Key Insights

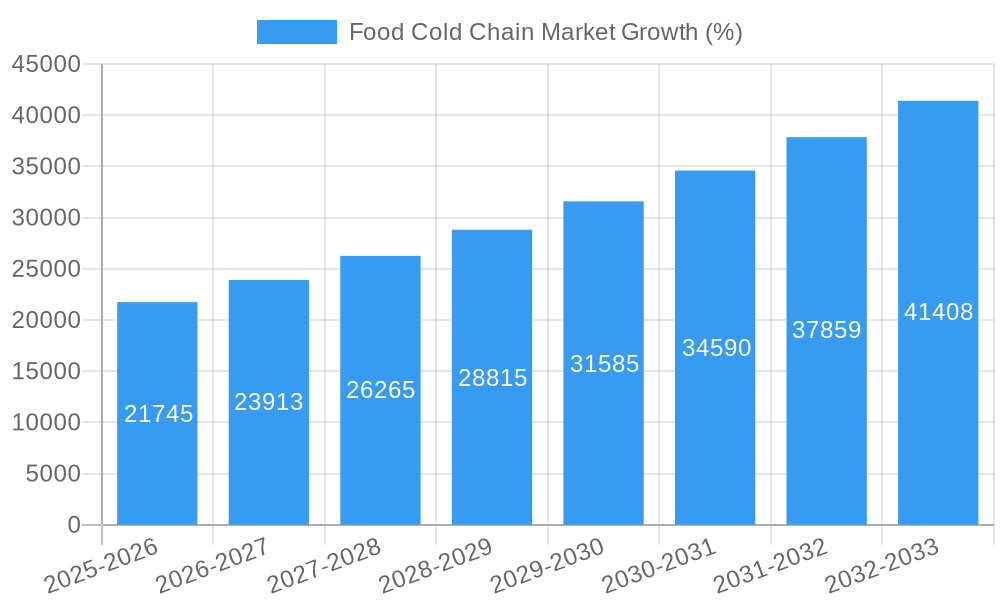

The global food cold chain market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033. This expansion is driven by several key factors. Rising consumer demand for fresh and processed food products, particularly in developing economies with burgeoning middle classes, fuels the need for efficient cold chain infrastructure to maintain quality and prevent spoilage. Furthermore, the increasing prevalence of foodborne illnesses is prompting stricter regulations and heightened emphasis on food safety, thereby driving investment in advanced cold chain technologies. E-commerce growth, especially in grocery delivery services, further contributes to market expansion by requiring sophisticated logistics and temperature-controlled transportation solutions. Significant advancements in refrigeration technologies, including energy-efficient equipment and improved cold storage solutions, are also contributing to market growth. However, high infrastructure costs, particularly in underdeveloped regions, and the challenges associated with maintaining consistent cold chain integrity across long distances remain significant restraints.

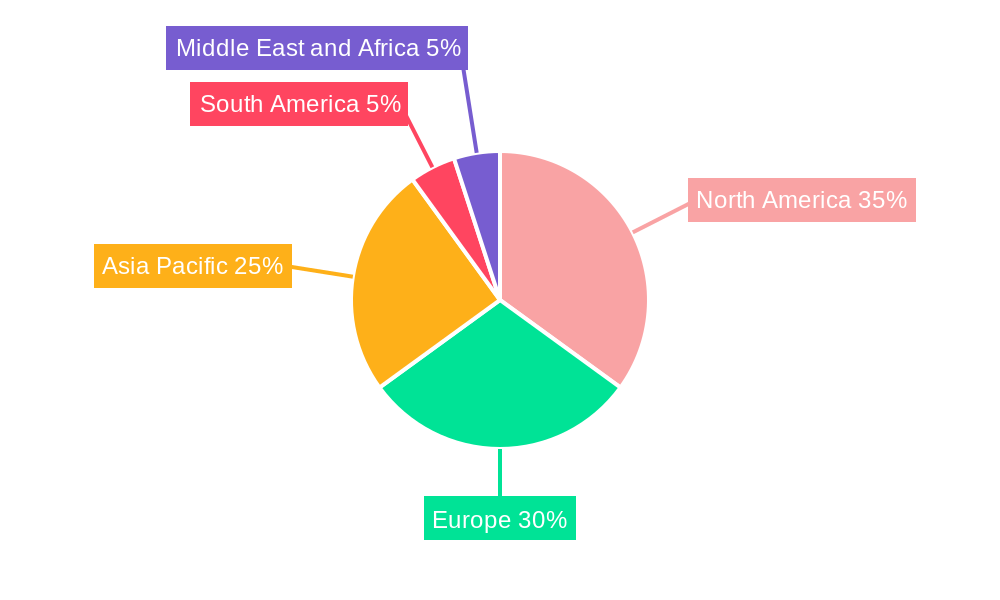

Segmentation reveals a diverse market landscape. The cold chain storage segment holds a substantial share, driven by the need for large-scale storage facilities for perishable goods. Within applications, fruits and vegetables, meat and seafood, and dairy and frozen desserts represent the largest segments, reflecting high consumer demand and perishability concerns. Geographically, North America and Europe currently dominate the market, but the Asia-Pacific region is poised for significant growth, fueled by rapid economic development and increasing urbanization. Key players like VersaCold Logistics Services, Lineage Logistics, and Americold Logistics are shaping market dynamics through strategic acquisitions, technological innovation, and expansion into new markets. The market's future trajectory hinges on sustained economic growth, technological advancements, evolving consumer preferences, and effective regulatory frameworks supporting food safety. Competitive intensity is expected to increase, with companies focusing on enhancing operational efficiency, improving logistics networks, and providing value-added services to gain a competitive edge.

Food Cold Chain Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Food Cold Chain Market, covering the period from 2019 to 2033. It offers in-depth insights into market dynamics, segmentation, key players, and future growth potential, providing valuable intelligence for industry stakeholders, investors, and businesses operating within this dynamic sector. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections (2025-2033), with 2025 serving as the base and estimated year. The market is segmented by Type (Cold Chain Storage, Cold Chain Transport) and Application (Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meal, Other Applications).

Food Cold Chain Market Concentration & Innovation

The Food Cold Chain Market exhibits a moderately concentrated structure, with a few large players holding significant market share. Lineage Logistics Holding LLC, AmeriCold Logistics LLC, and Agro Merchants Group are among the leading companies, each commanding a substantial portion of the market. However, the market also accommodates numerous smaller, regional players, creating a diverse competitive landscape. Market share data for 2024 indicates Lineage Logistics at approximately xx%, AmeriCold at xx%, and Agro Merchants at xx%, with the remaining share distributed among other participants.

Innovation in the food cold chain is driven by several factors, including:

- Technological advancements: IoT-enabled sensors, real-time tracking systems, and advanced refrigeration technologies are improving efficiency and reducing waste.

- Stringent regulatory frameworks: Increasing emphasis on food safety and quality standards is pushing for improved cold chain infrastructure and practices.

- Growing demand for fresh and processed foods: Expanding consumer preferences for convenience and readily available food are fueling the demand for efficient cold chain solutions.

- Mergers and Acquisitions (M&A): Consolidation in the sector, exemplified by Lineage Logistics' acquisition of Grupo Fuentes in 2022 (valued at approximately xx Million USD), is driving innovation and expansion. Other significant M&A deals in recent years include a total estimated value of xx Million USD.

- Product substitution: Increased adoption of sustainable and eco-friendly refrigerants is gradually replacing traditional solutions.

Food Cold Chain Market Industry Trends & Insights

The global Food Cold Chain Market is experiencing robust growth, driven by several key trends. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Several factors contribute to this growth:

- Rising disposable incomes: Increased purchasing power in developing economies is boosting demand for perishable food products, necessitating effective cold chain infrastructure.

- E-commerce expansion: The surge in online grocery shopping is driving the need for efficient last-mile delivery solutions for temperature-sensitive goods.

- Technological disruptions: The adoption of AI, machine learning, and blockchain technology is enhancing traceability, transparency, and efficiency in the cold chain.

- Consumer preference shift: Growing consumer awareness of food safety and quality is pushing for stricter cold chain management practices.

- Intensifying competition: Existing players are expanding their operations and investing in advanced technologies to maintain competitiveness. Market penetration of advanced technologies like IoT-based monitoring systems is projected to reach xx% by 2033.

Dominant Markets & Segments in Food Cold Chain Market

The Asia-Pacific region currently holds the dominant position in the global Food Cold Chain Market, driven by factors such as rapid economic growth, rising population, and increasing urbanization. Within this region, countries like India and China are experiencing significant market expansion.

- Key Drivers for Asia-Pacific Dominance:

- Rapid economic growth and rising disposable incomes.

- Expanding retail infrastructure, including supermarkets and hypermarkets.

- Increasing investment in cold chain infrastructure development.

- Government initiatives to promote food safety and quality.

The Cold Chain Storage segment dominates the market by type, due to the increasing demand for large-scale storage facilities to accommodate the growing volume of perishable goods. The Meat and Seafood segment is the leading application area, owing to the highly perishable nature of these products and stringent requirements for temperature control during storage and transportation. European countries also represent a significant market, especially for high-value products.

Food Cold Chain Market Product Developments

Recent product innovations focus on improving efficiency, safety, and sustainability in the food cold chain. This includes the development of smart refrigerated containers with integrated sensors and tracking systems, as well as the implementation of energy-efficient refrigeration technologies. The market also sees a growing emphasis on sustainable packaging materials to reduce environmental impact. These developments are primarily driven by the need to minimize food spoilage and enhance overall supply chain visibility.

Report Scope & Segmentation Analysis

This report segments the Food Cold Chain Market by Type: Cold Chain Storage and Cold Chain Transport, and by Application: Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meals, and Other Applications. Each segment's growth projections and competitive dynamics are analyzed, providing a comprehensive understanding of the market landscape. The Cold Chain Storage segment is projected to grow at a CAGR of xx% while Cold Chain Transport is projected at xx% during the forecast period. Within applications, meat and seafood show the highest growth potential owing to increased demand and higher value compared to other segments.

Key Drivers of Food Cold Chain Market Growth

Several factors are driving the growth of the Food Cold Chain Market:

- Technological advancements: IoT sensors, AI-powered analytics, and automated systems are enhancing efficiency and reducing waste.

- Economic growth: Rising disposable incomes and expanding middle classes are increasing demand for perishable foods.

- Stringent regulations: Governments are implementing stricter food safety standards, driving investment in cold chain infrastructure.

- E-commerce growth: The rise of online grocery shopping necessitates efficient last-mile delivery solutions.

Challenges in the Food Cold Chain Market Sector

The Food Cold Chain Market faces various challenges:

- High infrastructure costs: Establishing and maintaining cold chain infrastructure can be expensive, particularly in developing regions.

- Supply chain disruptions: Global events like pandemics and natural disasters can disrupt cold chain operations, leading to food spoilage and losses.

- Energy consumption: Refrigeration systems consume significant energy, leading to high operating costs and environmental concerns.

- Lack of skilled workforce: A shortage of trained personnel can hamper efficient operation and maintenance of cold chain facilities. This leads to an estimated xx Million USD in annual losses.

Emerging Opportunities in Food Cold Chain Market

Several opportunities exist in the Food Cold Chain Market:

- Expansion into emerging markets: Developing economies offer significant growth potential for cold chain services.

- Adoption of sustainable practices: Companies are increasingly focusing on eco-friendly refrigerants and packaging to reduce their environmental footprint.

- Integration of advanced technologies: Artificial intelligence, machine learning, and blockchain can enhance traceability and transparency in the cold chain.

- Development of specialized cold chain solutions: Tailored solutions for specific food products, such as pharmaceuticals and vaccines, are gaining traction.

Leading Players in the Food Cold Chain Market

- VersaCold Logistics Services

- AGRO Merchants Group

- Lineage Logistics Holding LLC

- Gruppo Marconi Logistica

- DSV A/S

- AmeriCold Logistics LLC

- Kloosterboer Group BV

- Henningsen Cold Storage Co

- Celsius Logistics

- Nichirei Corporation

Key Developments in Food Cold Chain Market Industry

- September 2022: Celsius Logistics launched a smart last-mile delivery platform in India.

- September 2022: Lineage Logistics LLC acquired Grupo Fuentes in Spain.

- August 2021: GeoTab unveiled cold chain vans with advanced refrigeration capabilities.

Strategic Outlook for Food Cold Chain Market

The Food Cold Chain Market is poised for significant growth, fueled by technological advancements, rising consumer demand, and expanding e-commerce. Investments in infrastructure, sustainable practices, and innovative technologies will be key to capturing future market opportunities. The market is expected to witness further consolidation through M&A activity, leading to a more concentrated yet innovative landscape.

Food Cold Chain Market Segmentation

-

1. Type

- 1.1. Cold Chain Storage

- 1.2. Cold Chain Transport

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Meat and Seafood

- 2.3. Dairy and Frozen Dessert

- 2.4. Bakery and Confectionery

- 2.5. Ready-to-Eat Meal

- 2.6. Other Applications

Food Cold Chain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Food Cold Chain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Growing Investments in Cold Chain Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Storage

- 5.1.2. Cold Chain Transport

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Meat and Seafood

- 5.2.3. Dairy and Frozen Dessert

- 5.2.4. Bakery and Confectionery

- 5.2.5. Ready-to-Eat Meal

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cold Chain Storage

- 6.1.2. Cold Chain Transport

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits and Vegetables

- 6.2.2. Meat and Seafood

- 6.2.3. Dairy and Frozen Dessert

- 6.2.4. Bakery and Confectionery

- 6.2.5. Ready-to-Eat Meal

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cold Chain Storage

- 7.1.2. Cold Chain Transport

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits and Vegetables

- 7.2.2. Meat and Seafood

- 7.2.3. Dairy and Frozen Dessert

- 7.2.4. Bakery and Confectionery

- 7.2.5. Ready-to-Eat Meal

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cold Chain Storage

- 8.1.2. Cold Chain Transport

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits and Vegetables

- 8.2.2. Meat and Seafood

- 8.2.3. Dairy and Frozen Dessert

- 8.2.4. Bakery and Confectionery

- 8.2.5. Ready-to-Eat Meal

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cold Chain Storage

- 9.1.2. Cold Chain Transport

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits and Vegetables

- 9.2.2. Meat and Seafood

- 9.2.3. Dairy and Frozen Dessert

- 9.2.4. Bakery and Confectionery

- 9.2.5. Ready-to-Eat Meal

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cold Chain Storage

- 10.1.2. Cold Chain Transport

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits and Vegetables

- 10.2.2. Meat and Seafood

- 10.2.3. Dairy and Frozen Dessert

- 10.2.4. Bakery and Confectionery

- 10.2.5. Ready-to-Eat Meal

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Spain

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Rest of Europe

- 13. Asia Pacific Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 VersaCold Logistics Services

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 AGRO Merchants Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lineage Logistics Holding LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Gruppo Marconi Logistica

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DSV A/S

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AmeriCold Logistics LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kloosterboer Group BV

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Henningsen Cold Storage Co

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Celsius Logistics*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nichirei Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 VersaCold Logistics Services

List of Figures

- Figure 1: Global Food Cold Chain Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Cold Chain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Food Cold Chain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Spain Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: China Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Australia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: South Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Saudi Arabia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East and Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Cold Chain Market?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Food Cold Chain Market?

Key companies in the market include VersaCold Logistics Services, AGRO Merchants Group, Lineage Logistics Holding LLC, Gruppo Marconi Logistica, DSV A/S, AmeriCold Logistics LLC, Kloosterboer Group BV, Henningsen Cold Storage Co, Celsius Logistics*List Not Exhaustive, Nichirei Corporation.

3. What are the main segments of the Food Cold Chain Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Growing Investments in Cold Chain Infrastructure.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

September 2022: Celcius Logistics, India's fastest-growing cold-chain marketplace startup, launched its smart last-mile delivery platform that addresses and fixes the most pertinent pain points in India's fragile cold supply chains. The brand has also partnered with vehicle owners and automotive manufacturers to create a robust on-ground network of reefer vehicles that will be integrated with the smart platform created with a unique Inventory Management System (IMS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Cold Chain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Cold Chain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Cold Chain Market?

To stay informed about further developments, trends, and reports in the Food Cold Chain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence