Key Insights

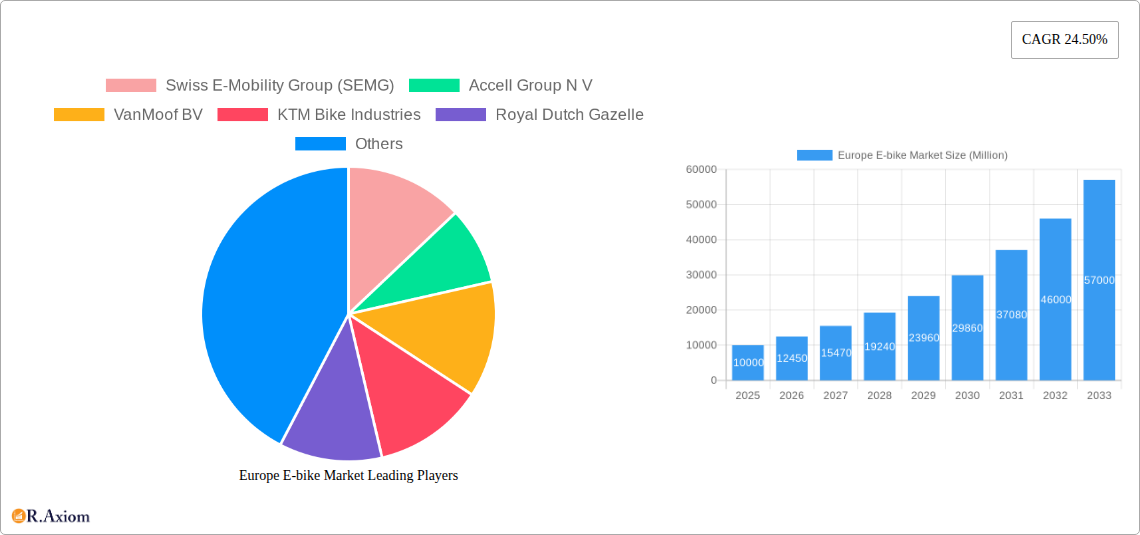

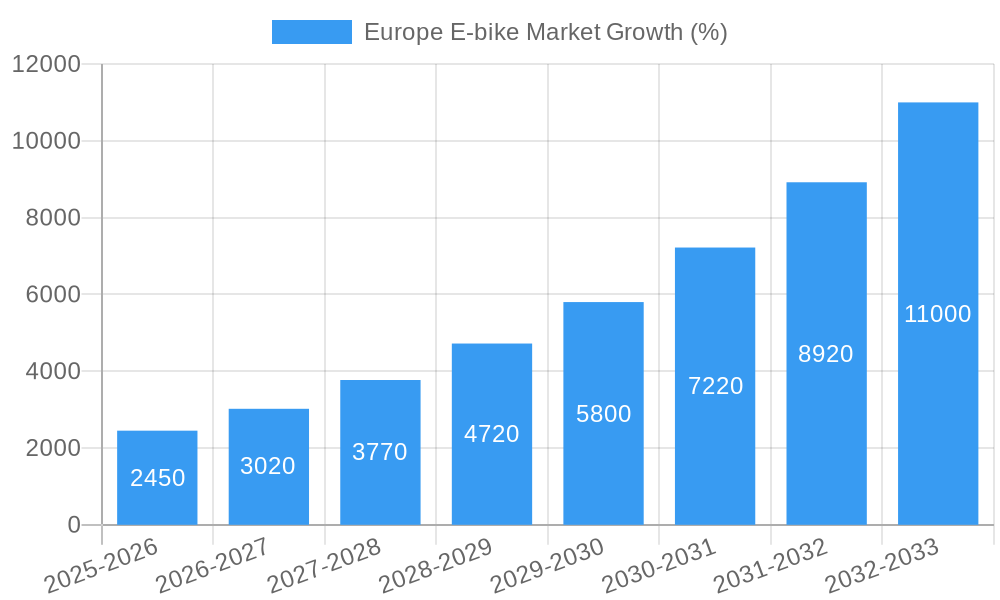

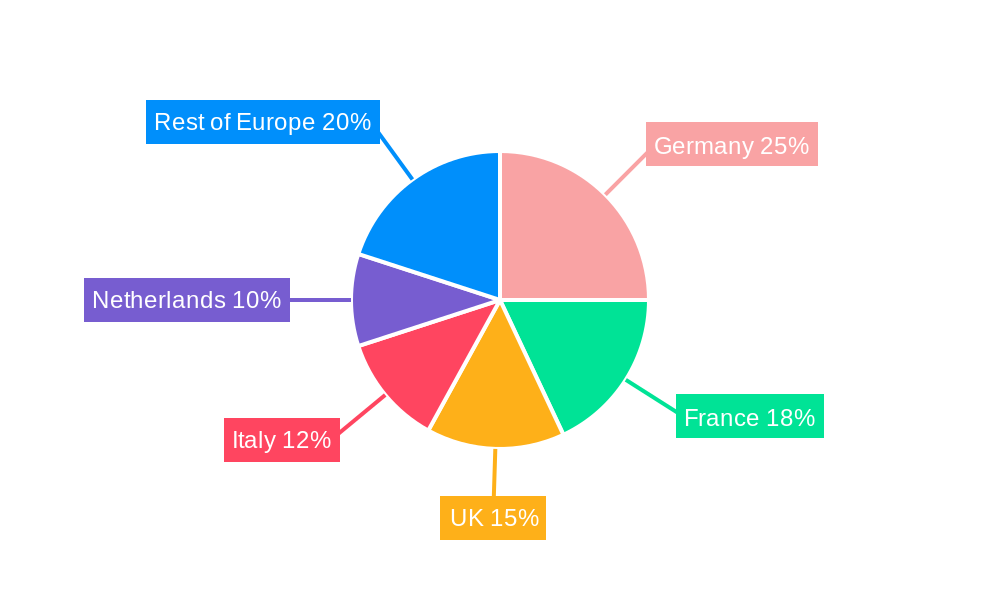

The European e-bike market is experiencing robust growth, driven by increasing environmental concerns, rising fuel costs, and the expanding popularity of cycling as a sustainable mode of transportation. The market, valued at approximately €[Estimate based on market size and value unit, for example: 10 Billion] in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 24.50% from 2025 to 2033, indicating substantial expansion. This growth is fueled by several key factors: a shift towards eco-friendly commuting options, government incentives promoting e-bike adoption (e.g., subsidies and tax breaks), and continuous technological advancements leading to improved battery life, performance, and design aesthetics. The market segmentation reveals a diverse landscape, with Lithium-ion batteries gaining market share over Lead-acid due to their superior performance and longer lifespan. The Pedal Assisted propulsion type dominates the market, reflecting consumer preference for a balance between human effort and electric assistance. Germany, France, and the United Kingdom are currently the leading markets within Europe, but growth is anticipated across all major countries, fueled by expanding infrastructure like dedicated cycling lanes and charging stations. The increasing demand for e-bikes for both city/urban commuting and trekking/leisure activities signifies the versatility and widespread appeal of this transportation mode. Competition is intense, with both established bicycle manufacturers and new entrants vying for market share, leading to innovation and increased accessibility. Challenges include supply chain constraints, potential fluctuations in raw material prices, and the need for further improvements in charging infrastructure to support the growing number of e-bikes.

The significant growth trajectory of the European e-bike market offers substantial opportunities for manufacturers, distributors, and related businesses. However, success will depend on adapting to evolving consumer preferences, investing in research and development to enhance product features and sustainability, and effectively addressing the challenges posed by supply chain complexities. Strategies focusing on sustainable production methods, innovative designs catering to diverse user needs, and creating robust distribution networks will play a crucial role in capturing market share in this rapidly expanding sector. Furthermore, collaborations with city municipalities to enhance cycling infrastructure will be essential for further stimulating demand and achieving sustainable urban transportation goals.

Europe E-bike Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe e-bike market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It dives deep into market segmentation, competitive dynamics, technological advancements, and key growth drivers, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers.

Europe E-bike Market Market Concentration & Innovation

The European e-bike market exhibits a moderately concentrated landscape, with key players like Accell Group N.V., Giant Manufacturing Co. Ltd., and Trek Bicycle Corporation holding significant market share. However, the market also features a multitude of smaller, specialized brands catering to niche segments. Market share data for 2024 indicates Accell Group holds approximately xx% market share, followed by Giant at xx% and Trek at xx%. The remaining share is distributed amongst numerous smaller players, signifying a dynamic competitive environment.

Innovation is a crucial driver, fueled by advancements in battery technology (Lithium-ion dominance over Lead Acid), improved motor efficiency, and smart connectivity features. Stringent emission regulations across various European countries further incentivize e-bike adoption. Product substitution is relatively low, with e-bikes primarily competing with traditional bicycles and, to a lesser extent, other micro-mobility solutions like scooters.

End-user trends show a growing preference for lightweight, high-performance e-bikes with extended range capabilities and integrated technology. The market witnesses consistent M&A activity, although precise deal values for recent years remain undisclosed (estimated at xx Million in 2022). These activities often involve larger players acquiring smaller, specialized brands to expand their product portfolios and geographical reach.

Europe E-bike Market Industry Trends & Insights

The European e-bike market is experiencing robust growth, driven by several factors. Increasing environmental awareness, coupled with government incentives promoting sustainable transportation, significantly fuels market expansion. Furthermore, rising fuel costs and urban congestion are pushing consumers towards eco-friendly and efficient commuting solutions. Technological advancements, such as lighter and more powerful batteries, improved motor systems, and smart features, continue to enhance the appeal and functionality of e-bikes.

Consumer preferences are shifting towards aesthetically pleasing designs, enhanced comfort features, and integration with smartphone applications. The market exhibits a strong competitive landscape, with both established players and emerging startups vying for market share. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, with market penetration steadily increasing across major European countries. Germany, the Netherlands, and France remain leading markets, demonstrating high adoption rates and consistent growth. The overall market size in 2024 was valued at approximately xx Million.

Dominant Markets & Segments in Europe E-bike Market

- Leading Region: Western Europe, driven by high disposable income, robust cycling infrastructure, and favorable government policies.

- Leading Countries: Germany, Netherlands, and France dominate due to strong consumer demand, supportive government initiatives (e.g., subsidies and tax breaks), and well-established cycling infrastructure.

- Dominant Battery Type: Lithium-ion batteries clearly dominate due to their higher energy density, longer lifespan, and superior performance. The market share of Lithium-ion batteries is estimated at xx%.

- Dominant Propulsion Type: Pedal-assisted e-bikes hold the largest market share, catering to a broader range of users who prefer a balance of human effort and electric assistance.

- Dominant Application Type: City/Urban e-bikes constitute the largest segment, reflecting the increasing use of e-bikes for daily commuting and urban exploration.

Key Drivers for Dominant Markets:

- Germany: Robust economy, government subsidies, extensive cycling infrastructure.

- Netherlands: High bicycle ownership rates, flat terrain, extensive cycling infrastructure.

- France: Growing environmental awareness, government initiatives, expanding cycling infrastructure in urban areas.

Further analysis reveals a significant preference for lithium-ion batteries due to superior performance, longer lifespan and a growing demand for longer range e-bikes in the urban applications

Europe E-bike Market Product Developments

Recent product innovations showcase a trend toward lighter, more integrated designs with enhanced connectivity and longer battery life. Manufacturers are increasingly incorporating smart features, such as GPS tracking, anti-theft systems, and smartphone integration. Competitive advantages are driven by factors such as superior battery technology, innovative motor systems, lightweight frame designs, and unique styling. These advancements cater to the evolving needs and preferences of consumers, focusing on enhanced usability, convenience, and safety.

Report Scope & Segmentation Analysis

This report analyzes the Europe e-bike market across various segments:

- Battery Type: Lead Acid Battery, Lithium-ion Battery, Others (with growth projections and market size for each).

- Country: Austria, Belgium, Czech Republic, France, Germany, Italy, Luxembourg, Netherlands, Poland, Spain, Switzerland, UK, Rest-of-Europe (with market size and competitive dynamics for each).

- Propulsion Type: Pedal Assisted, Speed Pedelec, Throttle Assisted (with growth projections and market size for each).

- Application Type: Cargo/Utility, City/Urban, Trekking (with growth projections and market size for each).

Each segment is analyzed in detail, providing insights into growth potential, market size, and competitive dynamics.

Key Drivers of Europe E-bike Market Growth

Several factors drive the Europe e-bike market's growth. Government incentives, such as subsidies and tax breaks, play a crucial role in boosting adoption rates. Rising environmental awareness and concerns about air quality further enhance the appeal of e-bikes as a sustainable transportation solution. Technological advancements, including improved battery technology and motor efficiency, are making e-bikes more attractive and affordable. Furthermore, the development of dedicated cycling infrastructure in many European cities is improving safety and convenience for e-bike users.

Challenges in the Europe E-bike Market Sector

The European e-bike market faces several challenges. Supply chain disruptions, particularly related to battery components, can impact production and pricing. The high initial cost of e-bikes remains a barrier for some consumers, despite decreasing prices over time. Additionally, safety concerns, particularly related to e-bike accidents and theft, are being addressed through improved safety features and regulations. Competition from other micro-mobility solutions, such as e-scooters, also presents a challenge. These factors result in an estimated xx% reduction in market growth during periods of economic instability.

Emerging Opportunities in Europe E-bike Market

Significant opportunities exist in the Europe e-bike market. The expanding cargo/utility e-bike segment presents considerable growth potential, driven by last-mile delivery services and urban logistics. Integration of advanced technologies, such as AI-powered features and improved connectivity, can enhance user experience and create new revenue streams. Furthermore, the development of more affordable e-bike models can unlock broader market access. The rising demand for sustainable and eco-friendly transportation in rural areas represent a strong emerging market opportunity.

Leading Players in the Europe E-bike Market Market

- Swiss E-Mobility Group (SEMG)

- Accell Group N V

- VanMoof BV

- KTM Bike Industries

- Royal Dutch Gazelle

- Fritzmeier Systems GmbH & Co KG (M1 Sporttechnik)

- Volt Electric Bikes

- Merida Industry Co Ltd

- Pedego Electric Bikes

- Giant Manufacturing Co Ltd

- Riese & Müller

- Kalkhoff Werke GmbH

- Trek Bicycle Corporation

- Yamaha Bicycle

- Brompton Bicycle

Key Developments in Europe E-bike Market Industry

- August 2022: VanMoof launched the S3 Aluminum, a high-end e-bike, impacting the premium segment.

- November 2022: Giant unveiled the Stormguard E+, a full-suspension e-bike, expanding the range of available models.

- December 2022: Volt Bikes partnered with City AM for an ESG-focused project, highlighting a growing emphasis on sustainability.

These developments highlight the industry's focus on innovation, sustainability, and expanding market reach.

Strategic Outlook for Europe E-bike Market Market

The Europe e-bike market exhibits strong growth potential over the forecast period (2025-2033), driven by continued technological advancements, supportive government policies, and growing consumer demand for sustainable transportation solutions. Expansion into emerging segments, such as cargo bikes and integration of smart features, will shape future market dynamics. Companies focusing on innovation, sustainability, and meeting diverse consumer needs are poised to capture significant market share. The market is anticipated to reach a value of xx Million by 2033.

Europe E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Europe E-bike Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Germany Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe E-bike Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Swiss E-Mobility Group (SEMG)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Accell Group N V

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 VanMoof BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 KTM Bike Industries

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Royal Dutch Gazelle

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fritzmeier Systems GmbH & Co KG (M1 Sporttechnik)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Volt Electric Bikes

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Merida Industry Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Pedego Electric Bikes

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Giant Manufacturing Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Riese & Müller

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Kalkhoff Werke GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Trek Bicycle Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Yamaha Bicycle

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Brompton Bicycle

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Swiss E-Mobility Group (SEMG)

List of Figures

- Figure 1: Europe E-bike Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe E-bike Market Share (%) by Company 2024

List of Tables

- Table 1: Europe E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Europe E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Europe E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: Europe E-bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe E-bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe E-bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 15: Europe E-bike Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 16: Europe E-bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 17: Europe E-bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe E-bike Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-bike Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the Europe E-bike Market?

Key companies in the market include Swiss E-Mobility Group (SEMG), Accell Group N V, VanMoof BV, KTM Bike Industries, Royal Dutch Gazelle, Fritzmeier Systems GmbH & Co KG (M1 Sporttechnik), Volt Electric Bikes, Merida Industry Co Ltd, Pedego Electric Bikes, Giant Manufacturing Co Ltd, Riese & Müller, Kalkhoff Werke GmbH, Trek Bicycle Corporation, Yamaha Bicycle, Brompton Bicycle.

3. What are the main segments of the Europe E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

December 2022: Volt Bikes and City AM collaborate for the Launch of an ESG-Focused Project. Impact AM is a brand-new division of City AM that specializes in environmental, social, and governance issues.November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.August 2022: The S3 Aluminum, a streamlined, high-end e-bike from VanMoof, has been released. Raw welding and a brushed metal frame are all that remains of the S3 Aluminum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-bike Market?

To stay informed about further developments, trends, and reports in the Europe E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence