Key Insights

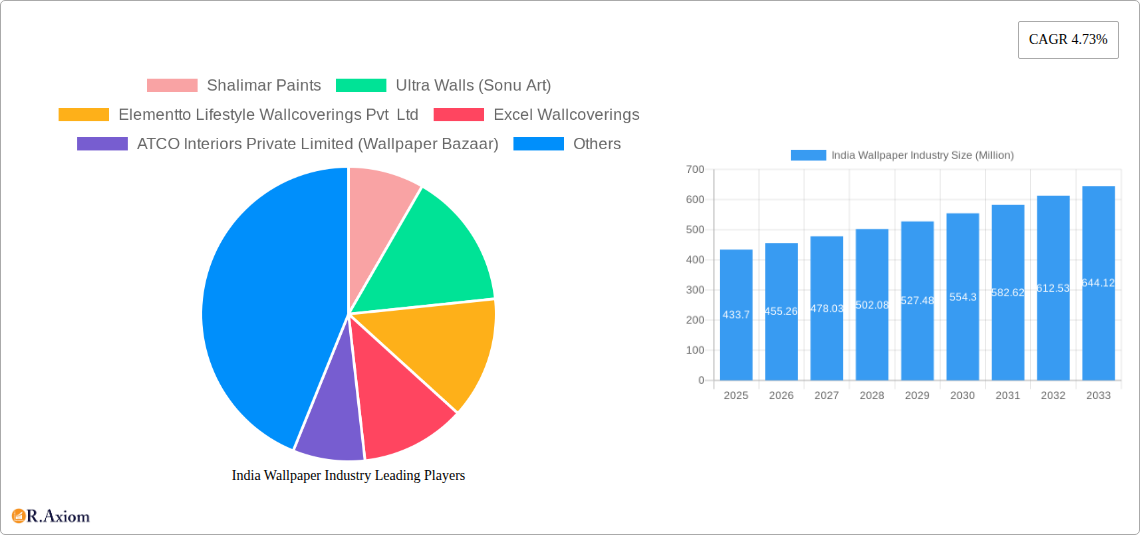

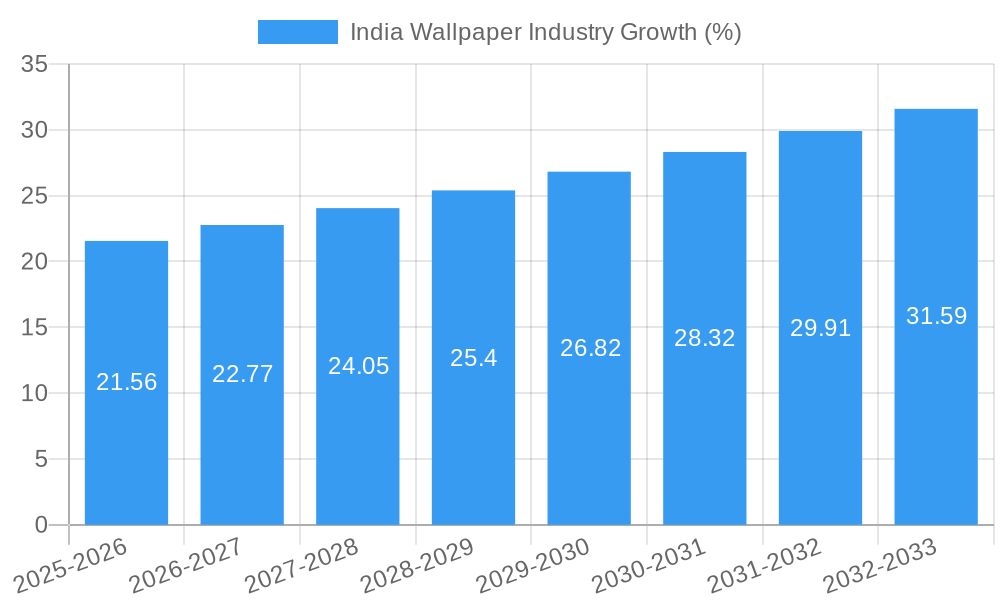

The Indian wallpaper market, valued at ₹433.70 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.73% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes and a burgeoning middle class are fueling increased spending on home improvement and interior design, creating significant demand for aesthetically pleasing and functional wall coverings. The growing popularity of contemporary interior design styles, particularly among younger homeowners, further stimulates market growth. E-commerce platforms have broadened accessibility, making diverse wallpaper options available nationwide, contributing significantly to market expansion. While the preference for vinyl-based wallpapers remains dominant, the market is witnessing a growing interest in eco-friendly and sustainable options like non-woven and fabric wallpapers, indicating a shift towards conscious consumerism. This trend, coupled with the increasing popularity of customized and personalized wallpaper designs, is reshaping the industry landscape. The residential sector currently constitutes the largest market segment, but the commercial segment is expected to experience accelerated growth driven by increasing investments in hospitality and office spaces. Competition is intense, with both established paint manufacturers like Asian Paints and Shalimar Paints diversifying into the wallpaper market and specialized wallpaper companies vying for market share. The market is segmented geographically, with potential for regional variations based on income levels, design preferences, and urbanization rates.

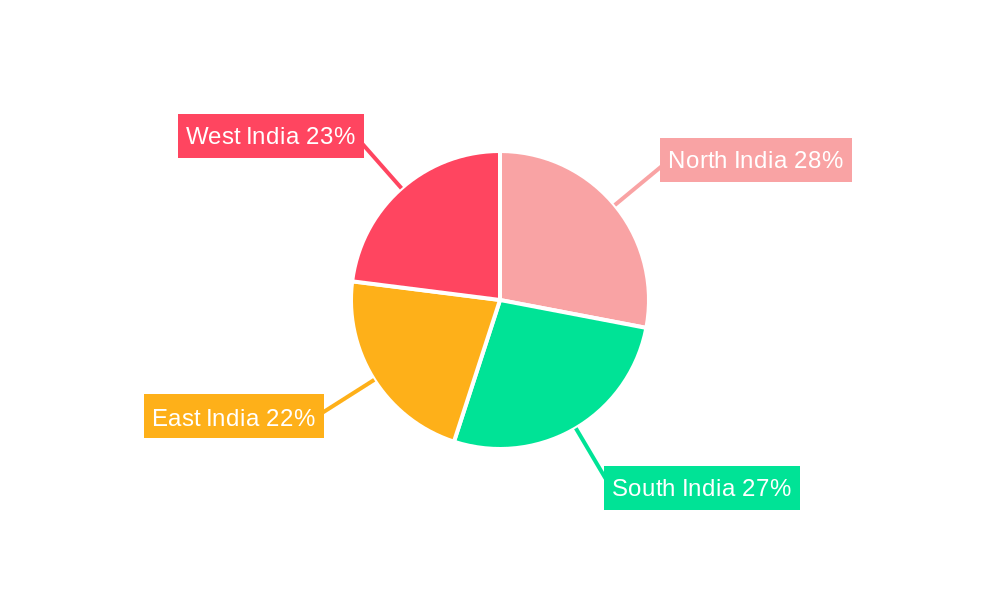

The competitive landscape is dynamic, featuring both large paint manufacturers leveraging their existing distribution networks and smaller specialized players offering niche designs and customization options. Geographical variations exist within the Indian market, with North and South India potentially exhibiting different growth trajectories due to varying economic development and consumer preferences. Despite the promising growth outlook, challenges remain. Price sensitivity among certain consumer segments and the availability of cheaper alternatives like paint might impede market expansion. Furthermore, maintaining consistent quality and addressing consumer concerns regarding durability and maintenance could play a crucial role in long-term market success. The future of the Indian wallpaper market hinges on adapting to changing consumer preferences, leveraging technological advancements in design and manufacturing, and navigating the evolving competitive landscape.

India Wallpaper Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the India wallpaper industry, covering market size, segmentation, growth drivers, challenges, and future outlook from 2019 to 2033. The report includes detailed insights into market concentration, innovation, leading players, and key industry developments. With a base year of 2025 and an estimated year of 2025, this report offers valuable data for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The forecast period spans 2025-2033, while the historical period analyzed is 2019-2024. The report's findings are crucial for investors, manufacturers, distributors, and policymakers interested in the Indian wallpaper market.

India Wallpaper Industry Market Concentration & Innovation

The Indian wallpaper market exhibits a moderately fragmented landscape with several major players and numerous smaller regional players competing for market share. While precise market share data for each company is proprietary, Asian Paints Ltd and Berger Paints Ltd, with their extensive distribution networks and brand recognition, command significant market share. Other prominent players include Shalimar Paints, Ultra Walls (Sonu Art), Elementto Lifestyle Wallcoverings Pvt Ltd, Excel Wallcoverings, ATCO Interiors Private Limited (Wallpaper Bazaar), Gratex Industries Ltd, WOLTOP INDIA PVT LTD, Adornis Wallpapers, Happy Walls, Marshalls Wallcoverings, and Kamdhenu Paint. The market is witnessing increasing consolidation through mergers and acquisitions (M&A) although specific deal values are unavailable for public reporting (xx Million).

Innovation in the industry is driven by factors such as:

- Technological advancements: Introduction of new materials, printing techniques, and designs.

- Changing consumer preferences: Demand for eco-friendly, customizable, and aesthetically appealing wallpapers.

- E-commerce growth: Online platforms are facilitating wider reach and increased product variety.

Regulatory frameworks, while not overly restrictive, influence product safety and environmental standards. Product substitutes, like paint and other wall coverings, exert competitive pressure. End-user trends increasingly favor sustainable and design-focused options.

India Wallpaper Industry Industry Trends & Insights

The Indian wallpaper industry is projected to experience a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising disposable incomes: An expanding middle class fuels demand for home improvement and interior décor.

- Urbanization: A significant shift in population from rural to urban areas boosts demand for aesthetically pleasing homes.

- Growing awareness of interior design: Increased access to information through media and online platforms drives demand for stylish and functional wall coverings.

- E-commerce penetration: The rising popularity of online shopping platforms significantly expands market reach and accessibility.

Technological disruptions, such as digital printing and new material technologies, are enhancing product quality and design customization. Consumer preferences are shifting towards eco-friendly, durable, and easy-to-install wallpapers, leading to greater emphasis on non-woven and vinyl-based options. Competitive dynamics are marked by both price competition and differentiation through product innovation and branding. The market penetration of wallpapers, especially in residential sectors, is steadily increasing, although precise figures remain unavailable (xx%).

Dominant Markets & Segments in India Wallpaper Industry

By Type: Vinyl-based wallpapers currently dominate the market, owing to their durability, affordability, and wide availability. Non-woven wallpapers are gaining traction due to their superior quality and ease of installation. The paper/traditional wallpaper segment maintains a niche market catering to specific design preferences. Fabric (Textile) wallpapers represent a premium segment, catering to high-end residential and commercial projects.

By Distribution Channel: Retail channels, including home improvement stores and specialized wallpaper shops, continue to be the primary distribution channel. E-commerce is experiencing significant growth, offering convenience and wider selection to consumers.

By End User: The residential sector constitutes the largest segment, driven by the aforementioned factors like rising incomes and urbanization. Commercial sectors, including offices and hospitality spaces, represent a significant and growing segment as businesses increasingly focus on enhancing their aesthetics and creating a positive brand image.

Key Drivers:

- Economic growth and rising disposable incomes: These factors are driving increased spending on home improvement and interior decoration.

- Government initiatives promoting affordable housing: These initiatives stimulate demand for cost-effective wall coverings.

- Growing construction activity: A surge in infrastructure development and new residential projects boosts wallpaper demand.

- Favorable demographic trends: A young and expanding population drives the demand for stylish and modern homes.

India Wallpaper Industry Product Developments

Recent product innovations center on enhancing durability, aesthetics, and ease of installation. Digital printing technology is facilitating greater design customization and flexibility. Eco-friendly materials and sustainable manufacturing practices are gaining prominence, aligning with consumer preferences for environmentally conscious products. The market is also seeing the introduction of wallpapers with advanced features, such as sound insulation or stain resistance, catering to specific end-user needs and enhancing their competitive advantages.

Report Scope & Segmentation Analysis

The report segments the Indian wallpaper market by type (Vinyl-based, Non-woven, Paper/Traditional Wallpaper, Fabric (Textile)), distribution channel (E-commerce, Retail), and end-user (Residential, Commercial). Growth projections vary significantly across segments. The vinyl-based segment is expected to maintain its dominance, while non-woven and e-commerce channels exhibit the highest growth potential. Competitive dynamics are influenced by factors such as pricing strategies, product differentiation, and brand recognition. Market sizes for each segment are estimated (xx Million for each) and detailed further within the full report.

Key Drivers of India Wallpaper Industry Growth

The growth of the India wallpaper industry is driven by a confluence of factors: rising disposable incomes leading to increased spending on home improvement, rapid urbanization creating a larger market for home décor products, and technological advancements in printing and material science leading to innovative and attractive wallpaper options. Additionally, the burgeoning e-commerce sector provides easier access to a broader range of products, boosting sales and market expansion. Government policies encouraging affordable housing further contribute to the growth trajectory.

Challenges in the India Wallpaper Industry Sector

Challenges facing the industry include fluctuating raw material prices, intense competition from substitute products, and the need to manage a complex and sometimes unreliable supply chain. Furthermore, there are potential regulatory hurdles related to environmental standards and product safety. These factors can impact profitability and growth projections, requiring companies to adopt efficient strategies to mitigate risks. The overall impact of these challenges is estimated to be xx% reduction on profit margins.

Emerging Opportunities in India Wallpaper Industry

Emerging opportunities lie in the increasing demand for customizable, eco-friendly, and technologically advanced wallpapers. Expansion into rural markets holds significant potential, alongside catering to the growing commercial and hospitality segments. The exploration of innovative materials and designs, incorporating smart features or integrating with home automation systems, presents further growth avenues.

Leading Players in the India Wallpaper Industry Market

- Shalimar Paints

- Ultra Walls (Sonu Art)

- Elementto Lifestyle Wallcoverings Pvt Ltd

- Excel Wallcoverings

- ATCO Interiors Private Limited (Wallpaper Bazaar)

- Gratex Industries Ltd

- WOLTOP INDIA PVT LTD

- Adornis Wallpapers

- Happy Walls

- Asian Paints Ltd

- Marshalls Wallcoverings

- Kamdhenu Paint

- Berger Paints Ltd

Key Developments in India Wallpaper Industry Industry

April 2022: Launch of the "Noor" wallpaper series by UDC Homes, highlighting Indian artistry and design. This launch significantly impacted the market by showcasing high-quality, culturally relevant designs.

January 2022: Introduction of "Wander" wallpapers from Coordonne (Spain) by Nirmals Furnishings, showcasing luxury and international design trends to the Indian market. This development introduced a high-end product line and potentially impacted the premium segment's growth.

Strategic Outlook for India Wallpaper Industry Market

The Indian wallpaper industry presents a promising outlook, driven by sustained economic growth, urbanization, and evolving consumer preferences. The market's expansion into newer segments, such as commercial spaces and online channels, offers substantial growth potential. Continuous innovation in product design and material technology will be crucial to maintaining competitiveness and capturing a larger market share. A focus on sustainability and eco-friendly practices will resonate with increasingly environmentally conscious consumers.

India Wallpaper Industry Segmentation

-

1. Type

- 1.1. Vinyl-based

- 1.2. Non-woven

- 1.3. Paper/Traditional Wallpaper

- 1.4. Fabric (Textile)

-

2. Distribution Channel

- 2.1. E-commerce

- 2.2. Retail

-

3. End User

- 3.1. Residential

-

3.2. Commerci

- 3.2.1. Hospitality

- 3.2.2. Corporate Office Space

- 3.2.3. Salons and Spas

- 3.2.4. Hospitals

- 3.2.5. Other Commercial End Users

India Wallpaper Industry Segmentation By Geography

- 1. India

India Wallpaper Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Infrastructural Development And Changing Lifestyle; Growing Consumer Preference for decorative wallpaper instead of Painting

- 3.3. Market Restrains

- 3.3.1. Awareness And Alternatives; Shorter Life-span on Exposure to Heat & Moisture

- 3.4. Market Trends

- 3.4.1. Vinyl Based Wallpapers Account for the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vinyl-based

- 5.1.2. Non-woven

- 5.1.3. Paper/Traditional Wallpaper

- 5.1.4. Fabric (Textile)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. E-commerce

- 5.2.2. Retail

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commerci

- 5.3.2.1. Hospitality

- 5.3.2.2. Corporate Office Space

- 5.3.2.3. Salons and Spas

- 5.3.2.4. Hospitals

- 5.3.2.5. Other Commercial End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Wallpaper Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shalimar Paints

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ultra Walls (Sonu Art)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Elementto Lifestyle Wallcoverings Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Excel Wallcoverings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ATCO Interiors Private Limited (Wallpaper Bazaar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gratex Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 WOLTOP INDIA PVT LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Adornis Wallpapers

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Happy Walls

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Asian Paints Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Marshalls Wallcoverings

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kamdhenu Paint*List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Berger Paints Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Shalimar Paints

List of Figures

- Figure 1: India Wallpaper Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Wallpaper Industry Share (%) by Company 2024

List of Tables

- Table 1: India Wallpaper Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Wallpaper Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Wallpaper Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Wallpaper Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: India Wallpaper Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Wallpaper Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Wallpaper Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Wallpaper Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Wallpaper Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: India Wallpaper Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: India Wallpaper Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wallpaper Industry?

The projected CAGR is approximately 4.73%.

2. Which companies are prominent players in the India Wallpaper Industry?

Key companies in the market include Shalimar Paints, Ultra Walls (Sonu Art), Elementto Lifestyle Wallcoverings Pvt Ltd, Excel Wallcoverings, ATCO Interiors Private Limited (Wallpaper Bazaar), Gratex Industries Ltd, WOLTOP INDIA PVT LTD, Adornis Wallpapers, Happy Walls, Asian Paints Ltd, Marshalls Wallcoverings, Kamdhenu Paint*List Not Exhaustive, Berger Paints Ltd.

3. What are the main segments of the India Wallpaper Industry?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 433.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Infrastructural Development And Changing Lifestyle; Growing Consumer Preference for decorative wallpaper instead of Painting.

6. What are the notable trends driving market growth?

Vinyl Based Wallpapers Account for the Significant Market Share.

7. Are there any restraints impacting market growth?

Awareness And Alternatives; Shorter Life-span on Exposure to Heat & Moisture.

8. Can you provide examples of recent developments in the market?

April 2022: Noor, a series of wallpapers by UDC Homes, honored India's illustrious architectural past and the skilled craft of the country's artisans. The new, colorful wallpaper patterns, which take their name from the Arabic word for light, "Nur," symbolize the various facets of nature and beauty, like the flutter of a bird, a hint of vegetation, and the peace just before dusk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wallpaper Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wallpaper Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wallpaper Industry?

To stay informed about further developments, trends, and reports in the India Wallpaper Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence