Key Insights

The Nordic commercial printing market is poised for steady expansion, projected to reach $797.02 billion by 2033. Driven by a Compound Annual Growth Rate (CAGR) of 2.2% from 2025 to 2033, the sector's growth is primarily propelled by the burgeoning packaging industry, a direct consequence of escalating e-commerce activities and heightened consumer goods demand. Offset lithography continues its reign as the predominant printing technique, though inkjet printing is gaining significant traction owing to its adaptability and cost-efficiency for short print runs and personalized marketing initiatives. While the publishing sector's growth moderates amidst digital media's ascendancy, sustained demand for premium catalogs and niche publications offers resilience. Key market constraints include rising operational expenditures, intensified competition from digital printing alternatives, and the ongoing migration towards digital marketing platforms.

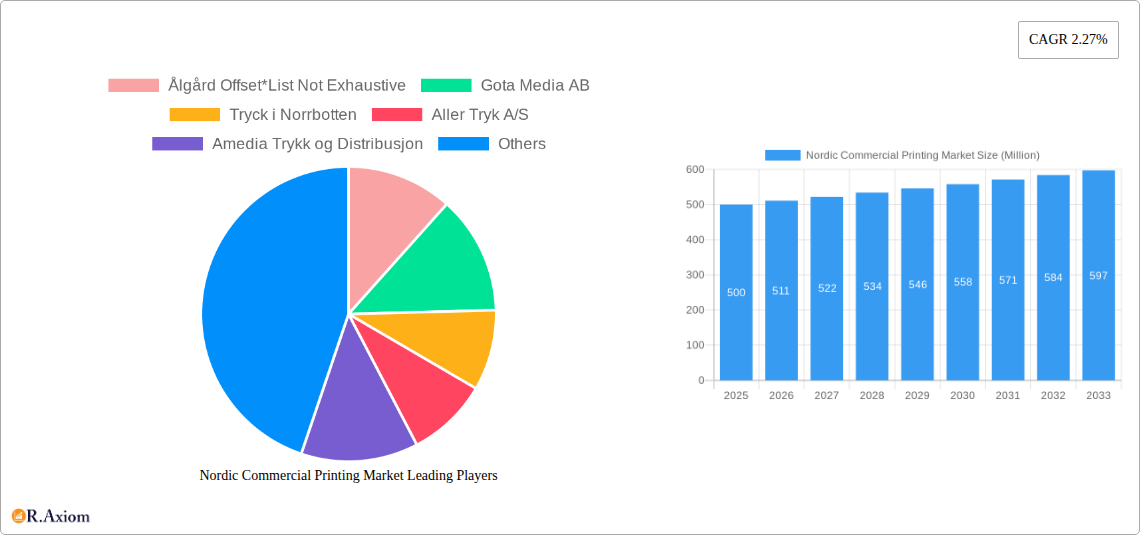

Nordic Commercial Printing Market Market Size (In Billion)

Key trends influencing the Nordic commercial printing landscape encompass the accelerating adoption of environmentally conscious printing methods, the integration of automation and advanced digital printing technologies for enhanced efficiency and cost reduction, and an increasing emphasis on bespoke and personalized printing solutions to satisfy dynamic consumer preferences. Industry leaders are actively embracing these shifts through strategic technological investments and service portfolio diversification. The market is granularly segmented by printing technology (including offset lithography, inkjet, flexographic, screen, gravure, and others) and application areas (such as packaging, advertising, publishing, and more), presenting distinct opportunities for specialized enterprises. While regional nuances exist across Sweden, Norway, Finland, Denmark, and the broader Nordic region, the overarching market trajectory remains largely uniform.

Nordic Commercial Printing Market Company Market Share

Nordic Commercial Printing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nordic commercial printing market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The study incorporates detailed segmentation by type (Offset Lithography, Inkjet, Flexographic, Screen, Gravure, Other Types) and application (Packaging, Advertising, Publishing, Other Applications), offering granular insights into market size, growth projections, and key players. The report's findings are supported by rigorous data analysis and informed by expert opinions.

Nordic Commercial Printing Market Market Concentration & Innovation

The Nordic commercial printing market exhibits a moderately concentrated landscape, with several large players commanding significant market share. While precise market share data for each company is proprietary and varies year to year, Ålgård Offset, Gota Media AB, and Amedia Trykk og Distribusjon are among the notable companies influencing market dynamics. The level of concentration is influenced by factors such as economies of scale, technological capabilities, and strategic acquisitions. Innovation plays a critical role, with companies continuously investing in advanced printing technologies, such as high-speed inkjet presses and digital printing solutions, to enhance efficiency, reduce costs, and cater to evolving customer demands. Regulatory frameworks, particularly concerning environmental sustainability and data privacy, are significant factors affecting market behavior. The emergence of digital printing as a substitute for traditional methods poses a competitive challenge, compelling companies to diversify their offerings and invest in digital capabilities. Consumer preferences are shifting towards personalized and on-demand printing services, driving innovation in personalized packaging and customized marketing materials. The M&A landscape in the Nordic region has seen a moderate level of activity in recent years, with deal values ranging from xx Million to xx Million, primarily driven by the desire to expand market reach and enhance technological capabilities. These transactions often involve smaller players being acquired by larger conglomerates to consolidate market share.

- Key Metrics: Market concentration ratio (CR4/CR8) - xx%; Average M&A deal value - xx Million.

- Innovation Drivers: Digital printing technologies, sustainability initiatives, personalized printing solutions.

- Regulatory Frameworks: Environmental regulations, data privacy laws.

- Product Substitutes: Digital printing, online marketing.

- End-User Trends: Demand for personalization, short run printing, fast turnaround.

Nordic Commercial Printing Market Industry Trends & Insights

The Nordic commercial printing market is experiencing a period of transition, characterized by both challenges and opportunities. While overall market size is predicted to be approximately xx Million in 2025, the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%. Market growth is primarily driven by factors such as the increasing demand for packaging solutions across various industries, the ongoing need for marketing and advertising materials despite the rise of digital media, and the sustained demand for printed publications in specific niches. Significant technological disruptions, particularly the increasing adoption of digital printing technologies, are reshaping the competitive landscape. This shift necessitates considerable investment in new technologies and necessitates a strategic shift for traditional players. Consumer preferences are also evolving towards sustainability, with an increasing demand for eco-friendly printing materials and processes. Competitive dynamics are characterized by intense competition, especially among companies offering similar printing services and technologies. Companies are actively employing strategies to differentiate their offerings, focusing on specialization, innovation, and building strong customer relationships to maintain market share. Market penetration of digital printing technologies continues to increase year by year, steadily replacing some traditional methods.

Dominant Markets & Segments in Nordic Commercial Printing Market

Within the Nordic region, Sweden and Norway represent the largest markets for commercial printing. These countries possess a higher concentration of industries that heavily rely on printed materials, coupled with robust infrastructure supporting print production. While specific data for market share by country is unavailable in this context, Sweden's and Norway's advanced economies and robust business environments contribute to higher demand compared to other Nordic countries.

By Type:

- Offset Lithography: Remains the dominant segment, driven by its cost-effectiveness for high-volume printing. Key drivers include established infrastructure and economies of scale.

- Inkjet: Experiencing significant growth due to its flexibility and suitability for short-run and personalized printing. Drivers include the rise of on-demand printing and personalization demands.

- Other Types: This segment's growth is primarily driven by specialized printing applications catering to niche markets.

By Application:

- Packaging: A major segment due to its reliance on printed materials across food, beverages, and consumer goods. Economic factors, consumerism and strong retail sectors influence packaging demand.

- Publishing: Remains a significant segment, but facing challenges due to the growth of digital content. Infrastructure and established publishing houses ensure its continued relevance.

- Advertising: Facing pressure from digital marketing, but still relevant for high-impact campaigns. Successful advertising campaigns using print materials create demand.

Nordic Commercial Printing Market Product Developments

Recent product innovations include the integration of smart printing technologies, enhancing efficiency and enabling real-time tracking. The development of eco-friendly inks and substrates addresses growing environmental concerns. Companies are increasingly focusing on value-added services, like design and finishing, to differentiate their offerings and capture premium margins. These developments reflect the industry's efforts to adapt to evolving customer needs and technological advancements. The market's successful integration of these technologies reflects a good market fit for these innovations.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Nordic commercial printing market, segmented by type (Offset Lithography, Inkjet, Flexographic, Screen, Gravure, Other Types) and application (Packaging, Advertising, Publishing, Other Applications). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The growth projections for each segment vary, with inkjet and other specialized printing techniques exhibiting faster growth compared to more traditional methods like offset lithography. Competitive dynamics are influenced by factors such as technological advancements, pricing strategies, and service offerings. Market size estimates are provided for the historical period (2019-2024), base year (2025), and forecast period (2025-2033).

Key Drivers of Nordic Commercial Printing Market Growth

Several factors contribute to the growth of the Nordic commercial printing market. These include the rising demand for packaging from the expanding consumer goods sector, the continued need for high-quality printed marketing materials in various industries, and the ongoing requirement for printed books and other publications, especially within niche markets. Government regulations promoting sustainable printing practices are also driving growth in the eco-friendly segment.

Challenges in the Nordic Commercial Printing Market Sector

The Nordic commercial printing market faces challenges, including increasing competition from digital printing technologies and a rising cost of raw materials. The industry is also grappling with labor shortages in skilled trades and adapting to evolving consumer demands for environmentally sustainable printing practices. These factors impact profitability and necessitate the adoption of efficient and sustainable practices. The quantification of these impacts is complex, but analysis suggests a projected xx% reduction in profit margins by xx due to rising material costs alone.

Emerging Opportunities in Nordic Commercial Printing Market

Emerging opportunities lie in personalized printing, specialized packaging solutions, and the growth of sustainable printing practices. The adoption of advanced printing technologies and value-added services also presents significant growth potential. This segment is experiencing rapid growth due to consumers' and businesses' increasing demand for customized solutions and environmentally conscious products.

Leading Players in the Nordic Commercial Printing Market Market

- Ålgård Offset

- Gota Media AB (Gota Media AB)

- Tryck i Norrbotten

- Aller Tryk A/S

- Amedia Trykk og Distribusjon

- ScandBook Holding

- V-TAB AB

- Pressgrannar AB

- Botnia Print

- Bold Printing Group AB

- UPC Center

- Schibsted Trykk AS

- Daily Print

- Alma Manu Oy

Key Developments in Nordic Commercial Printing Market Industry

- 2022 Q4: Gota Media AB invested xx Million in a new high-speed inkjet printing press.

- 2023 Q1: Amedia Trykk og Distribusjon acquired a smaller competitor, expanding its market share.

- 2023 Q3: Several key players announced significant investments in sustainable printing technologies.

Strategic Outlook for Nordic Commercial Printing Market Market

The Nordic commercial printing market is poised for continued growth, driven by demand for specialized printing solutions, sustainable packaging, and personalized printing services. Companies that successfully integrate advanced technologies, focus on sustainability, and offer value-added services are expected to outperform their competitors. The future holds significant potential for those who adapt to evolving market dynamics and consumer preferences.

Nordic Commercial Printing Market Segmentation

-

1. Type

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Types

-

2. Application

- 2.1. Packaging

- 2.2. Advertising

- 2.3. Publishing

- 2.4. Other Applications

Nordic Commercial Printing Market Segmentation By Geography

- 1. Sweden

- 2. Norway

- 3. Finland

- 4. Denmark

- 5. Rest of Nordic Region

Nordic Commercial Printing Market Regional Market Share

Geographic Coverage of Nordic Commercial Printing Market

Nordic Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Potential Industry Sectors & Increased Demand for Promotional Materials by the Retail

- 3.2.2 Food and Beverage Industries; The Introduction of Eco-friendly Practices

- 3.2.3 Reducing the Printing Industry's Impact on the Environment

- 3.3. Market Restrains

- 3.3.1. ; Increase in Digitization and Rising Dependence on Feedstock Prices

- 3.4. Market Trends

- 3.4.1. Digital Printing is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Advertising

- 5.2.3. Publishing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.3.2. Norway

- 5.3.3. Finland

- 5.3.4. Denmark

- 5.3.5. Rest of Nordic Region

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Sweden Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Offset Lithography

- 6.1.2. Inkjet

- 6.1.3. Flexographic

- 6.1.4. Screen

- 6.1.5. Gravure

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Packaging

- 6.2.2. Advertising

- 6.2.3. Publishing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Norway Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Offset Lithography

- 7.1.2. Inkjet

- 7.1.3. Flexographic

- 7.1.4. Screen

- 7.1.5. Gravure

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Packaging

- 7.2.2. Advertising

- 7.2.3. Publishing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Finland Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Offset Lithography

- 8.1.2. Inkjet

- 8.1.3. Flexographic

- 8.1.4. Screen

- 8.1.5. Gravure

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Packaging

- 8.2.2. Advertising

- 8.2.3. Publishing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Denmark Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Offset Lithography

- 9.1.2. Inkjet

- 9.1.3. Flexographic

- 9.1.4. Screen

- 9.1.5. Gravure

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Packaging

- 9.2.2. Advertising

- 9.2.3. Publishing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Nordic Region Nordic Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Offset Lithography

- 10.1.2. Inkjet

- 10.1.3. Flexographic

- 10.1.4. Screen

- 10.1.5. Gravure

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Packaging

- 10.2.2. Advertising

- 10.2.3. Publishing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ålgård Offset*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gota Media AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tryck i Norrbotten

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aller Tryk A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amedia Trykk og Distribusjon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ScandBook Holding

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 V-TAB AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pressgrannar AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Botnia Print

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bold Printing Group AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 UPC Center

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Schibsted Trykk AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Daily Print

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Alma Manu Oy

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ålgård Offset*List Not Exhaustive

List of Figures

- Figure 1: Nordic Commercial Printing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nordic Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Nordic Commercial Printing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Nordic Commercial Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Nordic Commercial Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Nordic Commercial Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Nordic Commercial Printing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Nordic Commercial Printing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Nordic Commercial Printing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Nordic Commercial Printing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordic Commercial Printing Market?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the Nordic Commercial Printing Market?

Key companies in the market include Ålgård Offset*List Not Exhaustive, Gota Media AB, Tryck i Norrbotten, Aller Tryk A/S, Amedia Trykk og Distribusjon, ScandBook Holding, V-TAB AB, Pressgrannar AB, Botnia Print, Bold Printing Group AB, UPC Center, Schibsted Trykk AS, Daily Print, Alma Manu Oy.

3. What are the main segments of the Nordic Commercial Printing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 797.02 billion as of 2022.

5. What are some drivers contributing to market growth?

; Potential Industry Sectors & Increased Demand for Promotional Materials by the Retail. Food and Beverage Industries; The Introduction of Eco-friendly Practices. Reducing the Printing Industry's Impact on the Environment.

6. What are the notable trends driving market growth?

Digital Printing is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

; Increase in Digitization and Rising Dependence on Feedstock Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordic Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordic Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordic Commercial Printing Market?

To stay informed about further developments, trends, and reports in the Nordic Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence