Key Insights

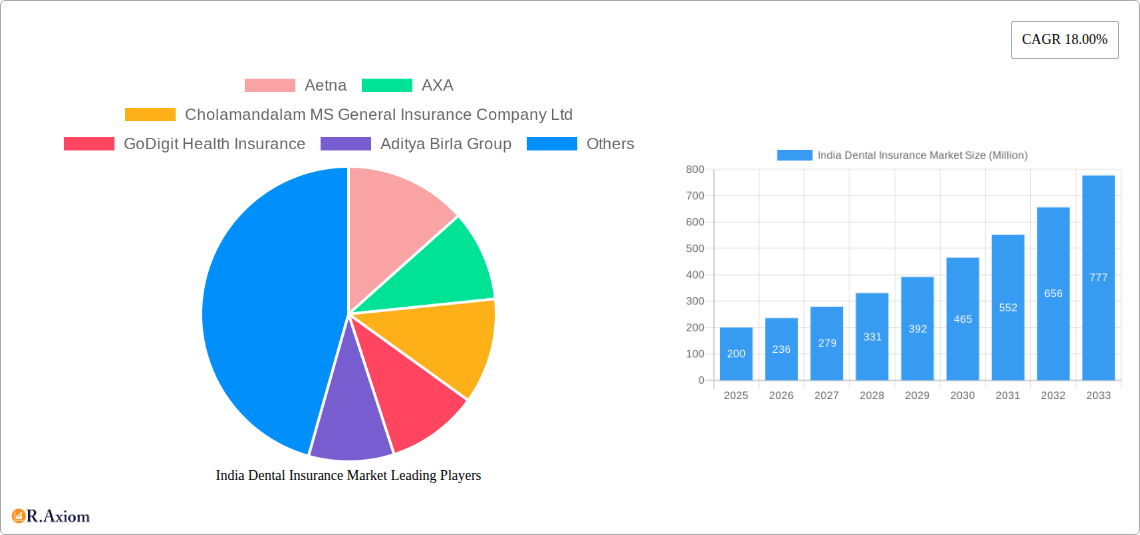

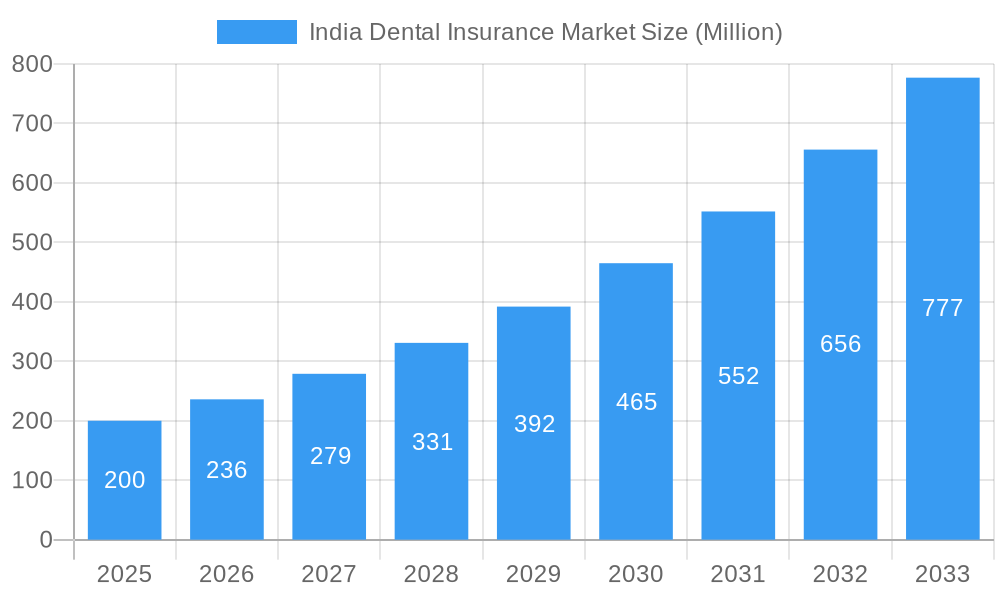

The Indian dental insurance market is experiencing robust growth, projected to reach a substantial size with a Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033. This expansion is fueled by several key drivers. Rising dental awareness among the Indian population, particularly within the burgeoning middle class, is leading to increased demand for preventive and restorative dental care. A growing senior citizen population, more susceptible to dental issues, further contributes to market growth. The increasing affordability and accessibility of dental insurance plans, coupled with innovative product offerings from insurers like bundled dental and health plans, are also significant catalysts. Technological advancements in dental procedures and the rising adoption of dental health maintenance organizations (DHMOs) and other coverage models are streamlining access to care and boosting market expansion. While the market faces certain restraints, such as limited dental insurance awareness in rural areas and high treatment costs for complex procedures, the overall outlook remains highly positive.

India Dental Insurance Market Market Size (In Million)

The market segmentation reveals diverse opportunities. Preventive dental care, due to its cost-effectiveness and rising awareness of preventative oral hygiene, is a significant segment. The corporate sector increasingly offers dental insurance as an employee benefit, driving the corporate end-user segment's growth. Geographical distribution shows varied penetration, with urban areas exhibiting higher adoption rates compared to rural regions. This presents a significant opportunity for insurers to expand their reach and educate the population about the benefits of dental insurance. Key players like Aetna, AXA, and others are competing intensely, leveraging strategic partnerships and technological advancements to capture market share. The market's future will be shaped by a combination of factors including government initiatives to promote oral health, technological innovations, and continued expansion of insurance coverage to previously underserved populations. The projected growth trajectory indicates a promising future for the Indian dental insurance sector.

India Dental Insurance Market Company Market Share

India Dental Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Dental Insurance Market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The report values are expressed in Millions.

India Dental Insurance Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian dental insurance market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits a moderately concentrated structure, with a few large players like Aetna, AXA, and Aditya Birla Group holding significant market share, estimated at xx% collectively in 2025. However, the market also features numerous smaller players, particularly since the IRDAI relaxations in 2022. Innovation is driven by the increasing demand for affordable and comprehensive dental coverage, leading to the development of new product offerings like specialized dental plans for seniors and minors. The regulatory framework, primarily governed by the IRDAI, significantly influences market dynamics. Product substitutes, such as out-of-pocket payments, still hold a considerable market share. End-user trends show a rising preference for standalone dental insurance plans, rather than bundled health insurance offerings. M&A activity has been relatively moderate, with deal values estimated at xx Million in the historical period, but is expected to increase with the enhanced funding opportunities for smaller players.

India Dental Insurance Market Industry Trends & Insights

The India Dental Insurance Market is experiencing robust growth, driven by factors such as rising dental awareness, increasing disposable incomes, and a growing elderly population. Technological disruptions, particularly in tele-dentistry and digital health platforms, are facilitating market expansion. Consumer preferences are shifting towards comprehensive coverage, including preventive care. The competitive landscape is characterized by intense price competition, product differentiation, and strategic partnerships. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is fueled by increasing affordability, government initiatives promoting health insurance, and a wider acceptance of dental insurance as an essential component of overall health coverage.

Dominant Markets & Segments in India Dental Insurance Market

The Indian dental insurance market shows significant regional variations, with metropolitan areas demonstrating higher penetration rates than rural areas due to greater awareness and accessibility. Within segments, the Individual end-user segment dominates, driven by rising individual health consciousness and affordability concerns. Among procedures, Preventive care is the largest segment, reflecting a growing emphasis on early dental health.

- Key Drivers for Individual Segment: Rising disposable incomes, increased health awareness, and affordable plan options.

- Key Drivers for Preventive Care Segment: Government initiatives promoting preventive healthcare and increasing public awareness of the importance of dental hygiene.

- Other Dominant Segments: The Senior Citizen demographic is a rapidly growing segment, as awareness and need for dental care increases with age. Corporates are increasingly offering dental insurance as a benefit to attract and retain talent.

The dominance of these segments is further strengthened by factors such as favorable economic policies promoting health insurance, improving healthcare infrastructure, and readily available dental clinics. However, rural areas still lack adequate penetration due to low awareness levels and limited access to dental care facilities.

India Dental Insurance Market Product Developments

Recent product innovations include specialized plans catering to specific demographics (e.g., senior citizens, children) and the integration of tele-dentistry services. Companies are leveraging technology to improve customer experience through user-friendly online portals and mobile apps, enhancing claim processing and customer service. These innovations are aimed at improving market fit and providing a competitive advantage by addressing specific customer needs and simplifying the insurance process. Dental health maintenance organizations (DHMOs) are gaining popularity, focusing on preventive care.

Report Scope & Segmentation Analysis

This report segments the India Dental Insurance Market based on Procedure (Preventive, Major, Basic), End User (Individual, Corporates), Demographics (Senior Citizen, Minors, Other Demographics), and Coverage (Dental Health Maintenance Organizations (DHMO), Dental Preferred Provider Organization (DPO), Dental Indemnity Plan (DIP), Dental Point of Service (DPS)). Each segment’s growth trajectory, market size, and competitive dynamics are analyzed, including growth projections. The market size for each segment will be detailed within the full report.

Key Drivers of India Dental Insurance Market Growth

Several factors propel the growth of the India Dental Insurance Market. Firstly, the rising awareness of oral health and its impact on overall well-being drives demand for comprehensive dental coverage. Secondly, the escalating cost of dental procedures pushes individuals and corporates towards insurance solutions. Thirdly, the increased penetration of health insurance schemes and the government's focus on healthcare further supports market expansion. Finally, the development and adoption of innovative products and technologies tailored to diverse customer segments fuel market growth.

Challenges in the India Dental Insurance Market Sector

The Indian dental insurance market faces challenges such as low awareness levels in rural areas, high treatment costs, and limited access to quality dental care in certain regions. Regulatory hurdles, particularly those related to product pricing and claims processing, can also constrain market growth. Furthermore, significant competition from existing players and the need to build trust among consumers represent significant barriers. These challenges result in lower-than-expected market penetration, particularly in rural regions, impacting overall revenue growth. The precise quantification of these impacts is included in the full report.

Emerging Opportunities in India Dental Insurance Market

The market presents several opportunities. Expanding into underserved rural markets through strategic partnerships with local healthcare providers is key. Leveraging technology to improve accessibility and affordability of dental care through tele-dentistry and digital platforms is also promising. Furthermore, creating specialized products targeting specific demographics (e.g., senior citizens, children) and incorporating preventive care services can boost market growth. The integration of artificial intelligence (AI) in claims processing and risk assessment offers further efficiency gains.

Leading Players in the India Dental Insurance Market Market

- Aetna

- AXA

- Cholamandalam MS General Insurance Company Ltd

- GoDigit Health Insurance

- Aditya Birla Group

- Delta Dental

- Star Health & Allied Insurance

- Policy bazaar

- Allianz

- Humana Dental Insurance

Key Developments in India Dental Insurance Market Industry

- November 2022: IRDAI relaxed regulations concerning market-linked products, data transparency with account aggregators, and increased tie-ups for corporate agents and IMFs, fostering market expansion for smaller players.

- November 2022: IRDAI allowed increased dilution of promoter shares (up to 26%), potentially boosting funding for smaller insurers and expansion within the niche dental insurance sector.

Strategic Outlook for India Dental Insurance Market Market

The India Dental Insurance Market holds immense future potential due to rising health awareness, increasing disposable incomes, and favorable regulatory changes. Focus on preventive care, digitalization, and customized product offerings will drive future growth. Strategic partnerships and expansion into underserved markets will be crucial for market leadership. The market's long-term outlook is positive, with continued growth expected throughout the forecast period.

India Dental Insurance Market Segmentation

-

1. Coverage

- 1.1. Dental Health Maintenance Organizations(DHMO)

- 1.2. Dental Preferred Provider Organization(DEPO)

- 1.3. Dental Indemnity Plan(DIP)

- 1.4. Dental Point of Service(DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End User

- 3.1. Individual

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior Citizen

- 4.2. Minors

- 4.3. Other Demographics

India Dental Insurance Market Segmentation By Geography

- 1. India

India Dental Insurance Market Regional Market Share

Geographic Coverage of India Dental Insurance Market

India Dental Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate

- 3.3. Market Restrains

- 3.3.1. Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 3.4. Market Trends

- 3.4.1 Changing eating habits affecting dental insurance market

- 3.4.2 because of early tooth diseases.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Dental Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental Health Maintenance Organizations(DHMO)

- 5.1.2. Dental Preferred Provider Organization(DEPO)

- 5.1.3. Dental Indemnity Plan(DIP)

- 5.1.4. Dental Point of Service(DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior Citizen

- 5.4.2. Minors

- 5.4.3. Other Demographics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aetna

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cholamandalam MS General Insurance Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GoDigit Health Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aditya Birla Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delta Dental

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Star Health & Allied Insurance**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Policy bazaar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allianz

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Humana Dental Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aetna

List of Figures

- Figure 1: India Dental Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Dental Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: India Dental Insurance Market Revenue undefined Forecast, by Coverage 2020 & 2033

- Table 2: India Dental Insurance Market Revenue undefined Forecast, by Procedure 2020 & 2033

- Table 3: India Dental Insurance Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: India Dental Insurance Market Revenue undefined Forecast, by Demographics 2020 & 2033

- Table 5: India Dental Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: India Dental Insurance Market Revenue undefined Forecast, by Coverage 2020 & 2033

- Table 7: India Dental Insurance Market Revenue undefined Forecast, by Procedure 2020 & 2033

- Table 8: India Dental Insurance Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: India Dental Insurance Market Revenue undefined Forecast, by Demographics 2020 & 2033

- Table 10: India Dental Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Dental Insurance Market?

The projected CAGR is approximately 16%.

2. Which companies are prominent players in the India Dental Insurance Market?

Key companies in the market include Aetna, AXA, Cholamandalam MS General Insurance Company Ltd, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance**List Not Exhaustive, Policy bazaar, Allianz, Humana Dental Insurance.

3. What are the main segments of the India Dental Insurance Market?

The market segments include Coverage, Procedure, End User, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate.

6. What are the notable trends driving market growth?

Changing eating habits affecting dental insurance market. because of early tooth diseases..

7. Are there any restraints impacting market growth?

Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards..

8. Can you provide examples of recent developments in the market?

On 25 November 2022, IRDAI relaxed regulations related to market-linked products, increased transparency of data with account aggregators, and increased the maximum number of tie-ups from 6 to 9 for corporate agents and IMFs. These relaxations shall increase the scope for small insurers to expand in India with niche offerings such as dental insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Dental Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Dental Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Dental Insurance Market?

To stay informed about further developments, trends, and reports in the India Dental Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence