Key Insights

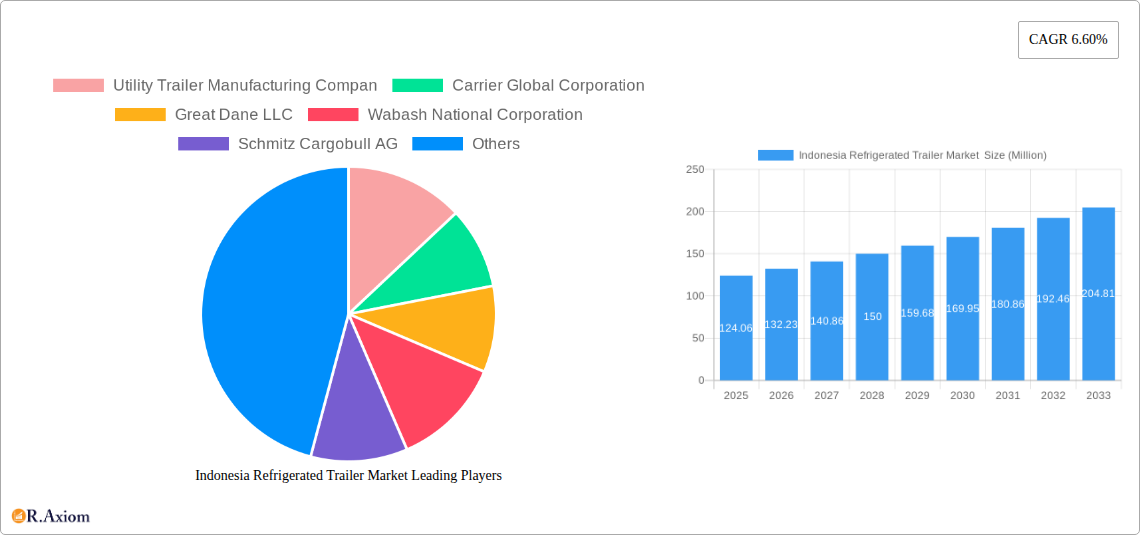

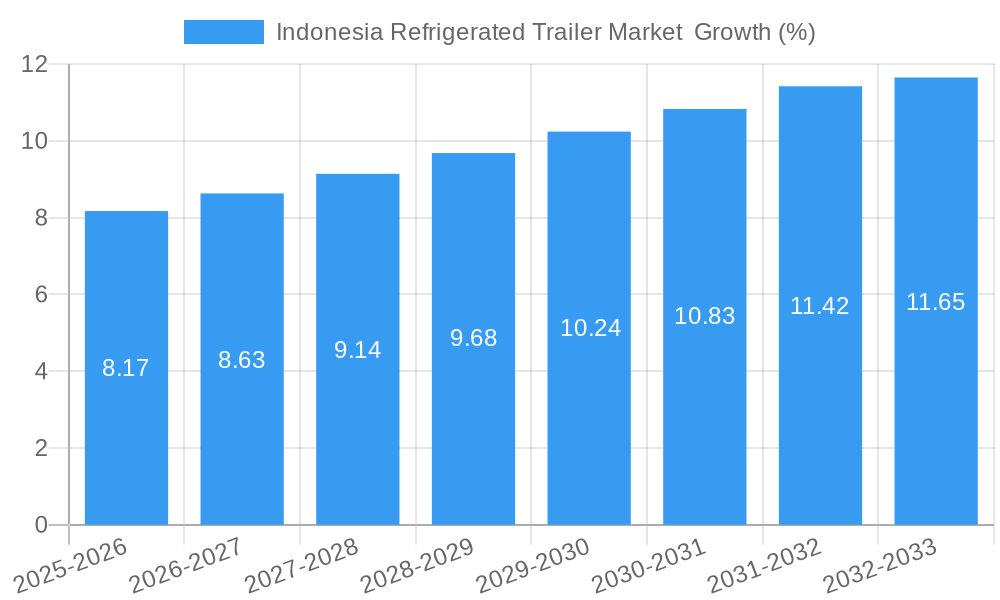

The Indonesian refrigerated trailer market, valued at $124.06 million in 2025, is projected to experience robust growth, driven by the expanding food and beverage sector, particularly within dairy, fruits and vegetables, and meat and seafood segments. This growth is further fueled by increasing e-commerce penetration and the need for efficient cold chain logistics to maintain product quality and prevent spoilage. The rising demand for temperature-controlled transportation across Indonesia's diverse geography necessitates a strong refrigerated trailer fleet. While the single-axle segment currently holds a significant market share, the demand for tandem and multi-axle trailers is anticipated to rise due to the increasing payload requirements for longer hauls and larger volumes. Key players like Utility Trailer Manufacturing Company, Carrier Global Corporation, and Great Dane LLC are actively competing in this market, focusing on technological advancements in refrigeration units and trailer design to enhance efficiency and reduce operational costs. The market's growth, however, faces potential restraints such as high initial investment costs for refrigerated trailers and the need for ongoing maintenance. Nevertheless, government initiatives promoting food safety and cold chain infrastructure development are poised to create positive growth momentum throughout the forecast period (2025-2033).

The projected Compound Annual Growth Rate (CAGR) of 6.60% suggests a substantial increase in market value over the next decade. This growth is expected to be driven by both organic expansion within existing segments and the potential entry of new players offering innovative solutions. Factors such as improvements in road infrastructure and the development of efficient transportation networks will contribute to the market's positive trajectory. Furthermore, the rising consumer awareness of food safety and quality is indirectly influencing the demand for reliable refrigerated transportation solutions, creating a favorable environment for market expansion. Competition among established players will likely intensify, leading to technological advancements and potentially more competitive pricing. The market segmentation by product type (frozen and chilled food), axle type (single, tandem, multi-axle), and end-user further illustrates the diverse aspects of this dynamic and expanding industry in Indonesia.

Indonesia Refrigerated Trailer Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Refrigerated Trailer Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The report meticulously examines market segmentation, key players, growth drivers, challenges, and emerging opportunities within the Indonesian refrigerated trailer landscape. Expect detailed analysis supported by robust data and projections, enabling informed strategic planning and investment decisions. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Indonesia Refrigerated Trailer Market Concentration & Innovation

This section delves into the competitive landscape of the Indonesian refrigerated trailer market, analyzing market concentration, innovation drivers, regulatory influences, and key industry trends. The market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller players compete in niche segments. Market share data for 2024 reveals that the top 5 players collectively hold approximately 60% of the market, with Carrier Global Corporation and Wabash National Corporation leading the pack. Innovation is driven primarily by the increasing demand for fuel-efficient and technologically advanced trailers, alongside stricter emission regulations. Recent mergers and acquisitions (M&A) activity has been relatively modest, with deal values averaging xx Million in the past five years. This trend reflects a strategic consolidation within the industry, with larger players seeking to expand their product portfolios and geographic reach. End-user trends reveal a growing preference for sophisticated temperature control systems, enhanced monitoring capabilities, and sustainable designs.

- Market Concentration: Top 5 players hold ~60% market share (2024).

- Innovation Drivers: Fuel efficiency, technology advancements, emission regulations.

- M&A Activity: Moderate activity, average deal value xx Million (past 5 years).

- Regulatory Framework: Emphasis on safety and environmental standards.

- Product Substitutes: Limited direct substitutes; competition from alternative transportation modes.

- End-User Trends: Demand for advanced features & sustainable designs.

Indonesia Refrigerated Trailer Market Industry Trends & Insights

The Indonesian refrigerated trailer market is witnessing robust growth, driven by a burgeoning food and beverage sector, expanding e-commerce logistics, and the increasing adoption of cold chain practices. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration of refrigerated trailers remains relatively low compared to developed nations, presenting a significant opportunity for growth. Technological disruptions, such as the integration of IoT sensors and telematics, are reshaping the industry by enhancing operational efficiency and improving supply chain visibility. Consumer preferences are shifting towards more sustainable and environmentally friendly options, creating demand for trailers with reduced carbon footprints. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and the entry of new players.

Dominant Markets & Segments in Indonesia Refrigerated Trailer Market

The Indonesian refrigerated trailer market is characterized by diverse segments based on product type, axle type, and end-user. The chilled food segment currently dominates the product type segment, driven by strong demand from the rapidly growing processed food industry. The tandem axle segment holds the largest share of the axle type segment, due to its optimal balance of capacity and maneuverability. Within end-users, the fruits and vegetables sector is the largest, fueled by the country's agricultural output and increasing exports. The dominance of these segments is primarily influenced by factors such as:

- Chilled Food (Product Type): High demand from the processed food industry.

- Tandem Axle (Axle Type): Optimal balance of capacity and maneuverability.

- Fruits and Vegetables (End-User): Strong agricultural output and export growth.

Key Drivers:

- Rapid growth of the food and beverage sector

- Expansion of e-commerce and cold chain logistics

- Increasing urbanization and changing consumer lifestyles

- Government initiatives supporting infrastructure development

- Favorable economic conditions

Indonesia Refrigerated Trailer Market Product Developments

Recent years have witnessed significant product innovation in the Indonesian refrigerated trailer market. Leading manufacturers are focusing on developing fuel-efficient trailers, advanced refrigeration units, and integrated telematics systems. The emphasis is on enhancing operational efficiency, reducing environmental impact, and improving cargo security. Technological advancements such as the integration of IoT sensors and real-time temperature monitoring systems are crucial to improving supply chain management. The market is seeing a clear trend towards lightweight and aerodynamic designs to reduce fuel consumption and improve operational costs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Indonesia Refrigerated Trailer Market, segmented by product type (Frozen Food, Chilled Food), axle type (Single Axle, Tandem Axle, Three or More than Three Axle), and end-user (Dairy Products, Fruits and Vegetables, Meat and Seafood, Other End-Users). Each segment is assessed for its market size, growth projections, and competitive dynamics. The growth potential varies across segments, with the chilled food segment expected to exhibit robust growth due to rising demand for processed food products. Similarly, the tandem axle segment is expected to retain its dominance due to its versatility.

Key Drivers of Indonesia Refrigerated Trailer Market Growth

The growth of the Indonesian refrigerated trailer market is primarily driven by:

- Expanding food and beverage sector: Increased demand for refrigerated transport.

- Growth of e-commerce: Need for efficient last-mile delivery of perishable goods.

- Government infrastructure investment: Improved transportation networks.

- Technological advancements: Enhanced efficiency and cost reduction.

Challenges in the Indonesia Refrigerated Trailer Market Sector

The Indonesian refrigerated trailer market faces certain challenges, including:

- High infrastructure costs: Building and maintaining cold storage facilities.

- Fluctuations in fuel prices: Affecting operational costs.

- Competition from other transportation modes: Rail and sea freight.

- Limited availability of skilled labor: Affecting maintenance and operations.

Emerging Opportunities in Indonesia Refrigerated Trailer Market

Several opportunities are emerging in the Indonesian refrigerated trailer market, including:

- Growth of the cold chain logistics sector: Creating demand for specialized trailers.

- Adoption of sustainable refrigeration technologies: Reducing environmental impact.

- Expansion of e-commerce and online grocery delivery: Fueling demand for last-mile delivery solutions.

- Increased focus on food safety and quality: Demand for reliable temperature control.

Leading Players in the Indonesia Refrigerated Trailer Market Market

- Utility Trailer Manufacturing Company

- Carrier Global Corporation

- Great Dane LLC

- Wabash National Corporation

- Schmitz Cargobull AG

- Grey & Adams Ltd

- Trane Technologies Company LLC

- Leonard Truck and Trailer Inc

Key Developments in Indonesia Refrigerated Trailer Market Industry

- September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit for cargo rail and intermodal applications. This signifies a move towards more efficient and sustainable transportation solutions within the industry.

- April 2022: Thermo King introduced the new Precedent S-750i Trailer, enhancing long-haul and local food distribution capabilities. This caters to the growing demand for efficient and reliable refrigerated transport solutions for food products.

Strategic Outlook for Indonesia Refrigerated Trailer Market Market

The Indonesian refrigerated trailer market is poised for significant growth over the forecast period, driven by factors such as the expanding food and beverage sector, the rise of e-commerce, and increased investment in cold chain infrastructure. Companies focusing on innovation, sustainable solutions, and efficient logistics will be best positioned to capture market share. The adoption of advanced technologies and strategic partnerships will further enhance growth opportunities. The market’s potential lies in addressing the growing need for reliable and efficient cold chain solutions in Indonesia.

Indonesia Refrigerated Trailer Market Segmentation

-

1. Product Type

- 1.1. Frozen Food

- 1.2. Chilled Food

-

2. Axle Type

- 2.1. Single Axle

- 2.2. Tandem Axle

- 2.3. Three or More than Three Axle

-

3. End-User

- 3.1. Dairy Products

- 3.2. Fruits and Vegetables

- 3.3. Meat and Sea Food

- 3.4. Other End-Users

Indonesia Refrigerated Trailer Market Segmentation By Geography

- 1. Indonesia

Indonesia Refrigerated Trailer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Expansion of Cold Chain Logistics Across the Region

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost May Affect the Growth

- 3.4. Market Trends

- 3.4.1. Rise in Transportation of Frozen Food Across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Refrigerated Trailer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Food

- 5.1.2. Chilled Food

- 5.2. Market Analysis, Insights and Forecast - by Axle Type

- 5.2.1. Single Axle

- 5.2.2. Tandem Axle

- 5.2.3. Three or More than Three Axle

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Dairy Products

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat and Sea Food

- 5.3.4. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Utility Trailer Manufacturing Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Global Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Great Dane LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wabash National Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schmitz Cargobull AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grey & Adams Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trane Technologies Company LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leonard Truck and Trailer Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Utility Trailer Manufacturing Compan

List of Figures

- Figure 1: Indonesia Refrigerated Trailer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Refrigerated Trailer Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Axle Type 2019 & 2032

- Table 4: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Axle Type 2019 & 2032

- Table 9: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Refrigerated Trailer Market ?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the Indonesia Refrigerated Trailer Market ?

Key companies in the market include Utility Trailer Manufacturing Compan, Carrier Global Corporation, Great Dane LLC, Wabash National Corporation, Schmitz Cargobull AG, Grey & Adams Ltd, Trane Technologies Company LLC, Leonard Truck and Trailer Inc.

3. What are the main segments of the Indonesia Refrigerated Trailer Market ?

The market segments include Product Type, Axle Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Expansion of Cold Chain Logistics Across the Region.

6. What are the notable trends driving market growth?

Rise in Transportation of Frozen Food Across the Country.

7. Are there any restraints impacting market growth?

High Maintenance Cost May Affect the Growth.

8. Can you provide examples of recent developments in the market?

September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit. The unit is suitable for cargo rail and intermodal applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Refrigerated Trailer Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Refrigerated Trailer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Refrigerated Trailer Market ?

To stay informed about further developments, trends, and reports in the Indonesia Refrigerated Trailer Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence