Key Insights

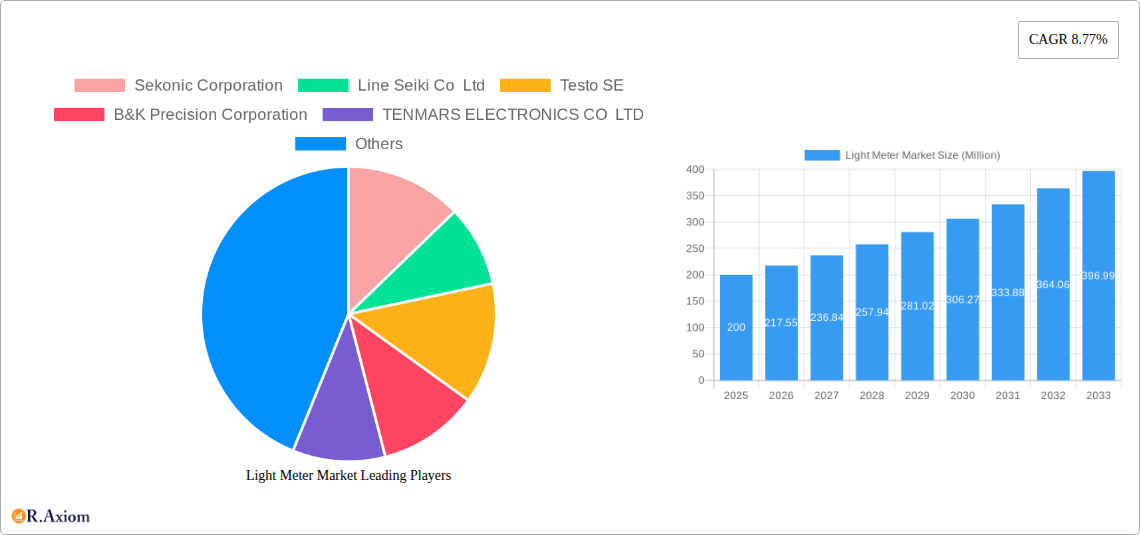

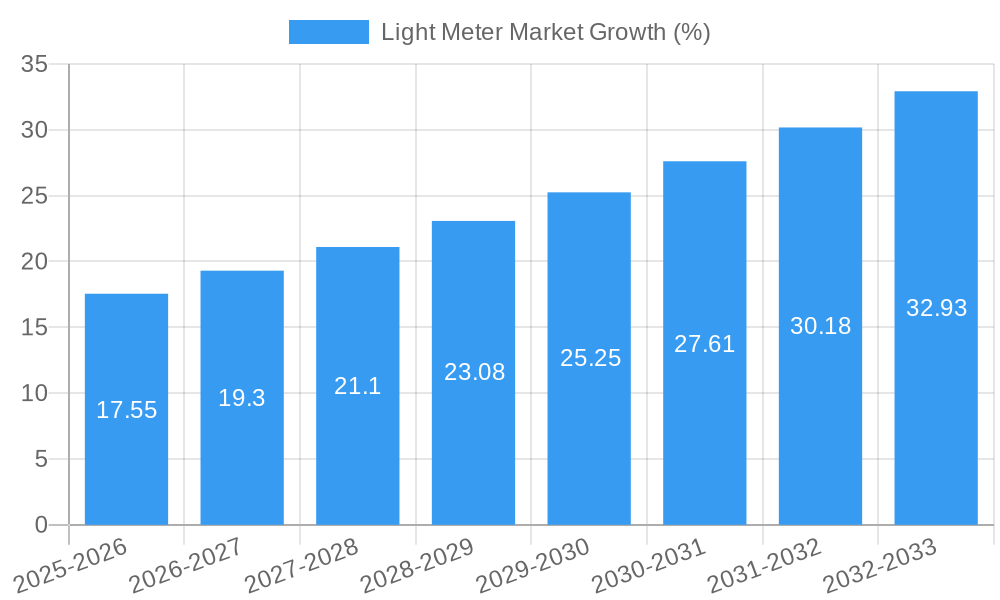

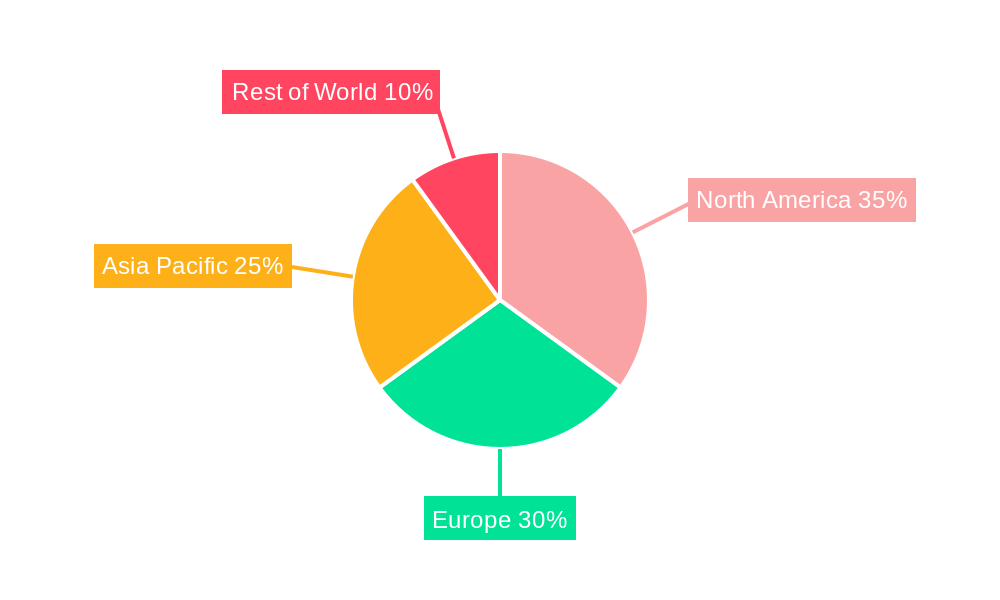

The global light meter market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.77% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of advanced lighting technologies in various sectors, including photography, cinematography, manufacturing, and healthcare, fuels the demand for precise and reliable light measurement tools. The growing prevalence of LED lighting, requiring specialized meters for accurate assessment, is another significant driver. Furthermore, stringent quality control measures in manufacturing plants necessitate the use of light meters, contributing to market growth. The rising demand for advanced features like data logging, wireless connectivity, and user-friendly interfaces in light meters further enhances market appeal. However, factors such as the relatively high cost of advanced light meters and the availability of cheaper alternatives could restrain market expansion to some extent. Segmentation reveals that LED light meters are gaining prominence due to the widespread adoption of LED technology. Geographically, North America and Europe currently dominate the market, but the Asia-Pacific region is expected to witness significant growth due to rapid industrialization and increasing investments in advanced technologies.

The competitive landscape is characterized by a mix of established players and emerging companies. Key players like Sekonic Corporation, Line Seiki Co Ltd, and Testo SE are leveraging their technological expertise and brand reputation to maintain market leadership. However, the market also presents opportunities for smaller companies to gain traction by offering specialized or cost-effective solutions. The market's future trajectory hinges on technological innovation, including the development of more accurate, portable, and feature-rich light meters catering to specialized applications. The integration of smart technologies and the increasing demand for customized solutions will shape the competitive dynamics and drive future market growth. Continued expansion into emerging markets will also be crucial for sustained market expansion in the coming years.

Light Meter Market: A Comprehensive Report Covering 2019-2033

This detailed report provides an in-depth analysis of the global Light Meter market, covering the period 2019-2033. It offers valuable insights into market dynamics, competitive landscape, technological advancements, and future growth projections, making it an indispensable resource for industry stakeholders, investors, and researchers. The report uses 2025 as its base year and forecasts market trends until 2033, leveraging data from the historical period (2019-2024). The market is segmented by type (General Purpose Light Meters, LED Light Meters, UV Light Meters) and application (Photography and Cinematography, Manufacturing Plants, Clinics and Hospitals, Others). Key players analyzed include Sekonic Corporation, Line Seiki Co Ltd, Testo SE, B&K Precision Corporation, TENMARS ELECTRONICS CO LTD, LIT SYSTEMS AB, Amprobe Instrument Corporation (Danaher Corporation), KERN & SOHN GmbH, Hioki E E Corporation, FLIR Systems, and Martindale Electric Co Ltd. The total market size is projected to reach xx Million by 2033.

Light Meter Market Market Concentration & Innovation

The Light Meter market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller players and the continuous emergence of new technologies contribute to a dynamic competitive environment. Market concentration is further analyzed through metrics like the Herfindahl-Hirschman Index (HHI) and market share analysis of key players. Innovation is driven by the increasing demand for higher accuracy, improved portability, and specialized applications across various industries. Regulatory frameworks, particularly those related to safety and environmental compliance, influence product design and market access. The market witnesses continuous product innovation, with several new models launched each year. Several factors drive innovation: advancements in sensor technology, miniaturization of components, and rising demand for precise light measurement across diverse applications. Substitutes for light meters, such as smartphone apps with light-measuring capabilities, pose a competitive challenge. End-user trends, including the rising popularity of digital photography and the growth of various industrial applications, are propelling market growth. Mergers and acquisitions (M&A) activity remains moderate, with deal values ranging from xx Million to xx Million in recent years.

- Market Share: Sekonic Corporation holds approximately xx% market share, followed by Line Seiki Co Ltd with xx%.

- M&A Activity: In the past five years, there have been approximately xx M&A deals in the Light Meter market, with an average deal value of xx Million.

Light Meter Market Industry Trends & Insights

The Light Meter market is experiencing robust growth, driven by increasing demand across diverse sectors. Technological advancements, such as the incorporation of advanced sensors and digital connectivity, are enhancing the functionality and usability of light meters. Consumer preferences are shifting towards more portable, user-friendly, and precise devices. The market is characterized by intense competition, with companies focusing on product differentiation, technological innovation, and strategic partnerships to gain a competitive edge. The Compound Annual Growth Rate (CAGR) for the Light Meter market is estimated at xx% during the forecast period (2025-2033). Market penetration is high in developed regions but remains relatively low in developing economies, presenting significant growth opportunities. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) into light meters, are expected to further transform the market. The rising adoption of digital photography and the expanding use of light meters in industrial processes are primary growth drivers.

Dominant Markets & Segments in Light Meter Market

The North American region currently dominates the Light Meter market, driven by factors including high technological adoption rates, robust R&D activities, and a large base of professional photographers and industrial users. Within the market segmentation, the General Purpose Light Meters segment holds the largest market share due to its wide applicability across various sectors. The LED Light Meters and UV Light Meters segments are exhibiting faster growth rates, driven by increasing demand from the manufacturing and healthcare sectors. The Photography and Cinematography application segment is a key driver of market growth, with the increasing professional and amateur usage driving significant sales.

Key Drivers for North American Dominance:

- Strong economic growth

- High technological adoption

- Large number of professional photographers and industrial users

- Well-established distribution networks

Key Drivers for General Purpose Light Meters Segment:

- Versatility and wide applicability

- Cost-effectiveness

- Ease of use

Key Drivers for LED Light Meters Segment:

- Increasing demand from manufacturing plants

- Energy efficiency

- High accuracy

Key Drivers for UV Light Meters Segment:

- Rising applications in healthcare (UV sterilization)

- Growing demand in manufacturing (UV curing)

- Stringent regulations related to UV exposure

Light Meter Market Product Developments

Recent years have witnessed significant advancements in Light Meter technology, with a focus on improved accuracy, enhanced portability, and specialized functionalities. Manufacturers are increasingly integrating digital connectivity, data logging capabilities, and advanced sensor technologies to enhance product offerings. This is particularly evident in the growing availability of sophisticated LED and UV light meters. The trend towards miniaturization and user-friendly interfaces is also apparent. These improvements aim to cater to evolving demands across different applications, ranging from professional photography to industrial processes and medical diagnostics. The market's competitive dynamics are marked by a continuous stream of product launches, with companies striving to offer unique value propositions to their target customer segments.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Light Meter market, segmented by type and application.

By Type:

- General Purpose Light Meters: This segment accounts for the largest market share, offering versatile light measurement capabilities across numerous applications. The segment is expected to witness steady growth, driven by the widespread use of light meters in diverse industries. Competitive dynamics are driven by pricing and feature differentiation.

- LED Light Meters: This segment is experiencing rapid growth, driven by the rising demand for LED lighting and the need for precise measurement in various industrial applications. Technological advancements, such as the integration of advanced sensors and digital connectivity, are further fueling market expansion.

- UV Light Meters: This segment showcases substantial growth potential, spurred by the increasing applications of UV light in industries like manufacturing (UV curing) and healthcare (UV sterilization). The segment's competitive dynamics are shaped by the need for high accuracy and compliance with safety regulations.

By Application:

- Photography and Cinematography: This remains a key application segment, driven by the continued popularity of photography and film production. The segment is characterized by high demand for accuracy and portability.

- Manufacturing Plants: This segment is witnessing significant growth, driven by the increasing use of light meters in quality control and process optimization. The focus is on robust and reliable devices capable of withstanding industrial environments.

- Clinics and Hospitals: The use of light meters in healthcare is expanding, particularly in UV sterilization and phototherapy applications. The focus here is on accuracy, safety, and compliance with medical standards.

- Other Applications: This segment encompasses various niche applications, including scientific research, environmental monitoring, and agricultural practices, offering pockets of growth for specialized light meters.

Key Drivers of Light Meter Market Growth

Several factors are driving the growth of the Light Meter market. The rising demand for accurate light measurement across various industries, particularly in manufacturing and healthcare, is a primary driver. Technological advancements, leading to more accurate, portable, and user-friendly devices, are also contributing to market expansion. Furthermore, increasing awareness of the importance of light quality in different applications fuels market growth. Government regulations concerning light exposure in various sectors further contribute to market demand. The growing popularity of digital photography and cinematography also serves as a strong driver for light meter adoption.

Challenges in the Light Meter Market Sector

The Light Meter market faces several challenges. The availability of low-cost, less accurate substitutes, such as smartphone apps with light-measuring capabilities, poses a competitive threat. Supply chain disruptions, especially concerning essential components, can impact production and pricing. Stricter regulatory requirements and safety standards can increase manufacturing costs and complicate market entry. Intense competition among established and emerging players necessitates continuous innovation and adaptation to stay ahead.

Emerging Opportunities in Light Meter Market

The Light Meter market presents several emerging opportunities. The growing adoption of LED lighting and UV technologies across various industries presents significant demand for specialized light meters. The integration of advanced features like AI and IoT offers opportunities for enhanced product functionality and data analysis. Expansion into developing markets with increasing demand for light measurement tools presents a significant growth opportunity. The development of niche light meters tailored to specific industrial, medical, or scientific applications presents further growth potential.

Leading Players in the Light Meter Market Market

- Sekonic Corporation

- Line Seiki Co Ltd

- Testo SE

- B&K Precision Corporation

- TENMARS ELECTRONICS CO LTD

- LIT SYSTEMS AB

- Amprobe Instrument Corporation (Danaher Corporation)

- KERN & SOHN GmbH

- Hioki E E Corporation

- FLIR Systems

- Martindale Electric Co Ltd

Key Developments in Light Meter Market Industry

- June 2023: TTArtisan launched the Light Meter II, a refined shoe-mount light meter for film cameras, improving on the 2021 model. This signifies innovation in niche markets and a focus on user experience improvements.

- February 2023: Hoya introduced the NX series air-cooled LED UV curing system for flexo printing, incorporating a UVC light meter. This indicates increasing demand for integrated solutions and the importance of light measurement in industrial processes.

Strategic Outlook for Light Meter Market Market

The Light Meter market is poised for continued growth, driven by technological advancements, expanding applications, and increasing demand across diverse sectors. Future growth will likely be influenced by factors like the increasing adoption of LED and UV technologies, the integration of advanced features like AI and IoT, and the exploration of new applications in areas such as environmental monitoring and scientific research. Companies focusing on innovation, product differentiation, and strategic partnerships will be well-positioned to capitalize on these emerging opportunities.

Light Meter Market Segmentation

-

1. Type

- 1.1. General Purpose Light Meters

- 1.2. LED Light Meters

- 1.3. UV Light Meters

-

2. Application

- 2.1. Photography and Cinematography

- 2.2. Manufacturing Plants

- 2.3. Clinics and Hospitals

- 2.4. Others Application

Light Meter Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Latin America

- 5. Middle East and Africa

Light Meter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Light Meters in the Photography and Cinematography Industry Worldwide; Regulations to Improve Workplace Lighting

- 3.3. Market Restrains

- 3.3.1. Development of Smartphone Applications and Light Measuring Devices to Substitute Light Meters

- 3.4. Market Trends

- 3.4.1. LED Type Light Meters Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Purpose Light Meters

- 5.1.2. LED Light Meters

- 5.1.3. UV Light Meters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Photography and Cinematography

- 5.2.2. Manufacturing Plants

- 5.2.3. Clinics and Hospitals

- 5.2.4. Others Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General Purpose Light Meters

- 6.1.2. LED Light Meters

- 6.1.3. UV Light Meters

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Photography and Cinematography

- 6.2.2. Manufacturing Plants

- 6.2.3. Clinics and Hospitals

- 6.2.4. Others Application

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General Purpose Light Meters

- 7.1.2. LED Light Meters

- 7.1.3. UV Light Meters

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Photography and Cinematography

- 7.2.2. Manufacturing Plants

- 7.2.3. Clinics and Hospitals

- 7.2.4. Others Application

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General Purpose Light Meters

- 8.1.2. LED Light Meters

- 8.1.3. UV Light Meters

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Photography and Cinematography

- 8.2.2. Manufacturing Plants

- 8.2.3. Clinics and Hospitals

- 8.2.4. Others Application

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General Purpose Light Meters

- 9.1.2. LED Light Meters

- 9.1.3. UV Light Meters

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Photography and Cinematography

- 9.2.2. Manufacturing Plants

- 9.2.3. Clinics and Hospitals

- 9.2.4. Others Application

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General Purpose Light Meters

- 10.1.2. LED Light Meters

- 10.1.3. UV Light Meters

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Photography and Cinematography

- 10.2.2. Manufacturing Plants

- 10.2.3. Clinics and Hospitals

- 10.2.4. Others Application

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Rest of the World Light Meter Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Middle East and Africa

- 14.1.2 Latin America

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Sekonic Corporation

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Line Seiki Co Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Testo SE

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 B&K Precision Corporation

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 TENMARS ELECTRONICS CO LTD

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 LIT SYSTEMS AB*List Not Exhaustive

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Amprobe Instrument Corporation ( Danaher Corporation)

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 KERN & SOHN GmbH

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Hioki E E Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 FLIR Systems

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Martindale Electric Co Ltd

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Sekonic Corporation

List of Figures

- Figure 1: Global Light Meter Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Light Meter Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Light Meter Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Light Meter Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Light Meter Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Light Meter Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Light Meter Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Light Meter Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Light Meter Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Light Meter Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Light Meter Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Light Meter Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Light Meter Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Light Meter Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Latin America Light Meter Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Latin America Light Meter Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Light Meter Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Light Meter Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Light Meter Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Middle East and Africa Light Meter Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Middle East and Africa Light Meter Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Light Meter Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Light Meter Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East and Africa Light Meter Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Light Meter Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Light Meter Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Middle East and Africa Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Latin America Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: India Light Meter Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Global Light Meter Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Light Meter Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Light Meter Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Light Meter Market?

The projected CAGR is approximately 8.77%.

2. Which companies are prominent players in the Light Meter Market?

Key companies in the market include Sekonic Corporation, Line Seiki Co Ltd, Testo SE, B&K Precision Corporation, TENMARS ELECTRONICS CO LTD, LIT SYSTEMS AB*List Not Exhaustive, Amprobe Instrument Corporation ( Danaher Corporation), KERN & SOHN GmbH, Hioki E E Corporation, FLIR Systems, Martindale Electric Co Ltd.

3. What are the main segments of the Light Meter Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Light Meters in the Photography and Cinematography Industry Worldwide; Regulations to Improve Workplace Lighting.

6. What are the notable trends driving market growth?

LED Type Light Meters Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Development of Smartphone Applications and Light Measuring Devices to Substitute Light Meters.

8. Can you provide examples of recent developments in the market?

June 2023 - TTArtisan has announced the Light Meter II, a second-generation attempt at its shoe-mount meter that improves on the original released in 2021. The original TTArtisan Light Meter could work on any film camera system, but the company marketed it for use with Leica cameras. The design is simple, and the light meter is mounted to the shoe of any camera and was operated via three dials, one for shutter speed and the other for aperture, while a third was built into the aperture dial to control ISO.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Light Meter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Light Meter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Light Meter Market?

To stay informed about further developments, trends, and reports in the Light Meter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence