Key Insights

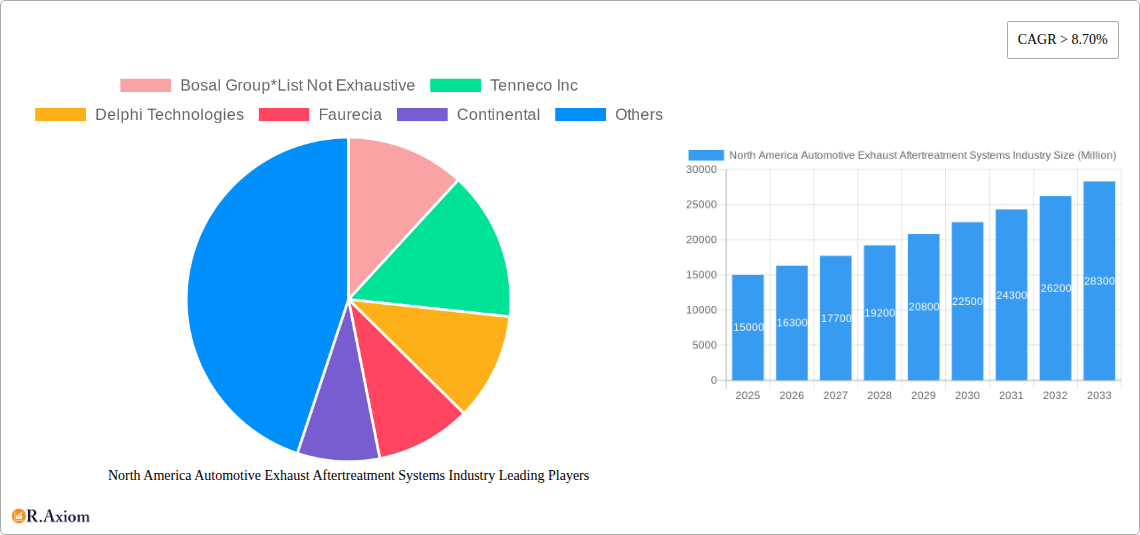

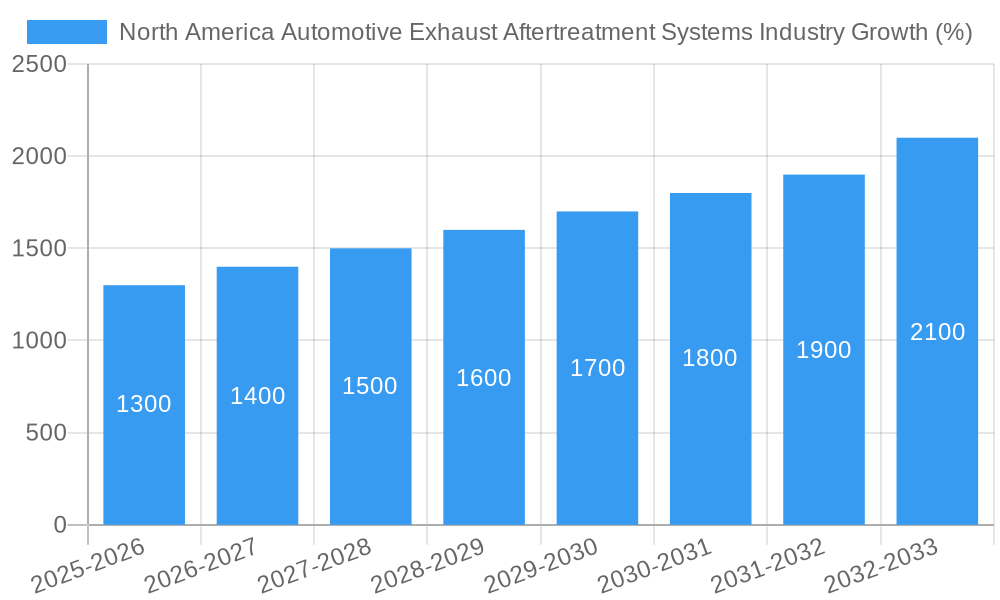

The North American automotive exhaust aftertreatment systems market is experiencing robust growth, driven by stringent emission regulations, increasing vehicle production, and a rising demand for fuel-efficient vehicles. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to exhibit a compound annual growth rate (CAGR) exceeding 8.70% from 2025 to 2033. This growth is fueled by the increasing adoption of advanced aftertreatment technologies, such as particulate matter control systems and carbon compound control systems, across passenger cars and commercial vehicles. The United States currently holds the largest market share within North America, followed by Canada, with Mexico and the rest of North America contributing significantly. Key players like Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, Continental, and Donaldson Company are driving innovation and competition within this dynamic sector. The market segmentation by vehicle type, fuel type, and filter type allows for targeted strategies and product development to cater to specific customer needs.

However, challenges remain. Fluctuations in raw material prices and the overall economic climate can impact market growth. Furthermore, the development and adoption of alternative fuel vehicles, such as electric and hybrid vehicles, while presenting long-term opportunities, could present short-term challenges for the traditional exhaust aftertreatment systems market in the near future. Ongoing research and development in the sector aim to address these challenges and maintain the steady growth trajectory by creating more efficient and cost-effective solutions compatible with a wide range of vehicle types and powertrains. The market's future success hinges on the industry's ability to adapt to evolving technological advancements and regulatory landscapes.

North America Automotive Exhaust Aftertreatment Systems Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the North America automotive exhaust aftertreatment systems market, covering the period 2019-2033. It offers valuable insights into market dynamics, competitive landscape, and future growth opportunities, enabling stakeholders to make informed strategic decisions. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025) to project market trends for the forecast period (2025-2033). The total market value in 2025 is estimated at xx Million.

North America Automotive Exhaust Aftertreatment Systems Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the North American automotive exhaust aftertreatment systems industry. The market is moderately concentrated, with key players such as Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, Continental, and Donaldson Company holding significant market share. However, the presence of numerous smaller players contributes to a competitive environment. The estimated market share of Bosal Group in 2025 is xx%, while Tenneco Inc holds approximately xx%.

Innovation is driven primarily by stringent emission regulations (e.g., EPA standards), increasing demand for fuel efficiency, and advancements in materials science and catalytic converter technology. The industry witnesses continuous product development, focusing on enhancing emission control efficiency and durability. Mergers and acquisitions (M&A) have played a significant role in shaping the market landscape, with deal values exceeding xx Million in the past five years. These activities are primarily aimed at expanding product portfolios, geographical reach, and technological capabilities. Several key M&A deals include [Insert details of at least 2 significant M&A deals with values if available, otherwise, use "xx Million" as a placeholder for the value].

North America Automotive Exhaust Aftertreatment Systems Industry Industry Trends & Insights

The North American automotive exhaust aftertreatment systems market is experiencing robust growth, fueled by stringent emission regulations, rising environmental awareness, and the increasing adoption of advanced emission control technologies. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration of advanced aftertreatment systems, such as particulate matter control systems, is steadily increasing, driven by the growing popularity of diesel vehicles and stricter emission standards. Technological advancements, including the integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance, are further propelling market growth. Consumer preference for environmentally friendly vehicles is also a significant driver. The shift towards electric vehicles presents both challenges and opportunities. While it reduces the demand for conventional aftertreatment systems in the passenger car segment, it concurrently opens avenues for developing specialized technologies for battery thermal management and related applications. Competitive dynamics are shaped by factors such as technological innovation, cost optimization, and strategic partnerships.

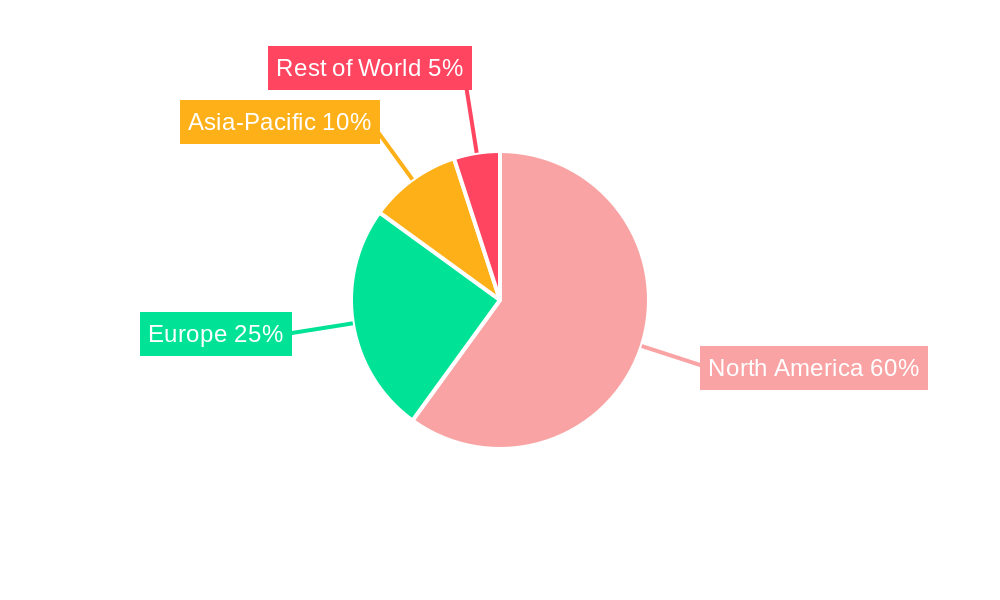

Dominant Markets & Segments in North America Automotive Exhaust Aftertreatment Systems Industry

The United States dominates the North American automotive exhaust aftertreatment systems market, accounting for xx% of the total market value in 2025. This dominance is attributed to several factors:

- Strong automotive manufacturing base: The US boasts a large and well-established automotive manufacturing sector, creating a substantial demand for aftertreatment systems.

- Stringent emission regulations: The stringent environmental regulations enforced in the US drive the adoption of advanced aftertreatment technologies.

- Robust economic conditions: A healthy economy fuels vehicle sales and consequently, the demand for aftertreatment systems.

Within the segments, the passenger car segment holds a larger market share than the commercial vehicle segment, primarily due to the higher volume of passenger car sales in North America. Similarly, diesel-powered vehicles contribute more significantly to the market than gasoline-powered vehicles, due to the continued prevalence of diesel engines in commercial vehicles. Particulate matter control systems constitute the largest segment in terms of filter type, driven by the need to reduce particulate emissions from diesel vehicles.

North America Automotive Exhaust Aftertreatment Systems Industry Product Developments

Recent product innovations focus on enhancing emission control efficiency, reducing system weight and cost, and improving durability. This includes the development of advanced catalysts, filters, and sensors capable of achieving higher conversion efficiencies and withstanding harsher operating conditions. New applications are emerging in areas such as battery thermal management systems for electric vehicles. Competitive advantages are increasingly derived from proprietary technologies, superior manufacturing processes, and strong supply chain management.

Report Scope & Segmentation Analysis

This report segments the North American automotive exhaust aftertreatment systems market by vehicle type (passenger cars and commercial vehicles), fuel type (gasoline and diesel), filter type (particulate matter control system, carbon compounds control system, and others), and country (United States, Canada, and Rest of North America). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The United States is the largest market, followed by Canada. The diesel fuel segment is expected to show strong growth, driven by the need for stricter emission controls. Particulate matter control systems dominate the filter type segment.

Key Drivers of North America Automotive Exhaust Aftertreatment Systems Industry Growth

Growth is primarily driven by:

- Stringent emission regulations: Governments are increasingly enforcing stricter emission standards, mandating the use of advanced aftertreatment systems.

- Technological advancements: Continuous innovation in catalyst and filter technology leads to improved emission control and fuel efficiency.

- Rising environmental awareness: Growing public concern about air quality boosts demand for cleaner vehicles.

Challenges in the North America Automotive Exhaust Aftertreatment Systems Industry Sector

The industry faces challenges such as:

- Fluctuating raw material prices: The prices of precious metals used in catalysts can significantly impact production costs.

- Supply chain disruptions: Global supply chain issues can affect the availability of raw materials and components.

- Intense competition: The market is highly competitive, requiring companies to constantly innovate and optimize costs.

Emerging Opportunities in North America Automotive Exhaust Aftertreatment Systems Industry

Opportunities exist in:

- Electric vehicle technology: Development of specialized aftertreatment systems for electric vehicles (e.g., battery thermal management).

- Advanced materials: The use of novel materials can lead to lighter, more efficient, and durable systems.

- Aftermarket demand: The aftermarket segment offers significant opportunities for providing replacement and maintenance services.

Leading Players in the North America Automotive Exhaust Aftertreatment Systems Industry Market

- Bosal Group

- Tenneco Inc

- Delphi Technologies

- Faurecia

- Continental

- Donaldson Company

Key Developments in North America Automotive Exhaust Aftertreatment Systems Industry Industry

- [Year/Month]: Company X launches a new generation of particulate filter technology.

- [Year/Month]: Company Y acquires Company Z, expanding its product portfolio.

- [Year/Month]: New emission regulations are introduced in the US, impacting market demand.

- [Add at least 3 more bullet points with specific years/months and significant developments]

Strategic Outlook for North America Automotive Exhaust Aftertreatment Systems Market

The North American automotive exhaust aftertreatment systems market is poised for continued growth, driven by long-term trends such as stricter emission regulations and technological advancements. Opportunities abound in developing innovative solutions for electric vehicles and integrating advanced materials to improve system efficiency and durability. Companies that can effectively manage supply chain challenges, adapt to evolving regulations, and innovate continuously will be well-positioned to capitalize on the market's future potential.

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

-

3. Filter Type

- 3.1. Particulate matter control system

- 3.2. Carbon compounds control system

- 3.3. Others

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Exhaust Aftertreatment Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Rules and Regulations in Vehicle Safety

- 3.3. Market Restrains

- 3.3.1. Integration Complexity

- 3.4. Market Trends

- 3.4.1. Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Filter Type

- 5.3.1. Particulate matter control system

- 5.3.2. Carbon compounds control system

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bosal Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tenneco Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Delphi Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Faurecia

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Donaldson Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Bosal Group*List Not Exhaustive

List of Figures

- Figure 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Automotive Exhaust Aftertreatment Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 5: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 14: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Exhaust Aftertreatment Systems Industry?

The projected CAGR is approximately > 8.70%.

2. Which companies are prominent players in the North America Automotive Exhaust Aftertreatment Systems Industry?

Key companies in the market include Bosal Group*List Not Exhaustive, Tenneco Inc, Delphi Technologies, Faurecia, Continental, Donaldson Company.

3. What are the main segments of the North America Automotive Exhaust Aftertreatment Systems Industry?

The market segments include Vehicle Type, Fuel Type, Filter Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Rules and Regulations in Vehicle Safety.

6. What are the notable trends driving market growth?

Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type.

7. Are there any restraints impacting market growth?

Integration Complexity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Exhaust Aftertreatment Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Exhaust Aftertreatment Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Exhaust Aftertreatment Systems Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Exhaust Aftertreatment Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence