Key Insights

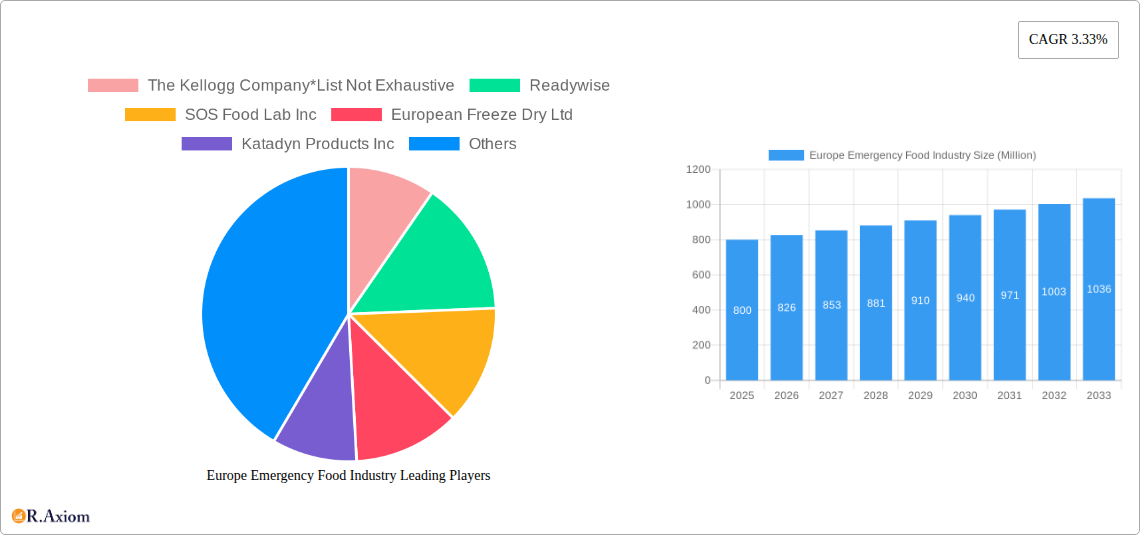

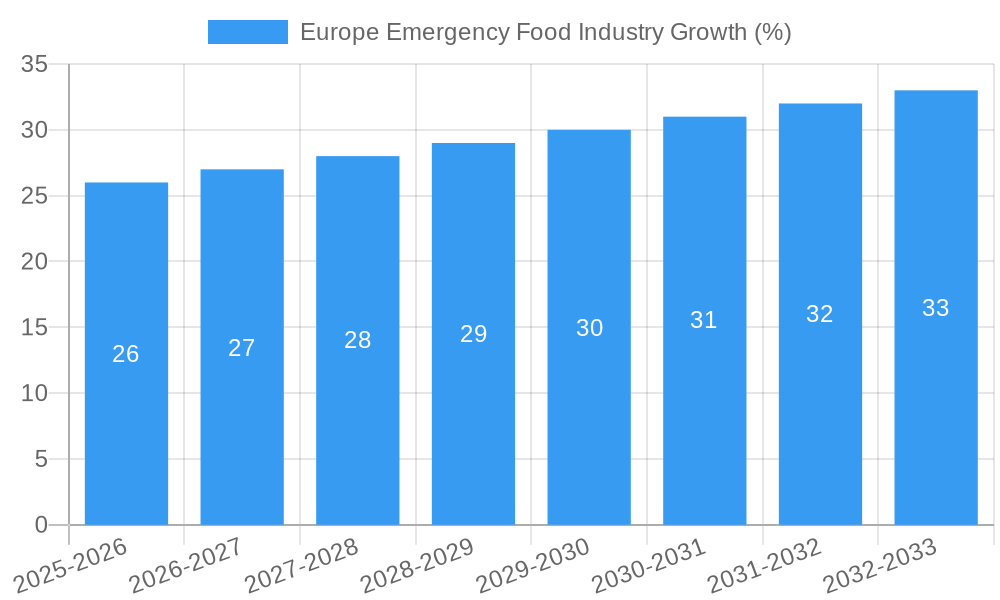

The European emergency food market, valued at approximately €800 million in 2025, is projected to experience steady growth, driven by increasing awareness of preparedness for natural disasters and geopolitical instability. A compound annual growth rate (CAGR) of 3.33% from 2025 to 2033 suggests a market size exceeding €1.1 billion by 2033. This growth is fueled by several key factors. Firstly, heightened consumer concern regarding food security, particularly in light of recent supply chain disruptions and conflicts, is boosting demand for long-shelf-life, nutritious emergency food supplies. Secondly, the growing popularity of outdoor activities like camping and hiking is driving demand for convenient and lightweight emergency food options, such as freeze-dried meals and snack bars. Finally, government initiatives promoting disaster preparedness and civil defense strategies are indirectly contributing to market expansion. While logistical challenges and price sensitivity may pose some constraints, the overall market outlook remains positive.

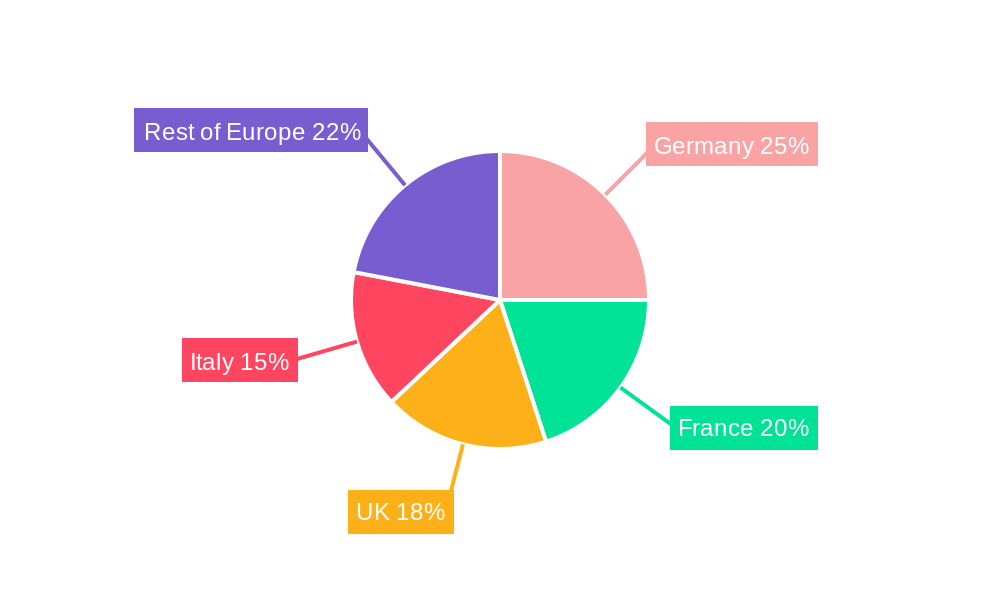

The market segmentation reveals a diverse range of product types catering to varied consumer needs. Freeze-dried fruits and vegetables, along with ready meals, constitute significant segments, reflecting the consumer preference for lightweight and nutritious options with extended shelf lives. Canned goods, although more bulky, maintain a substantial presence due to their affordability and accessibility. The presence of key players like Kellogg’s, alongside specialized companies like Readywise and SOS Food Lab, indicates a competitive landscape with both established brands and niche players vying for market share. The regional analysis, focusing on key European markets such as Germany, France, Italy, and the UK, shows varying levels of penetration depending on consumer preferences, disaster preparedness awareness, and economic factors. Further research into specific regional trends and consumer behavior within these markets would provide more granular insights into growth opportunities.

Europe Emergency Food Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Emergency Food Industry, covering market size, growth trends, key players, and future outlook from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Europe Emergency Food Industry Market Concentration & Innovation

The European emergency food industry exhibits a moderately concentrated market structure, with a few large players holding significant market share, alongside numerous smaller, specialized businesses. The Kellogg Company, for example, holds an estimated xx% market share in the ready-to-eat segment (2025). However, the market is witnessing increased competition from smaller companies focusing on niche product offerings or innovative preservation techniques. Innovation is driven by consumer demand for longer shelf-life products, improved nutritional profiles, and more convenient packaging. Regulatory frameworks, including food safety standards and labeling requirements, significantly influence product development and market entry. Substitutes, such as traditional food preservation methods, compete with emergency food products, albeit with limitations in shelf life and nutritional value. End-user trends reveal a growing preference for lightweight, shelf-stable options suitable for various emergency scenarios – from natural disasters to personal preparedness.

M&A activities in the industry have been relatively modest in recent years, with an estimated total deal value of €xx Million between 2019 and 2024. However, increased interest from private equity firms and larger food companies suggests potential for increased consolidation in the forecast period.

- Market Share (2025): The Kellogg Company (xx%), Readywise (xx%), Others (xx%)

- M&A Deal Value (2019-2024): €xx Million

- Key Innovation Drivers: Extended shelf-life technologies, improved nutrition, convenient packaging

Europe Emergency Food Industry Industry Trends & Insights

The European emergency food market is experiencing robust growth, driven by increasing consumer awareness of the importance of emergency preparedness, rising instances of extreme weather events, and growing demand for convenient, nutritious, and long-lasting food options. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of €xx Million by 2033. This growth is fueled by technological advancements in food preservation and packaging, leading to longer shelf-life products and improved nutritional content. Consumer preferences shift toward healthier options, including organic and non-GMO products. Competitive dynamics are shaped by both price competition and differentiation through product innovation and brand building. Market penetration of freeze-dried and ready-to-eat meals is rising steadily, driven by increased consumer convenience and shelf-life expectations.

Dominant Markets & Segments in Europe Emergency Food Industry

Germany and France represent the largest markets within Europe for emergency food, driven by robust economies, high levels of consumer awareness regarding emergency preparedness, and well-developed retail infrastructure. The freeze-dried ready meals segment dominates by product type, accounting for the largest market share (xx%) in 2025, due to its convenience and nutritional value compared to other options.

- Key Drivers for Germany & France:

- Strong consumer awareness of emergency preparedness.

- Robust retail infrastructure supporting product distribution.

- Higher disposable income allowing for preparedness investment.

- Freeze-Dried Ready Meals Dominance:

- Convenience and ease of preparation.

- Longer shelf life compared to canned alternatives.

- Higher nutritional retention than traditional canning.

Other segments, such as freeze-dried fruits and vegetables, snack bars, and canned juices, also exhibit significant growth potential, driven by increasing demand for diverse and nutritious emergency food options. The UK and Italy show strong regional growth potential, driven by increased governmental emphasis on preparedness in the face of climate change and evolving consumer preferences for healthy and convenient food options.

Europe Emergency Food Industry Product Developments

Recent innovations focus on lightweight, compact packaging, improved taste and texture of freeze-dried products, and the incorporation of functional ingredients to enhance nutritional value. Advancements in freeze-drying technology are leading to more natural-tasting products with longer shelf-lives. The development of shelf-stable ready-to-eat meals containing diverse meal components continues to expand the market appeal of these offerings. This increased focus on taste, nutrition and convenience is driving the demand for emergency foods beyond niche survivalist consumers and into the broader market for home preparedness.

Report Scope & Segmentation Analysis

This report segments the European emergency food market by product type, including:

Freeze-dried/Canned Fruits and Vegetables: This segment shows steady growth driven by the demand for nutritious and lightweight options. The market size in 2025 is estimated at €xx Million, projected to reach €xx Million by 2033. Competition is moderate.

Freeze-dried Ready Meals: The largest segment, exhibiting strong growth due to convenience and nutritional value. The 2025 market size is estimated at €xx Million, expected to reach €xx Million by 2033. Competition is higher in this sector, with significant product differentiation.

Snack Bars: A smaller but growing segment, characterized by convenience and portability. The market size in 2025 is estimated at €xx Million, projected to reach €xx Million by 2033. Competition is moderate.

Canned Juice: A niche segment with stable growth driven by long shelf-life and easy accessibility. The market size in 2025 is estimated at €xx Million, projected to reach €xx Million by 2033. Competition is low.

Freeze-dried Dairy: Growth is moderate driven by increasing focus on nutrient-rich options. The market size in 2025 is estimated at €xx Million, projected to reach €xx Million by 2033. Competition is moderate.

Freeze-dried Meat: This segment experiences steady growth, driven by higher demand for protein sources. The market size in 2025 is estimated at €xx Million, expected to reach €xx Million by 2033. Competition is moderate.

Key Drivers of Europe Emergency Food Industry Growth

Several factors contribute to the market's growth: Increased awareness of emergency preparedness among consumers, coupled with rising frequency and severity of natural disasters and geopolitical instability, is driving demand. Technological advancements in food preservation and packaging are extending shelf-life and improving product quality. Favorable government regulations and initiatives promoting food security are further supporting market growth. Lastly, the increasing adoption of online retail channels is enhancing accessibility to these products.

Challenges in the Europe Emergency Food Industry Sector

The industry faces challenges including stringent regulations concerning food safety and labeling, impacting production costs and market entry. Supply chain disruptions and fluctuations in raw material prices create uncertainty. Intense competition from established food companies and smaller specialized brands puts pressure on pricing and profitability. These factors contribute to the moderate growth trajectory currently observed. Increased regulatory scrutiny and raw material price volatility are contributing to supply chain uncertainty and increased operational costs.

Emerging Opportunities in Europe Emergency Food Industry

The market presents opportunities in developing innovative products with enhanced nutritional value and appealing flavors. Expansion into new markets with less developed emergency food sectors provides significant growth potential. The integration of technology to improve traceability and consumer information builds trust. Focus on sustainable and environmentally friendly packaging increases market appeal with environmentally-conscious consumers.

Leading Players in the Europe Emergency Food Industry Market

- The Kellogg Company

- Readywise

- SOS Food Lab Inc

- European Freeze Dry Ltd

- Katadyn Products Inc

- Expedition Foods Limited

- Malton Foods Limited

- Melograno SRL

- Lyofood SP Z O O

Key Developments in Europe Emergency Food Industry Industry

- 2022 Q4: Readywise launched a new line of organic freeze-dried meals.

- 2023 Q1: SOS Food Lab Inc. secured a significant investment for expansion into new markets.

- 2023 Q3: A major merger between two smaller European emergency food companies was announced. (Details not yet publicly available, estimated deal value €xx Million).

Strategic Outlook for Europe Emergency Food Industry Market

The European emergency food industry is poised for continued growth, driven by long-term trends such as increasing consumer awareness of disaster preparedness and evolving consumer preferences for convenient and nutritious food options. The market offers significant opportunities for businesses that can innovate with new products and technologies that address consumer needs and emerging trends. Continued focus on product differentiation, sustainable practices, and effective supply chain management will be critical for success in this dynamic sector.

Europe Emergency Food Industry Segmentation

-

1. Product Type

- 1.1. Freeze-dried/Canned Fruits and Vegetables

- 1.2. Freeze-dried Ready Meals

- 1.3. Snack Bars

- 1.4. Canned Juice

- 1.5. Freeze-dried Dairy

- 1.6. Freeze-dried Meat

Europe Emergency Food Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Emergency Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried/Canned Fruits and Vegetables

- 5.1.2. Freeze-dried Ready Meals

- 5.1.3. Snack Bars

- 5.1.4. Canned Juice

- 5.1.5. Freeze-dried Dairy

- 5.1.6. Freeze-dried Meat

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Freeze-dried/Canned Fruits and Vegetables

- 6.1.2. Freeze-dried Ready Meals

- 6.1.3. Snack Bars

- 6.1.4. Canned Juice

- 6.1.5. Freeze-dried Dairy

- 6.1.6. Freeze-dried Meat

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Freeze-dried/Canned Fruits and Vegetables

- 7.1.2. Freeze-dried Ready Meals

- 7.1.3. Snack Bars

- 7.1.4. Canned Juice

- 7.1.5. Freeze-dried Dairy

- 7.1.6. Freeze-dried Meat

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Freeze-dried/Canned Fruits and Vegetables

- 8.1.2. Freeze-dried Ready Meals

- 8.1.3. Snack Bars

- 8.1.4. Canned Juice

- 8.1.5. Freeze-dried Dairy

- 8.1.6. Freeze-dried Meat

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Freeze-dried/Canned Fruits and Vegetables

- 9.1.2. Freeze-dried Ready Meals

- 9.1.3. Snack Bars

- 9.1.4. Canned Juice

- 9.1.5. Freeze-dried Dairy

- 9.1.6. Freeze-dried Meat

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Freeze-dried/Canned Fruits and Vegetables

- 10.1.2. Freeze-dried Ready Meals

- 10.1.3. Snack Bars

- 10.1.4. Canned Juice

- 10.1.5. Freeze-dried Dairy

- 10.1.6. Freeze-dried Meat

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Freeze-dried/Canned Fruits and Vegetables

- 11.1.2. Freeze-dried Ready Meals

- 11.1.3. Snack Bars

- 11.1.4. Canned Juice

- 11.1.5. Freeze-dried Dairy

- 11.1.6. Freeze-dried Meat

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Freeze-dried/Canned Fruits and Vegetables

- 12.1.2. Freeze-dried Ready Meals

- 12.1.3. Snack Bars

- 12.1.4. Canned Juice

- 12.1.5. Freeze-dried Dairy

- 12.1.6. Freeze-dried Meat

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 The Kellogg Company*List Not Exhaustive

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Readywise

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 SOS Food Lab Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 European Freeze Dry Ltd

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Katadyn Products Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Expedition Foods Limited

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Malton Foods Limited

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Melograno SRL

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Lyofood SP Z O O

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.1 The Kellogg Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Emergency Food Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Emergency Food Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Emergency Food Industry?

The projected CAGR is approximately 3.33%.

2. Which companies are prominent players in the Europe Emergency Food Industry?

Key companies in the market include The Kellogg Company*List Not Exhaustive, Readywise, SOS Food Lab Inc, European Freeze Dry Ltd, Katadyn Products Inc, Expedition Foods Limited, Malton Foods Limited, Melograno SRL, Lyofood SP Z O O.

3. What are the main segments of the Europe Emergency Food Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Emergency Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Emergency Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Emergency Food Industry?

To stay informed about further developments, trends, and reports in the Europe Emergency Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence