Key Insights

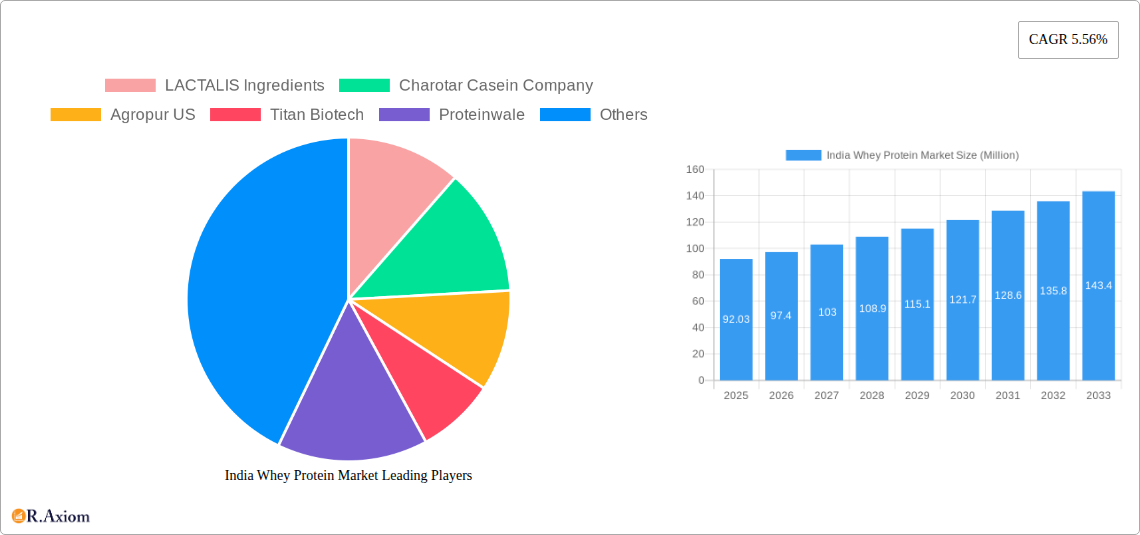

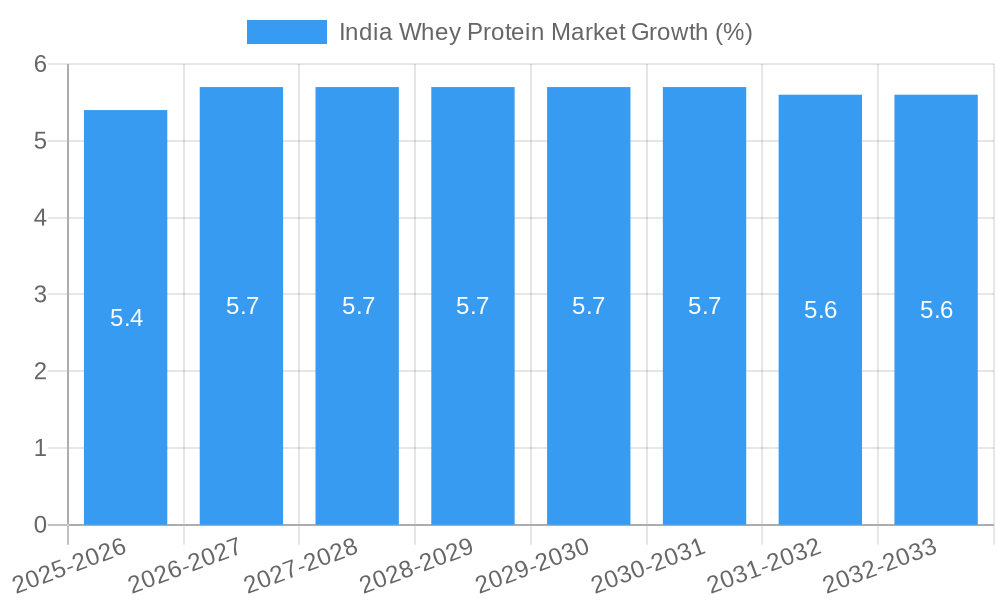

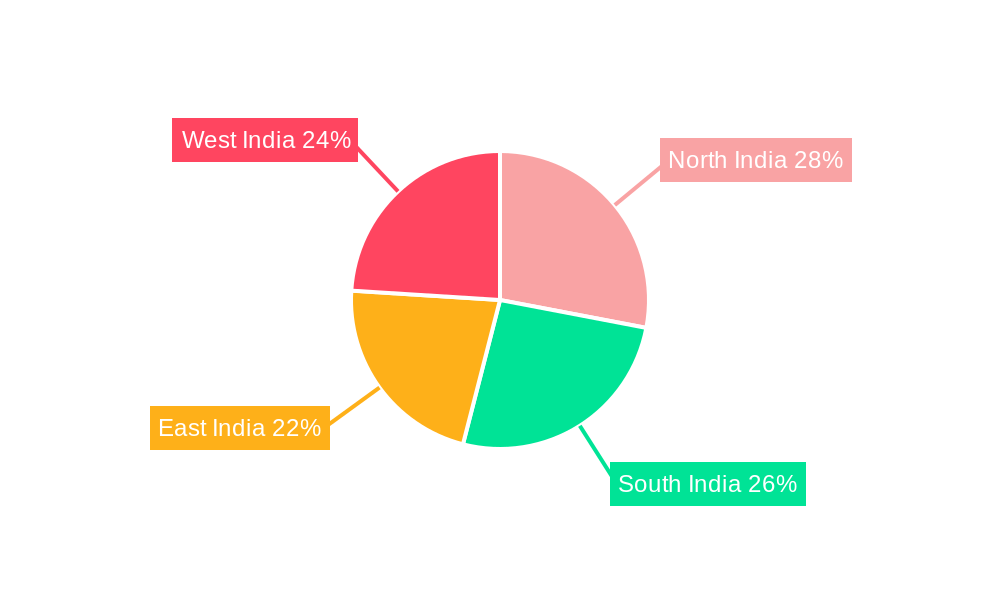

The India whey protein market, valued at $92.03 million in 2025, is projected to experience robust growth, driven by a rising health-conscious population, increasing awareness of fitness and nutrition, and a surge in demand for convenient protein supplements. The market's Compound Annual Growth Rate (CAGR) of 5.56% from 2025 to 2033 indicates a substantial expansion over the forecast period. Key drivers include the growing popularity of sports and performance nutrition, the increasing consumption of functional foods and fortified products, and the rising demand for infant formula containing whey protein. The market is segmented by application (sports and performance nutrition, infant formula, functional/fortified food) and product type (whey protein concentrate, whey protein isolate, hydrolyzed whey protein). While the precise market share of each segment isn't provided, sports and performance nutrition likely dominates, followed by infant formula and functional foods, reflecting current global trends. The regional breakdown shows significant potential across all regions (North, South, East, and West India), though specific regional market shares require further data. Leading players such as Lactalis Ingredients, Charotar Casein Company, and Glanbia PLC are strategically positioning themselves to capitalize on this burgeoning market, investing in product innovation and distribution channels.

The consistent growth is anticipated to continue due to several factors. Increased disposable incomes, coupled with greater access to information about health and wellness via digital platforms, are influencing consumer choices. Moreover, the evolving preferences for convenient and high-protein diets are fueling demand. However, potential restraints include fluctuating raw material prices and regulatory hurdles related to food safety and labeling. To maintain sustainable growth, companies will need to focus on product differentiation, emphasizing quality and safety, and exploring innovative marketing strategies to reach target consumer segments effectively. The expanding market presents significant opportunities for both established players and new entrants, particularly those focused on catering to the specific needs of various consumer groups within India.

This comprehensive report provides an in-depth analysis of the India whey protein market, covering market size, growth drivers, challenges, opportunities, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors. The market is segmented by application (Sports and Performance Nutrition, Infant Formula, Functional/Fortified Food) and product type (Whey Protein Concentrate, Whey Protein Isolate, Hydrolyzed Whey Protein).

India Whey Protein Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian whey protein market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is moderately concentrated, with key players such as LACTALIS Ingredients, Charotar Casein Company, and Fonterra Group holding significant market share. However, the presence of numerous smaller players indicates a dynamic competitive environment. Precise market share figures for each company are unavailable at this time (xx%).

Innovation Drivers:

- Growing demand for health and wellness products.

- Increasing adoption of sports and fitness activities.

- Advancements in whey protein processing and formulation.

- Development of functional and fortified food products.

Regulatory Framework: The Indian government's regulations on food safety and labeling impact the industry, influencing product development and marketing strategies. Stringent quality standards drive innovation in manufacturing processes and product quality.

Product Substitutes: Plant-based protein sources, such as soy and pea protein, pose a competitive threat. However, whey protein continues to dominate due to its superior bioavailability and nutritional profile.

End-User Trends: Consumers are increasingly health-conscious and prefer high-quality, functional foods. This trend fuels the demand for premium whey protein products with added benefits like improved digestibility or enhanced muscle recovery.

M&A Activities: Recent mergers and acquisitions (M&A) activities reflect the consolidating nature of the market. While precise deal values are unavailable (xx Million), the acquisitions demonstrate a strategic focus on expanding production capacity and market reach.

India Whey Protein Market Industry Trends & Insights

The Indian whey protein market is experiencing significant growth, driven by several factors. The rising health consciousness among consumers, particularly in urban areas, and a burgeoning fitness culture are key contributors. Increased disposable income and changing lifestyles have fueled the demand for convenient and nutritious protein supplements. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to be xx% during the forecast period (2025-2033). Market penetration remains relatively low, presenting significant growth potential. Technological advancements, such as precision fermentation, are disrupting the industry, presenting opportunities for sustainable and innovative protein sources. This technological disruption, along with evolving consumer preferences for clean label products and personalized nutrition, is influencing the competitive landscape. Key players are responding to these trends by introducing new products and expanding their distribution networks. The competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and brand building.

Dominant Markets & Segments in India Whey Protein Market

The Indian whey protein market is dominated by the Sports and Performance Nutrition segment, driven by a rapidly growing fitness culture and increased participation in sports. The Whey Protein Concentrate segment holds the largest market share in terms of product type, owing to its lower cost compared to isolates and hydrolysates. While data is unavailable for precise market sizing (xx Million for each segment), analysis suggests that the urban regions of India show greater adoption of whey protein.

Key Drivers of Dominance:

Sports and Performance Nutrition: Rising health consciousness, increasing gym memberships, and participation in fitness activities.

Whey Protein Concentrate: Cost-effectiveness and wide availability.

Urban Regions: Higher disposable income, greater awareness of health and fitness.

Infant Formula: Growing preference for nutritious infant formulas contributes to a notable segment, although data suggests its market share is smaller than the sports nutrition segment.

Functional/Fortified Food: This segment's growth is linked to the rising popularity of health-conscious food choices and functional foods. This segment is relatively small, however, reflecting consumers' less established purchasing habits in this area.

India Whey Protein Market Product Developments

Recent innovations focus on enhancing product quality, taste, and functionality. Companies are introducing whey protein products with improved solubility, digestibility, and added functional benefits, such as enhanced muscle recovery or immune support. Technological advancements, such as microencapsulation and nanotechnology, are used to improve product stability and delivery. The market sees a growing trend towards clean label products with minimal processing and natural ingredients, reflecting the increasing consumer demand for transparency and authenticity. These developments aim to cater to the evolving needs and preferences of health-conscious consumers.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the India whey protein market, segmented by application and product type.

Application:

- Sports and Performance Nutrition: This segment is characterized by high growth potential due to the increasing popularity of fitness activities and health consciousness. Market size is expected to reach xx Million by 2033.

- Infant Formula: This segment is driven by the growing demand for nutritious infant formulas. The market size is estimated at xx Million in 2025.

- Functional/Fortified Food: This segment is characterized by moderate growth potential, driven by the rising popularity of functional foods. The estimated market size in 2025 is xx Million.

Product Type:

- Whey Protein Concentrate: This segment dominates the market due to its cost-effectiveness and wide availability. The projected market size for 2033 is xx Million.

- Whey Protein Isolate: This segment is growing due to its high protein content and purity. The estimated market size in 2025 is xx Million.

- Hydrolyzed Whey Protein: This niche segment caters to consumers seeking rapid protein absorption. The estimated market size in 2025 is xx Million.

Key Drivers of India Whey Protein Market Growth

The growth of the Indian whey protein market is fueled by several key factors:

- The rising prevalence of health and wellness trends, including increased fitness activity and dietary awareness, drives demand for protein supplements.

- Increasing disposable incomes and urbanization lead to higher spending on health and wellness products, creating a larger consumer base.

- The increasing availability of whey protein products through various distribution channels enhances accessibility.

Challenges in the India Whey Protein Market Sector

Several challenges hinder the growth of the Indian whey protein market:

- Concerns regarding the authenticity and quality of certain whey protein products, particularly from smaller or less established brands, deter consumers.

- The fluctuating prices of raw materials, such as milk, impact the cost of production and profitability for manufacturers.

- Competition from plant-based protein alternatives is increasing, posing a challenge to market dominance. This is impacting market share, with projections placing the loss at approximately xx% annually.

Emerging Opportunities in India Whey Protein Market

The Indian whey protein market presents several exciting opportunities:

- Growing demand for specialized whey protein products, such as those targeted towards specific dietary needs or age groups, presents a niche opportunity for innovation and product development.

- The increasing adoption of e-commerce and online retail channels provides new avenues for reaching consumers.

- The expansion of the fitness and wellness industry provides a larger target market for protein supplements.

Leading Players in the India Whey Protein Market Market

- LACTALIS Ingredients

- Charotar Casein Company

- Agropur US

- Titan Biotech

- Proteinwale

- Glanbia PLC

- Arla Foods Amba

- Medisysbiotech Private Limited

- Euroserum

- Fonterra Group

Key Developments in India Whey Protein Market Industry

- June 2022: NZMP launched Pro-OptimaTM, a functional Whey Protein Concentrate. This launch expands the range of high-quality whey protein products available in the market, further driving competition and innovation.

- August 2022: Fonterra and DSM launched a precision fermentation startup for sustainable dairy proteins, indicating a shift towards environmentally friendly production methods. This move increases the market's focus on sustainable production, potentially attracting environmentally-conscious consumers.

- May 2022: Perfect Day Foods' expansion into India, including the acquisition of Sterling Biotech's manufacturing plants, significantly increases production capacity and market reach. This demonstrates a significant investment in the Indian market and potential for increased competition.

Strategic Outlook for India Whey Protein Market Market

The Indian whey protein market exhibits strong growth potential, driven by the factors discussed above. The focus on product innovation, sustainable production, and strategic partnerships will be crucial for success. Companies that can effectively cater to the evolving needs and preferences of health-conscious consumers, while maintaining competitive pricing and ensuring product quality, are well-positioned to capture significant market share in the years to come. The expanding market presents opportunities for both established players and new entrants.

India Whey Protein Market Segmentation

-

1. Product Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

India Whey Protein Market Segmentation By Geography

- 1. India

India Whey Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Costs and Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Surge in Participation of Sports and Physical Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 LACTALIS Ingredients

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Charotar Casein Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Agropur US

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Titan Biotech

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Proteinwale

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Glanbia PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arla Foods Amba

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medisysbiotech Private Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Euroserum

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fonterra Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LACTALIS Ingredients

List of Figures

- Figure 1: India Whey Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Whey Protein Market Share (%) by Company 2024

List of Tables

- Table 1: India Whey Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Whey Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Whey Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: India Whey Protein Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: India Whey Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Whey Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: India Whey Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Whey Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Whey Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Whey Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Whey Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: India Whey Protein Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 21: India Whey Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: India Whey Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 23: India Whey Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Whey Protein Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Whey Protein Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the India Whey Protein Market?

Key companies in the market include LACTALIS Ingredients, Charotar Casein Company, Agropur US, Titan Biotech, Proteinwale, Glanbia PLC, Arla Foods Amba, Medisysbiotech Private Limited*List Not Exhaustive, Euroserum, Fonterra Group.

3. What are the main segments of the India Whey Protein Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 92.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein.

6. What are the notable trends driving market growth?

Surge in Participation of Sports and Physical Activities.

7. Are there any restraints impacting market growth?

High Manufacturing Costs and Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

May 2022: Perfect Day Foods, a California-based food technology startup making whey and casein proteins using precision fermentation, expanded its footprint in animal-free products by investing both in India. The company launched a new Enterprise Biology Hub in Salt Lake City and also announced its plans to expand in India with a liquidation buy-off of Mumbai-based Sterling Biotech, acquiring two manufacturing plants in Gujarat and another in Tamil Nadu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Whey Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Whey Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Whey Protein Market?

To stay informed about further developments, trends, and reports in the India Whey Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence