Key Insights

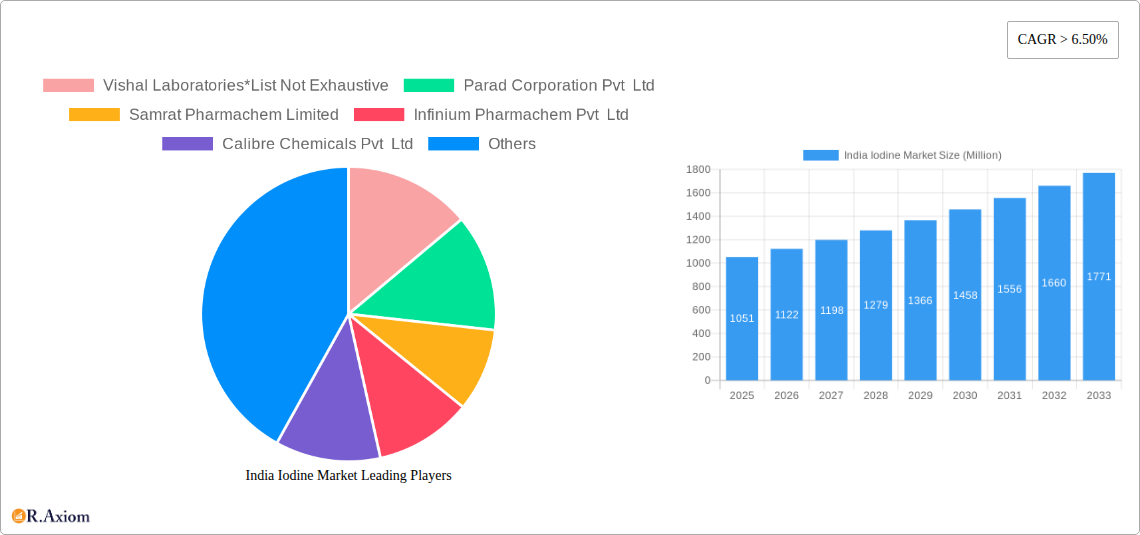

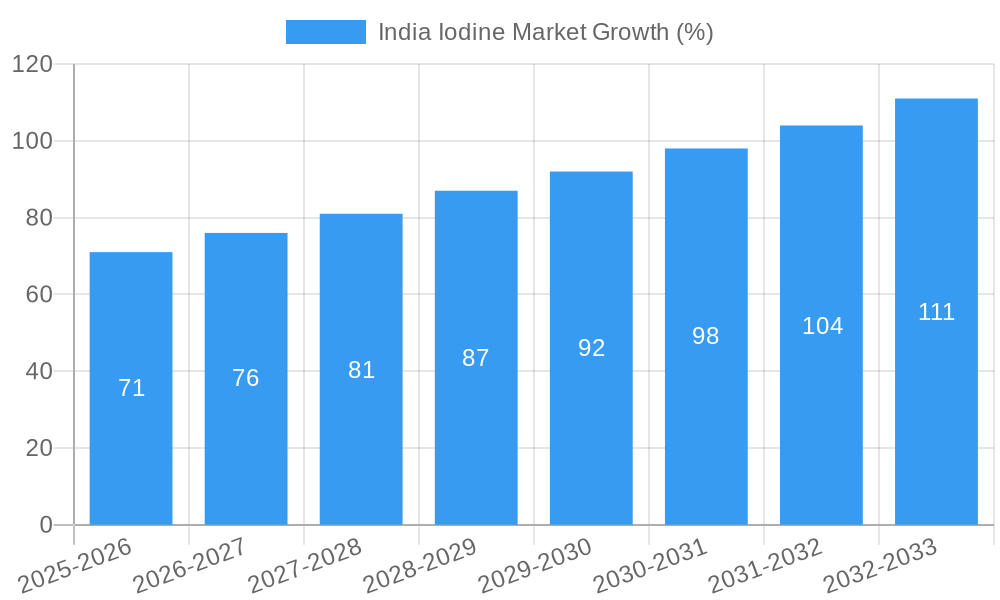

The India iodine market, valued at approximately ₹1051 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing demand from the animal feed industry, particularly in poultry and livestock, is a major contributor. Iodine is crucial for thyroid function in animals, impacting productivity and health. The growing awareness of iodine deficiency disorders (IDD) among both animals and humans is pushing the demand for iodine-rich feed supplements. Secondly, the medical sector's consistent need for iodine in pharmaceuticals, particularly for disinfectants and contrast agents used in medical imaging, further bolsters market growth. Furthermore, the expanding application of iodine in specialized sectors like biocides, optical polarizing films, and fluorochemicals contributes to market dynamism. The market segmentation reveals significant opportunities within inorganic salts and complexes, which are commonly employed in numerous applications. While data on specific regional contributions (North, South, East, and West India) isn't explicitly provided, a logical assumption, based on India's diverse agricultural and industrial landscape, suggests a relatively even distribution of market share across regions, though potential variations may exist due to differing levels of industrialization and agricultural practices.

The growth trajectory, however, is likely to encounter some challenges. Supply chain disruptions, price fluctuations in raw materials (such as seaweed and underground brine), and the emergence of alternative technologies could influence market growth. However, the overall outlook remains optimistic given the fundamental need for iodine across various sectors and the government's initiatives focused on addressing iodine deficiency disorders, particularly in rural areas. The presence of numerous domestic players including Vishal Laboratories, Parad Corporation Pvt Ltd, and others signifies a competitive landscape, encouraging innovation and product diversification to cater to diverse market needs. The forecast period of 2025-2033 holds significant potential for both established players and new entrants, with considerable scope for market expansion and technological advancements within the India iodine market.

India Iodine Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Iodine Market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this growing market. The total market size in 2025 is estimated at xx Million.

India Iodine Market Market Concentration & Innovation

The India Iodine market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Vishal Laboratories, Parad Corporation Pvt Ltd, Samrat Pharmachem Limited, Infinium Pharmachem Pvt Ltd, Calibre Chemicals Pvt Ltd, Salvi Chemical Industries Ltd, Akron Healthcare Pvt Ltd, Glide Chem Private Limited, Iochem Corporation, Kiva Holding Inc, Eskay Iodine Pvt Ltd, and Deep Water Chemicals are key players, though market share data for each is currently unavailable (xx). Innovation within the industry is driven by the development of new iodine-based products for diverse applications, such as advanced biocides and specialized medical treatments. Regulatory frameworks, including those concerning environmental protection and product safety, significantly impact market operations. Product substitutes, such as alternative disinfectants and materials used in certain applications, pose competitive pressure. End-user trends toward sustainable and environmentally friendly products influence market growth. Mergers and acquisitions (M&A) activities, like the acquisition of Calibre Chemicals by Everstone Capital in August 2021 for USD 100 Million, demonstrate the strategic importance of market consolidation and expansion.

- Market Concentration: Moderately concentrated, with a few dominant players. Exact market share data unavailable (xx).

- Innovation Drivers: Development of new iodine-based products for various applications.

- Regulatory Framework: Stringent environmental and product safety regulations.

- Product Substitutes: Presence of alternative materials and disinfectants.

- End-User Trends: Growing preference for sustainable and eco-friendly products.

- M&A Activities: Significant M&A activity, exemplified by Everstone Capital's acquisition of Calibre Chemicals.

India Iodine Market Industry Trends & Insights

The India Iodine market is experiencing robust growth, driven by increasing demand across various sectors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Technological advancements in iodine extraction and purification techniques are enhancing efficiency and reducing costs. Consumer preferences are shifting towards higher-quality, specialized iodine products, particularly in the medical and biocides segments. The competitive landscape is dynamic, with existing players expanding their product portfolios and exploring new applications while new entrants continue to emerge. Market penetration is currently xx% and is expected to increase significantly by 2033. Further research is needed to accurately assess the impact of technological disruptions and predict the precise CAGR and market penetration rates.

Dominant Markets & Segments in India Iodine Market

While precise data on regional dominance is unavailable (xx), the animal feeds application segment currently represents a substantial portion of the market, followed by medical applications. Within sources, Underground Brine is expected to be the most dominant segment due to its cost-effectiveness and large reserves in India. Among forms, inorganic salts and complexes hold the largest market share due to their established use in multiple applications.

- Key Drivers (Animal Feeds): Growing livestock population and increasing demand for animal feed additives.

- Key Drivers (Medical): Rising healthcare expenditure and increasing prevalence of iodine deficiency disorders.

- Key Drivers (Underground Brine): Cost-effectiveness and readily available reserves in India.

- Key Drivers (Inorganic Salts & Complexes): Established applications and cost efficiency.

- Dominance Analysis: Animal feeds and medical applications currently dominate, with Underground Brine expected to lead in sources and inorganic salts and complexes in forms.

India Iodine Market Product Developments

Recent product developments include formulations focusing on enhanced bioavailability and targeted delivery of iodine for specific applications. This reflects technological trends toward creating more effective and efficient iodine-based solutions. These innovations improve the market fit by addressing specific end-user needs and offering competitive advantages in terms of efficacy and safety. Specific examples are currently unavailable (xx).

Report Scope & Segmentation Analysis

This report segments the India Iodine market by source (Underground Brine, Caliche Ore, Recycling, Seaweeds), form (Inorganic Salts and Complexes, Organic Compounds, Elementals and Isotopes), and application (Animal Feeds, Medical, Biocides, Optical Polarizing Films, Fluorochemicals, Nylon, Other Applications). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing valuable insights into market opportunities. Detailed data for growth projections and market sizes are currently unavailable (xx).

Key Drivers of India Iodine Market Growth

Key growth drivers include rising demand from various sectors like animal feed, pharmaceuticals, and industrial applications. Government initiatives promoting animal husbandry and healthcare also contribute to market expansion. Technological advancements in iodine extraction and purification processes further boost market growth by enhancing efficiency and reducing costs. The increasing awareness of iodine deficiency disorders fuels the demand for iodine-based supplements in the medical sector.

Challenges in the India Iodine Market Sector

Challenges include price volatility of raw materials and fluctuations in global iodine prices. Supply chain disruptions and logistical issues can impact market stability. Competition from alternative products and substitutes poses a significant challenge to market growth. Regulatory compliance and stringent environmental standards add to operational costs and complexity. Quantifiable impacts of these challenges are currently unavailable (xx).

Emerging Opportunities in India Iodine Market

Emerging opportunities lie in the development of novel iodine-based products with specialized applications in advanced medical therapies, high-performance materials, and niche industrial processes. Expanding into untapped market segments, such as specialized biocides and advanced materials applications, offers significant potential for growth. Exploring export opportunities to other countries with growing iodine demand presents another lucrative opportunity.

Leading Players in the India Iodine Market Market

- Vishal Laboratories

- Parad Corporation Pvt Ltd

- Samrat Pharmachem Limited

- Infinium Pharmachem Pvt Ltd

- Calibre Chemicals Pvt Ltd

- Salvi Chemical Industries Ltd

- Akron Healthcare Pvt Ltd

- Glide Chem Private Limited

- Iochem Corporation

- Kiva Holding Inc

- Eskay Iodine Pvt Ltd

- Deep Water Chemicals

Key Developments in India Iodine Market Industry

- August 2021: Singapore-based Everstone Capital acquired a controlling stake in Calibre Chemicals Pvt. Ltd. for USD 100 Million, boosting Calibre's global ambitions.

- April 2021: Launch of i2cure, a healthcare brand using molecular iodine to combat viral infections, in collaboration with Dr. Jack Kessler. This expansion into new applications could significantly impact market dynamics.

Strategic Outlook for India Iodine Market Market

The India Iodine market presents significant growth potential driven by increasing demand, technological advancements, and expansion into new applications. Focusing on innovation, strategic partnerships, and efficient supply chain management will be crucial for companies to succeed in this dynamic market. The long-term outlook remains positive, with substantial opportunities for market expansion and diversification.

India Iodine Market Segmentation

-

1. Source

- 1.1. Underground Brine

- 1.2. Caliche Ore

- 1.3. Recycling

- 1.4. Seaweeds

-

2. Form

- 2.1. Inorganic Salts and Complexes

- 2.2. Organic Compounds

- 2.3. Elementals and Isotopes

-

3. Application

- 3.1. Animal Feeds

- 3.2. Medical

- 3.3. Biocides

- 3.4. Optical Polarizing Films

- 3.5. Fluorochemicals

- 3.6. Nylon

- 3.7. Other Applications

India Iodine Market Segmentation By Geography

- 1. India

India Iodine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Pharmaceutical Industry; Growth in the Animal Feed Industry

- 3.3. Market Restrains

- 3.3.1. Health-related Side-effects of Iodine Consumption

- 3.4. Market Trends

- 3.4.1. Rising Application of Iodine in Medical Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Iodine Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Underground Brine

- 5.1.2. Caliche Ore

- 5.1.3. Recycling

- 5.1.4. Seaweeds

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Inorganic Salts and Complexes

- 5.2.2. Organic Compounds

- 5.2.3. Elementals and Isotopes

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Animal Feeds

- 5.3.2. Medical

- 5.3.3. Biocides

- 5.3.4. Optical Polarizing Films

- 5.3.5. Fluorochemicals

- 5.3.6. Nylon

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North India India Iodine Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Iodine Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Iodine Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Iodine Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vishal Laboratories*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Parad Corporation Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samrat Pharmachem Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infinium Pharmachem Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Calibre Chemicals Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Salvi Chemical Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Akron Healthcare Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Glide Chem Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Iochem Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kiva Holding Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Eskay Iodine Pvt Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Deep Water Chemicals

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Vishal Laboratories*List Not Exhaustive

List of Figures

- Figure 1: India Iodine Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Iodine Market Share (%) by Company 2024

List of Tables

- Table 1: India Iodine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Iodine Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Iodine Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: India Iodine Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 5: India Iodine Market Revenue Million Forecast, by Form 2019 & 2032

- Table 6: India Iodine Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 7: India Iodine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: India Iodine Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 9: India Iodine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Iodine Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: India Iodine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India Iodine Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: North India India Iodine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North India India Iodine Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: South India India Iodine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South India India Iodine Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: East India India Iodine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East India India Iodine Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: West India India Iodine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West India India Iodine Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: India Iodine Market Revenue Million Forecast, by Source 2019 & 2032

- Table 22: India Iodine Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 23: India Iodine Market Revenue Million Forecast, by Form 2019 & 2032

- Table 24: India Iodine Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 25: India Iodine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: India Iodine Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 27: India Iodine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: India Iodine Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Iodine Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the India Iodine Market?

Key companies in the market include Vishal Laboratories*List Not Exhaustive, Parad Corporation Pvt Ltd, Samrat Pharmachem Limited, Infinium Pharmachem Pvt Ltd, Calibre Chemicals Pvt Ltd, Salvi Chemical Industries Ltd, Akron Healthcare Pvt Ltd, Glide Chem Private Limited, Iochem Corporation, Kiva Holding Inc, Eskay Iodine Pvt Ltd, Deep Water Chemicals.

3. What are the main segments of the India Iodine Market?

The market segments include Source, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1051 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Pharmaceutical Industry; Growth in the Animal Feed Industry.

6. What are the notable trends driving market growth?

Rising Application of Iodine in Medical Applications.

7. Are there any restraints impacting market growth?

Health-related Side-effects of Iodine Consumption.

8. Can you provide examples of recent developments in the market?

August 2021: Singapore-based Everstone Capital announced the acquisition of a controlling stake in Calibre Chemicals Pvt. Ltd. for a value of USD 100 million. The move is anticipated to benefit Calibre Chemicals with Everstone's operational expertise and experience helping the company realize its global goals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Iodine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Iodine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Iodine Market?

To stay informed about further developments, trends, and reports in the India Iodine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence