Key Insights

The Irish Life Insurance Market is poised for a period of steady, albeit modest, growth, with a projected market size of €21.1 billion in 2025. While the CAGR is estimated at a conservative 0.6% for the forecast period of 2025-2033, this indicates a mature market where incremental gains are the norm. The primary drivers of this market are likely to be a growing awareness of financial planning needs, an aging population requiring long-term care and retirement solutions, and potentially evolving regulatory landscapes that encourage life insurance uptake. The market's stability suggests a resilient demand for life insurance products, driven by fundamental human needs for security and financial protection for loved ones.

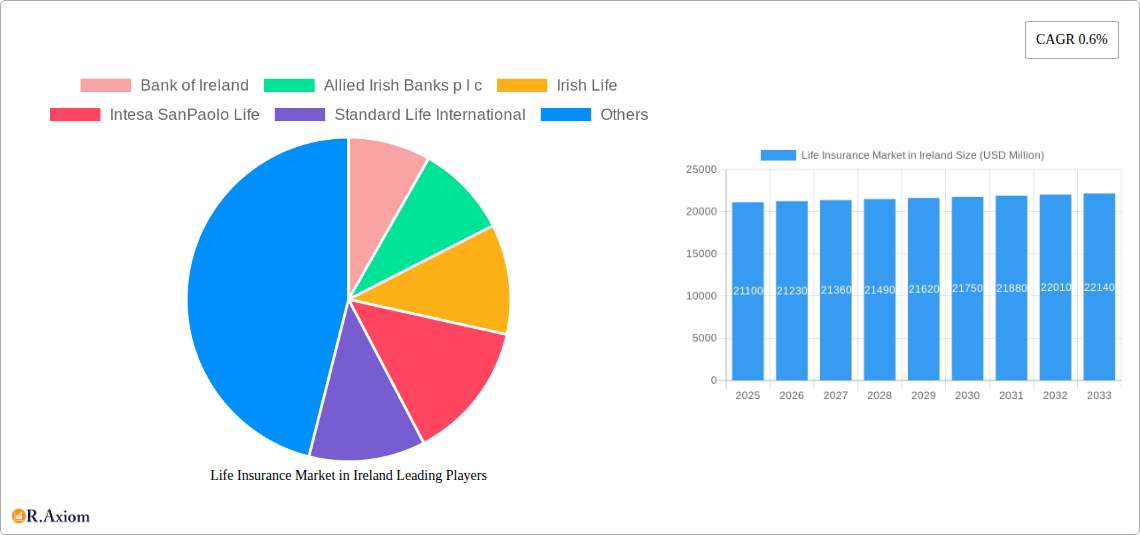

Life Insurance Market in Ireland Market Size (In Billion)

The structure of the Irish Life Insurance Market is characterized by a clear segmentation across various insurance types and distribution channels. Life insurance continues to be a dominant force, encompassing both individual and group policies. Non-life insurance segments, including property, motor, health, and travel insurance, also contribute significantly to the overall financial services ecosystem, though the focus here remains on life protection. Distribution channels are diversifying, with a notable presence of brokers and agents, complemented by the increasing influence of banks and the rapidly expanding online channel. This multi-faceted approach to distribution allows insurers to reach a broader customer base and cater to different preferences, contributing to the overall market's sustained presence, even with a low CAGR. Key players like Bank of Ireland, Allied Irish Banks, Irish Life, and Zurich Insurance Group are actively shaping the competitive landscape.

Life Insurance Market in Ireland Company Market Share

This in-depth report provides a definitive analysis of the Life Insurance Market in Ireland, encompassing a detailed historical review (2019-2024), a robust base year analysis (2025), and a precise forecast period (2025-2033). Leveraging high-traffic keywords such as "Ireland life insurance," "life insurance market Ireland," "Irish insurance industry," "life assurance Ireland," "financial services Ireland," and "insurance growth Ireland," this research is indispensable for insurance providers, financial institutions, regulatory bodies, and investors seeking to understand and capitalize on the dynamic Irish life insurance landscape. We project the market to reach USD 60 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033.

Life Insurance Market in Ireland Market Concentration & Innovation

The Life Insurance Market in Ireland exhibits a moderate level of concentration, with key players vying for market share. Major companies like Irish Life, New Ireland Assurance, and Bank of Ireland are at the forefront, alongside international giants such as Zurich Insurance Group and Standard Life International. Innovation is a critical differentiator, fueled by advancements in digital platforms, personalized product offerings, and enhanced customer experience. Regulatory frameworks, including those set by the Central Bank of Ireland, play a significant role in shaping market dynamics, ensuring consumer protection and solvency. While direct product substitutes for life insurance are limited, alternative investment vehicles can influence consumer choices. End-user trends indicate a growing demand for flexible, digitally accessible policies and a focus on health and wellness integration. Mergers and Acquisitions (M&A) activities, with an estimated deal value of USD 3 billion in the historical period, continue to reshape the competitive landscape, fostering consolidation and strategic partnerships.

- Market Share Dynamics: Irish Life and New Ireland Assurance consistently hold significant market shares, estimated at 20% and 18% respectively.

- Innovation Drivers: Digital transformation, AI-powered underwriting, and InsurTech collaborations are key innovation catalysts.

- Regulatory Impact: Solvency II directives and consumer protection regulations influence product design and market entry.

- M&A Trends: Strategic acquisitions and consolidations are observed, aimed at expanding product portfolios and market reach.

Life Insurance Market in Ireland Industry Trends & Insights

The Life Insurance Market in Ireland is poised for substantial growth, propelled by a confluence of factors including an aging population, increasing disposable incomes, and a heightened awareness of financial security. The market penetration for life insurance in Ireland is estimated at 55% in the base year 2025, with significant room for expansion. Technological disruptions are revolutionizing the industry, with the adoption of AI, big data analytics, and blockchain facilitating more efficient underwriting, personalized customer experiences, and fraud detection. Consumer preferences are shifting towards flexible, needs-based products that offer comprehensive coverage, including critical illness and income protection. Digital channels are gaining traction, with a growing segment of consumers preferring online research and purchase of insurance policies. Competitive dynamics are intensifying, with established players investing heavily in digital capabilities and new entrants leveraging innovative business models. The CAGR for the Life Insurance Market in Ireland from 2025 to 2033 is projected to be 4.7%, indicating a healthy and sustained expansion. The total market size is estimated to reach USD 60 billion by 2033.

Dominant Markets & Segments in Life Insurance Market in Ireland

Within the Life Insurance Market in Ireland, the Individual Life Insurance segment is the dominant force, accounting for an estimated 70% of the total market value in 2025, projected to reach USD 42 billion by 2033. This dominance is driven by growing individual awareness of financial planning and the need for long-term security. The Group Life Insurance segment, while smaller, is experiencing steady growth, particularly within employee benefits packages, with an estimated market size of USD 18 billion by 2033. In the non-life insurance sphere, Health and Accident Insurance is a significant contributor, reflecting rising healthcare costs and a proactive approach to well-being. Property Insurance and Motor Insurance remain foundational non-life segments.

The Channel of Distribution landscape is evolving. Brokers continue to play a vital role, offering expert advice and personalized solutions, commanding an estimated 40% market share in distribution. Banks, through bancassurance partnerships, also represent a significant channel, estimated at 25%. Agents remain relevant, particularly for building trust and long-term relationships. The Online channel is rapidly gaining prominence, projected to reach 20% by 2033, driven by convenience and digital savviness.

- Key Drivers for Individual Life Insurance Dominance:

- Increasing financial literacy and long-term savings goals.

- Growing prevalence of dual-income households and the need for income replacement.

- Government incentives and tax benefits for life insurance policies.

- Key Drivers for Group Life Insurance Growth:

- Employer focus on employee welfare and retention strategies.

- Demand for comprehensive benefits packages.

- Dominance in Non-Life Segments:

- Health and Accident Insurance: Rising healthcare costs, government health initiatives.

- Property Insurance: Robust housing market, increased property ownership.

- Motor Insurance: High vehicle ownership, stringent driving regulations.

- Channel Dominance Factors:

- Brokers: Expertise, unbiased advice, personalized service.

- Banks: Existing customer relationships, integrated financial services.

- Online: Convenience, competitive pricing, accessibility for younger demographics.

Life Insurance Market in Ireland Product Developments

Product innovation in the Life Insurance Market in Ireland is characterized by the development of flexible, modular policies that cater to diverse individual needs. Key developments include the integration of wellness programs and preventative health services into life insurance plans, offering policyholders incentives for healthy lifestyles. Advancements in InsurTech are enabling personalized underwriting, faster claims processing, and enhanced customer engagement through digital platforms. The competitive advantage lies in offering policies that provide comprehensive protection, wealth accumulation opportunities, and adaptability to changing life circumstances, all delivered through seamless digital interfaces.

Report Scope & Segmentation Analysis

This report meticulously segments the Life Insurance Market in Ireland to provide granular insights. The Insurance Type segmentation includes: Life Insurance (Individual, Group), and Non-life Insurance (Property Insurance, Motor insurance, Health and accident insurance, Travel Insurance, Rest of Non-Life Insurance). The Channel of Distribution segmentation covers: Brokers, Agents, Banks, Online, Other Distribution Channels.

- Life Insurance (Individual): Projected to reach USD 42 billion by 2033, driven by increasing individual financial planning.

- Life Insurance (Group): Expected to grow to USD 18 billion by 2033, supported by employer-sponsored benefits.

- Non-life Insurance Segments: Collectively projected to exhibit steady growth, with Health and Accident Insurance showing particular resilience.

- Channel Dynamics: The Online channel is anticipated for rapid growth, while Brokers and Banks will maintain significant influence.

Key Drivers of Life Insurance Market in Ireland Growth

The growth of the Life Insurance Market in Ireland is underpinned by several key drivers. An aging population necessitates increased demand for retirement planning and life cover. Rising disposable incomes allow individuals to allocate more towards financial security. Technological advancements are enhancing accessibility, efficiency, and product customization, making insurance more appealing. Regulatory environments that promote financial inclusion and consumer protection also foster market expansion. Furthermore, a heightened awareness of financial resilience post-pandemic is prompting more individuals to seek life insurance solutions.

Challenges in the Life Insurance Market in Ireland Sector

Despite robust growth prospects, the Life Insurance Market in Ireland faces certain challenges. Regulatory hurdles and compliance costs can impact insurer profitability. Low interest rates have historically posed a challenge for life insurers' investment strategies. Increasing competition, both from established players and new InsurTech entrants, necessitates continuous innovation and cost management. Consumer inertia and a lack of financial literacy in certain demographics can hinder market penetration. Supply chain issues impacting the broader economy can also indirectly affect investment returns and consumer spending power.

Emerging Opportunities in Life Insurance Market in Ireland

Emerging opportunities within the Life Insurance Market in Ireland are abundant. The growing demand for personalized and modular insurance products presents a significant avenue for innovation. The expansion of the InsurTech ecosystem offers opportunities for collaborations and the development of AI-driven solutions for underwriting and customer service. The increasing focus on environmental, social, and governance (ESG) factors is creating demand for sustainable insurance products and investment strategies. Furthermore, exploring untapped segments within the population and developing products tailored for freelancers and the gig economy represent promising growth areas.

Leading Players in the Life Insurance Market in Ireland Market

- Bank of Ireland

- Allied Irish Banks p l c

- Irish Life

- Intesa SanPaolo Life

- Standard Life International

- Zurich Insurance Group

- Darta Saving Life Assurance

- XL Insurance

- New Ireland Assurance

- Utmost Paneurope

- Partner Reinsurance Europe

Key Developments in Life Insurance Market in Ireland Industry

- May 2022: FINEOS partnered with EY Ireland to accelerate smart digital transformation for insurance carriers in the life, accident, and health industry, aiming to positively impact the employee benefits value chain and achieve tangible operational efficiencies.

- April 2022: Assured Partners entered the Irish market by acquiring Gallivan Murphy Insurance Brokers Limited, signaling consolidation and expansion strategies within the broker network.

Strategic Outlook for Life Insurance Market in Ireland Market

The strategic outlook for the Life Insurance Market in Ireland is overwhelmingly positive, driven by sustained economic stability and evolving consumer needs. Key growth catalysts include continued digital transformation, the development of innovative and personalized product offerings, and strategic partnerships within the financial services ecosystem. The market is well-positioned to capitalize on the increasing demand for financial security and wealth management solutions. Investment in InsurTech and a focus on customer-centric approaches will be crucial for maintaining a competitive edge and unlocking future growth potential in this dynamic sector.

Life Insurance Market in Ireland Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Property Insurance

- 1.2.2. Motor insurance

- 1.2.3. Health and accident insurance

- 1.2.4. Travel Insurance

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Brokers

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Life Insurance Market in Ireland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life Insurance Market in Ireland Regional Market Share

Geographic Coverage of Life Insurance Market in Ireland

Life Insurance Market in Ireland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Online Sale of Insurance Policy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Property Insurance

- 5.1.2.2. Motor insurance

- 5.1.2.3. Health and accident insurance

- 5.1.2.4. Travel Insurance

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Brokers

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Property Insurance

- 6.1.2.2. Motor insurance

- 6.1.2.3. Health and accident insurance

- 6.1.2.4. Travel Insurance

- 6.1.2.5. Rest of Non-Life Insurance

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 6.2.1. Brokers

- 6.2.2. Agents

- 6.2.3. Banks

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Property Insurance

- 7.1.2.2. Motor insurance

- 7.1.2.3. Health and accident insurance

- 7.1.2.4. Travel Insurance

- 7.1.2.5. Rest of Non-Life Insurance

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 7.2.1. Brokers

- 7.2.2. Agents

- 7.2.3. Banks

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Property Insurance

- 8.1.2.2. Motor insurance

- 8.1.2.3. Health and accident insurance

- 8.1.2.4. Travel Insurance

- 8.1.2.5. Rest of Non-Life Insurance

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 8.2.1. Brokers

- 8.2.2. Agents

- 8.2.3. Banks

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Property Insurance

- 9.1.2.2. Motor insurance

- 9.1.2.3. Health and accident insurance

- 9.1.2.4. Travel Insurance

- 9.1.2.5. Rest of Non-Life Insurance

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 9.2.1. Brokers

- 9.2.2. Agents

- 9.2.3. Banks

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-life Insurance

- 10.1.2.1. Property Insurance

- 10.1.2.2. Motor insurance

- 10.1.2.3. Health and accident insurance

- 10.1.2.4. Travel Insurance

- 10.1.2.5. Rest of Non-Life Insurance

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 10.2.1. Brokers

- 10.2.2. Agents

- 10.2.3. Banks

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of Ireland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allied Irish Banks p l c

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Irish Life

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intesa SanPaolo Life

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Standard Life International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zurich Insurance Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Darta Saving Life Assurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 XL Insurance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 New Ireland Assurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Utmost Paneurope

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Partner Reinsurance Europe**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Bank of Ireland

List of Figures

- Figure 1: Global Life Insurance Market in Ireland Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 3: North America Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 5: North America Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 6: North America Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 9: South America Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 10: South America Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 11: South America Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 12: South America Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 15: Europe Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Europe Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 17: Europe Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 18: Europe Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 21: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 22: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 23: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 24: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 27: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 28: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 29: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 30: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 2: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 5: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 6: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 11: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 12: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 17: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 18: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 29: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 30: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 38: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 39: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life Insurance Market in Ireland?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Life Insurance Market in Ireland?

Key companies in the market include Bank of Ireland, Allied Irish Banks p l c, Irish Life, Intesa SanPaolo Life, Standard Life International, Zurich Insurance Group, Darta Saving Life Assurance, XL Insurance, New Ireland Assurance, Utmost Paneurope, Partner Reinsurance Europe**List Not Exhaustive.

3. What are the main segments of the Life Insurance Market in Ireland?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Online Sale of Insurance Policy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 23, 2022, FINEOS partnered with EY Ireland to accelerate smart digital transformation for insurance carriers in the life, accident, and health industry. It will positively impact the employee benefits value chain, from insurers and employers to employees, while also achieving tangible operational efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life Insurance Market in Ireland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life Insurance Market in Ireland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life Insurance Market in Ireland?

To stay informed about further developments, trends, and reports in the Life Insurance Market in Ireland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence