Key Insights

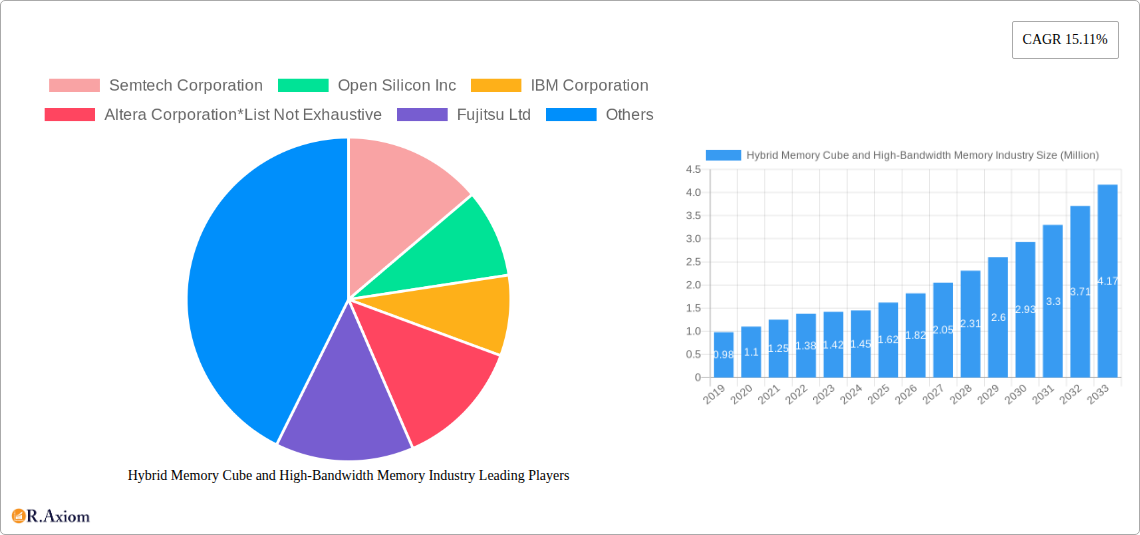

The Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) market is poised for substantial expansion, with a current market size of 1.45 Million and a projected Compound Annual Growth Rate (CAGR) of 15.11%. This robust growth is primarily fueled by the insatiable demand for higher memory bandwidth and lower power consumption across a spectrum of cutting-edge applications. Key drivers include the escalating complexity of artificial intelligence (AI) and machine learning (ML) workloads, which necessitate rapid data processing and retrieval. Furthermore, the proliferation of high-performance computing (HPC) in scientific research, financial modeling, and advanced simulations is creating significant demand for these advanced memory solutions. The telecommunications and networking sector is another crucial growth engine, as the deployment of 5G infrastructure and the increasing volume of data traffic require unprecedented memory capabilities for routers, switches, and base stations. Enterprise storage solutions are also witnessing a transformative shift, with HMC and HBM playing a vital role in accelerating database operations, analytics platforms, and data warehousing.

Hybrid Memory Cube and High-Bandwidth Memory Industry Market Size (In Million)

Several emergent trends are shaping the HMC and HBM landscape, including the continuous innovation in HBM generations (e.g., HBM3 and beyond) that offer even greater performance and density. The integration of advanced packaging technologies and the exploration of novel materials are also contributing to improved efficiency and cost-effectiveness. However, the market is not without its challenges. High manufacturing costs and the specialized nature of HMC and HBM production present a significant restrain to widespread adoption, particularly for smaller enterprises. The intricate design and validation processes further contribute to the initial investment hurdles. Despite these constraints, the undeniable performance advantages and the increasing criticality of memory bandwidth for next-generation technologies suggest that the HMC and HBM market will continue its upward trajectory, driven by leading players like Samsung Electronics, Micron Technologies, and Intel, among others, who are actively investing in research and development to overcome these limitations and cater to the evolving needs of the global technology ecosystem.

Hybrid Memory Cube and High-Bandwidth Memory Industry Company Market Share

Hybrid Memory Cube and High-Bandwidth Memory Industry Report: Market Analysis, Trends, and Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the global Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) market. Examining the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this study offers critical insights into market dynamics, technological advancements, key players, and emerging opportunities. The report is designed to equip industry stakeholders, including manufacturers, suppliers, investors, and end-users, with the data and analysis necessary to navigate this rapidly evolving landscape. With an estimated market size projected to reach $XX Million by 2025, the HMC and HBM market is poised for substantial growth, driven by the insatiable demand for higher memory performance across various high-performance computing applications.

Hybrid Memory Cube and High-Bandwidth Memory Industry Market Concentration & Innovation

The Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) market is characterized by a moderate level of concentration, dominated by a few key technology giants and specialized memory manufacturers. Innovation is the primary driver, fueled by the relentless pursuit of increased memory bandwidth, reduced latency, and improved power efficiency for demanding applications such as artificial intelligence (AI), machine learning (ML), high-performance computing (HPC), and advanced networking. Significant investment in research and development is channeled towards developing next-generation HBM technologies, including HBM3 and beyond, and exploring novel architectures for stacked memory.

Regulatory frameworks, while not overtly restrictive, tend to foster innovation through intellectual property protection and standardization initiatives, ensuring interoperability and market access. Product substitutes, such as GDDR6 and DDR5, exist but fall short of the extreme bandwidth and performance offered by HBM, particularly in specialized applications. End-user trends are heavily influenced by the exponential growth in data processing requirements, pushing the boundaries of traditional memory solutions. Mergers and acquisition (M&A) activities, while not as frequent as in broader semiconductor markets, are strategically focused on acquiring critical technologies and talent to bolster competitive positioning. M&A deal values in this niche sector are typically significant, reflecting the high intellectual property and specialized manufacturing capabilities involved. The market share of leading players is dynamic, with advancements in HBM stacking technology and fabrication processes dictating competitive advantage.

Hybrid Memory Cube and High-Bandwidth Memory Industry Industry Trends & Insights

The Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) industry is experiencing robust growth, driven by the escalating demand for superior memory performance across a spectrum of cutting-edge applications. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. This impressive expansion is propelled by several interconnected trends. Firstly, the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) workloads in data centers, autonomous systems, and scientific research necessitates memory solutions capable of handling massive datasets and complex computations with unprecedented speed. HBM, with its multi-die stacking architecture and 3D integration, offers a significant advantage in terms of bandwidth and proximity to processing units, thereby reducing latency and improving overall system efficiency.

Secondly, the burgeoning field of High-Performance Computing (HPC), encompassing scientific simulations, financial modeling, and advanced analytics, continues to push the performance envelope. These applications often require processing vast amounts of data in parallel, making the high bandwidth and capacity of HBM critical enablers. The increasing sophistication of graphics processing units (GPUs) and specialized AI accelerators further fuels the demand for HBM, as these processors are designed to leverage the immense throughput that HBM provides.

Consumer preferences, while indirectly influencing this market, are shaped by the demand for faster, more responsive devices and richer digital experiences. This translates to an indirect push for more powerful computing infrastructure, which in turn drives the need for advanced memory solutions. Furthermore, the telecommunications and networking sector is witnessing a significant transformation with the rollout of 5G and beyond, demanding higher throughput and lower latency for advanced network functions and real-time data processing. Enterprise storage solutions are also evolving, with a growing need for faster access to data in large-scale data centers and cloud environments.

Technological disruptions are a constant feature, with continuous advancements in HBM architecture, manufacturing processes, and integration techniques. The development of new HBM generations, such as HBM3 and future iterations, promises even greater bandwidth, capacity, and power efficiency. Key players are investing heavily in advanced packaging technologies and yield optimization to reduce manufacturing costs and increase accessibility. Competitive dynamics are intense, with a limited number of companies possessing the expertise and capital to develop and manufacture HBM. This competition, however, spurs further innovation and drives down costs over time. The market penetration of HBM is steadily increasing within its target applications, moving from niche HPC segments to broader AI/ML deployments and advanced graphics.

Dominant Markets & Segments in Hybrid Memory Cube and High-Bandwidth Memory Industry

The Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) market is experiencing significant growth and diversification, with distinct segments showcasing varying levels of dominance and potential.

Enterprise Storage

- Dominance Analysis: The enterprise storage segment is a primary driver for HBM adoption. With the exponential growth of data generated by businesses and the increasing reliance on cloud computing, the demand for faster data access and processing within data centers is paramount. HBM's ability to provide exceptionally high bandwidth is crucial for accelerating database operations, real-time analytics, and big data processing.

- Key Drivers:

- Data Growth: The relentless increase in data volumes necessitates higher memory performance for efficient storage and retrieval.

- AI/ML in Enterprise: AI-powered analytics, machine learning models for business intelligence, and predictive maintenance are heavily reliant on fast memory access for training and inference.

- Virtualization and Cloud Computing: Dense server environments and the need for rapid provisioning and resource allocation in cloud infrastructures benefit significantly from HBM's performance.

- Data Center Modernization: Upgrades to high-performance computing infrastructure within enterprises directly translate to increased demand for HBM.

Telecommunications and Networking

- Dominance Analysis: The telecommunications and networking sector is emerging as a critical growth area for HBM. The rollout of 5G, advancements in network function virtualization (NFV), and the development of intelligent network infrastructure are creating a substantial need for high-speed memory solutions. HBM's low latency and high bandwidth are essential for real-time packet processing, edge computing in telecommunication networks, and the deployment of complex network functions.

- Key Drivers:

- 5G and Beyond: The increased data rates and reduced latency requirements of 5G networks demand memory that can keep pace with high-speed data flows.

- Network Function Virtualization (NFV) and Software-Defined Networking (SDN): These technologies rely on flexible and high-performance computing, where HBM plays a crucial role in accelerating virtual network functions.

- Edge Computing: The decentralization of computing power to the network edge requires compact, high-performance memory for localized data processing and AI inference.

- Telematics and Connected Vehicles: The increasing complexity of connected vehicle systems and the associated data transmission and processing requirements will also boost HBM demand.

Other End-user Industries

- Dominance Analysis: This broad category encompasses industries where high-performance computing is essential, including scientific research, financial services, and advanced gaming. These sectors have historically been early adopters of cutting-edge memory technologies and continue to be significant consumers of HBM.

- Key Drivers:

- Scientific Research and Simulation: Complex simulations in fields like climate modeling, drug discovery, and particle physics require immense computational power and fast memory.

- Financial Services: High-frequency trading, risk analysis, and fraud detection demand real-time data processing and low-latency memory solutions.

- Advanced Gaming and Virtual Reality (VR)/Augmented Reality (AR): Immersive gaming experiences and the development of sophisticated VR/AR applications necessitate high frame rates and complex scene rendering, which are enabled by HBM.

- Automotive (ADAS and Autonomous Driving): Advanced Driver-Assistance Systems (ADAS) and the development of fully autonomous vehicles require massive amounts of data processing for sensor fusion, object recognition, and decision-making, making HBM a critical component.

Hybrid Memory Cube and High-Bandwidth Memory Industry Product Developments

Product development in the Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) industry is characterized by a relentless focus on enhancing memory bandwidth, reducing power consumption, and increasing capacity through advanced 3D stacking technologies. Innovations are primarily driven by the need to support the ever-growing demands of AI, HPC, and advanced networking. Companies are developing newer generations of HBM, such as HBM3 and beyond, which offer significantly higher data transfer rates and improved energy efficiency compared to their predecessors. These advancements enable faster training of complex AI models, more intricate scientific simulations, and higher throughput in networking equipment. The competitive advantage lies in achieving higher stacking densities, optimizing inter-die communication, and developing proprietary interconnect technologies that maximize performance and minimize latency. Market fit is ensured by close collaboration with processor manufacturers and system designers to integrate HBM seamlessly into high-performance architectures.

Report Scope & Segmentation Analysis

This report segments the Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) market by end-user industry, providing detailed analysis for each category.

Enterprise Storage

The enterprise storage segment is projected to witness substantial growth, driven by the increasing data demands of modern businesses. This segment's market size is estimated to reach $XX Million by 2025, with a projected CAGR of XX% through 2033. Competitive dynamics are influenced by the need for high-density, high-performance storage solutions that can accelerate data access for analytics and AI applications.

Telecommunications and Networking

The telecommunications and networking segment represents a rapidly expanding opportunity for HBM. With the ongoing deployment of 5G and the evolution of network infrastructure, this segment is anticipated to reach $XX Million by 2025 and grow at a CAGR of XX% during the forecast period. Key competitive factors include the ability to deliver low-latency, high-throughput memory solutions for real-time network processing and edge computing.

Other End-user Industries

This diverse segment, encompassing scientific research, automotive, and advanced gaming, is expected to contribute significantly to the HBM market. Its market size is estimated at $XX Million by 2025, with a projected CAGR of XX%. The competitive landscape is defined by the need for specialized memory solutions that can handle extreme computational loads and deliver unparalleled performance for simulations, AI inference, and immersive experiences.

Key Drivers of Hybrid Memory Cube and High-Bandwidth Memory Industry Growth

The growth of the Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) industry is propelled by several interconnected factors. Technologically, the insatiable demand for increased memory bandwidth and reduced latency across AI, machine learning, high-performance computing (HPC), and advanced networking applications is the primary catalyst. The development of more powerful GPUs, AI accelerators, and specialized processors directly fuels the need for HBM's superior performance. Economically, the massive investments in data center infrastructure, cloud computing, and 5G network rollouts create a substantial market for high-bandwidth memory solutions. Regulatory frameworks, particularly those supporting technological innovation and standardization, indirectly foster growth by creating a conducive environment for R&D and market adoption.

Challenges in the Hybrid Memory Cube and High-Bandwidth Memory Industry Sector

Despite its strong growth trajectory, the Hybrid Memory Cube (HBM) and High-Bandwidth Memory (HBM) industry faces several significant challenges. The primary restraint is the high manufacturing cost associated with the complex 3D stacking and advanced packaging techniques required for HBM production. This high cost limits its widespread adoption in cost-sensitive applications. Supply chain complexities are also a concern, as HBM relies on specialized materials, advanced fabrication processes, and a limited number of foundries, making it susceptible to disruptions. Technical challenges in scaling memory density, improving power efficiency at higher frequencies, and ensuring robust signal integrity across numerous stacked dies remain ongoing R&D hurdles. Furthermore, intense competition from alternative high-bandwidth memory solutions, even if not directly comparable in raw performance, puts pressure on pricing and market share.

Emerging Opportunities in Hybrid Memory Cube and High-Bandwidth Memory Industry

The Hybrid Memory Cube (HBM) and High-Bandwidth Memory (HBM) industry is ripe with emerging opportunities. The continued expansion of AI and machine learning across various sectors, including healthcare, finance, and autonomous systems, presents a massive potential market for HBM's superior processing capabilities. The ongoing deployment of 5G networks and the subsequent growth of edge computing offer another significant avenue, requiring high-performance memory for real-time data processing and localized AI inference. Furthermore, advancements in quantum computing and neuromorphic computing, while still in nascent stages, are likely to demand memory solutions that far exceed current capabilities, positioning HBM as a potential foundational technology. The increasing demand for immersive gaming and realistic virtual/augmented reality experiences also creates opportunities for HBM to power next-generation graphics and rendering.

Leading Players in the Hybrid Memory Cube and High-Bandwidth Memory Industry Market

- Semtech Corporation

- Open Silicon Inc

- IBM Corporation

- Altera Corporation

- Fujitsu Ltd

- Xilinx Inc

- Samsung Electronics Co Ltd

- Micron Technologies Inc

- ARM Holdings PLC

- Intel Corporation

Key Developments in Hybrid Memory Cube and High-Bandwidth Memory Industry Industry

- September 2023: Samsung Electronics introduced the Low Power Compression Attached Memory Module (LPCAMM) form factor, a significant advancement in DRAM for personal computers, laptops, and potentially data centers. This module boasts a speed of 7.5 gigabits-per-second (Gbps) and has undergone system verification on Intel's platform.

- May 2023: Taiwan Semiconductor Manufacturing Co. (TSMC) announced expansion plans in Japan and strengthened collaborations with local semiconductor partners. TSMC is currently constructing its first foundry in Kumamoto Prefecture, Southern Japan, in partnership with Sony Group Corp.

Strategic Outlook for Hybrid Memory Cube and High-Bandwidth Memory Industry Market

The strategic outlook for the Hybrid Memory Cube (HBM) and High-Bandwidth Memory (HBM) market is exceptionally strong, driven by the foundational role these technologies play in enabling next-generation computing. Growth catalysts include the ever-increasing demand for AI and machine learning performance, the global rollout of 5G infrastructure necessitating high-speed networking, and the sustained expansion of high-performance computing in scientific research and data analytics. Future market potential will be further unlocked by advancements in HBM architectures, such as HBM3 and beyond, offering greater bandwidth, capacity, and power efficiency. Strategic partnerships between memory manufacturers, processor designers, and system integrators will be crucial for seamless integration and wider adoption. The increasing complexity of data processing in industries like autonomous vehicles and advanced simulation environments also presents sustained opportunities for market expansion and innovation.

Hybrid Memory Cube and High-Bandwidth Memory Industry Segmentation

-

1. End-user Industry

- 1.1. Enterprise Storage

- 1.2. Telecommunications and Networking

- 1.3. Other End-user Industries

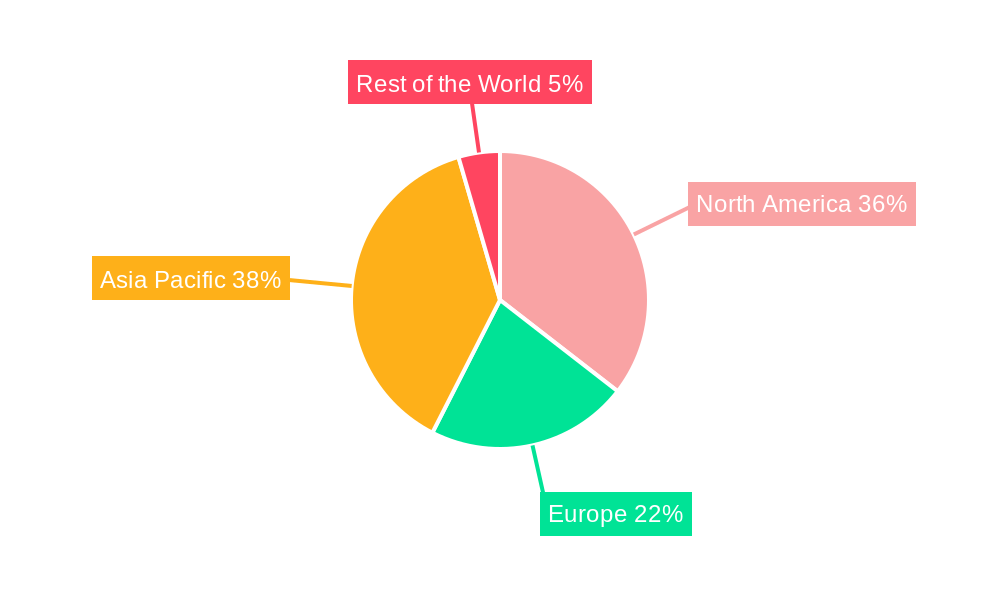

Hybrid Memory Cube and High-Bandwidth Memory Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Taiwan

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Hybrid Memory Cube and High-Bandwidth Memory Industry Regional Market Share

Geographic Coverage of Hybrid Memory Cube and High-Bandwidth Memory Industry

Hybrid Memory Cube and High-Bandwidth Memory Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Enterprise Storage Application

- 3.3. Market Restrains

- 3.3.1. Strong Presence of Existing DRAMs

- 3.4. Market Trends

- 3.4.1. Telecommunications and Networking Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hybrid Memory Cube and High-Bandwidth Memory Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Enterprise Storage

- 5.1.2. Telecommunications and Networking

- 5.1.3. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Hybrid Memory Cube and High-Bandwidth Memory Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Enterprise Storage

- 6.1.2. Telecommunications and Networking

- 6.1.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Enterprise Storage

- 7.1.2. Telecommunications and Networking

- 7.1.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Enterprise Storage

- 8.1.2. Telecommunications and Networking

- 8.1.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Hybrid Memory Cube and High-Bandwidth Memory Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Enterprise Storage

- 9.1.2. Telecommunications and Networking

- 9.1.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Semtech Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Open Silicon Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Altera Corporation*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fujitsu Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Xilinx Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Micron Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ARM Holdings PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Intel Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Semtech Corporation

List of Figures

- Figure 1: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: South Korea Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Taiwan Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Latin America Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Middle East Hybrid Memory Cube and High-Bandwidth Memory Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hybrid Memory Cube and High-Bandwidth Memory Industry?

The projected CAGR is approximately 15.11%.

2. Which companies are prominent players in the Hybrid Memory Cube and High-Bandwidth Memory Industry?

Key companies in the market include Semtech Corporation, Open Silicon Inc, IBM Corporation, Altera Corporation*List Not Exhaustive, Fujitsu Ltd, Xilinx Inc, Samsung Electronics Co Ltd, Micron Technologies Inc, ARM Holdings PLC, Intel Corporation.

3. What are the main segments of the Hybrid Memory Cube and High-Bandwidth Memory Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Enterprise Storage Application.

6. What are the notable trends driving market growth?

Telecommunications and Networking Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Strong Presence of Existing DRAMs.

8. Can you provide examples of recent developments in the market?

September 2023 - Samsung Electronics recently introduced the Low Power Compression Attached Memory Module (LPCAMM) form factor, marking a significant advancements in the DRAM market for personal computers, laptops, and potentially data centers. This enhanced development, boasting a remarkable speed of 7.5 gigabits-per-second (Gbps), has successfully undergone rigorous system verification on Intel's platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hybrid Memory Cube and High-Bandwidth Memory Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hybrid Memory Cube and High-Bandwidth Memory Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hybrid Memory Cube and High-Bandwidth Memory Industry?

To stay informed about further developments, trends, and reports in the Hybrid Memory Cube and High-Bandwidth Memory Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence