Key Insights

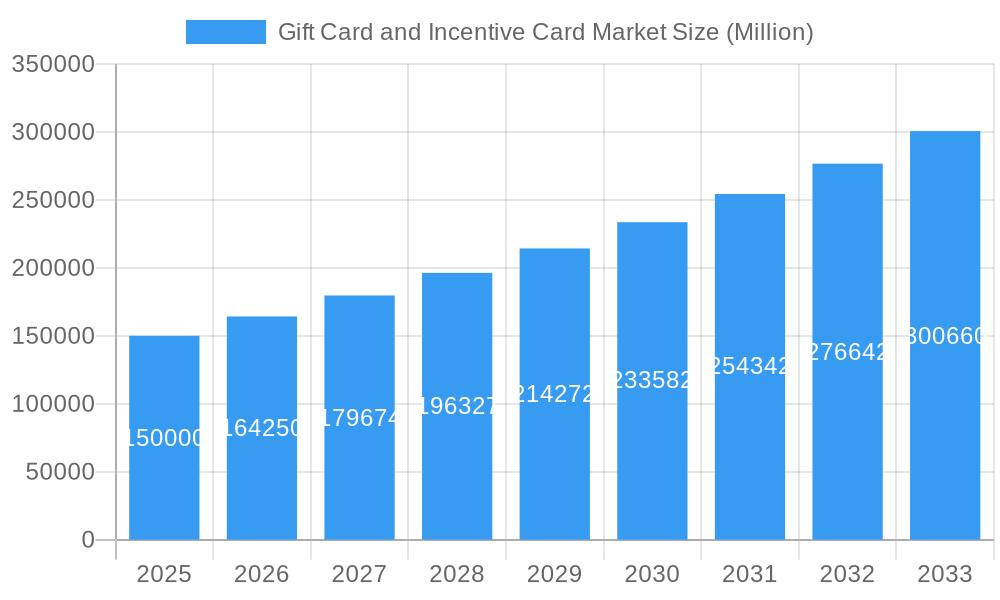

The global gift card and incentive card market is poised for significant expansion. Projections indicate a robust compound annual growth rate (CAGR) of 7.9% from 2025 to 2033, driving the market size to 234149.9 million. This growth is primarily fueled by the burgeoning e-commerce sector and the increasing adoption of digital gift cards, offering enhanced convenience and personalization in gifting. Concurrently, the widespread implementation of incentive programs by corporations for employee and customer rewards further bolsters demand for incentive cards. The market is meticulously segmented by card type (closed-loop vs. open-loop), consumer type (individual vs. corporate), distribution channel (online vs. offline), and spend category (e-commerce, dining, entertainment, travel, etc.). Open-loop cards are increasingly favored for their superior flexibility over merchant-specific closed-loop alternatives. The corporate segment demonstrates substantial growth, attributed to the strategic use of gift and incentive cards for employee recognition, loyalty, and reward initiatives. Online distribution channels are rapidly expanding, meeting the demand for accessible purchasing and redemption experiences.

Gift Card and Incentive Card Market Market Size (In Billion)

Evolving consumer preferences and rapid technological advancements continue to shape market dynamics. The seamless integration of mobile payment solutions and the proliferation of digital wallets are simplifying gift card transactions. However, potential market restraints include the persistent risks of fraud and security breaches, alongside evolving regulatory frameworks. Key industry leaders such as Sodexo, Carrefour, PayPal, Amazon, and Walmart are actively investing in technological innovations and strategic partnerships to solidify their market presence and address the diverse needs of both consumers and businesses. Significant regional variations exist, with North America and Europe currently dominating market share. The Asia-Pacific region, however, is anticipated to experience substantial growth, driven by rising disposable incomes and shifting consumer behaviors.

Gift Card and Incentive Card Market Company Market Share

Global Gift Card and Incentive Card Market Analysis: Size, Growth, and Forecast (2025-2033)

This comprehensive report delivers an in-depth analysis of the global Gift Card and Incentive Card market from 2025 to 2033. It provides critical insights into market trends, segmentation, competitive landscape, and future growth trajectories, empowering stakeholders with actionable intelligence for strategic decision-making in this dynamic industry. The analysis is underpinned by extensive data aggregation and expert market evaluations, offering a clear and impactful market overview. The Base Year for this analysis is 2025, with the Forecast Period extending through 2033.

Gift Card and Incentive Card Market Concentration & Innovation

This section analyzes the competitive landscape of the gift card and incentive card market, examining market concentration, innovation drivers, regulatory influences, and industry dynamics. The market is characterized by a mix of large multinational corporations and smaller specialized players. Key players like Sodexo, Carrefour SA, Auchan Group SA, PayPal Inc, Aldi Group, American Express Company, Amazon.com Inc, Blackhawk Network Holdings Inc, Apple Inc, and Walmart Inc hold significant market share, but the market also features numerous smaller, niche players.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players accounting for a significant portion of the overall revenue. Precise market share figures for each company will be detailed within the full report. However, preliminary analysis suggests a top five market share of approximately XX%.

- Innovation Drivers: Technological advancements, particularly in digital payment technologies and mobile wallets, are key innovation drivers. The development of loyalty programs integrated with gift cards and the rise of personalized and customizable gift card options are also pushing innovation.

- Regulatory Frameworks: Government regulations concerning financial transactions and consumer protection significantly influence the market. Compliance with these regulations is crucial for market participants.

- Product Substitutes: Other forms of digital payments, such as peer-to-peer transfers and mobile payment apps, pose a competitive threat. However, the convenience and social aspects of gift cards maintain their market relevance.

- End-User Trends: Shifting consumer preferences toward digital transactions and the increasing adoption of e-commerce are shaping the market. Corporate usage of incentive cards for employee rewards and client engagement also drives significant market growth.

- M&A Activities: The market has witnessed several mergers and acquisitions in recent years. For instance, InComm Payment’s acquisition of The Card Network in October 2022 demonstrates the ongoing consolidation in the industry. The full report will include a detailed analysis of M&A activity, including deal values and their strategic implications. The total value of M&A deals in the past five years is estimated at approximately $XX Million.

Gift Card and Incentive Card Market Industry Trends & Insights

The global gift card and incentive card market is experiencing robust growth, driven by several key factors. The increasing popularity of e-commerce and digital transactions has fueled the adoption of digital gift cards and online redemption options. Furthermore, the market benefits from the rising trend of gifting and the increasing demand for corporate incentive programs. Technological advancements, such as the integration of gift cards with mobile wallets and loyalty programs, have enhanced convenience and user experience, thereby stimulating market expansion.

The competitive landscape is dynamic, with established players continuously innovating and smaller players emerging with niche offerings. The market's growth is influenced by economic conditions, consumer spending patterns, and regulatory changes. The compound annual growth rate (CAGR) for the period 2019–2024 is estimated at XX%, and the projected CAGR for 2025-2033 is XX%. The market penetration rate for gift cards is currently estimated at approximately XX% globally. Specific regional penetration rates are provided in the complete report. The report delves into these trends, analyzing their impact on market dynamics and providing forecasts for future growth.

Dominant Markets & Segments in Gift Card and Incentive Card Market

The global Gift Card and Incentive Card market shows significant variations across different segments and geographic regions. Detailed analysis identifies dominant segments and regions.

Leading Region: North America currently holds the largest market share, driven by high consumer spending and the prevalence of e-commerce. Europe and Asia-Pacific are also exhibiting strong growth.

Dominant Segments:

- Card Type: Open-loop cards (e.g., Visa, Mastercard gift cards) are currently the dominant card type, offering greater flexibility to consumers.

- Consumer: The individual consumer segment holds the largest market share, driven by gifting and personal spending. However, the corporate segment is also exhibiting strong growth, driven by incentive programs.

- Distribution Channel: Online channels are increasingly important, with online sales representing a large and growing portion of the total market.

- Spend Category: E-commerce and departmental stores currently represent the largest spend category, followed by restaurants and bars, and supermarkets/hypermarkets.

Key Drivers for Dominant Segments (examples):

- North America: High disposable income, mature e-commerce infrastructure, and strong consumer culture.

- Open-loop cards: Flexibility and wider acceptance at various merchants.

- Individual Consumers: Gifting culture and personal spending on discretionary items.

- Online Distribution: Convenience, accessibility, and wider reach.

- E-commerce: The growing popularity of online shopping and digital gift cards.

Gift Card and Incentive Card Market Product Developments

Recent product innovations focus on enhancing user experience and personalization. This includes features such as mobile-integrated gift cards, customizable designs, and loyalty program integrations. Furthermore, the development of virtual gift cards and digital delivery options has broadened accessibility and streamlined the purchase and redemption process. These innovations aim to cater to evolving consumer preferences and provide competitive advantages in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Gift Card and Incentive Card market, encompassing various parameters:

- Card Type: Closed-loop cards (usable only at specific merchants) and open-loop cards (usable at multiple merchants) are analyzed individually, providing market size projections and competitive dynamics for each segment.

- Consumer: The market is segmented into individual and corporate consumers, assessing growth rates and specific spending patterns for each segment.

- Distribution Channel: Online and offline distribution channels are examined, analyzing sales trends, market penetration, and future growth potential for both avenues.

- Spend Category: Key spend categories including e-commerce & departmental stores, restaurants & bars, supermarkets/hypermarkets, entertainment & gaming, specialty stores, health & wellness, travel and others are analyzed. Each category's market size, growth potential, and competitive dynamics are assessed.

Key Drivers of Gift Card and Incentive Card Market Growth

Several factors propel growth in the gift card and incentive card market: The increasing popularity of e-commerce and digital payments provides a convenient and accessible platform for gift card transactions. Furthermore, the rise of corporate incentive programs and loyalty schemes boosts demand for incentive cards. Government regulations promoting financial inclusion and digital transactions also create a favorable environment for market expansion.

Challenges in the Gift Card and Incentive Card Market Sector

The gift card and incentive card market faces several challenges. These include the competition from other digital payment methods, security concerns related to fraud and data breaches, and the costs associated with managing and processing transactions. Changes in consumer preferences and regulatory compliance also pose significant hurdles. The market is also subject to macroeconomic fluctuations influencing overall consumer spending.

Emerging Opportunities in Gift Card and Incentive Card Market

The emergence of new technologies, such as blockchain and cryptocurrencies, presents opportunities for innovation in the gift card market. The increasing adoption of mobile wallets and the integration of gift cards with loyalty programs further present opportunities for growth. Expansion into emerging markets and untapped consumer segments also holds significant potential.

Leading Players in the Gift Card and Incentive Card Market Market

- Sodexo

- Carrefour SA

- Auchan Group SA

- PayPal Inc

- Aldi Group

- American Express Company

- Amazon.com Inc

- Blackhawk Network Holdings Inc

- Apple Inc

- Walmart Inc

Key Developments in Gift Card and Incentive Card Market Industry

- October 2022: InComm Payments acquired The Card Network, expanding its gift card solutions.

- June 2022: Apple launched its "all-in-one" Apple Gift Card in Europe, expanding its reach.

Strategic Outlook for Gift Card and Incentive Card Market Market

The gift card and incentive card market exhibits significant growth potential. Continued technological advancements, increasing consumer adoption of digital payment methods, and the expansion of corporate incentive programs will drive market expansion in the coming years. Companies focusing on innovation, personalization, and secure transaction platforms will be well-positioned to capitalize on these opportunities. The market is poised for sustained growth, driven by a confluence of technological and consumer-driven factors.

Gift Card and Incentive Card Market Segmentation

-

1. Card Type

- 1.1. Closed-Loop Card

- 1.2. Open-Loop Card

-

2. Consumer

- 2.1. Individual

- 2.2. Corporate

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

-

4. Spend Category

- 4.1. E-commerce & departmental stores

- 4.2. Restaurants & Bars

- 4.3. Supermarket

- 4.4. Hypermarket and Convenience Store

- 4.5. Entertainment & Gaming

- 4.6. Specialty Store

- 4.7. Health & Wellness

- 4.8. Travel

- 4.9. Others

Gift Card and Incentive Card Market Segmentation By Geography

- 1. North America

- 2. South America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Gift Card and Incentive Card Market Regional Market Share

Geographic Coverage of Gift Card and Incentive Card Market

Gift Card and Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Growing E-commerce Worldwide is Driving the Adoption of Gift Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Closed-Loop Card

- 5.1.2. Open-Loop Card

- 5.2. Market Analysis, Insights and Forecast - by Consumer

- 5.2.1. Individual

- 5.2.2. Corporate

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Spend Category

- 5.4.1. E-commerce & departmental stores

- 5.4.2. Restaurants & Bars

- 5.4.3. Supermarket

- 5.4.4. Hypermarket and Convenience Store

- 5.4.5. Entertainment & Gaming

- 5.4.6. Specialty Store

- 5.4.7. Health & Wellness

- 5.4.8. Travel

- 5.4.9. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Asia Pacific

- 5.5.4. Europe

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. North America Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 6.1.1. Closed-Loop Card

- 6.1.2. Open-Loop Card

- 6.2. Market Analysis, Insights and Forecast - by Consumer

- 6.2.1. Individual

- 6.2.2. Corporate

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Spend Category

- 6.4.1. E-commerce & departmental stores

- 6.4.2. Restaurants & Bars

- 6.4.3. Supermarket

- 6.4.4. Hypermarket and Convenience Store

- 6.4.5. Entertainment & Gaming

- 6.4.6. Specialty Store

- 6.4.7. Health & Wellness

- 6.4.8. Travel

- 6.4.9. Others

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 7. South America Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 7.1.1. Closed-Loop Card

- 7.1.2. Open-Loop Card

- 7.2. Market Analysis, Insights and Forecast - by Consumer

- 7.2.1. Individual

- 7.2.2. Corporate

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Spend Category

- 7.4.1. E-commerce & departmental stores

- 7.4.2. Restaurants & Bars

- 7.4.3. Supermarket

- 7.4.4. Hypermarket and Convenience Store

- 7.4.5. Entertainment & Gaming

- 7.4.6. Specialty Store

- 7.4.7. Health & Wellness

- 7.4.8. Travel

- 7.4.9. Others

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 8. Asia Pacific Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 8.1.1. Closed-Loop Card

- 8.1.2. Open-Loop Card

- 8.2. Market Analysis, Insights and Forecast - by Consumer

- 8.2.1. Individual

- 8.2.2. Corporate

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Spend Category

- 8.4.1. E-commerce & departmental stores

- 8.4.2. Restaurants & Bars

- 8.4.3. Supermarket

- 8.4.4. Hypermarket and Convenience Store

- 8.4.5. Entertainment & Gaming

- 8.4.6. Specialty Store

- 8.4.7. Health & Wellness

- 8.4.8. Travel

- 8.4.9. Others

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 9. Europe Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 9.1.1. Closed-Loop Card

- 9.1.2. Open-Loop Card

- 9.2. Market Analysis, Insights and Forecast - by Consumer

- 9.2.1. Individual

- 9.2.2. Corporate

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Spend Category

- 9.4.1. E-commerce & departmental stores

- 9.4.2. Restaurants & Bars

- 9.4.3. Supermarket

- 9.4.4. Hypermarket and Convenience Store

- 9.4.5. Entertainment & Gaming

- 9.4.6. Specialty Store

- 9.4.7. Health & Wellness

- 9.4.8. Travel

- 9.4.9. Others

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 10. Middle East and Africa Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 10.1.1. Closed-Loop Card

- 10.1.2. Open-Loop Card

- 10.2. Market Analysis, Insights and Forecast - by Consumer

- 10.2.1. Individual

- 10.2.2. Corporate

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Spend Category

- 10.4.1. E-commerce & departmental stores

- 10.4.2. Restaurants & Bars

- 10.4.3. Supermarket

- 10.4.4. Hypermarket and Convenience Store

- 10.4.5. Entertainment & Gaming

- 10.4.6. Specialty Store

- 10.4.7. Health & Wellness

- 10.4.8. Travel

- 10.4.9. Others

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sodexo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carrefour SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Auchan Group SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PayPal Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aldi Group**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American Express Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amazon com Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blackhawk Network Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apple Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Walmart Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sodexo

List of Figures

- Figure 1: Global Gift Card and Incentive Card Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Gift Card and Incentive Card Market Revenue (million), by Card Type 2025 & 2033

- Figure 3: North America Gift Card and Incentive Card Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 4: North America Gift Card and Incentive Card Market Revenue (million), by Consumer 2025 & 2033

- Figure 5: North America Gift Card and Incentive Card Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 6: North America Gift Card and Incentive Card Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America Gift Card and Incentive Card Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Gift Card and Incentive Card Market Revenue (million), by Spend Category 2025 & 2033

- Figure 9: North America Gift Card and Incentive Card Market Revenue Share (%), by Spend Category 2025 & 2033

- Figure 10: North America Gift Card and Incentive Card Market Revenue (million), by Country 2025 & 2033

- Figure 11: North America Gift Card and Incentive Card Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Gift Card and Incentive Card Market Revenue (million), by Card Type 2025 & 2033

- Figure 13: South America Gift Card and Incentive Card Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 14: South America Gift Card and Incentive Card Market Revenue (million), by Consumer 2025 & 2033

- Figure 15: South America Gift Card and Incentive Card Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 16: South America Gift Card and Incentive Card Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: South America Gift Card and Incentive Card Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: South America Gift Card and Incentive Card Market Revenue (million), by Spend Category 2025 & 2033

- Figure 19: South America Gift Card and Incentive Card Market Revenue Share (%), by Spend Category 2025 & 2033

- Figure 20: South America Gift Card and Incentive Card Market Revenue (million), by Country 2025 & 2033

- Figure 21: South America Gift Card and Incentive Card Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Gift Card and Incentive Card Market Revenue (million), by Card Type 2025 & 2033

- Figure 23: Asia Pacific Gift Card and Incentive Card Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 24: Asia Pacific Gift Card and Incentive Card Market Revenue (million), by Consumer 2025 & 2033

- Figure 25: Asia Pacific Gift Card and Incentive Card Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 26: Asia Pacific Gift Card and Incentive Card Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 27: Asia Pacific Gift Card and Incentive Card Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Asia Pacific Gift Card and Incentive Card Market Revenue (million), by Spend Category 2025 & 2033

- Figure 29: Asia Pacific Gift Card and Incentive Card Market Revenue Share (%), by Spend Category 2025 & 2033

- Figure 30: Asia Pacific Gift Card and Incentive Card Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Gift Card and Incentive Card Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Europe Gift Card and Incentive Card Market Revenue (million), by Card Type 2025 & 2033

- Figure 33: Europe Gift Card and Incentive Card Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 34: Europe Gift Card and Incentive Card Market Revenue (million), by Consumer 2025 & 2033

- Figure 35: Europe Gift Card and Incentive Card Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 36: Europe Gift Card and Incentive Card Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Europe Gift Card and Incentive Card Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Europe Gift Card and Incentive Card Market Revenue (million), by Spend Category 2025 & 2033

- Figure 39: Europe Gift Card and Incentive Card Market Revenue Share (%), by Spend Category 2025 & 2033

- Figure 40: Europe Gift Card and Incentive Card Market Revenue (million), by Country 2025 & 2033

- Figure 41: Europe Gift Card and Incentive Card Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Gift Card and Incentive Card Market Revenue (million), by Card Type 2025 & 2033

- Figure 43: Middle East and Africa Gift Card and Incentive Card Market Revenue Share (%), by Card Type 2025 & 2033

- Figure 44: Middle East and Africa Gift Card and Incentive Card Market Revenue (million), by Consumer 2025 & 2033

- Figure 45: Middle East and Africa Gift Card and Incentive Card Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 46: Middle East and Africa Gift Card and Incentive Card Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 47: Middle East and Africa Gift Card and Incentive Card Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Middle East and Africa Gift Card and Incentive Card Market Revenue (million), by Spend Category 2025 & 2033

- Figure 49: Middle East and Africa Gift Card and Incentive Card Market Revenue Share (%), by Spend Category 2025 & 2033

- Figure 50: Middle East and Africa Gift Card and Incentive Card Market Revenue (million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Gift Card and Incentive Card Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 2: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 3: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 5: Global Gift Card and Incentive Card Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 7: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 8: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 10: Global Gift Card and Incentive Card Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 12: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 13: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 15: Global Gift Card and Incentive Card Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 17: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 18: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 20: Global Gift Card and Incentive Card Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 22: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 23: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 25: Global Gift Card and Incentive Card Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Global Gift Card and Incentive Card Market Revenue million Forecast, by Card Type 2020 & 2033

- Table 27: Global Gift Card and Incentive Card Market Revenue million Forecast, by Consumer 2020 & 2033

- Table 28: Global Gift Card and Incentive Card Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Gift Card and Incentive Card Market Revenue million Forecast, by Spend Category 2020 & 2033

- Table 30: Global Gift Card and Incentive Card Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gift Card and Incentive Card Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Gift Card and Incentive Card Market?

Key companies in the market include Sodexo, Carrefour SA, Auchan Group SA, PayPal Inc, Aldi Group**List Not Exhaustive, American Express Company, Amazon com Inc, Blackhawk Network Holdings Inc, Apple Inc, Walmart Inc.

3. What are the main segments of the Gift Card and Incentive Card Market?

The market segments include Card Type, Consumer, Distribution Channel, Spend Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 234149.9 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Growing E-commerce Worldwide is Driving the Adoption of Gift Cards.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

In October 2022, InComm Payments, a leading global payments technology firm, acquired The Card Network, a domestic gift card provider. InComm Payments offers a customizable and personable gift card solution to consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gift Card and Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gift Card and Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gift Card and Incentive Card Market?

To stay informed about further developments, trends, and reports in the Gift Card and Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence