Key Insights

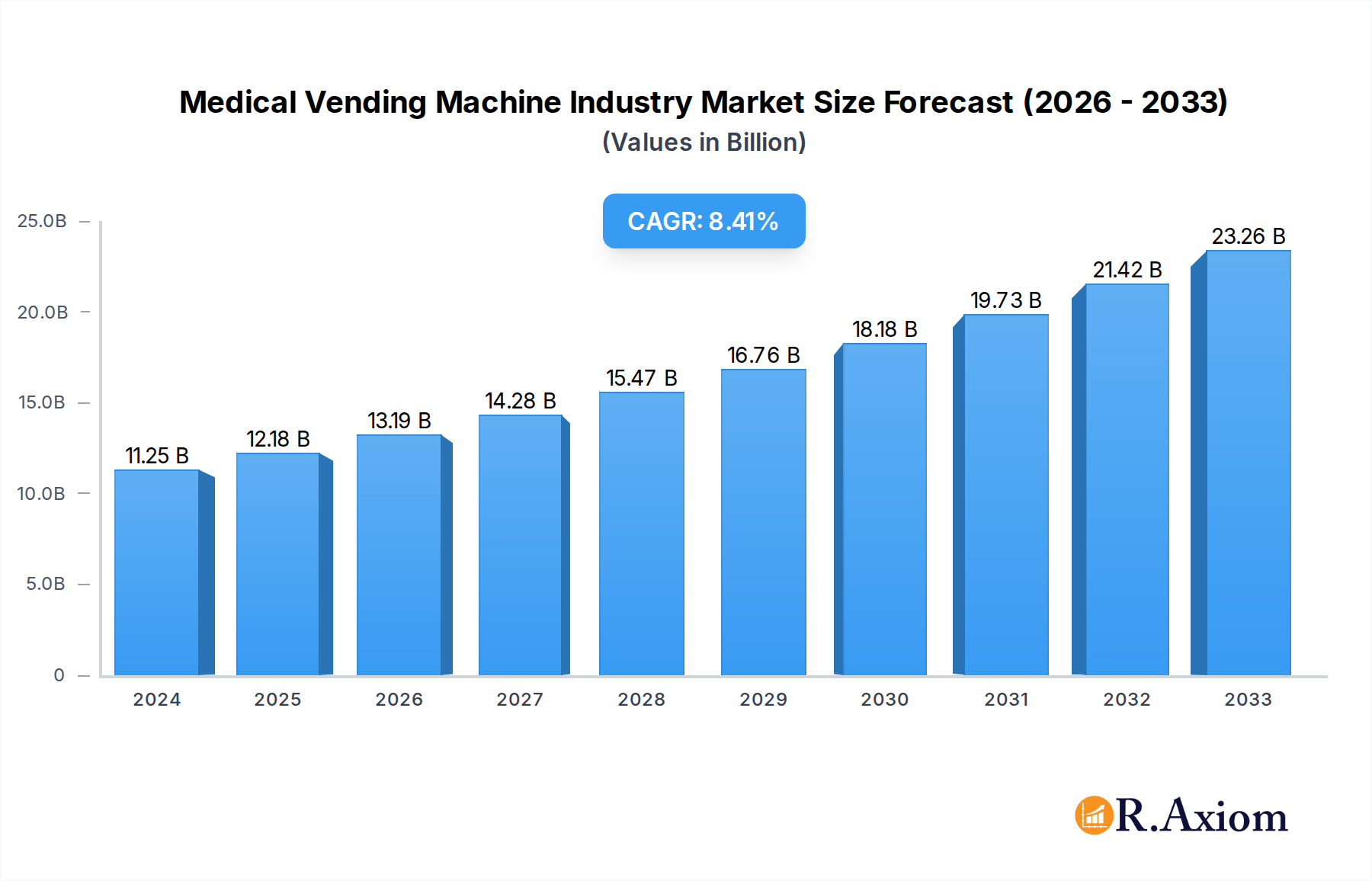

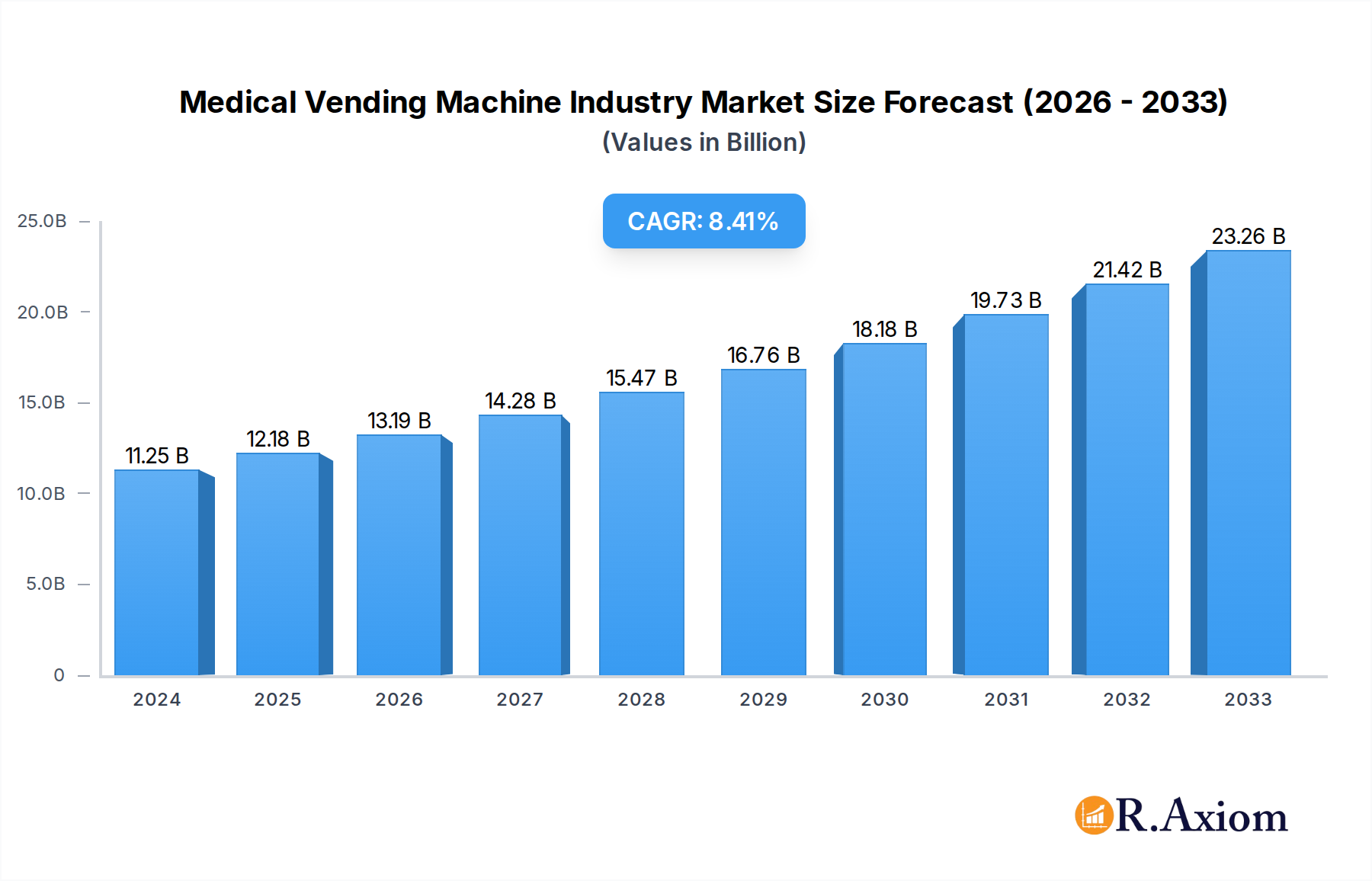

The global Medical Vending Machine market is poised for robust expansion, demonstrating a significant market size of USD 11,250.75 million in 2024. This growth is propelled by an impressive Compound Annual Growth Rate (CAGR) of 8.72%, indicating sustained and strong development over the forecast period. The increasing demand for automated dispensing solutions in healthcare settings is a primary driver. Hospitals are increasingly adopting these machines to streamline medication and supply management, reduce errors, and improve patient safety. Similarly, retail pharmacies are leveraging medical vending machines to offer 24/7 access to essential over-the-counter medications and health products, enhancing convenience for consumers. The ongoing digital transformation within the healthcare industry, coupled with the need for greater efficiency and reduced operational costs, further fuels market penetration. Key technological advancements, such as integrated inventory management systems and enhanced security features, are also contributing to the adoption of these sophisticated vending solutions.

Medical Vending Machine Industry Market Size (In Billion)

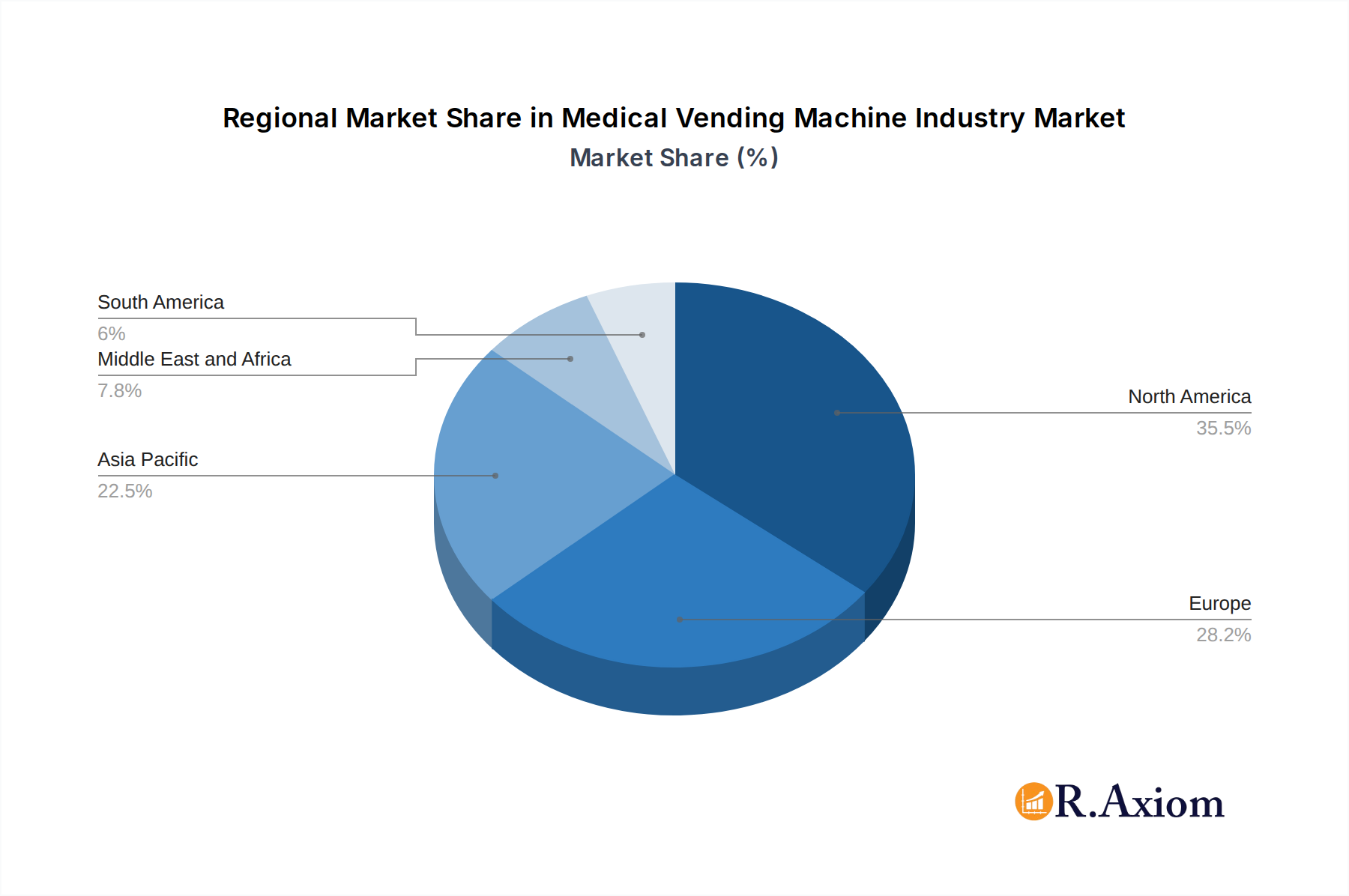

Further analysis of the market reveals a dynamic landscape shaped by evolving consumer expectations and healthcare delivery models. The market is segmented into various product types, including Benchtop and Floor Standing Medical Vending Machines, catering to diverse space and operational requirements. End-users predominantly comprise hospitals, retail pharmacies, and a growing "Others" category, which includes clinics, long-term care facilities, and even corporate wellness centers. The competitive environment features prominent players like Becton Dickinson and Company, Pharmashop24 srl, Parata Systems, and Omnicell, all actively innovating to capture market share. Geographic expansion is also a key trend, with North America and Europe currently leading in adoption, while the Asia Pacific region shows immense untapped potential driven by a growing healthcare infrastructure and increasing disposable incomes. The focus on patient-centric care and the drive towards greater automation across the healthcare value chain will continue to be instrumental in shaping the trajectory of the medical vending machine market.

Medical Vending Machine Industry Company Market Share

Medical Vending Machine Industry Market Concentration & Innovation

The Medical Vending Machine Industry is characterized by a moderate to high market concentration, with a few key players holding significant market share. In the Base Year 2025, the estimated market share of leading companies like Becton Dickinson and Company, Pharmashop24 srl, and Omnicell collectively accounted for over 60% of the global market. Innovation is a critical differentiator, driven by advancements in automation, artificial intelligence for inventory management, and secure dispensing technologies. Regulatory frameworks, particularly those surrounding pharmaceutical dispensing and patient data privacy (e.g., HIPAA compliance in the US), play a crucial role in shaping product development and market entry. The threat of product substitutes is relatively low, as dedicated medical vending machines offer unique advantages in controlled dispensing and accessibility. End-user trends are heavily influenced by the demand for convenient access to medications and medical supplies, especially in non-traditional healthcare settings. Mergers and acquisitions (M&A) activities are moderately prevalent, with reported M&A deal values in the last five years (2019-2024) exceeding 1,500 million. These acquisitions are often aimed at expanding product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominance by key players like Becton Dickinson and Company, Pharmashop24 srl, and Omnicell.

- Innovation Drivers: AI-powered inventory, secure dispensing, automation.

- Regulatory Influence: HIPAA compliance, pharmaceutical dispensing regulations.

- M&A Activity: Increasing consolidation to gain market share and technological integration, with total deal values exceeding 1,500 million during the historical period.

Medical Vending Machine Industry Industry Trends & Insights

The Medical Vending Machine Industry is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This robust growth is underpinned by several key trends. The increasing demand for healthcare accessibility and convenience is a primary driver, as vending machines offer 24/7 access to over-the-counter medications, personal protective equipment (PPE), and basic medical supplies. Technological disruptions are revolutionizing the sector, with the integration of smart technologies such as IoT sensors for real-time inventory tracking, contactless payment systems, and remote monitoring capabilities. Artificial intelligence is also being leveraged for predictive analytics, optimizing stock levels and reducing waste. Consumer preferences are shifting towards self-service options, which medical vending machines effectively cater to, particularly in retail pharmacies and hospitals looking to streamline operations and improve patient experience. Competitive dynamics are intensifying, with established players investing heavily in R&D to enhance their product offerings and new entrants seeking niche markets. The growing prevalence of chronic diseases and an aging global population further bolster the demand for accessible healthcare solutions, making medical vending machines an increasingly indispensable part of the healthcare ecosystem. Market penetration is expected to rise sharply, especially in urban and semi-urban areas where convenience is a significant factor. The estimated market size in the Base Year 2025 is approximately 5,000 million, with projections indicating a substantial increase by the end of the forecast period.

Dominant Markets & Segments in Medical Vending Machine Industry

The North America region currently dominates the Medical Vending Machine Industry, driven by strong healthcare infrastructure, high adoption rates of advanced technologies, and a significant presence of leading market players like Parata Systems and Omnicell. The United States, in particular, accounts for a substantial portion of the regional market share, supported by favorable reimbursement policies and a continuous drive for operational efficiency in healthcare settings.

Within Product Types, the Floor Standing Medical Vending Machine segment is the largest contributor to the market.

- Key Drivers for Floor Standing Dominance:

- Larger Capacity: These machines can hold a wider variety and larger volume of products, essential for high-traffic locations like hospitals and large retail pharmacies.

- Advanced Features: Often equipped with more sophisticated dispensing mechanisms, temperature control, and security features.

- Space Utilization: Despite their size, they offer efficient space utilization compared to multiple smaller units for diverse product needs.

The Hospitals segment represents the dominant end-user market.

- Key Drivers for Hospital Dominance:

- Streamlined Medication and Supply Distribution: Hospitals use vending machines for internal distribution of medications, PPE, and medical supplies to various departments, reducing manual handling and errors.

- 24/7 Accessibility: Critical for round-the-clock patient care, ensuring medical staff can access necessary items at any time.

- Cost Reduction: Optimizes inventory management and reduces the need for extensive staffing for distribution.

- Infection Control: Touchless dispensing options contribute to better hygiene.

The Retail Pharmacies segment is a rapidly growing end-user, with companies like CVS Health increasingly integrating these solutions to offer convenience and expand their service offerings. The Benchtop Medical Vending Machine segment is also experiencing growth, particularly for smaller clinics, doctor's offices, and specialized pharmacies requiring compact solutions.

Medical Vending Machine Industry Product Developments

Product development in the Medical Vending Machine Industry is heavily focused on enhancing user experience, security, and operational efficiency. Innovations include the integration of AI for intelligent inventory management and predictive maintenance, ensuring machines are always stocked and functional. Advanced secure dispensing mechanisms are crucial for the safe distribution of prescription medications. Furthermore, the adoption of IoT connectivity allows for real-time data analytics on usage patterns, enabling better demand forecasting. Competitive advantages are being built through user-friendly interfaces, contactless payment options, and compliance with stringent healthcare regulations.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Medical Vending Machine Industry, segmented by Product Type into Benchtop Medical Vending Machines and Floor Standing Medical Vending Machines, and by End User into Hospitals, Retail Pharmacies, and Others. The Benchtop Medical Vending Machine segment, projected to reach approximately 2,500 million by 2033, caters to smaller clinics and specialized needs, offering compact solutions with a focus on specific product categories. The Floor Standing Medical Vending Machine segment is expected to maintain its dominance, with a projected market size exceeding 7,500 million by 2033, due to its larger capacity and wider application in high-volume environments. The Hospitals segment, valued at over 6,000 million in 2025, is anticipated to grow steadily as healthcare facilities prioritize efficiency and accessibility. The Retail Pharmacies segment, projected to experience the highest growth rate, is expected to reach over 3,500 million by 2033, driven by increasing consumer demand for convenience. The ‘Others’ segment, encompassing clinics, research institutions, and corporate wellness centers, is also a growing area of opportunity.

Key Drivers of Medical Vending Machine Industry Growth

The Medical Vending Machine Industry is propelled by several critical growth drivers. The increasing demand for accessible healthcare solutions is paramount, especially in underserved areas and for individuals requiring on-demand access to medications and supplies. Technological advancements such as AI, IoT, and automation are enhancing the functionality, efficiency, and security of vending machines. Economic factors like the need for cost-effective healthcare delivery push institutions towards automated solutions that reduce labor costs and optimize inventory management. Regulatory support for innovative healthcare delivery models also plays a significant role.

- Technological Advancements: AI for inventory, IoT for remote monitoring, secure dispensing.

- Economic Factors: Cost reduction in healthcare operations, inventory optimization.

- Accessibility Needs: 24/7 availability of medical products, serving diverse patient populations.

Challenges in the Medical Vending Machine Industry Sector

Despite its growth potential, the Medical Vending Machine Industry faces several challenges. Stringent regulatory compliance related to pharmaceutical dispensing and data security can be a significant hurdle, requiring substantial investment in compliant systems. High initial capital investment for advanced machines can be a barrier for smaller entities. Supply chain disruptions, as witnessed globally, can impact the availability of components and finished products, affecting operational continuity. Cybersecurity threats are also a growing concern, necessitating robust security measures to protect sensitive patient data.

- Regulatory Hurdles: Compliance with pharmaceutical dispensing laws and data privacy regulations.

- Initial Investment Costs: High upfront costs for sophisticated vending systems.

- Supply Chain Volatility: Potential for disruptions in component and finished product delivery.

- Cybersecurity Risks: Protecting patient data and machine integrity from breaches.

Emerging Opportunities in Medical Vending Machine Industry

The Medical Vending Machine Industry is ripe with emerging opportunities. The expansion into emerging markets with growing healthcare needs presents a significant avenue for growth. The development of specialized vending machines for specific medical conditions or product categories (e.g., diabetes supplies, wound care) offers niche market potential. The increasing adoption of telehealth services can be complemented by vending machines for dispensing associated medical devices and prescriptions. Furthermore, partnerships with pharmaceutical companies for direct-to-consumer dispensing models can unlock new revenue streams.

- Geographical Expansion: Tapping into underdeveloped healthcare markets globally.

- Niche Product Specialization: Developing machines for specific medical needs and product types.

- Integration with Telehealth: Synergistic offerings for remote patient care.

- Strategic Partnerships: Collaborations with pharmaceutical manufacturers for wider reach.

Leading Players in the Medical Vending Machine Industry Market

- Becton Dickinson and Company

- Pharmashop24 srl

- Parata Systems

- Omnicell

- InstyMeds

- ScriptPro LLC

- Capsa Healthcare

- Magex

- CVS Health

- Xenco Medical

Key Developments in Medical Vending Machine Industry Industry

- 2023/Q4: Parata Systems launches an advanced automated dispensing system with enhanced cybersecurity features, addressing growing concerns in the healthcare sector.

- 2024/Q1: Omnicell announces strategic partnerships with several hospital networks to expand its automated medication management solutions, impacting over 500 healthcare facilities.

- 2024/Q2: Pharmashop24 srl introduces a new line of compact medical vending machines designed for retail pharmacies, aiming to increase market penetration in this segment.

- 2024/Q3: Capsa Healthcare expands its distribution network across Europe, estimating a 15% increase in market reach for its medication dispensing solutions.

- 2024/Q4: CVS Health reports a significant increase in the usage of its in-store medical vending machines, contributing to an estimated 10% rise in customer convenience metrics.

Strategic Outlook for Medical Vending Machine Industry Market

The future of the Medical Vending Machine Industry is exceptionally promising, fueled by ongoing technological innovation and a persistent societal need for accessible and efficient healthcare solutions. Strategic initiatives focusing on expanding into underserved regions, developing AI-driven predictive capabilities for inventory management, and enhancing the user experience through intuitive interfaces will be key growth catalysts. The increasing integration of vending machines into broader healthcare ecosystems, including telehealth and hospital supply chain optimization, will further solidify their importance. Investments in robust cybersecurity and adherence to evolving regulatory landscapes will be crucial for sustained success and market leadership. The industry is on track for substantial expansion, driven by its ability to address critical healthcare access and operational efficiency challenges.

Medical Vending Machine Industry Segmentation

-

1. Product Type

- 1.1. Benchtop Medical Vending Machine

- 1.2. Floor Standing Medical Vending Machine

-

2. End User

- 2.1. Hospitals

- 2.2. Retail Pharmacies

- 2.3. Others

Medical Vending Machine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Vending Machine Industry Regional Market Share

Geographic Coverage of Medical Vending Machine Industry

Medical Vending Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Dependency on Prescription Medicines in Remote Areas; Increasing Demand for Efficient Inventory Management; Technological Advancements In Medical Vending Systems

- 3.3. Market Restrains

- 3.3.1. ; Risk Associated With misuse and Hacking

- 3.4. Market Trends

- 3.4.1. Pharmacies Segment is Expected to Witness a Healthy CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Benchtop Medical Vending Machine

- 5.1.2. Floor Standing Medical Vending Machine

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Retail Pharmacies

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Benchtop Medical Vending Machine

- 6.1.2. Floor Standing Medical Vending Machine

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Retail Pharmacies

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Benchtop Medical Vending Machine

- 7.1.2. Floor Standing Medical Vending Machine

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Retail Pharmacies

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Benchtop Medical Vending Machine

- 8.1.2. Floor Standing Medical Vending Machine

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Retail Pharmacies

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Benchtop Medical Vending Machine

- 9.1.2. Floor Standing Medical Vending Machine

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Retail Pharmacies

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Medical Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Benchtop Medical Vending Machine

- 10.1.2. Floor Standing Medical Vending Machine

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Retail Pharmacies

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pharmashop24 srl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Parata Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Omnicell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 InstyMeds

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ScriptPro LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Capsa Healthcare

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Magex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CVS Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xenco Medical*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Medical Vending Machine Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Medical Vending Machine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Medical Vending Machine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Medical Vending Machine Industry Revenue (million), by End User 2025 & 2033

- Figure 5: North America Medical Vending Machine Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Medical Vending Machine Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America Medical Vending Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Medical Vending Machine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 9: Europe Medical Vending Machine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Medical Vending Machine Industry Revenue (million), by End User 2025 & 2033

- Figure 11: Europe Medical Vending Machine Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Medical Vending Machine Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Medical Vending Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Medical Vending Machine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Medical Vending Machine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Medical Vending Machine Industry Revenue (million), by End User 2025 & 2033

- Figure 17: Asia Pacific Medical Vending Machine Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Medical Vending Machine Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Vending Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Medical Vending Machine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Medical Vending Machine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Medical Vending Machine Industry Revenue (million), by End User 2025 & 2033

- Figure 23: Middle East and Africa Medical Vending Machine Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Medical Vending Machine Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Medical Vending Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Medical Vending Machine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: South America Medical Vending Machine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Medical Vending Machine Industry Revenue (million), by End User 2025 & 2033

- Figure 29: South America Medical Vending Machine Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Medical Vending Machine Industry Revenue (million), by Country 2025 & 2033

- Figure 31: South America Medical Vending Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global Medical Vending Machine Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global Medical Vending Machine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 11: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 12: Global Medical Vending Machine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Germany Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 21: Global Medical Vending Machine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: China Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Japan Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Australia Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 29: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 30: Global Medical Vending Machine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: GCC Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Global Medical Vending Machine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 35: Global Medical Vending Machine Industry Revenue million Forecast, by End User 2020 & 2033

- Table 36: Global Medical Vending Machine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 37: Brazil Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Medical Vending Machine Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Vending Machine Industry?

The projected CAGR is approximately 8.72%.

2. Which companies are prominent players in the Medical Vending Machine Industry?

Key companies in the market include Becton Dickinson and Company, Pharmashop24 srl, Parata Systems, Omnicell, InstyMeds, ScriptPro LLC, Capsa Healthcare, Magex, CVS Health, Xenco Medical*List Not Exhaustive.

3. What are the main segments of the Medical Vending Machine Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11250.75 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Dependency on Prescription Medicines in Remote Areas; Increasing Demand for Efficient Inventory Management; Technological Advancements In Medical Vending Systems.

6. What are the notable trends driving market growth?

Pharmacies Segment is Expected to Witness a Healthy CAGR.

7. Are there any restraints impacting market growth?

; Risk Associated With misuse and Hacking.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Vending Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Vending Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Vending Machine Industry?

To stay informed about further developments, trends, and reports in the Medical Vending Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence