Key Insights

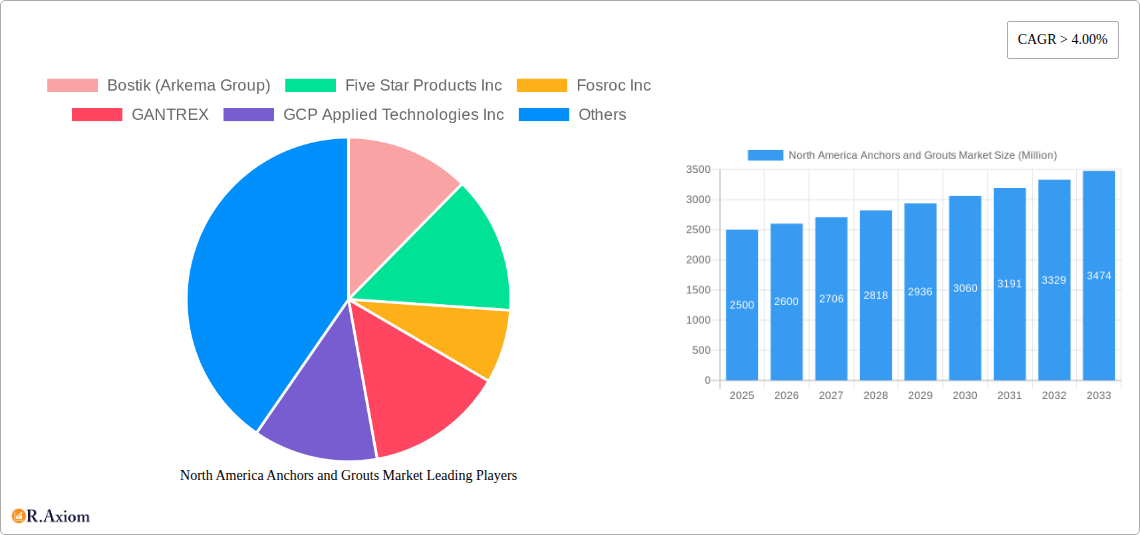

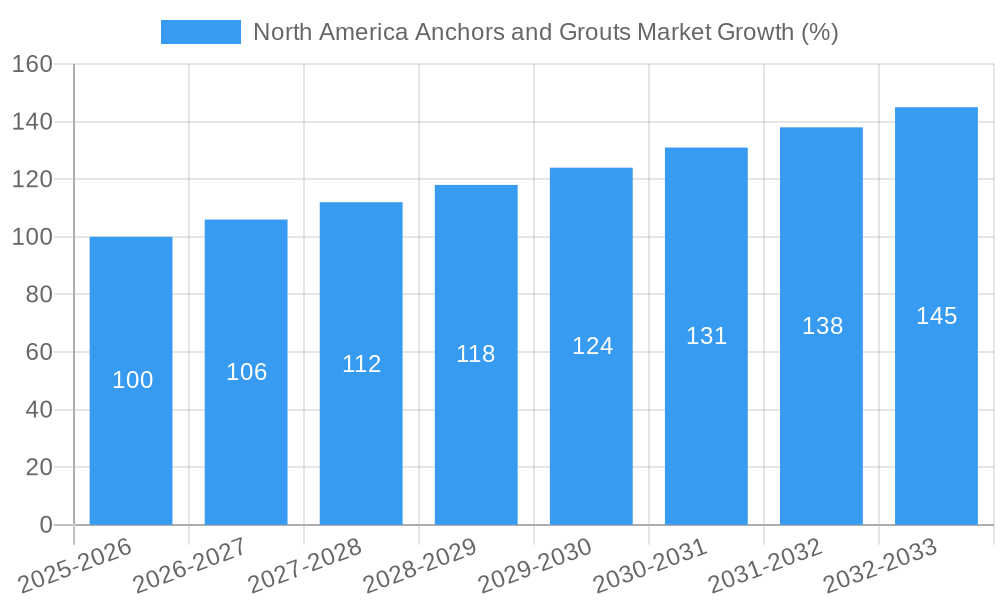

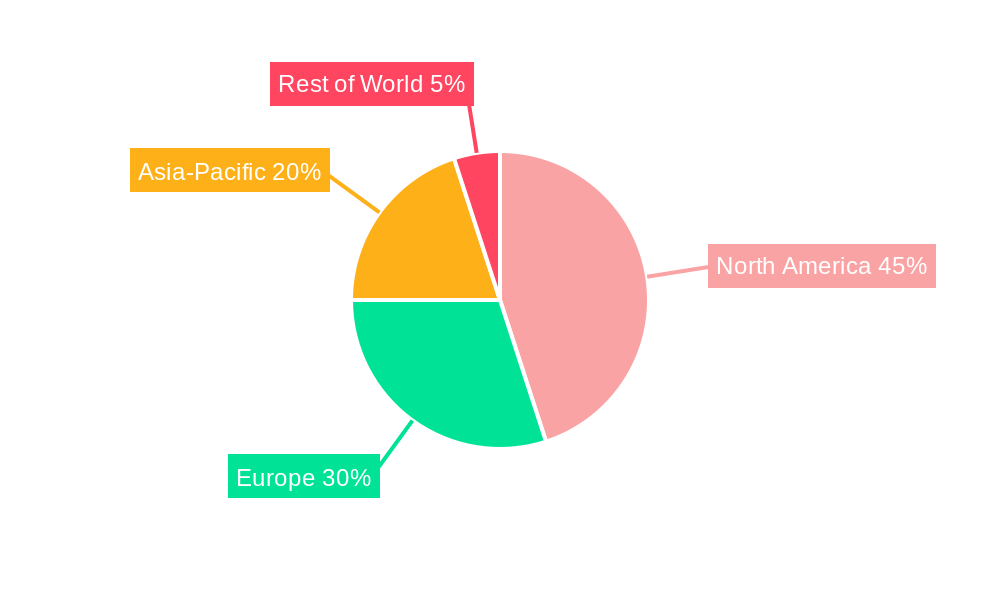

The North America anchors and grouts market is experiencing robust growth, driven by a surge in construction activities, particularly in infrastructure development and commercial projects. The market's compound annual growth rate (CAGR) exceeding 4.00% from 2019 to 2024 indicates a significant expansion. This growth is fueled by increasing demand for high-performance anchoring systems in diverse applications, including building facades, bridge construction, and industrial settings. Furthermore, the rising adoption of sustainable construction practices and the increasing preference for chemical-based grouts that enhance project efficiency are further bolstering market growth. Key players like Bostik, Henkel, and Sika are leveraging technological advancements to develop innovative products with improved strength, durability, and ease of application, thereby stimulating market expansion. The market segmentation likely includes categories based on product type (epoxy, cement, etc.), application (structural anchoring, crack injection), and end-user (construction, infrastructure). While precise regional breakdowns are absent, the North American market, due to its significant construction sector and robust economic activity, commands a substantial share of the overall anchors and grouts market.

The market's future trajectory promises further expansion through 2033. However, potential restraints include fluctuating raw material prices and supply chain disruptions. The market's growth could also be influenced by government regulations related to construction materials and environmental concerns. To mitigate these challenges, manufacturers are focusing on supply chain diversification, exploring cost-effective raw materials, and investing in research and development to enhance product performance and sustainability. The competitive landscape is characterized by both large multinational corporations and specialized regional players, resulting in a dynamic market with ongoing innovation and product differentiation. The market's success will depend on manufacturers’ ability to innovate, provide superior customer service, and adapt to evolving industry demands.

North America Anchors and Grouts Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America anchors and grouts market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this report meticulously examines market dynamics, growth drivers, challenges, and opportunities within this crucial sector. The estimated market size in 2025 is xx Million.

North America Anchors and Grouts Market Market Concentration & Innovation

The North America anchors and grouts market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for each company require extensive proprietary data analysis, companies such as Sika AG, Sika AG, Mapei SpA, and GCP Applied Technologies Inc. are recognized as major players. The market is characterized by both organic growth strategies (product innovation, expansion) and inorganic growth (mergers and acquisitions). Recent M&A activity highlights this trend: In May 2022, Sika AG's acquisition of United Gilsonite Laboratories (UGL) for an undisclosed sum significantly bolstered its position in the high-value waterproofing segment. Further, the April 2022 acquisition of GCP Applied Technologies by Saint-Gobain for approximately USD 2.3 Billion demonstrates the significant consolidation occurring within the industry. These deals underscore the strategic importance of gaining market share and expanding product portfolios. Innovation in the sector is driven by demands for high-performance materials with improved durability, sustainability, and ease of application. Regulatory frameworks focusing on environmental protection and building codes also influence product development, prompting companies to offer eco-friendly, high-performance anchors and grouts. Substitutes, such as advanced adhesive systems, exert competitive pressure, while evolving end-user preferences (e.g., demand for faster setting times, specialized applications) necessitate continuous product refinement.

North America Anchors and Grouts Market Industry Trends & Insights

The North America anchors and grouts market is experiencing robust growth, driven by several key factors. The booming construction industry, particularly in infrastructure development and residential construction, fuels significant demand. Technological advancements, such as the introduction of high-strength, rapidly setting grouts and innovative anchoring systems, are enhancing efficiency and performance. Increased focus on sustainable building practices is also impacting the market, with manufacturers developing eco-friendly, low-VOC products that meet stringent environmental standards. Consumer preferences for aesthetically pleasing and easy-to-use products are influencing innovation. The competitive landscape is highly dynamic, with established players and emerging companies vying for market share through product differentiation, pricing strategies, and strategic partnerships. The CAGR for the forecast period (2025-2033) is estimated at xx%, reflecting the positive growth trajectory. Market penetration is steadily increasing, particularly in specialized segments such as seismic retrofitting and industrial applications. Technological disruptions, such as the adoption of 3D printing in construction, present both opportunities and challenges.

Dominant Markets & Segments in North America Anchors and Grouts Market

While a precise breakdown of regional and segment dominance requires a full market analysis, some preliminary observations can be made. The United States is expected to hold the largest market share within North America, owing to its substantial construction activities and robust infrastructure spending. Within segments, epoxy grouts are experiencing higher growth due to their superior strength, durability and chemical resistance, thus being preferred in demanding applications.

- Key Drivers in the United States:

- Robust infrastructure spending programs.

- High residential construction activity.

- Increased investment in commercial and industrial building projects.

- Favorable economic conditions (subject to cyclical variations).

Further analysis within the report will delve deeper into the specific drivers in various sub-segments across different countries within North America to showcase the dynamics of the market with detailed dominance analysis.

North America Anchors and Grouts Market Product Developments

Recent product innovations focus on enhancing performance and sustainability. New formulations of epoxy grouts offer improved strength, faster setting times, and enhanced resistance to chemicals and moisture. Anchoring systems are evolving with innovative designs that simplify installation and improve load-bearing capacity. Manufacturers are increasingly incorporating recycled materials and low-VOC components into their products to meet growing environmental concerns and building codes. These improvements cater to the evolving needs of various industries and align with the overarching trends of higher performance, ease of use, and sustainability.

Report Scope & Segmentation Analysis

This report segments the North America anchors and grouts market across various parameters:

- By Product Type: Epoxy grouts, cement-based grouts, polyurethane grouts, and others. Each segment exhibits unique growth projections and competitive dynamics, reflecting the varying performance characteristics and applications of these products.

- By Application: Residential construction, commercial construction, infrastructure projects, industrial applications, and others. Market size and growth vary significantly across these applications due to differing construction volumes and material specifications.

- By Region: United States, Canada, Mexico. Regional differences in construction activity and regulatory frameworks influence market dynamics within each region.

The detailed analysis within this report offers in-depth insight into the market size, growth projections, and competitive landscape for each segment.

Key Drivers of North America Anchors and Grouts Market Growth

Several factors are driving market expansion:

- Increased Construction Activity: Growth in residential, commercial, and infrastructure projects fuels high demand for anchors and grouts.

- Technological Advancements: Innovations in material formulations lead to superior performance and efficiency.

- Infrastructure Development: Government investments in infrastructure upgrades are boosting market demand significantly.

Challenges in the North America Anchors and Grouts Market Sector

The industry faces several challenges:

- Fluctuations in Raw Material Prices: The cost of key raw materials can impact product pricing and profitability.

- Supply Chain Disruptions: Global events can cause supply chain bottlenecks, affecting production and delivery timelines.

- Competition: The market is competitive, requiring continuous innovation and cost optimization.

These challenges can affect the overall growth trajectory, requiring companies to implement strategic measures to mitigate the impact.

Emerging Opportunities in North America Anchors and Grouts Market

New opportunities are emerging:

- Green Building Initiatives: Growing demand for sustainable construction products opens avenues for eco-friendly solutions.

- Specialized Applications: Expansion into niche applications like seismic retrofitting and industrial projects creates further market potential.

- Technological Innovations: Adopting advanced technologies like 3D printing presents new opportunities for growth and development.

Leading Players in the North America Anchors and Grouts Market Market

- Bostik (Arkema Group)

- Five Star Products Inc

- Fosroc Inc

- GANTREX

- GCP Applied Technologies Inc

- Henkel AG & Co KGaA

- Laticrete International Inc

- Mapei SpA

- MBCC Group (BASF SE)

- Saint-Gobain Weber

- Sika AG

- Thermax Global

Key Developments in North America Anchors and Grouts Market Industry

- May 2022: Sika AG acquired United Gilsonite Laboratories (UGL), expanding its waterproofing solutions portfolio.

- April 2022: GCP Applied Technologies was acquired by Saint-Gobain, creating a larger player in the market.

Strategic Outlook for North America Anchors and Grouts Market Market

The North America anchors and grouts market is poised for continued growth, fueled by a robust construction sector, technological advancements, and a rising emphasis on sustainable building practices. Opportunities abound in specialized applications and the development of eco-friendly products. Companies that successfully adapt to evolving market dynamics, embrace innovation, and meet the needs of a growing construction sector are best positioned for long-term success.

North America Anchors and Grouts Market Segmentation

-

1. Product Type

- 1.1. Cementitious Fixing

- 1.2. Resin Fixing

- 1.3. Other Product Types

-

2. End-user Industry

- 2.1. Residential

- 2.2. Non-residential

- 2.3. Infrastructure

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Anchors and Grouts Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Anchors and Grouts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansions of Petrochemical Plants; Development in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. Expansions of Petrochemical Plants; Development in the Construction Industry

- 3.4. Market Trends

- 3.4.1. Non-Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Anchors and Grouts Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cementitious Fixing

- 5.1.2. Resin Fixing

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.2.3. Infrastructure

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Anchors and Grouts Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cementitious Fixing

- 6.1.2. Resin Fixing

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.2.3. Infrastructure

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Anchors and Grouts Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cementitious Fixing

- 7.1.2. Resin Fixing

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.2.3. Infrastructure

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Anchors and Grouts Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cementitious Fixing

- 8.1.2. Resin Fixing

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.2.3. Infrastructure

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Bostik (Arkema Group)

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Five Star Products Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Fosroc Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GANTREX

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 GCP Applied Technologies Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Henkel AG & Co KGaA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Laticrete International Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mapei SpA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 MBCC Group (BASF SE)

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Saint-Gobain Weber

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Sika AG

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Thermax Global*List Not Exhaustive

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Bostik (Arkema Group)

List of Figures

- Figure 1: Global North America Anchors and Grouts Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United States North America Anchors and Grouts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: United States North America Anchors and Grouts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: United States North America Anchors and Grouts Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 5: United States North America Anchors and Grouts Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 6: United States North America Anchors and Grouts Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: United States North America Anchors and Grouts Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: United States North America Anchors and Grouts Market Revenue (Million), by Country 2024 & 2032

- Figure 9: United States North America Anchors and Grouts Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Canada North America Anchors and Grouts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Canada North America Anchors and Grouts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Canada North America Anchors and Grouts Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: Canada North America Anchors and Grouts Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: Canada North America Anchors and Grouts Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Canada North America Anchors and Grouts Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Canada North America Anchors and Grouts Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Canada North America Anchors and Grouts Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Mexico North America Anchors and Grouts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Mexico North America Anchors and Grouts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Mexico North America Anchors and Grouts Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Mexico North America Anchors and Grouts Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Mexico North America Anchors and Grouts Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Mexico North America Anchors and Grouts Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Mexico North America Anchors and Grouts Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Mexico North America Anchors and Grouts Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North America Anchors and Grouts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North America Anchors and Grouts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global North America Anchors and Grouts Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global North America Anchors and Grouts Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global North America Anchors and Grouts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global North America Anchors and Grouts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global North America Anchors and Grouts Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Global North America Anchors and Grouts Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global North America Anchors and Grouts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global North America Anchors and Grouts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global North America Anchors and Grouts Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Global North America Anchors and Grouts Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global North America Anchors and Grouts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global North America Anchors and Grouts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global North America Anchors and Grouts Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Global North America Anchors and Grouts Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global North America Anchors and Grouts Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Anchors and Grouts Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Anchors and Grouts Market?

Key companies in the market include Bostik (Arkema Group), Five Star Products Inc, Fosroc Inc, GANTREX, GCP Applied Technologies Inc, Henkel AG & Co KGaA, Laticrete International Inc, Mapei SpA, MBCC Group (BASF SE), Saint-Gobain Weber, Sika AG, Thermax Global*List Not Exhaustive.

3. What are the main segments of the North America Anchors and Grouts Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expansions of Petrochemical Plants; Development in the Construction Industry.

6. What are the notable trends driving market growth?

Non-Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Expansions of Petrochemical Plants; Development in the Construction Industry.

8. Can you provide examples of recent developments in the market?

In May 2022, Sika AG acquired United Gilsonite Laboratories (UGL), a prominent provider of coatings and waterproofing solutions for the construction sector in the United States. UGL goods are available at significant shops in the United States. This purchase will contribute to Sika's high-value-added concrete and masonry waterproofing solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Anchors and Grouts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Anchors and Grouts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Anchors and Grouts Market?

To stay informed about further developments, trends, and reports in the North America Anchors and Grouts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence