Key Insights

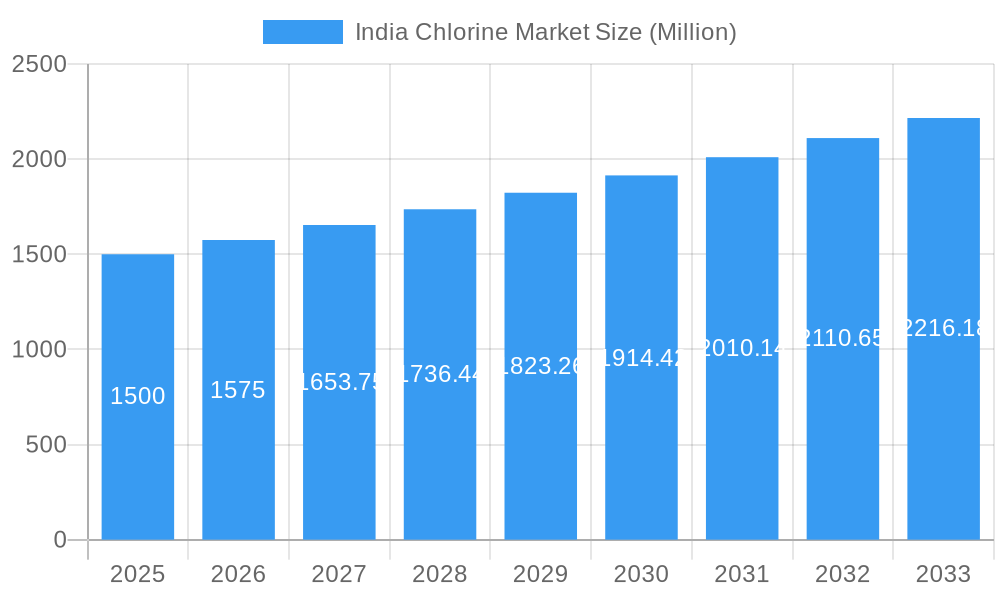

The India Chlorine Market is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of 5.5%. This growth is underpinned by robust demand from key sectors including polyvinyl chloride (PVC) production, water treatment, and the burgeoning chemical and pharmaceutical industries. With an estimated market size of 23040.9 million in the base year 2024, the market is segmented across applications, geographical regions, and production methodologies, reflecting its diverse industrial importance.

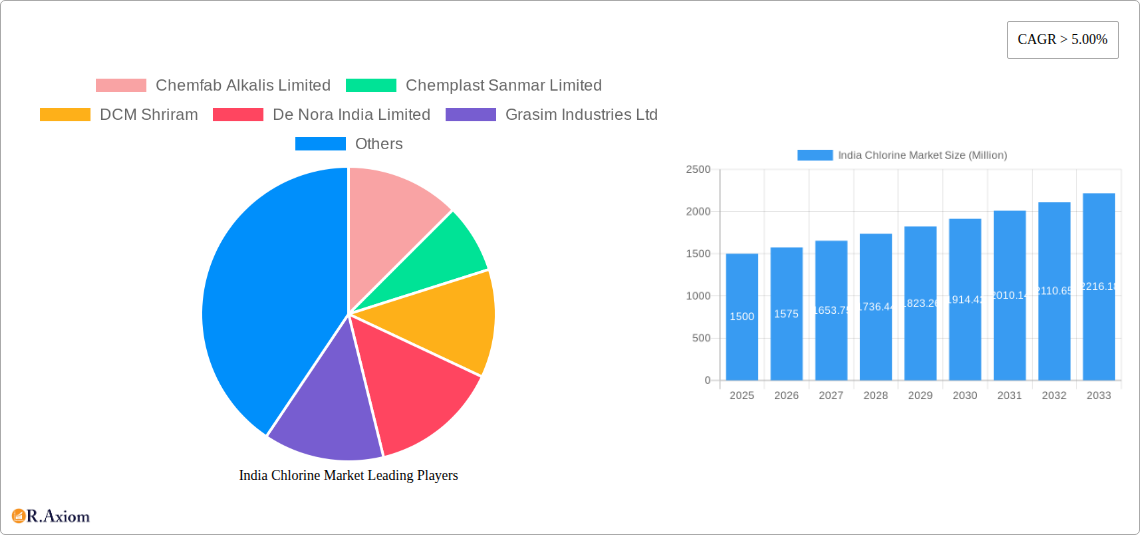

India Chlorine Market Market Size (In Billion)

Despite facing challenges such as stringent environmental regulations, raw material price volatility, and the imperative for energy efficiency, the Indian chlorine sector demonstrates resilience. Leading players like Chemfab Alkalis Limited, Chemplast Sanmar Limited, and Tata Chemicals Limited are strategically investing in capacity expansion and application diversification to navigate these hurdles and secure competitive advantage. The sustained growth trajectory forecast for the period 2024-2033 highlights the sector's inherent potential.

India Chlorine Market Company Market Share

This comprehensive market analysis offers critical insights into the India Chlorine Market from 2019 to 2033. It details market size, growth catalysts, prevailing challenges, and emerging opportunities, utilizing historical data (2019-2024), base year (2024), and forecasts for the projected years. An in-depth examination of key industry participants, including Chemfab Alkalis Limited and Chemplast Sanmar Limited, provides a complete market perspective. This report is an indispensable resource for investors, industry stakeholders, and decision-makers seeking a thorough understanding of this dynamic market.

India Chlorine Market Concentration & Innovation

The India chlorine market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies are unavailable for this report without proprietary data, we estimate that the top five players account for approximately xx% of the total market value. Innovation in the sector is driven by increasing demand for chlorine derivatives across various industries, coupled with stringent environmental regulations pushing for more efficient and sustainable production methods.

Several factors influence market concentration:

- Economies of scale: Large-scale production facilities enable cost advantages, deterring smaller entrants.

- Technological advancements: Companies investing heavily in R&D gain a competitive edge.

- Regulatory landscape: Environmental regulations influence production technologies and favor companies adhering to standards.

- Mergers and Acquisitions (M&A): Recent M&A activity, though specific deal values are unavailable for this report (xx Million), has influenced market consolidation. Further consolidation is expected.

Product substitution is limited due to the unique properties of chlorine, but increasing competition from alternative materials for specific applications warrants monitoring. End-user trends reveal a growing demand for chlorine in water treatment, PVC production, and other sectors, driving market expansion.

India Chlorine Market Industry Trends & Insights

The India chlorine market is experiencing robust growth, driven by a surge in demand from various sectors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, exceeding the global average. This growth is fueled by several factors, including:

- Expanding infrastructure projects: Construction and infrastructure development significantly increase demand for chlorine-based products, notably PVC.

- Industrialization: Rapid industrialization across numerous sectors fuels demand.

- Growing population: An expanding population increases the demand for water treatment and sanitation, boosting chlorine consumption.

- Government initiatives: Government investments in infrastructure and water treatment infrastructure projects continue to spur demand.

Technological disruptions in the industry primarily focus on improving production efficiency and environmental sustainability. The market penetration of advanced technologies like membrane cell technology is expected to increase, though precise figures are currently unavailable, for example, xx% by 2033. Competitive dynamics are intense, with companies focusing on cost reduction, product diversification, and strategic partnerships.

Dominant Markets & Segments in India Chlorine Market

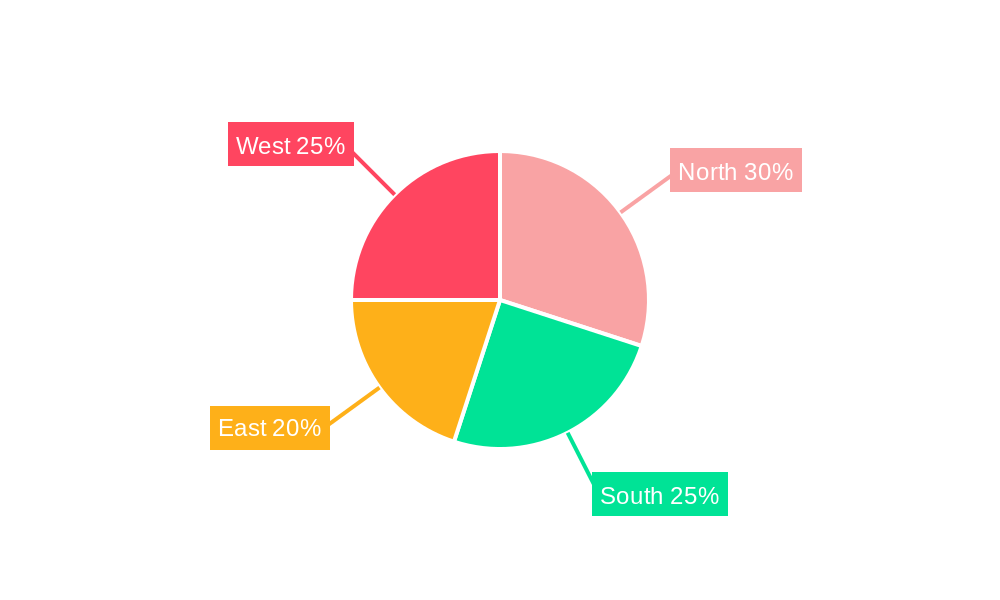

While region-specific data is limited in this summary report, the western and southern regions of India are expected to hold significant dominance due to higher industrial concentration and infrastructure development. Precise market share is unavailable in this report without further dedicated research (xx% for Western region and xx% for Southern region). This dominance is further driven by:

- Favorable government policies: State-level policies supporting industrial growth have a positive impact.

- Robust infrastructure: Well-established infrastructure facilitates efficient production and distribution.

- Proximity to raw materials: Easy access to raw materials lowers production costs.

The key segments within the India chlorine market include various applications, though market size breakdown is currently unavailable:

- Water Treatment

- PVC Production

- Pulp and Paper

- Other Industries

India Chlorine Market Product Developments

Recent product developments focus on improving the efficiency of chlorine production and expanding its applications. The increased adoption of membrane cell technology reduces energy consumption and environmental impact. New applications in advanced materials and specialized chemical processes are emerging, further driving innovation within the sector.

Report Scope & Segmentation Analysis

This report segments the India chlorine market based on:

Product Type: Liquid Chlorine, Chlorine Dioxide, etc. (Precise growth projections and market size for each type are unavailable for this report).

Application: Water Treatment, PVC, Pulp and Paper and others (Precise growth projections and market size for each application are unavailable for this report).

Region: [Regions will be detailed in the full report]. (Precise growth projections and market size for each region are unavailable for this report).

Each segment's growth is intricately linked to specific market drivers and challenges, resulting in varied competitive dynamics across these categories.

Key Drivers of India Chlorine Market Growth

The growth of the India chlorine market is driven by:

- Rapid industrialization and urbanization leading to increased demand for chlorine derivatives.

- Rising demand for water treatment and sanitation solutions, especially in urban areas.

- Government initiatives promoting infrastructure development and industrial growth.

- Technological advancements improving production efficiency and reducing environmental impact.

Challenges in the India Chlorine Market Sector

Several challenges hinder the growth of the India chlorine market:

- Stringent environmental regulations demanding sustainable production methods.

- Fluctuations in raw material prices impacting production costs.

- Intense competition among existing players.

- Potential supply chain disruptions.

Emerging Opportunities in India Chlorine Market

Emerging opportunities in the India chlorine market include:

- Growing demand for chlorine-based products in emerging industries.

- Expansion into new geographic markets.

- Development of innovative chlorine-based products with advanced applications.

- Focus on sustainable and eco-friendly production methods.

Leading Players in the India Chlorine Market Market

- Chemfab Alkalis Limited

- Chemplast Sanmar Limited

- DCM Shriram

- De Nora India Limited

- Grasim Industries Ltd

- Gujarat Alkali and Chemicals Limited

- Gujarat Fluorochemicals Ltd

- Lords Chloro Alkali Limited

- Meghmani Finechem Limited

- Nirma Limited

- Sree Rayalaseema Alkalies and Chemicals Limited

- Tata Chemicals Limited

- List Not Exhaustive

Key Developments in India Chlorine Market Industry

June 2022: Gujarat Alkalies and Chemicals (GACL) announced a INR 20 billion (USD 268 Million) investment to expand its caustic soda production capacity to 900,000 MTPA by the end of 2022. This expansion significantly impacts the market's supply dynamics.

May 2022: Chemfab Alkalis Limited announced plans to build a new chlor-alkali plant in Puducherry, investing approximately INR 3.5 billion (USD 47 Million) in liquid chlorine and hydrogen production. This indicates a significant market entry and expansion strategy.

Strategic Outlook for India Chlorine Market Market

The India chlorine market is poised for sustained growth in the coming years. Continued industrialization, infrastructure development, and increasing focus on water treatment will fuel demand. Companies with a focus on sustainable production methods and technological innovation are expected to gain a competitive advantage. The market's future potential is significant, presenting lucrative opportunities for existing and new players.

India Chlorine Market Segmentation

-

1. Application

- 1.1. EDC/PVC

- 1.2. Isocyanates and Oxygenates

- 1.3. Chloromethanes

- 1.4. Solvent and Epichlorohydrin

- 1.5. Inorganic Chemicals

- 1.6. Other Applications

-

2. End-user Industry

- 2.1. Water Treatment

- 2.2. Pharmaceuticals

- 2.3. Chemicals

- 2.4. Pulp and Paper

- 2.5. Plastics

- 2.6. Pesticides

- 2.7. Other End-user Industries

India Chlorine Market Segmentation By Geography

- 1. India

India Chlorine Market Regional Market Share

Geographic Coverage of India Chlorine Market

India Chlorine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry

- 3.3. Market Restrains

- 3.3.1. Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry

- 3.4. Market Trends

- 3.4.1. Growing Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Chlorine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. EDC/PVC

- 5.1.2. Isocyanates and Oxygenates

- 5.1.3. Chloromethanes

- 5.1.4. Solvent and Epichlorohydrin

- 5.1.5. Inorganic Chemicals

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Water Treatment

- 5.2.2. Pharmaceuticals

- 5.2.3. Chemicals

- 5.2.4. Pulp and Paper

- 5.2.5. Plastics

- 5.2.6. Pesticides

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chemfab Alkalis Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemplast Sanmar Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DCM Shriram

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Nora India Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grasim Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gujarat Alkali and Chemicals Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gujarat Fluorochemicals Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lords Chloro Alkali Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meghmani Finechem Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nirma Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sree Rayalaseema Alkalies and Chemicals Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tata Chemicals Limited*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Chemfab Alkalis Limited

List of Figures

- Figure 1: India Chlorine Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Chlorine Market Share (%) by Company 2025

List of Tables

- Table 1: India Chlorine Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: India Chlorine Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: India Chlorine Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Chlorine Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: India Chlorine Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Chlorine Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Chlorine Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the India Chlorine Market?

Key companies in the market include Chemfab Alkalis Limited, Chemplast Sanmar Limited, DCM Shriram, De Nora India Limited, Grasim Industries Ltd, Gujarat Alkali and Chemicals Limited, Gujarat Fluorochemicals Ltd, Lords Chloro Alkali Limited, Meghmani Finechem Limited, Nirma Limited, Sree Rayalaseema Alkalies and Chemicals Limited, Tata Chemicals Limited*List Not Exhaustive.

3. What are the main segments of the India Chlorine Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 23040.9 million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry.

6. What are the notable trends driving market growth?

Growing Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

Growth in the Pharmaceutical Industry; Widening Usage in Water Treatment Industry.

8. Can you provide examples of recent developments in the market?

June 2022: Gujarat Alkalies and Chemicals (GACL) announced that it would expand its installed capacity of caustic soda production to 900,000 MTPA by 2022 end. The project will reportedly be completed with an investment of INR 20 billion (USD 268 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Chlorine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Chlorine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Chlorine Market?

To stay informed about further developments, trends, and reports in the India Chlorine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence