Key Insights

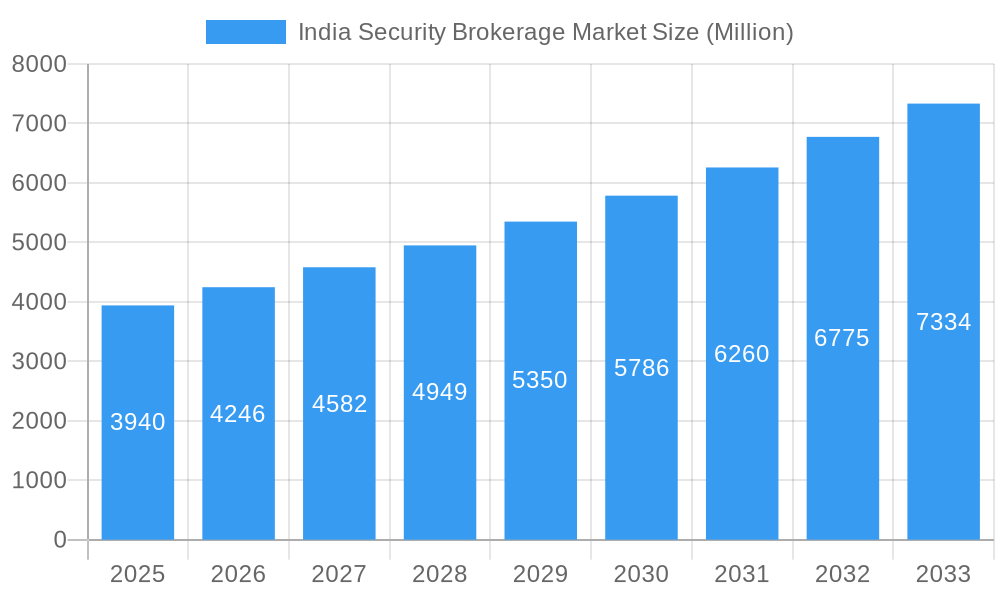

The India Security Brokerage Market, valued at $3.94 billion in 2025, is projected to experience robust growth, driven by increasing internet and smartphone penetration, a burgeoning young population actively participating in investments, and government initiatives promoting financial literacy. The market's Compound Annual Growth Rate (CAGR) of 7.89% from 2019 to 2024 suggests a sustained upward trajectory. This growth is fueled by a shift towards digital platforms, offering convenience and accessibility to a wider investor base. The rise of discount brokers like Zerodha, Upstox, and Groww has intensified competition, leading to innovative offerings and lower brokerage fees. While regulatory changes and market volatility pose potential challenges, the overall market outlook remains positive, with increasing participation from both retail and institutional investors contributing significantly to market expansion. The forecast period (2025-2033) anticipates continued expansion, propelled by technological advancements, expanding financial inclusion, and a growing preference for online trading.

India Security Brokerage Market Market Size (In Billion)

The competitive landscape is highly fragmented, with established players like ICICI Direct competing alongside disruptive fintech startups. These startups are leveraging technology to enhance user experience, providing advanced trading tools, and offering personalized investment advice. The market's segmentation, while not explicitly detailed, likely includes various service offerings (e.g., full-service brokerage, discount brokerage), customer demographics (e.g., retail investors, institutional investors), and geographical regions. Continued innovation in trading technologies, coupled with evolving investor preferences, will shape the future trajectory of this dynamic market. Future growth may be influenced by factors such as the overall economic climate, investor sentiment, and any further regulatory developments impacting the brokerage sector. The consistent adoption of digital platforms and growing financial awareness among the Indian population should continue to drive market expansion.

India Security Brokerage Market Company Market Share

India Security Brokerage Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Security Brokerage Market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. Expected market values are presented in Millions (USD).

India Security Brokerage Market Market Concentration & Innovation

The Indian security brokerage market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Zerodha, Angel Broking, Upstox, and Groww are prominent examples, holding a combined market share estimated at xx%. However, the market also features numerous smaller players, fostering intense competition. Innovation is a key driver, fueled by the adoption of fintech technologies, including mobile trading platforms, algorithmic trading tools, and AI-powered investment advice. The regulatory framework, primarily overseen by SEBI (Securities and Exchange Board of India), plays a crucial role in shaping market practices and ensuring investor protection. The increasing preference for online and mobile trading platforms presents a significant challenge to traditional brokerage firms, necessitating significant technological investments and adaptations.

Key Metrics & Observations:

- Market Concentration: xx% held by top 4 players (estimated).

- M&A Activity: Significant M&A activity observed, particularly in the fintech space (e.g., Groww's acquisition of Indiabulls Housing Finance's mutual fund business). Total M&A deal value in the last 5 years estimated at xx Million USD.

- Innovation Drivers: Fintech advancements, regulatory changes, evolving investor preferences.

- Product Substitutes: Robo-advisors, direct-to-consumer investment platforms.

- End-User Trends: Increasing adoption of mobile trading, preference for low-cost brokerage services, demand for personalized investment solutions.

India Security Brokerage Market Industry Trends & Insights

The Indian security brokerage market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing financial literacy, and a burgeoning middle class actively participating in investments. Technological disruptions, especially the proliferation of mobile-first platforms, have significantly impacted market dynamics. Consumers increasingly prefer user-friendly interfaces, low fees, and access to a wider range of investment products. The competitive landscape is highly dynamic, characterized by fierce competition among established players and the emergence of new fintech entrants. Market penetration of online brokerage services continues to rise, with a CAGR of xx% projected for the forecast period.

- Market Growth Drivers: Rising disposable incomes, increasing financial literacy, government initiatives promoting financial inclusion, technological advancements.

- Technological Disruptions: Mobile trading apps, algorithmic trading, AI-powered investment solutions.

- Consumer Preferences: Ease of use, low cost, personalized investment advice, diverse investment options.

- Competitive Dynamics: Intense competition, market consolidation, strategic partnerships, product diversification.

Dominant Markets & Segments in India Security Brokerage Market

The Indian security brokerage market is largely dominated by the urban centers, particularly in major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai. These regions exhibit higher levels of financial literacy, internet penetration, and disposable incomes, driving higher adoption of online brokerage services. Rural markets present a significant untapped potential, however, requiring focused strategies to address challenges like digital literacy and infrastructure limitations.

Key Drivers of Regional Dominance:

- Economic factors: Higher disposable income, greater financial awareness, improved infrastructure.

- Technological infrastructure: Better internet connectivity, increased smartphone penetration.

- Regulatory support: Supportive government policies and initiatives to promote financial inclusion.

The market is segmented by customer type (retail vs. institutional), brokerage type (full-service vs. discount), and service offerings (trading, investment advisory, portfolio management).

India Security Brokerage Market Product Developments

The Indian security brokerage market witnesses continuous product innovation, with a focus on enhancing user experience and leveraging technology. New mobile trading apps with advanced features, AI-powered trading tools, and robo-advisory services are reshaping the competitive landscape. These developments are improving market access, efficiency, and transparency, appealing to a broader spectrum of investors. The integration of artificial intelligence and machine learning is set to further revolutionize investment strategies and risk management.

Report Scope & Segmentation Analysis

This report segments the Indian security brokerage market by customer type (retail and institutional investors), service type (full-service and discount brokerages), product type (equities, derivatives, mutual funds, etc.), and region. Each segment exhibits distinct growth trajectories and competitive dynamics. For example, the retail segment is experiencing rapid growth, driven by the rise of online trading, while the institutional segment remains relatively mature, albeit characterized by increasing demand for sophisticated trading and analytical tools. Growth projections vary across segments, reflecting diverse market dynamics and opportunities.

Key Drivers of India Security Brokerage Market Growth

Several key factors fuel the growth of the Indian security brokerage market. The rising middle class with increased disposable income is a major driver, as is growing financial awareness and participation in the capital markets. Government initiatives promoting financial inclusion, along with supportive regulatory frameworks, further encourage market expansion. The rapid advancement and adoption of fintech technologies, especially mobile trading platforms, enhances accessibility and efficiency, further accelerating growth.

Challenges in the India Security Brokerage Market Sector

The Indian security brokerage market faces several challenges. Regulatory compliance costs can be significant for brokerages, especially for smaller firms. Competition is fierce, impacting profitability. Cybersecurity threats and data privacy concerns are significant issues that require robust security measures. Additionally, reaching and educating investors in under-served rural areas presents a significant challenge.

Emerging Opportunities in India Security Brokerage Market

Significant opportunities exist in the Indian security brokerage market. Expanding into underserved rural markets through digital outreach holds immense potential. The increasing adoption of AI-powered solutions offers opportunities for enhanced risk management and personalized investment advice. The growing popularity of alternative investments creates a niche for brokers to offer diversified portfolios. Furthermore, strategic partnerships with fintech companies can enhance service offerings and expand market reach.

Key Developments in India Security Brokerage Market Industry

- May 2023: Groww acquired a 100 percent stake in Indiabulls Housing Finance's mutual fund business for 21.23 Million USD, aiming to enhance accessibility and transparency in mutual fund investments.

- March 2022: Axis Bank acquired Citibank's consumer businesses in India, including wealth management, signaling increased competition and market consolidation within the broader financial services sector.

Strategic Outlook for India Security Brokerage Market Market

The Indian security brokerage market holds significant growth potential, driven by increasing financial inclusion, technological advancements, and a burgeoning investor base. Strategic partnerships, product innovation, and expansion into underserved markets will be crucial for success. The focus on enhancing user experience and leveraging AI and data analytics will differentiate players and capture market share. The continued evolution of regulatory frameworks will require adaptability and compliance from all stakeholders.

India Security Brokerage Market Segmentation

-

1. Type of Security

- 1.1. Bonds

- 1.2. Stocks

- 1.3. Treasury Notes

- 1.4. Derivatives

- 1.5. Other Types of Securities

-

2. Brokerage Service

- 2.1. Stocks

- 2.2. Insurance

- 2.3. Mortgage

- 2.4. Real Estate

- 2.5. Forex

- 2.6. Leasing

- 2.7. Other Brokerage Services

-

3. Service

- 3.1. Full-Service

- 3.2. Discount

- 3.3. Online

- 3.4. Robo Advisor

- 3.5. Brokers-Dealers

India Security Brokerage Market Segmentation By Geography

- 1. India

India Security Brokerage Market Regional Market Share

Geographic Coverage of India Security Brokerage Market

India Security Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.3. Market Restrains

- 3.3.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.4. Market Trends

- 3.4.1. Increasing Demat account and brokerage business affecting Indian Security Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Security Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 5.1.1. Bonds

- 5.1.2. Stocks

- 5.1.3. Treasury Notes

- 5.1.4. Derivatives

- 5.1.5. Other Types of Securities

- 5.2. Market Analysis, Insights and Forecast - by Brokerage Service

- 5.2.1. Stocks

- 5.2.2. Insurance

- 5.2.3. Mortgage

- 5.2.4. Real Estate

- 5.2.5. Forex

- 5.2.6. Leasing

- 5.2.7. Other Brokerage Services

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Full-Service

- 5.3.2. Discount

- 5.3.3. Online

- 5.3.4. Robo Advisor

- 5.3.5. Brokers-Dealers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zerodha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Angel Brokers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Upstox

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groww

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 5 paisa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SAS Online

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India Infoline

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Smart Online

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Flyers Securities

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ICICI direct stock broker**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zerodha

List of Figures

- Figure 1: India Security Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Security Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 2: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 3: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 4: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 5: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 7: India Security Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Security Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 10: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 11: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 12: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 13: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 15: India Security Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Security Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Security Brokerage Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the India Security Brokerage Market?

Key companies in the market include Zerodha, Angel Brokers, Upstox, Groww, 5 paisa, SAS Online, India Infoline, Trade Smart Online, Flyers Securities, ICICI direct stock broker**List Not Exhaustive.

3. What are the main segments of the India Security Brokerage Market?

The market segments include Type of Security, Brokerage Service, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.94 Million as of 2022.

5. What are some drivers contributing to market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

6. What are the notable trends driving market growth?

Increasing Demat account and brokerage business affecting Indian Security Brokerage Market.

7. Are there any restraints impacting market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

8. Can you provide examples of recent developments in the market?

May 2023: Fintech unicorn Groww acquired a 100 percent stake in the mutual fund business of Indiabulls Housing Finance for INR 175.62 crores (21.23 million USD). The acquisition was made to make mutual funds more accessible, simpler, and transparent, besides lowering the cost by Groww.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Security Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Security Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Security Brokerage Market?

To stay informed about further developments, trends, and reports in the India Security Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence