Key Insights

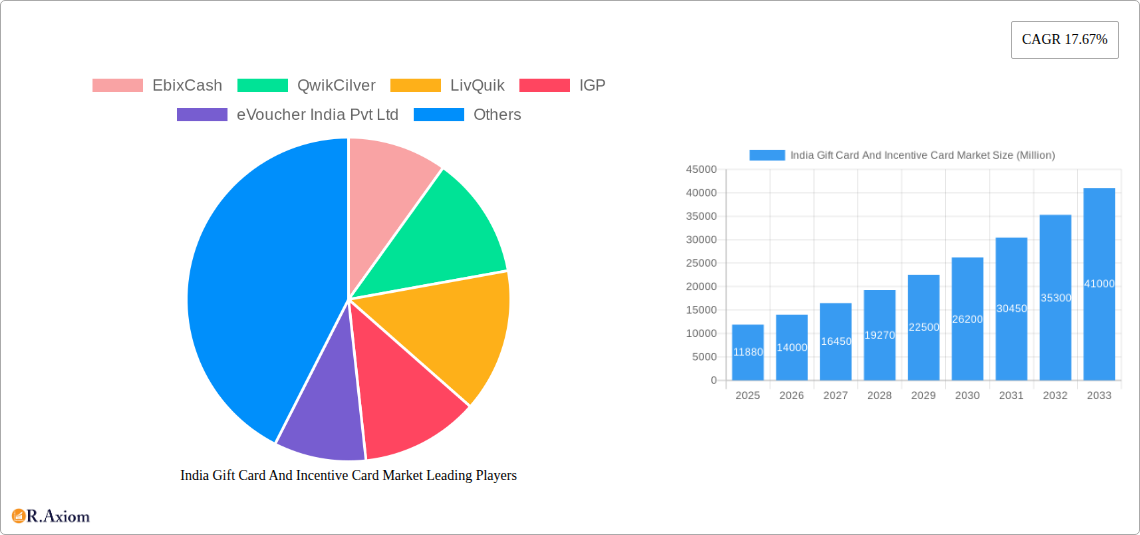

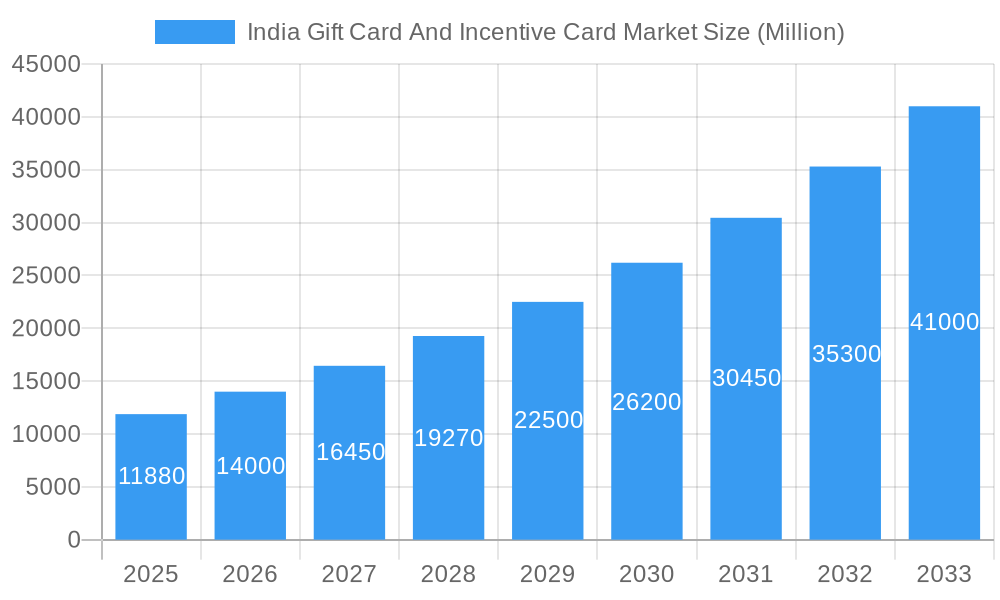

The India gift card and incentive card market is experiencing robust growth, projected to reach \$11.88 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.67% from 2025 to 2033. This expansion is fueled by several key factors. Increased disposable incomes, particularly among the burgeoning middle class, are driving higher consumer spending on experiential gifts and rewarding employees. The rise of e-commerce and digital payment platforms has significantly simplified the purchase and redemption of gift cards, broadening accessibility and convenience. Furthermore, businesses are increasingly leveraging incentive cards for employee motivation and customer loyalty programs, recognizing their effectiveness in boosting engagement and brand advocacy. The market's segmentation, while not fully detailed, likely includes various card types (physical vs. digital, prepaid vs. reloadable), target demographics, and distribution channels (online vs. offline). Key players like EbixCash, QwikCilver, and others are driving innovation with personalized offerings and integrated loyalty programs.

India Gift Card And Incentive Card Market Market Size (In Billion)

The market's growth trajectory is expected to remain positive throughout the forecast period (2025-2033). However, potential restraints include the risk of fraud and security concerns associated with digital gift cards, requiring robust security measures from market players. Competition among numerous providers necessitates ongoing innovation and differentiation to retain market share. Furthermore, evolving consumer preferences and technological advancements continuously reshape the market landscape, demanding agile adaptation from companies. To sustain growth, businesses must focus on enhancing user experience, strengthening security protocols, and leveraging data analytics to personalize offerings and optimize marketing strategies. The market presents a significant opportunity for companies to capitalize on the growing demand for convenient and personalized gifting and incentive solutions.

India Gift Card And Incentive Card Market Company Market Share

India Gift Card and Incentive Card Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Gift Card and Incentive Card Market, covering the period from 2019 to 2033. It offers valuable insights into market size, growth drivers, challenges, opportunities, and competitive landscape, equipping stakeholders with actionable intelligence for strategic decision-making. The report uses 2025 as the base year and provides estimations for 2025 and forecasts for 2025-2033, based on data from the historical period of 2019-2024. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

India Gift Card And Incentive Card Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Indian gift card and incentive card market. The market is characterized by a moderately concentrated landscape, with key players holding significant market share. EbixCash, QwikCilver, and GyFTR are among the leading players, collectively holding an estimated XX% market share in 2025. However, the market also features several smaller players, indicating a competitive environment.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be XX in 2025, suggesting a moderately concentrated market.

- Innovation Drivers: The increasing adoption of digital technologies, coupled with evolving consumer preferences, is driving innovation in the market. This includes the development of mobile-first gift card platforms, personalized gift card options, and integrated loyalty programs.

- Regulatory Framework: The Reserve Bank of India (RBI) regulations play a crucial role in shaping the market dynamics. Compliance with KYC/AML norms influences the operational aspects of gift card issuers and platforms.

- Product Substitutes: Other digital payment methods and online reward programs pose a degree of substitution threat.

- End-User Trends: The increasing preference for digital gift cards and the rising adoption of online and mobile shopping are key end-user trends fueling market growth.

- M&A Activities: The Indian gift card and incentive card market has witnessed several M&A activities in recent years, valued at approximately XX Million cumulatively between 2019 and 2024. These activities demonstrate strategic consolidation and expansion efforts by major players.

India Gift Card And Incentive Card Market Industry Trends & Insights

The Indian gift card and incentive card market is experiencing robust growth driven by several factors. The burgeoning e-commerce sector, increased digital adoption, and a shift towards cashless transactions are key catalysts. The market's growth is further fueled by the rising popularity of corporate gifting, employee incentive programs, and the increasing use of gift cards for various occasions.

Technological advancements are transforming the sector, leading to the emergence of innovative solutions like virtual gift cards and integrated loyalty programs. Consumer preferences are evolving towards personalized and customized gift cards, prompting companies to offer greater flexibility and customization options. Competitive dynamics are intense, with companies focusing on product differentiation, customer experience enhancement, and strategic partnerships to gain market share. The market penetration of gift cards is estimated to be approximately XX% in 2025, with significant growth potential in the coming years. The market is expected to experience a compound annual growth rate (CAGR) of XX% from 2025 to 2033.

Dominant Markets & Segments in India Gift Card And Incentive Card Market

The metropolitan areas of India, particularly in Tier 1 and Tier 2 cities, are currently dominating the gift card and incentive card market. This dominance stems from higher disposable incomes, increased digital literacy, and a greater adoption of e-commerce. Rural areas are showing promising growth potential, driven by increasing smartphone penetration and rising internet access.

- Key Drivers of Dominance in Metropolitan Areas:

- High disposable incomes and spending power

- Higher digital literacy and e-commerce adoption

- Concentrated presence of major corporate players and businesses

- Advanced infrastructure supporting digital transactions

The market is segmented by type (physical and digital), distribution channel (online and offline), end-user (corporate, individuals), and redemption methods. The digital segment holds a significant market share and is experiencing rapid growth due to the convenience and accessibility it provides. The corporate sector is a primary driver, utilizing gift cards and incentives for employee engagement and rewards programs.

India Gift Card And Incentive Card Market Product Developments

Recent product developments focus on enhancing user experience, security, and flexibility. Virtual gift cards and mobile-based platforms are gaining popularity, offering enhanced convenience and accessibility. Innovative features such as personalized gift card designs and integrated loyalty programs are enhancing the overall customer experience. The market is witnessing increased integration with payment gateways and mobile wallets, streamlining the redemption process and promoting seamless transactions.

Report Scope & Segmentation Analysis

This report segments the India Gift Card and Incentive Card Market based on various parameters to provide a granular understanding of the market dynamics. Segments include:

- By Type: Physical Gift Cards, Digital Gift Cards (e-gift cards and mobile gift cards)

- By Distribution Channel: Online (e-commerce platforms, dedicated websites), Offline (retail stores, supermarkets)

- By End-User: Corporate, Individuals

- By Redemption: Online, Offline

Each segment exhibits varying growth rates and competitive dynamics. Digital gift cards are experiencing the fastest growth, driven by the rising adoption of digital technologies and mobile payments. The corporate sector is a significant market segment, with substantial potential for growth.

Key Drivers of India Gift Card And Incentive Card Market Growth

The growth of the India Gift Card and Incentive Card market is propelled by several key factors:

- Rise of E-commerce: The rapid expansion of e-commerce has created significant demand for digital gift cards and online redemption options.

- Growing Smartphone Penetration: Increased smartphone usage has made digital gift cards easily accessible to a wider audience.

- Increased Digital Payment Adoption: The shift towards digital payments is driving the adoption of digital gift cards as a convenient payment and gifting method.

- Corporate Gifting and Incentive Programs: Companies are increasingly using gift cards and incentive programs to engage employees and reward customers.

- Favorable Government Policies: Government initiatives promoting digital transactions are indirectly supporting the growth of the market.

Challenges in the India Gift Card And Incentive Card Market Sector

Despite the positive growth outlook, the market faces several challenges:

- Security Concerns: The risk of fraud and security breaches is a major concern for both consumers and businesses.

- Competition: The market is competitive, with numerous players vying for market share.

- Regulatory Compliance: Adherence to regulatory guidelines and compliance requirements can pose operational challenges.

- High Transaction Fees: Transaction fees associated with gift card processing can affect profitability for businesses.

Emerging Opportunities in India Gift Card And Incentive Card Market

The Indian gift card and incentive card market presents several exciting opportunities:

- Expansion into Rural Markets: Untapped potential exists in rural areas, with increasing mobile and internet penetration.

- Personalized and Customized Gift Cards: Growing demand for personalized gift cards creates scope for innovation and product differentiation.

- Integration with Loyalty Programs: Integrating gift cards with loyalty programs can enhance customer engagement and retention.

- Development of Niche Gift Cards: Catering to specific demographics or interests can create unique market opportunities.

Leading Players in the India Gift Card And Incentive Card Market Market

- EbixCash

- QwikCilver

- LivQuik

- IGP

- eVoucher India Pvt Ltd

- Woohoo

- Zingoy

- Giftstoindia24x7

- GyFTR

- You Got a Gift

Key Developments in India Gift Card And Incentive Card Market Industry

- December 2023: Pine Labs’ Qwikcilver and Foodpanda collaborated to launch Foodpanda Gift Cards, enhancing convenience for customers.

- October 2023: YES Bank partnered with ONDC to introduce the ONDC Network Gift Card, expanding accessibility across various brands.

Strategic Outlook for India Gift Card And Incentive Card Market Market

The future of the Indian gift card and incentive card market looks promising, with sustained growth driven by continued digitalization, evolving consumer preferences, and increasing adoption of digital payment solutions. The market presents significant opportunities for innovation, expansion into untapped markets, and strategic partnerships. The focus on enhancing security measures and improving user experience will be crucial for sustained success in this dynamic market.

India Gift Card And Incentive Card Market Segmentation

-

1. Card Type

- 1.1. E-Gift card

- 1.2. Physical card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

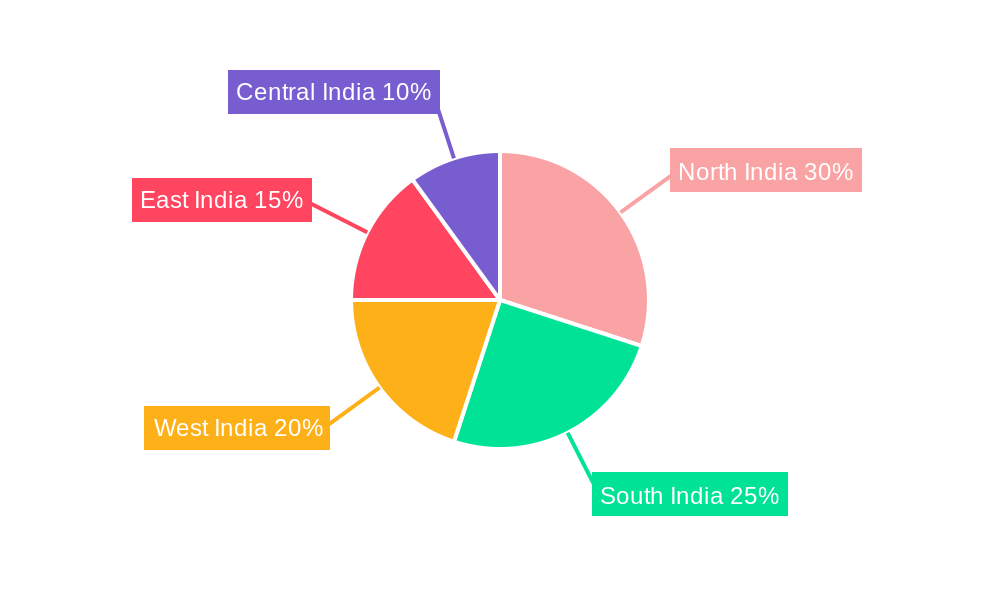

India Gift Card And Incentive Card Market Segmentation By Geography

- 1. India

India Gift Card And Incentive Card Market Regional Market Share

Geographic Coverage of India Gift Card And Incentive Card Market

India Gift Card And Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.3. Market Restrains

- 3.3.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.4. Market Trends

- 3.4.1. The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gift Card And Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. E-Gift card

- 5.1.2. Physical card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EbixCash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QwikCilver

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LivQuik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IGP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eVoucher India Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Woohoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zingoy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giftstoindia24x

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GyFTR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 You Got a Gift**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EbixCash

List of Figures

- Figure 1: India Gift Card And Incentive Card Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Gift Card And Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 4: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 5: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Gift Card And Incentive Card Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Gift Card And Incentive Card Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 12: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 13: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Gift Card And Incentive Card Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Gift Card And Incentive Card Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gift Card And Incentive Card Market?

The projected CAGR is approximately 17.67%.

2. Which companies are prominent players in the India Gift Card And Incentive Card Market?

Key companies in the market include EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, You Got a Gift**List Not Exhaustive.

3. What are the main segments of the India Gift Card And Incentive Card Market?

The market segments include Card Type, Consumer Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

6. What are the notable trends driving market growth?

The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry.

7. Are there any restraints impacting market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

8. Can you provide examples of recent developments in the market?

In December 2023, Pine Labs’ Qwikcilver and Foodpanda collaborated to introduce Foodpanda Gift Cards, a more advanced solution that allows Foodpanda customers to redeem and check their purchases conveniently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gift Card And Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gift Card And Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gift Card And Incentive Card Market?

To stay informed about further developments, trends, and reports in the India Gift Card And Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence