Key Insights

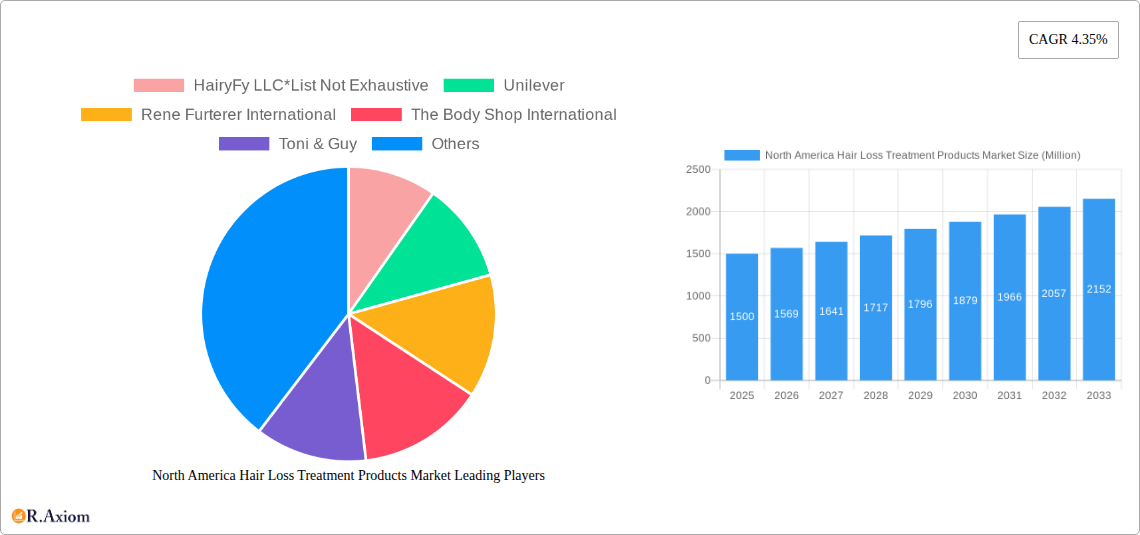

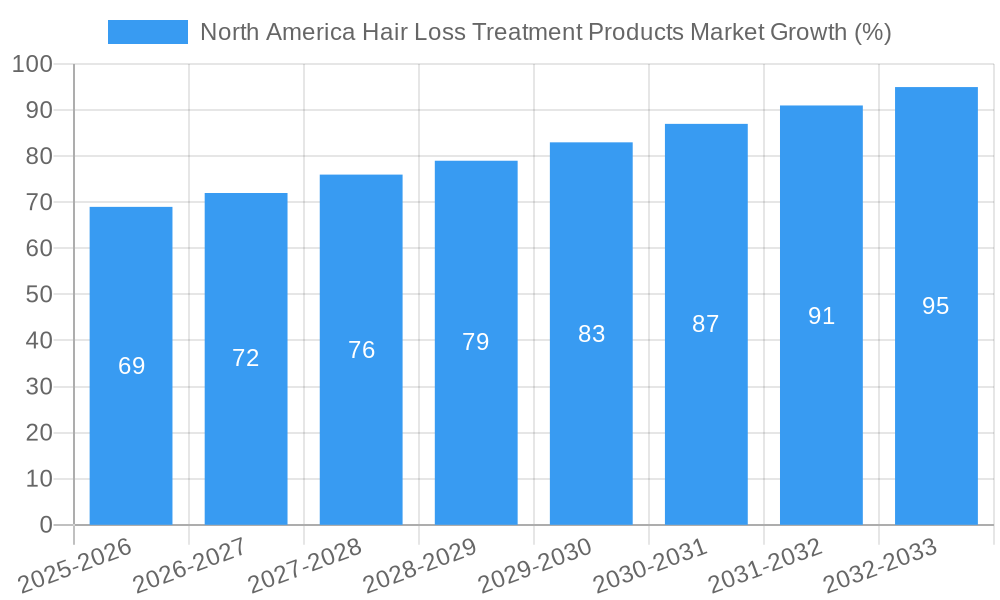

The North American hair loss treatment products market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.35% from 2025 to 2033. This growth is fueled by several key market drivers. Increasing awareness of hair loss solutions, coupled with a rising prevalence of androgenetic alopecia (male and female pattern baldness) across various age groups, significantly boosts demand. The market is witnessing a notable shift towards technologically advanced and clinically proven products, including topical treatments, oral supplements containing vitamins and minerals like biotin and zinc, and innovative serums and oils infused with natural ingredients. Furthermore, the expanding e-commerce sector provides convenient access to a wider variety of products, contributing to market expansion. While pricing pressures and potential side effects associated with certain treatments can pose challenges, the overall positive perception of hair loss treatment products, coupled with increasing disposable incomes in North America, is anticipated to fuel continued market growth.

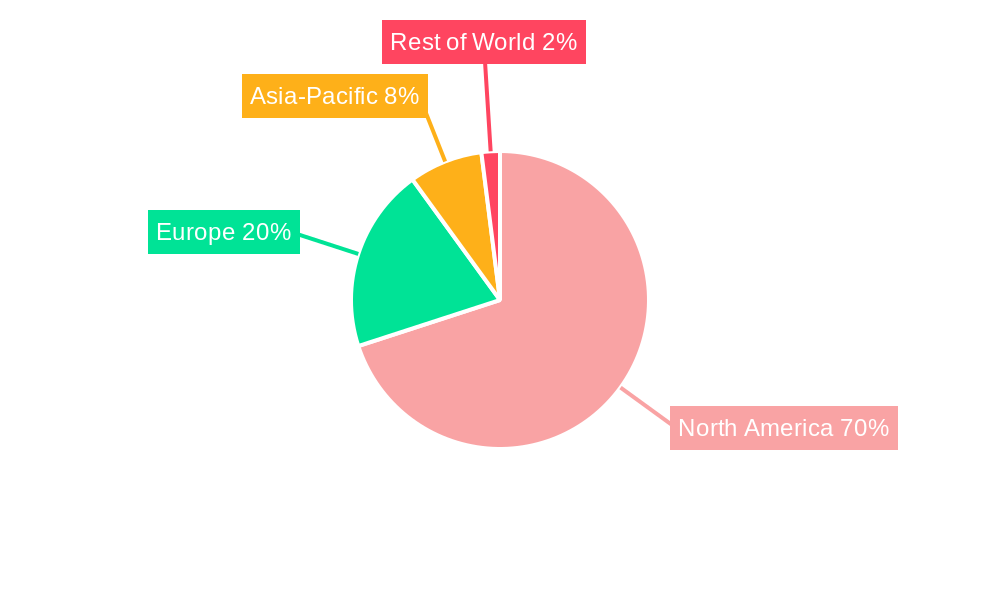

Segmentation within the market reveals a diverse landscape. Shampoos and conditioners represent a significant portion of the market due to their accessibility and ease of use. However, the segments encompassing supplements, serums & oils are witnessing faster growth due to their targeted approach to address the root causes of hair loss. Distribution channels are equally varied, with supermarkets and hypermarkets continuing to be major players alongside the rapidly expanding online retail sector. The dominance of established players such as Unilever, Procter & Gamble, and L'Oreal, combined with the emergence of innovative niche brands focusing on specific hair types and concerns, further shapes the market dynamics. The United States, as the largest economy in North America, is expected to hold the largest market share, followed by Canada and Mexico. Future market developments will likely be characterized by greater innovation in product formulations, personalized treatments, and an increased emphasis on natural and organic ingredients.

This detailed report provides a comprehensive analysis of the North America hair loss treatment products market, offering actionable insights for industry stakeholders. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by product type (shampoos & conditioners, supplements & vitamins, serums & oils, others), distribution channel (supermarkets/hypermarkets, departmental stores, specialist retailers, pharmacies & drug stores, online retail stores, other channels), and geography (United States, Canada, Mexico, Rest of North America). Key players analyzed include HairyFy LLC, Unilever, Rene Furterer International, The Body Shop International, Toni & Guy, Procter & Gamble, Back of Bottle, Coty INC, Amway, Fleuria Beauty, Triple Hair Group Inc, Johnson & Johnson Inc, L'Oréal, and Harklinikken. The report projects a market value of xx Million by 2033.

North America Hair Loss Treatment Products Market Concentration & Innovation

The North American hair loss treatment products market exhibits a moderately concentrated landscape, with established players like Unilever, Procter & Gamble, and L'Oréal holding significant market share. However, the emergence of niche brands focusing on natural ingredients and specialized formulations, like Fleuria Beauty and HairyFy, indicates increasing competition. Market share data for 2024 suggests Unilever holds approximately xx%, while Procter & Gamble holds approximately xx%, and L'Oréal holds approximately xx%. Smaller players collectively contribute the remaining xx%.

Innovation is a key driver, with companies investing heavily in research and development to create more effective and targeted treatments. This includes advancements in active ingredients, delivery systems, and personalized solutions. Regulatory frameworks, particularly concerning the approval and labeling of active ingredients like minoxidil, influence product development and market entry. Substitute products, including alternative therapies and hair restoration procedures, exert competitive pressure. End-user trends, such as increasing awareness of hair loss and a growing preference for natural and organic products, shape market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values primarily in the xx Million range, reflecting strategic moves to expand product portfolios and market reach. Specific examples of M&A are not publicly available currently and are estimated at xx Million in total value.

- Market Concentration: Moderately concentrated, dominated by large multinational companies.

- Innovation Drivers: R&D investment in active ingredients, delivery systems, and personalized solutions.

- Regulatory Frameworks: Impact product development and ingredient approvals.

- Product Substitutes: Alternative therapies and hair restoration procedures.

- End-User Trends: Growing awareness and preference for natural products.

- M&A Activities: Moderate activity, primarily focusing on portfolio expansion (estimated total value: xx Million).

North America Hair Loss Treatment Products Market Industry Trends & Insights

The North America hair loss treatment products market is experiencing robust growth, driven by several factors. The rising prevalence of hair loss among both men and women, fueled by factors such as stress, genetics, and lifestyle choices, is a primary growth catalyst. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). Increased consumer awareness, fueled by social media and marketing campaigns, plays a significant role in market penetration. This increased awareness is leading to higher adoption rates of hair loss treatment products. Technological advancements, such as the development of more effective active ingredients and improved delivery systems, are improving product efficacy and expanding market opportunities. However, competitive dynamics remain intense, with established players facing challenges from smaller, niche brands offering innovative and specialized products. Consumer preferences are shifting towards natural and organic ingredients, prompting companies to reformulate products and enhance their sustainability credentials. Market penetration for natural products within the hair loss treatment segment is estimated to be around xx% in 2025.

Dominant Markets & Segments in North America Hair Loss Treatment Products Market

The United States represents the largest market within North America, accounting for approximately xx% of the total market value. This dominance is attributed to several factors including:

- High Prevalence of Hair Loss: A significant portion of the population experiences hair loss, fueling demand.

- Strong Economic Conditions: A robust economy supports consumer spending on personal care products.

- Extensive Distribution Network: A well-established retail infrastructure ensures widespread product availability.

By Product Type: The shampoos and conditioners segment holds the largest market share, driven by its accessibility and widespread use. However, supplements and vitamins, and serums & oils are experiencing faster growth rates due to their perceived efficacy in treating hair loss.

By Distribution Channel: Online retail stores are exhibiting the fastest growth, reflecting changing consumer shopping habits and the convenience offered by e-commerce platforms. However, pharmacies and drug stores remain a significant distribution channel, benefiting from their established customer base and trusted brand image.

North America Hair Loss Treatment Products Market Product Developments

Recent product innovations focus on incorporating natural ingredients, advanced delivery systems (e.g., nanotechnology), and targeted formulations to address specific hair loss types. Companies are increasingly emphasizing the use of clinically proven ingredients and highlighting product efficacy through scientific studies and marketing campaigns. This trend reflects an increased focus on achieving a strong market fit by developing products that directly address consumer needs and preferences. Technological advancements continue to shape the market, and newer products incorporate ingredients and formulation techniques previously unavailable.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the North America hair loss treatment products market based on product type, distribution channel, and geography. Each segment is analyzed based on historical data, current market size, and future growth projections. The competitive dynamics within each segment are assessed, highlighting key players and their market strategies. Growth projections and competitive dynamics vary across segments. For example, the supplements and vitamins segment shows significantly higher growth projections than the shampoos and conditioners segment. Similarly, online retail channels exhibit much faster growth than traditional retail channels like supermarkets and hypermarkets.

Key Drivers of North America Hair Loss Treatment Products Market Growth

The North America hair loss treatment products market is driven by several key factors: the rising prevalence of hair loss, increased consumer awareness, technological advancements leading to more effective products, and a growing preference for natural and organic ingredients. Economic factors, such as disposable income levels, also contribute to market growth. Favorable regulatory environments that encourage innovation and product development further propel market expansion.

Challenges in the North America Hair Loss Treatment Products Market Sector

Challenges facing the market include intense competition, fluctuating raw material costs impacting profitability, stringent regulatory requirements, and consumer skepticism regarding product efficacy. The prevalence of counterfeit and substandard products also poses a challenge. These factors collectively result in a complex and dynamic competitive environment, influencing business strategies and market growth. The estimated impact on market growth due to these factors is a reduction in the overall CAGR by approximately xx%.

Emerging Opportunities in North America Hair Loss Treatment Products Market

Emerging opportunities include the growing demand for personalized hair loss treatments, the rise of telehealth and online consultations for hair loss solutions, and the expansion of the market into underserved segments. Further opportunities exist in incorporating advanced technologies like AI and machine learning in product development and customization, as well as exploring novel active ingredients. The development of sustainable and eco-friendly products caters to the growing awareness of environmental concerns among consumers.

Leading Players in the North America Hair Loss Treatment Products Market Market

- Unilever

- Rene Furterer International

- The Body Shop International

- Toni & Guy

- Procter & Gamble

- Back of Bottle

- Coty INC

- Amway

- Fleuria Beauty

- Triple Hair Group Inc

- Johnson & Johnson Inc

- L'Oréal

- Harklinikken

- HairyFy LLC

Key Developments in North America Hair Loss Treatment Products Market Industry

- Jan 2023: Fleuria Beauty launched an active botanical hair growth serum, expanding the market for natural hair loss treatments.

- May 2022: HairyFy released its hair loss kit, targeting the men's hair care segment with a unique formula.

- Mar 2022: Triple Hair Group Inc. launched Plenty Natural, a natural hair growth product line for women, broadening the market's offerings.

Strategic Outlook for North America Hair Loss Treatment Products Market Market

The North America hair loss treatment products market is poised for sustained growth, driven by evolving consumer preferences, technological advancements, and increasing awareness regarding hair loss solutions. Future market potential lies in personalized treatments, leveraging technological advancements to provide tailored solutions that cater to individual needs. This strategic approach will enhance market penetration and drive overall growth within the industry.

North America Hair Loss Treatment Products Market Segmentation

-

1. Product Type

- 1.1. Shampoos and Conditioners

- 1.2. Supplements and Vitamins

- 1.3. Serum & oil

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Departmental Stores

- 2.3. Specialist Retailer

- 2.4. Pharmacies And Drug Stores

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

-

3. North America

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Hair Loss Treatment Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Hair Loss Treatment Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Hair Care Products in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoos and Conditioners

- 5.1.2. Supplements and Vitamins

- 5.1.3. Serum & oil

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Departmental Stores

- 5.2.3. Specialist Retailer

- 5.2.4. Pharmacies And Drug Stores

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by North America

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 HairyFy LLC*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unilever

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rene Furterer International

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Body Shop International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toni & Guy

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Procter & Gamble

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Back of Bottle

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Coty INC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amway

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fleuria Beauty

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Triple Hair Group Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Johnson & Johnson Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 L'oreal

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Harklinikken

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 HairyFy LLC*List Not Exhaustive

List of Figures

- Figure 1: North America Hair Loss Treatment Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hair Loss Treatment Products Market Share (%) by Company 2024

List of Tables

- Table 1: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Hair Loss Treatment Products Market Revenue Million Forecast, by North America 2019 & 2032

- Table 8: North America Hair Loss Treatment Products Market Volume K Units Forecast, by North America 2019 & 2032

- Table 9: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 23: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Hair Loss Treatment Products Market Revenue Million Forecast, by North America 2019 & 2032

- Table 26: North America Hair Loss Treatment Products Market Volume K Units Forecast, by North America 2019 & 2032

- Table 27: North America Hair Loss Treatment Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Hair Loss Treatment Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 29: United States North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 31: Canada North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hair Loss Treatment Products Market?

The projected CAGR is approximately 4.35%.

2. Which companies are prominent players in the North America Hair Loss Treatment Products Market?

Key companies in the market include HairyFy LLC*List Not Exhaustive, Unilever, Rene Furterer International, The Body Shop International, Toni & Guy, Procter & Gamble, Back of Bottle, Coty INC, Amway, Fleuria Beauty, Triple Hair Group Inc, Johnson & Johnson Inc, L'oreal, Harklinikken.

3. What are the main segments of the North America Hair Loss Treatment Products Market?

The market segments include Product Type, Distribution Channel, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Increasing Expenditure on Hair Care Products in United States.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

Jan 2023: Hair care brand Fleuria Beauty launched active botanical hair growth serum. This luxury hair growth and repair serum has 31 plant-based oils and extracts, according to the company. The majority of the ingredients in its serum are grown and harvested mostly on the founder's organic farm in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hair Loss Treatment Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hair Loss Treatment Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hair Loss Treatment Products Market?

To stay informed about further developments, trends, and reports in the North America Hair Loss Treatment Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence