Key Insights

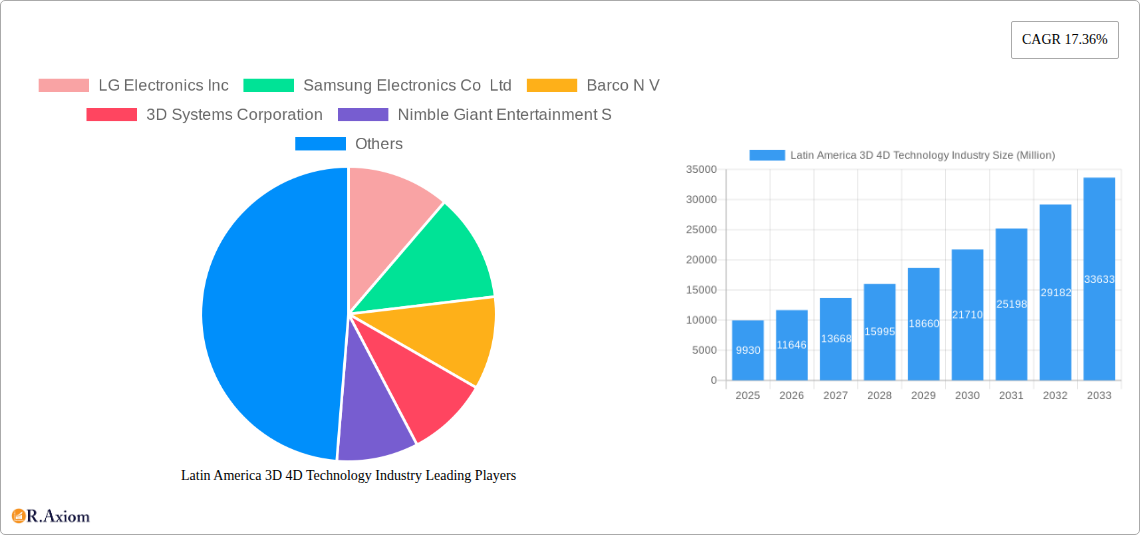

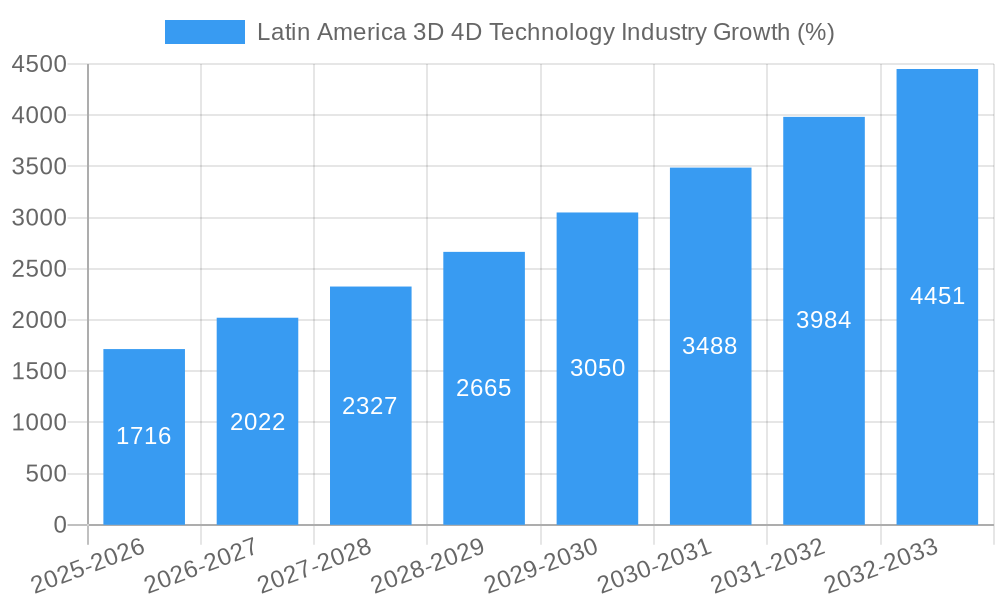

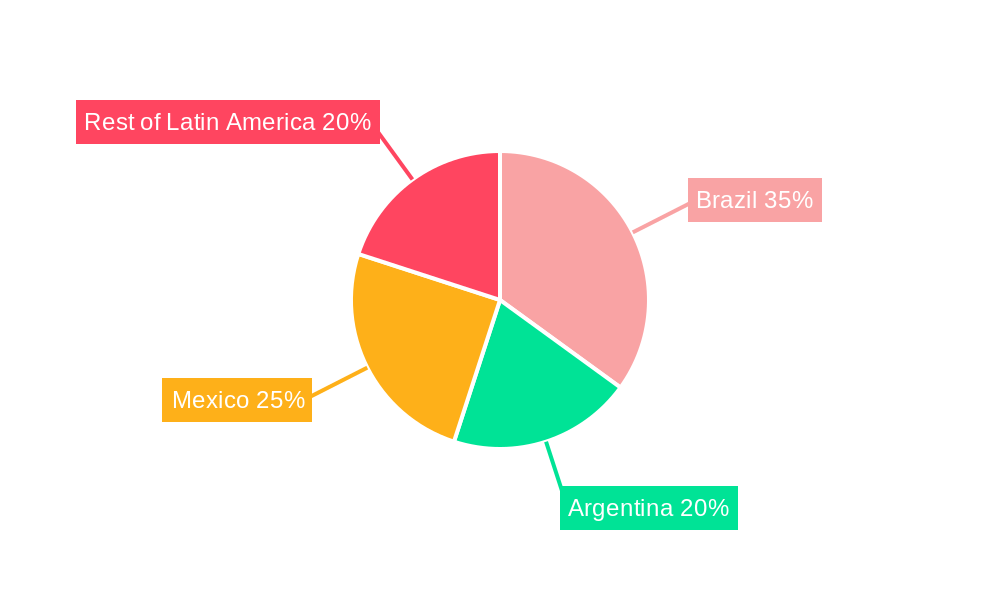

The Latin American 3D/4D technology market, valued at $9.93 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 17.36% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing adoption across diverse end-user industries, particularly healthcare (for medical imaging, prosthetics, and surgical planning), entertainment and media (for immersive gaming and film production), and education (for interactive learning tools), is significantly boosting demand. Secondly, technological advancements in 3D sensors, integrated circuits, and printers are continuously improving the quality, affordability, and accessibility of 3D/4D technologies. The proliferation of smartphones and other connected devices also contributes to market expansion, facilitating wider access to 3D/4D content and applications. Brazil, Argentina, and Mexico represent the largest national markets within the region, driven by their relatively advanced economies and technological infrastructure. However, growth opportunities exist across other Latin American countries as technological penetration expands. While data limitations prevent precise breakdowns across individual product and service segments, the significant CAGR indicates strong and diversified demand across the board. This is further supported by the presence of established players such as LG Electronics, Samsung, and 3D Systems Corporation, who are likely contributing to market development through their product offerings and market presence.

Despite its positive outlook, the market faces some challenges. High initial investment costs for 3D/4D technology can pose a barrier to entry for smaller businesses and individuals. Furthermore, the need for skilled professionals to operate and maintain this advanced technology can hinder widespread adoption in some regions. Overcoming these limitations through targeted investment in infrastructure, education, and training programs will be crucial for realizing the full potential of the Latin American 3D/4D technology market. Nevertheless, the overall trajectory remains strongly positive, indicating substantial future opportunities for growth and innovation within this dynamic sector.

Latin America 3D & 4D Technology Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin American 3D and 4D technology industry, covering market size, growth projections, key players, and emerging trends from 2019 to 2033. The study encompasses key segments including 3D printing, 3D gaming, 3D sensors, and other applications across diverse end-user industries like healthcare, entertainment, and education. This report is crucial for businesses, investors, and stakeholders seeking to understand the dynamics and future potential of this rapidly evolving market.

Latin America 3D & 4D Technology Industry Market Concentration & Innovation

The Latin American 3D & 4D technology market exhibits a moderately concentrated landscape, with a few dominant players and a growing number of niche players. Market share is largely influenced by technological advancements, product diversification, and strategic partnerships. Innovation is driven by the increasing demand for advanced imaging, gaming technologies, and cost-effective 3D printing solutions. Regulatory frameworks vary across Latin American countries, influencing market access and adoption rates. Product substitutes, primarily traditional manufacturing methods, pose a challenge but are gradually being overcome by the cost-effectiveness and efficiency of 3D/4D technologies. End-user trends towards personalization and customization are bolstering demand. The M&A activity in this sector is moderate, with deal values averaging approximately xx Million in recent years.

- Market Leaders: Several multinational companies, including LG Electronics Inc, Samsung Electronics Co Ltd, and Barco N V, hold significant market share.

- Market Share Distribution: The top five players hold approximately xx% of the market share, with the remaining share distributed among numerous smaller companies.

- M&A Activity: Recent mergers and acquisitions have focused on expanding product portfolios and geographical reach within the region. The total value of M&A deals in the period 2019-2024 reached approximately xx Million.

Latin America 3D & 4D Technology Industry Trends & Insights

The Latin American 3D and 4D technology market is experiencing robust growth, driven by several key factors. The increasing adoption of 3D printing in various sectors, coupled with advancements in 3D gaming and sensor technologies, is fueling market expansion. Technological disruptions, such as the development of more affordable and accessible 3D printers and the rise of virtual and augmented reality (VR/AR) applications, are transforming the industry. Consumer preferences for personalized products and experiences are further driving demand. The competitive landscape is dynamic, with both established players and new entrants vying for market share. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration rates expected to rise from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Latin America 3D & 4D Technology Industry

Brazil, Mexico, and Argentina are the leading markets within Latin America for 3D & 4D technologies. The 3D printer segment currently holds the largest market share among product categories, driven by increasing adoption in manufacturing and other industries. Within end-user industries, the healthcare sector demonstrates the strongest growth, followed by the entertainment and media segment.

- Key Drivers in Brazil: Robust industrial sector, increasing government investment in technology.

- Key Drivers in Mexico: Growing manufacturing sector, proximity to the US market.

- Key Drivers in Argentina: Developing technological infrastructure, increasing investment in education and research.

- Key Drivers in Rest of Latin America: Emerging markets with potential for growth, increasing adoption in niche sectors.

The dominance of these markets and segments is driven by factors including robust economic growth, favorable government policies promoting technological innovation, and expanding infrastructure supporting technology adoption.

Latin America 3D & 4D Technology Industry Product Developments

Recent product innovations focus on enhancing printing speed, resolution, and material compatibility for 3D printers. Advanced 3D sensors are being developed for various applications, including healthcare and industrial automation. In the gaming segment, the focus is on higher fidelity graphics and immersive experiences through improvements in processing power and software development. These developments reflect a broader trend towards increasing cost-effectiveness, user-friendliness, and wider applications across different industries.

Report Scope & Segmentation Analysis

This report segments the Latin American 3D & 4D technology market by country (Brazil, Argentina, Mexico, Rest of Latin America), product (3D sensors, 3D integrated circuits, 3D transistors, 3D printers, 3D gaming, other products), and end-user industry (healthcare, entertainment and media, education, other end-user industries). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The 3D printer segment is anticipated to witness the highest growth rate, driven by increasing applications across diverse sectors.

Key Drivers of Latin America 3D & 4D Technology Industry Growth

Several factors are propelling the growth of the Latin American 3D & 4D technology industry. Technological advancements are reducing costs and improving the performance of 3D printers and related technologies. Increasing government investments in research and development are fueling innovation and adoption. The expanding manufacturing and healthcare sectors are key drivers of demand. Furthermore, the growing interest in personalized products and experiences is fostering the adoption of 3D technologies.

Challenges in the Latin America 3D & 4D Technology Industry Sector

The industry faces several challenges, including relatively high initial investment costs for 3D printing technology, a shortage of skilled professionals in some areas, and varying levels of technological infrastructure across Latin American countries. Regulatory uncertainties and supply chain disruptions also impact market growth. These factors collectively reduce the rate of market penetration in some segments.

Emerging Opportunities in Latin America 3D & 4D Technology Industry

The Latin American market presents significant growth opportunities in niche sectors such as personalized medicine and customized educational tools, leveraging the capabilities of 3D printing and sensor technologies. The rising popularity of 3D gaming is driving the demand for advanced gaming hardware and software, while advancements in VR/AR applications are creating new possibilities in entertainment and training.

Leading Players in the Latin America 3D & 4D Technology Industry Market

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Barco N V

- 3D Systems Corporation

- Nimble Giant Entertainment S

- Autodesk Inc

- Stratasys Inc

- Dolby Laboratories Inc

- Panasonic Corporation

- Sony Corporation

Key Developments in Latin America 3D & 4D Technology Industry

- June 2023: Pragmatic Play's partnership with Salsa Technology significantly expands 3D gaming access across Latin America.

- June 2023: Celaya Tequila's charity initiative demonstrates 3D printing's application in affordable housing in Mexico.

Strategic Outlook for Latin America 3D & 4D Technology Industry Market

The Latin American 3D & 4D technology market shows substantial promise for continued growth. Increasing adoption across diverse industries, technological advancements, and supportive government policies will drive market expansion. The focus on innovation and addressing challenges related to cost and accessibility will determine the overall success and future trajectory of the market. The market is poised for significant expansion during the forecast period, driven by the factors outlined above, presenting both challenges and substantial opportunities for stakeholders.

Latin America 3D 4D Technology Industry Segmentation

-

1. Products

- 1.1. 3D Sensors

- 1.2. 3D Integrated Circuits

- 1.3. 3D Transistors

- 1.4. 3D Printer

- 1.5. 3D Gaming

- 1.6. Other Products

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Entertainment and Media

- 2.3. Education

- 2.4. Other End-user Industries

Latin America 3D 4D Technology Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America 3D 4D Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing End-User Applications of 3D Printing; Increased Investment in R&D Expected to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. High Product Associated Costs and Availability of 3D Printing Materials; Economic Instability of the Region

- 3.4. Market Trends

- 3.4.1. Healthcare is Expected to Hold Prominent Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. 3D Sensors

- 5.1.2. 3D Integrated Circuits

- 5.1.3. 3D Transistors

- 5.1.4. 3D Printer

- 5.1.5. 3D Gaming

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Entertainment and Media

- 5.2.3. Education

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Brazil Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America 3D 4D Technology Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 LG Electronics Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Electronics Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Barco N V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 3D Systems Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nimble Giant Entertainment S

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Autodesk Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Stratasys Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dolby Laboratories Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG Electronics Inc

List of Figures

- Figure 1: Latin America 3D 4D Technology Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America 3D 4D Technology Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 3: Latin America 3D 4D Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 13: Latin America 3D 4D Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America 3D 4D Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America 3D 4D Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America 3D 4D Technology Industry?

The projected CAGR is approximately 17.36%.

2. Which companies are prominent players in the Latin America 3D 4D Technology Industry?

Key companies in the market include LG Electronics Inc, Samsung Electronics Co Ltd, Barco N V, 3D Systems Corporation, Nimble Giant Entertainment S, Autodesk Inc, Stratasys Inc, Dolby Laboratories Inc, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Latin America 3D 4D Technology Industry?

The market segments include Products, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing End-User Applications of 3D Printing; Increased Investment in R&D Expected to Boost Market Growth.

6. What are the notable trends driving market growth?

Healthcare is Expected to Hold Prominent Market Share.

7. Are there any restraints impacting market growth?

High Product Associated Costs and Availability of 3D Printing Materials; Economic Instability of the Region.

8. Can you provide examples of recent developments in the market?

June 2023: Pragmatic Play has significantly strengthened its position in Latin America by collaborating with Salsa Technology, the region's prominent provider of iGaming solutions. As a result of the agreement, Pragmatic Play's vast game library will now be accessible to even more gamers throughout Latin America. Salsa Technology will also benefit from Pragmatic Play's Virtual Sports material, which includes in-depth 3D renderings of sports like football and motorsport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America 3D 4D Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America 3D 4D Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America 3D 4D Technology Industry?

To stay informed about further developments, trends, and reports in the Latin America 3D 4D Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence