Key Insights

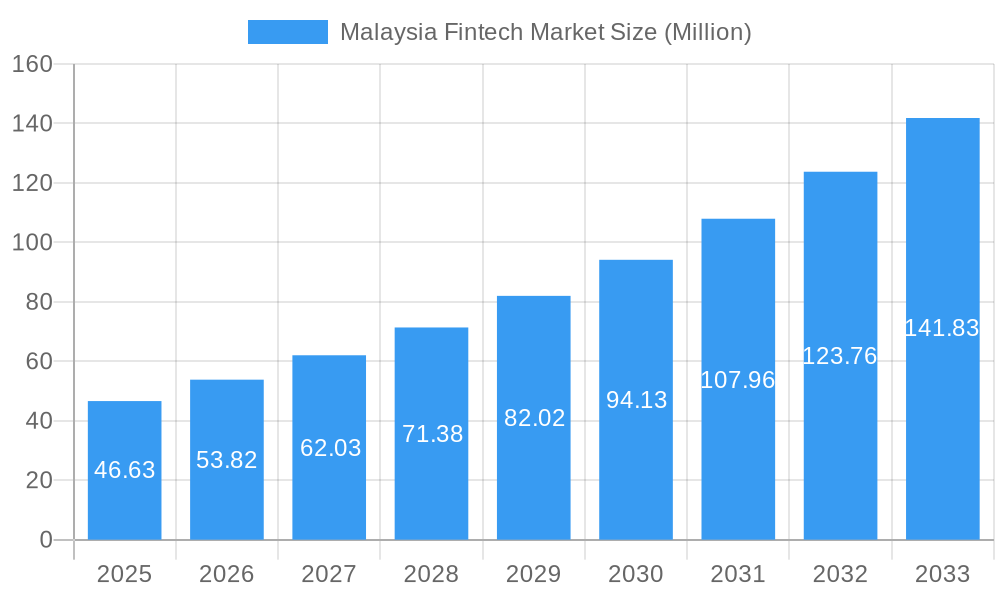

The Malaysian Fintech market, valued at $46.63 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.56% from 2025 to 2033. This surge is driven by several key factors. Increasing smartphone penetration and internet access among the Malaysian population fuels the adoption of digital financial services. Government initiatives promoting financial inclusion and digitalization further contribute to market expansion. The rise of e-commerce and the growing preference for cashless transactions are also significant drivers. Furthermore, the innovative solutions offered by Fintech companies, catering to diverse needs from peer-to-peer lending to mobile payments and investment platforms, are attracting a wider user base. Competition is fierce, with established players like Capital Bay and Jirnexu alongside emerging companies such as HelloGold and MoneyMatch vying for market share. While challenges remain, such as cybersecurity concerns and regulatory hurdles, the overall outlook for the Malaysian Fintech sector remains highly positive.

Malaysia Fintech Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued high growth, fueled by ongoing digital transformation across various sectors of the Malaysian economy. The increasing adoption of open banking APIs is expected to unlock new opportunities for innovation and collaboration within the ecosystem. The market segmentation, although not explicitly detailed, likely encompasses areas such as payment gateways, lending platforms, wealth management technologies, and insurance technology (Insurtech). Continued investment in Fintech infrastructure and talent development will be crucial to sustaining this growth trajectory. A potential area of concern could be the need for robust consumer protection measures to maintain trust and confidence in the sector as it expands. The presence of numerous established and emerging players indicates a dynamic and competitive landscape, promising further innovation and market evolution in the coming years.

Malaysia Fintech Market Company Market Share

Malaysia Fintech Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysian Fintech market, covering its evolution from 2019 to 2024 (historical period), present state (base year 2025 and estimated year 2025), and future projections until 2033 (forecast period). It offers valuable insights for investors, businesses, and policymakers seeking to understand this dynamic sector. The report utilizes extensive data and analysis to explore market concentration, innovation, trends, dominant segments, leading players, and future opportunities within the Malaysian Fintech landscape.

Malaysia Fintech Market Concentration & Innovation

The Malaysian Fintech market exhibits a moderately concentrated landscape with several key players vying for dominance. Market share analysis reveals that while a few large companies hold significant positions, a considerable number of smaller, innovative firms are actively contributing to market growth. The innovation landscape is vibrant, driven by factors including a supportive government regulatory framework, the increasing adoption of digital technologies by consumers, and the growing need for financial inclusion. M&A activity has played a significant role in shaping the market, with deal values reaching xx Million USD in the recent past.

- Market Concentration: xx% of market share held by top 5 players (estimated).

- Innovation Drivers: Government initiatives, technological advancements, rising digital literacy.

- Regulatory Frameworks: Supportive policies promoting innovation and financial inclusion.

- Product Substitutes: Traditional banking services remain a primary substitute.

- End-User Trends: Increasing smartphone penetration and mobile payment adoption.

- M&A Activities: xx number of deals valued at xx Million USD in the last 5 years (estimated).

Malaysia Fintech Market Industry Trends & Insights

The Malaysian Fintech market is experiencing robust growth, driven by a confluence of factors including rising smartphone penetration, surging internet usage, and a growing demand for convenient and accessible financial services. This dynamic market boasts a projected Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). Market penetration of digital financial services is rapidly increasing, with an estimated [Insert Updated Percentage]% penetration rate achieved in 2025. The landscape is being reshaped by technological disruptions such as AI, blockchain, and big data analytics, creating fertile ground for innovative FinTech players. Consumer preferences are shifting decisively towards personalized, user-friendly, and secure financial solutions, further fueling market expansion.

Dominant Markets & Segments in Malaysia Fintech Market

The Malaysian Fintech market showcases robust growth across diverse segments, with particularly strong performance in mobile payments, e-commerce finance, and digital lending. Kuala Lumpur and other major urban centers serve as key growth engines, but expansion is also evident in secondary cities as internet and mobile penetration increases.

- Key Drivers:

- Government initiatives promoting digitalization, including substantial financial allocations for digital infrastructure development and financial inclusion programs.

- Robust and expanding digital infrastructure, with high internet penetration and increasing 4G/5G coverage.

- Widespread adoption of smartphones and mobile internet, particularly amongst younger demographics.

- Increased financial inclusion efforts targeting underserved populations, driving access to financial services.

- Strong government support for MSMEs (Micro, Small, and Medium Enterprises) through various funding schemes and initiatives.

- A young and tech-savvy population eager to adopt new financial technologies.

The dominance of these segments is fueled by a synergistic interplay of factors: supportive government policies, readily available technological infrastructure, a digitally adept consumer base, and a thriving entrepreneurial ecosystem.

Malaysia Fintech Market Product Developments

Recent product innovations underscore a strong emphasis on mobile-first solutions, seamless integrated payment gateways, and personalized financial management tools tailored to individual customer needs. The application of AI and machine learning is significantly enhancing risk assessment, fraud detection, and customer service. Competitive advantages are increasingly determined by superior user experience, robust security features, strategic partnerships, and innovative data-driven services.

Report Scope & Segmentation Analysis

This report segments the Malaysian Fintech market based on various factors, including payment methods, service offerings, and target customers. Each segment offers unique growth projections and competitive dynamics. Growth projections for each segment vary, with mobile payments and digital lending expected to exhibit higher growth compared to other areas.

- Payments: Mobile payments, online payments, etc. (detailed market sizes and growth projections for each will be provided within the full report).

- Services: Lending, investing, insurance, wealth management, etc. (detailed market sizes and growth projections for each will be provided within the full report).

- Customer Base: Individuals, MSMEs, large enterprises (detailed market sizes and growth projections for each will be provided within the full report).

Key Drivers of Malaysia Fintech Market Growth

Several key factors are propelling the growth of the Malaysian Fintech market. The government's unwavering commitment to digitalization, evidenced by significant investments (e.g., USD 0.26 billion for MSMEs' digital transformation) and supportive regulatory frameworks, is creating a vibrant ecosystem for Fintech firms. Simultaneously, the rising smartphone penetration and expanding internet access are broadening the market's reach, while the increasing demand for accessible and convenient financial services fuels further expansion. Furthermore, the growing adoption of open banking APIs is fostering innovation and competition within the sector.

Challenges in the Malaysia Fintech Market Sector

The Malaysian Fintech market faces challenges like regulatory uncertainty in certain areas, the need for improved cybersecurity infrastructure, and intense competition from established financial institutions. These challenges can impact growth rates and profitability. Furthermore, overcoming consumer trust barriers and addressing concerns about data privacy are crucial for continued market expansion.

Emerging Opportunities in Malaysia Fintech Market

The expanding adoption of open banking APIs offers significant opportunities for innovation, allowing for greater data sharing and collaboration among Fintech firms and traditional banks. The rising popularity of blockchain technology and its potential applications in areas such as supply chain finance and cross-border payments present new avenues for growth.

Leading Players in the Malaysia Fintech Market Market

- Capital Bay

- Jirnexu

- Mobi

- Moca

- HelloGold

- MoneyMatch

- MyCash online

- Prime keeper

- Policy Street

- pitchIN

- Mhub

Key Developments in Malaysia Fintech Market Industry

- March 2023: USD 8.76 Million allocated to the Malaysia Co-Investment Fund (MYCIF) to boost P2P and ECF market liquidity. This increased MYCIF funds to USD 65.34 Million, facilitating funding for Fintech firms and MSMEs.

- March 2023: USD 0.26 Billion government investment to accelerate MSME digitalization, including e-commerce and online advertising grants. This initiative broadened market reach for Fintech companies and other businesses.

Strategic Outlook for Malaysia Fintech Market Market

The Malaysian Fintech market holds significant potential for future growth, driven by ongoing government support, increasing digital adoption, and the emergence of innovative financial solutions. The continued focus on financial inclusion and the expansion of digital infrastructure will further unlock opportunities for growth and create a more inclusive and dynamic financial ecosystem in the years to come. This presents significant opportunities for both established players and new entrants to capitalize on emerging trends and technologies.

Malaysia Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Investments

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Others

Malaysia Fintech Market Segmentation By Geography

- 1. Malaysia

Malaysia Fintech Market Regional Market Share

Geographic Coverage of Malaysia Fintech Market

Malaysia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Regulatory Changes Ignited Fintech Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Investments

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Capital Bay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jirnexu

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mobi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moca

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HelloGold

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MoneyMatch

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MyCash online

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Prime keeper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Policy Street

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 pitchIN

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mhub**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Capital Bay

List of Figures

- Figure 1: Malaysia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Malaysia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Malaysia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Malaysia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Malaysia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: Malaysia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: Malaysia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Malaysia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Fintech Market?

The projected CAGR is approximately 15.56%.

2. Which companies are prominent players in the Malaysia Fintech Market?

Key companies in the market include Capital Bay, Jirnexu, Mobi, Moca, HelloGold, MoneyMatch, MyCash online, Prime keeper, Policy Street, pitchIN, Mhub**List Not Exhaustive.

3. What are the main segments of the Malaysia Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.63 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Regulatory Changes Ignited Fintech Adoption.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: An excess of USD 8.76 million would be given to the Malaysia Co-Investment Fund (MYCIF) to improve price discovery opportunities and further increase the liquidity of the peer-to-peer (P2P) and equity crowdfunding (ECF) markets. It would increase the total amount of accumulated funds under MYCIF that are available to MYR 300 million (65.34 USD million), according to the Securities Commission (SC). It proved crucial in securing funding for fintech firms as well as MSMEs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Fintech Market?

To stay informed about further developments, trends, and reports in the Malaysia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence