Key Insights

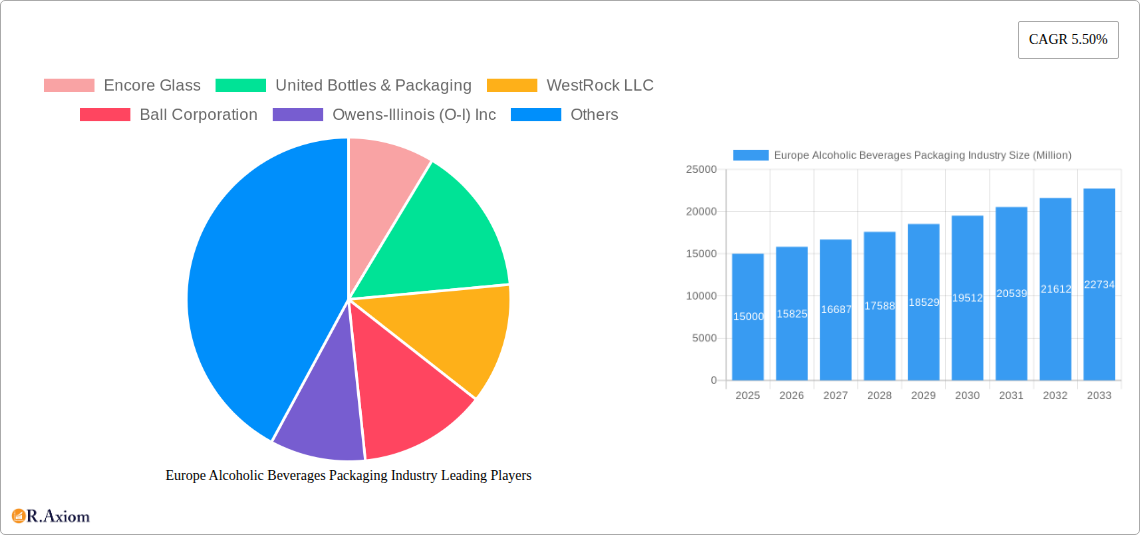

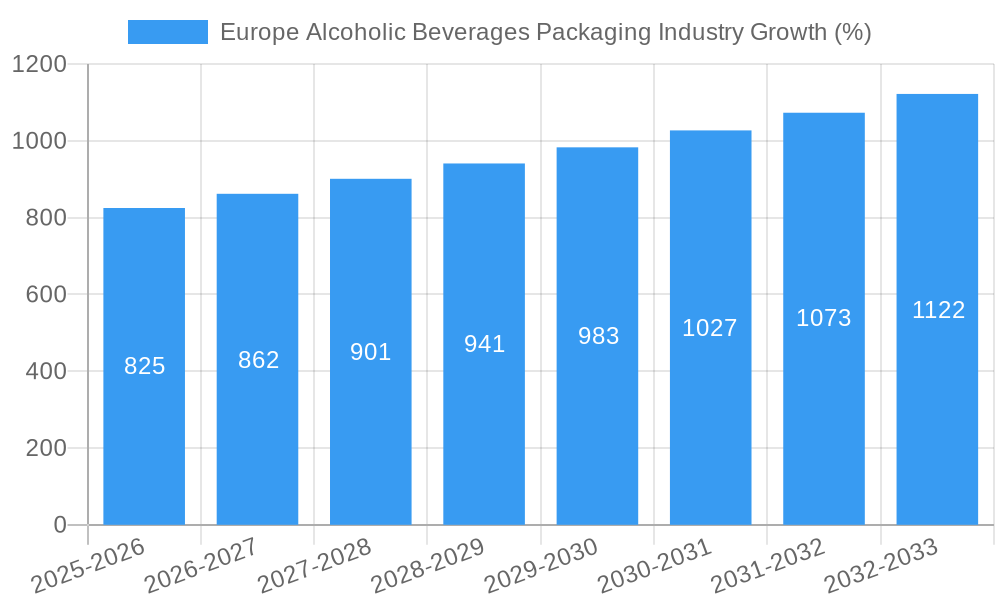

The European alcoholic beverages packaging market, valued at approximately €XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.50% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of craft beers and premium spirits, coupled with increasing consumer demand for convenient and sustainable packaging solutions, is significantly boosting market demand. Growth in the ready-to-drink (RTD) segment, particularly among younger demographics, is another major contributor. Furthermore, the ongoing trend toward lightweighting packaging to reduce transportation costs and environmental impact is influencing material choices, with a gradual shift towards more sustainable options like recycled paper and plastic. However, fluctuating raw material prices and stringent environmental regulations pose challenges to market growth. Competition among established players like Amcor Ltd, Ball Corporation, and Owens-Illinois (O-I) Inc., alongside the emergence of innovative packaging technologies, further shapes the market landscape.

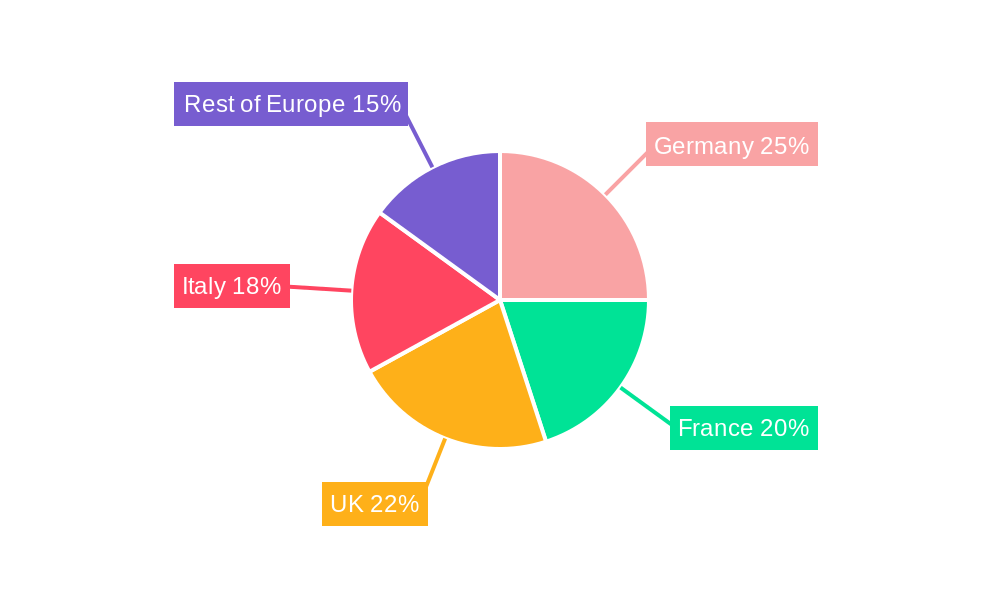

The market segmentation reveals that glass bottles maintain a significant share, particularly in the wine and spirits sectors, owing to their perceived premium image and suitability for preserving product quality. However, the plastic and metal can segments are witnessing considerable growth, driven by their cost-effectiveness and versatility. Regional variations exist, with Germany, France, the UK, and Italy representing the largest markets within Europe. The continued focus on sustainability initiatives within the alcoholic beverage industry is expected to drive innovation in packaging materials and designs, further shaping the market trajectory over the forecast period. This includes increased adoption of recycled content, biodegradable materials, and innovative closures designed to enhance product preservation and reduce waste.

Europe Alcoholic Beverages Packaging Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Alcoholic Beverages Packaging industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market.

Europe Alcoholic Beverages Packaging Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation trends, regulatory environment, and market dynamics within the European alcoholic beverages packaging industry. The market exhibits a moderately concentrated structure, with several major players holding significant market share. However, the presence of smaller, specialized companies also contributes to a dynamic competitive environment.

Market Concentration: The top 10 companies, including Encore Glass, United Bottles & Packaging, WestRock LLC, Ball Corporation, Owens-Illinois (O-I) Inc, Ardagh Group SA, Crown Holdings Incorporated, Berry Global Inc, IntraPac International LL, and Brick Packaging LLC, collectively account for an estimated xx% of the market share in 2025. Amcor Ltd also plays a significant role. Precise market share figures will vary by segment.

Innovation Drivers: Sustainability is a key driver, with increasing demand for eco-friendly materials like recycled plastic and paper-based alternatives. Lightweighting and improved barrier properties are also crucial areas of innovation. Furthermore, advancements in printing and labeling technologies enhance brand differentiation and consumer appeal.

Regulatory Framework: EU regulations concerning food safety, material recyclability, and labeling significantly influence industry practices and innovation. Compliance with these regulations is paramount for market participation.

Product Substitutes: While traditional packaging materials remain dominant, alternative solutions, such as biodegradable and compostable packaging, are gaining traction. The growth of these substitutes depends on factors such as cost-effectiveness, performance, and consumer acceptance.

End-User Trends: Consumers increasingly prefer convenient and aesthetically pleasing packaging, driving demand for innovative designs and formats. Premiumization trends also influence packaging choices, with luxury brands opting for high-quality, visually appealing packaging.

M&A Activities: Recent mergers and acquisitions, such as Amcor's acquisition of a flexible packaging facility in the Czech Republic (August 2022) and Berlin Packaging's purchase of Panvetri (April 2022), reflect the industry’s consolidation and expansion strategies. These deals, valued collectively at an estimated xx Million, illustrate the strategic importance of acquisitions in securing market share and expanding product portfolios.

Europe Alcoholic Beverages Packaging Industry Industry Trends & Insights

The European alcoholic beverages packaging market is experiencing robust growth, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, indicating significant expansion potential. This growth is fueled by several interconnected trends:

- Rising Alcoholic Beverage Consumption: Increased consumption of alcoholic beverages across various segments like wine, spirits, and ready-to-drink cocktails is driving demand for packaging solutions.

- Premiumization and Brand Differentiation: The trend towards premium alcoholic beverages necessitates sophisticated and attractive packaging to highlight product quality and brand identity.

- E-commerce Growth: The burgeoning online alcohol sales market requires packaging that can withstand transportation and maintain product integrity.

- Sustainability Concerns: Growing environmental consciousness among consumers and stricter regulations are pushing the industry towards sustainable packaging solutions.

- Technological Advancements: Innovations in materials science, printing techniques, and closure systems continually improve packaging functionality, aesthetics, and sustainability.

- Changing Consumer Preferences: Consumers' evolving preferences for convenient formats, such as pouches and cans, are shaping packaging choices.

- Competitive Dynamics: The competitive landscape is characterized by both established players and emerging entrants, leading to continuous innovation and price competition. Market penetration of sustainable materials is steadily increasing with an estimated xx% penetration rate by 2033.

Dominant Markets & Segments in Europe Alcoholic Beverages Packaging Industry

The European alcoholic beverages packaging market is fragmented across various segments and countries. However, certain segments and regions exhibit stronger growth potential and dominance.

By Primary Material: Glass remains a dominant material, particularly for premium wine and spirits. However, plastic continues to hold a substantial share due to its cost-effectiveness and versatility, while metal cans, especially for beer and RTDs, are also significant. Paper-based packaging is gaining traction driven by sustainability concerns.

By Alcoholic Products: Wine packaging dominates the market, followed by beer and spirits. The RTD segment demonstrates the fastest growth due to increasing popularity of pre-mixed cocktails and other convenience drinks.

By Product Type: Glass bottles maintain a strong position across several alcoholic beverage categories. Plastic bottles are prevalent in the mass-market segments. Metal cans are strongly associated with beer, while cartons and pouches cater to a growing market seeking convenience and environmentally friendly packaging options.

By Country: The United Kingdom, France, Germany, and Italy are major markets, reflecting their robust wine, beer, and spirits industries and substantial alcoholic beverage consumption. The Rest of Europe also contributes significantly to the overall market size.

- Key Drivers (United Kingdom): Strong economy, established alcohol industry, sophisticated consumer preferences, stringent regulations.

- Key Drivers (France): Established wine industry, tourism, premium product focus, stringent environmental regulations.

- Key Drivers (Germany): Strong beer industry, large population, demand for convenient packaging, focus on sustainability.

- Key Drivers (Italy): Thriving wine industry, export-oriented production, focus on quality, strong regional brands.

- Key Drivers (Rest of Europe): Growing consumer spending in several countries, emerging markets within Central and Eastern Europe.

Europe Alcoholic Beverages Packaging Industry Product Developments

The industry is witnessing significant innovation in packaging materials, design, and functionality. Lightweighting of containers, improved barrier properties for extended shelf life, and enhanced printing technologies for better branding are key areas of development. Sustainable alternatives, such as recycled materials, bioplastics, and compostable packaging, are also gaining significant traction. These innovations are directly addressing consumer preferences for convenience, sustainability, and premium aesthetics.

Report Scope & Segmentation Analysis

This report meticulously segments the European alcoholic beverages packaging market across several key dimensions:

By Primary Material: Glass, plastic, metal, and paper, each with specific growth projections and competitive dynamics.

By Alcoholic Products: Wine, spirits, beer, ready-to-drink (RTD), and other types of alcoholic beverages, showing individual market sizes and anticipated growth.

By Product Type: Plastic bottles, glass bottles, metal cans, cartons, pouches, and other product types, each presenting unique market dynamics.

By Country: United Kingdom, France, Italy, Germany, and Rest of Europe, detailed breakdown of market performance and growth outlook for each region.

Each segment's analysis includes market size estimation, growth projections, competitive landscapes, and influential factors such as consumer trends and regulatory changes.

Key Drivers of Europe Alcoholic Beverages Packaging Industry Growth

Several factors contribute to the growth of this market:

- Technological advancements: Innovation in materials, design, and printing technologies.

- Economic growth: Increasing disposable incomes fueling higher alcoholic beverage consumption.

- Favorable regulatory environment: Regulations promoting sustainable packaging solutions.

- Consumer preferences: Growing demand for convenience, premiumization, and sustainability.

Challenges in the Europe Alcoholic Beverages Packaging Industry Sector

The industry faces challenges such as:

- Fluctuating raw material prices: Impacting production costs and profitability.

- Stringent environmental regulations: Requiring investments in sustainable packaging solutions.

- Intense competition: Pressuring pricing strategies and requiring continuous innovation.

- Supply chain disruptions: Affecting availability of materials and timely delivery.

Emerging Opportunities in Europe Alcoholic Beverages Packaging Industry

The industry presents promising opportunities:

- Growth of the RTD market: Creating demand for innovative packaging solutions.

- Increased adoption of sustainable packaging: Opening avenues for eco-friendly alternatives.

- Expansion into emerging markets within Europe: Uncovering untapped potential in Central and Eastern Europe.

- Customization and personalization of packaging: Creating opportunities for brand differentiation.

Leading Players in the Europe Alcoholic Beverages Packaging Industry Market

- Encore Glass

- United Bottles & Packaging

- WestRock LLC

- Ball Corporation

- Owens-Illinois (O-I) Inc

- Ardagh Group SA

- Crown Holdings Incorporated

- Berry Global Inc

- IntraPac International LL

- Brick Packaging LLC

- Amcor Ltd

Key Developments in Europe Alcoholic Beverages Packaging Industry Industry

- August 2022: Amcor acquired a top-tier flexible packaging facility in the Czech Republic, enhancing its capacity to meet rising European demand.

- April 2022: Berlin Packaging acquired Panvetri, a glass and metal packaging provider, expanding its product portfolio in the wine and olive oil sectors.

Strategic Outlook for Europe Alcoholic Beverages Packaging Industry Market

The European alcoholic beverages packaging market is poised for continued growth, driven by increasing beverage consumption, premiumization trends, and a growing focus on sustainability. Opportunities exist for companies that invest in innovative, eco-friendly packaging solutions and effectively adapt to evolving consumer preferences. The market's future potential is significant, with considerable room for expansion across various segments and geographies.

Europe Alcoholic Beverages Packaging Industry Segmentation

-

1. Primary Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Alcoholic Products

- 2.1. Wine

- 2.2. Spirits

- 2.3. Beer

- 2.4. Ready-to-drink (RTD)

- 2.5. Other Types of Alcoholic Beverages

-

3. Product Type

- 3.1. Plastic Bottles

- 3.2. Glass Bottles

- 3.3. Metal Cans

- 3.4. Cartons

- 3.5. Pouches

- 3.6. Other Product Types

Europe Alcoholic Beverages Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Alcoholic Beverages Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth

- 3.4. Market Trends

- 3.4.1. Glass Packaging is Expected to have a Major Share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Alcoholic Products

- 5.2.1. Wine

- 5.2.2. Spirits

- 5.2.3. Beer

- 5.2.4. Ready-to-drink (RTD)

- 5.2.5. Other Types of Alcoholic Beverages

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Plastic Bottles

- 5.3.2. Glass Bottles

- 5.3.3. Metal Cans

- 5.3.4. Cartons

- 5.3.5. Pouches

- 5.3.6. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Germany Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Encore Glass

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 United Bottles & Packaging

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 WestRock LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ball Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Owens-Illinois (O-I) Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ardagh Group SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Crown Holdings Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Berry Global Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IntraPac International LL

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Brick Packaging LLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Amcor Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Encore Glass

List of Figures

- Figure 1: Europe Alcoholic Beverages Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Alcoholic Beverages Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Primary Material 2019 & 2032

- Table 3: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Alcoholic Products 2019 & 2032

- Table 4: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Primary Material 2019 & 2032

- Table 15: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Alcoholic Products 2019 & 2032

- Table 16: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Alcoholic Beverages Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Alcoholic Beverages Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Alcoholic Beverages Packaging Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Europe Alcoholic Beverages Packaging Industry?

Key companies in the market include Encore Glass, United Bottles & Packaging, WestRock LLC, Ball Corporation, Owens-Illinois (O-I) Inc, Ardagh Group SA, Crown Holdings Incorporated, Berry Global Inc, IntraPac International LL, Brick Packaging LLC, Amcor Ltd.

3. What are the main segments of the Europe Alcoholic Beverages Packaging Industry?

The market segments include Primary Material, Alcoholic Products, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks.

6. What are the notable trends driving market growth?

Glass Packaging is Expected to have a Major Share in the market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth.

8. Can you provide examples of recent developments in the market?

August 2022 - Amcor, a responsible packaging solutions development and production pioneer, announced that it had acquired a top-tier flexible packaging facility in the Czech Republic. The site's advantageous location instantly improves Amcor's capacity to meet rising customer demand across its flexible packaging network in Europe. With this acquisition, the company is investing in quickening its flexible business' organic growth in Europe's lucrative categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Alcoholic Beverages Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Alcoholic Beverages Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Alcoholic Beverages Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Alcoholic Beverages Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence