Key Insights

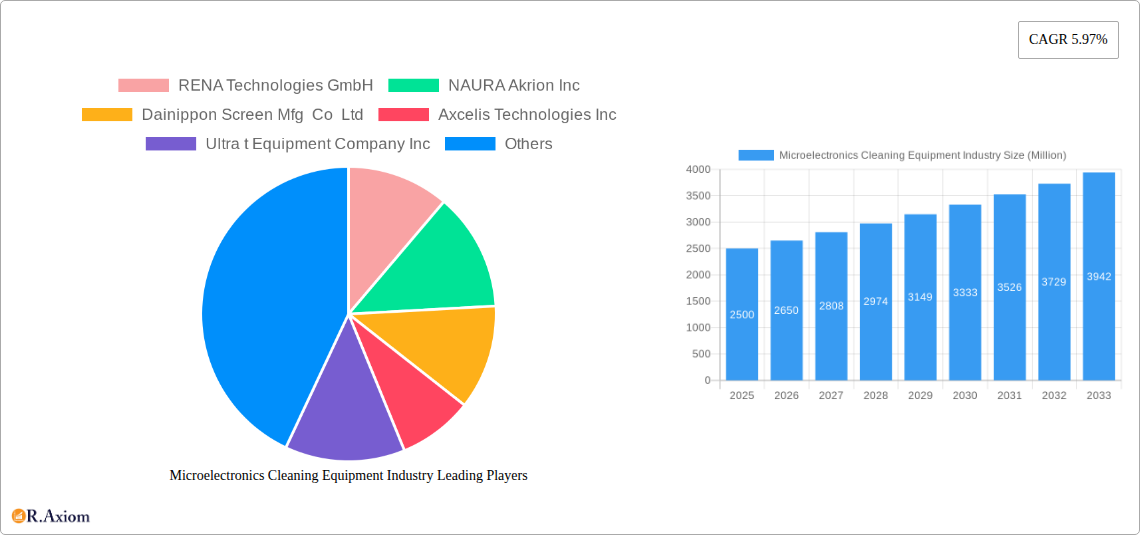

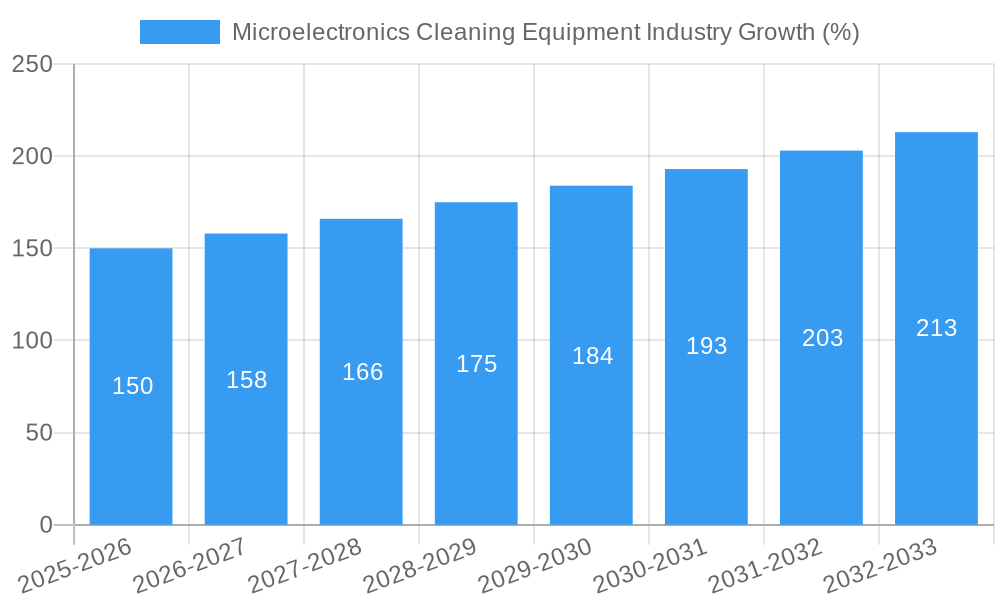

The microelectronics cleaning equipment market, valued at approximately $2.5 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced semiconductor devices and the miniaturization of electronics. A compound annual growth rate (CAGR) of 5.97% from 2025 to 2033 indicates a significant expansion, reaching an estimated market value exceeding $4 billion by 2033. This growth is fueled by several key factors. The rising adoption of advanced semiconductor nodes in integrated circuits (ICs) necessitates more sophisticated and efficient cleaning processes to ensure optimal device performance and yield. Furthermore, the burgeoning demand for microelectromechanical systems (MEMS) in various applications, including automotive sensors and medical devices, contributes to market expansion. The increasing prevalence of wet cleaning technologies, particularly aqueous and cryogenic solutions, dominates the market currently, while dry cleaning technologies like plasma cleaning are gaining traction due to their superior cleaning capabilities and environmental friendliness. However, the high initial investment costs associated with advanced cleaning equipment and the stringent regulatory environment surrounding chemical usage pose significant challenges to market growth.

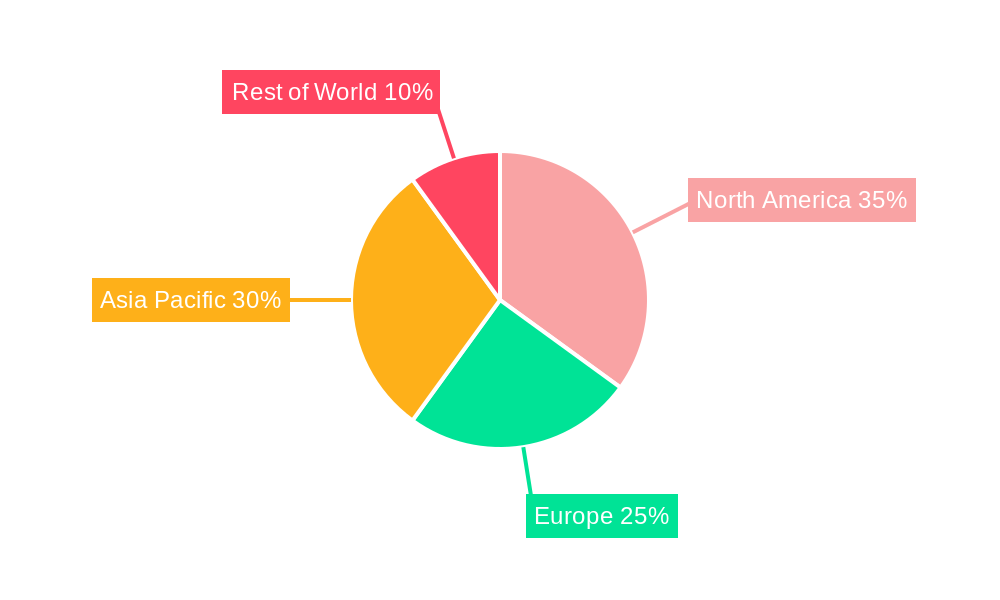

Segment-wise analysis reveals that the integrated circuit (IC) segment holds the largest market share, followed by the printed circuit board (PCB) segment. Within the technology segment, wet cleaning methods currently dominate, although the adoption of dry cleaning methods, specifically plasma cleaning, is anticipated to accelerate due to their superior efficiency and reduced environmental impact. Key players like RENA Technologies, NAURA Akrion, and Dainippon Screen are driving innovation in this field, continually developing advanced cleaning technologies to meet the evolving demands of the microelectronics industry. Regionally, the Asia-Pacific region is projected to witness the most significant growth, driven by the high concentration of semiconductor manufacturing facilities in this region. North America and Europe will maintain a significant market share, driven by strong R&D efforts and established manufacturing bases. The sustained growth trajectory of the microelectronics industry, coupled with the continuous innovation in cleaning technologies, ensures that this market will remain a dynamic and lucrative sector for investors and technology providers in the coming years.

Microelectronics Cleaning Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global microelectronics cleaning equipment market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and researchers. The report analyzes market dynamics, key players, emerging trends, and future growth prospects, providing a thorough understanding of this crucial sector within the microelectronics industry. The market size is projected to reach xx Million by 2033.

Microelectronics Cleaning Equipment Industry Market Concentration & Innovation

The microelectronics cleaning equipment market exhibits a moderately concentrated landscape, with several key players holding significant market share. RENA Technologies GmbH, NAURA Akrion Inc., and Dainippon Screen Mfg Co. Ltd. are among the leading companies, each contributing significantly to the overall market revenue. The market share of these top players is estimated to be around xx%, reflecting a degree of consolidation. However, the presence of several smaller players and emerging companies indicates a competitive environment. Innovation is driven by the constant demand for higher precision and efficiency in semiconductor manufacturing. Stringent regulatory frameworks regarding environmental impact and worker safety also influence technological advancements. The industry sees continuous innovation in cleaning technologies, including advancements in wet, dry, and plasma cleaning methods. Product substitutes are limited, with the specific cleaning requirements of different microelectronic components dictating the suitability of various technologies. M&A activities have played a moderate role in shaping the market landscape, with deal values estimated to be in the range of xx Million in recent years. This activity is driven by companies seeking to expand their product portfolios and market reach. End-user trends point towards increased demand for higher-throughput, automated cleaning systems to meet rising production volumes.

- Market Concentration: xx% held by top 3 players

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Drivers: Higher precision, efficiency, environmental regulations, safety standards.

Microelectronics Cleaning Equipment Industry Industry Trends & Insights

The global microelectronics cleaning equipment market is witnessing robust growth, driven by the increasing demand for advanced microelectronic devices across various applications. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, indicating strong market expansion. Technological advancements, particularly in plasma cleaning and cryogenic cleaning solutions, are significantly impacting market dynamics. The rising adoption of advanced semiconductor technologies like 5G and AI necessitates cleaner and more precise cleaning processes, thus boosting market growth. Consumer preference for high-performance, reliable electronics is further fueling demand. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and mergers and acquisitions, with players focusing on expanding their product portfolio and geographical reach. Market penetration of advanced cleaning technologies is increasing steadily, with plasma cleaning showing significant potential. The emergence of new applications, such as flexible electronics and advanced packaging technologies, also presents promising opportunities for market expansion. The shift towards automation and Industry 4.0 principles is another key factor driving the market’s evolution.

Dominant Markets & Segments in Microelectronics Cleaning Equipment Industry

The Integrated Circuit (IC) segment dominates the microelectronics cleaning equipment market by application, driven by the high volume of IC production and stringent cleanliness requirements. Asia-Pacific region leads in terms of market share, fueled by substantial semiconductor manufacturing capacity. Within the types of cleaning equipment, single-wafer spray systems represent a significant segment due to their high efficiency and precision, while batch systems continue to hold relevance for certain applications. Regarding cleaning technologies, wet cleaning remains the most prevalent approach but the demand for dry and plasma cleaning is growing exponentially, owing to their advantages in certain applications and reduced environmental impact.

- Dominant Region: Asia-Pacific

- Dominant Application Segment: Integrated Circuits (ICs)

- Dominant Cleaning Type: Wet Cleaning (though dry and plasma cleaning are rapidly growing)

- Key Drivers (Asia-Pacific): Strong semiconductor manufacturing base, favorable government policies, substantial investments in R&D.

Microelectronics Cleaning Equipment Industry Product Developments

Recent product innovations focus on improving cleaning efficiency, reducing chemical consumption, and enhancing process control. This includes the development of advanced plasma cleaning systems offering greater precision and compatibility with various materials, as well as advancements in wet cleaning solutions using environmentally friendly chemicals. The integration of automation and data analytics features in cleaning equipment provides improved process monitoring and optimization. These innovations address the market needs for higher throughput, reduced costs, and enhanced quality in microelectronics manufacturing.

Report Scope & Segmentation Analysis

This report segments the market by Type (Single System, Single-Wafer Spray Systems, Batch System), Technology (Wet, HF Acid Solutions, Aqueous, Cryogenic Cleaning Solutions, Dry, Plasma Cleaning Solution, Emerging Solutions), and Application (Printed Circuit Board (PCB), Microelectromechanical Systems (MEMS), Integrated Circuit (ICs), Display, Hard Disk Drives (HDDs), Others). Each segment is analyzed based on market size, growth projections, and competitive landscape. The market size for each segment is estimated using both historical data and future projections. Growth rates are provided for each segment, along with insights into the key drivers and challenges affecting their respective development. The competitive dynamics within each segment are described, identifying key players and their market positions.

Key Drivers of Microelectronics Cleaning Equipment Industry Growth

The growth of the microelectronics cleaning equipment market is fueled by several key factors. The ongoing miniaturization of microelectronic devices requires increasingly sophisticated cleaning techniques. The increasing demand for advanced electronic devices across various industries such as consumer electronics, automotive, and healthcare directly drives the need for advanced cleaning equipment. Furthermore, stringent regulations regarding environmental compliance and worker safety are pushing the industry towards cleaner and more sustainable cleaning processes. Government initiatives promoting technological advancements and investments in the semiconductor industry also play a vital role.

Challenges in the Microelectronics Cleaning Equipment Industry Sector

The microelectronics cleaning equipment industry faces challenges like high initial investment costs for advanced cleaning systems, intense competition, and the need for continuous technological upgrades. Stringent environmental regulations necessitate the development of eco-friendly cleaning solutions, adding to cost pressures. Supply chain disruptions and fluctuations in raw material prices pose additional hurdles. The highly specialized nature of the equipment also limits the market penetration to a specific customer base.

Emerging Opportunities in Microelectronics Cleaning Equipment Industry

Emerging opportunities exist in the development of environmentally friendly cleaning solutions, the integration of Artificial Intelligence (AI) and machine learning for process optimization, and the expansion into new applications such as flexible electronics and advanced packaging technologies. The increasing demand for higher-throughput cleaning systems in high-volume manufacturing presents further potential. Expansion into emerging economies with growing semiconductor industries also represents significant opportunities.

Leading Players in the Microelectronics Cleaning Equipment Industry Market

- RENA Technologies GmbH

- NAURA Akrion Inc

- Dainippon Screen Mfg Co Ltd

- Axcelis Technologies Inc

- Ultra t Equipment Company Inc

- Axus Technology LL

- Speedline Technologies Inc

- Quantum Global Technologies LLC

- TEL FSI Inc

- Panasonic Corporation

Key Developments in Microelectronics Cleaning Equipment Industry Industry

- 2022 Q4: RENA Technologies GmbH launched a new generation of plasma cleaning system.

- 2023 Q1: Dainippon Screen Mfg Co Ltd announced a strategic partnership for developing advanced wet cleaning solutions.

- 2023 Q2: Axcelis Technologies Inc. acquired a smaller competitor, expanding its market share. (Further specific developments would be included here based on actual events)

Strategic Outlook for Microelectronics Cleaning Equipment Industry Market

The future of the microelectronics cleaning equipment market appears bright, with continued growth driven by technological advancements, increasing demand for advanced electronic devices, and the growing need for efficient and sustainable cleaning solutions. The market is poised for further consolidation through mergers and acquisitions, as companies seek to expand their product portfolios and global reach. The focus on innovation in areas such as plasma and cryogenic cleaning will continue to shape market dynamics. Companies that can effectively adapt to the evolving technological landscape and regulatory environment will be best positioned for success in this dynamic and growing market.

Microelectronics Cleaning Equipment Industry Segmentation

-

1. Type

-

1.1. Single System

- 1.1.1. Single-Wafer Cryogenic Systems

- 1.1.2. Single-Wafer Spray Systems

-

1.2. Batch System

- 1.2.1. Batch Immersion Cleaning Systems

- 1.2.2. Batch Spray Cleaning Systems

-

1.1. Single System

-

2. Technology (Qualitative Trend Analysis)

-

2.1. Wet

- 2.1.1. RCA Cleaning

- 2.1.2. Sulphuric Acid Solutions

- 2.1.3. HF Acid Solutions

-

2.2. Aqueous

- 2.2.1. FEOL Cleaning Solutions

- 2.2.2. BEOL Cleaning Solutions

- 2.2.3. Emerging Aqueous Solutions

- 2.2.4. Cryogenic Cleaning Solutions

-

2.3. Dry

- 2.3.1. Vapor-Phase Cleaning Solution

- 2.3.2. Plasma Cleaning Solution

-

2.4. Emerging Solutions

- 2.4.1. Laser Cleaning

- 2.4.2. Chemical Treatment Solutions

- 2.4.3. Dry Particle Solutions

- 2.4.4. Water Purity Solutions

-

2.1. Wet

-

3. Application

- 3.1. Printed Circuit Board (PCB)

- 3.2. Microelectromechanical Systems (MEMS)

- 3.3. Integrated Circuit (ICs)

- 3.4. Display

- 3.5. Hard Disk Drives (HDD)s

- 3.6. Others

Microelectronics Cleaning Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Microelectronics Cleaning Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in the Semiconductor Wafer Industry; Increasing use of MEMS; Increasing Demand for Smartphones & Tablets

- 3.3. Market Restrains

- 3.3.1. Growth in Gesture Recognition Market

- 3.4. Market Trends

- 3.4.1. Microelectromechanical Systems (MEMS) to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single System

- 5.1.1.1. Single-Wafer Cryogenic Systems

- 5.1.1.2. Single-Wafer Spray Systems

- 5.1.2. Batch System

- 5.1.2.1. Batch Immersion Cleaning Systems

- 5.1.2.2. Batch Spray Cleaning Systems

- 5.1.1. Single System

- 5.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 5.2.1. Wet

- 5.2.1.1. RCA Cleaning

- 5.2.1.2. Sulphuric Acid Solutions

- 5.2.1.3. HF Acid Solutions

- 5.2.2. Aqueous

- 5.2.2.1. FEOL Cleaning Solutions

- 5.2.2.2. BEOL Cleaning Solutions

- 5.2.2.3. Emerging Aqueous Solutions

- 5.2.2.4. Cryogenic Cleaning Solutions

- 5.2.3. Dry

- 5.2.3.1. Vapor-Phase Cleaning Solution

- 5.2.3.2. Plasma Cleaning Solution

- 5.2.4. Emerging Solutions

- 5.2.4.1. Laser Cleaning

- 5.2.4.2. Chemical Treatment Solutions

- 5.2.4.3. Dry Particle Solutions

- 5.2.4.4. Water Purity Solutions

- 5.2.1. Wet

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Printed Circuit Board (PCB)

- 5.3.2. Microelectromechanical Systems (MEMS)

- 5.3.3. Integrated Circuit (ICs)

- 5.3.4. Display

- 5.3.5. Hard Disk Drives (HDD)s

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single System

- 6.1.1.1. Single-Wafer Cryogenic Systems

- 6.1.1.2. Single-Wafer Spray Systems

- 6.1.2. Batch System

- 6.1.2.1. Batch Immersion Cleaning Systems

- 6.1.2.2. Batch Spray Cleaning Systems

- 6.1.1. Single System

- 6.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 6.2.1. Wet

- 6.2.1.1. RCA Cleaning

- 6.2.1.2. Sulphuric Acid Solutions

- 6.2.1.3. HF Acid Solutions

- 6.2.2. Aqueous

- 6.2.2.1. FEOL Cleaning Solutions

- 6.2.2.2. BEOL Cleaning Solutions

- 6.2.2.3. Emerging Aqueous Solutions

- 6.2.2.4. Cryogenic Cleaning Solutions

- 6.2.3. Dry

- 6.2.3.1. Vapor-Phase Cleaning Solution

- 6.2.3.2. Plasma Cleaning Solution

- 6.2.4. Emerging Solutions

- 6.2.4.1. Laser Cleaning

- 6.2.4.2. Chemical Treatment Solutions

- 6.2.4.3. Dry Particle Solutions

- 6.2.4.4. Water Purity Solutions

- 6.2.1. Wet

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Printed Circuit Board (PCB)

- 6.3.2. Microelectromechanical Systems (MEMS)

- 6.3.3. Integrated Circuit (ICs)

- 6.3.4. Display

- 6.3.5. Hard Disk Drives (HDD)s

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single System

- 7.1.1.1. Single-Wafer Cryogenic Systems

- 7.1.1.2. Single-Wafer Spray Systems

- 7.1.2. Batch System

- 7.1.2.1. Batch Immersion Cleaning Systems

- 7.1.2.2. Batch Spray Cleaning Systems

- 7.1.1. Single System

- 7.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 7.2.1. Wet

- 7.2.1.1. RCA Cleaning

- 7.2.1.2. Sulphuric Acid Solutions

- 7.2.1.3. HF Acid Solutions

- 7.2.2. Aqueous

- 7.2.2.1. FEOL Cleaning Solutions

- 7.2.2.2. BEOL Cleaning Solutions

- 7.2.2.3. Emerging Aqueous Solutions

- 7.2.2.4. Cryogenic Cleaning Solutions

- 7.2.3. Dry

- 7.2.3.1. Vapor-Phase Cleaning Solution

- 7.2.3.2. Plasma Cleaning Solution

- 7.2.4. Emerging Solutions

- 7.2.4.1. Laser Cleaning

- 7.2.4.2. Chemical Treatment Solutions

- 7.2.4.3. Dry Particle Solutions

- 7.2.4.4. Water Purity Solutions

- 7.2.1. Wet

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Printed Circuit Board (PCB)

- 7.3.2. Microelectromechanical Systems (MEMS)

- 7.3.3. Integrated Circuit (ICs)

- 7.3.4. Display

- 7.3.5. Hard Disk Drives (HDD)s

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single System

- 8.1.1.1. Single-Wafer Cryogenic Systems

- 8.1.1.2. Single-Wafer Spray Systems

- 8.1.2. Batch System

- 8.1.2.1. Batch Immersion Cleaning Systems

- 8.1.2.2. Batch Spray Cleaning Systems

- 8.1.1. Single System

- 8.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 8.2.1. Wet

- 8.2.1.1. RCA Cleaning

- 8.2.1.2. Sulphuric Acid Solutions

- 8.2.1.3. HF Acid Solutions

- 8.2.2. Aqueous

- 8.2.2.1. FEOL Cleaning Solutions

- 8.2.2.2. BEOL Cleaning Solutions

- 8.2.2.3. Emerging Aqueous Solutions

- 8.2.2.4. Cryogenic Cleaning Solutions

- 8.2.3. Dry

- 8.2.3.1. Vapor-Phase Cleaning Solution

- 8.2.3.2. Plasma Cleaning Solution

- 8.2.4. Emerging Solutions

- 8.2.4.1. Laser Cleaning

- 8.2.4.2. Chemical Treatment Solutions

- 8.2.4.3. Dry Particle Solutions

- 8.2.4.4. Water Purity Solutions

- 8.2.1. Wet

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Printed Circuit Board (PCB)

- 8.3.2. Microelectromechanical Systems (MEMS)

- 8.3.3. Integrated Circuit (ICs)

- 8.3.4. Display

- 8.3.5. Hard Disk Drives (HDD)s

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single System

- 9.1.1.1. Single-Wafer Cryogenic Systems

- 9.1.1.2. Single-Wafer Spray Systems

- 9.1.2. Batch System

- 9.1.2.1. Batch Immersion Cleaning Systems

- 9.1.2.2. Batch Spray Cleaning Systems

- 9.1.1. Single System

- 9.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 9.2.1. Wet

- 9.2.1.1. RCA Cleaning

- 9.2.1.2. Sulphuric Acid Solutions

- 9.2.1.3. HF Acid Solutions

- 9.2.2. Aqueous

- 9.2.2.1. FEOL Cleaning Solutions

- 9.2.2.2. BEOL Cleaning Solutions

- 9.2.2.3. Emerging Aqueous Solutions

- 9.2.2.4. Cryogenic Cleaning Solutions

- 9.2.3. Dry

- 9.2.3.1. Vapor-Phase Cleaning Solution

- 9.2.3.2. Plasma Cleaning Solution

- 9.2.4. Emerging Solutions

- 9.2.4.1. Laser Cleaning

- 9.2.4.2. Chemical Treatment Solutions

- 9.2.4.3. Dry Particle Solutions

- 9.2.4.4. Water Purity Solutions

- 9.2.1. Wet

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Printed Circuit Board (PCB)

- 9.3.2. Microelectromechanical Systems (MEMS)

- 9.3.3. Integrated Circuit (ICs)

- 9.3.4. Display

- 9.3.5. Hard Disk Drives (HDD)s

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 RENA Technologies GmbH

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 NAURA Akrion Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Dainippon Screen Mfg Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Axcelis Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ultra t Equipment Company Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Axus Technology LL

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Speedline Technologies Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Quantum Global Technologies LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 TEL FSI Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 RENA Technologies GmbH

List of Figures

- Figure 1: Global Microelectronics Cleaning Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 13: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 14: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 21: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 22: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 29: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 30: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 37: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 38: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 4: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 16: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 20: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 24: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 28: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microelectronics Cleaning Equipment Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Microelectronics Cleaning Equipment Industry?

Key companies in the market include RENA Technologies GmbH, NAURA Akrion Inc, Dainippon Screen Mfg Co Ltd, Axcelis Technologies Inc, Ultra t Equipment Company Inc, Axus Technology LL, Speedline Technologies Inc, Quantum Global Technologies LLC, TEL FSI Inc, Panasonic Corporation.

3. What are the main segments of the Microelectronics Cleaning Equipment Industry?

The market segments include Type, Technology (Qualitative Trend Analysis), Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in the Semiconductor Wafer Industry; Increasing use of MEMS; Increasing Demand for Smartphones & Tablets.

6. What are the notable trends driving market growth?

Microelectromechanical Systems (MEMS) to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Growth in Gesture Recognition Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microelectronics Cleaning Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microelectronics Cleaning Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microelectronics Cleaning Equipment Industry?

To stay informed about further developments, trends, and reports in the Microelectronics Cleaning Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence