Key Insights

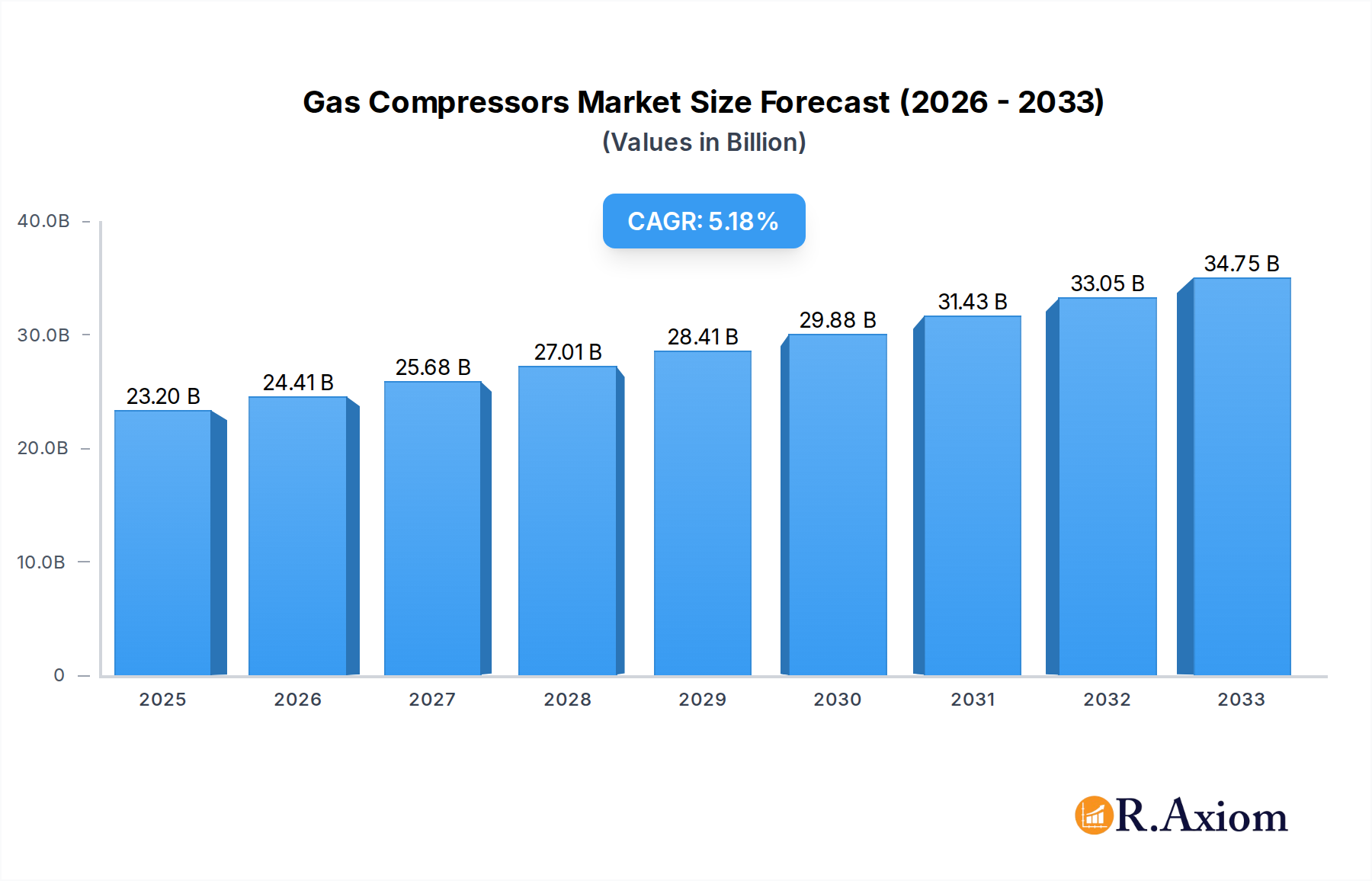

The global Gas Compressors Market is poised for substantial growth, estimated at USD 23.2 billion in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This robust expansion is primarily fueled by the increasing demand from key industrial sectors, notably the Oil and Gas industry, which relies heavily on efficient compression for exploration, production, and transportation of natural gas and crude oil. The burgeoning Power Sector, driven by the need for reliable energy generation and storage solutions, also presents a significant growth avenue. Furthermore, the expanding Petrochemical and Chemical Industries are witnessing heightened demand for compressors in various manufacturing processes, from polymerization to the production of essential chemicals. The Industrial Gases segment, crucial for applications ranging from healthcare to manufacturing, is also a significant contributor to market expansion. Innovations in compressor technology, focusing on energy efficiency, reduced emissions, and enhanced reliability, are acting as key drivers, enabling manufacturers to meet stricter environmental regulations and operational cost demands.

Gas Compressors Market Market Size (In Billion)

The market dynamics are further shaped by evolving global energy landscapes and technological advancements. The transition towards cleaner energy sources and the increasing importance of hydrogen as a fuel are creating new opportunities for specialized gas compressor solutions. While the market benefits from these drivers, certain restraints, such as the high initial capital investment for advanced compressor systems and fluctuating raw material prices, could temper growth to some extent. However, the increasing focus on operational efficiency and the lifecycle cost of equipment is expected to mitigate these concerns. Geographically, North America and Asia Pacific are expected to lead the market in terms of both size and growth, owing to substantial investments in energy infrastructure and industrial development. Emerging applications in areas like carbon capture and storage are also contributing to the diversified growth trajectory of the Gas Compressors Market.

Gas Compressors Market Company Market Share

This in-depth analysis of the global Gas Compressors Market provides critical insights into its current landscape and future trajectory. Spanning from 2019 to 2033, with a base year of 2025, this report offers a detailed examination of market dynamics, segmentation, key players, and emerging trends. Understand the strategic imperatives and growth catalysts driving this multi-billion dollar industry, essential for stakeholders in the Oil and Gas, Power Sector, Petrochemical and Chemical Industries, and Industrial Gases sectors.

Gas Compressors Market Market Concentration & Innovation

The Gas Compressors Market exhibits a moderate level of market concentration, with a few dominant global players holding significant market share. However, intense competition and continuous innovation are key characteristics. Innovation drivers include the increasing demand for energy efficiency, stringent environmental regulations, and the development of advanced materials and smart technologies for compressor operation and maintenance. Key innovations focus on reducing energy consumption, enhancing reliability, and integrating digital solutions for predictive maintenance and remote monitoring. Regulatory frameworks, particularly concerning emissions and safety standards, are shaping product development and market entry strategies. While direct product substitutes are limited, advancements in alternative energy storage solutions and process optimization techniques can indirectly influence demand. End-user trends are leaning towards compact, modular, and high-performance compressors tailored for specific applications within the Oil and Gas sector, renewable energy integration in the Power Sector, and process intensification in Petrochemical and Chemical Industries. Mergers and Acquisitions (M&A) activities, with deal values in the hundreds of millions to billions, are strategic moves by leading companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activity has focused on acquiring specialized compressor technologies and expanding service networks.

Gas Compressors Market Industry Trends & Insights

The Gas Compressors Market is poised for robust growth, driven by escalating global energy demand and the crucial role of compressors in various industrial processes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching a market size estimated at over $65 billion by 2033. This expansion is fueled by ongoing investments in upstream and midstream Oil and Gas infrastructure, particularly in developing economies, where the demand for efficient gas transportation and processing remains high. The Power Sector is another significant growth driver, with an increasing reliance on natural gas for power generation and the growing integration of renewable energy sources, which often require compression for energy storage solutions. Technological disruptions are continuously reshaping the market. The development of variable speed drives, advanced sealing technologies, and more efficient aerodynamic designs are leading to substantial energy savings for end-users, aligning with global sustainability goals. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is revolutionizing compressor monitoring, diagnostics, and predictive maintenance, thereby reducing downtime and operational costs. Consumer preferences are shifting towards customized solutions, energy-efficient designs, and comprehensive lifecycle services, including installation, maintenance, and upgrades. The competitive dynamics are characterized by a blend of global conglomerates and specialized regional players, each vying for market share through technological innovation, strategic partnerships, and aggressive pricing strategies. The market penetration of high-efficiency compressor technologies is steadily increasing as industries prioritize operational cost reduction and environmental compliance. The demand for specialized compressors for applications like carbon capture and hydrogen compression is also emerging as a significant trend.

Dominant Markets & Segments in Gas Compressors Market

The Gas Compressors Market is characterized by a dominant presence in the Oil and Gas end-user industry, driven by extensive exploration, production, transportation, and processing activities worldwide. This sector alone accounts for over 55% of the global market revenue. Key drivers for its dominance include the growing demand for natural gas as a cleaner energy source, ongoing development of offshore and onshore oil and gas fields, and the need for efficient gas reinjection and processing. The Petrochemical and Chemical Industries represent the second-largest segment, fueled by the increasing global demand for plastics, fertilizers, and other chemical derivatives that rely heavily on compressed gases. Economic policies supporting industrial expansion and infrastructure development in emerging economies are significant contributors to growth in this segment.

- Leading Region: North America currently holds the largest market share, primarily due to its mature Oil and Gas industry, extensive shale gas production, and significant investments in petrochemical manufacturing.

- Key Country: The United States leads in terms of market size and consumption, followed by China and Saudi Arabia, reflecting their substantial energy and industrial footprints.

- Dominant Type: Positive Displacement compressors, particularly screw and reciprocating types, dominate the market due to their versatility, reliability, and suitability for a wide range of pressures and flow rates across various applications.

- Drivers for Positive Displacement: High efficiency at varying loads, precise control over gas flow, and robust performance in harsh environments.

- Market Share: Historically holds over 60% of the total compressor market.

- Significant Segment: Dynamic Displacement compressors, primarily centrifugal and axial types, are gaining traction, especially in high-volume applications within the Oil and Gas and Power Sector.

- Drivers for Dynamic Displacement: High flow rates, continuous operation, and suitability for large-scale industrial processes.

- Growth Projection: Expected to witness higher CAGR due to increasing demand in large-scale LNG facilities and power plants.

The Power Sector is a rapidly growing segment, driven by the shift towards natural gas as a primary fuel source for electricity generation and the increasing need for gas compression in renewable energy storage systems. The Industrial Gases sector also contributes significantly, with demand for compressed air and specialty gases across manufacturing, healthcare, and electronics industries. Infrastructure development, government initiatives promoting industrialization, and the adoption of advanced manufacturing technologies are key factors bolstering the dominance and growth of these segments.

Gas Compressors Market Product Developments

Continuous product innovation is a hallmark of the Gas Compressors Market. Leading manufacturers are focusing on developing compressors with enhanced energy efficiency through advanced aerodynamic designs and variable speed drives, significantly reducing operational costs and environmental impact. The integration of digital technologies, including IoT sensors and AI-driven analytics, is enabling predictive maintenance, remote monitoring, and optimized performance. New product developments are tailored for specific applications, such as high-pressure compressors for hydrogen fueling stations, compact and modular compressors for remote oil and gas exploration, and specialized compressors for carbon capture technologies. These innovations aim to provide greater reliability, reduced footprint, and improved safety, thereby offering a competitive advantage and meeting the evolving demands of various end-user industries.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Gas Compressors Market segmented by Type and End-user Industries.

- Type:

- Positive Displacement: This segment encompasses reciprocating and rotary screw compressors, known for their reliability and efficiency across a wide range of pressures and flow rates. Expected to maintain a significant market share due to its versatility.

- Dynamic Displacement: This segment includes centrifugal and axial compressors, primarily utilized for high-volume, continuous gas handling. Projected to experience robust growth, especially in large-scale infrastructure projects.

- End-user Industries:

- Oil and Gas: The largest and most crucial segment, encompassing exploration, production, transportation, and refining. Expected to see consistent demand driven by global energy needs.

- Power Sector: A rapidly expanding segment, driven by natural gas power generation and energy storage solutions.

- Petrochemical and Chemical Industries: Significant growth is anticipated due to increasing demand for chemicals and plastics.

- Industrial Gases: Steady growth is projected, supported by diverse manufacturing and healthcare applications.

- Other End-user Industries: This segment includes food & beverage, pharmaceuticals, and general manufacturing, exhibiting moderate but stable growth.

Key Drivers of Gas Compressors Market Growth

The Gas Compressors Market is propelled by several key drivers. Firstly, the escalating global demand for energy, particularly natural gas, necessitates efficient compression technologies for transportation and processing. Secondly, technological advancements leading to more energy-efficient and environmentally compliant compressor designs are crucial for meeting stringent regulations and reducing operational costs. Thirdly, significant investments in infrastructure development within the Oil and Gas, Petrochemical and Chemical Industries, and the Power Sector, especially in emerging economies, directly boost the demand for new compressor installations. Furthermore, the growing emphasis on industrial automation and smart manufacturing is driving the adoption of advanced compressors with integrated digital monitoring and control systems.

Challenges in the Gas Compressors Market Sector

Despite robust growth, the Gas Compressors Market faces several challenges. Stringent environmental regulations and evolving emissions standards can increase manufacturing costs and require significant R&D investment to comply. Supply chain disruptions, raw material price volatility, and geopolitical uncertainties can impact production timelines and cost-effectiveness. The high initial capital expenditure for advanced compressor systems can be a barrier for some end-users, particularly smaller enterprises. Intense competition among established players and the emergence of new entrants can lead to pricing pressures and impact profit margins. Furthermore, the skilled labor shortage for installation, operation, and maintenance of complex compressor systems poses a significant operational challenge for the industry.

Emerging Opportunities in Gas Compressors Market

The Gas Compressors Market is ripe with emerging opportunities. The burgeoning demand for hydrogen as a clean fuel creates a significant market for high-pressure hydrogen compressors in refueling stations and industrial applications. The increasing focus on carbon capture, utilization, and storage (CCUS) technologies will drive demand for specialized compressors designed for CO2 capture and transport. The expansion of liquefied natural gas (LNG) infrastructure globally, particularly for small-scale and floating LNG facilities, presents opportunities for modular and compact compressor solutions. Furthermore, the retrofitting and upgrading of existing compressor fleets with energy-efficient technologies and digital solutions offer substantial aftermarket service revenue.

Leading Players in the Gas Compressors Market Market

- Ingersoll Rand Inc

- Siemens Energy AG

- Bauer Compressors Inc

- Atlas Copco AB

- Ariel Corporation

- Burckhardt Compression Holding AG

- General Electric Company

- HMS Group

- Howden Group Ltd

Key Developments in Gas Compressors Market Industry

- January 2022: Burckhardt Compression was awarded a supply contract by TECNIMONT SpA and Tecnimont Private Ltd to provide solutions to India Oil Corporation's polypropylene plant in Bihar, India. The agreement will see Burckhardt supplying the carrier gas compressor and nitrogen gas compressor packages for the plant's refining complex. This development strengthens Burckhardt's position in the petrochemical sector in Asia.

- April 2021: Siemens Energy AG supplied 20 centrifugal compression systems for one of Saudi Aramco's gas storage projects. The Hawiyah UnayzahGas Reservoir Storage facility is located 260 km east of Riyadh. The scope of the contract includes the supply of 20 compressor trains, which will strengthen Siemens Energy's market position in the oil and gas midstream sector.

Strategic Outlook for Gas Compressors Market Market

The strategic outlook for the Gas Compressors Market is highly positive, driven by the ongoing global energy transition and industrial expansion. Key growth catalysts include sustained demand from the Oil and Gas sector, the increasing adoption of natural gas in the Power Sector, and the growth of Petrochemical and Chemical Industries. Opportunities in emerging technologies like hydrogen compression and CCUS are expected to become significant revenue streams. Strategic focus on product innovation, particularly in energy efficiency and digital integration, will be critical for maintaining competitive advantage. Expansion into emerging markets and a strong emphasis on aftermarket services will further enhance market penetration and revenue generation, positioning the industry for continued substantial growth in the coming decade.

Gas Compressors Market Segmentation

-

1. Type

- 1.1. Positive Displacement

- 1.2. Dynamic Displacement

-

2. End-user Industries

- 2.1. Oil and Gas

- 2.2. Power Sector

- 2.3. Petrochemical and Chemical Industries

- 2.4. Industrial Gases

- 2.5. Other End-user Industries

Gas Compressors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Gas Compressors Market Regional Market Share

Geographic Coverage of Gas Compressors Market

Gas Compressors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing

- 3.3. Market Restrains

- 3.3.1. 4.; High Exploration Cost

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Displacement

- 5.1.2. Dynamic Displacement

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Oil and Gas

- 5.2.2. Power Sector

- 5.2.3. Petrochemical and Chemical Industries

- 5.2.4. Industrial Gases

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Positive Displacement

- 6.1.2. Dynamic Displacement

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Oil and Gas

- 6.2.2. Power Sector

- 6.2.3. Petrochemical and Chemical Industries

- 6.2.4. Industrial Gases

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Positive Displacement

- 7.1.2. Dynamic Displacement

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Oil and Gas

- 7.2.2. Power Sector

- 7.2.3. Petrochemical and Chemical Industries

- 7.2.4. Industrial Gases

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Positive Displacement

- 8.1.2. Dynamic Displacement

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Oil and Gas

- 8.2.2. Power Sector

- 8.2.3. Petrochemical and Chemical Industries

- 8.2.4. Industrial Gases

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Positive Displacement

- 9.1.2. Dynamic Displacement

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Oil and Gas

- 9.2.2. Power Sector

- 9.2.3. Petrochemical and Chemical Industries

- 9.2.4. Industrial Gases

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Gas Compressors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Positive Displacement

- 10.1.2. Dynamic Displacement

- 10.2. Market Analysis, Insights and Forecast - by End-user Industries

- 10.2.1. Oil and Gas

- 10.2.2. Power Sector

- 10.2.3. Petrochemical and Chemical Industries

- 10.2.4. Industrial Gases

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ingersoll Rand Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens Energy AG*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bauer Compressors Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atlas Copco AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ariel Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Burckhardt Compression Holding AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HMS Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Howden Group Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ingersoll Rand Inc

List of Figures

- Figure 1: Global Gas Compressors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Gas Compressors Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Gas Compressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Gas Compressors Market Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 5: North America Gas Compressors Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: North America Gas Compressors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Gas Compressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gas Compressors Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Gas Compressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Gas Compressors Market Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 11: Europe Gas Compressors Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: Europe Gas Compressors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Gas Compressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gas Compressors Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Gas Compressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Gas Compressors Market Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 17: Asia Pacific Gas Compressors Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: Asia Pacific Gas Compressors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Gas Compressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Gas Compressors Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Gas Compressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Gas Compressors Market Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 23: South America Gas Compressors Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: South America Gas Compressors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Gas Compressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gas Compressors Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Gas Compressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Gas Compressors Market Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 29: Middle East and Africa Gas Compressors Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: Middle East and Africa Gas Compressors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Gas Compressors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Gas Compressors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Gas Compressors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 9: Global Gas Compressors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Gas Compressors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Gas Compressors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Gas Compressors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Gas Compressors Market Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 18: Global Gas Compressors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Compressors Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Gas Compressors Market?

Key companies in the market include Ingersoll Rand Inc, Siemens Energy AG*List Not Exhaustive, Bauer Compressors Inc, Atlas Copco AB, Ariel Corporation, Burckhardt Compression Holding AG, General Electric Company, HMS Group, Howden Group Ltd.

3. What are the main segments of the Gas Compressors Market?

The market segments include Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Exploration Cost.

8. Can you provide examples of recent developments in the market?

In January 2022, Burckhardt Compression was awarded a supply contract by TECNIMONT SpA and Tecnimont Private Ltd to provide solutions to India Oil Corporation's polypropylene plant in Bihar, India. The agreement will see Burckhardt supplying the carrier gas compressor and nitrogen gas compressor packages for the plant's refining complex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Compressors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Compressors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Compressors Market?

To stay informed about further developments, trends, and reports in the Gas Compressors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence