Key Insights

The Latin American jewelry market, valued at approximately $8.58 billion in 2024, is projected to experience robust expansion with a Compound Annual Growth Rate (CAGR) of 6.4% from 2024 to 2033. This growth is propelled by a burgeoning middle class in key economies such as Brazil, Argentina, and Mexico, driving increased discretionary spending on luxury and premium jewelry. The expanding reach of e-commerce channels enhances consumer accessibility and convenience, especially in areas with limited brick-and-mortar retail. Evolving fashion trends and a growing demand for bespoke and distinctive jewelry pieces further stimulate market activity. Deep-rooted cultural significance associated with jewelry, symbolizing status and heritage, also contributes to market dynamism. Potential headwinds include economic instability in specific Latin American nations and fluctuations in precious metal prices.

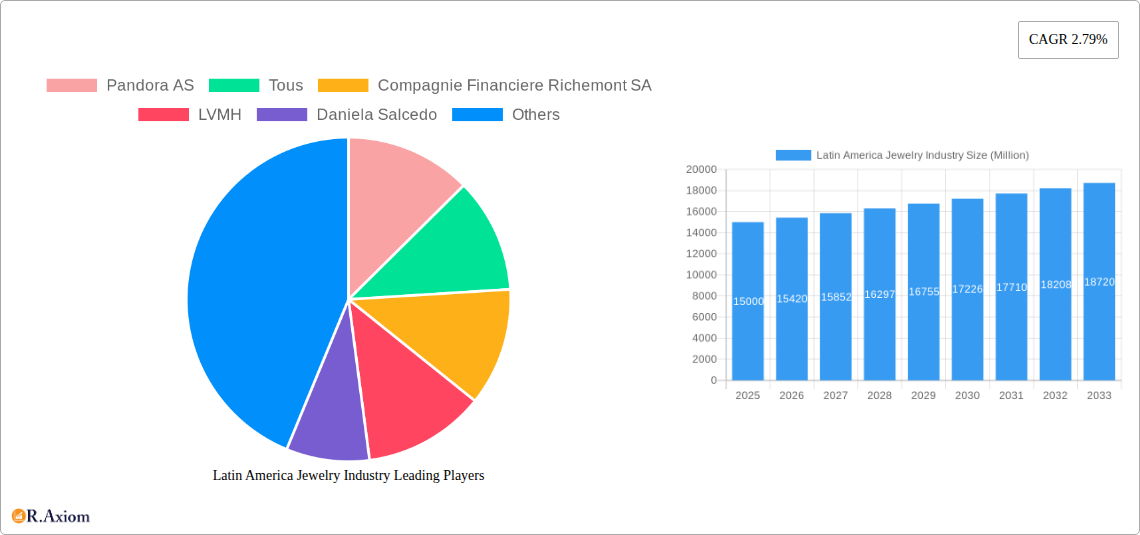

Latin America Jewelry Industry Market Size (In Billion)

The market is segmented by product category (precious and fashion jewelry), type (necklaces, rings, earrings, bracelets, charms, and others), and distribution channel (offline and online retail). Leading global and regional players, including Pandora, Tous, and Richemont, are actively engaged in competitive strategies focused on brand equity, product innovation, and strategic retail expansion. Brazil is anticipated to maintain its position as the largest market within Latin America, owing to its substantial population and established jewelry manufacturing infrastructure.

Latin America Jewelry Industry Company Market Share

E-commerce is poised for exceptional growth within this market. The increasing smartphone penetration and widespread internet access across Latin America are creating an opportune environment for online jewelry sales, benefiting both established brands and emerging direct-to-consumer jewelry businesses. Analysis indicates that demand for precious metals, particularly gold and silver, will continue to lead, with fashion jewelry exhibiting moderate growth influenced by current trends and affordability. The emphasis on personalized adornments and ethically sourced materials is expected to shape future consumer preferences, fostering innovation from both existing and new market participants. Understanding these evolving market dynamics is paramount for businesses aiming to leverage opportunities in the expanding Latin American jewelry landscape.

This report offers a comprehensive analysis of the Latin American jewelry industry, detailing market size, segmentation, growth catalysts, challenges, and prospects from 2019 to 2033. The analysis is grounded in extensive primary and secondary research, providing actionable intelligence for manufacturers, retailers, investors, and policymakers. The base year for this assessment is 2024, with projections for 2024 and a forecast period extending to 2033. The historical period reviewed is 2019-2024. The total market valuation in 2024 is estimated at $8.58 billion.

Latin America Jewelry Industry Market Concentration & Innovation

The Latin American jewelry market exhibits a moderately concentrated structure, with a few multinational players like Pandora AS, Tous, Compagnie Financiere Richemont SA, and LVMH holding significant market share. However, a substantial portion of the market is occupied by smaller, local players and independent designers, particularly in the costume jewelry segment. In 2025, the top 5 players are estimated to hold approximately xx% of the market share. Market concentration is expected to increase slightly by 2033 due to ongoing consolidation and the expansion of larger brands.

Innovation in the Latin American jewelry industry is driven by several factors:

- Consumer demand for unique and personalized designs: This fuels the growth of independent designers and custom jewelry services.

- Technological advancements: 3D printing, laser engraving, and other technologies are improving production efficiency and design possibilities.

- Sustainable and ethical sourcing: Growing consumer awareness is pushing companies to adopt sustainable practices and source materials responsibly.

Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values totaling approximately $xx Million in the period 2019-2024. However, increased competition and the desire to expand market reach could lead to a rise in M&A activity in the coming years. Regulatory frameworks vary across Latin American countries, impacting both production and distribution. The rise of e-commerce poses a significant challenge to traditional offline retailers. Substitute products, such as fashion accessories and imitation jewelry, also affect market dynamics.

Latin America Jewelry Industry Industry Trends & Insights

The Latin American jewelry industry is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for self-expression through jewelry. The compound annual growth rate (CAGR) is projected to be xx% from 2025 to 2033. This growth is fueled by increasing demand across all segments, but particularly in the real jewelry category, where demand for high-quality precious metals and gemstones is on the rise. Market penetration of online retail channels is increasing rapidly, driven by the growing adoption of e-commerce platforms and the expanding reach of internet access in the region.

Technological disruptions, such as the rise of e-commerce and personalized design tools, are reshaping the industry landscape. Consumer preferences are evolving towards more unique, handcrafted, and sustainable jewelry. Competitive dynamics are intense, with both large multinational corporations and smaller, local players vying for market share. The increasing prevalence of social media platforms and influencer marketing significantly impacts consumer purchasing decisions. These platforms shape trends and create new avenues for product discovery and sales. The preference for sustainable and ethically sourced jewelry continues to grow as consumers become increasingly aware of the social and environmental impact of their purchasing choices.

Dominant Markets & Segments in Latin America Jewelry Industry

Brazil remains the dominant market for jewelry in Latin America, accounting for approximately xx% of the total market value in 2025. This dominance is attributed to a large and affluent consumer base, a strong domestic manufacturing sector, and a rich jewelry-making tradition. Mexico and Colombia are also significant markets, showing promising growth potential.

By category, real jewelry commands a larger market share than costume jewelry, driven by the increasing demand for high-quality pieces and investment potential. Within the types of jewelry, necklaces and earrings consistently rank as the most popular categories, followed by rings and bracelets. Offline retail stores continue to dominate the distribution channel, but the online retail segment is rapidly gaining traction.

Key drivers of Brazil's dominance:

- Strong domestic manufacturing base

- High consumer spending on luxury goods

- Established jewelry-making traditions

- Favorable economic conditions (although subject to fluctuation)

- Well-developed retail infrastructure

Key drivers for Mexico and Colombia's growth:

- Rising middle class with increasing disposable income

- Growing popularity of fashion and personal adornment

- Expanding e-commerce infrastructure

Latin America Jewelry Industry Product Developments

Recent product innovations focus on personalized designs, sustainable materials, and technological integration. 3D printing allows for greater customization options, while advancements in gemstone treatments enhance their quality and durability. The use of recycled metals and ethically sourced gemstones is becoming increasingly prevalent, catering to the growing demand for environmentally and socially responsible products. These innovations enhance the competitive advantages of companies, providing them with unique selling propositions to capture consumer attention. The integration of technology allows for efficient tracking of supply chains and facilitates direct interaction between designers and consumers.

Report Scope & Segmentation Analysis

This report segments the Latin American jewelry market in the following ways:

By Category:

- Real Jewelry: This segment includes jewelry made from precious metals (gold, silver, platinum) and gemstones. Growth is projected to be xx% from 2025 to 2033, driven by increasing consumer preference for high-value, durable pieces. Competition is intense, with both established brands and independent jewelers competing for market share.

- Costume Jewelry: This segment comprises jewelry made from less expensive materials such as base metals, plastic, and imitation stones. This segment's growth is expected to be xx% from 2025-2033, driven by affordability and trendy designs. Competition is high due to a large number of players offering various styles and price points.

By Type:

- Necklaces, Rings, Earrings, Charms & Bracelets: Each segment has its own specific consumer preferences and growth trajectories. Necklaces and earrings are consistently popular, whereas charms and bracelets have shown significant growth in recent years.

- Others: This category includes body jewelry, cufflinks, and other accessories. This segment offers niche opportunities for smaller players specializing in unique and less conventional designs.

By Distribution Channel:

- Offline Retail Stores: This segment still dominates the market but faces challenges from the rise of e-commerce. Growth is expected at xx% from 2025-2033. Competition is high, with brick-and-mortar stores needing to adapt to evolving consumer expectations.

- Online Retail Stores: This segment is experiencing rapid growth due to increased internet penetration and the convenience it offers. The growth rate is estimated at xx% from 2025-2033. The competitive landscape is quickly evolving, with established brands and new e-commerce platforms competing for market share.

Key Drivers of Latin America Jewelry Industry Growth

Several factors drive the growth of the Latin American jewelry industry:

- Rising Disposable Incomes: The growth of the middle class in several Latin American countries has led to increased spending on discretionary items, including jewelry.

- Urbanization: The increasing urbanization in the region is leading to a shift in consumer preferences towards more fashion-conscious and trendy products.

- Tourism: The growing tourism sector in the region provides a boost to jewelry sales, with many tourists purchasing jewelry as souvenirs.

- E-commerce Expansion: The expansion of e-commerce platforms has provided greater access to jewelry products for consumers across Latin America.

Challenges in the Latin America Jewelry Industry Sector

The Latin American jewelry industry faces several challenges:

- Economic Volatility: Economic fluctuations and currency instability in several Latin American countries can significantly impact consumer spending on jewelry.

- Supply Chain Disruptions: Global supply chain disruptions can affect the availability of raw materials and finished products.

- Counterfeit Products: The prevalence of counterfeit jewelry in the market undermines the value of authentic products and erodes consumer confidence.

- Stringent Regulations: Varying regulatory frameworks across Latin American countries can pose challenges for manufacturers and distributors. These challenges can lead to significant increases in costs and time to market, hindering growth potential.

Emerging Opportunities in Latin America Jewelry Industry

Several emerging opportunities exist in the Latin American jewelry industry:

- Sustainable and Ethical Sourcing: Consumers are increasingly demanding sustainable and ethically sourced jewelry, creating opportunities for companies that prioritize these values.

- Personalized Jewelry: The demand for personalized and custom-designed jewelry is growing, offering opportunities for businesses that can offer tailored products.

- Technological Integration: The integration of technology in jewelry design and production can enhance efficiency, customization, and consumer experience.

- E-commerce Growth: The ongoing growth of e-commerce provides opportunities to reach a wider consumer base and lower distribution costs.

Leading Players in the Latin America Jewelry Industry Market

- Pandora AS

- Tous

- Compagnie Financiere Richemont SA

- LVMH

- Daniela Salcedo

- H Stern Jewelers Inc

- Manoel Bernardes SA

- Joias Vivara

- Haramara Jewelry

- Daniel Espinosa Jewelry

Key Developments in Latin America Jewelry Industry Industry

- 2022 Q4: Pandora AS launched a new collection focusing on sustainable materials.

- 2023 Q1: A major merger between two significant regional jewelry retailers took place in Brazil, reshaping the competitive landscape. (Specific details of the merger are not available at this time and require further research.)

- 2024 Q2: LVMH invested in a new technology for gemstone enhancement, streamlining production. (Details on the technology are not available at this time.)

(Further developments require additional data and research.)

Strategic Outlook for Latin America Jewelry Industry Market

The Latin American jewelry industry is poised for continued growth over the forecast period. Rising disposable incomes, urbanization, and the expansion of e-commerce will continue to drive demand. However, companies need to adapt to evolving consumer preferences, address sustainability concerns, and navigate economic volatility to succeed. Opportunities exist in personalized jewelry, sustainable sourcing, and technological integration. By focusing on innovation and adapting to market trends, companies can capture the significant growth potential of this dynamic sector.

Latin America Jewelry Industry Segmentation

-

1. Category

- 1.1. Real Jewelry

- 1.2. Costume Jewelry

-

2. Type

- 2.1. Necklaces

- 2.2. Rings

- 2.3. Earrings

- 2.4. Charms & Bracelets

- 2.5. Others

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

-

4. Geography

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

- 4.4. Rest of Latin America

Latin America Jewelry Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Jewelry Industry Regional Market Share

Geographic Coverage of Latin America Jewelry Industry

Latin America Jewelry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market

- 3.3. Market Restrains

- 3.3.1. Possibility of Rashes and Allergic Reactions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Diamond in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Real Jewelry

- 5.1.2. Costume Jewelry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Necklaces

- 5.2.2. Rings

- 5.2.3. Earrings

- 5.2.4. Charms & Bracelets

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Mexico

- 5.5.3. Colombia

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Real Jewelry

- 6.1.2. Costume Jewelry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Necklaces

- 6.2.2. Rings

- 6.2.3. Earrings

- 6.2.4. Charms & Bracelets

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Retail Stores

- 6.3.2. Online Retail Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Mexico

- 6.4.3. Colombia

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Mexico Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Real Jewelry

- 7.1.2. Costume Jewelry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Necklaces

- 7.2.2. Rings

- 7.2.3. Earrings

- 7.2.4. Charms & Bracelets

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Retail Stores

- 7.3.2. Online Retail Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Mexico

- 7.4.3. Colombia

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Colombia Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Real Jewelry

- 8.1.2. Costume Jewelry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Necklaces

- 8.2.2. Rings

- 8.2.3. Earrings

- 8.2.4. Charms & Bracelets

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Retail Stores

- 8.3.2. Online Retail Stores

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Mexico

- 8.4.3. Colombia

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Rest of Latin America Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Real Jewelry

- 9.1.2. Costume Jewelry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Necklaces

- 9.2.2. Rings

- 9.2.3. Earrings

- 9.2.4. Charms & Bracelets

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Retail Stores

- 9.3.2. Online Retail Stores

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Colombia

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pandora AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tous

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Compagnie Financiere Richemont SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LVMH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daniela Salcedo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 H Stern Jewelers Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manoel Bernardes SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Joias Vivara

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Haramara Jewelry*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daniel Espinosa Jewelry

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pandora AS

List of Figures

- Figure 1: Latin America Jewelry Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Jewelry Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Jewelry Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 12: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 17: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 22: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Jewelry Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Latin America Jewelry Industry?

Key companies in the market include Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry*List Not Exhaustive, Daniel Espinosa Jewelry.

3. What are the main segments of the Latin America Jewelry Industry?

The market segments include Category, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market.

6. What are the notable trends driving market growth?

Growing Demand for Diamond in the Market.

7. Are there any restraints impacting market growth?

Possibility of Rashes and Allergic Reactions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Jewelry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Jewelry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Jewelry Industry?

To stay informed about further developments, trends, and reports in the Latin America Jewelry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence