Key Insights

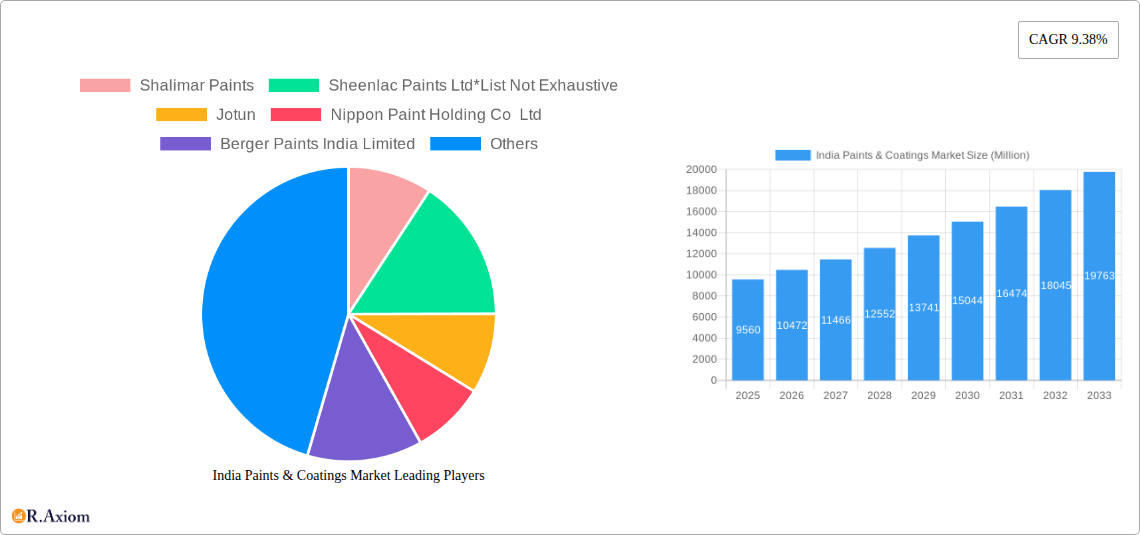

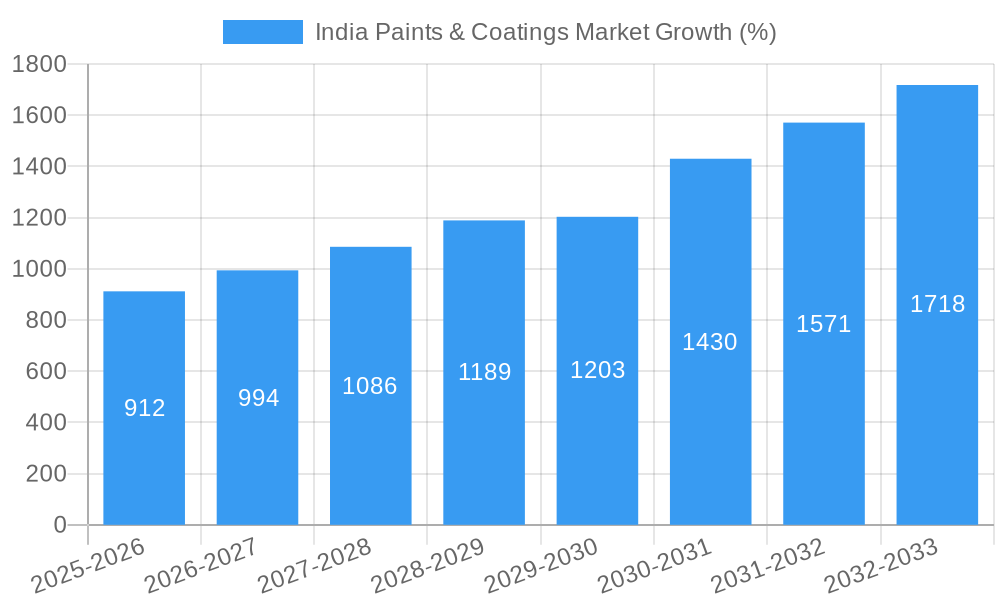

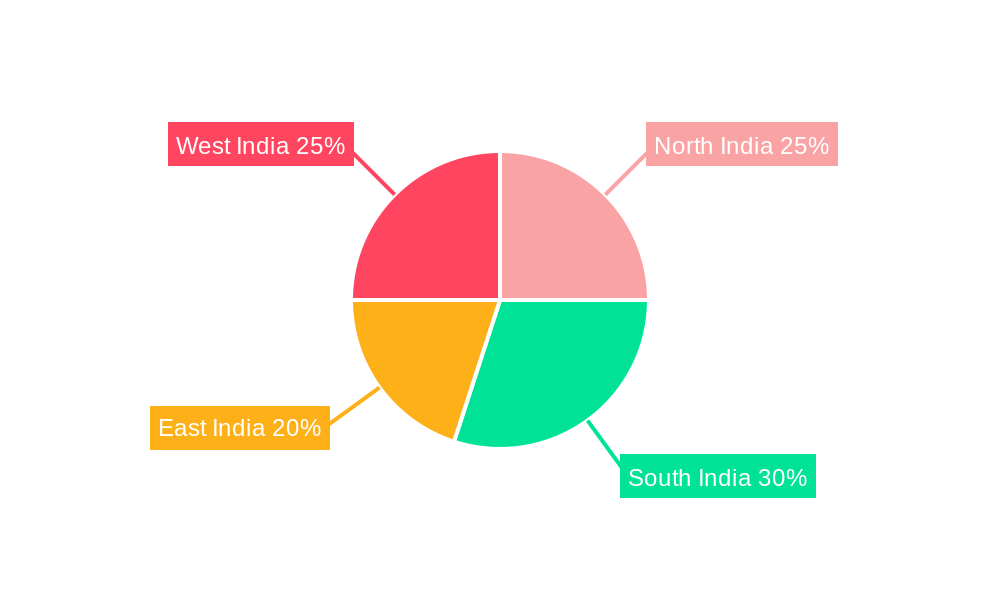

The India paints and coatings market, valued at ₹9560 million in 2025, exhibits robust growth potential, projected to expand at a CAGR of 9.38% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning construction sector, particularly in infrastructure development and residential building, significantly boosts demand for architectural coatings. The automotive industry's expansion, coupled with a rising preference for aesthetically pleasing and durable vehicle finishes, further fuels market growth. Increasing industrial activity across diverse sectors like packaging and general manufacturing contributes to the demand for protective and specialized coatings. Furthermore, the growing awareness of sustainable practices is driving the adoption of water-borne coatings, a key technological trend shaping market dynamics. However, volatile raw material prices and stringent environmental regulations pose challenges to market expansion. The market is segmented by resin type (acrylic, alkyd, polyurethane, epoxy, polyester, others), end-user industry (architectural, automotive, wood, protective coatings, general industrial, transportation, packaging), and technology (water-borne, solvent-borne, powder, radiation-cured). Key players such as Asian Paints, Berger Paints India, Kansai Nerolac Paints, and others dominate the market, leveraging their established distribution networks and brand recognition. Regional variations in market growth are expected, with Southern and Western India likely witnessing faster expansion due to higher infrastructural development and industrial activity.

The competitive landscape is characterized by both domestic and multinational players. Large players enjoy significant market share due to their extensive distribution networks and established brand reputation. However, smaller regional players are gaining traction by focusing on niche segments and offering customized solutions. Future growth will likely be driven by technological advancements, particularly in sustainable and high-performance coatings. The increasing focus on green building initiatives and the rising demand for environmentally friendly paints and coatings will further shape market dynamics. Government regulations promoting sustainable practices will also influence the market's trajectory. The market's long-term outlook remains positive, supported by consistent economic growth and sustained infrastructure development across India. Strategic acquisitions, mergers, and new product launches are anticipated to further shape the competitive landscape.

India Paints & Coatings Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India paints and coatings market, offering actionable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of market trends, growth drivers, and challenges. The report covers key segments including resin type, end-user industry, and technology, and profiles leading players such as Asian Paints, Berger Paints India Limited, and Kansai Nerolac Paints Limited. This report is essential for businesses seeking to understand and capitalize on opportunities within this dynamic market.

India Paints & Coatings Market Market Concentration & Innovation

The Indian paints and coatings market is characterized by a moderate level of concentration, with a few major players holding significant market share. Asian Paints, for instance, commands a substantial portion, followed by Berger Paints India Limited and Kansai Nerolac Paints Limited. However, the presence of several regional and specialized players prevents complete market dominance by a single entity. Innovation is driven by factors such as the growing demand for eco-friendly coatings, stringent environmental regulations, and increasing consumer preference for high-performance products.

Several key metrics highlight this dynamic:

- Market Share: Asian Paints holds approximately xx%, followed by Berger Paints at xx% and Kansai Nerolac Paints at xx%. The remaining market share is distributed among numerous smaller players.

- M&A Activity: While precise deal values are not publicly available for all transactions, the market has witnessed several mergers and acquisitions in recent years, primarily aimed at expanding market reach and product portfolios. Significant deals valued at approximately USD xx Million have been observed in the past five years.

- Regulatory Framework: Government regulations focusing on VOC emissions and environmental sustainability are increasingly shaping product development and manufacturing processes. This has led to a rise in water-borne coatings and sustainable paint solutions.

- Product Substitutes: While traditional paints continue to dominate, the emergence of alternatives like textured coatings, self-cleaning paints, and antimicrobial coatings is presenting both challenges and opportunities for existing players.

- End-user Trends: The architectural segment remains the largest, driven by robust infrastructure development and urbanization. However, the automotive and industrial segments are also exhibiting significant growth potential.

India Paints & Coatings Market Industry Trends & Insights

The India paints and coatings market exhibits a robust growth trajectory, driven by factors such as expanding infrastructure projects, rising disposable incomes, and increasing urbanization. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a market value of approximately USD xx Million by 2033. Technological advancements, such as the development of water-borne coatings and powder coatings, are gaining significant traction, owing to their eco-friendly nature and enhanced performance characteristics.

Consumer preferences are shifting towards premium products with improved aesthetics, durability, and sustainability features. Competitive dynamics are intense, with established players focusing on capacity expansion, product diversification, and strategic partnerships to maintain market leadership. Market penetration of premium coatings is increasing, reflecting rising consumer awareness and willingness to pay a premium for superior quality. Furthermore, the growth of the e-commerce sector is creating new distribution channels and impacting the market landscape.

Dominant Markets & Segments in India Paints & Coatings Market

The architectural segment dominates the end-user industry, fueled by robust construction activities across both residential and commercial spaces. Within resin types, acrylic paints hold the largest market share due to their versatility, durability, and aesthetic appeal. Geographically, major metropolitan areas and rapidly developing states contribute most to the overall market size.

Key Drivers:

- Economic Growth: A strong GDP growth rate directly impacts construction activity and consumer spending.

- Government Initiatives: Government programs promoting affordable housing and infrastructure development are significant market catalysts.

- Urbanization: The ongoing migration from rural to urban areas fuels the demand for paints and coatings in newly constructed buildings and urban renewal projects.

Dominance Analysis:

The architectural segment’s dominance stems from the continuous expansion of urban landscapes and infrastructure projects. The high volume of construction across residential, commercial and industrial segments significantly drives demand for architectural coatings. The superior performance and aesthetic appeal of acrylic resin-based paints fuel its higher market share amongst resin types.

India Paints & Coatings Market Product Developments

Recent innovations in the Indian paints and coatings market focus on sustainable and high-performance products. This includes the development of low-VOC water-borne coatings, advanced powder coatings with improved durability and corrosion resistance, and specialized coatings for specific applications, such as antimicrobial coatings for healthcare facilities. These advancements respond directly to growing environmental concerns and the need for enhanced functional performance. Companies are also actively developing innovative application technologies, streamlining the painting process and reducing waste.

Report Scope & Segmentation Analysis

This report segments the India paints and coatings market based on resin type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Other Resin Types), end-user industry (Architectural, Automotive, Wood, Protective Coatings, General Industrial, Transportation, Packaging), and technology (Water-borne Coatings, Solvent-borne Coatings, Powder Coatings, Radiation Cured Coatings). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. Growth projections vary significantly across segments, with the architectural segment anticipated to maintain the highest growth rate over the forecast period.

Key Drivers of India Paints & Coatings Market Growth

The Indian paints and coatings market's growth is fueled by several key drivers:

- Rapid Urbanization: The ongoing shift from rural to urban areas fuels substantial demand for construction materials, including paints and coatings.

- Infrastructure Development: Government initiatives promoting infrastructure development, including roads, railways, and housing projects, significantly boosts market demand.

- Rising Disposable Incomes: Increasing disposable incomes among the middle class directly translate to higher spending on home improvement and decoration.

- Technological Advancements: Innovations such as water-based paints and self-cleaning coatings cater to the growing demand for eco-friendly and high-performance products.

Challenges in the India Paints & Coatings Market Sector

The Indian paints and coatings market faces several challenges:

- Fluctuating Raw Material Prices: Price volatility in raw materials like resins, pigments, and solvents directly impacts production costs and profitability.

- Stringent Environmental Regulations: Compliance with stringent environmental regulations necessitates investments in cleaner production technologies.

- Intense Competition: The market is highly competitive, with both domestic and international players vying for market share. This competitive pressure necessitates continuous innovation and cost optimization strategies.

Emerging Opportunities in India Paints & Coatings Market

Emerging opportunities lie in:

- Sustainable Coatings: Growing consumer awareness of environmental concerns is driving demand for eco-friendly paints and coatings.

- Specialized Coatings: There's increasing demand for specialized coatings catering to niche applications like protective coatings for infrastructure and antimicrobial coatings for healthcare.

- Digitalization: The adoption of digital technologies in paint manufacturing, sales, and distribution offers significant growth potential.

Leading Players in the India Paints & Coatings Market Market

- Asian Paints

- Berger Paints India Limited

- Kansai Nerolac Paints Limited

- Jotun

- Nippon Paint Holding Co Ltd

- Shalimar Paints

- Sheenlac Paints Ltd

- JSW PAINTS

- KAMDHENU COLOUR AND COATINGS LIMITED (KCCL)

- Indigo Paints

- Akzo Nobel N V

Key Developments in India Paints & Coatings Market Industry

- Dec 2023: AkzoNobel partnered with coatingAI to launch Flightpath, software designed to optimize paint application, reduce defects, lower material consumption, and decrease the carbon footprint.

- Oct 2022: Asian Paints announced a INR 2,650 crore (~USD 324.20 Million) investment in a new vinyl acetate plant monomer production facility in India, enhancing backward integration.

Strategic Outlook for India Paints & Coatings Market Market

The future of the India paints and coatings market appears bright, driven by continued urbanization, robust infrastructure development, and rising disposable incomes. Focusing on sustainable and high-performance products, strategic partnerships, and technological advancements will be crucial for success. The market’s growth will be underpinned by the increasing demand for specialized coatings catering to diverse applications and the adoption of sustainable and environmentally friendly paint solutions. Companies that adapt to evolving consumer preferences and technological disruptions are poised for significant growth in the coming years.

India Paints & Coatings Market Segmentation

-

1. Technology

- 1.1. Water-borne Coatings

- 1.2. Solvent-borne Coatings

- 1.3. Powder Coatings

- 1.4. Radiation Cured Coatings

-

2. Resin Type

- 2.1. Acrylic

- 2.2. Alkyd

- 2.3. Polyurethane

- 2.4. Epoxy

- 2.5. Polyester

- 2.6. Other Resin Types (Vinyl, Latex)

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Protective Coatings

- 3.5. General Industrial

- 3.6. Transportation

- 3.7. Packaging

India Paints & Coatings Market Segmentation By Geography

- 1. India

India Paints & Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction Industry in the Country; Recovery of The Automotive Industry

- 3.3. Market Restrains

- 3.3.1. Fluctuation in the Raw Material Prices; Stringent Environmental Regulations Regarding Volatile Organic Compounds (VOC)

- 3.4. Market Trends

- 3.4.1. Architectural Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Water-borne Coatings

- 5.1.2. Solvent-borne Coatings

- 5.1.3. Powder Coatings

- 5.1.4. Radiation Cured Coatings

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Acrylic

- 5.2.2. Alkyd

- 5.2.3. Polyurethane

- 5.2.4. Epoxy

- 5.2.5. Polyester

- 5.2.6. Other Resin Types (Vinyl, Latex)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Protective Coatings

- 5.3.5. General Industrial

- 5.3.6. Transportation

- 5.3.7. Packaging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North India India Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shalimar Paints

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sheenlac Paints Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jotun

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nippon Paint Holding Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Berger Paints India Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 JSW PAINTS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KAMDHENU COLOUR AND COATINGS LIMITED (KCCL)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Indigo Paints

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kansai Nerolac Paints Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Akzo Nobel N V

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Asian Paints

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Shalimar Paints

List of Figures

- Figure 1: India Paints & Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Paints & Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: India Paints & Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Paints & Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Paints & Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: India Paints & Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 5: India Paints & Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 6: India Paints & Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 7: India Paints & Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: India Paints & Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: India Paints & Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Paints & Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: India Paints & Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India Paints & Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: North India India Paints & Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North India India Paints & Coatings Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: South India India Paints & Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South India India Paints & Coatings Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: East India India Paints & Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East India India Paints & Coatings Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: West India India Paints & Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West India India Paints & Coatings Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: India Paints & Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: India Paints & Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 23: India Paints & Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 24: India Paints & Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 25: India Paints & Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: India Paints & Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 27: India Paints & Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: India Paints & Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Paints & Coatings Market?

The projected CAGR is approximately 9.38%.

2. Which companies are prominent players in the India Paints & Coatings Market?

Key companies in the market include Shalimar Paints, Sheenlac Paints Ltd*List Not Exhaustive, Jotun, Nippon Paint Holding Co Ltd, Berger Paints India Limited, JSW PAINTS, KAMDHENU COLOUR AND COATINGS LIMITED (KCCL), Indigo Paints, Kansai Nerolac Paints Limited, Akzo Nobel N V, Asian Paints.

3. What are the main segments of the India Paints & Coatings Market?

The market segments include Technology, Resin Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction Industry in the Country; Recovery of The Automotive Industry.

6. What are the notable trends driving market growth?

Architectural Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Fluctuation in the Raw Material Prices; Stringent Environmental Regulations Regarding Volatile Organic Compounds (VOC).

8. Can you provide examples of recent developments in the market?

Dec 2023: AkzoNobel collaborated with coatingAI to develop software to improve the paint application process and reduce carbon footprint. This technology is called Flightpath. This technology uses equipment settings to reduce defects and overspray. It also improves powder consumption, thereby reducing costs, avoiding rework, and saving time and energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Paints & Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Paints & Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Paints & Coatings Market?

To stay informed about further developments, trends, and reports in the India Paints & Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence