Key Insights

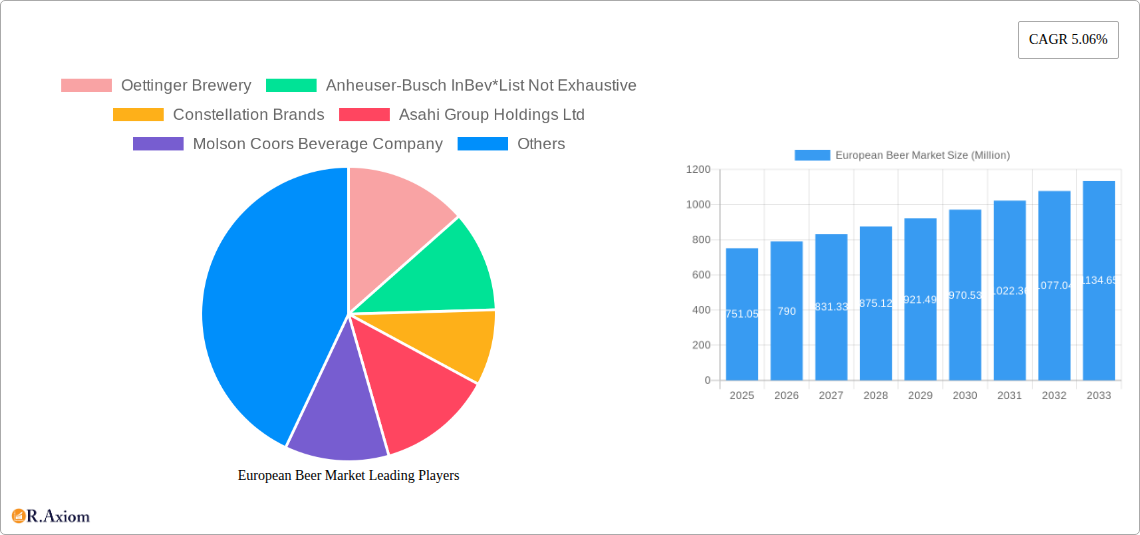

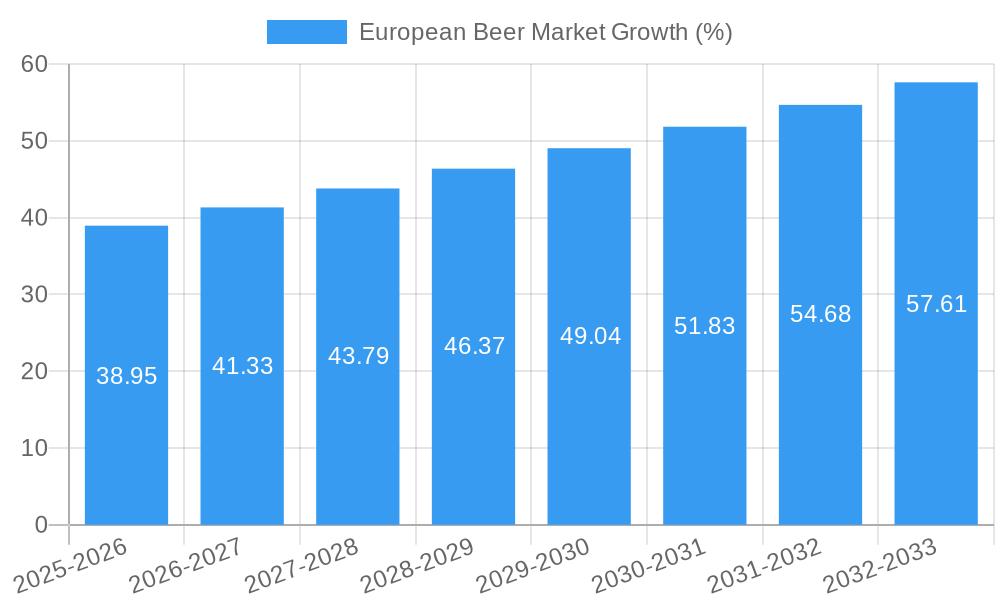

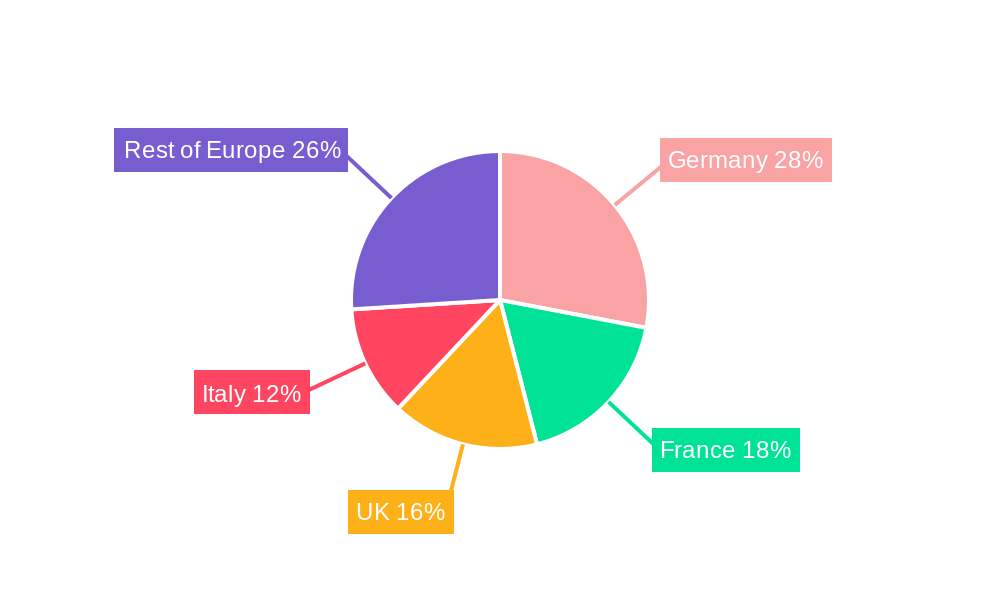

The European beer market, valued at €751.05 million in 2025, exhibits a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.06% from 2025 to 2033. This growth is fueled by several key factors. Premiumization, a significant trend, sees consumers increasingly opting for craft beers and specialty lagers, driving up average price points and overall market value. The on-trade sector, encompassing pubs, bars, and restaurants, is experiencing a resurgence post-pandemic, contributing significantly to sales growth, particularly for Ale and Lager product types. Furthermore, innovative packaging and distribution strategies, along with targeted marketing campaigns focusing on health and wellness-conscious consumers (e.g., low-calorie options), are further propelling market expansion. However, the market also faces challenges, including increasing excise duties and raw material costs, which might curb the growth rate. Competition among established players like Anheuser-Busch InBev, Heineken, and Carlsberg, alongside the emergence of smaller craft breweries, also intensifies the market dynamics. Germany, France, and the United Kingdom remain dominant markets within Europe, owing to strong established beer cultures and high per capita consumption. The off-trade channel, encompassing supermarkets and retail stores, remains a substantial revenue stream, though its growth may be slightly slower compared to the on-trade segment due to changing consumer preferences.

Regional variations within Europe are significant. Germany, with its strong brewing tradition and diverse beer styles, likely commands the largest market share, followed by the UK and France. Southern European countries may show comparatively slower growth due to differing drinking habits and cultural nuances. The increasing popularity of healthier alternatives like non-alcoholic and low-alcohol beers is a noteworthy trend that will likely influence the market's future development. This trend, coupled with sustainable practices adopted by several breweries, is shaping consumer preferences and driving innovation within the sector. The forecast period (2025-2033) suggests continued growth, though the rate might fluctuate slightly based on macroeconomic conditions and evolving consumer behavior. The continuing diversification of beer styles, coupled with targeted marketing towards specific consumer demographics, will likely be crucial in determining the market's future trajectory.

European Beer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European beer market, covering the period from 2019 to 2033. With a focus on market dynamics, key players, and future trends, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and 2025-2033 as the forecast period. All values are expressed in Millions.

European Beer Market Market Concentration & Innovation

The European beer market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Market leaders such as Anheuser-Busch InBev and Heineken exert considerable influence, leveraging their global scale and established brands. However, smaller, regional breweries and craft brewers also contribute significantly to the market's diversity and innovation. The market share of the top 5 players is estimated at xx% in 2025, while the remaining xx% is distributed among numerous smaller players. Innovation is driven by consumer demand for diverse product offerings, including low-alcohol and alcohol-free beers, craft brews, and premiumized options. Regulatory frameworks, particularly those concerning alcohol content and labeling, also play a significant role in shaping market dynamics. Substitute products, such as cider and ready-to-drink cocktails, are increasingly vying for consumer attention, impacting overall market growth. End-user trends, influenced by evolving health and wellness consciousness, are pushing the market towards healthier alternatives. M&A activities are frequent, with deal values varying considerably depending on the size and strategic importance of the acquired entities. In 2024, total M&A deal value in the European beer market was estimated at approximately $xx Million.

- Key Metrics:

- Top 5 players market share: xx% (2025)

- 2024 M&A Deal Value: $xx Million (estimated)

European Beer Market Industry Trends & Insights

The European beer market is experiencing a dynamic period of transformation, driven by several key trends. The market exhibits a CAGR of xx% during the forecast period (2025-2033). Market penetration of premium and craft beers continues to increase, fueled by changing consumer preferences towards higher-quality and more diverse products. Technological disruptions, particularly within production and distribution processes, are improving efficiency and reducing costs. Consumer preferences are increasingly shifting towards healthier options, driving growth in low-alcohol and alcohol-free beer segments. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. This heightened competition is leading to innovation, price adjustments, and strategic partnerships. Premiumization is another major trend, with consumers increasingly willing to pay more for high-quality, artisanal brews. Health-conscious consumers are driving growth in the non-alcoholic and low-alcohol segments. Overall, the industry is evolving at a rapid pace to cater to changing consumer preferences.

Dominant Markets & Segments in European Beer Market

- Leading Region: Western Europe, due to high per capita consumption and established beer culture.

- Leading Country: Germany (due to its long history of brewing and high consumption levels)

- Dominant Product Type: Lager remains the most popular product type, holding a significant market share.

- Key Drivers: Established preference, wide availability, affordability.

- Dominant Distribution Channel: Off-trade (supermarkets, convenience stores, etc.) accounts for a larger share of sales than the on-trade (pubs, bars, restaurants).

- Key Drivers: Convenience, price competitiveness, increased home consumption.

Germany's dominance stems from several factors: a deep-rooted beer culture, established brewing infrastructure, robust domestic demand, and a favorable regulatory environment. In contrast, the off-trade channel's dominance is fueled by changing consumer habits, increased convenience, and the affordability offered by supermarkets and other retailers. The economic strength of Western European countries also contributes to higher per capita consumption and market size. Infrastructure development, particularly in distribution and logistics, plays a key role in enhancing market access and driving growth.

European Beer Market Product Developments

Recent product innovations focus heavily on healthier options, with a surge in low-alcohol and alcohol-free beers. Companies are also emphasizing premiumization by offering unique flavors, artisanal brewing techniques, and sustainable sourcing. Technological advancements in brewing processes improve consistency, reduce costs, and enhance product quality. These product developments are aimed at aligning with evolving consumer preferences and increasing market competitiveness. The focus is on product differentiation and satisfying the evolving needs of the consumer base.

Report Scope & Segmentation Analysis

This report segments the European beer market by product type (Ale, Lager, Other Product Types) and distribution channel (On-trade, Off-trade).

Product Type:

- Lager: This segment holds the largest market share, with a projected xx% CAGR.

- Ale: This segment is experiencing steady growth, driven by increasing consumer preference for craft and specialty beers.

- Other Product Types: This category includes non-alcoholic beer and other specialty brews, showcasing high growth potential due to increasing health consciousness.

Distribution Channel:

- On-trade: The on-trade sector is expected to grow at a moderate pace, driven by the revival of the hospitality sector.

- Off-trade: This segment dominates the market, with growth driven by convenience and price competitiveness.

Key Drivers of European Beer Market Growth

Key drivers of the European beer market's growth include increasing consumer spending, changing consumer preferences towards premium and specialty beers, innovation in product offerings (like low-alcohol options), and the growing popularity of craft beer. Economic stability in major European markets supports this trend, while technological advancements improve production efficiency and reduce costs.

Challenges in the European Beer Market Sector

The European beer market faces several challenges, including increasing competition from substitute beverages, evolving consumer preferences (health consciousness), fluctuating raw material prices impacting production costs, and stringent regulatory environments that influence alcohol sales. Economic downturns could also impact consumer spending and negatively influence market growth. The increasing cost of raw materials also poses a challenge, impacting margins.

Emerging Opportunities in European Beer Market

The market presents significant opportunities in the growth of non-alcoholic and low-alcohol beer segments, increasing demand for premium and craft beers, the expansion of e-commerce channels, and the potential for innovative product offerings such as customized beers. The development of more sustainable brewing practices also presents an opportunity for enhanced brand image and growth.

Leading Players in the European Beer Market Market

- Oettinger Brewery

- Anheuser-Busch InBev

- Constellation Brands

- Asahi Group Holdings Ltd

- Molson Coors Beverage Company

- Carlsberg Group

- The Boston Beer Company Inc

- Kirin Holdings Co Ltd

- Heineken NV

- Bitburger Brewery

Key Developments in European Beer Market Industry

- January 2023: Asahi Europe & International launched its alcohol-free beer, Asahi Super Dry 0.0% across the United Kingdom.

- March 2023: Carlsberg Marston’s Brewing Company launched Carlsberg 0.0 across the United Kingdom.

- April 2023: Heineken launched its Spanish lager brand Cruzcampo on draught into pubs and bars across the United Kingdom.

- June 2023: The Brewers Association expanded its product portfolio in the United Kingdom by launching six American craft breweries featuring 14 different beers.

- December 2023: AB-InBev expanded its product portfolio in the United Kingdom with the launch of a new 4.5 percent ABV Italian-style lager, Via Roma.

These developments highlight the industry's focus on product diversification, particularly within the alcohol-free and craft beer segments. The expansion of international brands and the introduction of new products indicate a dynamic and competitive market landscape.

Strategic Outlook for European Beer Market Market

The European beer market shows strong potential for continued growth, driven by premiumization, health-conscious consumer choices, and the ongoing popularity of craft beers. Emerging opportunities lie in the expansion of e-commerce platforms, the development of personalized brewing experiences, and leveraging sustainable and ethical sourcing practices. The focus on innovation and adaptation to changing consumer preferences will be key to future success within this dynamic market.

European Beer Market Segmentation

-

1. Product Type

- 1.1. Ale

- 1.2. Lager

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

European Beer Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Spain

- 4. Italy

- 5. Germany

- 6. Russia

- 7. Rest of Europe

European Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Alcoholic Beverages; Health Conscious Consumers Accelerating Demand For Gluten-free Beer

- 3.3. Market Restrains

- 3.3.1. Threat From Other Alcoholic Beverages

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Alcoholic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Beer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ale

- 5.1.2. Lager

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Spain

- 5.3.4. Italy

- 5.3.5. Germany

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Beer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ale

- 6.1.2. Lager

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France European Beer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ale

- 7.1.2. Lager

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Spain European Beer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ale

- 8.1.2. Lager

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Beer Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ale

- 9.1.2. Lager

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Germany European Beer Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ale

- 10.1.2. Lager

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia European Beer Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Ale

- 11.1.2. Lager

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Beer Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Ale

- 12.1.2. Lager

- 12.1.3. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany European Beer Market Analysis, Insights and Forecast, 2019-2031

- 14. France European Beer Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy European Beer Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom European Beer Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands European Beer Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden European Beer Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe European Beer Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Oettinger Brewery

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Anheuser-Busch InBev*List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Constellation Brands

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Asahi Group Holdings Ltd

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Molson Coors Beverage Company

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Carlsberg Group

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 The Boston Beer Company Inc

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Kirin Holdings Co Ltd

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Heineken NV

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Bitburger Brewery

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Oettinger Brewery

List of Figures

- Figure 1: European Beer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Beer Market Share (%) by Company 2024

List of Tables

- Table 1: European Beer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Beer Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 5: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 7: European Beer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: European Beer Market Volume liter Forecast, by Region 2019 & 2032

- Table 9: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 11: Germany European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 13: France European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 15: Italy European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 19: Netherlands European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 21: Sweden European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe European Beer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe European Beer Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 25: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 27: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 29: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 31: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 33: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 35: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 37: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 39: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 41: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 43: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 45: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 47: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 49: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 51: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 53: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 55: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 57: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 58: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 59: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: European Beer Market Volume liter Forecast, by Country 2019 & 2032

- Table 61: European Beer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: European Beer Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 63: European Beer Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 64: European Beer Market Volume liter Forecast, by Distribution Channel 2019 & 2032

- Table 65: European Beer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: European Beer Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Beer Market?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the European Beer Market?

Key companies in the market include Oettinger Brewery, Anheuser-Busch InBev*List Not Exhaustive, Constellation Brands, Asahi Group Holdings Ltd, Molson Coors Beverage Company, Carlsberg Group, The Boston Beer Company Inc, Kirin Holdings Co Ltd, Heineken NV, Bitburger Brewery.

3. What are the main segments of the European Beer Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 751.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Alcoholic Beverages; Health Conscious Consumers Accelerating Demand For Gluten-free Beer.

6. What are the notable trends driving market growth?

Increasing Demand for Alcoholic Beverages.

7. Are there any restraints impacting market growth?

Threat From Other Alcoholic Beverages.

8. Can you provide examples of recent developments in the market?

December 2023: AB-InBev expanded its product portfolio in the United Kingdom with the launch of a new 4.5 percent ABV Italian-style lager, Via Roma, exclusively at the supermarket chain Sainsbury’s. Oettinger Brewery Anheuser-Busch InBev*List Not Exhaustive Constellation Brands Asahi Group Holdings Ltd Molson Coors Beverage Company Carlsberg Group The Boston Beer Company Inc Kirin Holdings Co Ltd Heineken NV Bitburger Brewery

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Beer Market?

To stay informed about further developments, trends, and reports in the European Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence