Key Insights

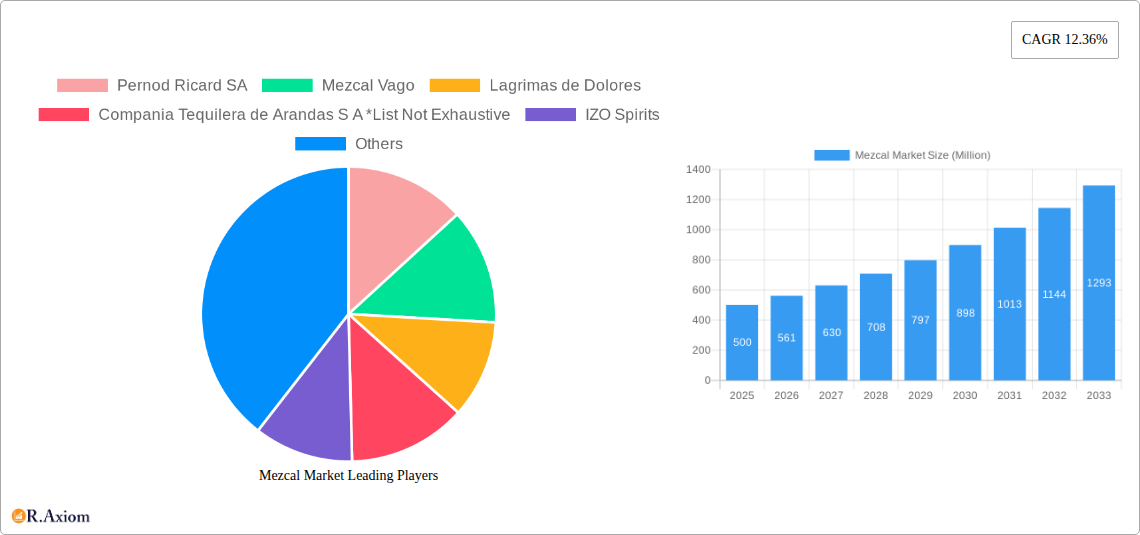

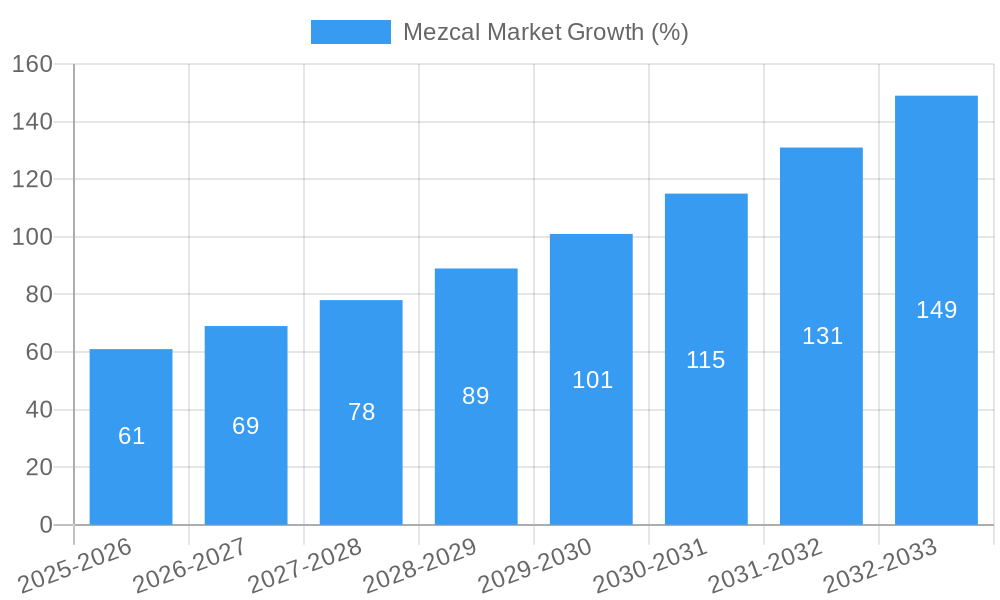

The global Mezcal market is experiencing robust growth, projected to reach a significant value by 2033, driven by a CAGR of 12.36% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing consumer awareness and appreciation for premium spirits, particularly those with a strong sense of place and heritage, are significantly boosting demand. Mezcal, with its artisanal production methods and unique smoky flavor profile, perfectly fits this trend. Secondly, the burgeoning cocktail culture globally is creating new avenues for Mezcal consumption, particularly in the on-trade channel (bars and restaurants). The rise of mixology and the creativity of bartenders in incorporating Mezcal into innovative cocktails are expanding its appeal beyond its traditional consumer base. Finally, the expanding distribution networks, both online and offline, are making Mezcal more accessible to consumers worldwide. This improved accessibility is crucial, particularly in regions outside of Mexico where awareness is still developing. While the market faces some restraints, such as the relatively high price point compared to other spirits and potential supply chain challenges related to sustainable production, the overall growth outlook remains highly positive.

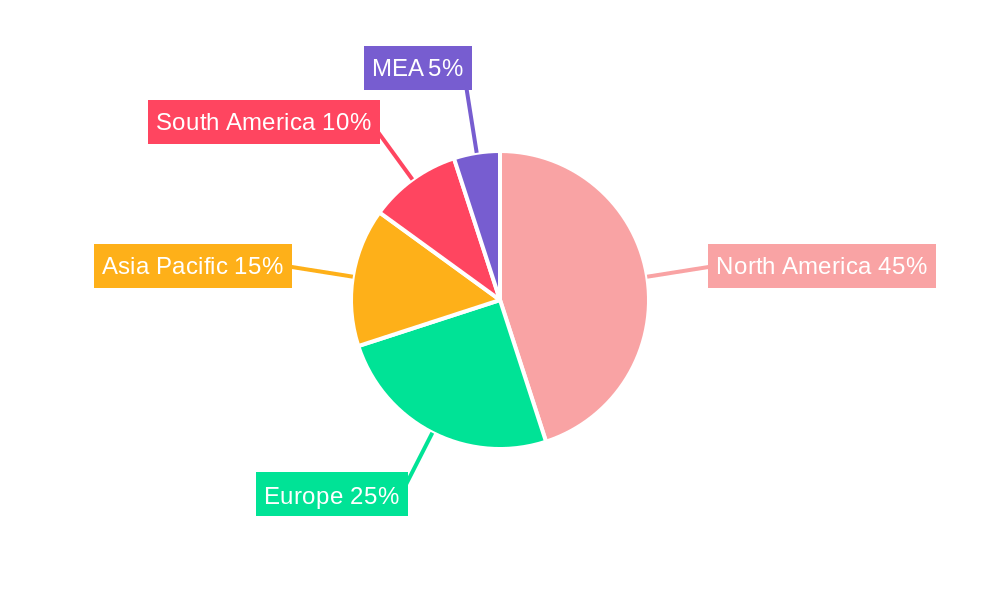

The segmentation of the Mezcal market reveals further insights. The premium segments, such as Añejo and Reposado Mezcal, are experiencing faster growth compared to Joven Mezcal, reflecting the increasing consumer preference for aged and complex spirits. Geographic analysis highlights strong growth in North America, particularly the United States, driven by increased consumption and growing Hispanic populations. However, significant opportunities exist in Europe and Asia-Pacific, where the market is still in its early stages of development, presenting considerable potential for future expansion. Major players like Pernod Ricard, Diageo, and smaller, artisanal producers are actively shaping the market landscape through strategic investments, brand building, and product innovation. This competitive landscape fosters further innovation and ensures a diverse range of products for consumers to choose from. Overall, the Mezcal market is poised for continued expansion, driven by evolving consumer preferences, innovative product offerings, and the global reach of sophisticated spirits.

Mezcal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mezcal market, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses operating within or seeking entry into this dynamic market. The total market value is predicted to reach xx Million by 2033.

Mezcal Market Market Concentration & Innovation

The Mezcal market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, artisanal producers contributes to a dynamic competitive environment. Market share data for 2024 indicates that the top five players hold approximately xx% of the market, while the remaining xx% is distributed among numerous smaller companies. Innovation is driven by factors including the increasing demand for premium and craft mezcals, experimentation with different agave varietals and production techniques, and a growing focus on sustainable and ethical sourcing. Regulatory frameworks, while generally supportive of the industry, present ongoing challenges related to production standards and labeling. Product substitutes, such as tequila and other spirits, exert some competitive pressure, but the unique characteristics of mezcal maintain its distinct appeal. End-user trends show a growing preference for high-quality, artisanal products with strong brand stories and authentic regional origins. Mergers and acquisitions (M&A) activity is notable, with recent deals exceeding xx Million in value, reflecting industry consolidation and expansion strategies.

- Key Market Share Holders (2024): Pernod Ricard SA (xx%), Diageo PLC (xx%), Others (xx%)

- M&A Activity Highlights (2019-2024):

- Diageo PLC's acquisition of Mezcal Unión (January 2022) - xx Million

- Other notable M&A deals totaling xx Million

Mezcal Market Industry Trends & Insights

The Mezcal market is experiencing robust growth, driven primarily by increasing global awareness and appreciation for the spirit. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to remain strong throughout the forecast period (2025-2033), reaching a CAGR of xx%. This growth is fueled by several key factors: rising consumer disposable incomes, particularly in key export markets, a growing preference for premium and craft spirits, and increased tourism to Mexico. Technological advancements in production processes are enhancing efficiency and quality, and the market is witnessing increased adoption of e-commerce platforms, expanding distribution reach. However, competitive pressures and the need for sustainable sourcing practices are crucial considerations. Consumer preferences show a clear trend towards high-quality, artisanal mezcals with distinct flavor profiles and compelling brand narratives. Market penetration is particularly high in the US and European markets, with increasing adoption in other regions.

Dominant Markets & Segments in Mezcal Market

The United States represents the dominant market for Mezcal, accounting for xx% of global consumption in 2024, driven by strong demand for premium spirits and a growing appreciation for Mexican culture. Other key markets include several European countries (e.g., UK, France, Germany) and select Asian markets.

- Dominant Region: North America (Specifically, the United States)

- Key Drivers for US Market Dominance:

- High disposable incomes

- Strong interest in premium spirits

- Extensive distribution networks

- Growing awareness of Mezcal's unique qualities.

Segment Analysis:

- Distribution Channel: The off-trade channel (retail stores, online sales) currently holds a larger market share compared to the on-trade channel (bars, restaurants), reflecting the increasing convenience of purchasing spirits through retail channels. However, both channels are expected to show significant growth.

- Product Type: Mezcal Joven is the largest segment by volume due to its accessibility and affordability. However, Mezcal Reposado and Añejo are growing at a faster rate, reflecting the expanding appreciation for aged mezcals' nuanced flavors. Other Product Types, encompassing flavored and innovative variations, represent a significant growth opportunity.

Mezcal Market Product Developments

Product innovation in the Mezcal market is focused on enhancing flavor profiles, expanding product variety (e.g., different agave varietals, aging techniques), and exploring new packaging formats. Technological advancements in distillation and aging techniques are leading to improvements in quality and consistency. The market is also witnessing the emergence of organic and sustainably produced mezcals, appealing to consumers’ growing interest in ethical consumption. These product developments cater to the evolving tastes of consumers seeking high-quality, distinctive, and authentic mezcals.

Report Scope & Segmentation Analysis

This report segments the Mezcal market by Distribution Channel (On-Trade, Off-Trade) and Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Añejo, Other Product Types). Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail within the report. The report provides a detailed breakdown of market sizes for each segment for the historical period, the base year, and the forecast period. The competitive dynamics within each segment are assessed considering factors such as brand positioning, price points, and distribution strategies.

Key Drivers of Mezcal Market Growth

Several factors fuel the Mezcal market's growth: the increasing popularity of premium spirits, particularly among millennials and Gen Z; the rising demand for authentic and artisanal products; the expanding distribution networks in both domestic and international markets; and favorable regulatory environments in key markets that support industry growth and the protection of Mezcal’s unique identity. The rise of e-commerce platforms is also enabling wider market access, contributing to enhanced sales.

Challenges in the Mezcal Market Sector

Challenges facing the Mezcal market include the limited availability of agave, leading to price fluctuations and potential supply chain disruptions. Stringent regulatory frameworks and production standards, while necessary to ensure product quality, can also pose obstacles for smaller producers. Increasing competition from other spirits and the need for sustainable sourcing practices present further challenges. These factors exert a quantifiable impact on market growth and profitability, requiring strategic adaptation by industry players.

Emerging Opportunities in Mezcal Market

Emerging opportunities include expanding into new and underpenetrated markets, particularly in Asia and other parts of the world. The development of innovative product lines (e.g., ready-to-drink cocktails) and the exploration of new agave varietals offer significant potential. The growth of the premium and super-premium segments presents lucrative opportunities for brands focusing on quality and authenticity. Adopting sustainable production practices and emphasizing brand storytelling around terroir and agave heritage resonate with ethical consumers, expanding market appeal.

Leading Players in the Mezcal Market Market

- Pernod Ricard SA

- Mezcal Vago

- Lagrimas de Dolores

- Compania Tequilera de Arandas S A

- IZO Spirits

- El Silencio Holdings INC

- Fidencio Mezcal

- William Grant & Sons Ltd

- Ilegal Mezcal SA

- Rey Campero

- Diageo PLC

Key Developments in Mezcal Market Industry

- October 2021: IZO Spirits launched a limited-edition Mezcal Añejo Cenizo, showcasing product innovation and premiumization.

- January 2022: Diageo PLC's acquisition of Mezcal Unión signaled industry consolidation and the growing interest of major players in the mezcal market.

- March 2022: Compañia Tequilera de Arandas S.A. de C.V.'s expansion of Lobos 1707 into the Canadian market highlights the increasing international appeal of premium tequila and mezcal brands.

Strategic Outlook for Mezcal Market Market

The Mezcal market is poised for continued growth, driven by the factors discussed above. The focus on premiumization, sustainable sourcing, and innovative product development will be key to success. Expanding into new markets and leveraging e-commerce platforms will be crucial for reaching a wider consumer base. Brands with strong brand storytelling and a commitment to authenticity are well-positioned to capitalize on the growing demand for high-quality, artisanal spirits. The long-term outlook for the Mezcal market remains exceptionally positive, with significant potential for further expansion and market penetration.

Mezcal Market Segmentation

-

1. Product Type

- 1.1. Mezcal Joven

- 1.2. Mezcal Reposado

- 1.3. Mezcal Anejo

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade Channel

-

2.2. Off-Trade Channel

- 2.2.1. Online Retail Stores

- 2.2.2. Offline Retail stores

Mezcal Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

- 3. Rest of the World

Mezcal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Premium Distilled Agave-Based Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Mezcal Joven

- 5.1.2. Mezcal Reposado

- 5.1.3. Mezcal Anejo

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade Channel

- 5.2.2. Off-Trade Channel

- 5.2.2.1. Online Retail Stores

- 5.2.2.2. Offline Retail stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Mezcal Joven

- 6.1.2. Mezcal Reposado

- 6.1.3. Mezcal Anejo

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade Channel

- 6.2.2. Off-Trade Channel

- 6.2.2.1. Online Retail Stores

- 6.2.2.2. Offline Retail stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Mezcal Joven

- 7.1.2. Mezcal Reposado

- 7.1.3. Mezcal Anejo

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade Channel

- 7.2.2. Off-Trade Channel

- 7.2.2.1. Online Retail Stores

- 7.2.2.2. Offline Retail stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of the World Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Mezcal Joven

- 8.1.2. Mezcal Reposado

- 8.1.3. Mezcal Anejo

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade Channel

- 8.2.2. Off-Trade Channel

- 8.2.2.1. Online Retail Stores

- 8.2.2.2. Offline Retail stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 United States

- 9.1.2 Canada

- 9.1.3 Mexico

- 10. Europe Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Germany

- 10.1.2 United Kingdom

- 10.1.3 France

- 10.1.4 Spain

- 10.1.5 Italy

- 10.1.6 Spain

- 10.1.7 Belgium

- 10.1.8 Netherland

- 10.1.9 Nordics

- 10.1.10 Rest of Europe

- 11. Asia Pacific Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Southeast Asia

- 11.1.6 Australia

- 11.1.7 Indonesia

- 11.1.8 Phillipes

- 11.1.9 Singapore

- 11.1.10 Thailandc

- 11.1.11 Rest of Asia Pacific

- 12. South America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Argentina

- 12.1.3 Peru

- 12.1.4 Chile

- 12.1.5 Colombia

- 12.1.6 Ecuador

- 12.1.7 Venezuela

- 12.1.8 Rest of South America

- 13. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United States

- 13.1.2 Canada

- 13.1.3 Mexico

- 14. MEA Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Arab Emirates

- 14.1.2 Saudi Arabia

- 14.1.3 South Africa

- 14.1.4 Rest of Middle East and Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Pernod Ricard SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Mezcal Vago

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Lagrimas de Dolores

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Compania Tequilera de Arandas S A *List Not Exhaustive

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 IZO Spirits

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 El Silencio Holdings INC

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Fidencio Mezcal

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 William Grant & Sons Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Ilegal Mezcal SA

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Rey Campero

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Diageo PLC

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global Mezcal Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mezcal Market Revenue (Million), by Product Type 2024 & 2032

- Figure 15: North America Mezcal Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: North America Mezcal Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Mezcal Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Mezcal Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe Mezcal Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Mezcal Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Europe Mezcal Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Europe Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Mezcal Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Rest of the World Mezcal Market Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Rest of the World Mezcal Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Rest of the World Mezcal Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Rest of the World Mezcal Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Rest of the World Mezcal Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Rest of the World Mezcal Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mezcal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Mezcal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 51: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: United States Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Canada Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Mexico Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Mezcal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: United Kingdom Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Germany Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Spain Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: France Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Italy Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Europe Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Mezcal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 67: Global Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 68: Global Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mezcal Market?

The projected CAGR is approximately 12.36%.

2. Which companies are prominent players in the Mezcal Market?

Key companies in the market include Pernod Ricard SA, Mezcal Vago, Lagrimas de Dolores, Compania Tequilera de Arandas S A *List Not Exhaustive, IZO Spirits, El Silencio Holdings INC, Fidencio Mezcal, William Grant & Sons Ltd, Ilegal Mezcal SA, Rey Campero, Diageo PLC.

3. What are the main segments of the Mezcal Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Increasing Demand for Premium Distilled Agave-Based Beverages.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

March 2022: Compañia Tequilera de Arandas S.A. de C.V.'s Lobos 1707, the ultra-premium tequila and mezcal brand, announced its launch into the Canadian market. Lobos 1707 commemorated its expansion with an official launch event in Toronto.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mezcal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mezcal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mezcal Market?

To stay informed about further developments, trends, and reports in the Mezcal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence