Key Insights

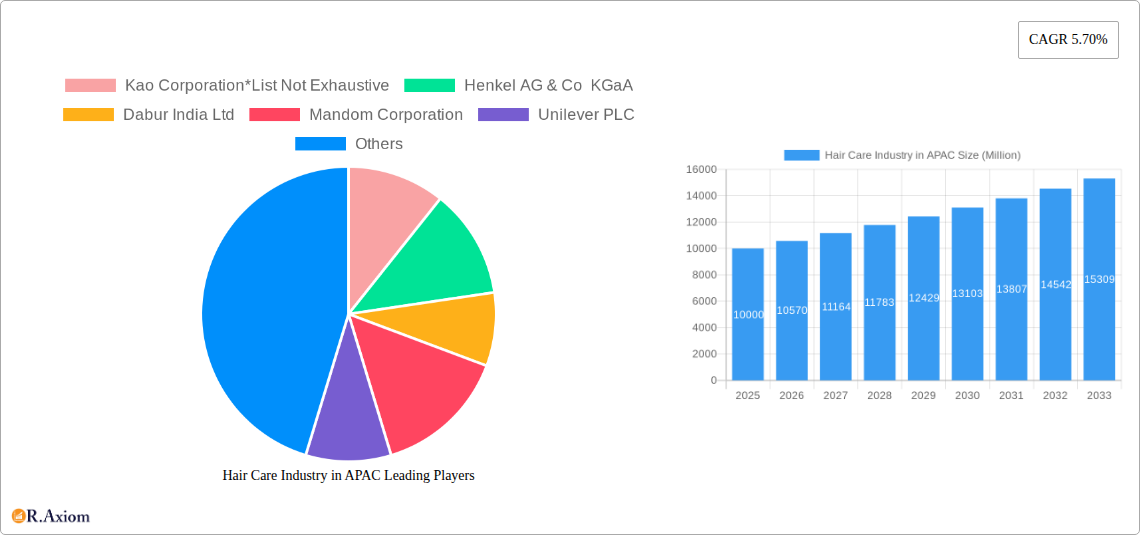

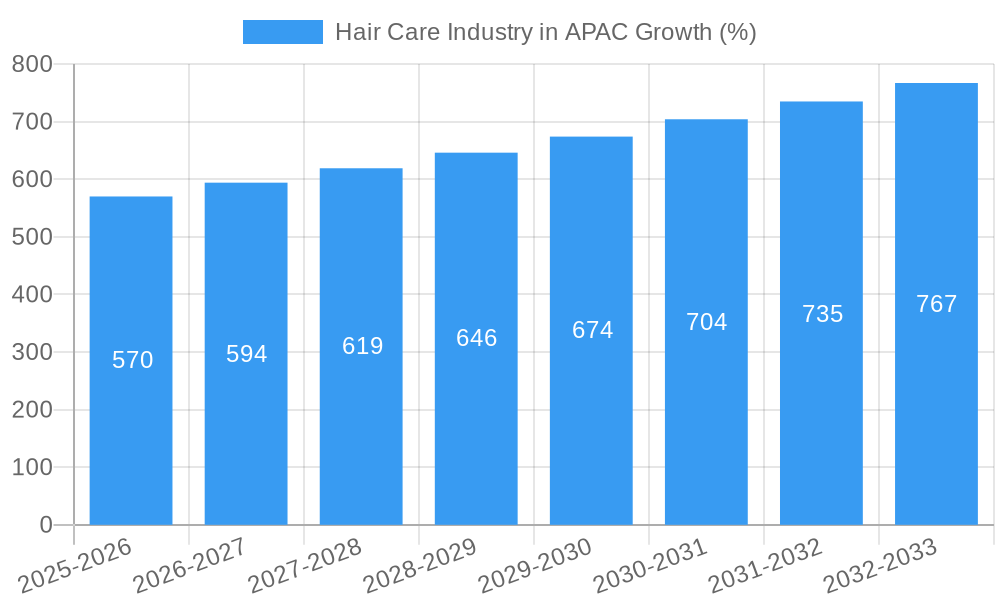

The Asia-Pacific (APAC) hair care market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across numerous APAC nations, particularly in rapidly developing economies like India and Southeast Asia, are empowering consumers to spend more on premium hair care products. Furthermore, increasing awareness of hair health and the growing prevalence of hair-related concerns, such as hair fall and damage, are driving demand for specialized products like hair oils, conditioners, and treatments. The burgeoning e-commerce sector within the region significantly contributes to market expansion, offering convenient access to a wider range of products and brands. The dominance of supermarkets and hypermarkets as distribution channels is expected to continue, though online retail is rapidly gaining traction, presenting a significant opportunity for both established and emerging players. The market segmentation reveals a diverse range of product types, with shampoos, conditioners, and hair styling products representing major revenue contributors. However, the demand for specialized hair care products catering to specific hair types and concerns is also witnessing significant growth.

Competition within the APAC hair care market is intense, with both multinational giants such as L'Oreal SA, Unilever PLC, and Procter & Gamble, and regional players like Dabur India and Marico Limited vying for market share. This competitive landscape is characterized by continuous product innovation, aggressive marketing strategies, and strategic acquisitions. Despite the positive outlook, certain challenges exist. Fluctuating raw material prices and the presence of counterfeit products pose potential threats to market growth. Furthermore, increasing awareness of the environmental impact of hair care products is driving demand for sustainable and ethically sourced options, prompting companies to adapt their product formulations and packaging strategies. To maintain growth, brands must invest heavily in research and development to create innovative, sustainable, and effective solutions that meet the evolving needs and preferences of the diverse consumer base in the APAC region.

Hair Care Industry in APAC: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Hair Care industry in the Asia-Pacific (APAC) region, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market researchers, seeking to understand the current market landscape and future growth opportunities. The report utilizes a robust methodology, incorporating historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). The market size is presented in Millions.

Hair Care Industry in APAC Market Concentration & Innovation

This section analyzes the competitive landscape of the APAC hair care market, examining market concentration, innovation drivers, regulatory frameworks, and merger & acquisition (M&A) activities. The market is characterized by a mix of multinational corporations and local players, with varying degrees of market share. The top players, including Kao Corporation, Henkel AG & Co KGaA, Unilever PLC, and L'Oreal SA, hold significant market share, but smaller regional players also contribute significantly.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the APAC hair care market is estimated to be xx in 2025, indicating a moderately concentrated market. This concentration is expected to remain relatively stable throughout the forecast period.

- Innovation Drivers: Key innovation drivers include the increasing demand for natural and organic products, the rising popularity of personalized hair care solutions, and technological advancements in hair care formulations and packaging. The development of waterless shampoos, as seen with Kao's launch in 2022, showcases this trend.

- Regulatory Frameworks: Regulatory frameworks vary across APAC countries, impacting product labeling, ingredient regulations, and environmental standards. Compliance with these regulations is crucial for market access and success.

- Product Substitutes: The market faces competition from alternative hair care methods and products, such as home remedies and DIY solutions. This competitive pressure necessitates continuous innovation and differentiation.

- End-User Trends: Consumer preferences are shifting towards natural, sustainable, and ethically sourced products. Demand for products catering to specific hair types and concerns (e.g., damaged hair, hair loss) is also increasing.

- M&A Activities: The APAC hair care industry has witnessed several M&A activities in recent years, with deal values totaling approximately xx Million in the historical period (2019-2024). These activities are expected to continue, driven by the desire for expansion and market consolidation.

Hair Care Industry in APAC Industry Trends & Insights

This section explores the key trends and insights shaping the APAC hair care market. Market growth is being driven by rising disposable incomes, increasing awareness of hair health, and the growing popularity of hair styling and coloring. However, challenges such as economic fluctuations, changing consumer preferences, and intense competition also exist.

The market is experiencing significant growth, with a Compound Annual Growth Rate (CAGR) of xx% projected during the forecast period (2025-2033). Market penetration remains relatively high in developed economies within APAC but continues to rise in developing economies, fueled by increasing urbanization and changing lifestyles. Technological disruptions, such as the adoption of e-commerce and personalized product recommendations, are also significantly impacting the market. Consumer preferences are evolving towards natural, sustainable, and ethically-sourced products, while a rising demand for convenience has led to the development of innovative products like waterless shampoos. Competitive dynamics are intense, with both multinational and local companies vying for market share through product innovation, marketing strategies, and distribution expansion.

Dominant Markets & Segments in Hair Care Industry in APAC

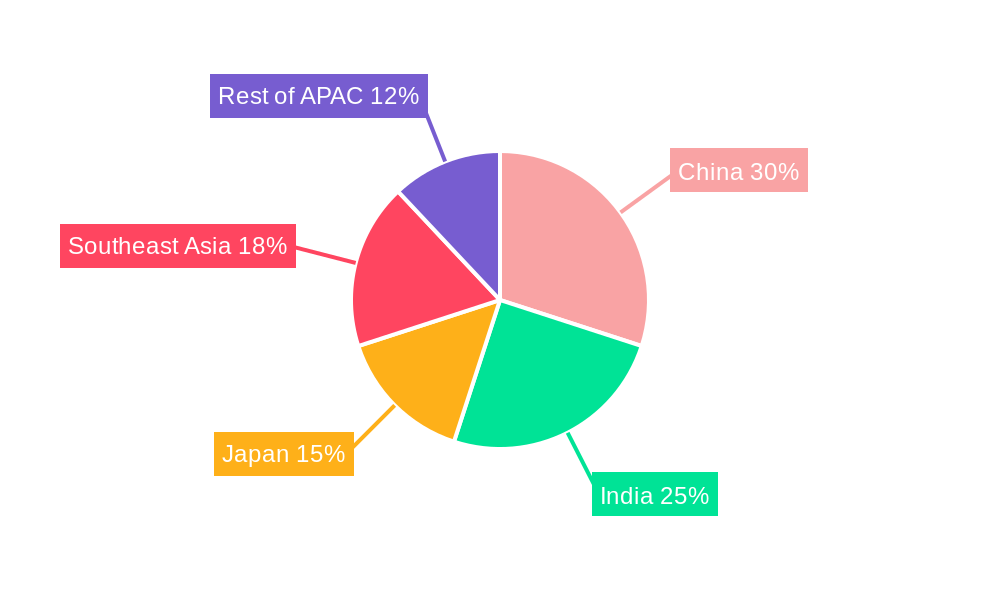

This section identifies the leading regions, countries, and segments within the APAC hair care market.

Dominant Regions/Countries:

- China and India are the largest markets, driven by their substantial populations and increasing consumer spending on personal care products. Other key markets include Japan, South Korea, and Australia, characterized by higher per capita consumption and advanced consumer preferences.

Dominant Product Types:

- Shampoo holds the largest market share, followed by conditioners and hair oils. The demand for hair colorants and styling gels is also significant, driven by changing fashion trends and rising disposable incomes.

Dominant Distribution Channels:

- Supermarkets/hypermarkets dominate the distribution landscape, followed by specialty stores. Online retail channels are rapidly gaining traction, driven by increased internet penetration and the convenience they offer. Pharmacy and drug stores also play a significant role, particularly for specialized hair care products.

Key Drivers:

- Economic Growth: Rising disposable incomes across APAC are fueling demand for hair care products.

- Urbanization: Urbanization is leading to changing lifestyles and increased awareness of personal grooming, boosting hair care consumption.

- Changing Consumer Preferences: Demand for natural, organic, and personalized hair care products is growing.

- Infrastructure Development: Improved logistics and distribution networks are enabling wider product availability.

Hair Care Industry in APAC Product Developments

The APAC hair care market is characterized by ongoing product innovation, driven by technological advancements and evolving consumer needs. Recent product launches, such as waterless dry shampoos, highlight the trend towards convenience and portability. Companies are increasingly focusing on developing products with natural and organic ingredients to cater to growing consumer demand for sustainable and ethical products. This trend also includes formulations tailored to specific hair types and concerns. Furthermore, personalization and customization of hair care products are emerging as key growth drivers. The incorporation of advanced technologies, such as AI-powered hair analysis and personalized product recommendations, is creating opportunities for enhanced customer experience and brand loyalty.

Report Scope & Segmentation Analysis

This report segments the APAC hair care market by product type (colorant, hair spray, conditioner, styling gel, hair oil, shampoo, other products) and distribution channel (supermarkets/hypermarkets, specialty stores, online retail stores, pharmacy and drug stores, other distribution channels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. For example, the shampoo segment shows robust growth, driven by increasing awareness of hair health, while online retail channels display significant growth potential due to increasing internet penetration. The specialty stores segment caters to premium products and personalized services, contributing a significant value but lower volume compared to supermarket channels.

Key Drivers of Hair Care Industry in APAC Growth

Several key factors drive the growth of the APAC hair care industry: rising disposable incomes in developing economies; increased consumer awareness of hair health and personal care; growing adoption of online retail channels; and the innovation and introduction of new product formulations, such as those incorporating natural and organic ingredients or targeting specific hair care needs. Government policies promoting domestic manufacturing and entrepreneurship in the beauty and personal care sector also significantly contribute to the growth trajectory.

Challenges in the Hair Care Industry in APAC Sector

The APAC hair care industry faces challenges such as intense competition, stringent regulatory requirements, fluctuating raw material prices, and the need for continuous product innovation to meet evolving consumer preferences. Counterfeit products and supply chain disruptions also pose significant challenges. The impact of these challenges is reflected in the xx Million variation of the predicted market size in 2033.

Emerging Opportunities in Hair Care Industry in APAC

Significant opportunities exist in the APAC hair care market, including the expansion into underserved rural markets; the development of customized and personalized hair care products utilizing advanced technologies; and the increasing demand for natural, organic, and sustainable hair care products. Furthermore, integrating digital marketing and e-commerce strategies can expand market reach and enhance customer engagement.

Leading Players in the Hair Care Industry in APAC Market

- Kao Corporation

- Henkel AG & Co KGaA

- Dabur India Ltd

- Mandom Corporation

- Unilever PLC

- L'Oreal SA

- Marico Limited

- The Procter & Gamble Company

- Hoyu Co Ltd

- Bajaj Consumer Care Ltd

Key Developments in Hair Care Industry in APAC Industry

- April 2022: Kao launched a waterless dry shampoo sheet, demonstrating innovation in portable hair care solutions.

- February 2022: Dabur India Ltd launched Virgin Coconut Oil, expanding its presence in the natural health care market.

- March 2021: Dabur India expanded its product offering with a premium shampoo line under the Dabur Vatika Select brand, showcasing a strategic move towards the e-commerce channel.

Strategic Outlook for Hair Care Industry in APAC Market

The APAC hair care market presents significant growth potential in the coming years, driven by increasing disposable incomes, evolving consumer preferences, and technological advancements. The continued focus on innovation, particularly in natural and sustainable products, and the effective leveraging of digital platforms will be crucial for success. Expanding into underserved markets and strategically utilizing M&A activities will also play a significant role in shaping the industry's future. The market is projected to reach xx Million by 2033, offering substantial growth opportunities for existing and new players.

Hair Care Industry in APAC Segmentation

-

1. Product Type

- 1.1. Colorant

- 1.2. Hair Spray

- 1.3. Conditioner

- 1.4. Styling Gel

- 1.5. Hair Oil

- 1.6. Shampoo

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Retail Stores

- 2.4. Pharmacy and Drug Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Japan

- 3.2. China

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Hair Care Industry in APAC Segmentation By Geography

- 1. Japan

- 2. China

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Hair Care Industry in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic/Herbal Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Colorant

- 5.1.2. Hair Spray

- 5.1.3. Conditioner

- 5.1.4. Styling Gel

- 5.1.5. Hair Oil

- 5.1.6. Shampoo

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Pharmacy and Drug Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.4.2. China

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Japan Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Colorant

- 6.1.2. Hair Spray

- 6.1.3. Conditioner

- 6.1.4. Styling Gel

- 6.1.5. Hair Oil

- 6.1.6. Shampoo

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Pharmacy and Drug Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Japan

- 6.3.2. China

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Colorant

- 7.1.2. Hair Spray

- 7.1.3. Conditioner

- 7.1.4. Styling Gel

- 7.1.5. Hair Oil

- 7.1.6. Shampoo

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Pharmacy and Drug Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Japan

- 7.3.2. China

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Colorant

- 8.1.2. Hair Spray

- 8.1.3. Conditioner

- 8.1.4. Styling Gel

- 8.1.5. Hair Oil

- 8.1.6. Shampoo

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Pharmacy and Drug Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Japan

- 8.3.2. China

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Colorant

- 9.1.2. Hair Spray

- 9.1.3. Conditioner

- 9.1.4. Styling Gel

- 9.1.5. Hair Oil

- 9.1.6. Shampoo

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Pharmacy and Drug Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Japan

- 9.3.2. China

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Colorant

- 10.1.2. Hair Spray

- 10.1.3. Conditioner

- 10.1.4. Styling Gel

- 10.1.5. Hair Oil

- 10.1.6. Shampoo

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Pharmacy and Drug Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Japan

- 10.3.2. China

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 12. Japan Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 13. India Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 15. Southeast Asia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 16. Australia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 17. Indonesia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 18. Phillipes Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 19. Singapore Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 20. Thailandc Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 21. Rest of Asia Pacific Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Kao Corporation*List Not Exhaustive

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 Henkel AG & Co KGaA

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Dabur India Ltd

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 Mandom Corporation

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Unilever PLC

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 L'Oreal SA

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 Marico Limited

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 The Procter & Gamble Company

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 Hoyu Co Ltd

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 Bajaj Consumer Care Ltd

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: Hair Care Industry in APAC Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hair Care Industry in APAC Share (%) by Company 2024

List of Tables

- Table 1: Hair Care Industry in APAC Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Hair Care Industry in APAC Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southeast Asia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Indonesia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Phillipes Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Singapore Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Thailandc Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Care Industry in APAC?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Hair Care Industry in APAC?

Key companies in the market include Kao Corporation*List Not Exhaustive, Henkel AG & Co KGaA, Dabur India Ltd, Mandom Corporation, Unilever PLC, L'Oreal SA, Marico Limited, The Procter & Gamble Company, Hoyu Co Ltd, Bajaj Consumer Care Ltd.

3. What are the main segments of the Hair Care Industry in APAC?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Increasing Demand for Organic/Herbal Hair Care Products.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

In April 2022, Kao launched a waterless dry shampoo sheet that was originally created for use in space. In response to the rising need for portable dry shampoos, Merit launched waterless dry shampoo, which included a shampoo sheet design originally created for use in space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Care Industry in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Care Industry in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Care Industry in APAC?

To stay informed about further developments, trends, and reports in the Hair Care Industry in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence