Key Insights

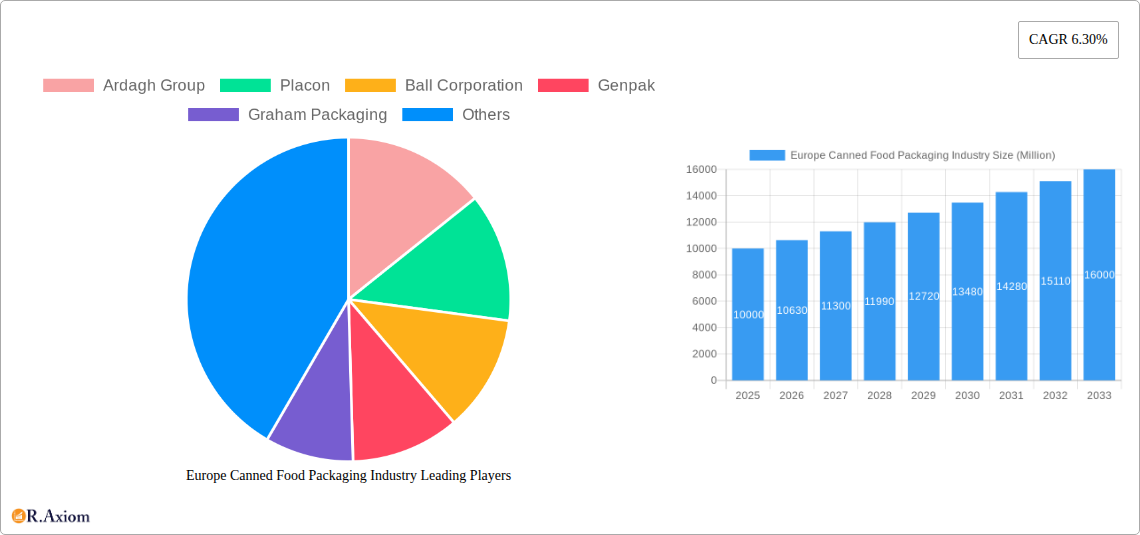

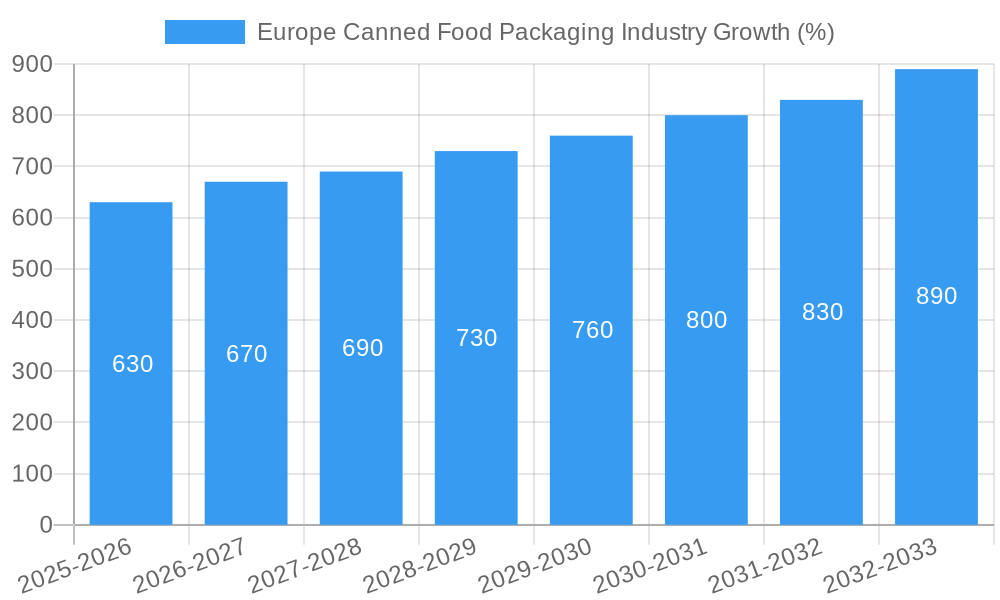

The European canned food packaging market, valued at approximately €[Estimate based on market size XX and value unit Million; Let's assume XX = 10000 for illustration purposes. Then the 2025 market size would be €10,000 million. Adjust this based on the actual value of XX]. in 2025, is projected to experience robust growth, driven by a CAGR of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for convenient and shelf-stable ready-made meals, meat, and seafood products is a significant driver, particularly amongst busy consumers and younger demographics. Furthermore, the growing popularity of sustainable and eco-friendly packaging solutions is influencing market trends, with manufacturers increasingly adopting recyclable materials like aluminum and steel. Technological advancements in packaging materials are also contributing to market growth, enhancing preservation, safety, and aesthetics. While the market faces challenges such as fluctuating raw material prices and stringent environmental regulations, the overall growth trajectory remains positive.

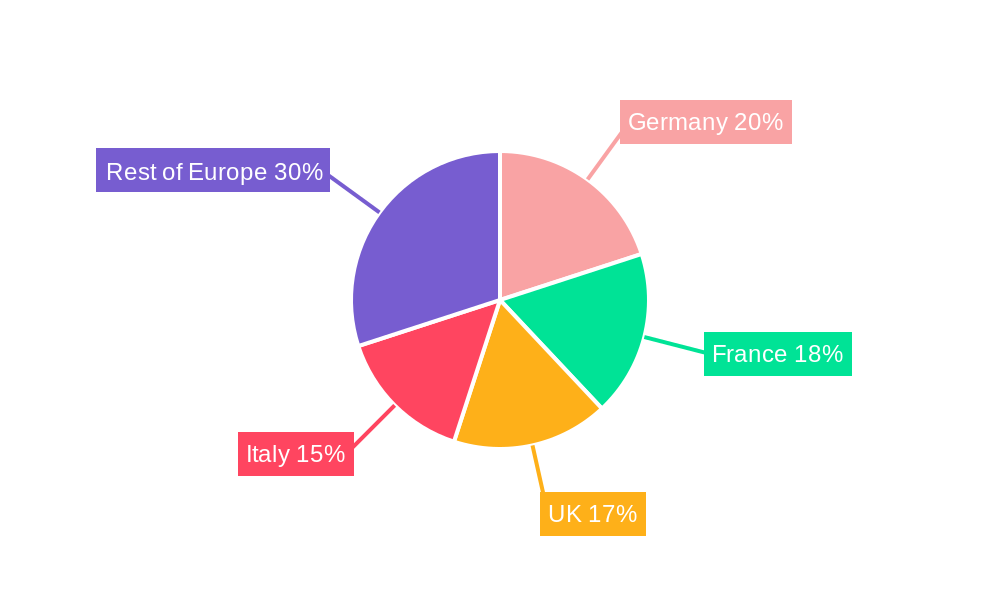

Germany, France, the United Kingdom, and Italy represent major market segments within Europe, reflecting their substantial food processing and consumption capacities. The preference for different packaging materials varies across these countries; for instance, steel may dominate in some regions due to its strength and recyclability, while aluminum's lightweight nature might be favored elsewhere. The market is segmented by material (metal, steel, aluminum, others), type of food product (ready-made meals, meat, seafood, others), and country. Competition is intense, with leading players like Ardagh Group, Ball Corporation, Crown Holdings Inc., and Amcor Limited vying for market share through innovation, strategic acquisitions, and expansion into new markets. The continued emphasis on food safety and extended shelf life, coupled with consumer demand for convenient and environmentally conscious packaging, positions the European canned food packaging market for considerable future growth. The forecast period suggests a substantial increase in market value by 2033, presenting lucrative opportunities for established players and new entrants alike.

Europe Canned Food Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe canned food packaging industry, covering market size, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The historical period analyzed is 2019-2024. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, and investors. The market is segmented by material (metal, steel, aluminum, others), type of food product (readymade meals, meat, seafood, others), and country (United Kingdom, Germany, France, Spain, Italy, Rest of Europe). Key players analyzed include Ardagh Group, Placon, Ball Corporation, Genpak, Graham Packaging, Crown Holdings Inc, Tetra Pak International, Toyo Seikan, Can-Pack S.A., Amcor Limited, CCL Industries Inc., and Pactiv. The total market size in 2025 is estimated to be xx Million.

Europe Canned Food Packaging Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the European canned food packaging industry, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with a few major players holding significant market share. However, smaller niche players also contribute significantly.

- Market Concentration: The top 5 players collectively hold an estimated xx% market share in 2025, indicating a moderately consolidated market.

- Innovation Drivers: Sustainability concerns are driving innovation towards eco-friendly materials and packaging designs. Lightweighting and improved barrier properties are other key focus areas.

- Regulatory Frameworks: EU regulations on food safety and packaging waste management significantly impact industry practices and innovation. Compliance costs can be substantial.

- Product Substitutes: Alternative packaging solutions, such as flexible pouches and retort packaging, are posing competitive pressure.

- End-User Trends: Growing demand for convenient and ready-to-eat meals is fueling the growth of the canned food packaging market.

- M&A Activities: The acquisition of Panvetri by Berlin Packaging in April 2022 illustrates the ongoing consolidation in the European packaging sector. While exact deal values are not publicly disclosed for many transactions, the observed M&A activity suggests increasing competition and a drive for greater market share. Further consolidation is anticipated in the coming years.

Europe Canned Food Packaging Industry Industry Trends & Insights

The European canned food packaging market is experiencing robust growth, driven by several factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for canned food products, particularly ready-to-eat meals, driven by changing lifestyles and busier schedules. The rising popularity of convenient and shelf-stable food options further propels market expansion. Technological advancements in packaging materials and manufacturing processes are enhancing the efficiency and sustainability of production. Consumer preferences for sustainable and eco-friendly packaging are also shaping the industry. However, fluctuating raw material prices and intense competition among various players pose challenges to consistent growth. Market penetration of sustainable packaging options is gradually increasing, projected to reach xx% by 2033.

Dominant Markets & Segments in Europe Canned Food Packaging Industry

The United Kingdom, Germany, and France are the leading national markets for canned food packaging in Europe. This dominance is attributable to factors such as robust food processing industries, strong consumer demand for canned goods, and well-established distribution networks.

- By Material: Metal remains the dominant packaging material, owing to its barrier properties, recyclability, and cost-effectiveness. Steel and aluminum are the most prevalent types of metal used.

- By Food Product: Readymade meals and meat products represent significant segments, driven by high consumer demand for convenience and shelf-stable options.

- By Country:

- United Kingdom: High consumption of canned foods and a strong food processing industry contribute to the UK's leading market position. Key drivers include well-developed retail infrastructure and consumer preference for convenience.

- Germany: Similar to the UK, Germany benefits from a large food processing sector and high demand for canned food products.

- France: France demonstrates a significant market for canned seafood and other specialty food items, contributing to its position among the leading countries.

- Italy, Spain, Rest of Europe: These countries exhibit steady growth, with varying degrees of market maturity and specific product preferences.

Europe Canned Food Packaging Industry Product Developments

Recent innovations focus on sustainable materials like recycled aluminum and bio-based polymers. Improved barrier technologies extend shelf life and reduce food waste. Lightweighting solutions optimize transportation costs and reduce the environmental impact. These developments cater to consumer demand for eco-friendly options and enhanced product quality, creating a competitive advantage for manufacturers.

Report Scope & Segmentation Analysis

The report comprehensively segments the European canned food packaging market based on material (metal, steel, aluminum, others), food product type (readymade meals, meat, seafood, others), and country (United Kingdom, Germany, France, Spain, Italy, Rest of Europe). Each segment is analyzed, providing market size estimations, growth projections, and competitive dynamics. Metal packaging is expected to maintain its dominance, driven by its protective and recyclable properties. The readymade meal segment is predicted to exhibit rapid growth due to changing consumer lifestyles.

Key Drivers of Europe Canned Food Packaging Industry Growth

The industry's growth is propelled by several factors: the rising demand for convenient and shelf-stable food products, particularly among busy consumers; the expansion of the food processing and retail sectors; advancements in packaging materials and technologies resulting in longer shelf life and improved sustainability; favorable government policies promoting food security and waste reduction; and increasing investments in research and development for sustainable packaging solutions.

Challenges in the Europe Canned Food Packaging Industry Sector

The industry faces challenges such as fluctuations in raw material prices (e.g., aluminum and steel), escalating energy costs impacting production expenses, strict environmental regulations requiring adherence to sustainable practices, and growing competition from alternative packaging materials like flexible pouches. These factors can affect profitability and necessitate strategic adaptation by industry players. Further, supply chain disruptions can cause production delays and increased costs. The overall impact of these challenges on profitability is estimated to be approximately xx Million annually.

Emerging Opportunities in Europe Canned Food Packaging Industry

Emerging opportunities include growing demand for sustainable and eco-friendly packaging options, increased adoption of lightweighting technologies to reduce transportation costs and environmental impact, the development of innovative packaging materials offering enhanced barrier protection and extended shelf life, and expansion into new markets within the European region, specifically targeting developing economies within the broader European Union.

Leading Players in the Europe Canned Food Packaging Industry Market

- Ardagh Group

- Placon

- Ball Corporation

- Genpak

- Graham Packaging

- Crown Holdings Inc

- Tetra Pak International

- Toyo Seikan

- Can-Pack S.A.

- Amcor Limited

- CCL Industries Inc

- Pactiv

Key Developments in Europe Canned Food Packaging Industry Industry

- February 2022: Resumption of shellfish trade between the US and Europe. This development positively impacted the seafood canning segment, boosting demand for related packaging solutions.

- April 2022: Berlin Packaging's acquisition of Panvetri. This acquisition strengthens Berlin Packaging's position in the European market, signaling further consolidation within the industry.

Strategic Outlook for Europe Canned Food Packaging Industry Market

The European canned food packaging market exhibits promising growth potential driven by the sustained demand for convenient food options and increasing focus on sustainable practices. Opportunities lie in innovation towards eco-friendly materials, advanced barrier technologies, and optimized production processes. Companies that prioritize sustainability, adopt innovative technologies, and effectively manage supply chain risks are expected to thrive in this dynamic market.

Europe Canned Food Packaging Industry Segmentation

-

1. Material

- 1.1. Metal

- 1.2. Steel

- 1.3. Aluminium

- 1.4. Others

-

2. Type of Food Product

- 2.1. Readymade Meals

- 2.2. Meat

- 2.3. Sea Food

- 2.4. Others

Europe Canned Food Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Canned Food Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Cconvenience by Consumers; Increase in Disposable Income and Changing Consumer Behaviour

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations over Single-Use Plastic-based Packaging

- 3.4. Market Trends

- 3.4.1. Aluminum to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Metal

- 5.1.2. Steel

- 5.1.3. Aluminium

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Food Product

- 5.2.1. Readymade Meals

- 5.2.2. Meat

- 5.2.3. Sea Food

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Germany Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Canned Food Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ardagh Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Placon

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ball Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Genpak

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Graham Packaging

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Crown Holdings Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Tetra Pak International

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toyo Seikan*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Can-Pack S A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Amcor Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 CCL industries Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Pactiv

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Ardagh Group

List of Figures

- Figure 1: Europe Canned Food Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Canned Food Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Canned Food Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Canned Food Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Europe Canned Food Packaging Industry Revenue Million Forecast, by Type of Food Product 2019 & 2032

- Table 4: Europe Canned Food Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Canned Food Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Canned Food Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 14: Europe Canned Food Packaging Industry Revenue Million Forecast, by Type of Food Product 2019 & 2032

- Table 15: Europe Canned Food Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Canned Food Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Canned Food Packaging Industry?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Europe Canned Food Packaging Industry?

Key companies in the market include Ardagh Group, Placon, Ball Corporation, Genpak, Graham Packaging, Crown Holdings Inc, Tetra Pak International, Toyo Seikan*List Not Exhaustive, Can-Pack S A, Amcor Limited, CCL industries Inc, Pactiv.

3. What are the main segments of the Europe Canned Food Packaging Industry?

The market segments include Material, Type of Food Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Cconvenience by Consumers; Increase in Disposable Income and Changing Consumer Behaviour.

6. What are the notable trends driving market growth?

Aluminum to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Government Regulations over Single-Use Plastic-based Packaging.

8. Can you provide examples of recent developments in the market?

April 2022 - Berlin Packaging, a US-based hybrid packaging company, acquired Italian glass and metal packaging supplier Panvetri. Based in Modugno, Panvetri serves food manufacturers, wine estates, cooperative wineries, and oil mills, primarily in Italy's Apulia and Basilicata regions. The acquisition is expected to help Berling Packaging further expand its presence in the European region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Canned Food Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Canned Food Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Canned Food Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Canned Food Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence