Key Insights

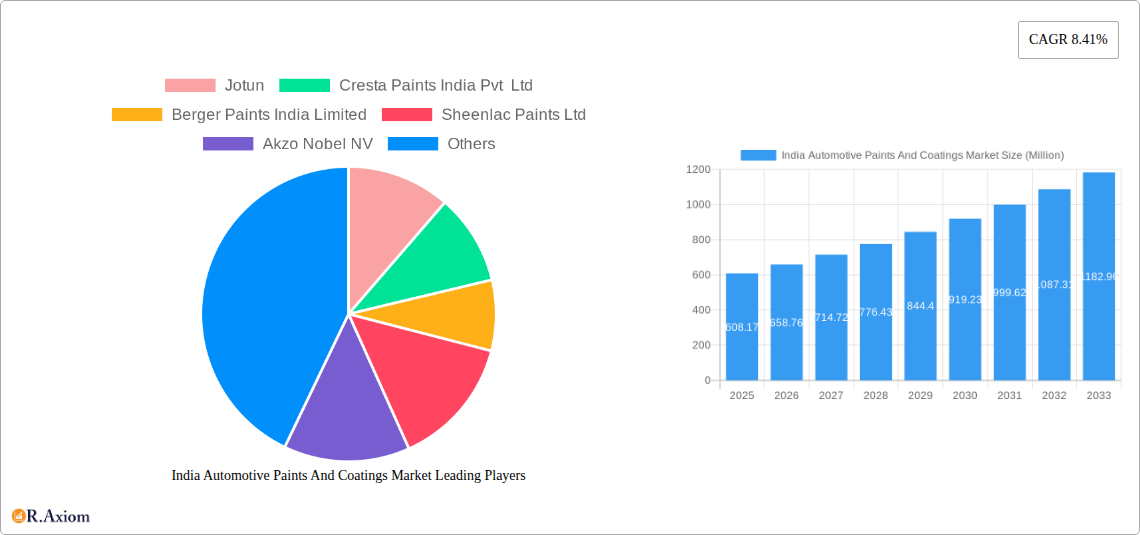

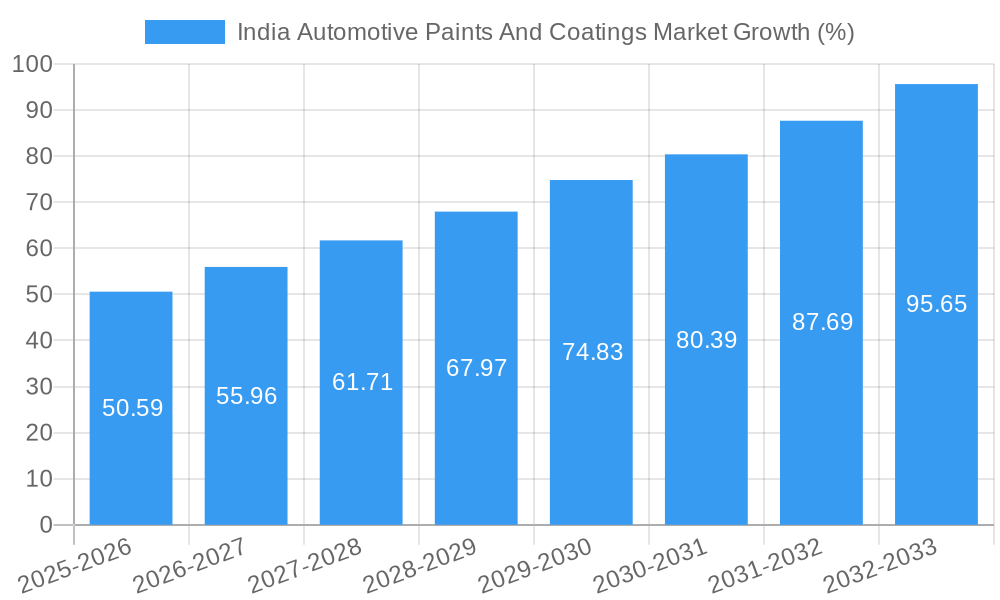

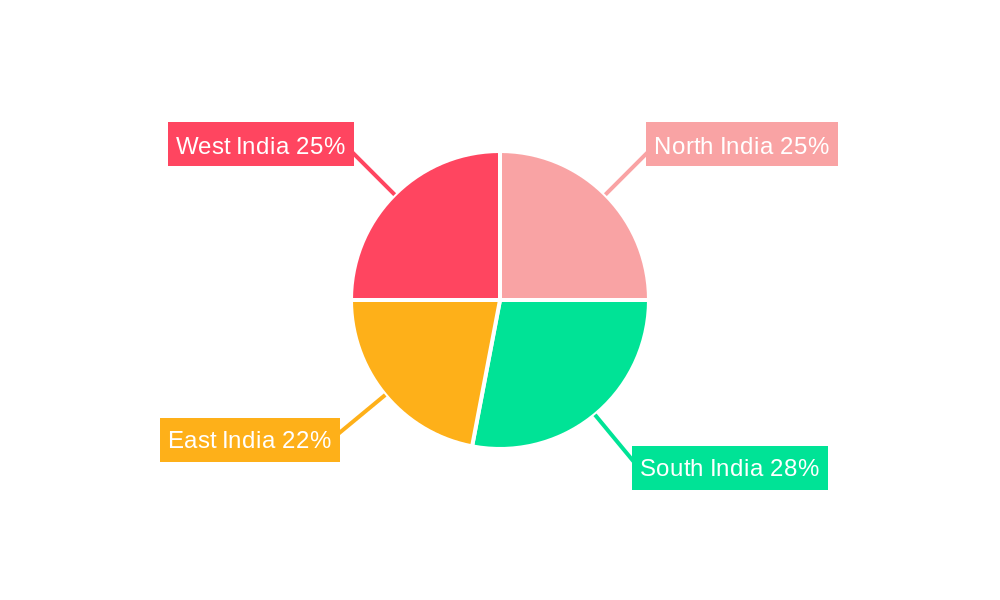

The India Automotive Paints and Coatings market, valued at ₹608.17 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.41% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning Indian automotive industry, fueled by rising disposable incomes and increasing vehicle ownership, particularly in the two-wheeler and passenger car segments, significantly boosts demand for high-quality paints and coatings. Furthermore, the growing preference for aesthetically pleasing and durable finishes is driving innovation in resin types, leading to the increased adoption of advanced technologies like water-borne and powder coatings. These environmentally friendly alternatives are gaining traction due to stricter emission regulations and growing environmental consciousness. The market segmentation reveals a strong preference for polyurethane and epoxy resins, owing to their superior performance characteristics. The automotive OEM segment dominates the application landscape, followed by the automotive refinish market, indicating a significant reliance on original equipment manufacturers and the growing aftermarket demand for repair and repainting services. Regional variations exist, with significant market contributions from all four regions (North, South, East, and West India), reflecting the widespread presence of the automotive industry across the country.

Growth within this market segment is projected to be primarily influenced by advancements in paint technology and the increasing demand for customized finishes. The continued expansion of the Indian automotive sector, coupled with supportive government policies aimed at promoting domestic manufacturing and attracting foreign investment, will further accelerate market growth. However, challenges like fluctuating raw material prices, increasing competition, and the need for continuous technological upgrades present opportunities for innovative companies to differentiate themselves and maintain a competitive edge. The leading players in the market are strategically investing in research and development to deliver superior products and cater to the evolving needs of both OEMs and the aftermarket. This dynamic market landscape promises continued growth, albeit with challenges requiring strategic adaptation and innovation.

India Automotive Paints and Coatings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Automotive Paints and Coatings market, offering valuable insights for industry stakeholders. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), projecting market trends and growth opportunities. Key segments analyzed include Resin Type (Polyurethane, Epoxy, Acrylic, Other Resin Types), Technology (Solvent-borne, Water-borne, Powder, Other Technologies), Layer (E-coat, Primer, Base Coat, Clear Coat), and Application (Automotive OEM, Automotive Refinish). Leading players such as Jotun, Cresta Paints India Pvt Ltd, Berger Paints India Limited, Sheenlac Paints Ltd, Akzo Nobel NV, Fabula Coatings India Pvt Ltd, BASF SE, Snowcem Paints, Kansai Nerolac Paints Limited, Nippon Paint (India) Company Limited, Kwality Paints and Coatings Pvt Ltd, and PPG Asian Paints are profiled, providing a competitive landscape analysis. The report's detailed segmentation and analysis makes it an indispensable resource for businesses looking to succeed in this dynamic market.

India Automotive Paints And Coatings Market Market Concentration & Innovation

The Indian automotive paints and coatings market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. Market share data for 2024 indicates that the top 5 players account for approximately XX% of the total market, while the remaining share is distributed among numerous regional and smaller players. Innovation is driven by the increasing demand for high-performance, eco-friendly coatings, stricter emission regulations, and the rising popularity of lightweight vehicles.

Several factors contribute to the competitive dynamics:

- Mergers and Acquisitions (M&A): While specific M&A deal values are unavailable for this report, the consolidation trend is evident. Recent deals, although not publicly disclosed, indicate an industry move towards enhanced manufacturing capabilities and broader product portfolios. These activities aim to strengthen market position and expand regional reach.

- Regulatory Frameworks: Government regulations regarding VOC emissions and environmental standards significantly influence the adoption of water-borne and powder coatings, driving innovation in these areas.

- Product Substitutes: The emergence of alternative materials and surface treatment technologies presents a challenge, demanding continuous innovation to maintain market relevance.

- End-User Trends: The growing preference for customized finishes and specialized coatings pushes companies to develop innovative solutions tailored to specific needs.

India Automotive Paints And Coatings Market Industry Trends & Insights

The Indian automotive paints and coatings market is experiencing robust growth, driven by the expanding automotive sector and increasing vehicle production. The market is projected to exhibit a CAGR of XX% during the forecast period (2025-2033). This growth is fueled by several factors:

- Rising Vehicle Production: The increasing demand for passenger cars and commercial vehicles is a key driver for the growth of the automotive paints and coatings market. The burgeoning middle class and government initiatives promoting infrastructure development further contribute to this trend.

- Technological Disruptions: The shift towards water-borne and powder coatings due to stricter environmental regulations and the growing adoption of advanced coating technologies like electrocoating (e-coat) are significant technological disruptions reshaping the industry. The market penetration of water-borne coatings is expected to reach XX% by 2033.

- Consumer Preferences: Consumers increasingly demand high-quality, durable, and aesthetically pleasing finishes, leading to the development of advanced coatings with enhanced properties such as scratch resistance and UV protection.

- Competitive Dynamics: The market is characterized by intense competition among domestic and international players, leading to continuous innovation and price optimization.

Dominant Markets & Segments in India Automotive Paints And Coatings Market

Within the Indian automotive paints and coatings market, the Automotive OEM segment holds the largest share, driven by high vehicle production volumes. Geographically, the market is dominated by major automotive manufacturing hubs.

- Key Drivers for Automotive OEM Dominance:

- Strong growth in domestic automobile production

- Increasing adoption of advanced coating technologies

- Investments in automotive manufacturing facilities

- Dominant Resin Type: Polyurethane paints hold the largest market share due to their excellent performance characteristics, including durability and UV resistance.

- Dominant Technology: Solvent-borne coatings currently dominate the market; however, the share of water-borne coatings is rapidly increasing due to stricter environmental regulations and growing demand for eco-friendly solutions.

- Dominant Layer: Primer coatings constitute a significant portion of the market, owing to their crucial role in surface preparation and corrosion protection.

India Automotive Paints And Coatings Market Product Developments

Recent product innovations focus on enhancing performance characteristics such as durability, scratch resistance, and UV protection. The development of environmentally friendly water-borne and powder coatings is a major trend. Companies are also investing in advanced coating technologies like e-coat to improve efficiency and reduce environmental impact. These developments cater to the growing demand for high-quality, sustainable automotive coatings and align with stringent environmental regulations.

Report Scope & Segmentation Analysis

This report segments the Indian automotive paints and coatings market based on resin type, technology, layer, and application. Each segment is analyzed to provide a detailed understanding of its market size, growth potential, and competitive dynamics. Growth projections are provided for each segment based on the forecast period (2025-2033). The competitive landscape within each segment is thoroughly analyzed considering factors like technological advancements and market share distribution.

Resin Type: Polyurethane, Epoxy, Acrylic, and Other Resin Types – each exhibits unique properties and market demand, leading to variations in market size and growth projections.

Technology: Solvent-borne, Water-borne, Powder, and Other Technologies – This segment showcases the dynamic shift towards eco-friendly options like water-borne and powder coatings.

Layer: E-coat, Primer, Base Coat, and Clear Coat – Each layer plays a crucial role in the overall paint system, demanding specific performance attributes and impacting market size.

Application: Automotive OEM and Automotive Refinish – The OEM segment dominates due to high production volumes, while the refinish segment shows steady growth due to the increasing number of vehicles on the road.

Key Drivers of India Automotive Paints And Coatings Market Growth

Several factors fuel the growth of the Indian automotive paints and coatings market. The expansion of the automotive industry, coupled with rising vehicle production and sales, is a major driver. Government initiatives supporting infrastructure development and economic growth contribute significantly. Furthermore, the increasing preference for high-quality, durable coatings and the shift towards environmentally friendly options further stimulate market expansion. Stricter emission regulations are pushing the adoption of water-borne and powder coatings, also impacting growth.

Challenges in the India Automotive Paints And Coatings Market Sector

The Indian automotive paints and coatings market faces certain challenges. Fluctuations in raw material prices and supply chain disruptions pose significant threats. Intense competition among numerous players creates price pressure. Additionally, stringent environmental regulations require continuous innovation and investment in eco-friendly technologies. These factors can affect profitability and hinder growth if not managed effectively. The impact of these challenges is estimated to reduce the overall market growth by approximately XX% in the forecast period.

Emerging Opportunities in India Automotive Paints And Coatings Market

The Indian market offers several opportunities. The growing demand for lightweight vehicles creates opportunities for coatings designed for specific materials. The rising popularity of electric vehicles (EVs) opens avenues for specialized coatings catering to their unique requirements. Furthermore, the increasing focus on sustainability offers prospects for eco-friendly coatings. Exploring rural markets and expanding distribution networks presents further growth potential.

Leading Players in the India Automotive Paints And Coatings Market Market

- Jotun

- Cresta Paints India Pvt Ltd

- Berger Paints India Limited

- Sheenlac Paints Ltd

- Akzo Nobel NV

- Fabula Coatings India Pvt Ltd

- BASF SE

- Snowcem Paints

- Kansai Nerolac Paints Limited

- Nippon Paint (India) Company Limited

- Kwality Paints and Coatings Pvt Ltd

- PPG Asian Paints

Key Developments in India Automotive Paints And Coatings Market Industry

- May 2022: BASF expanded its Automotive Coatings Application Center in Mangalore, India, enhancing customer service capabilities. This significantly boosts their local presence and responsiveness to market demands.

- February 2022: AkzoNobel extended its long-standing partnership with McLaren Racing, focusing on sustainability, innovation, and product development. This collaboration underscores the importance of technological advancements and sustainable practices in the industry.

Strategic Outlook for India Automotive Paints And Coatings Market Market

The Indian automotive paints and coatings market holds significant future potential. Continued growth in the automotive sector, coupled with the rising adoption of advanced technologies and eco-friendly solutions, will drive market expansion. Strategic investments in research and development, coupled with a focus on sustainability and customer-centric innovation, will be crucial for success in this dynamic market. Companies focusing on addressing challenges like raw material price volatility and supply chain disruptions will gain a competitive edge.

India Automotive Paints And Coatings Market Segmentation

-

1. Resin Type

- 1.1. Polyurethane

- 1.2. Epoxy

- 1.3. Acrylic

- 1.4. Other Resin Types

-

2. Technology

- 2.1. Solvent-borne

- 2.2. Water-borne

- 2.3. Powder

- 2.4. Other Technologies

-

3. Layer

- 3.1. E-coat

- 3.2. Primer

- 3.3. Base Coat

- 3.4. Clear Coat

-

4. Application

- 4.1. Automotive OEM

- 4.2. Automotive Refinish

India Automotive Paints And Coatings Market Segmentation By Geography

- 1. India

India Automotive Paints And Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Automotive Refinish; Increasing Demand for Functional Coatings; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Ongoing Shortage of Semiconductors; Other Restraints

- 3.4. Market Trends

- 3.4.1. Polyurethane Resin Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyurethane

- 5.1.2. Epoxy

- 5.1.3. Acrylic

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solvent-borne

- 5.2.2. Water-borne

- 5.2.3. Powder

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Layer

- 5.3.1. E-coat

- 5.3.2. Primer

- 5.3.3. Base Coat

- 5.3.4. Clear Coat

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Automotive OEM

- 5.4.2. Automotive Refinish

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North India India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automotive Paints And Coatings Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Jotun

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cresta Paints India Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Berger Paints India Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sheenlac Paints Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Akzo Nobel NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fabula Coatings India Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Snowcem Paints*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kansai Nerolac Paints Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nippon Paint (India) Company Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kwality Paints and Coatings Pvt Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PPG Asian Paints

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Jotun

List of Figures

- Figure 1: India Automotive Paints And Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automotive Paints And Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: India Automotive Paints And Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automotive Paints And Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: India Automotive Paints And Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: India Automotive Paints And Coatings Market Volume liter Forecast, by Resin Type 2019 & 2032

- Table 5: India Automotive Paints And Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: India Automotive Paints And Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 7: India Automotive Paints And Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 8: India Automotive Paints And Coatings Market Volume liter Forecast, by Layer 2019 & 2032

- Table 9: India Automotive Paints And Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: India Automotive Paints And Coatings Market Volume liter Forecast, by Application 2019 & 2032

- Table 11: India Automotive Paints And Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Automotive Paints And Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 13: India Automotive Paints And Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Automotive Paints And Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 15: North India India Automotive Paints And Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Automotive Paints And Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 17: South India India Automotive Paints And Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Automotive Paints And Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 19: East India India Automotive Paints And Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Automotive Paints And Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 21: West India India Automotive Paints And Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Automotive Paints And Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 23: India Automotive Paints And Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 24: India Automotive Paints And Coatings Market Volume liter Forecast, by Resin Type 2019 & 2032

- Table 25: India Automotive Paints And Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: India Automotive Paints And Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 27: India Automotive Paints And Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 28: India Automotive Paints And Coatings Market Volume liter Forecast, by Layer 2019 & 2032

- Table 29: India Automotive Paints And Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: India Automotive Paints And Coatings Market Volume liter Forecast, by Application 2019 & 2032

- Table 31: India Automotive Paints And Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Automotive Paints And Coatings Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Paints And Coatings Market?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the India Automotive Paints And Coatings Market?

Key companies in the market include Jotun, Cresta Paints India Pvt Ltd, Berger Paints India Limited, Sheenlac Paints Ltd, Akzo Nobel NV, Fabula Coatings India Pvt Ltd, BASF SE, Snowcem Paints*List Not Exhaustive, Kansai Nerolac Paints Limited, Nippon Paint (India) Company Limited, Kwality Paints and Coatings Pvt Ltd, PPG Asian Paints.

3. What are the main segments of the India Automotive Paints And Coatings Market?

The market segments include Resin Type, Technology, Layer, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 608.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Automotive Refinish; Increasing Demand for Functional Coatings; Other Drivers.

6. What are the notable trends driving market growth?

Polyurethane Resin Type to Dominate the Market.

7. Are there any restraints impacting market growth?

Ongoing Shortage of Semiconductors; Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: BASF expanded its Automotive Coatings Application Center at the Coatings Technology Center in Mangalore, India in order to boost its customer service capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Paints And Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Paints And Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Paints And Coatings Market?

To stay informed about further developments, trends, and reports in the India Automotive Paints And Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence