Key Insights

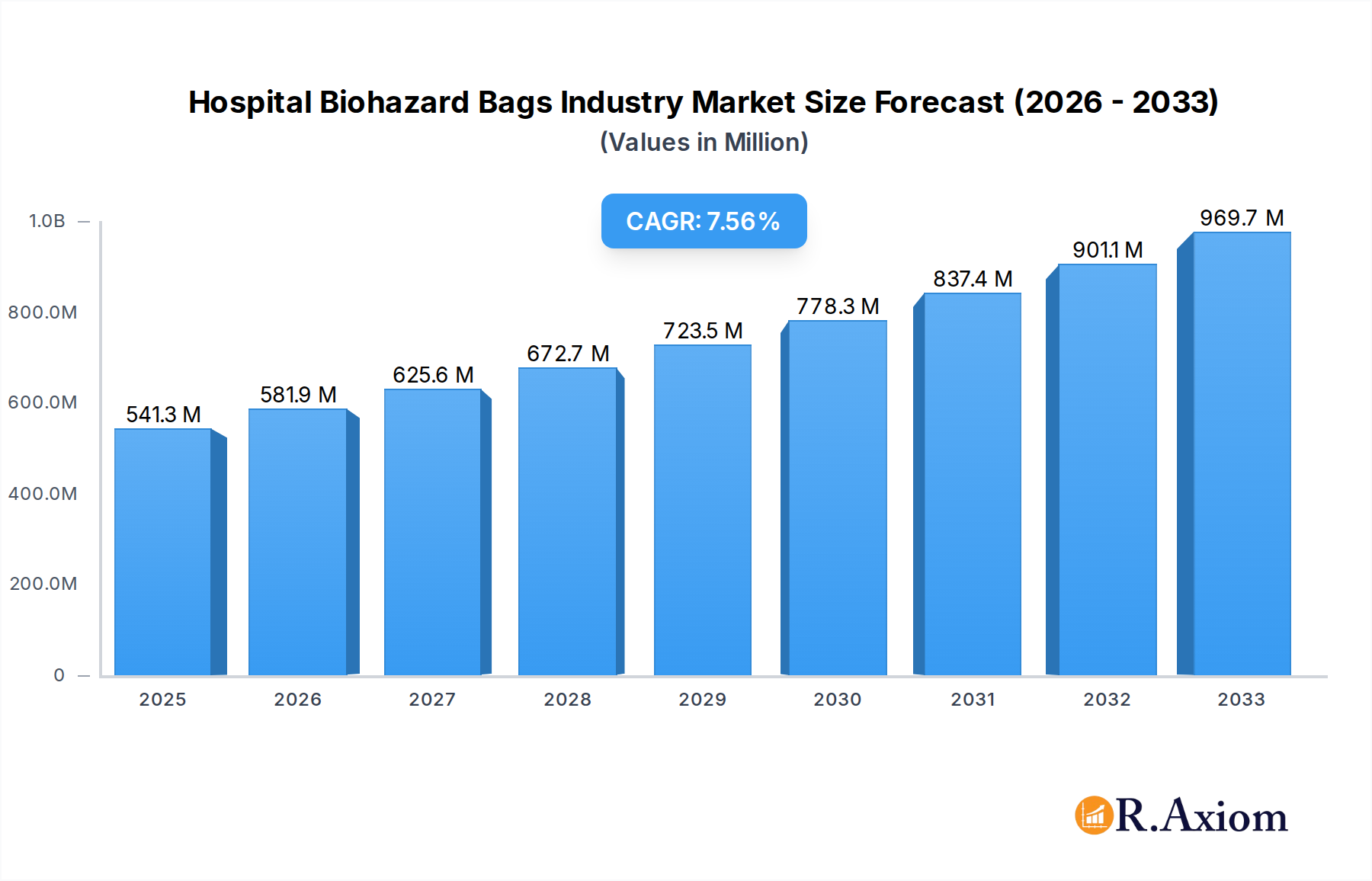

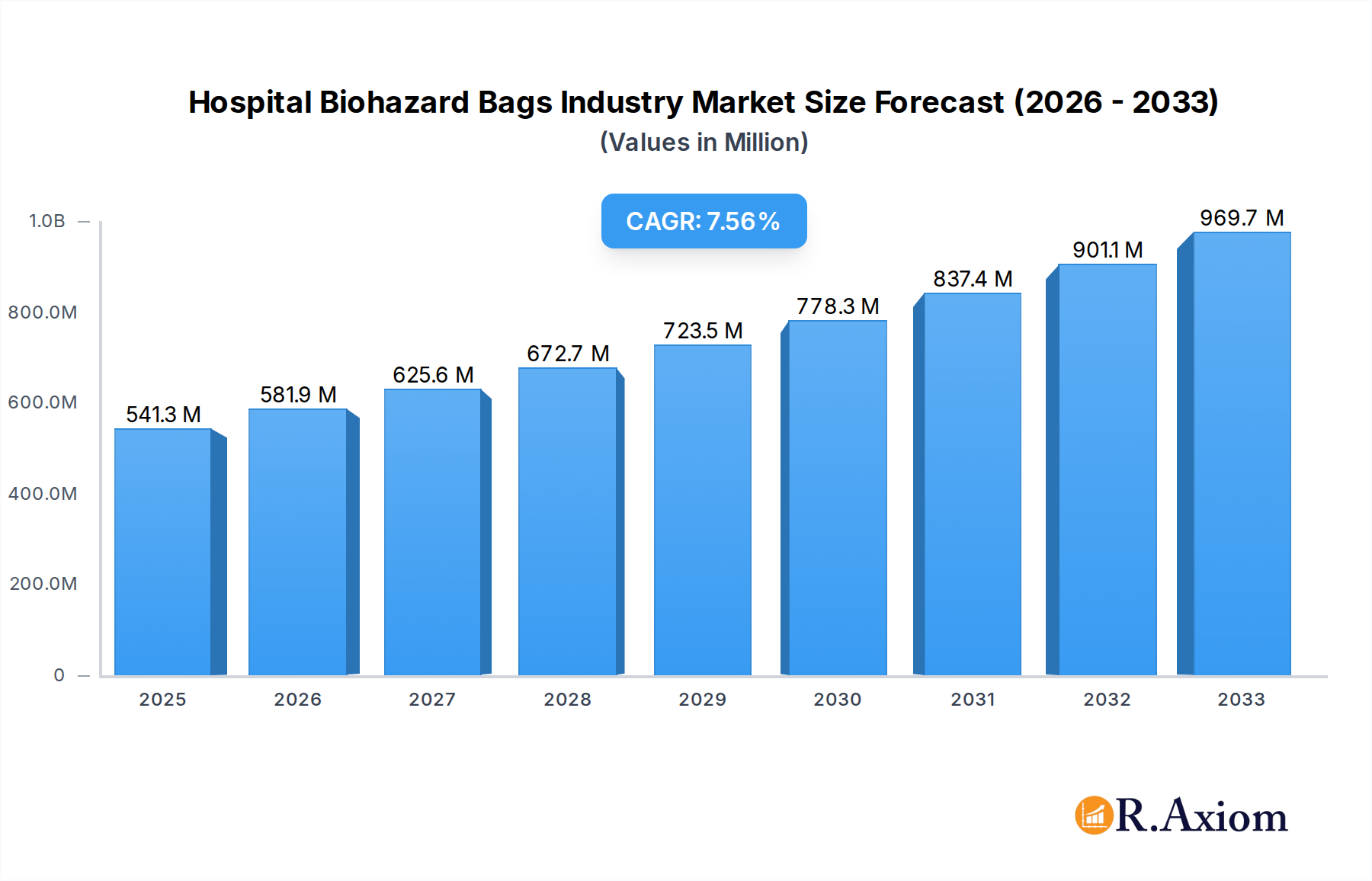

The global Hospital Biohazard Bags market is projected to experience robust growth, reaching an estimated $541.28 million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 7.6% through 2033. This upward trajectory is primarily fueled by the increasing volume of regulated medical waste generated by healthcare facilities worldwide. Escalating concerns surrounding infection control and the safe disposal of infectious materials, coupled with stringent government regulations mandating the use of specialized biohazard bags, are significant drivers. The growing prevalence of chronic diseases and the expanding healthcare infrastructure, particularly in emerging economies, further contribute to the demand for these critical containment solutions. Advancements in material science, leading to more durable and leak-proof biohazard bags, are also playing a crucial role in market expansion.

Hospital Biohazard Bags Industry Market Size (In Million)

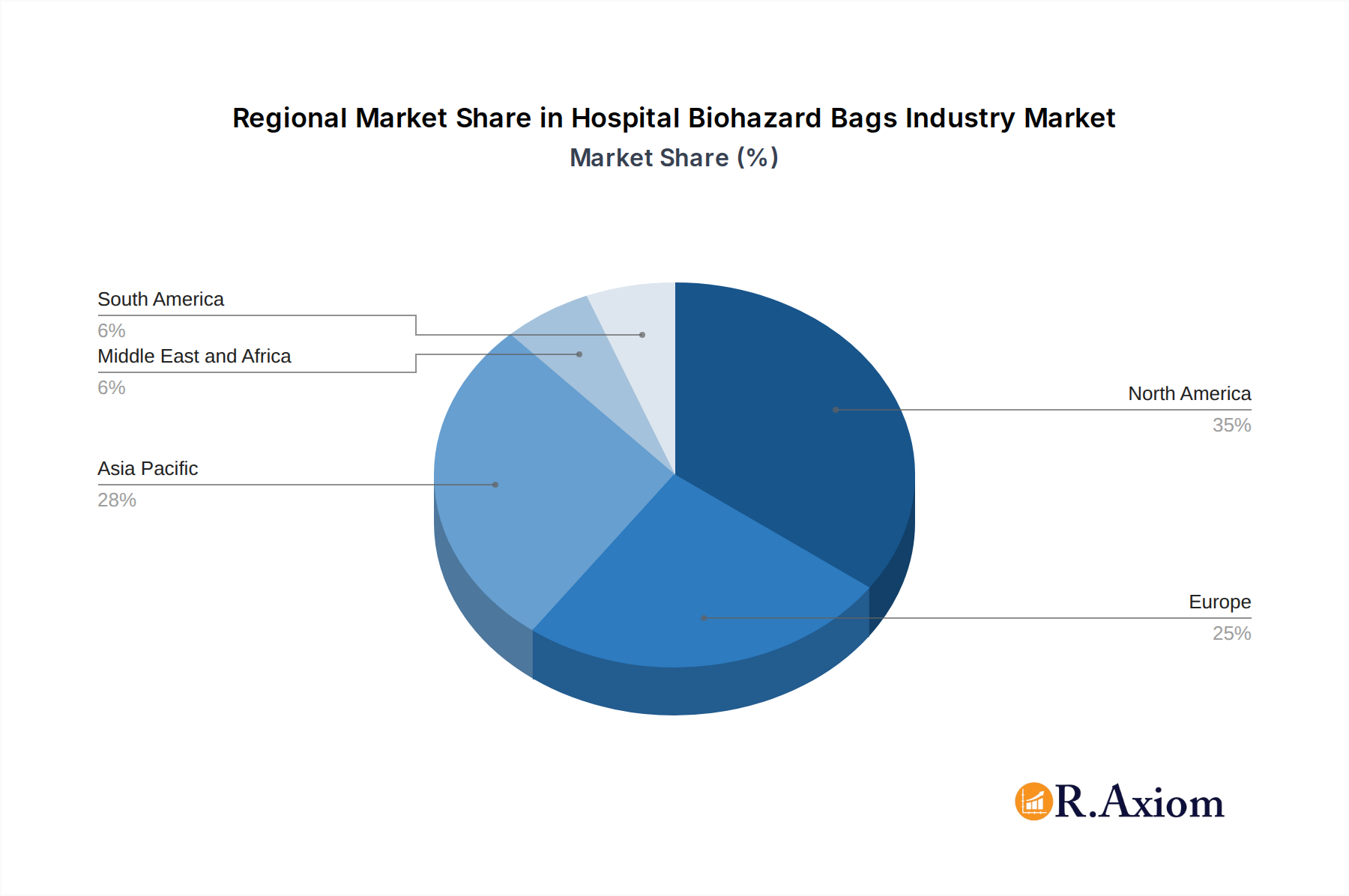

The market is segmented by product material, with LDPE, HDPE, Cellophane, and Polypropylene being the key categories. Applications span across infectious waste, healthcare waste management, chemical and pharmaceutical waste, and other specialized uses. Hospitals represent the largest end-user segment, followed by diagnostic laboratories and other healthcare entities. Geographically, North America is anticipated to maintain a dominant market share, driven by its advanced healthcare systems and strict waste disposal protocols. However, the Asia Pacific region is expected to witness the highest growth rate, propelled by rapid industrialization, increasing healthcare spending, and a growing awareness of biohazard management best practices. Restraints such as the fluctuating prices of raw materials and the availability of cheaper, less regulated alternatives in some regions could pose challenges, but the overarching need for safety and compliance ensures continued market vitality.

Hospital Biohazard Bags Industry Company Market Share

This in-depth report provides a detailed examination of the global Hospital Biohazard Bags Industry, encompassing market dynamics, key players, segmentation, and future projections. Spanning the historical period of 2019-2024 and projecting growth through 2033, with a base year of 2025, this analysis is designed for industry stakeholders seeking actionable insights and strategic advantages. The market is segmented by product material (LDPE, HDPE, Cellophane, Polypropylene), application (Infections, Healthcare Waste, Chemical & Pharmaceutical, Other Applications), and end-user (Hospitals, Diagnostic Laboratories, Other End Users).

Hospital Biohazard Bags Industry Market Concentration & Innovation

The Hospital Biohazard Bags Industry exhibits a moderate level of market concentration, with several key players vying for significant market share. In the historical period, the market share of leading companies is estimated to be around 60% to 70%, with Thermo Fisher Scientific and Merck KGaA often leading in terms of revenue. Innovation is primarily driven by the demand for enhanced safety features, improved puncture resistance, and greater sustainability. Regulatory frameworks, such as those governing medical waste disposal, play a crucial role in shaping product development and market entry. The increasing focus on infection control and the growing volume of healthcare waste are key innovation drivers. While direct product substitutes are limited due to stringent safety requirements, advancements in waste management technologies and alternative disposal methods present indirect competitive pressures. End-user trends lean towards specialized bags for specific biohazardous materials and an increasing preference for recyclable or biodegradable options, influencing product design and material selection. Mergers and acquisitions (M&A) have been strategic moves to consolidate market presence and expand product portfolios. For instance, acquisitions in the past few years have seen deal values ranging from $50 million to $200 million, aimed at enhancing manufacturing capabilities and expanding geographic reach.

Hospital Biohazard Bags Industry Industry Trends & Insights

The global Hospital Biohazard Bags Industry is poised for robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.5% during the forecast period of 2025–2033. This expansion is largely fueled by the escalating global healthcare expenditures, the increasing incidence of infectious diseases, and the stringent regulations surrounding the safe disposal of medical and hazardous waste. The COVID-19 pandemic significantly accelerated the demand for high-quality biohazard bags, highlighting their critical role in preventing the spread of pathogens. Technological disruptions are manifesting in the development of advanced materials offering superior puncture and tear resistance, as well as enhanced barrier properties to contain hazardous substances effectively. Smart biohazard bags with integrated tracking or labeling capabilities are also emerging as a niche but growing segment. Consumer preferences are increasingly shifting towards eco-friendly and sustainable solutions, prompting manufacturers to explore biodegradable and recyclable materials, albeit with a constant emphasis on maintaining their efficacy and compliance with safety standards. Competitive dynamics are characterized by both established players and emerging manufacturers focusing on product differentiation through features, certifications, and competitive pricing. The market penetration of biohazard bags is high in developed economies due to well-established healthcare infrastructure and stringent waste management protocols, while developing economies present significant growth potential as their healthcare systems expand and regulatory frameworks strengthen. The overall market size is estimated to reach over $3,500 million by 2033.

Dominant Markets & Segments in Hospital Biohazard Bags Industry

North America and Europe currently dominate the global Hospital Biohazard Bags Industry, driven by well-established healthcare infrastructures, stringent waste management regulations, and a high prevalence of healthcare-associated infections. The United States, in particular, represents a significant market share due to its advanced healthcare system and robust regulatory compliance.

Product Material:

- LDPE (Low-Density Polyethylene): This segment holds a substantial market share due to its flexibility, cost-effectiveness, and excellent puncture resistance, making it ideal for a wide range of biohazardous waste. Key drivers include its widespread availability and proven performance in containment.

- HDPE (High-Density Polyethylene): Offering superior strength and chemical resistance, HDPE bags are favored for applications involving sharper waste or more aggressive chemicals. Economic policies promoting durable and reliable containment solutions contribute to its demand.

- Polypropylene: While less prevalent than LDPE and HDPE, polypropylene finds application in specialized biohazard bags, particularly for sterilization processes or when higher temperature resistance is required.

- Cellophane: Primarily used in niche applications, often in combination with other materials, for its biodegradability and transparency.

Application:

- Healthcare Waste: This is the largest and fastest-growing segment. The increasing volume of medical waste generated globally, coupled with stricter disposal norms, fuels demand. Key drivers include a growing patient population and an increase in surgical procedures.

- Infections: Bags specifically designed for containing infectious materials from patients with communicable diseases, such as during pandemics, are crucial. Public health initiatives and awareness campaigns around infection control significantly impact this segment.

- Chemical & Pharmaceutical: Biohazard bags used for disposing of chemical and pharmaceutical waste from laboratories and manufacturing facilities are critical for environmental protection. Regulatory compliance for hazardous substance disposal is a primary driver.

- Other Applications: This segment includes waste from research facilities, veterinary clinics, and other settings that generate biohazardous materials.

End User:

- Hospitals: As the primary generators of medical waste, hospitals are the largest end-user segment. Their continuous need for safe disposal solutions for various types of biohazardous materials underscores their dominance. Infrastructure development in healthcare facilities contributes to this segment's growth.

- Diagnostic Laboratories: These facilities generate specialized biohazardous waste, including biological samples and reagents, making them significant consumers of biohazard bags. The increasing number of diagnostic tests and research activities support this segment.

- Other End Users: This includes research institutions, blood banks, funeral homes, and industrial settings that handle biohazardous materials.

Hospital Biohazard Bags Industry Product Developments

Product developments in the Hospital Biohazard Bags Industry are centered on enhancing safety, compliance, and sustainability. Innovations include bags with integrated sealing mechanisms for enhanced containment, improved puncture resistance to prevent leaks from sharp objects, and the incorporation of antimicrobial agents to inhibit microbial growth. Advancements in material science are leading to the development of more robust and eco-friendlier options, such as biodegradable plastics and recycled materials, without compromising on safety standards. These developments offer competitive advantages by meeting the evolving needs of healthcare facilities for safer, more efficient, and environmentally responsible waste management solutions.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Hospital Biohazard Bags Industry, segmented across key categories to provide granular insights.

- Product Material: The report meticulously analyzes the market for bags manufactured from LDPE, HDPE, Cellophane, and Polypropylene. Each material segment is assessed for its market size, growth projections, and competitive landscape, highlighting the specific advantages and applications of each.

- Application: The analysis delves into the utilization of biohazard bags across diverse applications, including the containment of waste related to Infections, general Healthcare Waste, Chemical & Pharmaceutical waste, and Other Applications. Growth projections and market share for each application are detailed.

- End User: The report segments the market by end-user, focusing on Hospitals, Diagnostic Laboratories, and Other End Users. Market penetration, key drivers, and competitive dynamics within each end-user segment are thoroughly examined with specific growth forecasts.

Key Drivers of Hospital Biohazard Bags Industry Growth

The Hospital Biohazard Bags Industry is propelled by several significant growth drivers. Foremost among these is the global increase in healthcare expenditures and the subsequent rise in medical waste generation. Stringent government regulations mandating the safe disposal of biohazardous materials are a primary catalyst, ensuring a consistent demand for compliant packaging solutions. Furthermore, the growing awareness and concern regarding hospital-acquired infections and the need to prevent the spread of infectious diseases, particularly highlighted by recent global health events, are driving the adoption of high-quality biohazard bags. Technological advancements in material science, leading to more durable, leak-proof, and puncture-resistant bags, also contribute to market expansion by offering enhanced safety and reliability.

Challenges in the Hospital Biohazard Bags Industry Sector

Despite robust growth, the Hospital Biohazard Bags Industry faces several challenges. The cost of raw materials, particularly specialized polymers, can fluctuate significantly, impacting manufacturing costs and final product pricing. Stringent regulatory compliance requirements, while a driver, also pose a challenge, demanding continuous investment in product testing and certification. The disposal of used biohazard bags themselves presents an environmental concern, with a growing demand for more sustainable options that do not compromise on safety. Competitive pressures from established players and new entrants, especially in price-sensitive markets, can also restrain profitability. Supply chain disruptions, as witnessed during global events, can impact the availability of essential raw materials and finished goods.

Emerging Opportunities in Hospital Biohazard Bags Industry

Emerging opportunities in the Hospital Biohazard Bags Industry lie in the development and adoption of sustainable and eco-friendly biohazard bags, catering to the growing environmental consciousness. Advancements in smart packaging, such as bags with embedded RFID tags for better tracking and inventory management, present a niche but growing opportunity. The expansion of healthcare infrastructure in developing economies offers significant untapped market potential. Furthermore, the development of specialized biohazard bags for emerging infectious diseases or for handling specific types of pharmaceutical waste can create new revenue streams. Increased focus on point-of-care waste management solutions and improved disposal technologies also present avenues for innovation and market growth.

Leading Players in the Hospital Biohazard Bags Industry Market

- Transcendia Inc

- Merck KGaA

- Bionics Scientific Technologies Pvt Ltd

- Harbour Group (SP Bel-Art)

- Desco Medical India

- Welpack Industries Pvt Ltd

- TUFPAK INC

- International Plastics Inc

- Champion Plastics

- Inteplast Group Corporation (Minigrip LLC)

- Thermo Fisher Scientific

Key Developments in Hospital Biohazard Bags Industry Industry

- April 2022: The West Bengal Bench of the Authority for Advance Ruling (AAR) announced in April 2022 that services offered to the State Government for collecting and disposing of bio-medical waste are exempt from GST. This ruling impacts the cost structure and operational dynamics for waste management providers within the state.

- January 2022: The South Delhi Municipal Corporation (SDMC) established helpline numbers for collecting biomedical waste from the residences of Covid-19 patients. This initiative reflects a growing focus on decentralized waste management solutions and increased public health safety measures.

Strategic Outlook for Hospital Biohazard Bags Industry Market

The strategic outlook for the Hospital Biohazard Bags Industry remains positive, driven by persistent global health concerns and evolving waste management needs. Key growth catalysts include continued investments in healthcare infrastructure, particularly in emerging economies, and the ongoing demand for enhanced biosafety measures. Companies that can innovate in sustainable materials while maintaining stringent safety standards will likely capture significant market share. Strategic partnerships and collaborations focused on improving waste disposal technologies and expanding market reach will be crucial. The industry is expected to witness further consolidation through M&A activities as companies seek to strengthen their competitive positions and expand their product portfolios to meet diverse end-user requirements.

Hospital Biohazard Bags Industry Segmentation

-

1. Product Material

- 1.1. LDPE

- 1.2. HDPE

- 1.3. Cellophane

- 1.4. Polypropylene

-

2. Application

- 2.1. Infections

- 2.2. Healthcare Waste

- 2.3. Chemical & Pharmaceutical

- 2.4. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostic Laboratories

- 3.3. Other End Users

Hospital Biohazard Bags Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hospital Biohazard Bags Industry Regional Market Share

Geographic Coverage of Hospital Biohazard Bags Industry

Hospital Biohazard Bags Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Flow of Samples in Diagnostic Labs; Growing Number of Hospital Beds in Developing Countries

- 3.3. Market Restrains

- 3.3.1. Presence of Alternatives

- 3.4. Market Trends

- 3.4.1. Hospital Segment is Expected to Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Material

- 5.1.1. LDPE

- 5.1.2. HDPE

- 5.1.3. Cellophane

- 5.1.4. Polypropylene

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infections

- 5.2.2. Healthcare Waste

- 5.2.3. Chemical & Pharmaceutical

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Laboratories

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Material

- 6. North America Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Material

- 6.1.1. LDPE

- 6.1.2. HDPE

- 6.1.3. Cellophane

- 6.1.4. Polypropylene

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infections

- 6.2.2. Healthcare Waste

- 6.2.3. Chemical & Pharmaceutical

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostic Laboratories

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Material

- 7. Europe Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Material

- 7.1.1. LDPE

- 7.1.2. HDPE

- 7.1.3. Cellophane

- 7.1.4. Polypropylene

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infections

- 7.2.2. Healthcare Waste

- 7.2.3. Chemical & Pharmaceutical

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Laboratories

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Material

- 8. Asia Pacific Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Material

- 8.1.1. LDPE

- 8.1.2. HDPE

- 8.1.3. Cellophane

- 8.1.4. Polypropylene

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infections

- 8.2.2. Healthcare Waste

- 8.2.3. Chemical & Pharmaceutical

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostic Laboratories

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Material

- 9. Middle East and Africa Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Material

- 9.1.1. LDPE

- 9.1.2. HDPE

- 9.1.3. Cellophane

- 9.1.4. Polypropylene

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infections

- 9.2.2. Healthcare Waste

- 9.2.3. Chemical & Pharmaceutical

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostic Laboratories

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Material

- 10. South America Hospital Biohazard Bags Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Material

- 10.1.1. LDPE

- 10.1.2. HDPE

- 10.1.3. Cellophane

- 10.1.4. Polypropylene

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infections

- 10.2.2. Healthcare Waste

- 10.2.3. Chemical & Pharmaceutical

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Diagnostic Laboratories

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Transcendia Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bionics Scientific Technologies Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Harbour Group (SP Bel-Art)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Desco Medical India*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Welpack Industries Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TUFPAK INC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Plastics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Champion Plastics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inteplast Group Corporation (Minigrip LLC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thermo Fisher Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Transcendia Inc

List of Figures

- Figure 1: Global Hospital Biohazard Bags Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Hospital Biohazard Bags Industry Revenue (million), by Product Material 2025 & 2033

- Figure 3: North America Hospital Biohazard Bags Industry Revenue Share (%), by Product Material 2025 & 2033

- Figure 4: North America Hospital Biohazard Bags Industry Revenue (million), by Application 2025 & 2033

- Figure 5: North America Hospital Biohazard Bags Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Hospital Biohazard Bags Industry Revenue (million), by End User 2025 & 2033

- Figure 7: North America Hospital Biohazard Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Hospital Biohazard Bags Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Hospital Biohazard Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hospital Biohazard Bags Industry Revenue (million), by Product Material 2025 & 2033

- Figure 11: Europe Hospital Biohazard Bags Industry Revenue Share (%), by Product Material 2025 & 2033

- Figure 12: Europe Hospital Biohazard Bags Industry Revenue (million), by Application 2025 & 2033

- Figure 13: Europe Hospital Biohazard Bags Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Hospital Biohazard Bags Industry Revenue (million), by End User 2025 & 2033

- Figure 15: Europe Hospital Biohazard Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Hospital Biohazard Bags Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Hospital Biohazard Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hospital Biohazard Bags Industry Revenue (million), by Product Material 2025 & 2033

- Figure 19: Asia Pacific Hospital Biohazard Bags Industry Revenue Share (%), by Product Material 2025 & 2033

- Figure 20: Asia Pacific Hospital Biohazard Bags Industry Revenue (million), by Application 2025 & 2033

- Figure 21: Asia Pacific Hospital Biohazard Bags Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Hospital Biohazard Bags Industry Revenue (million), by End User 2025 & 2033

- Figure 23: Asia Pacific Hospital Biohazard Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Hospital Biohazard Bags Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Hospital Biohazard Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hospital Biohazard Bags Industry Revenue (million), by Product Material 2025 & 2033

- Figure 27: Middle East and Africa Hospital Biohazard Bags Industry Revenue Share (%), by Product Material 2025 & 2033

- Figure 28: Middle East and Africa Hospital Biohazard Bags Industry Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Hospital Biohazard Bags Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Hospital Biohazard Bags Industry Revenue (million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Hospital Biohazard Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Hospital Biohazard Bags Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Hospital Biohazard Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Hospital Biohazard Bags Industry Revenue (million), by Product Material 2025 & 2033

- Figure 35: South America Hospital Biohazard Bags Industry Revenue Share (%), by Product Material 2025 & 2033

- Figure 36: South America Hospital Biohazard Bags Industry Revenue (million), by Application 2025 & 2033

- Figure 37: South America Hospital Biohazard Bags Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Hospital Biohazard Bags Industry Revenue (million), by End User 2025 & 2033

- Figure 39: South America Hospital Biohazard Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Hospital Biohazard Bags Industry Revenue (million), by Country 2025 & 2033

- Figure 41: South America Hospital Biohazard Bags Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 2: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 6: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 7: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 13: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 23: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 25: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 33: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 35: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: GCC Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Product Material 2020 & 2033

- Table 40: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Application 2020 & 2033

- Table 41: Global Hospital Biohazard Bags Industry Revenue million Forecast, by End User 2020 & 2033

- Table 42: Global Hospital Biohazard Bags Industry Revenue million Forecast, by Country 2020 & 2033

- Table 43: Brazil Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Hospital Biohazard Bags Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospital Biohazard Bags Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Hospital Biohazard Bags Industry?

Key companies in the market include Transcendia Inc, Merck KGaA, Bionics Scientific Technologies Pvt Ltd, Harbour Group (SP Bel-Art), Desco Medical India*List Not Exhaustive, Welpack Industries Pvt Ltd, TUFPAK INC, International Plastics Inc, Champion Plastics, Inteplast Group Corporation (Minigrip LLC), Thermo Fisher Scientific.

3. What are the main segments of the Hospital Biohazard Bags Industry?

The market segments include Product Material, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 541.28 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Flow of Samples in Diagnostic Labs; Growing Number of Hospital Beds in Developing Countries.

6. What are the notable trends driving market growth?

Hospital Segment is Expected to Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Presence of Alternatives.

8. Can you provide examples of recent developments in the market?

April 2022: The West Bengal Bench of the Authority for Advance Ruling (AAR) announced in April 2022 that services offered to the State Government for collecting and disposing of bio-medical waste are exempt from GST.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospital Biohazard Bags Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospital Biohazard Bags Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospital Biohazard Bags Industry?

To stay informed about further developments, trends, and reports in the Hospital Biohazard Bags Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence