Key Insights

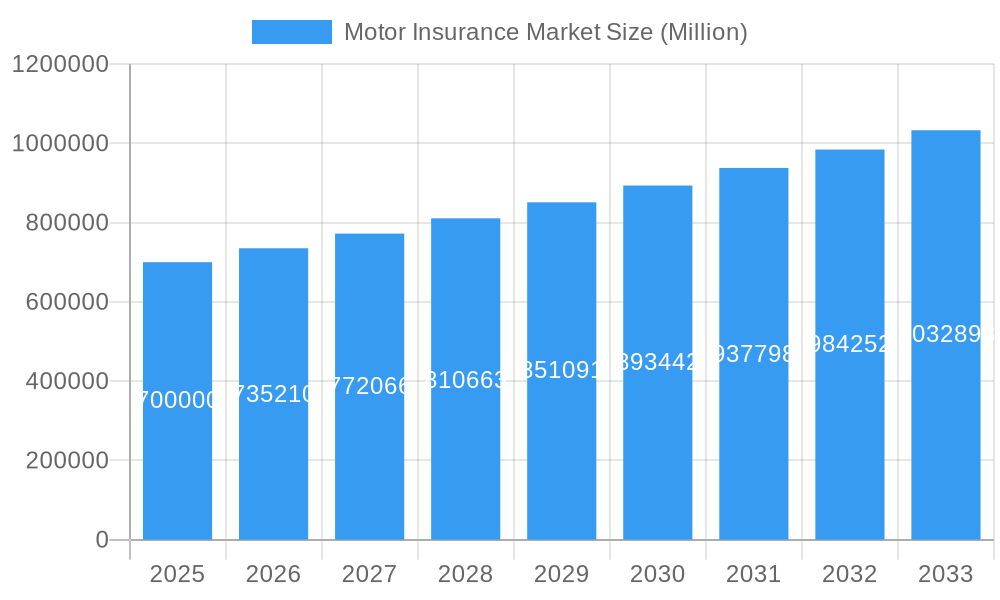

The global motor insurance market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.03% from 2025 to 2033. This expansion is fueled by several key drivers. Rising vehicle ownership, particularly in developing economies across Asia-Pacific and South America, significantly contributes to increased demand for motor insurance. Furthermore, stringent government regulations mandating minimum insurance coverage in many regions are bolstering market growth. The increasing adoption of telematics and connected car technologies presents opportunities for innovative insurance products and risk assessment models, further propelling market expansion. The market is segmented by vehicle type (passenger cars, commercial vehicles, motorcycles) and product type (third-party liability, comprehensive, collision). Passenger cars currently dominate the market share, reflecting their higher penetration rates globally. However, the commercial vehicle segment is poised for substantial growth, driven by increasing freight transportation and logistics activities. The comprehensive insurance segment is expected to maintain its leading position due to its broader coverage and rising consumer awareness of potential risks.

Motor Insurance Market Market Size (In Billion)

Competitive dynamics within the motor insurance market are intense, with a mix of global giants like Allianz SE, State Farm, and Ping An Insurance, alongside regional players and smaller niche insurers. Despite the positive outlook, the market faces certain constraints. Economic downturns can impact consumer spending on insurance, and fluctuating fuel prices can affect vehicle usage and claim frequency. The increasing prevalence of fraudulent claims also poses a significant challenge to insurers. To mitigate these risks, insurers are focusing on advanced fraud detection techniques, data analytics, and strategic partnerships to enhance operational efficiency and profitability. Geographic variations in market size and growth rates reflect differences in vehicle ownership patterns, regulatory environments, and economic conditions. North America and Europe currently hold substantial market shares, but the Asia-Pacific region is expected to witness the fastest growth, fueled by rapid economic development and rising middle-class incomes.

Motor Insurance Market Company Market Share

Motor Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global motor insurance market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. Key market segments, including vehicle types (passenger cars, commercial vehicles, motorcycles) and product types (third-party liability insurance, comprehensive insurance, collision insurance) are meticulously analyzed. The report leverages robust data and advanced analytical techniques to provide actionable insights and facilitate informed strategic planning. The market size in 2025 is estimated to be xx Million. This study also highlights key players such as PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, and Porto Seguro S A (list not exhaustive).

Motor Insurance Market Concentration & Innovation

This section analyzes the competitive landscape of the motor insurance market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. We examine the market share held by key players and analyze the impact of mergers and acquisitions on market dynamics. The consolidated market share of the top five players in 2024 was approximately xx%, indicating a moderately concentrated market. Significant M&A activity was observed during the historical period (2019-2024), with total deal values exceeding xx Million. These activities often involved strategic acquisitions to expand geographical reach and product offerings. Innovation in the sector is driven by technological advancements such as telematics, AI-powered risk assessment, and digital distribution channels. Regulatory frameworks vary across different regions, influencing product offerings and pricing strategies. The increasing popularity of ride-sharing services and the emergence of autonomous vehicles present both opportunities and challenges for the motor insurance market. The substitution of traditional insurance with alternative risk management solutions is also a factor influencing market concentration.

Motor Insurance Market Industry Trends & Insights

The global motor insurance market is characterized by strong growth, driven by factors such as increasing vehicle ownership, rising disposable incomes, and expanding insurance penetration in emerging markets. Technological disruptions, including the widespread adoption of telematics and the rise of Insurtech companies, are transforming the industry landscape. Consumer preferences are shifting towards more personalized and digitalized insurance products, demanding greater convenience and transparency. Competitive dynamics are intense, with established players facing increased competition from Insurtech startups and disruptive business models. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates vary significantly across different regions, with developed markets exhibiting higher penetration compared to emerging economies. This disparity presents lucrative growth opportunities for insurers targeting underserved markets. The increasing adoption of connected car technology and the growing use of data analytics are also influencing market trends.

Dominant Markets & Segments in Motor Insurance Market

The motor insurance market exhibits significant regional variations in terms of size and growth potential. [Specify the leading region/country here, e.g., North America] is currently the dominant market, driven by factors such as high vehicle ownership rates, robust economic growth, and a well-developed insurance sector.

Key Drivers:

- High vehicle density

- Stringent regulatory framework mandating insurance

- Developed insurance infrastructure

- High disposable incomes

Within the segments, passenger cars constitute the largest share of the market due to high vehicle ownership and the rising demand for comprehensive insurance coverage. However, the commercial vehicles segment is poised for significant growth, driven by the expansion of e-commerce and logistics industries. The motorcycles segment experiences diverse growth rates depending on the regional economic condition and regulatory landscape. In terms of product types, comprehensive insurance enjoys the largest market share, reflecting consumer preference for broader coverage. However, the demand for third-party liability insurance remains substantial, especially in regions with less stringent regulatory environments. The collision insurance segment shows steady growth driven by increasing awareness and the demand for protection against accidental damage.

Motor Insurance Market Product Developments

Significant advancements in telematics, artificial intelligence, and data analytics are driving product innovation in the motor insurance market. These technologies enable more accurate risk assessment, personalized pricing, and the development of usage-based insurance (UBI) models. The integration of connected car technology offers opportunities for real-time monitoring of driver behavior, leading to improved safety and more targeted insurance products. Insurers are leveraging these innovations to enhance customer experience, reduce costs, and gain a competitive advantage. Furthermore, the rising adoption of digital platforms and mobile applications facilitates ease of access and enhances customer engagement. This drives greater customer satisfaction and broader market penetration.

Report Scope & Segmentation Analysis

This report segments the motor insurance market based on vehicle type (passenger cars, commercial vehicles, motorcycles) and product type (third-party liability insurance, comprehensive insurance, collision insurance). Each segment is analyzed based on its market size, growth rate, and competitive dynamics. Growth projections indicate continued expansion for all segments, with the fastest growth anticipated in [Specify the fastest-growing segment here, e.g., the commercial vehicles segment]. Competitive dynamics vary depending on the segment, with some exhibiting higher levels of consolidation than others.

Vehicle Type:

- Passenger Cars: This segment is expected to continue its steady growth driven by increasing vehicle ownership and demand for comprehensive insurance.

- Commercial Vehicles: The segment shows high potential for growth, fuelled by the expansion of logistics and e-commerce activities.

- Motorcycles: The growth in this segment depends on several factors, including local regulations and economic conditions.

Product Type:

- Third-Party Liability Insurance: This remains a significant segment given the mandatory nature in many regions.

- Comprehensive Insurance: The segment is growing at a healthy rate due to customer preference for complete vehicle coverage.

- Collision Insurance: This segment is growing steadily as the awareness and demand for accident coverage increases.

Key Drivers of Motor Insurance Market Growth

The motor insurance market is driven by several key factors, including increasing vehicle ownership, especially in developing countries, and growing middle-class populations with higher disposable incomes. Furthermore, government regulations mandating insurance coverage in many regions contribute to market expansion. Technological advancements, such as telematics and AI-powered risk assessment, are enhancing efficiency and personalization of insurance services. The rising adoption of connected car technology further strengthens data-driven risk assessment and opens opportunities for innovative product development. Stringent safety regulations and a growing focus on road safety are also contributing factors.

Challenges in the Motor Insurance Market Sector

The motor insurance market faces several challenges, including increasing fraud and the difficulty of accurately assessing risk, particularly with the advent of new technologies. Regulatory hurdles and evolving legislation can impact profitability and operational efficiency. Fluctuations in fuel prices and economic instability can also affect consumer spending habits and insurance demand. Intense competition from established players and the emergence of new entrants, especially Insurtech companies, further intensifies the competitive pressure. These pressures can lead to reduced profit margins and necessitate increased investment in innovation and technology to maintain competitiveness. The rising cost of repairs, particularly for electric vehicles, also poses a significant challenge to insurers.

Emerging Opportunities in Motor Insurance Market

The motor insurance market presents exciting opportunities. The expansion of the sharing economy, with ride-hailing and car-sharing services, necessitates tailored insurance solutions. The development of autonomous vehicles creates new risk profiles and opens new avenues for innovative insurance products. The rising adoption of telematics and connected car technology provides data-driven insights to enable more precise risk assessment and personalized pricing strategies. Furthermore, expansion into underserved markets, particularly in developing economies, offers substantial growth potential. The integration of AI and machine learning presents opportunities to enhance claims processing, fraud detection, and customer service.

Leading Players in the Motor Insurance Market Market

Key Developments in Motor Insurance Market Industry

- January 2023: Allianz SE launched a new telematics-based insurance product.

- March 2022: GEICO acquired a smaller Insurtech company specializing in AI-powered risk assessment.

- June 2021: Ping An Insurance partnered with a technology firm to improve its claims processing system.

- September 2020: State Farm invested in the development of an autonomous vehicle insurance program. (Further developments can be added here with specific dates and impactful details)

Strategic Outlook for Motor Insurance Market Market

The motor insurance market is poised for continued growth, driven by technological advancements, changing consumer preferences, and expansion into new markets. Opportunities exist in leveraging telematics, AI, and big data to develop personalized and predictive insurance models. The growth of the sharing economy and the emergence of autonomous vehicles will shape future market dynamics, creating both challenges and opportunities for insurance providers. Strategic partnerships and acquisitions will play a crucial role in enhancing competitive advantage and securing market share. Insurers that successfully adapt to evolving technological and regulatory landscapes will be well-positioned to capture significant market share in the coming years.

Motor Insurance Market Segmentation

-

1. Policy Type

- 1.1. Third-party Liability

- 1.2. Third-party Fire and Theft

- 1.3. Comprehensive

Motor Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Motor Insurance Market Regional Market Share

Geographic Coverage of Motor Insurance Market

Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Emerging Countries Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Third-party Liability

- 5.1.2. Third-party Fire and Theft

- 5.1.3. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. North America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 6.1.1. Third-party Liability

- 6.1.2. Third-party Fire and Theft

- 6.1.3. Comprehensive

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 7. Europe Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 7.1.1. Third-party Liability

- 7.1.2. Third-party Fire and Theft

- 7.1.3. Comprehensive

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 8. Asia Pacific Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 8.1.1. Third-party Liability

- 8.1.2. Third-party Fire and Theft

- 8.1.3. Comprehensive

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 9. Middle East Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 9.1.1. Third-party Liability

- 9.1.2. Third-party Fire and Theft

- 9.1.3. Comprehensive

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 10. Latin America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 10.1.1. Third-party Liability

- 10.1.2. Third-party Fire and Theft

- 10.1.3. Comprehensive

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PICC Property and Casualty Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Fire and Marine Insurance Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allianz SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEICO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ping An Insurance (Group) Co of China Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ICICI Lombard General Insurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sompo Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 State Farm Mutual Automobile Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviva Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Porto Seguro S A**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PICC Property and Casualty Co Ltd

List of Figures

- Figure 1: Global Motor Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 3: North America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 4: North America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 7: Europe Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 8: Europe Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 11: Asia Pacific Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 12: Asia Pacific Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 15: Middle East Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 16: Middle East Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 19: Latin America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 20: Latin America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Latin America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 2: Global Motor Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 4: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 6: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 8: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 10: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 12: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Motor Insurance Market?

Key companies in the market include PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, Porto Seguro S A**List Not Exhaustive.

3. What are the main segments of the Motor Insurance Market?

The market segments include Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Emerging Countries Driving the Market Growth.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence