Key Insights

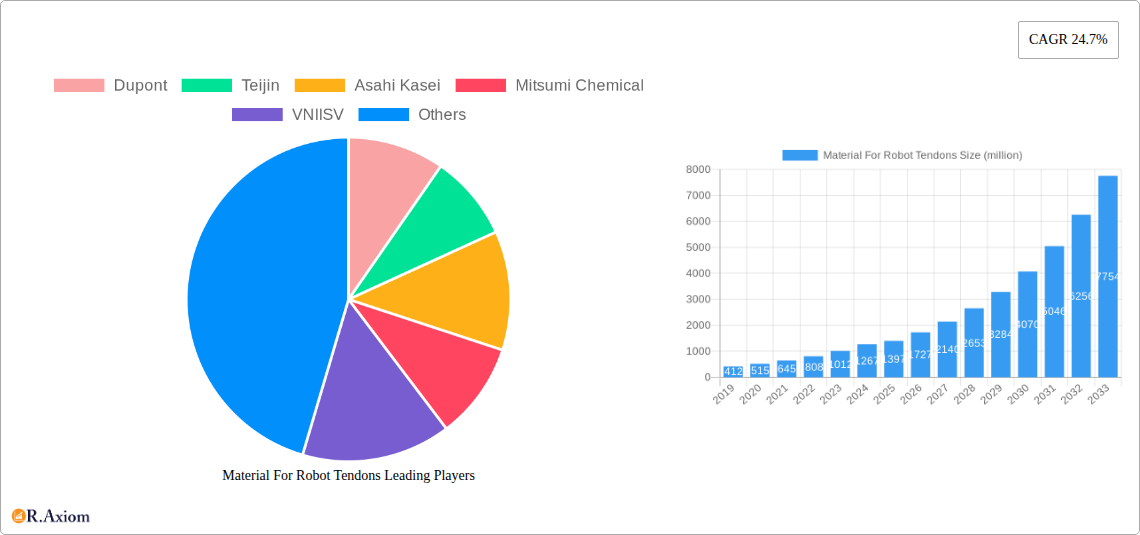

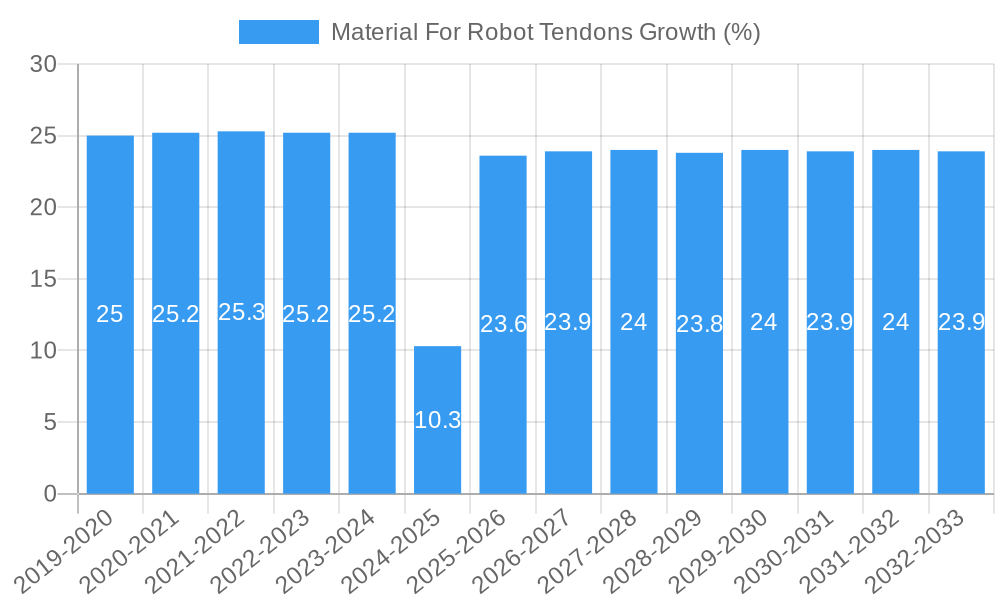

The Material for Robot Tendons market is poised for explosive growth, projected to reach a substantial \$1397 million by 2025, fueled by an impressive Compound Annual Growth Rate (CAGR) of 24.7%. This rapid expansion is driven by the increasing demand for sophisticated robotics across diverse applications, from intricate industrial automation to advanced home assistance and commercial services. The inherent need for materials that offer superior flexibility, strength, and durability in robotic articulation directly translates into a robust market for specialized robot tendon materials. Key drivers include the relentless pursuit of enhanced robotic dexterity for complex tasks, the growing integration of robots in healthcare for delicate surgeries and patient care, and the escalating adoption of collaborative robots in manufacturing to improve efficiency and safety. Furthermore, advancements in material science are continuously introducing novel polymers and composites that outperform traditional materials, enabling lighter, stronger, and more responsive robotic designs.

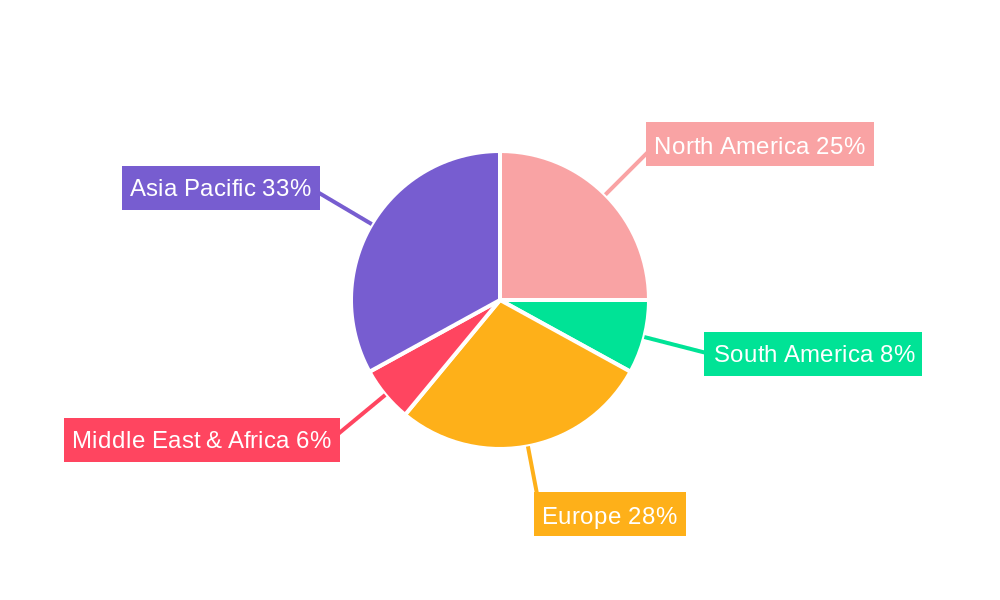

The market is segmented into distinct applications, with Home Robots, Commercial Robots, and Industrial Robots representing the primary growth areas. Industrial robots, in particular, will continue to dominate due to the ongoing automation wave in manufacturing and logistics. Within material types, Stainless Steel Materials, Polymer Fiber Materials, and Other specialized composites are gaining traction. Polymer fiber materials, such as high-performance synthetic fibers, are becoming increasingly popular due to their lightweight nature, exceptional tensile strength, and resistance to fatigue, crucial for high-cycle robotic operations. Companies like Dupont, Teijin, Asahi Kasei, and Dyneema (Avient) are at the forefront of innovation, developing next-generation materials to meet the evolving needs of robot manufacturers. Geographically, the Asia Pacific region, led by China and Japan, is expected to witness the highest growth due to its significant manufacturing base and rapid adoption of advanced robotics. North America and Europe are also significant markets, driven by technological advancements and the increasing sophistication of robotic applications.

Material For Robot Tendons Market Concentration & Innovation

The Material for Robot Tendons market exhibits a moderate concentration, with key players investing heavily in research and development to drive innovation. Leading companies like Dupont, Teijin, and Asahi Kasei are at the forefront, focusing on developing advanced polymer fiber materials and high-strength stainless steel alternatives that offer enhanced flexibility, durability, and load-bearing capacity. These innovations are critical for meeting the evolving demands of the robotics sector, particularly in sophisticated applications like industrial automation and advanced home robotics. Regulatory frameworks are gradually aligning to support the integration of novel materials, though stringent safety and performance standards remain a crucial consideration. Product substitutes, such as hydraulic and pneumatic actuators, continue to present competition, but the inherent advantages of robotic tendons—precision, energy efficiency, and biomimicry—are solidifying their market position. End-user trends are strongly influenced by the increasing demand for collaborative robots, dexterous manipulators, and autonomous systems, all of which rely on advanced tendon materials. Mergers and acquisitions (M&A) activities, while not at a peak, are anticipated to increase as larger corporations seek to acquire niche expertise and expand their portfolios in this rapidly growing segment. M&A deal values are projected to reach an estimated $500 million in the coming years, reflecting strategic consolidation and the pursuit of synergistic growth.

Material For Robot Tendons Industry Trends & Insights

The Material for Robot Tendons industry is experiencing robust growth, driven by a confluence of technological advancements and expanding applications across diverse sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, with the base year of 2025 setting a strong foundation for future expansion. Technological disruptions are a primary catalyst, with ongoing research into novel composite materials, smart fibers with embedded sensors, and bio-inspired materials revolutionizing the capabilities of robotic systems. These innovations enable robots to perform more intricate tasks with greater precision and responsiveness, directly impacting market penetration in high-value applications. Consumer preferences are shifting towards more sophisticated and versatile robots, from advanced home assistants capable of complex chores to highly specialized industrial robots that enhance manufacturing efficiency and safety. This demand translates into a greater need for lightweight, strong, and flexible tendon materials. Competitive dynamics are intensifying as established chemical and material science giants, including DSM, Honeywell, and Toyobo, vie for market share against emerging players like China BlueStar and YANTAI TAYHO ADVANCED MATERIALS. The market penetration of advanced polymer fiber materials is expected to surge, driven by their superior strength-to-weight ratios and cost-effectiveness compared to traditional stainless steel. Strategic partnerships and collaborations are becoming increasingly common as companies aim to leverage each other's expertise in material science and robotics integration. The overall market size is anticipated to reach $8 billion by 2033, a significant increase from an estimated $3 billion in 2025, underscoring the sector's immense potential and the critical role of material innovation.

Dominant Markets & Segments in Material For Robot Tendons

The Material for Robot Tendons market is currently dominated by Industrial Robot applications, which represent a significant portion of the global demand. This dominance is fueled by the relentless pursuit of automation and efficiency in manufacturing, automotive, and logistics sectors. Economic policies promoting industrialization and the adoption of advanced manufacturing technologies in regions like Asia-Pacific, particularly China, are key drivers. Infrastructure development supporting smart factories and increased investment in robotics research and development further bolster this segment.

- Key Drivers for Industrial Robot Dominance:

- High Demand for Automation: Factories worldwide are increasingly investing in robotic systems for repetitive, hazardous, and precision-intensive tasks.

- Technological Advancements: The development of more sophisticated industrial robots requires higher performance tendon materials capable of handling greater loads and offering enhanced durability.

- Cost-Effectiveness: While initial investment can be high, the long-term cost savings through increased productivity and reduced labor costs make industrial robots an attractive proposition.

- Safety Regulations: Increasingly stringent safety regulations in industrial environments drive the adoption of robots to minimize human exposure to hazardous conditions.

Within the Type segmentation, Polymer Fiber Materials are experiencing rapid growth and are poised to become the dominant category. While Stainless Steel Materials continue to hold a significant share due to their established reliability, the superior properties of advanced polymer fibers like Dyneema (Avient) are leading to their widespread adoption.

- Key Drivers for Polymer Fiber Material Dominance:

- Exceptional Strength-to-Weight Ratio: Polymer fibers offer unparalleled strength with minimal weight, crucial for agile and energy-efficient robotic designs.

- Flexibility and Durability: These materials provide excellent flexibility, crucial for intricate movements, and exhibit high resistance to wear and tear.

- Corrosion Resistance: Unlike some stainless steel variants, polymer fibers are resistant to corrosion, extending their lifespan in various environments.

- Customization and Innovation: Ongoing research allows for the tailoring of polymer fiber properties for specific robotic applications, fostering innovation.

- Cost-Effectiveness: As production scales, the cost of advanced polymer fibers is becoming increasingly competitive with traditional materials.

Geographically, Asia-Pacific, particularly China, is a dominant market due to its robust manufacturing base and significant investments in robotics. Countries like South Korea and Japan are also major contributors. The United States and Europe follow closely, driven by advanced research institutions and a strong demand for sophisticated robotic solutions in both industrial and commercial sectors.

Material For Robot Tendons Product Developments

Recent product developments in Material for Robot Tendons are centered on enhancing strength, flexibility, and the integration of sensing capabilities. Companies are innovating with ultra-high molecular weight polyethylene (UHMWPE) fibers, advanced carbon fiber composites, and bio-inspired materials that mimic natural muscle actuation. These advancements enable the creation of more dexterous, responsive, and energy-efficient robots. Key competitive advantages include improved load-carrying capacity, reduced material fatigue, and the potential for embedded sensors for real-time feedback, paving the way for more autonomous and adaptable robotic systems.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Material for Robot Tendons market, segmenting it across key applications and material types. The Application segments include Home Robots, Commercial Robots, Industrial Robot, and Other. The Type segments consist of Stainless Steel Materials, Polymer Fiber Materials, and Other. Market projections for each segment indicate substantial growth, with Industrial Robots and Polymer Fiber Materials expected to lead in market size and growth rate. Competitive dynamics within each segment are shaped by innovation, cost-effectiveness, and the specific performance requirements of the end-use.

Key Drivers of Material For Robot Tendons Growth

The growth of the Material for Robot Tendons sector is propelled by several key factors. Technologically, the escalating demand for advanced robotics in manufacturing, healthcare, and consumer electronics necessitates materials that offer superior strength, flexibility, and durability. Economic drivers include increased global investment in automation and the pursuit of operational efficiencies. Furthermore, favorable government initiatives supporting the robotics industry and advancements in material science research are providing a fertile ground for innovation and market expansion. The projected market size is expected to reach $8 billion by 2033.

Challenges in the Material For Robot Tendons Sector

Despite its promising growth, the Material for Robot Tendons sector faces several challenges. Regulatory hurdles related to material safety and performance standards can slow down product adoption. Supply chain issues, particularly concerning the availability and cost of specialized raw materials for advanced polymer fibers, can impact production volumes and pricing. Intense competitive pressures from established material providers and emerging innovators also necessitate continuous investment in R&D to maintain market relevance. The market is expected to reach $3 billion in 2025.

Emerging Opportunities in Material For Robot Tendons

Emerging opportunities in the Material for Robot Tendons market lie in the development of smart materials with integrated sensing capabilities, enabling real-time feedback and enhanced control for robots. The growing demand for soft robotics and bio-inspired actuation systems presents a significant avenue for innovation. Furthermore, the expansion of robotics into new domains like agriculture, construction, and space exploration opens up niche markets for specialized tendon materials with unique performance characteristics. The market is projected to grow at a CAGR of 12.5%.

Leading Players in the Material For Robot Tendons Market

- Dupont

- Teijin

- Asahi Kasei

- Mitsumi Chemical

- VNIISV

- DSM

- Honeywell

- Toyobo

- Magellan

- Dyneema (Avient)

- China BlueStar

- YANTAI TAYHO ADVANCED MATERIALS

- Zhejiang Kanglongda Special Protection Technology

- HANVO Safety

- Shandong Nanshan Fashion Sci-Tech

Key Developments in Material For Robot Tendons Industry

- 2023/10: Launch of new generation UHMWPE fibers by Dyneema (Avient) offering enhanced tensile strength for robotics applications.

- 2023/08: Teijin announces strategic investment in advanced composite research for robotics.

- 2022/11: Asahi Kasei develops innovative bio-inspired polymer for flexible robot actuators.

- 2022/07: Dupont introduces a new high-performance engineering plastic for robotic component manufacturing.

- 2021/09: China BlueStar expands its production capacity for specialty polymer fibers.

Strategic Outlook for Material For Robot Tendons Market

The strategic outlook for the Material for Robot Tendons market is highly optimistic, driven by sustained innovation and the expanding adoption of robotics across industries. Future growth catalysts include the increasing demand for collaborative robots, advancements in AI integration with robotic systems, and the development of more sustainable and bio-compatible materials. Companies that can effectively leverage cutting-edge material science, anticipate evolving end-user needs, and navigate the evolving regulatory landscape are poised for significant success in this dynamic market, which is projected to reach $8 billion by 2033.

Material For Robot Tendons Segmentation

-

1. Application

- 1.1. Home Robots

- 1.2. Commercial Robots

- 1.3. Industrial Robot

- 1.4. Other

-

2. Type

- 2.1. Stainless Steel Materials

- 2.2. Polymer Fiber Materials

- 2.3. Other

Material For Robot Tendons Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Material For Robot Tendons REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Robots

- 5.1.2. Commercial Robots

- 5.1.3. Industrial Robot

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stainless Steel Materials

- 5.2.2. Polymer Fiber Materials

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Robots

- 6.1.2. Commercial Robots

- 6.1.3. Industrial Robot

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stainless Steel Materials

- 6.2.2. Polymer Fiber Materials

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Robots

- 7.1.2. Commercial Robots

- 7.1.3. Industrial Robot

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stainless Steel Materials

- 7.2.2. Polymer Fiber Materials

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Robots

- 8.1.2. Commercial Robots

- 8.1.3. Industrial Robot

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stainless Steel Materials

- 8.2.2. Polymer Fiber Materials

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Robots

- 9.1.2. Commercial Robots

- 9.1.3. Industrial Robot

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stainless Steel Materials

- 9.2.2. Polymer Fiber Materials

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Material For Robot Tendons Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Robots

- 10.1.2. Commercial Robots

- 10.1.3. Industrial Robot

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Stainless Steel Materials

- 10.2.2. Polymer Fiber Materials

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dupont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teijin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asahi Kasei

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsumi Chemical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VNIISV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DSM

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyobo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Magellan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dyneema (Avient)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China BlueStar

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 YANTAI TAYHO ADVANCED MATERIALS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zhejiang Kanglongda Special Protection Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HANVO Safety

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Shandong Nanshan Fashion Sci-Tech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Dupont

List of Figures

- Figure 1: Global Material For Robot Tendons Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Material For Robot Tendons Revenue (million), by Application 2024 & 2032

- Figure 3: North America Material For Robot Tendons Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Material For Robot Tendons Revenue (million), by Type 2024 & 2032

- Figure 5: North America Material For Robot Tendons Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Material For Robot Tendons Revenue (million), by Country 2024 & 2032

- Figure 7: North America Material For Robot Tendons Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Material For Robot Tendons Revenue (million), by Application 2024 & 2032

- Figure 9: South America Material For Robot Tendons Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Material For Robot Tendons Revenue (million), by Type 2024 & 2032

- Figure 11: South America Material For Robot Tendons Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Material For Robot Tendons Revenue (million), by Country 2024 & 2032

- Figure 13: South America Material For Robot Tendons Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Material For Robot Tendons Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Material For Robot Tendons Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Material For Robot Tendons Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Material For Robot Tendons Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Material For Robot Tendons Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Material For Robot Tendons Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Material For Robot Tendons Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Material For Robot Tendons Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Material For Robot Tendons Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Material For Robot Tendons Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Material For Robot Tendons Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Material For Robot Tendons Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Material For Robot Tendons Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Material For Robot Tendons Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Material For Robot Tendons Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Material For Robot Tendons Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Material For Robot Tendons Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Material For Robot Tendons Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Material For Robot Tendons Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Material For Robot Tendons Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Material For Robot Tendons Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Material For Robot Tendons Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Material For Robot Tendons Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Material For Robot Tendons Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Material For Robot Tendons Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Material For Robot Tendons Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Material For Robot Tendons Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Material For Robot Tendons Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Material For Robot Tendons?

The projected CAGR is approximately 24.7%.

2. Which companies are prominent players in the Material For Robot Tendons?

Key companies in the market include Dupont, Teijin, Asahi Kasei, Mitsumi Chemical, VNIISV, DSM, Honeywell, Toyobo, Magellan, Dyneema (Avient), China BlueStar, YANTAI TAYHO ADVANCED MATERIALS, Zhejiang Kanglongda Special Protection Technology, HANVO Safety, Shandong Nanshan Fashion Sci-Tech.

3. What are the main segments of the Material For Robot Tendons?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1397 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Material For Robot Tendons," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Material For Robot Tendons report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Material For Robot Tendons?

To stay informed about further developments, trends, and reports in the Material For Robot Tendons, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence