Key Insights

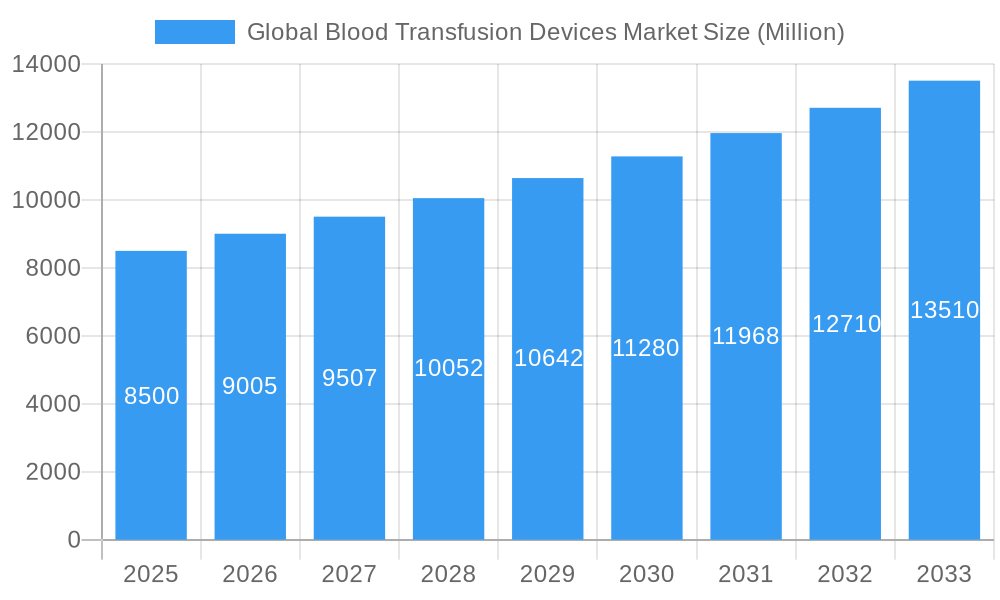

The Global Blood Transfusion Devices Market is projected for substantial growth, reaching an estimated market size of $5.45 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 6.8% from the 2025 base year. Key growth drivers include the rising incidence of chronic diseases, increasing trauma cases, and the escalating demand for transfusions in surgical procedures. Technological innovations enhancing transfusion safety and efficiency, alongside growing awareness of blood donation and improved blood banking infrastructure, are further propelling market expansion. Demographic shifts, particularly aging populations requiring more medical interventions, and the expanding healthcare infrastructure in emerging economies are also significant contributors.

Global Blood Transfusion Devices Market Market Size (In Billion)

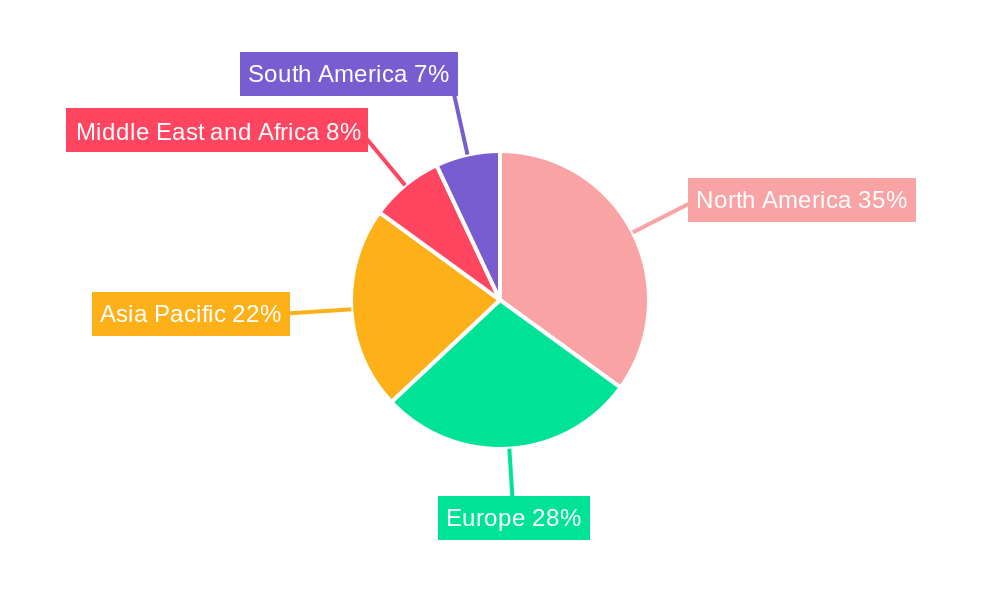

Market segmentation highlights strong demand for Blood Bags and Accessories, Filters, and Apheresis Devices, essential for safe and effective transfusions. Hospitals and Blood Banks are the primary end-users. Leading companies like Becton Dickinson and Company, Terumo Corporation, and Haemonetics Corporation are actively pursuing R&D, product innovation, and strategic partnerships. Emerging trends include the integration of point-of-care testing and the adoption of pathogen reduction systems. However, stringent regulations and the high cost of advanced technologies may present challenges. Geographically, North America and Europe are dominant markets, while Asia Pacific is expected to experience the most rapid growth due to its expanding healthcare sector and increasing patient populations.

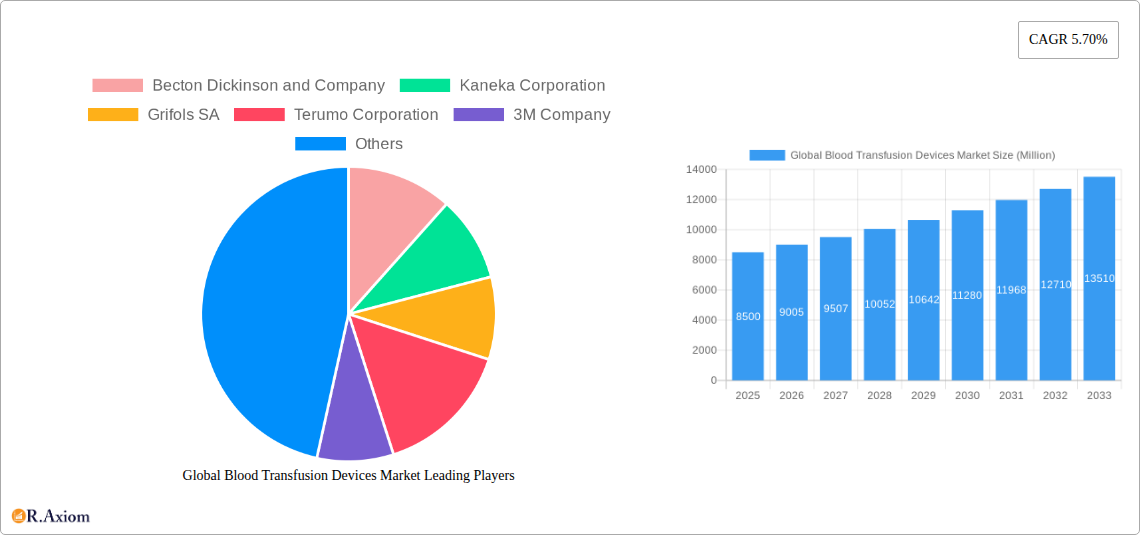

Global Blood Transfusion Devices Market Company Market Share

This comprehensive report offers deep insights into the Global Blood Transfusion Devices Market, providing actionable intelligence for stakeholders. Analyzing the historical period (2019-2024), the 2025 base year, and forecasting through 2033, this report utilizes high-impact keywords for optimal search visibility.

Global Blood Transfusion Devices Market Market Concentration & Innovation

The Global Blood Transfusion Devices Market exhibits a moderate to high level of concentration, with a few key players holding significant market share. Companies like Becton Dickinson and Company, Terumo Corporation, and Fresenius Kabi AG are prominent. Innovation is a critical driver, fueled by advancements in blood bag technology, apheresis devices, and pathogen reduction systems. The increasing focus on patient safety and infection control has spurred innovation in blood filters and consumables and supplies. Regulatory frameworks, including stringent approvals from bodies like the FDA and EMA, shape product development and market entry. Product substitutes, such as autologous blood transfusions, exist but are often limited by specific clinical scenarios. End-user trends are shifting towards more sophisticated devices in hospitals and ambulatory surgical centres to improve transfusion efficiency and safety. Mergers and acquisitions (M&A) are also prevalent, with significant M&A deal values often driven by companies seeking to expand their product portfolios and geographical reach. For instance, recent M&A activities have consolidated the market, further impacting market share dynamics.

Global Blood Transfusion Devices Market Industry Trends & Insights

The Global Blood Transfusion Devices Market is poised for significant growth, driven by an escalating demand for safe and efficient blood transfusions worldwide. This growth is underpinned by an increasing prevalence of chronic diseases, a rising number of surgical procedures, and a growing awareness of the critical role of blood transfusions in critical care settings. The market is experiencing a compound annual growth rate (CAGR) of approximately 6.8%, projected to reach an estimated market size of $15,500 Million by 2033. Technological disruptions are at the forefront, with innovations in pathogen reduction systems significantly enhancing blood safety by minimizing the risk of transfusion-transmitted infections. The development of advanced apheresis devices is enabling more targeted and efficient collection of specific blood components, catering to specialized therapeutic needs. Consumer preferences are increasingly focused on usability, disposability, and minimizing adverse reactions. The competitive landscape is characterized by intense innovation and strategic partnerships aimed at capturing market share. Companies are investing heavily in research and development to introduce next-generation blood bag and accessory solutions and smart blood mixers that offer enhanced monitoring and control. The market penetration of advanced blood filters is also on an upward trajectory, driven by their proven efficacy in removing leukocytes and other harmful substances.

Dominant Markets & Segments in Global Blood Transfusion Devices Market

The Global Blood Transfusion Devices Market is witnessing dominance from several key regions and segments. North America, particularly the United States, currently holds the largest market share due to its advanced healthcare infrastructure, high per capita healthcare spending, and robust adoption of innovative medical technologies.

Dominant Product Segments:

- Blood Bag and Accessory: This segment consistently leads the market due to the ubiquitous nature of blood transfusions and the ongoing need for sterile, high-quality blood storage solutions. The increasing demand for specialized blood bags, such as those with SAG-M additive solutions for extended shelf life, further bolsters its position. Economic policies supporting blood donation drives and the establishment of efficient blood banking networks in developing economies contribute to sustained demand.

- Consumables and Supplies: This broad category, encompassing items like tubing, connectors, and collection devices, is also a major revenue generator. The high volume of transfusions globally necessitates a constant supply of these disposable items.

- Filter: The growing emphasis on transfusion safety has propelled the demand for advanced blood filters, particularly leukocyte-reduction filters, which are crucial in preventing transfusion reactions and transmitting infections.

Dominant End-user Segments:

- Hospital: Hospitals remain the largest end-user of blood transfusion devices. The concentration of critical care units, surgical departments, and emergency rooms within hospitals drives consistent and high-volume demand for a comprehensive range of transfusion products. Government initiatives aimed at strengthening hospital healthcare systems and improving emergency preparedness directly benefit this segment.

- Blood Bank: As the primary collection, processing, and distribution hubs for blood products, blood banks are integral to the transfusion ecosystem. Investments in advanced blood processing and storage technologies by blood banks directly translate to increased procurement of specialized transfusion devices.

The infrastructure supporting efficient blood collection, processing, and transfusion services plays a pivotal role in the growth of these dominant segments and regions.

Global Blood Transfusion Devices Market Product Developments

Product innovation is significantly shaping the Global Blood Transfusion Devices Market. Key developments include the introduction of advanced blood bags with improved anticoagulant formulations for extended shelf life and reduced hemolysis. Sophisticated filters, such as pathogen-inactivated filters, are gaining traction to enhance transfusion safety. The market is also seeing advancements in apheresis devices for more efficient and personalized component collection. These innovations offer competitive advantages by improving efficacy, safety, and user convenience, directly addressing evolving clinical needs and regulatory demands for safer blood products.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Global Blood Transfusion Devices Market, segmented by product and end-user. The Product segmentation includes: Blood Bag and Accessory, Blood Mixer, Filter, Blood Component Separator, Apheresis Device, Pathogen Reduction System, Consumables and Supplies, and Other Products. The End-user segmentation encompasses: Hospital, Ambulatory Surgical Centres, Blood Bank, and Other End-users. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a granular view of market performance and future opportunities.

Key Drivers of Global Blood Transfusion Devices Market Growth

Several key factors are propelling the Global Blood Transfusion Devices Market. The rising global incidence of surgeries, trauma cases, and chronic diseases like cancer and anemia necessitates frequent blood transfusions. Advancements in transfusion technology, including the development of safer and more efficient blood bags, filters, and apheresis devices, are crucial growth catalysts. Stringent regulatory mandates focused on blood safety and infection control are driving the adoption of advanced pathogen reduction systems. Furthermore, increasing healthcare expenditure, particularly in emerging economies, and government initiatives to improve blood transfusion services are significant drivers.

Challenges in the Global Blood Transfusion Devices Market Sector

Despite robust growth, the Global Blood Transfusion Devices Market faces several challenges. Strict regulatory approval processes for new devices can be time-consuming and costly, hindering rapid market entry. The high cost of advanced apheresis devices and pathogen reduction systems can be a barrier to adoption in resource-limited settings, impacting their market penetration. Furthermore, concerns regarding the availability and quality of donated blood, coupled with potential supply chain disruptions for essential consumables and supplies, pose ongoing challenges to market stability and accessibility. Intense competition among established players and emerging market entrants also adds pressure on pricing.

Emerging Opportunities in Global Blood Transfusion Devices Market

The Global Blood Transfusion Devices Market presents significant emerging opportunities. The growing adoption of point-of-care transfusion diagnostics and real-time monitoring devices offers a promising avenue for innovation. The increasing demand for specialized blood components for personalized medicine and cell therapy creates a niche market for advanced blood component separators and apheresis devices. Furthermore, expanding healthcare infrastructure in developing countries and increasing government focus on establishing robust blood transfusion networks present substantial growth potential for all segments, from blood bags to pathogen reduction systems. The development of novel anticoagulants and preservatives for blood storage also opens up new avenues.

Leading Players in the Global Blood Transfusion Devices Market Market

- Becton Dickinson and Company

- Kaneka Corporation

- Grifols SA

- Terumo Corporation

- 3M Company

- Fresenius Kabi AG

- Macopharma SA

- Kawasumi Laboratories Inc

- B Braun Melsungen AG

- Haemonetics Corporation

- Immucor Inc

- Ecomed Solutions LLC

Key Developments in Global Blood Transfusion Devices Market Industry

- 2023: Launch of a new generation of leukocyte-reduction filters with enhanced efficiency and reduced blood loss.

- 2023: Acquisition of a specialized apheresis technology company to expand product portfolio in component separation.

- 2022: Introduction of a novel pathogen reduction system with broader efficacy against a wider range of viruses and bacteria.

- 2022: Strategic partnership established to develop advanced blood bags with integrated temperature monitoring capabilities.

- 2021: FDA approval received for a new additive solution for blood bags, extending shelf life and improving component quality.

- 2021: Significant investment announced in R&D for next-generation blood mixers with automated calibration features.

Strategic Outlook for Global Blood Transfusion Devices Market Market

The Global Blood Transfusion Devices Market is set for continued robust growth, driven by an aging global population, increasing surgical interventions, and a persistent demand for safe blood products. Strategic focus on technological innovation in pathogen reduction systems, advanced apheresis devices, and smart blood bag and accessory solutions will be critical for market leaders. Expansion into emerging markets, coupled with strategic partnerships and potential M&A activities, will shape the competitive landscape. The increasing emphasis on patient safety and efficiency will fuel the demand for integrated transfusion solutions, creating opportunities for companies that can offer comprehensive product portfolios and cutting-edge technologies to hospitals, blood banks, and ambulatory surgical centres.

Global Blood Transfusion Devices Market Segmentation

-

1. Product

- 1.1. Blood Bag and Accessory

- 1.2. Blood Mixer

- 1.3. Filter

- 1.4. Blood Component Separator

- 1.5. Apheresis Device

- 1.6. Pathogen Reduction System

- 1.7. Consumables and Supplies

- 1.8. Other Products

-

2. End-user

- 2.1. Hospital

- 2.2. Ambulatory Surgical Centres

- 2.3. Blood Bank

- 2.4. Other End-users

Global Blood Transfusion Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Blood Transfusion Devices Market Regional Market Share

Geographic Coverage of Global Blood Transfusion Devices Market

Global Blood Transfusion Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Surgical Procedures; Rise in the Number of Blood Disorders; Technological Advancements in the Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework; High Costs Associated with Handling of Blood and its Components

- 3.4. Market Trends

- 3.4.1. The Pathogen Reduction System is Expected to Witness a Healthy Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Blood Bag and Accessory

- 5.1.2. Blood Mixer

- 5.1.3. Filter

- 5.1.4. Blood Component Separator

- 5.1.5. Apheresis Device

- 5.1.6. Pathogen Reduction System

- 5.1.7. Consumables and Supplies

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Hospital

- 5.2.2. Ambulatory Surgical Centres

- 5.2.3. Blood Bank

- 5.2.4. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Blood Bag and Accessory

- 6.1.2. Blood Mixer

- 6.1.3. Filter

- 6.1.4. Blood Component Separator

- 6.1.5. Apheresis Device

- 6.1.6. Pathogen Reduction System

- 6.1.7. Consumables and Supplies

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Hospital

- 6.2.2. Ambulatory Surgical Centres

- 6.2.3. Blood Bank

- 6.2.4. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Blood Bag and Accessory

- 7.1.2. Blood Mixer

- 7.1.3. Filter

- 7.1.4. Blood Component Separator

- 7.1.5. Apheresis Device

- 7.1.6. Pathogen Reduction System

- 7.1.7. Consumables and Supplies

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Hospital

- 7.2.2. Ambulatory Surgical Centres

- 7.2.3. Blood Bank

- 7.2.4. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Blood Bag and Accessory

- 8.1.2. Blood Mixer

- 8.1.3. Filter

- 8.1.4. Blood Component Separator

- 8.1.5. Apheresis Device

- 8.1.6. Pathogen Reduction System

- 8.1.7. Consumables and Supplies

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Hospital

- 8.2.2. Ambulatory Surgical Centres

- 8.2.3. Blood Bank

- 8.2.4. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Blood Bag and Accessory

- 9.1.2. Blood Mixer

- 9.1.3. Filter

- 9.1.4. Blood Component Separator

- 9.1.5. Apheresis Device

- 9.1.6. Pathogen Reduction System

- 9.1.7. Consumables and Supplies

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Hospital

- 9.2.2. Ambulatory Surgical Centres

- 9.2.3. Blood Bank

- 9.2.4. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Blood Transfusion Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Blood Bag and Accessory

- 10.1.2. Blood Mixer

- 10.1.3. Filter

- 10.1.4. Blood Component Separator

- 10.1.5. Apheresis Device

- 10.1.6. Pathogen Reduction System

- 10.1.7. Consumables and Supplies

- 10.1.8. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Hospital

- 10.2.2. Ambulatory Surgical Centres

- 10.2.3. Blood Bank

- 10.2.4. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kaneka Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grifols SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Terumo Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fresenius Kabi AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Macopharma SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kawasumi Laboratories Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B Braun Melsungen AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haemonetics Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Immucor Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ecomed Solutions LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Global Blood Transfusion Devices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Blood Transfusion Devices Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Global Blood Transfusion Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Blood Transfusion Devices Market Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Global Blood Transfusion Devices Market Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Global Blood Transfusion Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Blood Transfusion Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Blood Transfusion Devices Market Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Global Blood Transfusion Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Blood Transfusion Devices Market Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Global Blood Transfusion Devices Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Global Blood Transfusion Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Blood Transfusion Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Blood Transfusion Devices Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Blood Transfusion Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Blood Transfusion Devices Market Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Global Blood Transfusion Devices Market Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Global Blood Transfusion Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Blood Transfusion Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Blood Transfusion Devices Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Blood Transfusion Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Blood Transfusion Devices Market Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East and Africa Global Blood Transfusion Devices Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East and Africa Global Blood Transfusion Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Blood Transfusion Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Blood Transfusion Devices Market Revenue (billion), by Product 2025 & 2033

- Figure 27: South America Global Blood Transfusion Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Blood Transfusion Devices Market Revenue (billion), by End-user 2025 & 2033

- Figure 29: South America Global Blood Transfusion Devices Market Revenue Share (%), by End-user 2025 & 2033

- Figure 30: South America Global Blood Transfusion Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Global Blood Transfusion Devices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Blood Transfusion Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Blood Transfusion Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Blood Transfusion Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 21: Global Blood Transfusion Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Blood Transfusion Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Blood Transfusion Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 35: Global Blood Transfusion Devices Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 36: Global Blood Transfusion Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Blood Transfusion Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Blood Transfusion Devices Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Global Blood Transfusion Devices Market?

Key companies in the market include Becton Dickinson and Company, Kaneka Corporation, Grifols SA, Terumo Corporation, 3M Company, Fresenius Kabi AG, Macopharma SA, Kawasumi Laboratories Inc *List Not Exhaustive, B Braun Melsungen AG, Haemonetics Corporation, Immucor Inc, Ecomed Solutions LLC.

3. What are the main segments of the Global Blood Transfusion Devices Market?

The market segments include Product, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.45 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Surgical Procedures; Rise in the Number of Blood Disorders; Technological Advancements in the Devices.

6. What are the notable trends driving market growth?

The Pathogen Reduction System is Expected to Witness a Healthy Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework; High Costs Associated with Handling of Blood and its Components.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Blood Transfusion Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Blood Transfusion Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Blood Transfusion Devices Market?

To stay informed about further developments, trends, and reports in the Global Blood Transfusion Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence