Key Insights

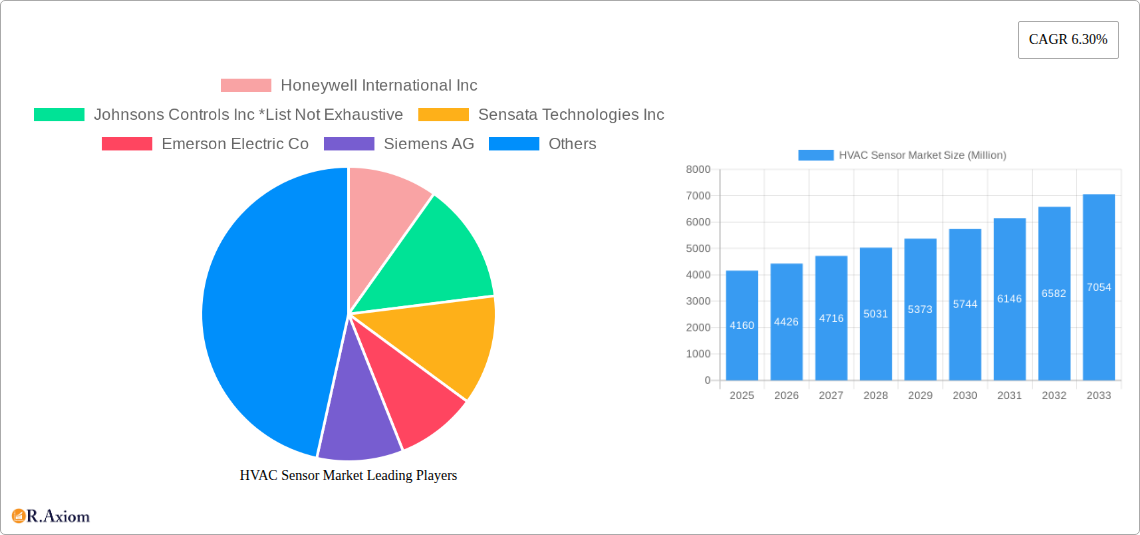

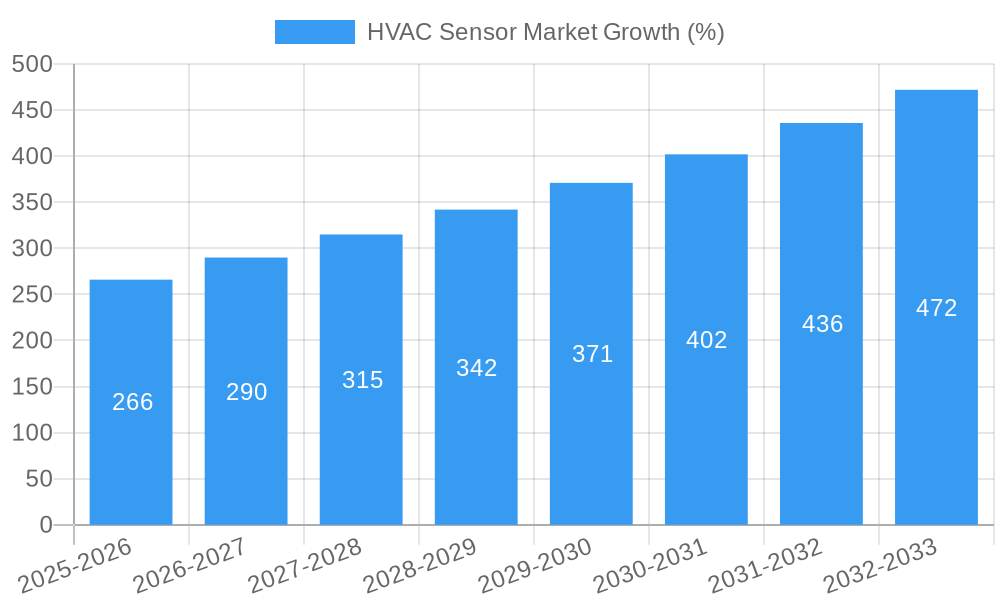

The HVAC sensor market, valued at $4.16 billion in 2025, is projected to experience robust growth, driven by increasing demand for energy-efficient and smart building technologies. A compound annual growth rate (CAGR) of 6.30% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated value exceeding $7 billion by 2033. This growth is fueled by several key factors. The rising adoption of smart home and building automation systems necessitates the integration of sophisticated sensor technologies for optimized HVAC control. Furthermore, stringent government regulations aimed at reducing energy consumption and improving indoor air quality are creating a compelling market for advanced sensors capable of precise environmental monitoring and control. The increasing focus on preventative maintenance and predictive analytics within the HVAC sector is another significant driver, as sensor data allows for timely interventions, reducing operational costs and downtime. Growth is segmented across various sensor types, including temperature, humidity, pressure & flow, motion, and smoke & gas sensors, with temperature and humidity sensors currently holding the largest market share due to their widespread application. The commercial and industrial sectors are expected to dominate end-user segments, driven by the larger scale of deployments and associated cost benefits. Leading players like Honeywell, Johnson Controls, and Siemens are actively investing in research and development, introducing innovative sensor technologies to meet evolving market needs and maintain their competitive edge.

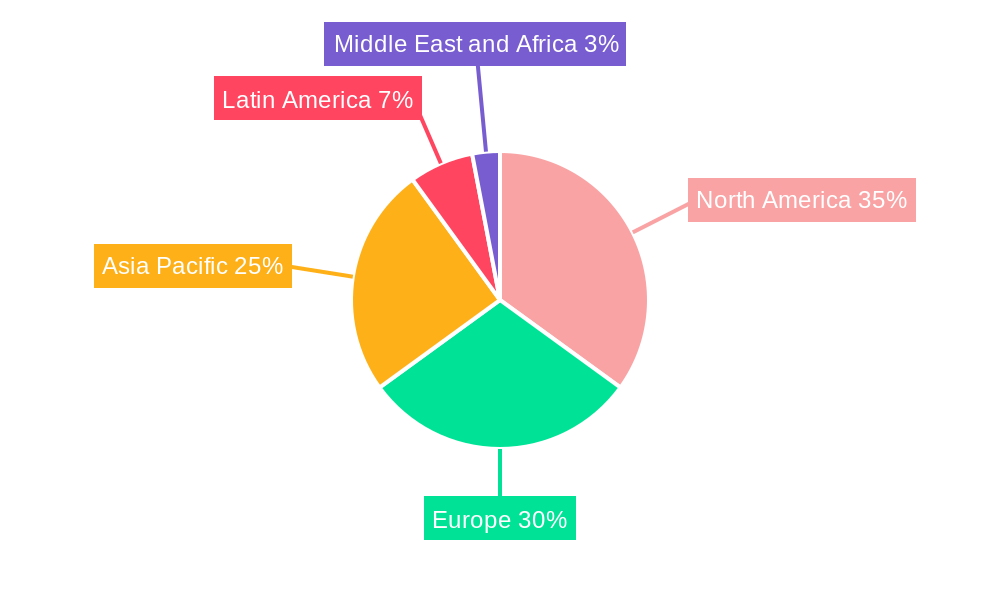

Technological advancements, particularly in the Internet of Things (IoT) and cloud computing, are shaping the future of the HVAC sensor market. The integration of these technologies allows for seamless data collection, analysis, and remote management of HVAC systems, improving efficiency and enabling predictive maintenance strategies. However, challenges remain, including the relatively high initial investment costs associated with installing and integrating sensor systems, particularly for smaller businesses or residential applications. Overcoming these barriers through innovative financing models and streamlined installation processes will be crucial for driving further market expansion. The increasing demand for improved data security and privacy is also a critical consideration, as sensitive building data requires robust security measures. The ongoing development of energy-harvesting technologies for sensors could address concerns about power consumption and maintenance needs, furthering market adoption. Regional growth will vary, with North America and Europe likely to maintain strong growth, while the Asia-Pacific region is poised for significant expansion driven by rapid urbanization and industrialization.

This in-depth report provides a comprehensive analysis of the HVAC sensor market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market size, segmentation, growth drivers, challenges, and future opportunities, providing a detailed forecast from 2025 to 2033. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

HVAC Sensor Market Market Concentration & Innovation

The HVAC sensor market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, Johnson Controls Inc, Sensata Technologies Inc, Emerson Electric Co, Siemens AG, Belimo Aircontrols (USA) Inc, Senmatic A/S, Sensirion AG, TE Connectivity Ltd, and Schneider Electric holding significant market share. However, the market also accommodates several smaller, specialized players contributing to innovation. Market share data for 2024 suggests a top 5 market share of approximately xx%, indicating a competitive but not overly dominated market.

Innovation in the HVAC sensor market is driven by the increasing demand for energy efficiency, smart home technologies, and improved building automation systems. Advancements in sensor technology, such as the development of more accurate, reliable, and cost-effective sensors, are key drivers. Regulatory frameworks, including energy efficiency standards and building codes, are influencing the adoption of advanced HVAC sensors. Product substitutes, primarily older, less efficient sensor technologies, are gradually being replaced by more sophisticated options. End-user trends, such as the preference for smart and connected devices, are creating opportunities for innovative sensor solutions.

Mergers and acquisitions (M&A) activity within the HVAC sensor market has been moderate, with deal values varying significantly depending on the size and strategic fit of the companies involved. Recent M&A activity has primarily focused on consolidating market share, expanding product portfolios, and accessing new technologies. The average M&A deal value in the last 5 years was approximately xx Million. The forecast for M&A activity in the coming years is anticipated to remain steady, with a focus on strategic partnerships and acquisitions of smaller, innovative sensor companies.

HVAC Sensor Market Industry Trends & Insights

The HVAC sensor market is experiencing robust growth, driven by several factors. The global market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is primarily fueled by increasing energy efficiency standards, growing demand for smart buildings, and rising adoption of building automation systems (BAS) across various end-user sectors.

Technological advancements in sensor technology, such as miniaturization, improved accuracy, and enhanced connectivity, are significantly impacting the market. The integration of advanced sensor technologies into smart HVAC systems is enabling real-time monitoring and control, enhancing energy efficiency, and improving comfort levels. Consumer preferences are shifting towards energy-efficient and smart home solutions, driving demand for advanced HVAC sensor-enabled systems. Competitive dynamics are intense, with established players and emerging companies vying for market share through product innovation, strategic partnerships, and aggressive marketing efforts. Market penetration of smart HVAC systems incorporating advanced sensors is increasing steadily, particularly in developed economies, with a current market penetration of approximately xx% expected to rise to xx% by 2033.

Dominant Markets & Segments in HVAC Sensor Market

Dominant Regions & Countries: The North American and European markets currently dominate the HVAC sensor market, driven by strong demand from commercial and industrial sectors. However, the Asia-Pacific region is projected to experience significant growth in the coming years, driven by rapid urbanization, economic development, and increasing adoption of smart building technologies.

Dominant Segments by Type:

- Temperature Sensors: This segment holds the largest market share, driven by its fundamental role in HVAC system control and monitoring. Key drivers include the ongoing demand for energy-efficient HVAC systems.

- Humidity Sensors: The demand for humidity sensors is rising due to the growing need for improved indoor air quality and comfort. The increasing awareness of the importance of humidity control in preventing the growth of mold and mildew is a significant driver of this segment’s growth.

- Pressure & Flow Sensors: This segment experiences steady growth, driven by the demand for advanced HVAC system diagnostics and performance optimization.

- Motion Sensors: This segment is experiencing growth due to increased adoption in smart building systems for optimized energy efficiency.

- Smoke & Gas Sensors: Demand is driven by stringent safety regulations and growing concerns regarding indoor air quality.

- Other Types: This segment includes various niche sensors for HVAC applications, with growth dependent on specific technological advancements and market needs.

Dominant Segments by End-user:

- Commercial & Industrial: This segment dominates the market due to the large-scale deployment of HVAC systems in buildings and industrial facilities. Key drivers include government regulations related to energy efficiency and rising awareness about improved indoor environmental quality (IEQ).

- Residential: This segment is showing rapid growth due to the increasing adoption of smart home technologies and energy-efficient HVAC systems. The rising disposable incomes in emerging economies are also supporting growth in this segment.

HVAC Sensor Market Product Developments

Recent product innovations include smart sensors with enhanced connectivity, improved accuracy, and energy-efficient designs. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) is enabling predictive maintenance and optimization of HVAC systems. These advancements offer significant competitive advantages by improving energy efficiency, enhancing system reliability, and reducing operational costs. The market fit for these new products is strong due to their alignment with trends toward increased energy efficiency and smart home technologies.

Report Scope & Segmentation Analysis

This report segments the HVAC sensor market by type (Temperature Sensors, Humidity Sensors, Pressure & Flow Sensors, Motion Sensors, Smoke & Gas Sensors, Other Types) and by end-user (Residential, Commercial & Industrial). Each segment is analyzed based on its market size, growth projections, and competitive landscape.

By Type: Each type of sensor is examined for its market size (XX Million in 2024), projected growth (xx% CAGR), and competitive intensity. The report analyzes the dominant technologies, key players, and future trends in each sensor type segment.

By End-user: The residential, commercial, and industrial segments are analyzed individually, focusing on market size (XX Million in 2024), future growth projections (xx% CAGR), and factors influencing market dynamics, like energy efficiency standards and building regulations. The competitive dynamics and market share within each segment are also analyzed.

Key Drivers of HVAC Sensor Market Growth

Several factors are driving the growth of the HVAC sensor market. Technological advancements, such as the development of smaller, more accurate, and more energy-efficient sensors, are enabling improved system performance and control. Stringent government regulations aimed at increasing energy efficiency in buildings are driving the adoption of advanced HVAC sensor technologies. Increasing consumer awareness of the importance of indoor air quality and comfort is leading to higher demand for smart HVAC systems equipped with advanced sensors. The rising adoption of smart home technologies and the growth of the Internet of Things (IoT) are further bolstering market growth.

Challenges in the HVAC Sensor Market Sector

The HVAC sensor market faces several challenges. High initial investment costs associated with implementing advanced sensor technologies can deter adoption, particularly in smaller businesses or residential settings. Supply chain disruptions and the rising cost of raw materials can affect the production and availability of sensors. Intense competition among established and emerging players can lead to price pressure and reduced profit margins. Strict regulatory compliance requirements can increase development and certification costs. These challenges collectively have reduced the predicted market growth by approximately xx% for the forecast period.

Emerging Opportunities in HVAC Sensor Market

The HVAC sensor market presents several emerging opportunities. The integration of artificial intelligence (AI) and machine learning (ML) is creating opportunities for predictive maintenance and improved system optimization. The rising demand for smart building solutions and the growth of the IoT are creating new opportunities for sensor manufacturers. The expansion of the HVAC sensor market into developing economies is creating significant potential for growth. The demand for sensors with enhanced functionalities, such as air quality monitoring and leak detection, is creating new avenues for innovation and expansion.

Leading Players in the HVAC Sensor Market Market

- Honeywell International Inc

- Johnson Controls Inc

- Sensata Technologies Inc

- Emerson Electric Co

- Siemens AG

- Belimo Aircontrols (USA) Inc

- Senmatic A/S

- Sensirion AG

- TE Connectivity Ltd

- Schneider Electric

Key Developments in HVAC Sensor Market Industry

February 2023: Danfoss announced a new compressor and sensor manufacturing facility in Apodaca, Mexico, significantly increasing production capacity for pressure sensors (1.6 Million units) and A2L leak detection sensors (1 Million units) by end of 2024. This expansion will likely increase market competition and potentially lower sensor prices.

January 2023: Lennox Industries launched the Lennox S40 Smart Thermostat and related accessories, enhancing its smart home product offerings and increasing demand for compatible sensors. This reflects a growing trend towards smart home technology integration within HVAC systems.

August 2022: Levoit launched the OasisMist Smart Humidifier, incorporating built-in sensors for automated humidity control. This product launch showcases the increasing integration of sensors into consumer-oriented HVAC products, further driving market demand.

Strategic Outlook for HVAC Sensor Market Market

The HVAC sensor market is poised for significant growth, driven by technological advancements, increasing demand for energy efficiency, and the rising adoption of smart building technologies. The integration of AI and IoT will further enhance the capabilities of HVAC systems, leading to improved performance, reduced operational costs, and increased energy savings. Expansion into emerging markets and the development of new sensor technologies will continue to drive market growth in the coming years. The market's future potential is substantial, with significant opportunities for both established players and new entrants.

HVAC Sensor Market Segmentation

-

1. Type

- 1.1. Temperature Sensors

- 1.2. Humidity Sensors

- 1.3. Pressure & Flow Sensors

- 1.4. Motion Sensors

- 1.5. Smoke & Gas Sensors

- 1.6. Other Types

-

2. End-user

- 2.1. Residential

- 2.2. Commercial & Industrial

HVAC Sensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

HVAC Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Sector; Growing Demand for HVAC Sensors in the Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Issues Related to Motion-Activated Air Conditioners

- 3.4. Market Trends

- 3.4.1. Increased Construction and Retrofit Activity to Aid the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Temperature Sensors

- 5.1.2. Humidity Sensors

- 5.1.3. Pressure & Flow Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Smoke & Gas Sensors

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Residential

- 5.2.2. Commercial & Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Temperature Sensors

- 6.1.2. Humidity Sensors

- 6.1.3. Pressure & Flow Sensors

- 6.1.4. Motion Sensors

- 6.1.5. Smoke & Gas Sensors

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Residential

- 6.2.2. Commercial & Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Temperature Sensors

- 7.1.2. Humidity Sensors

- 7.1.3. Pressure & Flow Sensors

- 7.1.4. Motion Sensors

- 7.1.5. Smoke & Gas Sensors

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Residential

- 7.2.2. Commercial & Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Temperature Sensors

- 8.1.2. Humidity Sensors

- 8.1.3. Pressure & Flow Sensors

- 8.1.4. Motion Sensors

- 8.1.5. Smoke & Gas Sensors

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Residential

- 8.2.2. Commercial & Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Temperature Sensors

- 9.1.2. Humidity Sensors

- 9.1.3. Pressure & Flow Sensors

- 9.1.4. Motion Sensors

- 9.1.5. Smoke & Gas Sensors

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Residential

- 9.2.2. Commercial & Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Temperature Sensors

- 10.1.2. Humidity Sensors

- 10.1.3. Pressure & Flow Sensors

- 10.1.4. Motion Sensors

- 10.1.5. Smoke & Gas Sensors

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Residential

- 10.2.2. Commercial & Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa HVAC Sensor Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Johnsons Controls Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sensata Technologies Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Emerson Electric Co

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Siemens AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Belimo Aircontrols (USA) Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Senmatic A/S

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sensirion AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TE Connectivity Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Schneider Electric

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global HVAC Sensor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 15: North America HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 16: North America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 21: Europe HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 22: Europe HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 27: Asia Pacific HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 28: Asia Pacific HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 33: Latin America HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Latin America HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa HVAC Sensor Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa HVAC Sensor Market Revenue (Million), by End-user 2024 & 2032

- Figure 39: Middle East and Africa HVAC Sensor Market Revenue Share (%), by End-user 2024 & 2032

- Figure 40: Middle East and Africa HVAC Sensor Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa HVAC Sensor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global HVAC Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global HVAC Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: HVAC Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 17: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 20: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 23: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 26: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global HVAC Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global HVAC Sensor Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 29: Global HVAC Sensor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVAC Sensor Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the HVAC Sensor Market?

Key companies in the market include Honeywell International Inc, Johnsons Controls Inc *List Not Exhaustive, Sensata Technologies Inc, Emerson Electric Co, Siemens AG, Belimo Aircontrols (USA) Inc, Senmatic A/S, Sensirion AG, TE Connectivity Ltd, Schneider Electric.

3. What are the main segments of the HVAC Sensor Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Sector; Growing Demand for HVAC Sensors in the Automotive Sector.

6. What are the notable trends driving market growth?

Increased Construction and Retrofit Activity to Aid the Market's Growth.

7. Are there any restraints impacting market growth?

Issues Related to Motion-Activated Air Conditioners.

8. Can you provide examples of recent developments in the market?

February 2023: Danfoss announced the construction of a new compressor and sensor manufacturing facility in Apodaca, Mexico. The new expansion is expected to produce medium and large scroll compressors, pressure sensors for HVAC/R, and A2L leak detection sensors for residential and commercial air conditioning and refrigeration. The facility is expected to be ready by the end of 2024, starting with a capacity for 100,000 compressor units, 1.6 million pressure sensors, and 1 million A2L leak detection sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVAC Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVAC Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVAC Sensor Market?

To stay informed about further developments, trends, and reports in the HVAC Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence