Key Insights

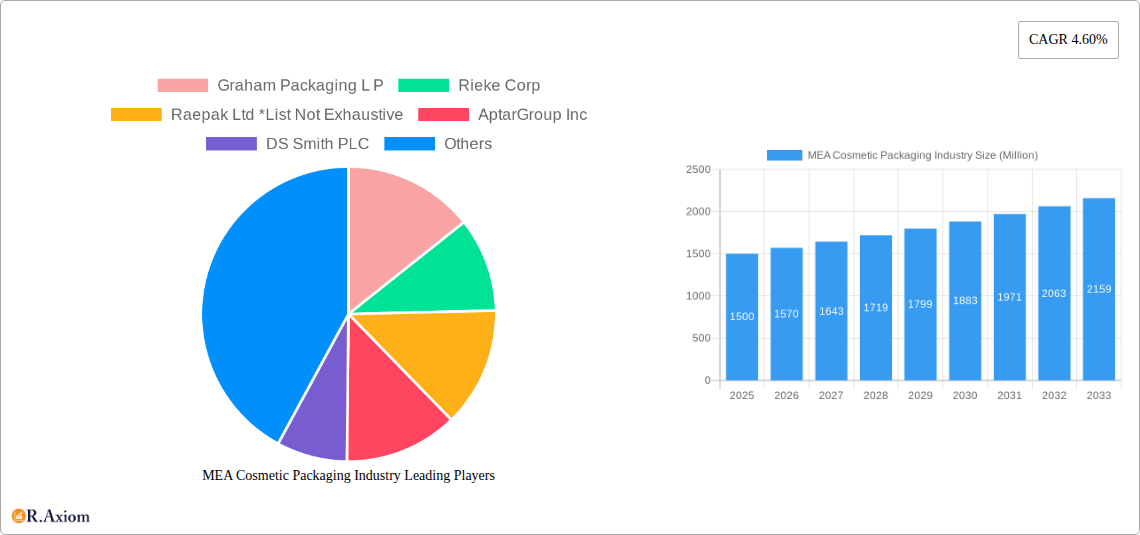

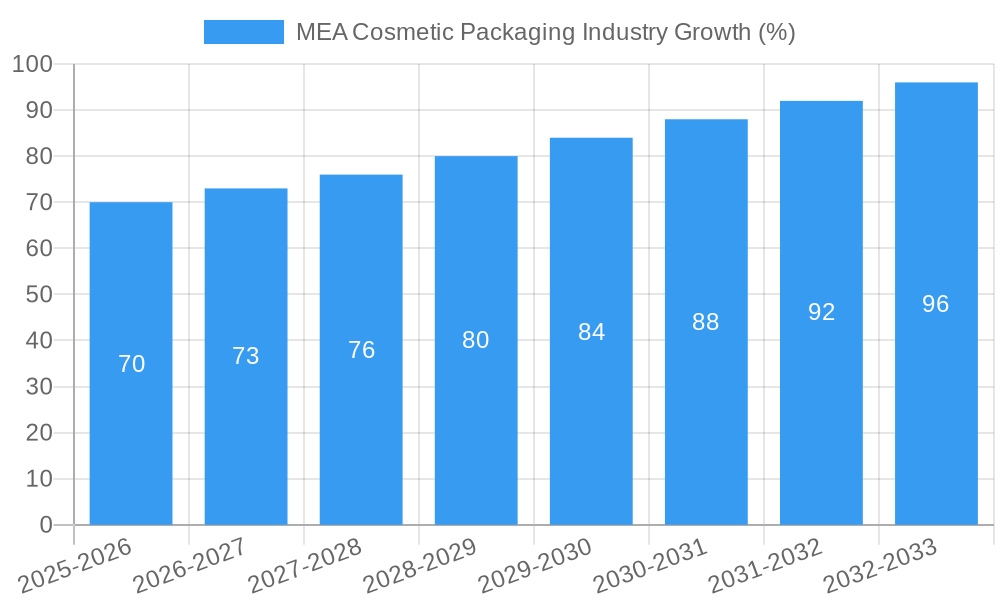

The Middle East and Africa (MEA) cosmetic packaging market is experiencing robust growth, driven by a surge in demand for beauty and personal care products across the region. The market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and unspecified market size), is projected to maintain a Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033. This expansion is fueled by several key factors: rising disposable incomes, particularly amongst the burgeoning middle class in countries like the UAE and Saudi Arabia; increasing consumer awareness of beauty trends and the desire for premium packaging; and the flourishing e-commerce sector facilitating wider product distribution and accessibility. Furthermore, the growing popularity of natural and organic cosmetics is impacting packaging choices, with a significant focus on sustainable and eco-friendly materials like recyclable plastics and paper-based solutions. The market is highly segmented, with plastic, glass, and metal packaging dominating the material type segment, while plastic bottles and containers, glass bottles and containers and folding cartons lead the product type segment. Hair care, skin care, and color cosmetics are the major consumer segments driving demand. Key players, including Graham Packaging, AptarGroup, Amcor, and Berry Global, are actively participating in this growth by focusing on innovation, sustainability, and customized packaging solutions catering to specific cosmetic needs.

However, despite the positive outlook, challenges remain. Fluctuations in raw material prices, particularly for plastics and metals, pose a significant threat to profitability and consistent pricing. Moreover, stringent regulations regarding packaging materials and waste management in some MEA countries could require companies to adapt their product offerings and packaging strategies. Competitive intensity, with both domestic and international players vying for market share, necessitates continuous product development and effective marketing strategies. Despite these challenges, the long-term outlook for the MEA cosmetic packaging market remains optimistic, promising substantial growth opportunities for companies that strategically address emerging market trends and prioritize sustainability. The increasing focus on luxury packaging and personalized beauty products is a major opportunity for the industry.

MEA Cosmetic Packaging Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Middle East and Africa (MEA) cosmetic packaging industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report utilizes a robust methodology to analyze market size, growth, trends, and key players, incorporating detailed segmentations and projections. The total market size in 2025 is estimated at xx Million, with a projected value of xx Million by 2033.

MEA Cosmetic Packaging Industry Market Concentration & Innovation

The MEA cosmetic packaging market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Companies like Amcor PLC, AptarGroup Inc, and Berry Global Group (formerly RPC Group PLC) command substantial market presence, estimated at a combined xx% in 2025. However, a significant number of smaller regional players contribute to a competitive dynamic. Innovation is a key driver, fueled by the increasing demand for sustainable packaging, sophisticated dispensing systems, and customized designs. Regulatory frameworks concerning material safety and environmental regulations, such as those focused on reducing plastic waste, significantly influence industry practices. The growing preference for eco-friendly alternatives like biodegradable plastics and recycled materials is driving innovation in this area. Product substitution is also an active force, with brands experimenting with innovative materials and designs. Mergers and acquisitions (M&A) have played a role in shaping the market landscape, with deal values totaling an estimated xx Million in the past five years. Notable transactions include [Insert specific M&A examples with deal values, if available; otherwise, state "Specific deal details are not publicly available"].

- Market Share: Amcor PLC (xx%), AptarGroup Inc (xx%), Berry Global Group (xx%), Others (xx%)

- M&A Activity: Significant activity observed in the past five years with a total estimated deal value of xx Million.

- Innovation Drivers: Sustainability, advanced dispensing technologies, customized designs, regulatory compliance.

MEA Cosmetic Packaging Industry Industry Trends & Insights

The MEA cosmetic packaging market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing consumer demand for premium cosmetics, and the expansion of the beauty and personal care sector. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, such as the adoption of smart packaging and digital printing, are revolutionizing product design and branding. Consumer preferences are shifting towards sustainable and ethically sourced packaging, pushing manufacturers to innovate in eco-friendly materials and production processes. Competitive dynamics are shaped by pricing pressures, brand loyalty, and the constant need for differentiation. The market penetration of sustainable packaging is expected to reach xx% by 2033, indicating significant market growth and change.

Dominant Markets & Segments in MEA Cosmetic Packaging Industry

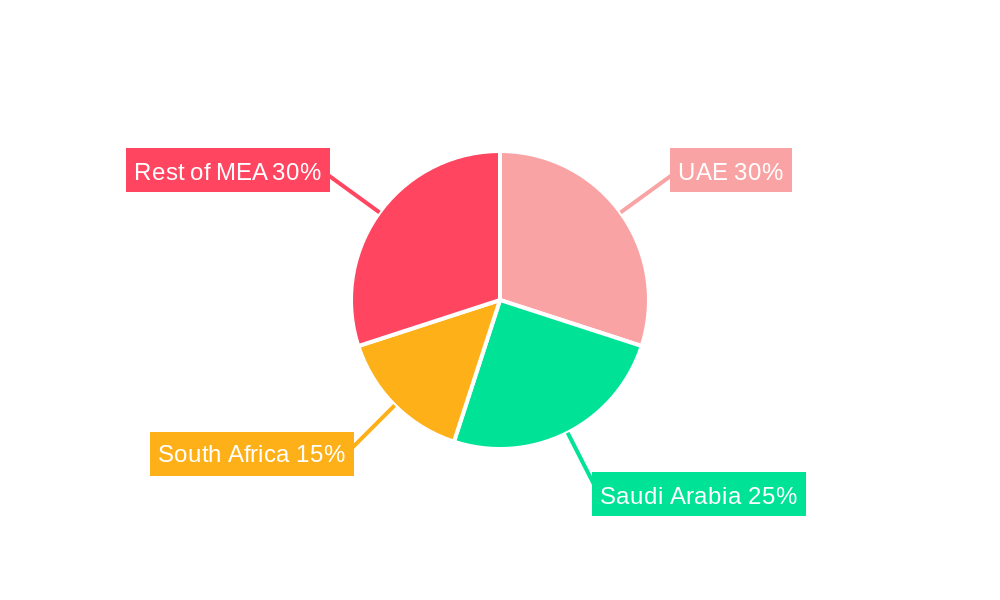

The UAE and Saudi Arabia represent the most significant markets within the MEA region, driven by high per capita consumption of cosmetics and a robust retail infrastructure. South Africa shows promising growth potential due to increasing disposable incomes and a burgeoning beauty sector. Within the segmentations:

- Material Type: Plastic remains the dominant material, accounting for xx% of the market in 2025, followed by glass (xx%) and paper (xx%).

- Product Type: Plastic bottles and containers are the leading product type, driven by their versatility and cost-effectiveness. Caps and closures and pumps and dispensers represent significant segments as well.

- Cosmetic Type: Skin care products drive the highest demand for packaging, followed by hair care and color cosmetics.

Key Drivers for Dominant Markets:

- UAE & Saudi Arabia: High disposable incomes, strong retail infrastructure, significant presence of international cosmetic brands.

- South Africa: Expanding middle class, growing demand for beauty products, increasing urbanization.

MEA Cosmetic Packaging Industry Product Developments

Recent product innovations focus on enhancing convenience, sustainability, and aesthetic appeal. Examples include lightweight packaging, refillable containers, and innovative dispensing mechanisms. Technological advancements like 3D printing and advanced material science enable the development of customized, eco-friendly, and cost-effective packaging solutions. These innovations improve market fit by addressing consumer demands for sustainability, convenience, and attractive presentation.

Report Scope & Segmentation Analysis

This report provides a granular segmentation analysis of the MEA cosmetic packaging market based on material type (Plastic, Glass, Metal, Paper), product type (Plastic Bottles and Containers, Glass Bottles and Containers, Metal Containers, Folding Cartons, Corrugated Boxes, Tubes and Sticks, Caps and Closures, Pump and Dispenser, Droppers, Ampoules, Flexible Plastic Packaging), cosmetic type (Hair Care, Color Cosmetics, Skin Care, Men's Grooming, Deodorants, Other Cosmetic Types), and country (UAE, Saudi Arabia, South Africa, Rest of MEA). Each segment's market size, growth projections, and competitive dynamics are detailed within the report. The report also analyses the various aspects of the packaging materials and the impact of different types of materials on the growth of the industry.

Key Drivers of MEA Cosmetic Packaging Industry Growth

Several factors contribute to the growth of the MEA cosmetic packaging market, including:

- Rising disposable incomes: Increased purchasing power among consumers fuels higher demand for cosmetic products and sophisticated packaging.

- Growing cosmetic market: The expansion of the beauty and personal care industry in the region drives demand for packaging.

- E-commerce growth: Online sales create opportunities for innovative and protective packaging solutions.

- Emphasis on sustainability: Growing awareness of environmental issues increases demand for eco-friendly packaging.

Challenges in the MEA Cosmetic Packaging Industry Sector

The MEA cosmetic packaging industry faces several challenges, including:

- Fluctuating raw material prices: Prices for plastics, glass, and other materials can significantly impact production costs.

- Stringent regulatory environment: Compliance with safety and environmental regulations adds complexity and cost.

- Supply chain disruptions: Geopolitical instability and logistical issues can affect the timely availability of materials and packaging.

- Intense competition: A large number of players compete for market share, leading to pricing pressures and the need for constant innovation.

Emerging Opportunities in MEA Cosmetic Packaging Industry

Several opportunities exist for growth and innovation within the MEA cosmetic packaging market:

- Sustainable packaging solutions: Growing demand for eco-friendly options presents a major opportunity for manufacturers.

- Smart packaging technology: Integration of digital features and sensors creates opportunities for product authentication and consumer engagement.

- Premiumization: Increased demand for luxury packaging solutions presents a high-value market segment.

- Regional expansion: Targeting underpenetrated markets within the MEA region can unlock significant growth potential.

Leading Players in the MEA Cosmetic Packaging Industry Market

- Graham Packaging L P

- Rieke Corp

- Raepak Ltd

- AptarGroup Inc

- DS Smith PLC

- Amcor PLC

- Cosmopak Ltd

- Albea SA

- RPC Group PLC (Berry Global Group)

- Silgan Holdings Inc

- Gerresheimer AG

Key Developments in MEA Cosmetic Packaging Industry Industry

- 2022 Q4: Amcor PLC launched a new range of sustainable packaging solutions for the cosmetics industry.

- 2023 Q1: AptarGroup Inc acquired a specialized closure manufacturer, expanding its product portfolio.

- 2023 Q2: Berry Global Group invested in a new facility dedicated to producing recycled PET packaging.

- [Add further specific examples of key developments with dates, if available].

Strategic Outlook for MEA Cosmetic Packaging Industry Market

The MEA cosmetic packaging market presents significant growth potential driven by the region's expanding cosmetic industry and increasing consumer demand for premium and sustainable products. Companies focused on innovation, sustainability, and localized production will be well-positioned to capitalize on emerging opportunities. The integration of smart technologies and tailored packaging solutions will further shape the market landscape. The market's future trajectory is tied to the continued economic growth of the MEA region and evolving consumer preferences.

MEA Cosmetic Packaging Industry Segmentation

-

1. Material type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper

-

2. Product Type

- 2.1. Plastic Bottles and Containers

- 2.2. Glass Bottles and Containers

- 2.3. Metal Containers

- 2.4. Folding Cartons

- 2.5. Corrugated Boxes

- 2.6. Tubes and Sticks

- 2.7. Caps and Closures

- 2.8. Pump and Dispenser

- 2.9. Droppers

- 2.10. Ampoules

- 2.11. Flexible Plastic Packaging

-

3. Cosmetic Type

- 3.1. Hair Care

- 3.2. Color Cosmetics

- 3.3. Skin Care

- 3.4. Men's Grooming

- 3.5. Deodorants

- 3.6. Other Co

MEA Cosmetic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Cosmetic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Focus on Innovation and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. ; Growing Sustainability Concerns

- 3.4. Market Trends

- 3.4.1. Sustainable Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles and Containers

- 5.2.2. Glass Bottles and Containers

- 5.2.3. Metal Containers

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated Boxes

- 5.2.6. Tubes and Sticks

- 5.2.7. Caps and Closures

- 5.2.8. Pump and Dispenser

- 5.2.9. Droppers

- 5.2.10. Ampoules

- 5.2.11. Flexible Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 5.3.1. Hair Care

- 5.3.2. Color Cosmetics

- 5.3.3. Skin Care

- 5.3.4. Men's Grooming

- 5.3.5. Deodorants

- 5.3.6. Other Co

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material type

- 6. North America MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material type

- 6.1.1. Plastic

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Paper

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plastic Bottles and Containers

- 6.2.2. Glass Bottles and Containers

- 6.2.3. Metal Containers

- 6.2.4. Folding Cartons

- 6.2.5. Corrugated Boxes

- 6.2.6. Tubes and Sticks

- 6.2.7. Caps and Closures

- 6.2.8. Pump and Dispenser

- 6.2.9. Droppers

- 6.2.10. Ampoules

- 6.2.11. Flexible Plastic Packaging

- 6.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 6.3.1. Hair Care

- 6.3.2. Color Cosmetics

- 6.3.3. Skin Care

- 6.3.4. Men's Grooming

- 6.3.5. Deodorants

- 6.3.6. Other Co

- 6.1. Market Analysis, Insights and Forecast - by Material type

- 7. South America MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material type

- 7.1.1. Plastic

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Paper

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plastic Bottles and Containers

- 7.2.2. Glass Bottles and Containers

- 7.2.3. Metal Containers

- 7.2.4. Folding Cartons

- 7.2.5. Corrugated Boxes

- 7.2.6. Tubes and Sticks

- 7.2.7. Caps and Closures

- 7.2.8. Pump and Dispenser

- 7.2.9. Droppers

- 7.2.10. Ampoules

- 7.2.11. Flexible Plastic Packaging

- 7.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 7.3.1. Hair Care

- 7.3.2. Color Cosmetics

- 7.3.3. Skin Care

- 7.3.4. Men's Grooming

- 7.3.5. Deodorants

- 7.3.6. Other Co

- 7.1. Market Analysis, Insights and Forecast - by Material type

- 8. Europe MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material type

- 8.1.1. Plastic

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Paper

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plastic Bottles and Containers

- 8.2.2. Glass Bottles and Containers

- 8.2.3. Metal Containers

- 8.2.4. Folding Cartons

- 8.2.5. Corrugated Boxes

- 8.2.6. Tubes and Sticks

- 8.2.7. Caps and Closures

- 8.2.8. Pump and Dispenser

- 8.2.9. Droppers

- 8.2.10. Ampoules

- 8.2.11. Flexible Plastic Packaging

- 8.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 8.3.1. Hair Care

- 8.3.2. Color Cosmetics

- 8.3.3. Skin Care

- 8.3.4. Men's Grooming

- 8.3.5. Deodorants

- 8.3.6. Other Co

- 8.1. Market Analysis, Insights and Forecast - by Material type

- 9. Middle East & Africa MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material type

- 9.1.1. Plastic

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Paper

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plastic Bottles and Containers

- 9.2.2. Glass Bottles and Containers

- 9.2.3. Metal Containers

- 9.2.4. Folding Cartons

- 9.2.5. Corrugated Boxes

- 9.2.6. Tubes and Sticks

- 9.2.7. Caps and Closures

- 9.2.8. Pump and Dispenser

- 9.2.9. Droppers

- 9.2.10. Ampoules

- 9.2.11. Flexible Plastic Packaging

- 9.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 9.3.1. Hair Care

- 9.3.2. Color Cosmetics

- 9.3.3. Skin Care

- 9.3.4. Men's Grooming

- 9.3.5. Deodorants

- 9.3.6. Other Co

- 9.1. Market Analysis, Insights and Forecast - by Material type

- 10. Asia Pacific MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material type

- 10.1.1. Plastic

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Paper

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plastic Bottles and Containers

- 10.2.2. Glass Bottles and Containers

- 10.2.3. Metal Containers

- 10.2.4. Folding Cartons

- 10.2.5. Corrugated Boxes

- 10.2.6. Tubes and Sticks

- 10.2.7. Caps and Closures

- 10.2.8. Pump and Dispenser

- 10.2.9. Droppers

- 10.2.10. Ampoules

- 10.2.11. Flexible Plastic Packaging

- 10.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 10.3.1. Hair Care

- 10.3.2. Color Cosmetics

- 10.3.3. Skin Care

- 10.3.4. Men's Grooming

- 10.3.5. Deodorants

- 10.3.6. Other Co

- 10.1. Market Analysis, Insights and Forecast - by Material type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Graham Packaging L P

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rieke Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raepak Ltd *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AptarGroup Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amcor PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cosmopak Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Albea SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RPC Group PLC (Berry Global Group)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silgan Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gerresheimer AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Graham Packaging L P

List of Figures

- Figure 1: Global MEA Cosmetic Packaging Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Cosmetic Packaging Industry Revenue (Million), by Material type 2024 & 2032

- Figure 3: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2024 & 2032

- Figure 4: North America MEA Cosmetic Packaging Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America MEA Cosmetic Packaging Industry Revenue (Million), by Cosmetic Type 2024 & 2032

- Figure 7: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2024 & 2032

- Figure 8: North America MEA Cosmetic Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America MEA Cosmetic Packaging Industry Revenue (Million), by Material type 2024 & 2032

- Figure 11: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2024 & 2032

- Figure 12: South America MEA Cosmetic Packaging Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: South America MEA Cosmetic Packaging Industry Revenue (Million), by Cosmetic Type 2024 & 2032

- Figure 15: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2024 & 2032

- Figure 16: South America MEA Cosmetic Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe MEA Cosmetic Packaging Industry Revenue (Million), by Material type 2024 & 2032

- Figure 19: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2024 & 2032

- Figure 20: Europe MEA Cosmetic Packaging Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe MEA Cosmetic Packaging Industry Revenue (Million), by Cosmetic Type 2024 & 2032

- Figure 23: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2024 & 2032

- Figure 24: Europe MEA Cosmetic Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (Million), by Material type 2024 & 2032

- Figure 27: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2024 & 2032

- Figure 28: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (Million), by Cosmetic Type 2024 & 2032

- Figure 31: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2024 & 2032

- Figure 32: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific MEA Cosmetic Packaging Industry Revenue (Million), by Material type 2024 & 2032

- Figure 35: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2024 & 2032

- Figure 36: Asia Pacific MEA Cosmetic Packaging Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Pacific MEA Cosmetic Packaging Industry Revenue (Million), by Cosmetic Type 2024 & 2032

- Figure 39: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2024 & 2032

- Figure 40: Asia Pacific MEA Cosmetic Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 3: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 5: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 7: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 9: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 14: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 16: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 21: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 23: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 34: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 36: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Material type 2019 & 2032

- Table 44: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 45: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2019 & 2032

- Table 46: Global MEA Cosmetic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific MEA Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Cosmetic Packaging Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the MEA Cosmetic Packaging Industry?

Key companies in the market include Graham Packaging L P, Rieke Corp, Raepak Ltd *List Not Exhaustive, AptarGroup Inc, DS Smith PLC, Amcor PLC, Cosmopak Ltd, Albea SA, RPC Group PLC (Berry Global Group), Silgan Holdings Inc, Gerresheimer AG.

3. What are the main segments of the MEA Cosmetic Packaging Industry?

The market segments include Material type, Product Type, Cosmetic Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Innovation and Attractive Packaging.

6. What are the notable trends driving market growth?

Sustainable Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Growing Sustainability Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Cosmetic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Cosmetic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Cosmetic Packaging Industry?

To stay informed about further developments, trends, and reports in the MEA Cosmetic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence