Key Insights

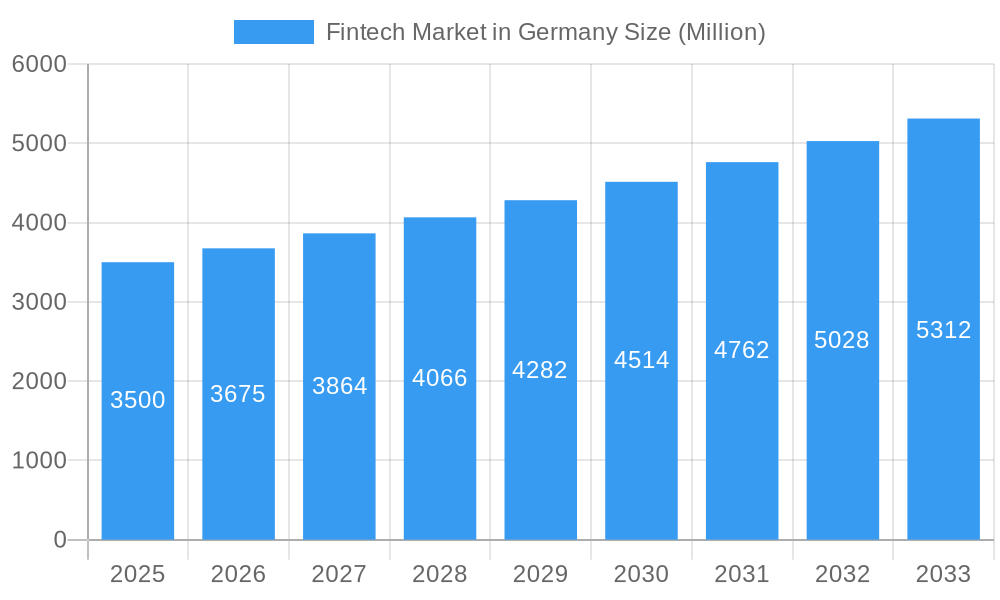

The German Fintech market is poised for significant expansion, fueled by rapid digital adoption, a robust startup ecosystem, and favorable regulatory environments. Key growth drivers include the surge in mobile payments, digital capital raising through platforms like crowdfunding, and the proliferation of neobanks and neobrokers. The market is projected to reach a size of 13.59 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.4%. The base year for these projections is 2025. Major market segments include mobile POS payments, digital capital raising, crowdlending, digital investment platforms, neobrokers, and neobanking, with digital payments dominating the service proposition. Leading innovators such as Mambu, Finleap Connect, N26, OneFor, and Trade Republic are actively shaping the financial services landscape.

Fintech Market in Germany Market Size (In Billion)

Despite regulatory compliance complexities and cybersecurity imperatives, the German Fintech market's growth trajectory remains strong. Technological advancements, particularly in AI and blockchain, are expected to mitigate these challenges. Growing consumer and business demand for personalized, convenient financial solutions will further propel market expansion. The sector's success in mobile payments, alongside the rise of innovative digital investment platforms and neobanking, solidifies Germany's position in the European Fintech arena. Future success hinges on balancing regulatory oversight with innovation, while prioritizing data security and consumer protection.

Fintech Market in Germany Company Market Share

This comprehensive report offers an in-depth analysis of the German Fintech market from 2019 to 2033, detailing market size, segmentation, key players, and future growth trajectories. Leveraging detailed data and insights, the report provides actionable strategies for industry stakeholders. The base year for analysis is 2025, with forecasts extending to 2033. The historical period reviewed is 2019-2024.

Fintech Market in Germany Market Concentration & Innovation

The German Fintech market is a dynamic landscape where established financial institutions and innovative startups coexist. While market concentration is moderate, with a few key players dominating specific niches like neobanking, a vibrant ecosystem of smaller, specialized firms thrives. Innovation is a powerful engine, propelled by cutting-edge technologies such as AI, blockchain, and mobile solutions. The regulatory environment, though constantly evolving, strikes a balance between encouraging innovation and safeguarding consumer interests. Digital solutions are rapidly replacing traditional financial services, demonstrating a clear trend of product substitution. German consumers increasingly favor convenient, personalized, and digitally-driven financial experiences. The significant M&A activity, with deal values reaching €XX million in 2024 (replace XX with actual value), reflects both consolidation within the sector and expansion strategies of key players. Illustrative examples include XX M&A deals (replace XX with actual number) in 2024, averaging €XX million (replace XX with actual value) per deal. While established players currently hold a larger market share, agile startups are quickly gaining ground, disrupting the status quo.

Fintech Market in Germany Industry Trends & Insights

The German Fintech market is experiencing robust growth, fueled by factors such as increasing smartphone penetration, rising digital literacy among the population, and a supportive regulatory climate. The market's Compound Annual Growth Rate (CAGR) is projected at XX% from 2025 to 2033 (replace XX with actual value), with market penetration anticipated to reach XX% by 2033 (replace XX with actual value). Technological advancements, especially in AI-powered personalized financial advice and secure blockchain-based transactions, are fundamentally altering the competitive landscape. Consumers are demanding seamless, omnichannel experiences, driving Fintech companies to invest heavily in user-friendly interfaces and highly personalized services. The competitive dynamics are intense, marked by fierce rivalry, strategic alliances, and a relentless pursuit of product innovation. The expanding adoption of Open Banking APIs is further accelerating market growth and fostering collaboration within the Fintech ecosystem.

Dominant Markets & Segments in Fintech Market in Germany

The German Fintech market shows significant strength across various segments.

By Product:

- Neo-banking: This segment is experiencing explosive growth due to the demand for convenient and user-friendly digital banking solutions. Key drivers include increasing customer dissatisfaction with traditional banking services, coupled with the ease of use and attractive features offered by Neo-banks. The market size for Neo-banking is estimated at xx Million in 2025.

- Digital Investment: The rise of digital investment platforms has attracted significant investment and user adoption, driven by the accessibility and transparency these platforms offer. Market size is estimated at xx Million in 2025.

By Service Proposition:

- Digital Payments: The digital payment landscape is experiencing significant growth, fueled by the increasing adoption of mobile wallets and contactless payments. The convenience and security offered by digital payments are key drivers of this growth. Market size for Digital Payments in 2025 is estimated at xx Million.

Other segments like Mobile POS Payments, Digital Capital Raising, Crowdlending, and Digital Assets are also showing steady growth, though at a slower pace compared to Neo-banking and Digital Payments. The strong digital infrastructure and relatively high financial literacy of the German population contribute to the overall market success.

Fintech Market in Germany Product Developments

Recent product innovations reflect a strong focus on personalized financial management tools, AI-powered risk assessment, and seamless integration with existing financial services. The market is witnessing the emergence of sophisticated robo-advisors, advanced fraud detection systems, and blockchain-based solutions for enhanced security and transparency. These developments are improving user experience and increasing market competitiveness.

Report Scope & Segmentation Analysis

This report segments the German Fintech market by product (Mobile POS Payments, Digital Capital Raising, Crowdlending, Digital Investment, Neobrokers, NeoBanking, Digital Assets) and service proposition (Digital Payments). Each segment’s growth projection, market size (in Millions), and competitive dynamics are analyzed in detail. For example, the NeoBanking segment is projected to grow at a CAGR of xx% from 2025-2033, while the Digital Payment segment is expected to reach xx Million by 2033. Competitive analysis within each segment reveals the leading players and their strategies.

Key Drivers of Fintech Market in Germany Growth

Several factors drive the growth of the German Fintech market. Technological advancements, particularly in AI and mobile technology, enable the creation of innovative and user-friendly financial products. The strong digital infrastructure and high internet penetration in Germany support the adoption of digital financial services. Furthermore, a supportive regulatory environment, including initiatives to foster innovation and competition, encourages the growth of the sector. Lastly, changing consumer preferences, with increased demand for convenient and personalized financial services, further accelerates market growth.

Challenges in the Fintech Market in Germany Sector

Despite its considerable growth potential, the German Fintech market faces significant challenges. Regulatory hurdles, particularly those concerning data privacy and compliance, can hinder innovation and create barriers to entry for new players. Supply chain disruptions and cybersecurity threats pose substantial risks. Furthermore, the intense competition from both established financial institutions and fellow Fintech companies puts pressure on profit margins and overall profitability. For instance, XX% of Fintech startups (replace XX with actual value) failed to secure Series A funding in 2024 due to competitive pressures.

Emerging Opportunities in Fintech Market in Germany

The German Fintech market presents several promising opportunities for growth. The widespread adoption of open banking APIs creates fertile ground for developing innovative financial products and services. The rising demand for sustainable and ethical finance presents a compelling opportunity for Fintech companies to create products and services aligned with these values. Finally, expanding into underserved market segments, such as SMEs and rural communities, offers significant untapped potential for market expansion.

Leading Players in the Fintech Market in Germany Market

- Mambu

- Finleap Connect

- N26

- OneFor

- Trade Republic

- AirBank

- Wefox Group

- Raisin DS

- NeuFund

- HoneyBook

- Hawk:AI

Key Developments in Fintech Market in Germany Industry

- June 2022: Airbank raised USD 20 Million to expand its global SMB banking solution focused on real-time cash flow management.

- March 2022: Raisin DS added private equity as a new asset class to its investment marketplace.

Strategic Outlook for Fintech Market in Germany Market

The German Fintech market is poised for continued robust growth, driven by ongoing technological innovation, evolving consumer preferences, and a supportive regulatory environment. The market’s potential is significant, with opportunities across various segments. Strategic partnerships and collaborations between Fintech companies and traditional financial institutions are expected to increase, fostering innovation and market expansion. The focus on enhanced security, personalized experiences, and sustainable finance will be key drivers of future growth.

Fintech Market in Germany Segmentation

-

1. Service proposition

-

1.1. Digital Payments

- 1.1.1. Digital Commerce

- 1.1.2. Mobile POS Payments

-

1.2. Digital Capital Raising

- 1.2.1. Crowdfunding

- 1.2.2. Crowdinvesting

- 1.2.3. Crowdlending

-

1.3. Digital Investment

- 1.3.1. Robo-Advisors

- 1.3.2. Neobrokers

- 1.4. NeoBanking

-

1.5. Digital Assets

- 1.5.1. Cryptocurrencies

- 1.5.2. NFT

-

1.1. Digital Payments

Fintech Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fintech Market in Germany Regional Market Share

Geographic Coverage of Fintech Market in Germany

Fintech Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Increase in Investments in Fintech Sector is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Digital Payments

- 5.1.1.1. Digital Commerce

- 5.1.1.2. Mobile POS Payments

- 5.1.2. Digital Capital Raising

- 5.1.2.1. Crowdfunding

- 5.1.2.2. Crowdinvesting

- 5.1.2.3. Crowdlending

- 5.1.3. Digital Investment

- 5.1.3.1. Robo-Advisors

- 5.1.3.2. Neobrokers

- 5.1.4. NeoBanking

- 5.1.5. Digital Assets

- 5.1.5.1. Cryptocurrencies

- 5.1.5.2. NFT

- 5.1.1. Digital Payments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. North America Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 6.1.1. Digital Payments

- 6.1.1.1. Digital Commerce

- 6.1.1.2. Mobile POS Payments

- 6.1.2. Digital Capital Raising

- 6.1.2.1. Crowdfunding

- 6.1.2.2. Crowdinvesting

- 6.1.2.3. Crowdlending

- 6.1.3. Digital Investment

- 6.1.3.1. Robo-Advisors

- 6.1.3.2. Neobrokers

- 6.1.4. NeoBanking

- 6.1.5. Digital Assets

- 6.1.5.1. Cryptocurrencies

- 6.1.5.2. NFT

- 6.1.1. Digital Payments

- 6.1. Market Analysis, Insights and Forecast - by Service proposition

- 7. South America Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 7.1.1. Digital Payments

- 7.1.1.1. Digital Commerce

- 7.1.1.2. Mobile POS Payments

- 7.1.2. Digital Capital Raising

- 7.1.2.1. Crowdfunding

- 7.1.2.2. Crowdinvesting

- 7.1.2.3. Crowdlending

- 7.1.3. Digital Investment

- 7.1.3.1. Robo-Advisors

- 7.1.3.2. Neobrokers

- 7.1.4. NeoBanking

- 7.1.5. Digital Assets

- 7.1.5.1. Cryptocurrencies

- 7.1.5.2. NFT

- 7.1.1. Digital Payments

- 7.1. Market Analysis, Insights and Forecast - by Service proposition

- 8. Europe Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 8.1.1. Digital Payments

- 8.1.1.1. Digital Commerce

- 8.1.1.2. Mobile POS Payments

- 8.1.2. Digital Capital Raising

- 8.1.2.1. Crowdfunding

- 8.1.2.2. Crowdinvesting

- 8.1.2.3. Crowdlending

- 8.1.3. Digital Investment

- 8.1.3.1. Robo-Advisors

- 8.1.3.2. Neobrokers

- 8.1.4. NeoBanking

- 8.1.5. Digital Assets

- 8.1.5.1. Cryptocurrencies

- 8.1.5.2. NFT

- 8.1.1. Digital Payments

- 8.1. Market Analysis, Insights and Forecast - by Service proposition

- 9. Middle East & Africa Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 9.1.1. Digital Payments

- 9.1.1.1. Digital Commerce

- 9.1.1.2. Mobile POS Payments

- 9.1.2. Digital Capital Raising

- 9.1.2.1. Crowdfunding

- 9.1.2.2. Crowdinvesting

- 9.1.2.3. Crowdlending

- 9.1.3. Digital Investment

- 9.1.3.1. Robo-Advisors

- 9.1.3.2. Neobrokers

- 9.1.4. NeoBanking

- 9.1.5. Digital Assets

- 9.1.5.1. Cryptocurrencies

- 9.1.5.2. NFT

- 9.1.1. Digital Payments

- 9.1. Market Analysis, Insights and Forecast - by Service proposition

- 10. Asia Pacific Fintech Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 10.1.1. Digital Payments

- 10.1.1.1. Digital Commerce

- 10.1.1.2. Mobile POS Payments

- 10.1.2. Digital Capital Raising

- 10.1.2.1. Crowdfunding

- 10.1.2.2. Crowdinvesting

- 10.1.2.3. Crowdlending

- 10.1.3. Digital Investment

- 10.1.3.1. Robo-Advisors

- 10.1.3.2. Neobrokers

- 10.1.4. NeoBanking

- 10.1.5. Digital Assets

- 10.1.5.1. Cryptocurrencies

- 10.1.5.2. NFT

- 10.1.1. Digital Payments

- 10.1. Market Analysis, Insights and Forecast - by Service proposition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mambu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Finleap Connect

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 N

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OneFor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trade Republic*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AirBank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wefox Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raisin DS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NeuFund

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HoneyBook

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hawk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Mambu

List of Figures

- Figure 1: Global Fintech Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 3: North America Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 4: North America Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 7: South America Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 8: South America Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 11: Europe Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 12: Europe Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 15: Middle East & Africa Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 16: Middle East & Africa Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fintech Market in Germany Revenue (billion), by Service proposition 2025 & 2033

- Figure 19: Asia Pacific Fintech Market in Germany Revenue Share (%), by Service proposition 2025 & 2033

- Figure 20: Asia Pacific Fintech Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Fintech Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 2: Global Fintech Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 4: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 9: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 14: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 25: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Fintech Market in Germany Revenue billion Forecast, by Service proposition 2020 & 2033

- Table 33: Global Fintech Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Fintech Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fintech Market in Germany?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Fintech Market in Germany?

Key companies in the market include Mambu, Finleap Connect, N, OneFor, Trade Republic*List Not Exhaustive, AirBank, Wefox Group, Raisin DS, NeuFund, HoneyBook, Hawk:AI.

3. What are the main segments of the Fintech Market in Germany?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Increase in Investments in Fintech Sector is Fueling the Market.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

June 2022: Airbank raised USD 20 million to make a comprehensive global SMB banking solution. The firm is focused on enabling real-time cash flow management instead of forcing small to medium-sized businesses (SMBs) to rely on weekly or monthly reporting to gain financial insights. This funding will help the company to expand its operation and capture more market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fintech Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fintech Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fintech Market in Germany?

To stay informed about further developments, trends, and reports in the Fintech Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence