Key Insights

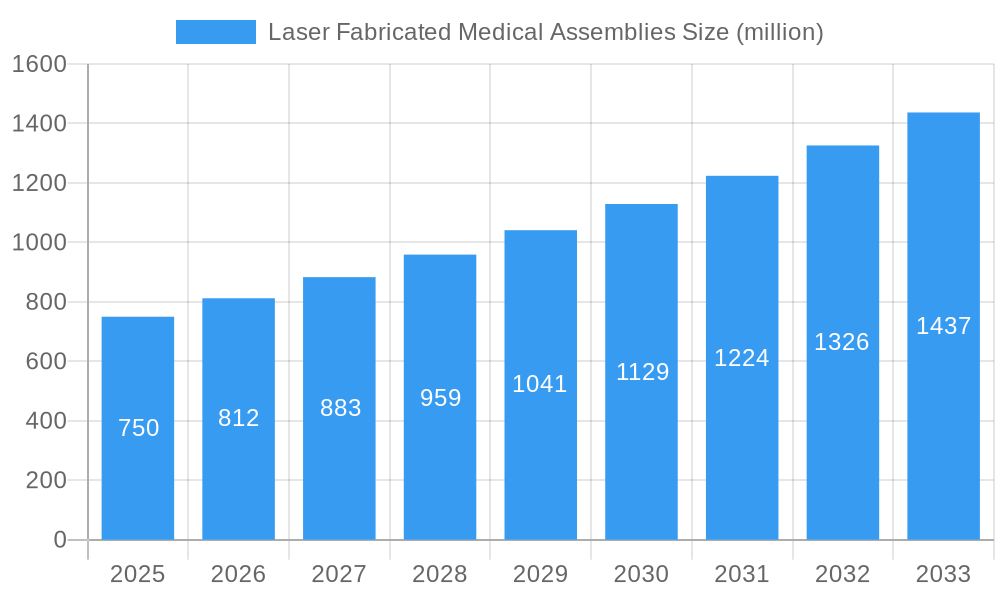

The global market for laser fabricated medical assemblies is poised for significant expansion, driven by the increasing demand for precision, intricate designs, and biocompatible materials in healthcare. With an estimated market size of approximately $750 million in 2025, and projected to grow at a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033, this sector is witnessing robust momentum. Key applications such as medical devices, surgical instruments, and implantable components are benefiting immensely from the high accuracy and minimal heat-affected zones offered by laser fabrication technologies. The ability to work with a diverse range of materials, including advanced metallic alloys and high-performance non-metallic polymers, further fuels its adoption. Trends such as miniaturization, personalized medicine, and the increasing complexity of medical device designs are directly aligning with the capabilities of laser-based manufacturing, making it an indispensable tool for innovation in the healthcare industry.

Laser Fabricated Medical Assemblies Market Size (In Million)

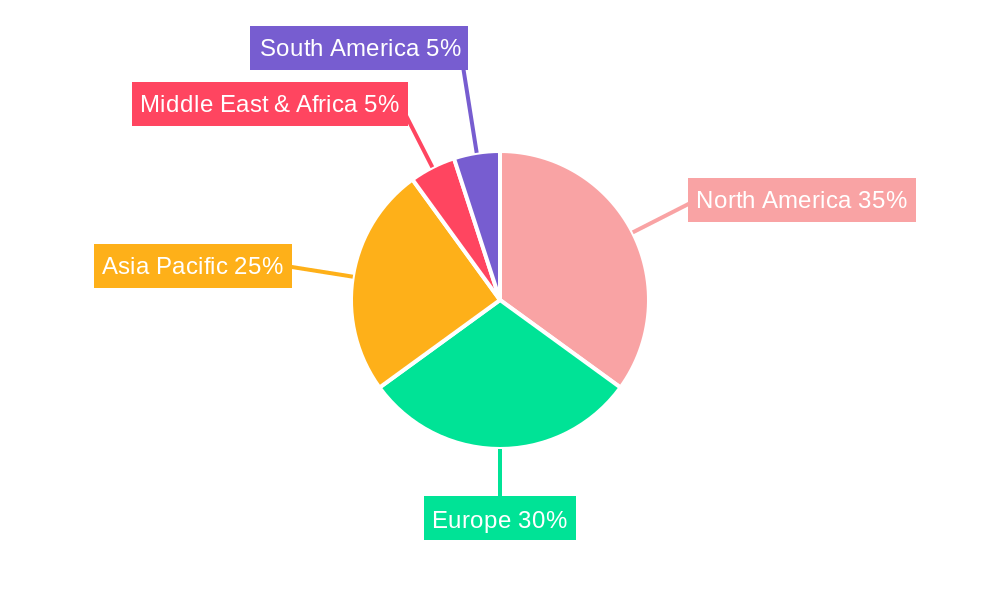

The growth trajectory of the laser fabricated medical assemblies market is further supported by favorable industry dynamics and ongoing technological advancements. While the inherent complexity and cost associated with specialized laser machinery and skilled personnel represent a restraining factor for some smaller entities, the long-term benefits of improved product performance, reduced waste, and faster prototyping are compelling. Geographically, North America and Europe are anticipated to maintain their dominance, owing to established healthcare infrastructures and significant investments in R&D. However, the Asia Pacific region, particularly China and India, is emerging as a rapidly growing market, driven by a burgeoning medical device manufacturing sector and increasing healthcare expenditure. The competitive landscape features a mix of established manufacturing players and specialized laser fabrication service providers, all vying to capitalize on the increasing need for sophisticated and reliable medical components.

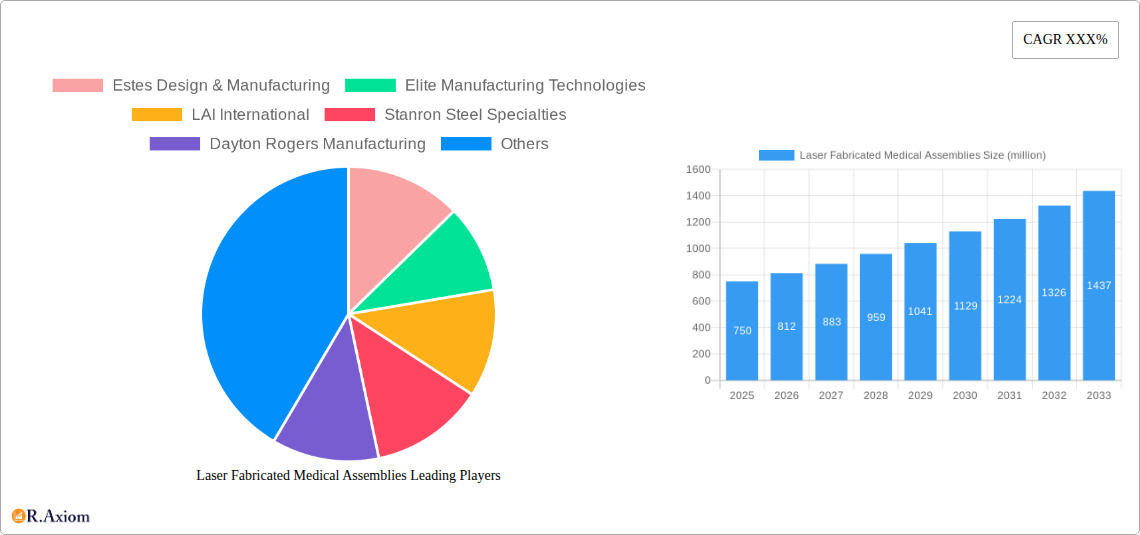

Laser Fabricated Medical Assemblies Company Market Share

This in-depth report provides a detailed examination of the global Laser Fabricated Medical Assemblies market, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this analysis leverages historical data from 2019-2024 to project future market performance. We cover key segments including Medical, Electronic, Aerospace, and Other applications, and Metallic Material and Non-metallic Material types.

Laser Fabricated Medical Assemblies Market Concentration & Innovation

The global Laser Fabricated Medical Assemblies market exhibits a moderate to high concentration, with several key players vying for market share. Innovation is a primary driver, fueled by advancements in laser technology, precision engineering, and material science. Companies are increasingly investing in research and development to create novel assembly solutions for complex medical devices, minimally invasive surgical tools, and advanced electronic components. Regulatory frameworks, particularly within the medical device sector, play a crucial role in shaping product development and market entry strategies, emphasizing stringent quality control and biocompatibility. The emergence of additive manufacturing alongside traditional laser fabrication techniques is also a significant innovation driver. Product substitutes, such as traditional welding and bonding methods, continue to be present, but laser fabrication offers distinct advantages in terms of precision, speed, and material compatibility. End-user trends favor miniaturization, increased functionality, and enhanced patient outcomes, pushing manufacturers to develop more sophisticated laser-fabricated assemblies. Mergers and acquisitions (M&A) activities are anticipated to continue as larger entities seek to acquire innovative technologies and expand their market reach. While specific M&A deal values are subject to market fluctuations, the strategic importance of acquiring laser fabrication capabilities for high-value medical and electronic applications remains consistently high, potentially reaching hundreds of millions in strategic acquisitions. Key companies like MicroGroup and Vita Needle are actively involved in these innovative pursuits, contributing to a significant portion of market share within their specialized niches.

Laser Fabricated Medical Assemblies Industry Trends & Insights

The Laser Fabricated Medical Assemblies industry is poised for significant growth, driven by a confluence of technological advancements, increasing demand from critical sectors, and evolving manufacturing paradigms. The projected Compound Annual Growth Rate (CAGR) for this market is robust, estimated to be in the range of 7.5% to 9.0% over the forecast period (2025–2033). This expansion is largely attributed to the escalating need for precision-engineered components in the medical device industry. As healthcare technologies advance, the demand for intricate, biocompatible, and sterile assemblies for implants, surgical instruments, diagnostic equipment, and drug delivery systems is surging. Laser fabrication's ability to achieve sub-micron tolerances, work with a wide array of materials including exotic alloys and biocompatible polymers, and perform intricate joint configurations without inducing thermal stress makes it indispensable.

Furthermore, the aerospace and electronics sectors are also significant contributors to market growth. In aerospace, laser fabricated assemblies are crucial for lightweight, high-strength components in aircraft interiors, propulsion systems, and satellite technology, where reliability and performance are paramount. The electronics industry benefits from the precision and speed of laser fabrication for assembling complex microelectronic components, sensors, and specialized connectors, particularly in demanding environments.

Technological disruptions, such as the integration of Artificial Intelligence (AI) and machine learning in laser processing for real-time quality control and process optimization, are enhancing efficiency and reducing manufacturing costs. The development of advanced laser sources, including femtosecond and picosecond lasers, allows for non-thermal processing of sensitive materials, further expanding the application scope. Consumer preferences, particularly in the medical field, are leaning towards less invasive procedures and personalized treatment solutions, which directly translates to a demand for highly sophisticated and custom-engineered medical devices. This trend necessitates advanced manufacturing capabilities like laser fabrication.

The competitive dynamics are characterized by a blend of established large-scale manufacturers and specialized niche players. Companies are investing heavily in automation and digital manufacturing technologies to streamline production, improve throughput, and maintain a competitive edge. Market penetration is steadily increasing across all key application segments, as the unique benefits of laser fabrication become more widely recognized and adopted. The ongoing refinement of laser welding, cutting, and marking techniques, coupled with advancements in CAD/CAM integration and robotic automation, will continue to redefine the manufacturing landscape for critical assemblies.

Dominant Markets & Segments in Laser Fabricated Medical Assemblies

The Laser Fabricated Medical Assemblies market is characterized by a clear dominance of specific regions and application segments, driven by a combination of economic policies, robust industrial infrastructure, and high demand for precision manufacturing.

Regionally, North America and Europe currently hold significant market share, driven by their well-established medical device industries, advanced technological adoption, and substantial government investment in healthcare and aerospace.

- North America: The United States, in particular, leads due to its high concentration of leading medical device manufacturers, significant R&D expenditure in healthcare innovation, and a strong aerospace and defense sector. Favorable regulatory environments for medical device approvals, coupled with robust supply chains for specialized materials, further bolster its position.

- Europe: Countries like Germany, the UK, and Switzerland are major contributors, owing to their sophisticated precision engineering capabilities, stringent quality standards, and a large base of medical and pharmaceutical companies. Strong government support for advanced manufacturing initiatives also plays a key role.

Application Segment Dominance:

Medical Application: This is unequivocally the most dominant application segment, accounting for a substantial portion of the market revenue, estimated to be over 60% in 2025.

- Key Drivers:

- Aging Global Population: Drives demand for medical devices, implants, and surgical tools.

- Advancements in Minimally Invasive Surgery: Requires highly intricate and precise instruments.

- Biocompatibility Requirements: Laser fabrication excels in joining materials that are safe for human implantation.

- Demand for Sterility and Purity: Laser processes can be performed in cleanroom environments, ensuring product integrity.

- Miniaturization of Medical Devices: Enables the creation of smaller, more complex components for wearables and implantable devices.

- Dominance Analysis: The medical segment's dominance is driven by the non-negotiable need for precision, reliability, and biocompatibility in healthcare products. Companies are leveraging laser fabrication to produce components for pacemakers, stents, orthopedic implants, diagnostic sensors, and advanced surgical robots. The market penetration here is very high, with laser fabrication becoming the standard for many critical medical assembly processes.

- Key Drivers:

Metallic Material Type: Metallic materials, particularly stainless steel, titanium, and specialized alloys, constitute the largest share within the material type segmentation.

- Key Drivers:

- Biocompatibility of Metals: Titanium and certain stainless steels are widely used in medical implants.

- Strength and Durability: Essential for aerospace and medical applications.

- Corrosion Resistance: Crucial for both medical and electronic devices.

- Established Manufacturing Processes: Extensive experience and infrastructure for metal fabrication.

- Dominance Analysis: Metallic materials remain the backbone of many high-performance assemblies due to their inherent properties. The ability of laser fabrication to precisely join, cut, and mark these materials without significant distortion or material degradation makes it a preferred choice. The market size for metallic material fabrication is projected to continue its upward trajectory.

- Key Drivers:

While Aerospace and Electronic segments are significant growth areas with substantial market potential, and Non-metallic Materials are gaining traction with advancements in polymer science, the current landscape is firmly led by the Medical application and Metallic materials due to their established needs and the proven capabilities of laser fabrication in meeting stringent requirements.

Laser Fabricated Medical Assemblies Product Developments

Recent product developments in laser fabricated medical assemblies highlight a strong focus on miniaturization, enhanced functionality, and novel material applications. Innovations include the development of ultra-fine laser welding techniques for micro-medical devices, such as implantable sensors and neural interfaces. Companies are also exploring advanced laser texturing and surface modification to improve biocompatibility and integration with biological tissues. Competitive advantages are being gained through the integration of laser fabrication with advanced robotics and AI for automated, high-volume production of complex assemblies. These technological trends are driving market fit by addressing the growing demand for highly specialized and reliable components in critical healthcare applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive market segmentation of the Laser Fabricated Medical Assemblies sector, analyzing key application and material type segments.

Application: Medical: This segment focuses on the use of laser fabricated assemblies in medical devices, surgical instruments, implants, and diagnostic equipment. Growth projections are robust, driven by an aging population and technological advancements in healthcare. The market size is significant and expected to expand considerably. Competitive dynamics are intense, with a focus on precision, biocompatibility, and regulatory compliance.

Application: Electronic: This segment covers laser fabricated assemblies for components in consumer electronics, telecommunications, and industrial electronics. Growth is propelled by the increasing demand for miniaturized and high-performance electronic devices. Market size is substantial and growing, with competitive pressures arising from cost-efficiency and rapid product cycles.

Application: Aerospace: This segment includes laser fabricated assemblies used in aircraft, satellites, and defense systems. Growth is driven by demand for lightweight, high-strength, and reliable components. The market size is considerable, characterized by stringent quality standards and long product development cycles.

Application: Other: This segment encompasses laser fabricated assemblies used in diverse industries beyond the primary three, such as automotive, industrial machinery, and energy. Growth will depend on the adoption rates in niche applications. Market size is smaller but offers potential for diversification.

Type: Metallic Material: This segment analyzes the fabrication of assemblies using various metals and alloys, including stainless steel, titanium, and precious metals. This is a dominant segment with strong growth, driven by the inherent properties of metals for high-performance applications.

Type: Non-metallic Material: This segment focuses on the fabrication of assemblies using polymers, ceramics, and composites. This segment is expected to witness significant growth as advanced non-metallic materials gain wider adoption for their unique properties and lighter weight.

Key Drivers of Laser Fabricated Medical Assemblies Growth

The growth of the Laser Fabricated Medical Assemblies market is primarily propelled by several key factors. Technologically, advancements in laser precision, speed, and the ability to process a wider range of materials, including advanced polymers and ceramics, are crucial. Economically, the increasing global healthcare expenditure and the continuous innovation in medical devices are creating substantial demand. Regulatory frameworks, while stringent, also drive adoption as laser fabrication ensures the highest levels of precision and traceability required for medical applications. The demand for miniaturization in both medical and electronic devices, coupled with the need for robust and lightweight components in the aerospace sector, further fuels market expansion.

Challenges in the Laser Fabricated Medical Assemblies Sector

Despite robust growth prospects, the Laser Fabricated Medical Assemblies sector faces several challenges. High initial investment costs for advanced laser systems and skilled personnel can be a barrier to entry for smaller companies. Stringent regulatory compliance, particularly in the medical device industry, necessitates rigorous validation processes and can lead to extended lead times. Supply chain disruptions for specialized materials can impact production schedules and costs. Moreover, the development and integration of new materials require extensive research and testing, posing technical challenges. Competitive pressures from established, lower-cost conventional manufacturing methods also persist in certain applications.

Emerging Opportunities in Laser Fabricated Medical Assemblies

Emerging opportunities in the Laser Fabricated Medical Assemblies market lie in the expanding applications of additive manufacturing combined with laser-based joining, offering unprecedented design freedom and customization. The growing demand for personalized medicine and bespoke medical devices presents a significant avenue for growth. Advancements in laser processing of novel biocompatible polymers and biodegradable materials open new frontiers in implantable devices and drug delivery systems. Furthermore, the integration of AI and machine learning for intelligent process control and quality assurance is creating opportunities for enhanced efficiency and reduced defect rates. Expansion into emerging economies with growing healthcare infrastructure also represents a substantial untapped market potential.

Leading Players in the Laser Fabricated Medical Assemblies Market

- Estes Design & Manufacturing

- Elite Manufacturing Technologies

- LAI International

- Stanron Steel Specialties

- Dayton Rogers Manufacturing

- EVS Metal

- Storm Power Components

- McAlpin Industries

- Fabcon

- Sequoia Tool

- Laserage

- G & J Steel & Tubing

- PMF Industries

- Marshall Manufacturing Company

- Rockford Specialties

- J&E Manufacturing

- Schmid Tool & Engineering

- RPM Engineering Corp.

- Vita Needle

- Wisconsin Metal Parts

- MicroGroup

- Quasar Industries

- Accurate Metal Fabricating

Key Developments in Laser Fabricated Medical Assemblies Industry

- 2023 March: MicroGroup announces a significant expansion of its laser welding capabilities to meet the growing demand for ultra-precision medical device components.

- 2023 September: Laserage introduces a new laser cutting service for advanced ceramics, expanding its material processing expertise for the medical and electronics sectors.

- 2024 February: Elite Manufacturing Technologies invests in next-generation femtosecond laser systems to enable non-thermal processing of highly sensitive medical implants.

- 2024 June: LAI International acquires a specialized laser additive manufacturing company, enhancing its portfolio for complex, high-value aerospace assemblies.

- 2024 October: Vita Needle expands its laser tube fabrication services, focusing on custom solutions for respiratory and drug delivery devices.

Strategic Outlook for Laser Fabricated Medical Assemblies Market

The strategic outlook for the Laser Fabricated Medical Assemblies market is exceptionally promising, characterized by continuous innovation and expanding applications. Growth catalysts include the increasing sophistication of medical devices, the persistent demand for lightweight and high-performance components in aerospace, and the relentless advancement of electronic technologies. The ongoing integration of AI and automation in laser fabrication processes will further enhance efficiency and precision, driving market penetration. Strategic partnerships and mergers between established manufacturers and technology providers are expected to accelerate market consolidation and innovation. The focus on sustainability and advanced material processing will also shape future market strategies, positioning laser fabrication as a cornerstone of advanced manufacturing for years to come.

Laser Fabricated Medical Assemblies Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Electronic

- 1.3. Aerospace

- 1.4. Other

-

2. Type

- 2.1. Metallic Material

- 2.2. Non-metallic Material

Laser Fabricated Medical Assemblies Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laser Fabricated Medical Assemblies Regional Market Share

Geographic Coverage of Laser Fabricated Medical Assemblies

Laser Fabricated Medical Assemblies REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XXX% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Electronic

- 5.1.3. Aerospace

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Metallic Material

- 5.2.2. Non-metallic Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Electronic

- 6.1.3. Aerospace

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Metallic Material

- 6.2.2. Non-metallic Material

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Electronic

- 7.1.3. Aerospace

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Metallic Material

- 7.2.2. Non-metallic Material

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Electronic

- 8.1.3. Aerospace

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Metallic Material

- 8.2.2. Non-metallic Material

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Electronic

- 9.1.3. Aerospace

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Metallic Material

- 9.2.2. Non-metallic Material

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Laser Fabricated Medical Assemblies Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Electronic

- 10.1.3. Aerospace

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Metallic Material

- 10.2.2. Non-metallic Material

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Estes Design & Manufacturing

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elite Manufacturing Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LAI International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stanron Steel Specialties

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dayton Rogers Manufacturing

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EVS Metal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Storm Power Components

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McAlpin Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fabcon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sequoia Tool

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Laserage

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 G & J Steel & Tubing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 PMF Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Marshall Manufacturing Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rockford Specialties

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 J&E Manufacturing

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Schmid Tool & Engineering

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 RPM Engineering Corp.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Vita Needle

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Wisconsin Metal Parts

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 MicroGroup

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Quasar Industries

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Accurate Metal Fabricating

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Estes Design & Manufacturing

List of Figures

- Figure 1: Global Laser Fabricated Medical Assemblies Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Laser Fabricated Medical Assemblies Revenue (million), by Application 2025 & 2033

- Figure 3: North America Laser Fabricated Medical Assemblies Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Laser Fabricated Medical Assemblies Revenue (million), by Type 2025 & 2033

- Figure 5: North America Laser Fabricated Medical Assemblies Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Laser Fabricated Medical Assemblies Revenue (million), by Country 2025 & 2033

- Figure 7: North America Laser Fabricated Medical Assemblies Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Laser Fabricated Medical Assemblies Revenue (million), by Application 2025 & 2033

- Figure 9: South America Laser Fabricated Medical Assemblies Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Laser Fabricated Medical Assemblies Revenue (million), by Type 2025 & 2033

- Figure 11: South America Laser Fabricated Medical Assemblies Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Laser Fabricated Medical Assemblies Revenue (million), by Country 2025 & 2033

- Figure 13: South America Laser Fabricated Medical Assemblies Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Laser Fabricated Medical Assemblies Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Laser Fabricated Medical Assemblies Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Laser Fabricated Medical Assemblies Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Laser Fabricated Medical Assemblies Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Laser Fabricated Medical Assemblies Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Laser Fabricated Medical Assemblies Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Laser Fabricated Medical Assemblies Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Laser Fabricated Medical Assemblies Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Laser Fabricated Medical Assemblies Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Laser Fabricated Medical Assemblies Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Laser Fabricated Medical Assemblies Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Laser Fabricated Medical Assemblies Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Laser Fabricated Medical Assemblies Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Laser Fabricated Medical Assemblies Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Laser Fabricated Medical Assemblies Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Laser Fabricated Medical Assemblies Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Laser Fabricated Medical Assemblies Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Laser Fabricated Medical Assemblies Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Laser Fabricated Medical Assemblies Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Laser Fabricated Medical Assemblies Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Fabricated Medical Assemblies?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Laser Fabricated Medical Assemblies?

Key companies in the market include Estes Design & Manufacturing, Elite Manufacturing Technologies, LAI International, Stanron Steel Specialties, Dayton Rogers Manufacturing, EVS Metal, Storm Power Components, McAlpin Industries, Fabcon, Sequoia Tool, Laserage, G & J Steel & Tubing, PMF Industries, Marshall Manufacturing Company, Rockford Specialties, J&E Manufacturing, Schmid Tool & Engineering, RPM Engineering Corp., Vita Needle, Wisconsin Metal Parts, MicroGroup, Quasar Industries, Accurate Metal Fabricating.

3. What are the main segments of the Laser Fabricated Medical Assemblies?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Fabricated Medical Assemblies," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Fabricated Medical Assemblies report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Fabricated Medical Assemblies?

To stay informed about further developments, trends, and reports in the Laser Fabricated Medical Assemblies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence