Key Insights

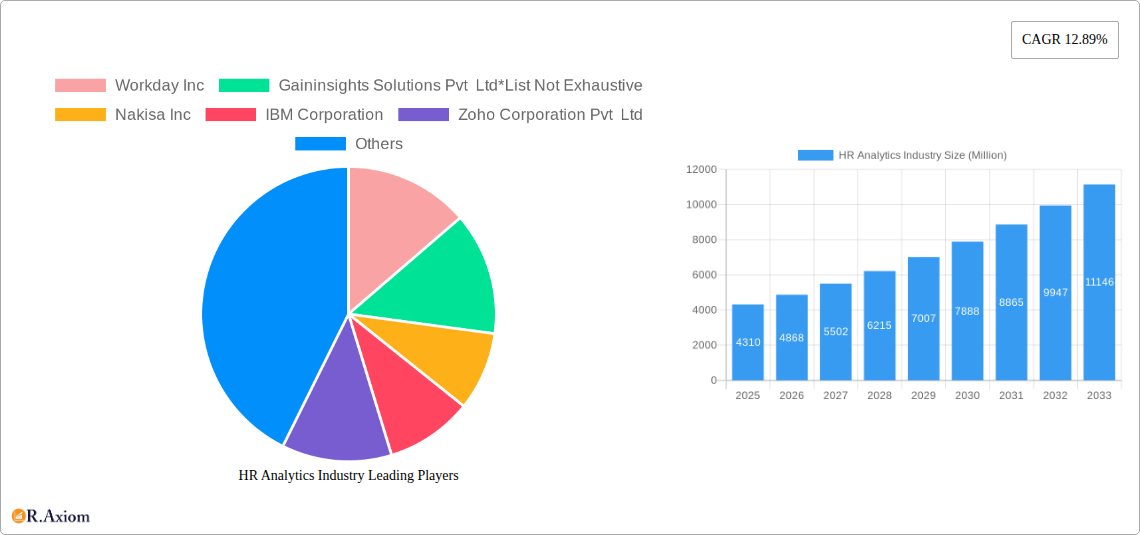

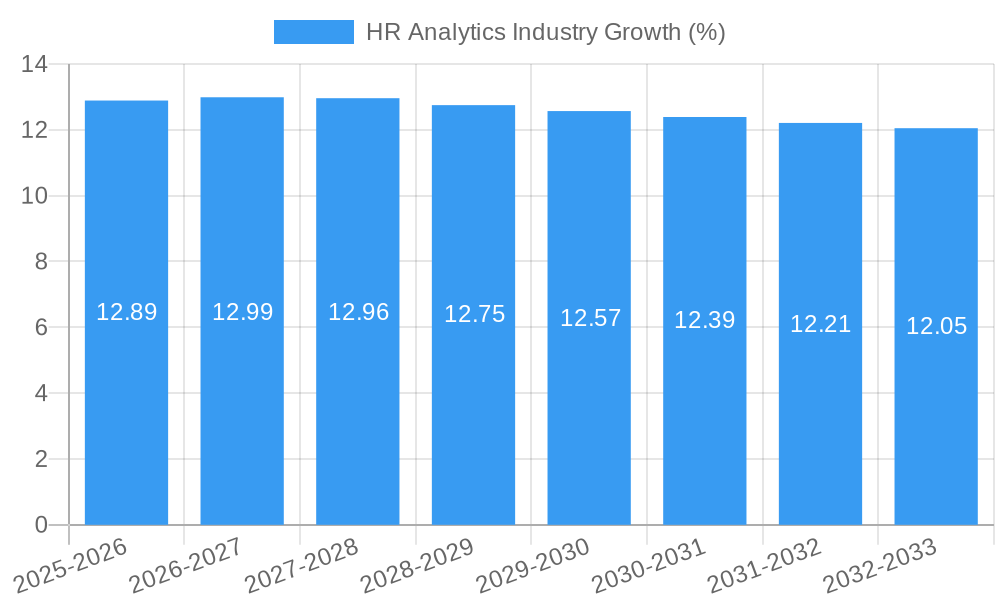

The global HR Analytics market is poised for significant expansion, projected to reach a substantial USD 4.31 billion in 2025. This growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 12.89%, indicating robust adoption and increasing reliance on data-driven decision-making within human resources functions. The escalating need for organizations to optimize workforce performance, enhance employee engagement, and identify talent gaps is a primary driver. Businesses are increasingly recognizing the strategic value of HR analytics in predicting employee turnover, improving recruitment processes, and fostering a more productive work environment. The shift towards cloud-based solutions is a dominant trend, offering scalability, flexibility, and cost-effectiveness compared to traditional on-premise deployments. This trend is particularly evident as companies across various sectors, including Telecom and IT, BFSI, and Healthcare, prioritize agility and rapid deployment of HR technologies. Furthermore, the proliferation of big data and advancements in AI and machine learning are empowering HR departments with sophisticated tools to derive deeper insights from their workforce data, further accelerating market growth.

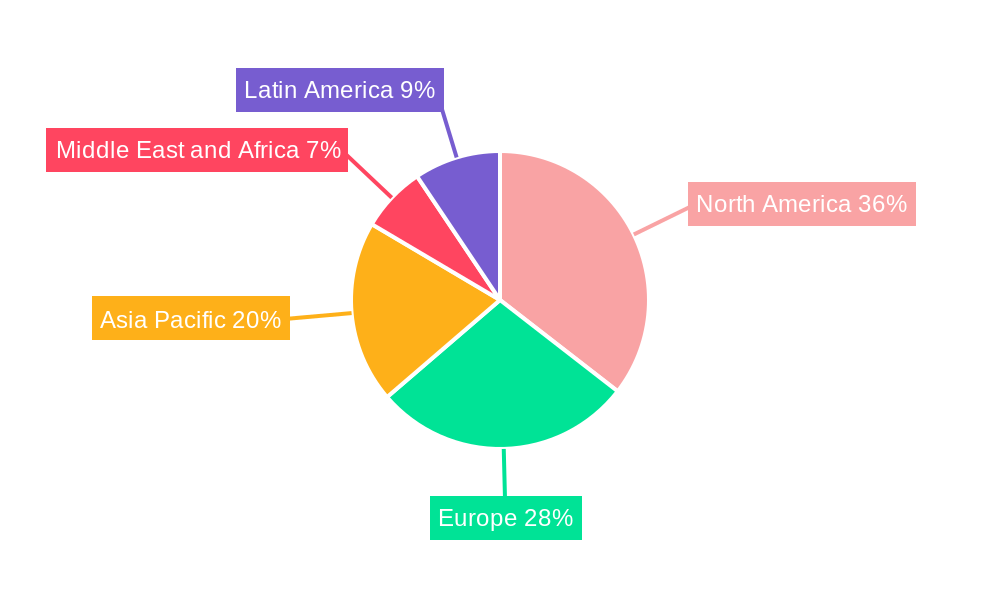

While the market is largely driven by the imperative for enhanced workforce management and strategic talent acquisition, certain factors may present challenges. The initial investment in sophisticated HR analytics software and the need for skilled personnel to interpret and act upon the data can act as restraints for smaller organizations. However, the increasing availability of user-friendly, subscription-based solutions and the growing emphasis on upskilling HR professionals are mitigating these concerns. The market is segmented across components, with solutions and services playing crucial roles. Deployment modes are bifurcating between on-premise and cloud, with a clear lean towards cloud adoption. The end-user industry landscape is diverse, with Telecom and IT, BFSI, Consumer Goods and Retail, Healthcare, and Manufacturing leading the charge in leveraging HR analytics. Geographically, North America and Europe are expected to remain dominant markets, driven by advanced technological infrastructure and a strong emphasis on data analytics. However, the Asia Pacific region, particularly India and China, is anticipated to witness substantial growth due to a burgeoning workforce and increasing digitalization across industries.

This in-depth report provides a detailed examination of the global HR analytics market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, the study offers actionable insights into market dynamics, growth drivers, challenges, and emerging opportunities. Leveraging high-traffic keywords and a structured format, this report is designed to equip industry stakeholders with critical data for strategic decision-making.

HR Analytics Industry Market Concentration & Innovation

The HR analytics market is characterized by a moderate level of concentration, with a few dominant players vying for market share, alongside a growing number of specialized vendors. Innovation is a key differentiator, driven by advancements in Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics. These technologies enable organizations to move beyond descriptive HR reporting to prescriptive insights, fostering a more strategic approach to talent management. Regulatory frameworks, such as GDPR and CCPA, are increasingly influencing data privacy and security standards within HR analytics solutions, necessitating compliance and robust data governance. Product substitutes, while present in the form of traditional HR software with limited analytical capabilities, are gradually being phased out as organizations recognize the indispensable value of dedicated HR analytics platforms. End-user trends are leaning towards self-service analytics, real-time insights, and integrated HR technology ecosystems. Mergers and Acquisitions (M&A) activity remains robust, with significant M&A deal values indicative of market consolidation and strategic expansion. For instance, the acquisition of smaller analytics firms by larger HR technology providers aims to bolster their AI/ML capabilities and expand their customer base. The market share for leading vendors is estimated to be in the high single-digit to low double-digit percentages.

HR Analytics Industry Industry Trends & Insights

The HR analytics industry is poised for substantial growth, driven by an escalating need for data-driven decision-making across all organizational functions. Market growth drivers are manifold, including the increasing complexity of global workforces, the demand for enhanced employee engagement and retention strategies, and the imperative to optimize talent acquisition processes. Technological disruptions, particularly in AI and ML, are revolutionizing the capabilities of HR analytics platforms. These advancements enable predictive modeling for employee turnover, performance forecasting, and personalized learning and development pathways. Consumer preferences are shifting towards user-friendly interfaces, customizable dashboards, and solutions that offer actionable recommendations rather than just raw data. The competitive landscape is intensifying, with established players and innovative startups alike investing heavily in R&D to offer sophisticated features like sentiment analysis, bias detection in hiring, and advanced workforce planning. The Compound Annual Growth Rate (CAGR) for the HR analytics market is projected to be in the range of 15% to 20% over the forecast period. Market penetration is steadily increasing as organizations of all sizes recognize the ROI of HR analytics in improving operational efficiency and strategic HR outcomes.

Dominant Markets & Segments in HR Analytics Industry

The global HR analytics market exhibits distinct regional dominance, with North America currently leading due to its early adoption of advanced technologies and a mature business environment. Within North America, the United States stands out as a key market, fueled by its robust economy and a high concentration of large enterprises investing in workforce optimization.

Component:

- Solutions: The solutions segment, encompassing analytical software and platforms, is experiencing significant growth. Key drivers include the increasing demand for advanced features like AI-powered insights, predictive modeling, and integrated talent management capabilities. This segment is projected to capture over 70% of the market revenue.

- Services: HR analytics services, including implementation, consulting, and support, are also critical. The demand is driven by organizations seeking expert guidance to leverage their HR data effectively and integrate analytics into their existing workflows.

Deployment Mode:

- Cloud: Cloud-based deployment models dominate the market, offering scalability, flexibility, and cost-effectiveness. The ease of integration with other cloud-based HR systems further bolsters its appeal. Cloud deployment is expected to account for approximately 85% of the market share.

- On-Premise: While declining, on-premise solutions still hold a niche for organizations with stringent data security requirements or legacy infrastructure.

End-User Industry:

- Telecom and IT: This sector leads adoption due to its dynamic nature, high employee turnover, and the critical need for specialized talent. Continuous innovation and a focus on employee experience are major drivers.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector leverages HR analytics for talent management, compliance, and risk assessment, making it a significant contributor to market growth.

- Consumer Goods and Retail: With a large and often dispersed workforce, these industries use HR analytics for workforce planning, performance management, and improving customer service through optimized staffing.

- Healthcare: The healthcare industry utilizes HR analytics to manage staffing shortages, improve patient care through workforce optimization, and enhance employee retention in a high-stress environment.

- Manufacturing: This sector benefits from HR analytics for improving operational efficiency, ensuring safety compliance, and managing a skilled labor force.

- Other End-user Industries: This includes sectors like government, education, and non-profits, which are increasingly adopting HR analytics to optimize their human capital.

HR Analytics Industry Product Developments

Product developments in the HR analytics industry are rapidly evolving, focusing on enhancing predictive capabilities and providing actionable insights. Innovations include AI-driven platforms that can forecast employee attrition with high accuracy, identify skill gaps for future workforce needs, and offer personalized employee development plans. Competitive advantages are being built through seamless integration with core HR systems, intuitive user interfaces, and robust data visualization tools. The emphasis is on democratizing analytics, allowing HR professionals without deep technical expertise to derive valuable insights. Real-time analytics dashboards are becoming standard, providing immediate visibility into key HR metrics and enabling proactive decision-making.

HR Analytics Industry Report Scope & Segmentation Analysis

This report comprehensively segments the HR analytics market across several key dimensions. The Component segmentation includes Solutions (software, platforms) and Services (consulting, implementation). The Deployment Mode is analyzed through On-Premise and Cloud offerings. The End-User Industry segmentation covers Telecom and IT, BFSI, Consumer Goods and Retail, Healthcare, Manufacturing, and Other End-user Industries. Each segment's growth projections, estimated market sizes, and competitive dynamics are thoroughly examined. For instance, the Cloud segment is projected to exhibit a CAGR of over 18% in market value, driven by its widespread adoption across all end-user industries.

Key Drivers of HR Analytics Industry Growth

The HR analytics industry's growth is primarily propelled by several key drivers. Technological advancements, particularly in AI and ML, are enabling more sophisticated predictive and prescriptive analytics. Economic factors, such as the increasing cost of employee turnover and the demand for a highly skilled workforce, push organizations to adopt data-driven HR strategies. Regulatory shifts mandating greater data privacy and workforce diversity reporting also contribute to the demand for robust HR analytics tools. Furthermore, the growing realization among businesses of the direct correlation between effective talent management and overall business success is a significant catalyst.

Challenges in the HR Analytics Industry Sector

Despite its growth, the HR analytics sector faces several challenges. Data privacy and security concerns remain paramount, with stringent regulations like GDPR requiring robust compliance measures. Integration complexities with existing legacy HR systems can hinder widespread adoption. A shortage of skilled data scientists and HR analysts capable of interpreting and leveraging complex HR data presents another significant barrier. Furthermore, resistance to change within organizations and the perceived cost of implementing new analytics solutions can also slow down market penetration. The competitive pressure to continuously innovate and offer cutting-edge features also puts a strain on smaller vendors.

Emerging Opportunities in HR Analytics Industry

The HR analytics industry is rife with emerging opportunities. The increasing focus on employee well-being and mental health is creating demand for analytics solutions that can track and improve employee wellness programs. The rise of the gig economy and remote work necessitates new approaches to workforce analytics, focusing on engagement, productivity, and compliance for distributed teams. AI-powered personalized learning and development offers a significant growth avenue, enabling tailored upskilling initiatives. Furthermore, the expansion of HR analytics into predictive workforce planning and succession management presents substantial opportunities for strategic impact.

Leading Players in the HR Analytics Industry Market

- Workday Inc

- Gaininsights Solutions Pvt Ltd

- Nakisa Inc

- IBM Corporation

- Zoho Corporation Pvt Ltd

- Tableau Software Inc

- Oracle Corporation

- Kronos Inc

- SAP SE

Key Developments in HR Analytics Industry Industry

- June 2022: GainInsights, a global data and analytics firm announced it has signed an agreement with DataSwitch, an emerging AI/ML-driven Data Transformation Platform, to accelerate analytics modernization initiatives through data pipeline innovation and accelerators for migration.

- May 2022: Visier, people analytics and on-demand solution for people-powered businesses established a strategic agreement with Deloitte. By combining cutting-edge technology with world-class consulting, Deloitte and Visier can provide business clients with guidance and professional services support throughout their HR analytics journey.

Strategic Outlook for HR Analytics Industry Market

- June 2022: GainInsights, a global data and analytics firm announced it has signed an agreement with DataSwitch, an emerging AI/ML-driven Data Transformation Platform, to accelerate analytics modernization initiatives through data pipeline innovation and accelerators for migration.

- May 2022: Visier, people analytics and on-demand solution for people-powered businesses established a strategic agreement with Deloitte. By combining cutting-edge technology with world-class consulting, Deloitte and Visier can provide business clients with guidance and professional services support throughout their HR analytics journey.

Strategic Outlook for HR Analytics Industry Market

The strategic outlook for the HR analytics market remains exceptionally positive, driven by its indispensable role in modern business operations. Future market potential lies in the continued integration of AI and ML to provide even deeper, predictive insights into workforce dynamics. The growing emphasis on employee experience, diversity, equity, and inclusion (DEI) will further fuel demand for sophisticated analytics tools that can measure and improve these critical areas. Strategic partnerships and acquisitions will continue to shape the competitive landscape, as companies seek to expand their capabilities and market reach. The ability of HR analytics to directly impact organizational performance and drive business outcomes ensures its continued growth and strategic importance.

HR Analytics Industry Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment Mode

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-User Industry

- 3.1. Telecom and IT

- 3.2. BFSI

- 3.3. Consumer Goods and Retail

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Other End-user Industries

HR Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

HR Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Trends in Cloud-based Solutions; Increase in Workforce and Need for Reduction in Attrition Rate

- 3.3. Market Restrains

- 3.3.1. 7.1 Increasing Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Telecom and IT Industry is Witnessing a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Telecom and IT

- 5.3.2. BFSI

- 5.3.3. Consumer Goods and Retail

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Telecom and IT

- 6.3.2. BFSI

- 6.3.3. Consumer Goods and Retail

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Telecom and IT

- 7.3.2. BFSI

- 7.3.3. Consumer Goods and Retail

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Telecom and IT

- 8.3.2. BFSI

- 8.3.3. Consumer Goods and Retail

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Telecom and IT

- 9.3.2. BFSI

- 9.3.3. Consumer Goods and Retail

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. On-Premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Telecom and IT

- 10.3.2. BFSI

- 10.3.3. Consumer Goods and Retail

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa HR Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Workday Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Gaininsights Solutions Pvt Ltd*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Nakisa Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 IBM Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Zoho Corporation Pvt Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tableau Software Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kronos Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SAP SE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Workday Inc

List of Figures

- Figure 1: Global HR Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America HR Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America HR Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America HR Analytics Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 15: North America HR Analytics Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 16: North America HR Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 17: North America HR Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 18: North America HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe HR Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe HR Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe HR Analytics Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 23: Europe HR Analytics Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 24: Europe HR Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 25: Europe HR Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 26: Europe HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific HR Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 29: Asia Pacific HR Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 30: Asia Pacific HR Analytics Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 31: Asia Pacific HR Analytics Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 32: Asia Pacific HR Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Asia Pacific HR Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Asia Pacific HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America HR Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Latin America HR Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Latin America HR Analytics Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 39: Latin America HR Analytics Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 40: Latin America HR Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 41: Latin America HR Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 42: Latin America HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa HR Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa HR Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa HR Analytics Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 47: Middle East and Africa HR Analytics Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 48: Middle East and Africa HR Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 49: Middle East and Africa HR Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 50: Middle East and Africa HR Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa HR Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global HR Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 4: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Global HR Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 29: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 30: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 34: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 35: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 36: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 42: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 43: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 44: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: India HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 50: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 51: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 52: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Brazil HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Argentina HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Latin America HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global HR Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 57: Global HR Analytics Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 58: Global HR Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 59: Global HR Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: United Arab Emirates HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Saudi Arabia HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa HR Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HR Analytics Industry?

The projected CAGR is approximately 12.89%.

2. Which companies are prominent players in the HR Analytics Industry?

Key companies in the market include Workday Inc, Gaininsights Solutions Pvt Ltd*List Not Exhaustive, Nakisa Inc, IBM Corporation, Zoho Corporation Pvt Ltd, Tableau Software Inc, Oracle Corporation, Kronos Inc, SAP SE.

3. What are the main segments of the HR Analytics Industry?

The market segments include Component, Deployment Mode, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Trends in Cloud-based Solutions; Increase in Workforce and Need for Reduction in Attrition Rate.

6. What are the notable trends driving market growth?

Telecom and IT Industry is Witnessing a Significant Share in the Market.

7. Are there any restraints impacting market growth?

7.1 Increasing Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

June 2022: GainInsights, a global data and analytics firm announced it has signed an agreement with DataSwitch, an emerging AI/ML-driven Data Transformation Platform, to accelerate analytics modernization initiatives through data pipeline innovation and accelerators for migration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HR Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HR Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HR Analytics Industry?

To stay informed about further developments, trends, and reports in the HR Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence