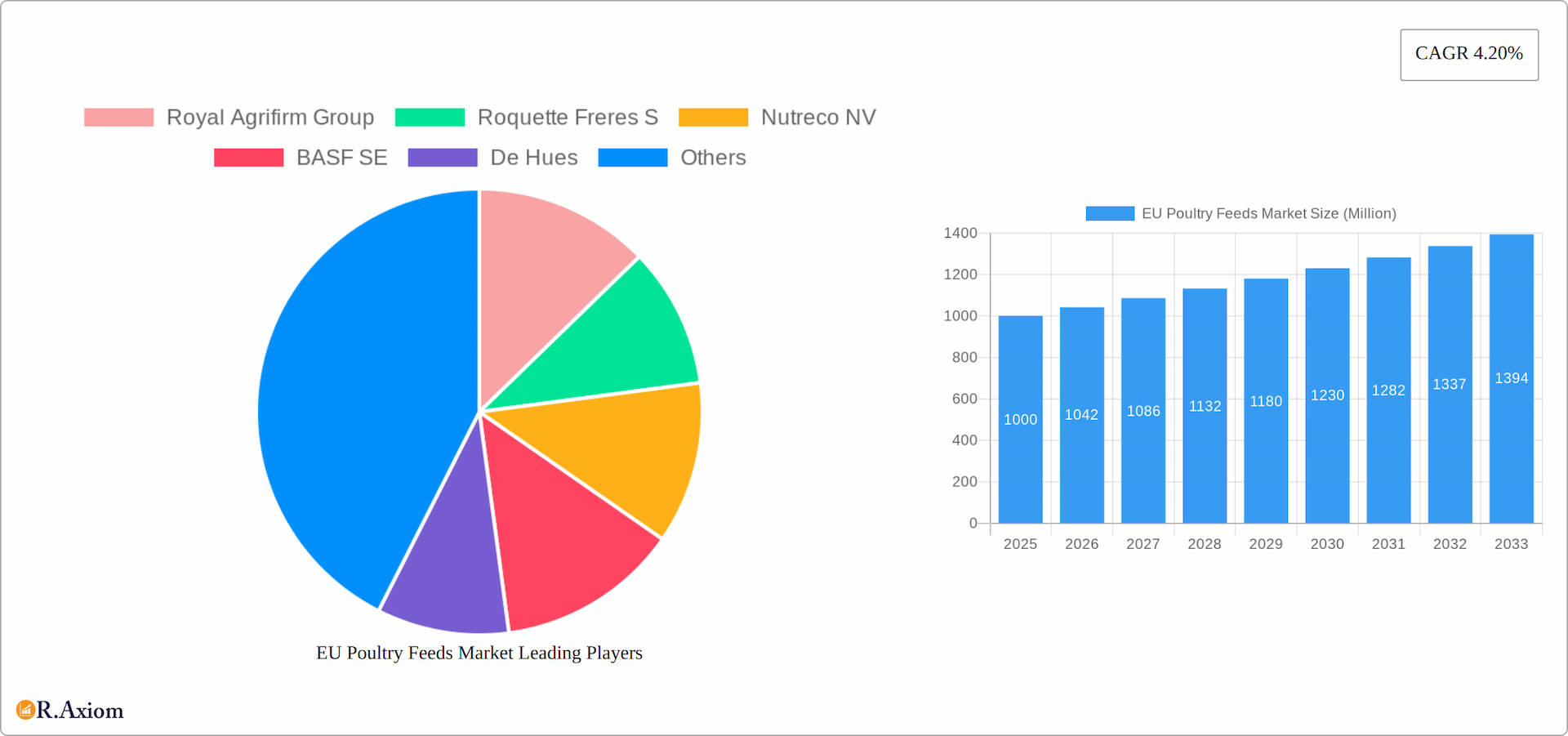

EU Poultry Feeds Market Company Market Share

This comprehensive report provides an in-depth analysis of the EU Poultry Feeds market, covering market size, growth drivers, challenges, opportunities, and competitive landscape. The report examines the market from 2019 to 2024 (historical period), estimates the market for 2025 (estimated year), and forecasts market trends from 2025 to 2033 (forecast period), using 2025 as the base year. The analysis encompasses various segments, including animal type and feed ingredients, and identifies key players shaping the market's trajectory. This report is an essential resource for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic market.

EU Poultry Feeds Market Market Concentration & Innovation

The EU poultry feeds market exhibits a moderately concentrated structure, with several large multinational companies holding significant market share. Companies like Cargill Inc, Nutreco NV, and De Heus dominate the landscape, leveraging their extensive distribution networks and established brand recognition. However, smaller regional players also contribute significantly, particularly in specialized feed segments. Market share data from 2024 indicates Cargill holds approximately xx% market share, Nutreco holds xx%, and De Heus holds xx%, with the remaining share distributed among other players including Royal Agrifirm Group, Roquette Freres S, BASF SE, Alltech Inc, Danish Agro, and Terrena.

Innovation in the EU poultry feeds market is driven by several factors, including:

- Technological advancements: Precision feed formulations, utilizing data analytics and advanced nutritional modeling, are gaining traction. This allows for optimized feed composition, leading to improved animal health, growth rates, and reduced feed costs.

- Regulatory pressures: The increasing focus on animal welfare and sustainable practices mandates the development of more environmentally friendly and antibiotic-free feed solutions. This is driving innovation in alternative protein sources and feed additives.

- Consumer demand: Growing consumer awareness regarding food safety and traceability fuels the demand for poultry produced with sustainable and ethically sourced feed. This has placed a premium on transparency and certification throughout the supply chain.

M&A activities have played a significant role in shaping the market landscape. For instance, the acquisition of Golpasz by De Heus in 2021 significantly strengthened De Heus's position in the Polish broiler feed market. While exact M&A deal values are confidential for many transactions, these activities demonstrate the pursuit of consolidation and market expansion within the sector. The total value of M&A deals within the EU poultry feeds market between 2019 and 2024 is estimated to be around xx Million. Regulatory frameworks, particularly those related to feed safety and environmental sustainability, heavily influence the market's development. Product substitutes, while not widespread, include alternative protein sources such as insect-based meals, which are gradually emerging as a sustainable option. End-user trends showcase a shift towards higher-value, specialized poultry feeds that cater to specific animal needs and production goals.

EU Poultry Feeds Market Industry Trends & Insights

The EU poultry feeds market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and the forecast period (2025-2033) projects a CAGR of xx%. This growth is fueled by increasing poultry consumption within the EU, underpinned by rising population and per capita income. The market penetration of specialized poultry feeds, catering to specific needs like improved egg production or disease resistance, is steadily increasing, contributing to this growth.

Technological disruptions are fundamentally reshaping the industry. Precision feeding, employing advanced analytics and sensor technologies, allows for real-time monitoring of feed consumption and animal performance, leading to optimized feed utilization and reduced waste. Furthermore, the growing adoption of automated feeding systems enhances efficiency and reduces labor costs.

Consumer preferences are impacting the market, with a growing demand for poultry produced using sustainable and ethical practices. This demand translates into increased adoption of feed formulations that minimize environmental impact and promote animal welfare. This involves a focus on reducing antibiotic use (as exemplified by the 2022 EU ban), improving feed digestibility, and incorporating sustainable ingredient sourcing.

Competitive dynamics are characterized by fierce competition among major players and a gradual consolidation of the market. Strategies employed by major companies include product diversification, technological innovation, and strategic acquisitions to enhance their market share and geographical reach. The market is also witnessing increased competition from smaller, specialized companies offering innovative and niche feed solutions.

Dominant Markets & Segments in EU Poultry Feeds Market

Within the EU poultry feeds market, several segments demonstrate significant dominance.

Animal Type: Broiler feed accounts for the largest market share, driven by high broiler meat consumption within the EU. Layer feed occupies the second largest segment, driven by the significant demand for eggs. Turkey feed holds a smaller but still substantial segment, while "other animal types" includes a diverse range of poultry species with comparatively lower market shares.

Ingredient: Cereals form the largest portion of poultry feed ingredients, owing to their cost-effectiveness and nutritional value. Oilseed meals, like soybean meal and rapeseed meal, provide essential protein sources and contribute to a significant segment. Molasses and fish oils/meals contribute to specialized feed formulations, offering specific nutritional benefits but accounting for smaller market shares compared to cereals and oilseed meals. Supplements, including vitamins, minerals, and amino acids, represent a smaller but crucial segment, ensuring complete and balanced nutrition. Other ingredients encompass a variety of minor components that contribute to the overall feed formulation.

Key drivers of dominance vary across segments. For example, broiler feed dominance is driven by high meat consumption and intensive farming practices. The significant market share of cereals is attributed to their availability, affordability, and nutritional composition. Economic policies impacting agricultural production and input costs influence the pricing and availability of various ingredients. Infrastructure, particularly transportation and storage facilities, plays a vital role in the efficient distribution of feed across the region. Certain regions within the EU, such as those with high poultry production concentrations, exhibit stronger market dominance than others.

EU Poultry Feeds Market Product Developments

Recent product innovations in the EU poultry feeds market focus on enhancing feed efficiency, improving animal health, and promoting sustainable practices. Mini-pellets, like Cargill's new chick feed, are gaining popularity due to their improved digestibility and reduced feed wastage. Formulations are also being optimized to reduce reliance on antibiotics, emphasizing natural immunostimulants and prebiotics. These product developments reflect technological advancements and increasing consumer demand for sustainable and ethically produced poultry. The competitive advantage hinges on providing superior nutritional value, improved feed efficiency, and enhanced animal welfare.

Report Scope & Segmentation Analysis

This comprehensive report provides a detailed analysis of the EU Poultry Feeds Market, segmented to offer a granular understanding of its various components. The segmentation allows for a precise assessment of market dynamics and growth potential within specific niches.

Animal Type: The market is segmented by animal type, encompassing layers, broilers, turkeys, and other poultry species. Each segment's market size, growth projections, and competitive landscape are thoroughly examined. Analysis reveals varying growth trajectories, with broiler and layer feed segments demonstrating consistent expansion.

Ingredient: The report further segments the market based on key ingredients, including cereals, oilseed meals, molasses, fish oils and fish meals, supplements, and other ingredients. A detailed assessment of each ingredient's market size, contribution to overall feed formulations, and projected growth is provided. The analysis considers the impact of ingredient availability, price volatility, and regulatory factors on market dynamics.

The report offers in-depth analysis of each segment, incorporating factors such as market size, growth rates, competitive intensity, and profitability projections. This detailed breakdown provides valuable insights for stakeholders seeking to navigate the complexities of this dynamic market.

Key Drivers of EU Poultry Feeds Market Growth

The robust growth of the EU Poultry Feeds market is fueled by a confluence of factors. A significant driver is the rising poultry consumption, propelled by population growth, increasing urbanization, and evolving dietary preferences towards protein-rich diets. The demand for higher-quality poultry products, characterized by improved taste, texture, and nutritional value, fuels the adoption of specialized and premium poultry feeds. Technological advancements, particularly in feed formulation and production, are enhancing efficiency and optimizing animal performance, leading to increased productivity and profitability.

Favorable economic conditions within the EU contribute significantly to investment in poultry farming, thereby driving market growth. Moreover, supportive regulatory frameworks focused on innovation and sustainable practices further promote market expansion. These supportive regulations foster the adoption of environmentally friendly feed production methods and enhance overall market stability.

Challenges in the EU Poultry Feeds Market Sector

Despite its growth trajectory, the EU poultry feeds market faces several challenges. Significant among these are fluctuating raw material prices, especially for key ingredients such as cereals and oilseed meals, which directly impact feed costs and the overall profitability of feed producers. Stringent regulatory requirements regarding feed safety and environmental sustainability create compliance hurdles for businesses, requiring investments in infrastructure and technology upgrades.

The increasingly competitive market landscape, characterized by both large multinational corporations and smaller, specialized players, puts pressure on profit margins. Supply chain disruptions, often stemming from geopolitical instability or unforeseen events, significantly impact ingredient availability and price stability, adding to the challenges faced by market participants. The report quantifies the impact of these challenges on profitability and market share dynamics.

Emerging Opportunities in EU Poultry Feeds Market

The EU poultry feeds market presents several emerging opportunities. The growing demand for sustainable and ethical poultry production creates opportunities for companies offering environmentally friendly and animal welfare-focused feed solutions. The increasing adoption of precision feeding technologies offers opportunities for providers of data-driven solutions and automated feeding systems. Furthermore, the exploration and adoption of novel protein sources, like insect-based meals, provide considerable potential for sustainable feed development and innovation.

Leading Players in the EU Poultry Feeds Market Market

- Royal Agrifirm Group

- Roquette Freres S

- Nutreco NV

- BASF SE

- De Heus

- Alltech Inc

- Cargill Inc

- Danish Agro

- Terrena

Key Developments in EU Poultry Feeds Market Industry

Sept 2022: Cargill's introduction of a novel mini-pellet chick feed exemplifies advancements in feed technology, enhancing chick growth and nutrient digestibility. This innovation highlights the industry's focus on improved feed efficiency and animal welfare.

Jan 2022: The EU's ban on the routine use of antibiotics in farmed animals represents a major regulatory shift, profoundly impacting feed formulation and prompting innovation in alternative disease prevention methods.

Mar 2021: De Heus's acquisition of Golpasz, a Polish broiler feed company, underscores the ongoing consolidation and market expansion strategies prevalent within the EU poultry feeds market.

[Add another recent development here with date and brief description]

Strategic Outlook for EU Poultry Feeds Market Market

The EU poultry feeds market is projected to experience sustained growth, driven by the persistent increase in poultry consumption and the evolving preferences of consumers. Businesses that successfully navigate the evolving regulatory landscape, actively embrace technological advancements, and prioritize sustainable practices will be best positioned to thrive. Further market consolidation is anticipated, with larger players strategically acquiring smaller companies to broaden their market reach and enhance their product portfolios. The focus on innovation in alternative protein sources and precision feeding technologies will continue to shape the future of the EU poultry feeds market, demanding adaptability and strategic foresight from market participants.

EU Poultry Feeds Market Segmentation

-

1. Animal Type

- 1.1. Layer

- 1.2. Broiler

- 1.3. Turkey

- 1.4. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Oilseed Meals

- 2.3. Molasses

- 2.4. Fish Oils and Fish Meals

- 2.5. Supplements

- 2.6. Other Ingredients

EU Poultry Feeds Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Spain

- 6. Russia

- 7. Rest of Europe

EU Poultry Feeds Market Regional Market Share

Geographic Coverage of EU Poultry Feeds Market

EU Poultry Feeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Growing Meat Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Layer

- 5.1.2. Broiler

- 5.1.3. Turkey

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Oilseed Meals

- 5.2.3. Molasses

- 5.2.4. Fish Oils and Fish Meals

- 5.2.5. Supplements

- 5.2.6. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Kingdom EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Layer

- 6.1.2. Broiler

- 6.1.3. Turkey

- 6.1.4. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Oilseed Meals

- 6.2.3. Molasses

- 6.2.4. Fish Oils and Fish Meals

- 6.2.5. Supplements

- 6.2.6. Other Ingredients

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Germany EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Layer

- 7.1.2. Broiler

- 7.1.3. Turkey

- 7.1.4. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Oilseed Meals

- 7.2.3. Molasses

- 7.2.4. Fish Oils and Fish Meals

- 7.2.5. Supplements

- 7.2.6. Other Ingredients

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Italy EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Layer

- 8.1.2. Broiler

- 8.1.3. Turkey

- 8.1.4. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Oilseed Meals

- 8.2.3. Molasses

- 8.2.4. Fish Oils and Fish Meals

- 8.2.5. Supplements

- 8.2.6. Other Ingredients

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. France EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Layer

- 9.1.2. Broiler

- 9.1.3. Turkey

- 9.1.4. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Oilseed Meals

- 9.2.3. Molasses

- 9.2.4. Fish Oils and Fish Meals

- 9.2.5. Supplements

- 9.2.6. Other Ingredients

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Spain EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Layer

- 10.1.2. Broiler

- 10.1.3. Turkey

- 10.1.4. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Oilseed Meals

- 10.2.3. Molasses

- 10.2.4. Fish Oils and Fish Meals

- 10.2.5. Supplements

- 10.2.6. Other Ingredients

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Russia EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Layer

- 11.1.2. Broiler

- 11.1.3. Turkey

- 11.1.4. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Oilseed Meals

- 11.2.3. Molasses

- 11.2.4. Fish Oils and Fish Meals

- 11.2.5. Supplements

- 11.2.6. Other Ingredients

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Rest of Europe EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 12.1.1. Layer

- 12.1.2. Broiler

- 12.1.3. Turkey

- 12.1.4. Other Animal Types

- 12.2. Market Analysis, Insights and Forecast - by Ingredient

- 12.2.1. Cereals

- 12.2.2. Oilseed Meals

- 12.2.3. Molasses

- 12.2.4. Fish Oils and Fish Meals

- 12.2.5. Supplements

- 12.2.6. Other Ingredients

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Royal Agrifirm Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Roquette Freres S

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nutreco NV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BASF SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 De Hues

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Alltech Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cargill Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Danish Agro

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Terrena

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Royal Agrifirm Group

List of Figures

- Figure 1: Global EU Poultry Feeds Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United Kingdom EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: United Kingdom EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: United Kingdom EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 7: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Germany EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: Germany EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: Germany EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 11: Germany EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: Germany EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Germany EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Italy EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Italy EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 17: Italy EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Italy EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Italy EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: France EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: France EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: France EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 23: France EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: France EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 25: France EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Spain EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Spain EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Spain EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Spain EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Spain EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Spain EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Russia EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 33: Russia EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 34: Russia EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 35: Russia EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 36: Russia EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Russia EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 39: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 40: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 41: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 42: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global EU Poultry Feeds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 9: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 12: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 15: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 17: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 18: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 20: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 21: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 23: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 24: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EU Poultry Feeds Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the EU Poultry Feeds Market?

Key companies in the market include Royal Agrifirm Group, Roquette Freres S, Nutreco NV, BASF SE, De Hues, Alltech Inc, Cargill Inc, Danish Agro, Terrena.

3. What are the main segments of the EU Poultry Feeds Market?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Growing Meat Production Drives the Market.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

Sept 2022: Cargill introduced a new mini-pellet chick feed to promote chick start in the first 120 hours of a bird's life, which includes precise amounts of protein, starch, fat, and additives in highly digestible ingredients to promote maximum nutrient digestibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EU Poultry Feeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EU Poultry Feeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EU Poultry Feeds Market?

To stay informed about further developments, trends, and reports in the EU Poultry Feeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence