Key Insights

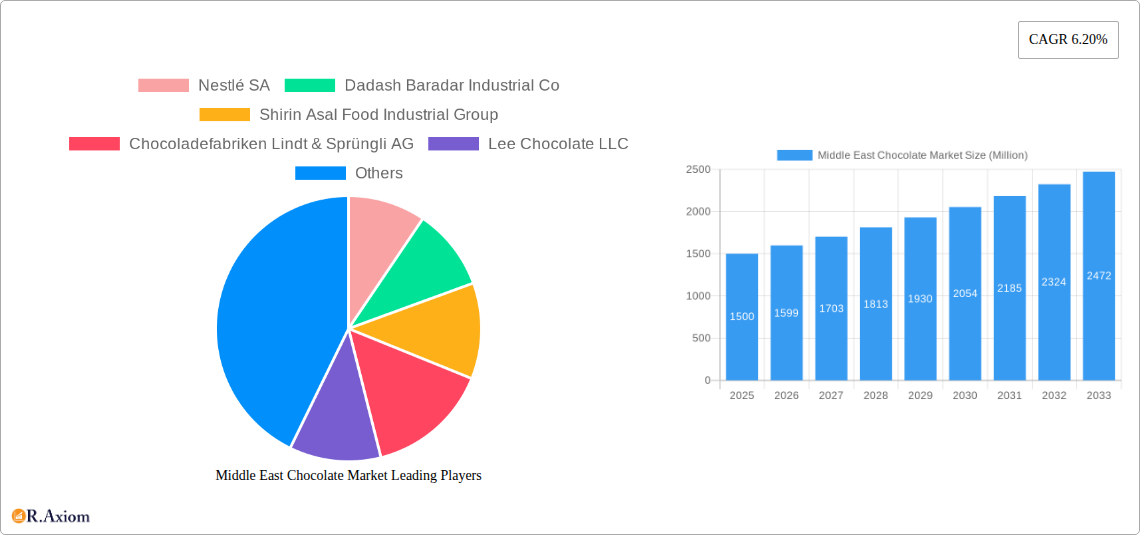

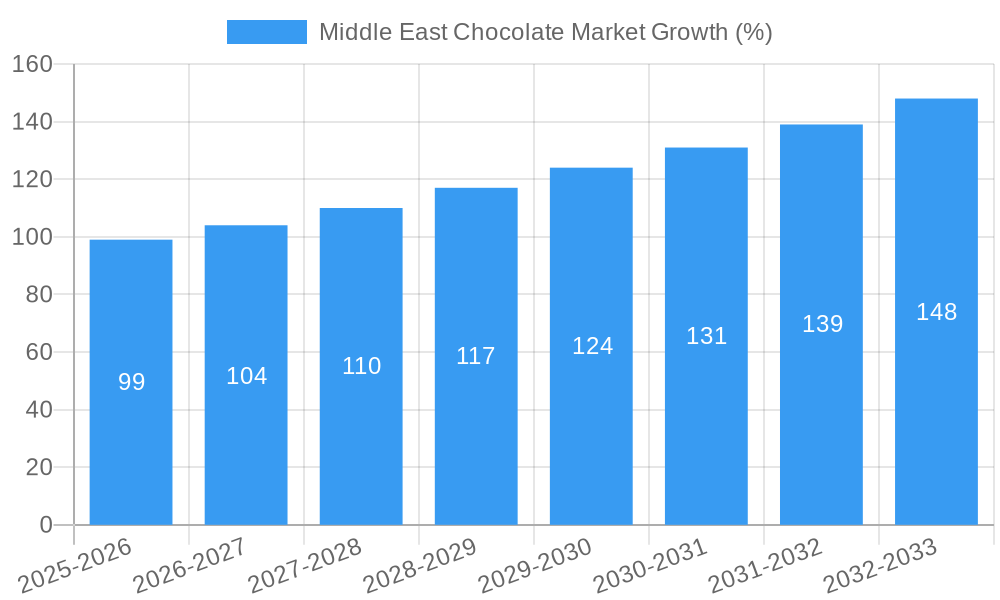

The Middle East chocolate market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region, particularly in the UAE and Saudi Arabia, are boosting consumer spending on premium confectionery items, including chocolate. A burgeoning young population with a sweet tooth and increasing Westernization of dietary habits further contribute to this growth. The popularity of gifting chocolate during religious festivals and special occasions also significantly impacts market demand. Furthermore, the diversification of chocolate product offerings, from traditional dark, milk, and white chocolate variants to innovative flavors and gourmet options, caters to evolving consumer preferences and fuels market expansion. Strong distribution networks, encompassing convenience stores, supermarkets, online retailers, and specialty chocolate boutiques, ensure widespread accessibility and contribute to market penetration.

However, certain factors act as restraints. Fluctuations in raw material prices, primarily cocoa beans, can impact profitability and pricing strategies for chocolate manufacturers. Health consciousness and growing awareness of sugar consumption may lead to a shift towards healthier alternatives, potentially slowing the growth of the overall market. Nevertheless, the ongoing development of healthier chocolate options, such as dark chocolate with higher cocoa content and reduced sugar, is mitigating this risk. The competitive landscape is marked by a mix of international giants like Nestlé and Mars, along with regional players such as Dadash Baradar and Patchi. This competitive dynamic ensures continuous innovation and caters to diverse consumer preferences. Market segmentation reveals significant growth potential in the premium chocolate segment, particularly within the UAE and Saudi Arabia. The online retail channel is also witnessing rapid growth as consumers increasingly adopt e-commerce for purchasing convenience and product discovery.

Middle East Chocolate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East chocolate market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Middle East Chocolate Market Concentration & Innovation

The Middle East chocolate market exhibits a moderately concentrated landscape, with multinational giants like Nestlé SA, Ferrero International SA, and Mars Incorporated holding significant market share. However, several regional players, such as Dadash Baradar Industrial Co and Shirin Asal Food Industrial Group, also contribute significantly, particularly within specific national markets. Market share data for 2025 estimates Nestlé at xx%, Ferrero at xx%, and Mars at xx%, while the remaining share is distributed among regional and smaller players.

Innovation is a key driver, fueled by increasing consumer demand for healthier and more diverse chocolate options. This is evident in the recent launches of plant-based chocolates by Barry Callebaut and the growing popularity of dark chocolate variants. Regulatory frameworks, while generally favorable to food manufacturing, do present challenges related to labeling, ingredient sourcing, and sustainability standards. Product substitutes, such as fruit-based snacks and confectionery alternatives, exert moderate pressure. End-user trends show a clear preference for premium and specialized chocolates, driving the growth of artisanal brands.

Mergers and acquisitions (M&A) activities have been moderate but are expected to increase as larger players seek to expand their market reach and product portfolios. Significant M&A deals within the past five years totaled approximately xx Million, primarily focused on smaller regional brands being acquired by larger corporations.

Middle East Chocolate Market Industry Trends & Insights

The Middle East chocolate market is experiencing robust growth, driven primarily by rising disposable incomes, increasing urbanization, and a growing preference for premium confectionery products. The market's CAGR during the forecast period (2025-2033) is projected at xx%, demonstrating significant expansion potential. This growth is further fueled by increasing tourism and a youthful population with a penchant for indulgence.

Technological disruptions, such as improved manufacturing processes and enhanced packaging solutions, contribute to increased efficiency and product quality. Consumer preferences are shifting towards healthier options, including dark chocolate with higher cocoa content, plant-based alternatives, and sugar-reduced varieties. Competitive dynamics are intense, with both multinational and regional players competing aggressively on price, quality, and innovation. Market penetration of premium chocolate is high in urban areas but remains relatively low in rural regions, representing a key area for future growth.

Dominant Markets & Segments in Middle East Chocolate Market

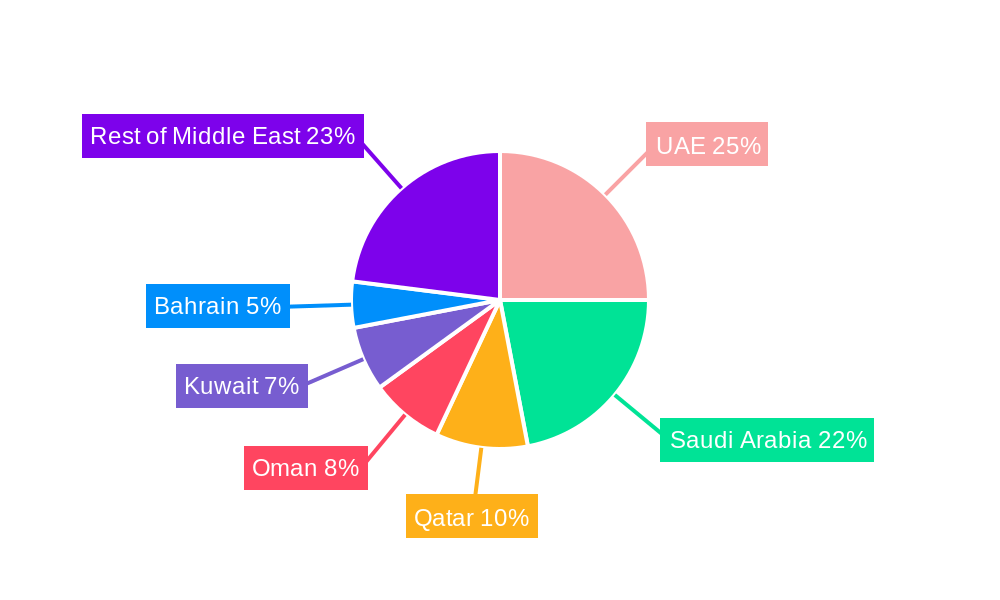

Leading Region: The United Arab Emirates (UAE) and Saudi Arabia dominate the Middle East chocolate market due to high per capita income, a robust retail infrastructure, and a strong preference for premium confectionery products.

Leading Country: The UAE holds the largest market share due to its high purchasing power and cosmopolitan population. Saudi Arabia is a close second, propelled by its large population and growing economy.

Leading Confectionery Variant: Milk chocolate remains the most popular variant, followed closely by dark chocolate, reflecting the diverse preferences among consumers. White chocolate holds a smaller, yet steadily growing, segment.

Leading Distribution Channel: Supermarket/hypermarkets hold the leading position for chocolate distribution, followed by convenience stores and online retailers. The online channel exhibits the highest growth potential.

The dominance of the UAE and Saudi Arabia stems from several key factors:

- Strong Economic Growth: Both countries have experienced significant economic growth, leading to increased disposable incomes and higher consumer spending on non-essential items like chocolates.

- Developed Retail Infrastructure: Modern and well-established retail networks, including large supermarkets and hypermarkets, facilitate widespread distribution and accessibility of chocolate products.

- Favorable Demographics: Young and increasingly affluent populations in both countries contribute to higher chocolate consumption.

Middle East Chocolate Market Product Developments

Recent product innovations focus heavily on health and wellness. Several major players have launched products with reduced sugar content, higher cocoa percentages, and plant-based alternatives. These innovations cater to growing consumer demand for healthier and more sustainable choices. The emphasis on unique flavor profiles and premium ingredients is also a strong trend, offering competitive advantages in a market increasingly sensitive to quality and authenticity. Technological advancements in processing and packaging are allowing for better preservation and enhanced consumer appeal.

Report Scope & Segmentation Analysis

This report segments the Middle East chocolate market based on confectionery variant (dark, milk, and white chocolate), distribution channel (convenience stores, online retail stores, supermarkets/hypermarkets, others), and country (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE, Rest of Middle East). Each segment's growth projections, market sizes, and competitive dynamics are analyzed, providing a granular understanding of market behavior.

Key Drivers of Middle East Chocolate Market Growth

Several factors contribute to the growth of the Middle East chocolate market. Rising disposable incomes are a major driver, enabling increased discretionary spending. Urbanization leads to greater accessibility of chocolate products through established retail channels. Changes in consumer lifestyles and preferences, favoring premium and healthier choices, also fuel market expansion. Furthermore, government initiatives promoting the food processing industry stimulate investments and capacity expansion. Finally, increased tourism brings in a significant influx of consumers seeking diverse chocolate options.

Challenges in the Middle East Chocolate Market Sector

The Middle East chocolate market faces several challenges. Fluctuations in raw material prices impact profitability. Stringent regulatory requirements for food safety and labeling can increase compliance costs. Intense competition, especially from international players, creates pricing pressure. Supply chain complexities, especially in sourcing high-quality cocoa beans, can disrupt production. Finally, consumer health concerns related to sugar content present an ongoing challenge for manufacturers.

Emerging Opportunities in Middle East Chocolate Market

Emerging opportunities include the growth of the e-commerce sector, creating new channels for sales and distribution. The increasing demand for premium and artisanal chocolates offers room for specialized brands. The expanding vegan and plant-based food market represents a significant opportunity for innovative product development. Focusing on healthier options, such as sugar-free and high-cocoa chocolates, aligns with evolving consumer preferences. Finally, tapping into the growing popularity of personalized and customized chocolate products can drive sales.

Leading Players in the Middle East Chocolate Market Market

- Nestlé SA

- Dadash Baradar Industrial Co

- Shirin Asal Food Industrial Group

- Chocoladefabriken Lindt & Sprüngli AG

- Lee Chocolate LLC

- Berry Callebaut

- Makaw Chocolate LLC

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A.Ş.

- IFFCO

- Patchi LLC

- Parand Chocolate Co

- Strauss Group Ltd

- Mondelēz International Inc

- Bostani Chocolatier Inc

- The Hershey Company

Key Developments in Middle East Chocolate Market Industry

November 2022: Nestlé announced plans to invest SAR 7 billion in Saudi Arabia over ten years, including USD 99.6 Million for a new manufacturing plant opening in 2025. This significantly strengthens Nestlé's position in the region.

November 2022: Barry Callebaut launched its 100% plant-based chocolate NXT in Saudi Arabia, tapping into the growing demand for vegan alternatives.

September 2022: Barry Callebaut launched its whole-fruit chocolate line under the Cacao Barry brand in the UAE, offering a healthier, lower-sugar option. These launches demonstrate a strong focus on innovation and catering to changing consumer preferences.

Strategic Outlook for Middle East Chocolate Market Market

The Middle East chocolate market presents significant growth potential. Continued economic expansion, increasing urbanization, and evolving consumer preferences towards healthier and premium options will drive market expansion. The growing popularity of online channels presents lucrative opportunities for businesses to broaden their reach. Innovative product development and strategic partnerships will be critical for success in this competitive landscape. The focus on sustainability and ethical sourcing will also become increasingly important in shaping future market dynamics.

Middle East Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Middle East Chocolate Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. United Arab Emirates Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dadash Baradar Industrial Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Shirin Asal Food Industrial Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Chocoladefabriken Lindt & Sprüngli AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lee Chocolate LLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Berry Callebaut

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Makaw Chocolate LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ferrero International SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mars Incorporated

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Yıldız Holding A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 IFFCO

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Patchi LLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Parand Chocolate Co

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Strauss Group Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Mondelēz International Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Bostani Chocolatier Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 The Hershey Company

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Middle East Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: Middle East Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Middle East Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 14: Middle East Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Middle East Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kuwait Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Bahrain Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Jordan Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Lebanon Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Chocolate Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Middle East Chocolate Market?

Key companies in the market include Nestlé SA, Dadash Baradar Industrial Co, Shirin Asal Food Industrial Group, Chocoladefabriken Lindt & Sprüngli AG, Lee Chocolate LLC, Berry Callebaut, Makaw Chocolate LLC, Ferrero International SA, Mars Incorporated, Yıldız Holding A, IFFCO, Patchi LLC, Parand Chocolate Co, Strauss Group Ltd, Mondelēz International Inc, Bostani Chocolatier Inc, The Hershey Company.

3. What are the main segments of the Middle East Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

November 2022: Nestlé announced plans to invest SAR 7 billion in the Kingdom of Saudi Arabia in the coming ten years in a strategic move to grow its longstanding business in the country, beginning with up to USD 99.6 million to establish a cutting-edge manufacturing plant – which is set to open in 2025.November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. NXT is the first-of-its-kind dairy-free, lactose-free, nut-free, allergen-free, 100% plant-based, and vegan dark and milk chocolate to respond to the growing demand for plant-based foods across the country.September 2022: Barry Callebaut launched its line of whole-fruit chocolates under the Cacao Barry brand in the United Arab Emirates. The product has less sugar than conventional dark chocolate and is made from pure cacao fruit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle East Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence