Key Insights

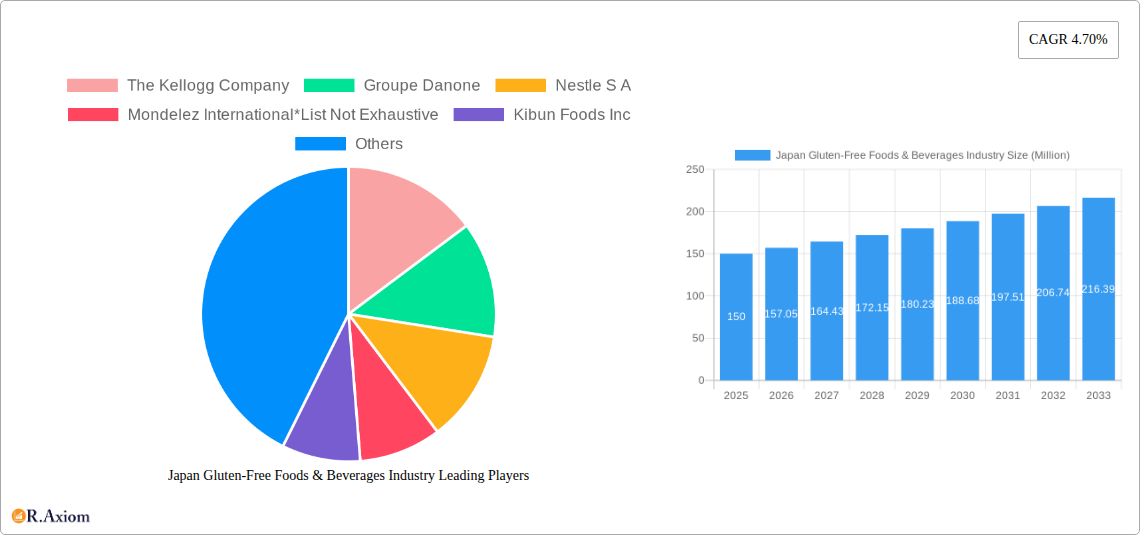

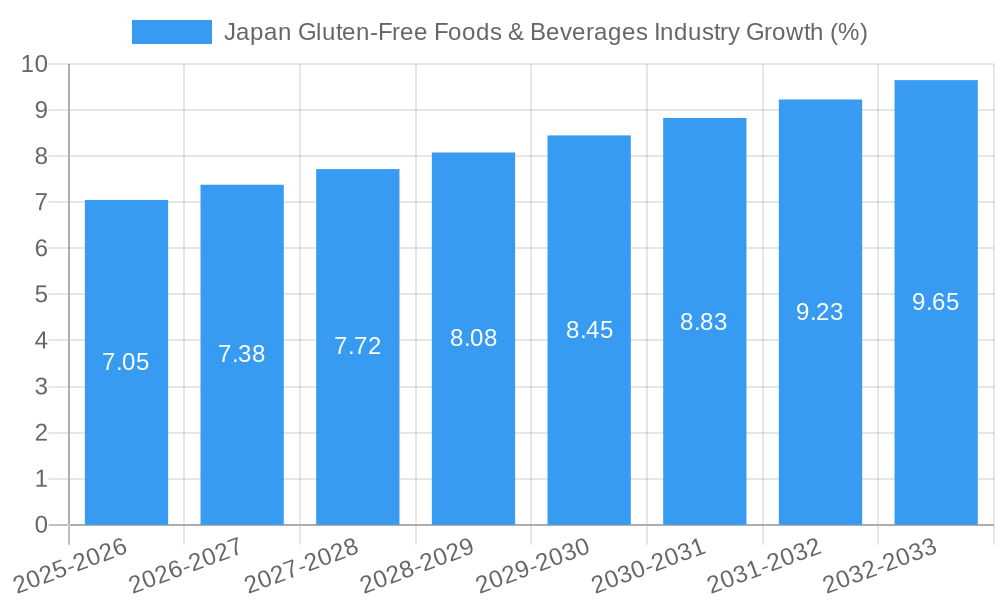

The Japan gluten-free foods and beverages market, while currently smaller than some global counterparts, exhibits robust growth potential. Driven by increasing awareness of celiac disease and gluten sensitivity, coupled with rising health consciousness among Japanese consumers, the market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This growth is fueled by several key trends, including the increasing availability of gluten-free product alternatives in supermarkets, hypermarkets, and online retail channels. The expanding range of gluten-free bakery & confectionery items, beverages, and other food categories caters to a broader consumer base, further stimulating market expansion. While the market faces some restraints, such as relatively higher prices for gluten-free products compared to conventional options and potential cultural resistance to adopting new food habits, the overall positive trajectory is undeniable. The significant presence of major global food companies like Kellogg's, Danone, Nestlé, and Mondelez International in the Japanese market signifies their confidence in this growing sector and their commitment to catering to the increasing demand. This suggests that the market's future success hinges on further innovation, broader product diversification, and sustained marketing efforts to educate consumers and overcome price sensitivities.

The segmentation of the market by distribution channels reveals a dynamic landscape. While supermarkets and hypermarkets currently hold a larger share, the online retail segment is experiencing the fastest growth, reflecting broader consumer adoption of e-commerce. Similarly, the product type segmentation shows strong demand for gluten-free bakery and confectionery items, indicative of consumers' desire to enjoy familiar foods without gluten. The Asia-Pacific region, particularly Japan, offers significant untapped potential due to its large population and growing health-conscious consumer base. Strategic marketing initiatives focusing on highlighting the health benefits and taste appeal of gluten-free foods will be crucial to unlocking this potential. Furthermore, collaborations between food manufacturers and healthcare professionals to provide accurate information and build consumer trust will prove increasingly important in solidifying the market's continued growth.

Japan Gluten-Free Foods & Beverages Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Japan gluten-free foods and beverages industry, offering valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on market opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report utilizes a robust methodology to assess market size, growth drivers, competitive dynamics, and future trends. All values are expressed in Millions.

Japan Gluten-Free Foods & Beverages Industry Market Concentration & Innovation

The Japan gluten-free foods and beverages market exhibits a moderately concentrated landscape, with key players such as The Kellogg Company, Groupe Danone, Nestle S.A., Mondelez International, Kibun Foods Inc, General Mills, and Hain Celestial Group holding significant market share. However, the market also features a considerable number of smaller, specialized players, particularly in the bakery and confectionery segments. Market share data for 2025 estimates that The Kellogg Company holds approximately 15%, Nestle S.A. holds 12%, and Mondelez International holds 10% of the market. The remaining market share is distributed among other players and smaller businesses.

Innovation is a key driver, fueled by increasing consumer demand for healthier and more convenient gluten-free options. This has led to significant product diversification, with the introduction of innovative gluten-free bread, pasta, snacks, and beverages. Regulatory frameworks in Japan, while not specifically restrictive to gluten-free products, are focused on food safety and labeling standards, positively influencing consumer trust. The prevalence of food allergies and intolerances continues to drive the market, leading to increased consumer preference for gluten-free alternatives. M&A activity in the sector has been moderate, with several smaller acquisitions aimed at expanding product portfolios and distribution networks. The total value of M&A deals within the last five years is estimated at ¥XX Million.

Japan Gluten-Free Foods & Beverages Industry Industry Trends & Insights

The Japan gluten-free foods and beverages industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the rising prevalence of celiac disease and gluten intolerance among the Japanese population, along with increased awareness of the health benefits of gluten-free diets. The market penetration of gluten-free products is currently estimated at xx%, indicating significant potential for future expansion. Technological advancements in gluten-free food processing and ingredient sourcing are further fueling market growth, enabling the production of high-quality products with improved taste and texture. The increasing adoption of online retail channels has significantly broadened market access, allowing smaller producers to reach a wider consumer base. However, competitive intensity is growing, requiring companies to prioritize product innovation, branding, and distribution strategies to maintain market share. The rising disposable incomes and changing lifestyles are contributing to the increased demand for convenient and premium gluten-free food options, further stimulating market expansion.

Dominant Markets & Segments in Japan Gluten-Free Foods & Beverages Industry

Leading Region/Segment: The Kanto region (including Tokyo) dominates the Japan gluten-free foods and beverages market, driven by high population density, increased consumer awareness, and high disposable incomes. The Bakery & Confectionery segment currently holds the largest market share, followed by Beverages.

By Distribution Channel: Supermarkets & Hypermarkets constitute the largest distribution channel, providing significant shelf space and broad consumer reach. However, online retail is experiencing rapid growth, boosted by consumer preference for home delivery and increased accessibility to niche products.

By Product Type:

- Bakery & Confectionery: High demand for gluten-free bread, cakes, and pastries is driving segment growth, spurred by innovations in gluten-free flour blends and baking techniques.

- Beverages: The gluten-free beer and alcoholic beverage segment is witnessing rapid growth, driven by increasing consumer preferences for healthier drinking options. Gluten-free soy milk and other plant-based beverages also contribute substantially to this segment.

- Other Segments: Condiments, seasonings, and spreads, while smaller segments, are exhibiting steady growth, reflecting consumer demand for gluten-free cooking and flavoring options. Dairy and dairy substitutes are also showing considerable promise, particularly in the growing vegan and plant-based food market.

Key drivers for the dominant segments include government initiatives promoting healthy eating habits, robust infrastructure supporting food distribution, and growing consumer preference for convenient and readily available options.

Japan Gluten-Free Foods & Beverages Industry Product Developments

Recent product innovations focus on improving the taste, texture, and nutritional value of gluten-free products, often mimicking the sensory characteristics of traditional gluten-containing counterparts. Technological advancements in gluten-free flour blends, using alternative grains like rice, corn, and tapioca, have significantly enhanced product quality. Companies are leveraging innovative processing techniques to improve texture and shelf life. The market is also witnessing increased development of gluten-free products catering to specific dietary needs, including vegan, organic, and low-calorie options, showcasing excellent market fit.

Report Scope & Segmentation Analysis

This report segments the Japan gluten-free foods and beverages market by distribution channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Others) and product type (Bakery & Confectionery, Beverages, Condiments, Seasonings & Spreads, Dairy & Dairy Substitutes, Meat & Meat Substitutes, Others). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed in detail. The market size for Supermarkets & Hypermarkets is estimated at ¥XX Million in 2025, while the Online Retail segment is projected to experience the fastest growth over the forecast period. In terms of product type, the Bakery & Confectionery segment is currently the largest, followed closely by Beverages. Competitive dynamics vary across segments, with some exhibiting higher levels of concentration than others.

Key Drivers of Japan Gluten-Free Foods & Beverages Industry Growth

The growth of the Japan gluten-free foods and beverages industry is fueled by several key factors. The rising prevalence of celiac disease and gluten intolerance is a significant driver, directly increasing demand. Furthermore, a growing awareness of the health benefits associated with gluten-free diets, encompassing weight management and reduced inflammation, further boosts the market. Technological advancements in food processing are contributing to better-tasting and more palatable products, while the expansion of online retail channels provides wider accessibility and convenience for consumers. Finally, increasing disposable incomes and a shift toward more health-conscious lifestyles contribute to a positive market outlook.

Challenges in the Japan Gluten-Free Foods & Beverages Industry Sector

Despite significant growth potential, the Japan gluten-free foods and beverages industry faces several challenges. The relatively high cost of gluten-free ingredients compared to traditional wheat-based counterparts presents a price barrier for consumers. Maintaining consistent product quality and taste can be challenging, limiting consumer satisfaction. Supply chain complexities and the limited availability of certain gluten-free ingredients may restrict production capacity and market expansion. Competition from both established food companies and new entrants is intensifying, requiring continuous innovation and strategic marketing to succeed. These factors collectively contribute to a complex market environment.

Emerging Opportunities in Japan Gluten-Free Foods & Beverages Industry

The Japan gluten-free foods and beverages market presents numerous emerging opportunities. The growing interest in plant-based diets creates a strong potential for the development and expansion of vegan and vegetarian gluten-free products. Innovations in ingredient sourcing and processing techniques, such as utilizing alternative grains and improving textures, represent significant opportunities to enhance the overall market experience. Expansion into untapped market segments, like the development of specialty gluten-free products catering to specific age groups or dietary requirements, presents significant avenues for market growth. Finally, leveraging the increasing penetration of online retail channels to reach a broader consumer base is crucial.

Leading Players in the Japan Gluten-Free Foods & Beverages Industry Market

- The Kellogg Company

- Groupe Danone

- Nestle S.A.

- Mondelez International

- Kibun Foods Inc

- General Mills

- Hain Celestial Group

Key Developments in Japan Gluten-Free Foods & Beverages Industry Industry

- October 2022: Nestle S.A. launched a new line of gluten-free confectionery products in Japan.

- March 2023: The Kellogg Company expanded its distribution network to increase the availability of its gluten-free cereals in convenience stores across Japan.

- July 2023: A new joint venture between two Japanese food companies focused on expanding the market for gluten-free pasta.

- (Add further developments as available with year/month and impact description)

Strategic Outlook for Japan Gluten-Free Foods & Beverages Industry Market

The Japan gluten-free foods and beverages industry is poised for sustained growth, driven by increasing consumer awareness, health consciousness, and ongoing product innovation. The expansion of online retail channels, alongside the potential for premiumization and niche product development, presents significant opportunities. Companies that prioritize product quality, consumer convenience, and innovative marketing strategies are best positioned to capitalize on the future market potential. Further technological advancements in ingredient sourcing and processing will play a vital role in shaping the industry's landscape.

Japan Gluten-Free Foods & Beverages Industry Segmentation

-

1. Product Type

- 1.1. Bakery & Confectionery

- 1.2. Beverages

- 1.3. Condiments, Seasonings & Spreads

- 1.4. Dairy & Dairy Substitutes

- 1.5. Meat & Meat Substitutes

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail

- 2.4. Others

Japan Gluten-Free Foods & Beverages Industry Segmentation By Geography

- 1. Japan

Japan Gluten-Free Foods & Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. The "Health halo" Effects of Healthy Food Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bakery & Confectionery

- 5.1.2. Beverages

- 5.1.3. Condiments, Seasonings & Spreads

- 5.1.4. Dairy & Dairy Substitutes

- 5.1.5. Meat & Meat Substitutes

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Japan Gluten-Free Foods & Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Kellogg Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Groupe Danone

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestle S A

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mondelez International*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kibun Foods Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 General Mills

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hain Celestial Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 The Kellogg Company

List of Figures

- Figure 1: Japan Gluten-Free Foods & Beverages Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Gluten-Free Foods & Beverages Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Japan Gluten-Free Foods & Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Japan Gluten-Free Foods & Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Gluten-Free Foods & Beverages Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Japan Gluten-Free Foods & Beverages Industry?

Key companies in the market include The Kellogg Company, Groupe Danone, Nestle S A, Mondelez International*List Not Exhaustive, Kibun Foods Inc, General Mills, Hain Celestial Group.

3. What are the main segments of the Japan Gluten-Free Foods & Beverages Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

The "Health halo" Effects of Healthy Food Consumption.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Gluten-Free Foods & Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Gluten-Free Foods & Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Gluten-Free Foods & Beverages Industry?

To stay informed about further developments, trends, and reports in the Japan Gluten-Free Foods & Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence