Key Insights

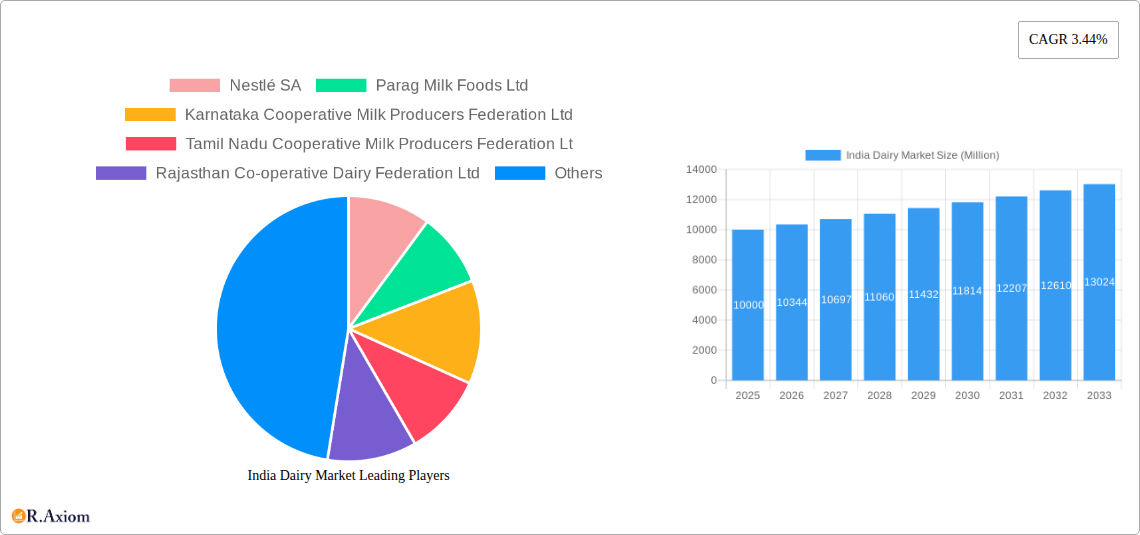

The Indian dairy market, a significant contributor to the nation's economy, is experiencing robust growth. With a Compound Annual Growth Rate (CAGR) of 3.44% between 2019 and 2024, the market demonstrates consistent expansion. This growth is fueled by several factors. Rising disposable incomes, coupled with a preference for dairy products in the Indian diet, are key drivers. Furthermore, increasing urbanization and a burgeoning middle class are expanding the consumer base for higher-value dairy products. The market is segmented into various channels, including off-trade (retail stores, supermarkets) and on-trade (restaurants, hotels), with off-trade currently holding a larger market share. Different dairy product categories, primarily butter, also contribute to this growth, with further segmentation existing within these product lines (e.g., salted versus unsalted butter). Major players like Nestlé, Parag Milk Foods, and various cooperative milk federations across different Indian states dominate the market, indicating a mix of organized and unorganized players. Regional variations exist, with potential for further growth in regions like North and West India, currently having strong performance. The presence of numerous regional players reflects the strong decentralized nature of India's dairy industry, indicating opportunities for both large multinational companies and smaller local dairy producers.

Challenges remain, including fluctuating milk production due to seasonal variations and climate change, and the need for further investment in modern dairy processing technologies to ensure consistent product quality and increased efficiency. Despite these constraints, the long-term outlook for the Indian dairy market is positive, driven by sustained demand, government initiatives to support the dairy industry, and the continuous diversification of product offerings. By 2033, the market is projected to witness significant expansion based on the sustained CAGR, reflecting considerable opportunities for both established and emerging players. The increasing focus on branded and processed dairy products suggests a shift towards greater formalization within the sector.

India Dairy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India dairy market, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth drivers, challenges, opportunities, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis and expert insights to paint a clear picture of the current market landscape and its future trajectory. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024. The market is segmented by category (e.g., Butter), distribution channel (Off-Trade), and other segments including On-Trade (Warehouse clubs, gas stations, etc.).

India Dairy Market Market Concentration & Innovation

The Indian dairy market exhibits a dynamic interplay of established players and emerging competitors. Market concentration is moderate, with a few dominant players like Amul holding significant market share, while numerous regional and smaller players contribute to the overall market volume. The market share of the top 5 players is estimated at xx% in 2025. Innovation is driven by consumer demand for value-added products, health-conscious options, and convenient formats. Regulatory frameworks, while evolving, aim to ensure quality and safety standards. Product substitutes, such as plant-based alternatives, are gaining traction, though dairy remains dominant. End-user trends reflect a growing preference for premium and specialized products. M&A activity has been consistent, with deals like Dodla Dairy's acquisition of Sri Krishna Milks in March 2022 signifying consolidation efforts. The total value of M&A deals in the dairy sector between 2019 and 2024 is estimated at xx Million USD.

- Key Players: Amul, Nestlé SA, Parag Milk Foods Ltd, etc.

- Innovation Drivers: Consumer demand for value-added and convenient products, health and wellness trends.

- Regulatory Landscape: Evolving regulations focusing on quality, safety, and traceability.

- M&A Activity: Significant consolidation through acquisitions, expanding market reach and product portfolios.

India Dairy Market Industry Trends & Insights

The India dairy market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and changing consumer preferences. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including automation in dairy processing and improved cold chain infrastructure, are enhancing efficiency and product quality. Consumer preferences are shifting towards healthier and more convenient options, leading to the growth of value-added products like flavored milk, yogurt, and cheese. Competitive dynamics are characterized by both intense competition and collaborative partnerships, with players focusing on product diversification and brand building. Market penetration of value-added dairy products is estimated at xx% in 2025, projected to reach xx% by 2033.

Dominant Markets & Segments in India Dairy Market

The Indian dairy market demonstrates regional variations in consumption patterns and market dynamics. While the national market is vast, certain regions show greater demand and higher market concentration. For example, states with established cooperative dairy structures like Gujarat and Maharashtra typically exhibit stronger market performance.

Category: Butter: The butter segment is experiencing steady growth due to its wide usage in both household and commercial applications. Increased demand for high-quality butter and specialized varieties is driving segment expansion.

Distribution Channel: Off-Trade: The Off-Trade distribution channel, including supermarkets, hypermarkets, and smaller retail outlets, dominates the market due to widespread accessibility and convenience.

Others (Warehouse clubs, gas stations, etc.): On-Trade: While a smaller segment, On-Trade channels are gaining traction, particularly in urban areas, catering to specific consumer segments and convenience needs.

Key drivers for dominance in these segments include robust consumer demand, established distribution networks, and favorable government policies. The growth of the organized retail sector has played a significant role in market expansion.

India Dairy Market Product Developments

The Indian dairy market witnesses continuous product innovation, driven by evolving consumer preferences and technological advancements. New product launches focus on healthier options, functional benefits, and enhanced convenience. Manufacturers are increasingly leveraging technology to improve production efficiency, enhance product quality, and extend shelf life. This includes investments in advanced processing techniques and packaging solutions. The focus on value-added products, such as probiotic yogurt and fortified milk, is a key driver of innovation and market differentiation.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Indian dairy market, segmented by category (Butter, etc.), distribution channel (Off-Trade, On-Trade), and other relevant segments. Each segment is analyzed in detail, providing insights into its growth trajectory, market size, competitive dynamics, and key players. Growth projections are provided for each segment based on current trends and future market expectations. The competitive landscape is analyzed to provide insights into market share, pricing strategies, and competitive advantages.

Key Drivers of India Dairy Market Growth

The India dairy market's growth is fuelled by several factors: increasing per capita income leading to higher spending power; rapid urbanization driving demand for convenient packaged products; rising health consciousness pushing the demand for functional dairy products; and government initiatives supporting dairy farming and processing. Technological advancements in processing and cold chain logistics further enhance efficiency and product quality.

Challenges in the India Dairy Market Sector

The Indian dairy market faces challenges including: fluctuating milk prices impacting profitability; inconsistent milk supply due to seasonal variations; inadequate cold chain infrastructure leading to product spoilage; and intense competition from both domestic and international players. Regulatory hurdles and compliance requirements also pose challenges for manufacturers.

Emerging Opportunities in India Dairy Market

The Indian dairy market presents significant opportunities. Growth in value-added and functional dairy products is promising. Expanding into new geographic markets, especially in rural areas, offers substantial potential. The increasing adoption of technology and innovation in dairy farming and processing presents further opportunities. The demand for sustainable and ethically sourced dairy products is also growing.

Leading Players in the India Dairy Market Market

- Nestlé SA

- Parag Milk Foods Ltd

- Karnataka Cooperative Milk Producers Federation Ltd

- Tamil Nadu Cooperative Milk Producers Federation Ltd

- Rajasthan Co-operative Dairy Federation Ltd

- Mother Dairy Fruit & Vegetable Pvt Ltd

- Hatsun Agro Product Ltd

- Gujarat Cooperative Milk Marketing Federation Ltd

- Britannia Industries

- Dodla Dairy Ltd

Key Developments in India Dairy Market Industry

- July 2022: Amul announced an investment of USD 60.57 Million to build a new dairy plant in Rajkot, expanding production capabilities across milk, yogurt, and buttermilk products. This significantly enhances Amul's production capacity and strengthens its market position.

- May 2022: Amul launched Isabcool flavor ice cream, a product innovation targeting health-conscious consumers with its inclusion of psyllium husk. This demonstrates Amul's focus on product diversification and innovation.

- March 2022: Dodla Dairy Ltd acquired Sri Krishna Milks for INR 50 crore (approximately xx Million USD), aiming to expand its business footprint and market share. This acquisition represents a strategic move towards consolidation in the Indian dairy market.

Strategic Outlook for India Dairy Market Market

The India dairy market is poised for continued growth, driven by strong domestic demand, supportive government policies, and increasing investments in the sector. Opportunities exist in value-added products, technological advancements, and expanding market reach. Strategic partnerships, product diversification, and sustainable practices will be crucial for success in this dynamic market.

India Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

India Dairy Market Segmentation By Geography

- 1. India

India Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North India India Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nestlé SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Parag Milk Foods Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Karnataka Cooperative Milk Producers Federation Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tamil Nadu Cooperative Milk Producers Federation Lt

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rajasthan Co-operative Dairy Federation Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mother Dairy Fruit & Vegetable Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hatsun Agro Product Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gujarat Cooperative Milk Marketing Federation Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Britannia Industries

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dodla Dairy Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestlé SA

List of Figures

- Figure 1: India Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: India Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: India Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 11: India Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: India Dairy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Dairy Market?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the India Dairy Market?

Key companies in the market include Nestlé SA, Parag Milk Foods Ltd, Karnataka Cooperative Milk Producers Federation Ltd, Tamil Nadu Cooperative Milk Producers Federation Lt, Rajasthan Co-operative Dairy Federation Ltd, Mother Dairy Fruit & Vegetable Pvt Ltd, Hatsun Agro Product Ltd, Gujarat Cooperative Milk Marketing Federation Ltd, Britannia Industries, Dodla Dairy Ltd.

3. What are the main segments of the India Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

July 2022: Amul announced an investment of USD 60.57 million to build a new dairy plant in Rajkot to expand its production capabilities across milk, yogurt, and buttermilk products.May 2022: Amul launched Isabcool flavor ice cream. It contains psyllium husk, which helps in proper digestion.March 2022: Dodla Dairy Ltd acquired Sri Krishna Milks for INR 50 crore. The acquisition aimed to expand the company's business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Dairy Market?

To stay informed about further developments, trends, and reports in the India Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence